4 Recovery of proven resources

A significant part of expected production over the next ten years will come from proven fields and discoveries. Sound utilisation of resources in fields and discoveries is very important for the activity level and the State’s income in a short and medium-term perspective. Several fields on the Norwegian Shelf have produced for a long time. Measures to improve recovery on these fields are urgent. Measures must be carried out quickly, before the operation of established infrastructure becomes unprofitable or technically unsuitable. Many measures could be described as time critical. Decisions need to be made quickly.

For discoveries that are not developed, the goal is to find development solutions that achieve the best resource management and create the most value for society. Many current discoveries are small, need to utilise existing infrastructure and be developed quickly in order to be profitable. It is important to carry out active preventive maintenance on existing infrastructure, as well as for modifications connecting new and old infrastructure to be carried out in a prudent manner.

The goal for exploitation of producing fields is to create the greatest possible value for society. This is achieved through evaluating and implementing measures that can improve recovery while also controlling costs. Phase-in of third-party resources to existing fields could contribute to prolonging the profitable production period, while also being an efficient development solution for minor discoveries. Some of the fields on the Norwegian Shelf have been producing for decades, and are currently in a phase where parts of the facilities must be replaced or supplemented. For example, investments are being made in new facilities both on Ekofisk and Eldfisk this year, and new compression capacity for gas is being considered on Troll and Åsgard.

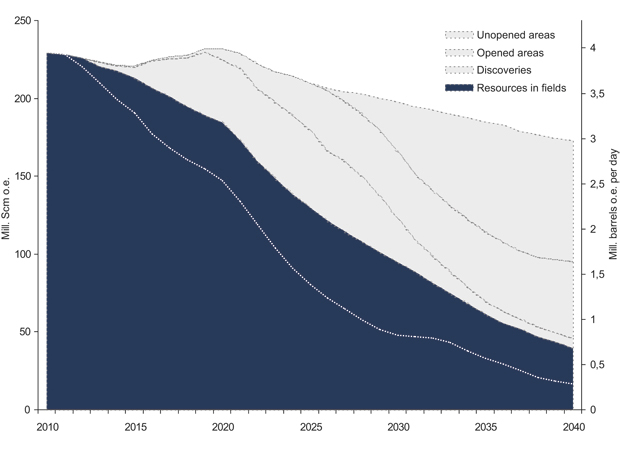

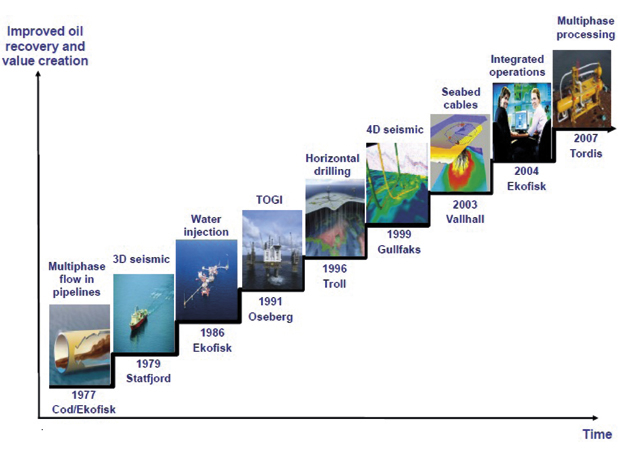

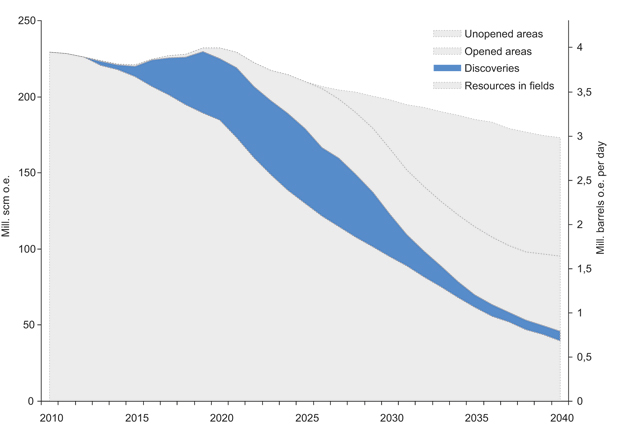

Figur 4.1 Possible production course on the Norwegian Shelf. Volumes from existing fields are highlighted. Production from approved measures is shown below the dashed line. Production that can be realised through planned measures, as well as increased efforts in improved recovery, is shown above the same line.

Kilde: Ministry of Petroleum and Energy and Norwegian Petroleum Directorate.

4.1 Potential and technology to recover more

Recovering more entails measures that contribute to maintain production in and around existing fields. Phase-in of new fields can also contribute to extended lifetimes for existing fields. Thus, measures to improve recovery also encompass measures that support rapid development of small discoveries.

In February 2010, the Ministry appointed an expert committee1 with the mandate to assess measures to improve recovery from existing fields on the Norwegian Continental Shelf. The Committee submitted its report in September 2010 and it was then submitted for public consultation. The Ministry received a considerable amount of input during the consultation round. The problems addressed by the Committee, and the main suggestions emphasised, are addressed in this Chapter.

4.1.1 Potential from higher recovery rate

The development on Ekofisk is a good example of the potential for improved recovery. When the field came on stream in 1971, the plan was to produce 17 per cent of the resources in the field. Today, the plan is to produce more than 50 per cent of the resources in place. The improved recovery rate constitutes several hundred million scm o.e. of oil. The challenge is that, based on current plans, nearly half of the oil originally in the field will remain in the reservoirs.

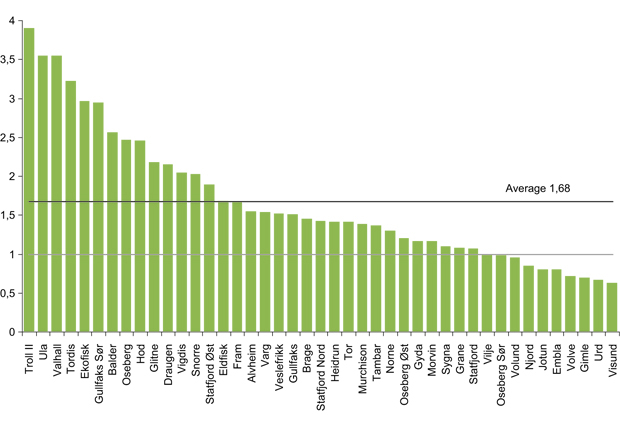

Fields on the Norwegian Continental Shelf have, on average, increased their oil reserves by a factor of 1.68 from the original development plan and up to 2010, cf. Figure 4.2. There are many reasons for this. Recovery has been better than expected and measures have been implemented which have contributed to an improved recovery rate and increased reserves because more oil (from new parts of the reservoir) is depleted.

Figur 4.2 Oil reserve increase compared with estimates in the original PDO.

Kilde: Norwegian Petroleum Directorate.

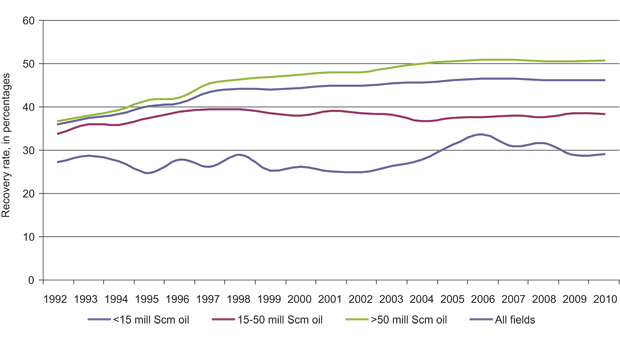

Figur 4.3 Development of expected recovery rate on the Norwegian Shelf.

Kilde: Norwegian Petroleum Directorate.

The current adopted plans provide an average expected recovery rate of 46 per cent for oil and 70 per cent for gas on the Norwegian Shelf. In comparison, the global oil recovery rate is about 22 per cent. The recovery rate varies from field to field, and depends on factors such as reservoir properties, recovery strategy and technology development. The recovery rate also correlates to the size of the field, cf. Figure 4.3. It is easier to achieve high recovery in major fields because, for instance, they normally have fixed platforms with drilling rigs which can carry out well work throughout their lifetime.

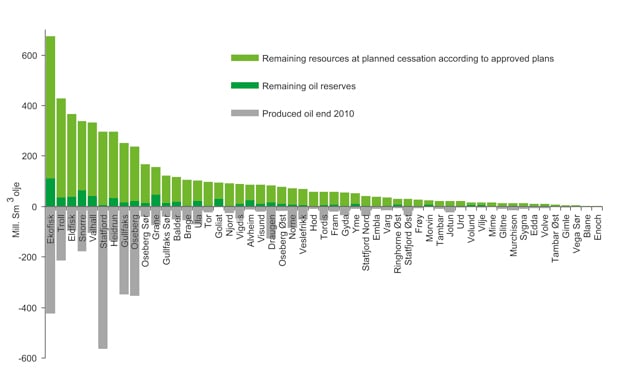

Figur 4.4 Distribution of produced oil, remaining oil reserves and resources.

Kilde: Norwegian Petroleum Directorate.

According to the current plans, and with the existing technology, about 30 billion barrels of oil will remain when Norwegian fields are shut down. Improvement of the recovery rate thus has a significant upside, for example, a one per cent increase of the recovery rate for fields that are currently operating will increase oil production by approximately 570 million barrels of oil. The gross sales income from such an oil volume is approximately NOK 325 billion2. The cost of producing the resources, as well as when the resources are produced, will determine the size of the values for this potential.

The remaining oil resources in the fields are considerable, cf. Figure 4.4. The resources are already proven, infrastructure exists and many wells are already in place. However, recovery of significant parts of these resources is technically challenging and costly. In order to recover some of this oil, multiple decisions need to be made by the licensee groups over the next several years.

When fields are shut down, it could impact the possibility for third-party use of infrastructure in the relevant area. Use of existing infrastructure can be crucial for the profitability of new and existing discoveries. This means that the window of opportunity for exploration and development of discoveries in mature areas is limited. It is therefore important to facilitate development of time-critical resources and discoveries near existing infrastructure.

The expert group for improved recovery has a vision that about 2.5 billion scm o.e., (or about 15.7 billion barrels) of oil can be produced from fields on the Norwegian Shelf, beyond the current plans. They believe that exploitation of this potential requires a high oil price and use of both existing and new technology. Furthermore, the Committee suggested measures must be implemented on both producing and future fields. The gross sales income from such a resource volume is nearly NOK 9000 billion. The costs associated with recovering the resources, as well as when they will potentially be produced, are crucial as regards the size of values that can be realised from this potential.

4.1.2 Solutions that could improve the recovery rate

Technology development has contributed to high recovery rates from many fields, cf. Figure 4.5. Water injection has been important on the Norwegian Shelf since the 1980s and was, for instance, crucial in improving the recovery rate on Ekofisk. Gas injection has taken place since the 1970s, and is currently used by about 20 fields. In the 1990s, recovery of oil from very thin oil zones was made possible by horizontal drilling on Troll. Several other technology breakthroughs, e.g. within 3D and 4D seismic3, have also been crucial in improving recovery.

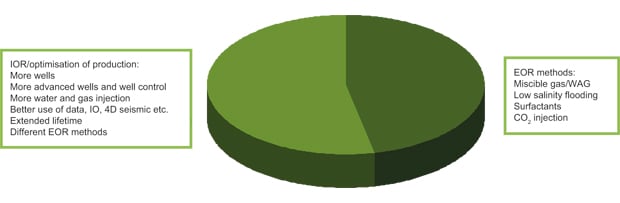

The remaining oil can be divided into two categories: mobile and immobile oil. Oil which is mobile with the applicable recovery method on a field can be recovered using multiple wells and more, long-term use of water and/or gas injection. The recovery rate from many fields can be increased relatively quickly using these measures.

Oil which cannot currently be squeezed out of the pores in the reservoirs using injection of water or gas, as currently done on the fields, is called immobile oil. This applies to large volumes of oil. Production of this oil requires considerable effort, for example in the form of injection of miscible gas and/or CO2 or chemicals added to the injection water.

Various technologies that could contribute to improved recovery can be grouped in the following manner:

Drilling and well

Injection techniques

Reservoir mapping

Integrated operations

Subsea solutions

Drilling and well

The oil companies carry out a number of measures to improve the recovery rate on their fields. Most projects currently carried out are within the drilling and well discipline. Drilling new development wells and maintenance of existing wells is a precondition for future production. How many, and where, wells are drilled form the basis for which possibilities will be available for further reserve growth and measures to improve the recovery rate. The least demanding oil resources are the first to be recovered from a field. On several fields these resources have already been recovered. It could therefore be challenging to recover the remaining resources. Complex pressure conditions and unclear barrier conditions in existing wells to be drilled are examples of challenges that must be resolved.

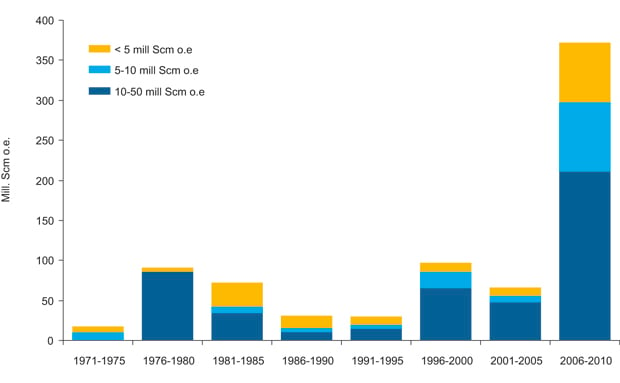

Figur 4.5 Recovery solutions over time for Norwegian fields.

Kilde: Expert committee for improved recovery.

The number of new production and injection wells has declined since the record year 2000. On many fields, the licensees have not been able to carry out the planned drilling programs in recent years. Over time, a considerable lag has built up, and some of the planned wells cannot be completed without updating the drilling equipment. This has also contributed to many fields not reaching their production goals in recent years. In the future, the number and quality of wells drilled will also be crucial for what production is achieved. Wells can be drilled and maintained both from mobile and fixed facilities. Drilling from fixed rigs is particularly important to realise the resources in the large oil fields.

Figur 4.6 Mobile and immobile oil and recovery methods.

Kilde: Norwegian Petroleum Directorate.

Injection techniques

More oil can be produced using known injection techniques and through development of new injection methods. On the Norwegian Shelf, water and gas injection has been used on many fields. Currently, more than 30 fields on the Norwegian Shelf utilise water injection and more than 20 fields utilise gas injection in some form or another. To date, gas injection is considered to have contributed up to 300 million scm of extra oil and condensate on the Norwegian Shelf. This is nearly as much as has been produced from Gullfaks or Oseberg up to now. By following the companies’ current adopted plans for gas injection, this could provide 60–100 million scm of oil that would not otherwise have been produced. Further development of existing technologies has great potential. In addition, there is a considerable potential for improved recovery of the immobile oil in particular, using more advanced recovery methods, such as:

Injecting water with added chemicals

Injecting water with a tailored salt content

Water-alternating gas injection (WAG) / Foam-assisted water-alternating gas injection (SAWAG)

Injection of CO2 gas

Gas injection with miscible conditions

A study carried out by the Norwegian Petroleum Directorate (NPD) in 2005, indicated additional oil recovery with CO2 in the order of 3–7 percentage points from certain fields. The NPD estimated the technical potential from 20 fields that could use CO2, to 150–300 million scm of oil. There are several challenges associated with this. In addition, the fields must have access to sufficient amounts of CO2.

In order to use these methods, a long-term perspective must be used for decisions as regards costs, technology, expected oil prices and willingness to take risks. A precondition for all methods is that the consideration for health, safety and the external environment is safeguarded in a good manner. The various injection techniques must be seen in connection with each other.

Reservoir mapping

Seismic surveys are an important prerequisite for recovering oil and gas deposits. The development has progressed from 2D seismic to 3D and 4D seismic. This has been important both to optimise production and to increase the likelihood of discoveries. The technology development has been headed by Norwegian and international seismic companies and in close cooperation with the oil companies on the Norwegian Shelf.

3D and 4D seismic contribute to a better understanding of the reservoir and reservoir fluid streams. Multiple wells are important as a data basis. Together, this contributes to better reservoir models, which can lead to more accurate drilling and optimal production.

Statoil has estimated that the use of 4D seismic on the Gullfaks field alone has provided value creation equalling about NOK 6 billion. The value creation from 4D seismic over the last ten years has been estimated at more than NOK 22 billion.

Integrated operations

Integrated operations involve using information technology to change work processes to achieve better decisions. Technology allows for equipment and processes to be remote-controlled. Functions and personnel can therefore also be moved onshore. This could improve recovery on fields through more energy efficient operations and better decisions. In 2007, the Norwegian Oil Industry Association (OLF) estimated the resource potential from integrated operations at about 1.9 billion barrels.

Subsea solutions

The development solutions on the Norwegian Continental Shelf have progressed from mainly fixed platforms to more use of subsea solutions. The seabed solutions have contributed to making more discoveries (more) profitable. This particularly applies to minor discoveries and discoveries in deep water. Currently, one-third of production on the Norwegian Shelf comes from subsea wells, and this percentage is rising.

Fields developed with seabed wells generally have a lower recovery rate than fields with wellheads that are above the sea surface (dry wellheads). This is e.g. due to higher maintenance costs. It is therefore challenging to prolong production and improve recovery cost-efficiently through more wells and interventions from seabed fields. Access to less costly vessels and methods to implement well operations are therefore important to improve recovery from fields with subsea wells.

4.2 Measures – the legal framework

Petroleum activity on the Norwegian Continental Shelf is regulated through an extensive legal framework based on cooperation between authorities and licensees. Within this framework, the following is an assessment of measures in connection with voting rules, policy for extending production licenses and following up mature fields.

Boks 4.1 Gas in tight reservoir formations on Linnorm

Linnorm is a Shell-operated gas discovery in the Norwegian Sea which was proven in 2005. It is challenging to find profitable methods to produce the gas in Linnorm. The discovery has complicated geology with six stacked reservoirs. There are high pressures and high temperatures here, a mixture of tight and conventional reservoir formations, a wellstream that becomes very corrosive, and which easily forms wax and hydrates. This requires several innovative solutions that challenge the limits for what has been possible or has been carried out so far. In the event of a potential development of Linnorm, a considerable amount of new technology will be developed, which could become very valuable for developments of other gas discoveries in tight formations.

The plan is to develop Linnorm with up to eight wells, a pipeline to the processing facility on a host platform and tie-in to a new pipeline which is planned to run to the existing gas processing facility for Ormen Lange at Nyhamna. A coordinated development could be relevant with Luva, which is located 300 kilometres north of Linnorm.

The operator is working with the Norwegian supply industry to find the limits of what is technically possible with the current technology and to push the limits where needed to achieve a development solution. This includes production technology for recovering gas from tight formations. More than half of the gas volumes in the Linnorm reservoirs are in so-called tight formations where the recoverable gas volumes from conventional production methods are too small to be profitable. Such reservoirs are often defined as “non-reservoir” and are thus excluded from volume calculations and development plans.

Up to the present, production from most tight gas reservoirs has taken place on land, where drilling costs are relatively low and many wells can be drilled. Thus the possibility for a good learning curve and optimisation of the technical solutions also increases. The oil industry is now moving technology from recovery of gas and oil from tight reservoirs onshore to offshore, and the first attempts have been made in the North Sea in the Dutch sector from installations resting on the seabed. The next step will involve doing this at greater water depths, in higher pressure and temperature areas, as well as recovery from floating platforms and/or subsea installations. Offshore wells are significantly more costly, and will require other solutions.

Tight gas can increase the potential for production in Norway; however, this will likely take place with considerably higher development and production costs than from fields with conventional reservoir types, i.e. a form of improved recovery of gas.

4.2.1 Voting rules

According to the expert committee, the current voting rules may make it difficult to make decisions in the partnership as small owner groups could stop profitable development projects proposed by the majority owners. For mature fields, the voting rules could also hinder improved recovery by companies focusing on production in the late phase not achieving an operations model that is necessary for this type of production, even though they have a high ownership interest in the partnership. The committee therefore suggests that the voting rules are changed so the majority principle can be applied to all production licenses.

Petroleum activities must be carried out in accordance with a production license, which gives the oil companies (licensees) an exclusive right to explore and produce petroleum in the area included in the license. A condition for awarding a production license is that the licensees must come to an agreement. By signing the agreement, the licensees form a partnership. This agreement is formulated by the Ministry, and contains e.g. a voting rule for the partnership’s decisions pursuant to the production license. The voting rules are stipulated by the Ministry. All subsequent changes are contingent upon the Ministry’s approval.

The voting rules form the basis for most decisions made within each partnership. They thus play an important role for resource management on the Norwegian Continental Shelf. Since the start of the petroleum activities on the Norwegian Shelf, Norwegian authorities have wanted a diverse selection of qualified companies to contribute expertise to the work in a production license. Broad-based technical input will increase the level of expertise in the production license and will contribute to the other licensees assessing the operator and checking the operator’s work. In order to give the companies an incentive to participate in the technical work, the voting rules have been designed so that all companies in each partnership, including the companies with small ownership interests, will have an actual possibility to influence decisions that are made. The voting rules on the Norwegian Shelf have therefore been designed differently from the voting rules in the company legislation, where more decisions require a joint owner majority of the votes cast (straight majority), but some decisions require a larger majority.

Since the mid-80s, the principle for designing the voting rules has been that decisions are made by a combination of a number of licensees (a majority) and their ownership interests (a majority). In a production license with three licensees the normal voting rule will thus be determined such that decisions are made if at least two of the licensees, which jointly represent at least 50 per cent of the ownership interest, have voted for a proposal. Similarly, decisions in production licensees with four licensees are made when at least three licensees that normally jointly represent at least 50 per cent of the ownership interest have voted for a proposal.

In some instances, the Ministry has seen that licensees with small ownership interests in a production license can have too much influence compared with licensees with considerable ownership interests. The desire to ensure that licensees with small ownership interests have influence – and thus an interest in contributing expertise – should therefore, in certain instances, be balanced somewhat better vis-à-vis the significance of interest majority. The size of ownership interests reflects the financial realities in the production license.

In the future, the voting rules will also mostly be based on a combination of majority in the number of licensees and ownership interests. However, the Ministry will to a larger degree emphasise interest majorities when stipulating new voting rules. In licenses with many small ownership interests you can, for instance, choose to design a voting rule which stipulates that they cannot block decisions that participants with more than two-thirds of the ownership interest want to make. With new awards, the Ministry will also be able to stipulate a voting rule based on a principle of pure interest majority if this is considered reasonable based on the composition of the partnership and the consideration for making it as easy to form a quorum as possible.

In the event of changes to the number of licensees or changes to licensees’ ownership interests in existing production licenses, the partnership, pursuant to the joint operating agreement, must propose new voting rules. The new voting rule is contingent upon the Ministry’s approval. If no proposals are made, the Ministry can determine new voting rules for the partnership. The new voting rules must be designed so that each party’s voting power is impacted as little as possible.

If special reasons so indicate, the Ministry can extend a production license beyond the license period determined upon the award. The Ministry will stipulate the conditions of such a special extension. In the future, the Ministry will in such instances assess the voting rule in the relevant license, and potentially set requirements for a new voting rule if there is a need to change the existing voting rule. A new voting rule will to a greater degree be based on a principle of interest majority.

The Government will:

To a greater degree emphasise interest majority when determining voting rules for awarding new production licenses.

4.2.2 Predictable extension of license period for production licenses

The expert committee proposes that the authorities must clarify the question of a new extension of the license period at an early point in time, when the need arises. The assessment regarding a new extension should be made on the basis of achieved results and long-term plans to increase the field’s value creation.

Investments in projects for improved recovery on the fields require the licensees to have a long-term perspective. A production license is first awarded for an initial period. During this period, the licensees must explore the awarded area. Following the expiry of this period, the licensees have a right to require an extension of the license period, as long as the mandatory work obligation is fulfilled. This period is nearing the end for many fields on the Norwegian Shelf.

Investment decisions made on fields that are currently nearing the end of the license period will also have financial effects in the years following the license period. The Ministry may extend the license period beyond the originally determined period, if the licensees apply for this – so-called new extension. Since it could be relevant for several licensees to apply for such a new extension of the license period, the Ministry believes it is important to determine a predictable policy to prevent under-investment in such fields.

A limited license period could result in the licensees under-investing in e.g., improved oil recovery, exploration, technology development and environmental technology towards the end of the duration of the license. This is because, in their investment decisions, licensees will not give full consideration to the value of activity that takes place after the expiry of the license period. This will then lead to socio-economically unfortunate decisions, and the squandering of resources. The result will be reduced value creation and lower State income, both due to lower returns on a potential State ownership interest and through lower tax revenues from the licensees.

This effect can be met with a new extension of the production licenses to the same licensee group, and on the same conditions. With a new extension, the State will also be able to change the conditions – for example by reserving the right to (increased) State participation in the license. This will, by itself, move in the direction of increasing the percentage of value creation from the field which falls to the State. The Ministry still assumes, however, that the value of an increased State ownership interest in licenses that are in a late phase normally will not offset the loss of State income that could result from lower value creation due to uncertainty about whether a new extension will be granted, and in such case, on what conditions. This is due to the State’s strong exposure in the activity through the tax system and direct ownership.

For some fields with significant remaining resources at the end of the license period and/or with low State participation, it could be appropriate to use the opportunity to increase the State ownership interest with a new extension of the production license. Ekofisk and Troll are examples of two fields where new extensions of the license period were contingent upon an increased SDFI interest.

In its application to extend a production license, the licensee group must provide a reason for why the license period is a limitation as regards good resource management in the field, and thus also a hindrance to the highest possible value creation.

According to the Petroleum Act, the licensees may apply for a new extension at any time during the license period, when they themselves believe the need arises. It is up to the Ministry to make a decision on such a new extension, and the conditions for the activity in the license can in such cases be changed, adapted or continued along the lines of the plans that are submitted.

In certain cases, the Ministry could make a new extension contingent upon, e.g., that a new or changed plan for development and operation is submitted by a certain deadline. If the stipulated condition(s) is not met, the original license period will still apply.

The Ministry sees that there could be good reasons for the licensees needing, at a certain stage, a degree of security that a project that will increase the field’s value creation can actually be implemented. There can be many directions and decisions that need to be made well before a final plan for the further operation of a field can be submitted to the authorities. However, the Ministry still presumes that the regulations already contain the instruments needed to determine a new extension.

The Government will:

Approve applications for new extensions of the license period for a production license with the same ownership structure if the application substantiates improved utilisation of reserves, unless special conditions call for something else. For some licenses, special factors such as low State ownership interest and/or significant remaining reserves, could require the SDFI interest to be increased, or other conditions to be renegotiated when extending the production license.

4.2.3 Follow-up of late-phase fields

The expert committee sees a need to formalise the production licenses’ work with measures for improved recovery. The committee has suggested that the licensees submit a simplified, revised development plan, when 80 per cent of the planned volume is produced, at the latest. The argument is that such a measure will advance the improved recovery work to a greater extent in the companies’ governing bodies. This will promote greater discipline in the companies’ work. At the same time, the Ministry will to a greater degree be involved in the companies’ work to achieve a higher recovery rate. The committee states that such a process will not entail significant additional work for the companies as the necessary information is currently already reported to the authorities.

Currently, the authorities have an impact on the companies’ plans for a field through the processing of development plans. This process is an important tool for the authorities to ensure good resource management on the fields. Approval of production schedules takes place when approving the development plan and through annual production licenses. The authorities can also, at their discretion, after the development plan and production schedule have been approved, require the licensees to carry out assessments of the resource utilisation in a field. This could become relevant, for instance if new information about the reservoir calls for a different recovery strategy. If necessary, the Ministry can, pursuant to applicable statutes and regulations, require the licensees to prepare a report on field-related factors, including alternative production and injection schemes and the total recovery rate for various production schedules.

Through the authorities’ general follow-up work as regards resource management, fields requiring special follow-up from the authorities may emerge. In addition to this follow-up, the authorities carry out an annual review of all fields on the shelf with the objective of identifying fields which require special attention.

The Ministry is concerned with ensuring sufficient attention to sound resource management from the licensees. This could be particularly important for fields in the tail phase. The Ministry agrees with the expert committee that it is important to elevate the work on improved recovery into the licensees’ governing bodies and furthermore, that this must not be done in a manner which entails unnecessary additional work for the companies. The Ministry will, based on these assessments, further consider the need for additional enhancement of the regulations to ensure sufficient attention to improved recovery and good resource management.

The Government will:

Intensify the follow-up of fields in the late phase.

Require new plans for recovery in late phase fields, where this is considered suitable.

Assess the need for further enhancement of the regulations to ensure sufficient attention to improved recovery and sound resource management.

4.3 Measures – cost level and profitability

The costs on the Norwegian Shelf have increased significantly in recent years and are higher than in other petroleum provinces, cf. Chapter 2.4. The high cost level has a direct effect on the profitability of measures for improved recovery and influences the lifetime of existing fields. The cost level development is paramount for the possibility of achieving improved recovery.

The challenges associated with costs are discussed by the expert committee and concern is expressed that a high cost level could impede investment decisions regarding improved recovery. The committee acknowledges that a cost reduction on the Norwegian Shelf is completely necessary to reach the potential within improved recovery. Furthermore, the committee emphasises that this requires joint efforts from authorities and the industry.

4.3.1 Drilling and wells

The expert committee proposes several measures to alleviate a pressured rig market on the Norwegian Shelf. To ensure sufficient drilling capacity, the committee suggests that long-term drilling and intervention contracts are used to a greater extent, so capacity will increase quickly enough on mature fields. The committee believes that the rig fleet must be improved by establishing international standards and requirements with joint interpretation and application. The committee believes that it should be investigated whether it is possible to take the initiative for such standardisation through the EU or EEA. This could reduce the rig rates, which make up a significant part of drilling costs on the Norwegian Shelf. According to the committee, the rig costs for development and operations amounted to more than NOK 15 billion in 2009.

Drilling new development wells and maintenance of existing wells is a prerequisite for future production. The number of wells and the condition of the wells form the basis for possibilities for reserve growth and measures to improve the recovery rate from fields. In the short term, drilling and wells are crucial in order to recover as much as possible of the remaining oil in existing fields. At the same time, it has become more challenging and time-demanding to drill and complete new wells from the fields. The reasons for this are complex, but are both due to factors relating to the condition of existing wells to be drilled from and other factors in the subsurface, for example pressure changes.

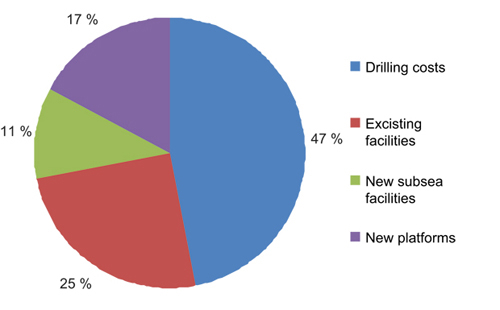

Drilling wells is the largest cost component in petroleum activities, cf. Figure 4.7. Drilling costs make up a large part of the costs in improved recovery measures, development and exploration. There is a great value potential in identifying and implementing cost-reducing measures associated with drilling on the Norwegian Shelf.

Increased rig rates are an important cause of the considerable growth in cost levels on the Norwegian Shelf in recent years. Econ Pöyry estimates that the cost level on the Norwegian Shelf has nearly tripled from 2004-2008. Even though the rig rates have declined somewhat after the peak towards the end of 2008, the level at the end of 2010 was still high. A comparison with the UK shelf carried out by Wood Mackenzie shows that the drilling cost per recoverable barrel is still more than 15 per cent higher on the Norwegian Shelf. No changes have been carried out in the HSE Regulations during this period that could have contributed to this development. The increase in rig rates is primarily considered to be caused by other factors in the rig market.

Figur 4.7 Distribution of investments in discoveries and fields in 2010.

Kilde: Ministry of Petroleum and Energy / Norwegian Petroleum Directorate.

The number of new production and injection wells has declined since the year 2000. The companies have not been able to carry out their planned drilling programs in recent years. The consequence is that a significant lag has built up in the drilling activity. Well maintenance – which is important for achieving established production plans, is also delayed because it takes longer to drill than expected, and few platforms can drill and carry out well maintenance simultaneously. It is important that the companies consider the possibility for using alternative methods for monitoring and maintenance of wells (well intervention) which do not require use of the fixed drilling equipment. For intervention in seabed wells, designated well intervention vessels have been built. The Ministry considers it important that more such vessels are built as it will free mobile drilling facilities for drilling development wells.

During the autumn of 2010, a total of 930 planned production and injection wells were reported for the period 2011-2020. Of these, about 310 will be drilled from fixed facilities. Drilling using the drilling facilities on the fixed installations is particularly important in realising the resources in the major oil fields. This is because most major oil fields are equipped with dedicated drilling rigs. Several of the fixed drilling rigs require upgrades and maintenance for the sufficient number of wells to be drilled. When upgrading and during maintenance of existing drilling facilities, it is important that the need for future wells is considered, both as regards challenges and number. In this connection, alternative drilling methods and new drilling technology must be considered, and necessary equipment must be installed in order to meet the challenges that are expected as the fields mature.

The Norwegian Petroleum Directorate, oil companies, consulting companies and other players point out that sufficient rig capacity will be a challenge on the Norwegian Shelf in the future. Many players point out that it is demanding to bring mobile rigs onto the Norwegian Shelf. Currently, about 30 mobile rigs operate on the Norwegian Shelf. In 2-3 years, many of the contracts will expire. Whether the rigs will then remain on the shelf remains unknown. A tight rig market, particularly after 2004, has led to several highly specific rigs being brought to the Norwegian Shelf. Of 21 semi-submersible rigs on the Norwegian Shelf, seven are equipped for drilling at water depths over 1000 metres. These are often not particularly suited for existing fields.

By increasing drilling capacity, costs can be reduced and the activity level can increase. Gains will be achieved directly through reduced rig rates and cheaper wells. At the same time, increased drilling capacity will mean more wells, and thus improved resource utilisation. The lack of the correct type rig could lead to fewer wells being drilled and/or that the drilling costs become unnecessarily high. This is particularly relevant for fields with long lifetimes and a significant need for wells.

The Ministry believes there is a need for more measures to improve the access to rigs and to limit the costs of drilling so the potential for improved recovery is realised. The exploration profitability will also increase through such measures. This is a task which requires measures mostly from the industry, but the authorities must also contribute.

The Ministry agrees with the committee that the capacity and efficiency of drilling activities will increase if the licensees to a greater extent agree to enter into contracts with more rigs on a more long-term basis. Within improved recovery, the potential for long-term contracts is particularly great. Players with wide portfolios of operating fields are especially suited for entering into such contracts. The Ministry therefore encourages such licensees to establish rig cooperation schemes, where rigs are contracted by several players on a long-term basis. The Ministry expects the industry to ensure access to sufficient vessels so the desired drilling can take place on the Norwegian Continental Shelf.

The Ministry believes that the Norwegian Shelf needs high rig capacity in order to realise the great potential in the existing fields. The future need for drilling on the fields is great. There should therefore be a basis for placing rigs adapted to Norwegian regulations on key fields that are adapted to the needs of these fields. The Ministry expects that the owners of the major fields will carry out such organisation. Many additional resources are time-critical and drilling must take place soon so as not to lose significant resources.

The Ministry agrees with the expert committee that it is desirable to increase the rig capacity on the Norwegian Shelf and to reduce costs. Improved flow of vessels involved in petroleum activities in the North-Atlantic onto the Norwegian Shelf is a measure that could contribute to this. The authorities will appoint an expert group in order to highlight and identify potential financial, industrial, regulatory or other obstacles to increasing rig capacity on the Norwegian Shelf and reducing costs. Through a comprehensive approach, the expert group will propose measures that could improve the flow of vessels involved in drilling on the Norwegian Shelf. A safety level equal to or higher than the current level will be used as a basis by the expert group.

In connection with developing fields, development and production with a fixed rig will be an alternative to hiring a mobile facility at moderate sea depths. Choosing a drilling solution depends on many factors. The number of wells and well interventions used as a basis has great significance. The geographical placement of the well as regards the production facility is another important Chapter, which is associated with the size and complexity of the reservoir. The cost picture also differs. Installation of fixed rigs requires considerable investments, while for mobile facilities the entire cost is continuous rig rent. It is important that these alternatives are considered by the licensees.

The Government will:

Appoint an expert group to highlight and identify obstacles that limit the rig capacity on the Norwegian Shelf and propose measures that could improve the flow of vessels involved in drilling on the Norwegian Shelf.

Encourage the licensees on the Norwegian Shelf to establish rig cooperation schemes, where rigs are contracted on a long-term basis.

Ensure installation of fixed rigs is considered by the licensees in connection with relevant, new developments.

4.3.2 Coordination

The expert committee proposes that the authorities, in cooperation with the petroleum industry, should carry out a thorough evaluation of the rewards associated with better coordination of fields on the Norwegian Shelf. The evaluation should emphasise the effect of coordination on profitability, including operating costs and the recovery rate on existing and surrounding fields. The analysis will form the basis for possible measures for better coordination on the Norwegian Continental Shelf.

There is extensive experience on the Norwegian Shelf with developing discoveries jointly, when this is most profitable. This type of solution is most manageable when the relevant discoveries have the same ownership. This could either be the case from the start or could be achieved through unitisation.

The Norwegian Petroleum Directorate has an important task in looking at development of new discoveries in an area context. Similarly, Gassco plays a part in looking at gas evacuation from new discoveries in a shelf perspective. When there could be advantages associated with a coordinated development of multiple discoveries, initiatives are made vis-à-vis the owners of the relevant discoveries to also evaluate the consequences of such a solution. Coordination could trigger major operational advantages that could provide both financial rewards and other benefits, such as making measures like power from shore more realistic.

The Government will:

Contribute to developments and fields being coordinated when this is the best solution as regards resource management.

4.3.3 Cost/benefit analyses in the event of new regulations/stricter practice

The expert committee has suggested that the authorities to a larger degree should highlight costs and benefits associated with changes in requirements and how they are put into practice for HSE and environmental measures, by establishing a transparent methodology along the lines of the Ministry of Finance’s guidelines for cost and benefit analyses. In this way, it will be easier to achieve a more comprehensive approach. The committee further suggests that, for late phase fields, the authorities must be cautious in stipulating new, costly and extensive requirements for HSE and the external environment, as this shortens a field’s lifetime and results in loss of values.

The Norwegian petroleum activities have shown good results both as regards safety and safeguarding the external environment. This is a result of targeted efforts over many years. As regards safety, functional risk-based regulations have been developed which emphasise prevention, safety and continuous improvement. National and international authority cooperation emphasising experience exchange and learning from accidents has also been an important factor. The activities are subject to strict requirements and instruments for both emissions to air and discharges to sea and for emergency preparedness for acute spills.

The considerations for health, safety and the external environment are important for all activity on the shelf. The stringent requirements for the safety level and safeguarding the external environment must be further developed. The safety regulations are an important reason why the Norwegian Shelf currently has facilities with high technical integrity and has had a positive development as regards safety. The Norwegian Shelf will continue to be a leader within safety. The extensive regulations established are a main reason for the activity having low emissions to air and discharges to sea compared with most other petroleum-producing countries.

In order to ensure a good basis for making decisions, e.g. in connection with regulatory amendments, the Instructions for Official Studies and Reports have been established. According to the Instructions for Official Studies and Reports, measures must be impact-assessed and the consequences must be quantified as far as possible. This applies for the petroleum sector in the same manner as for all other sectors. The overall effect of the factors included must be addressed. The consequences must be considered in relation to all overall or general considerations that could be of significance when assessing whether the measure should be implemented. Affected authorities should be included in the decision process before a decision is made.

The Ministry is concerned with good goal management in the sector, and is therefore concerned with ensuring that sound processes, pursuant to the Instructions for Official Studies and Reports, are implemented. It is important that cost/benefit analyses are used. These are important issues that the Ministry will continue to work on.

The Government will:

Further develop stringent requirements for the safety level and safeguarding the external environment on the Norwegian Shelf, also for fields in the late phase.

4.3.4 Joint effort to reduce operating costs

The cost level within Norwegian petroleum activities has grown significantly in recent years, and has reached such a high level that it could threaten the long-term development of the industry if the oil and gas price falls back to historic levels. Many profitable business opportunities could be lost if we do not achieve better cost control. The cost development experienced in recent years has a very complicated background and encompasses both international and domestic factors.

The expert committee directs several proposals to the industry. This includes a proposal for joint efforts to reduce operating costs on the Norwegian Shelf. Many of the other proposals directed at the industry also focus on reducing costs, including the need for standardising processes, solutions and adjustments in the contract regime. Controlling the cost level is mainly the industry’s responsibility. There are many different issues associated with market conditions, organisation of the activity and other factors that contribute to an unfavourable cost development.

The industry has established the KonKraft agency, where they cooperate on factors that are crucial to the further development of the Norwegian Shelf. Trade unions, suppliers and oil companies participate in the agency. An important part of the work in KonKraft involves directing focus to the oil and gas industry’s possibilities and challenges.

Improved recovery is an area in which the Ministry believes that KonKraft can make a positive contribution. Through its participants and composition, KonKraft is well-positioned to establish appropriate follow-up of the various areas where the industry is challenged by the expert committee to improve recovery. The Ministry has therefore requested that KonKraft prepare a proposal for processing/follow-up of the various proposals the expert committee has presented, as well as considering if, and potentially how, joint efforts to reduce operating costs on the Norwegian Continental Shelf can be organised. In total, KonKraft’s assignment encompasses 16 different proposals from the expert committee. This work is already underway in KonKraft.

The Government will:

Follow-up KonKraft’s work on following up the expert committee’s measures directed at the industry.

4.4 Measures – player composition and competition situation

The player scenario on the shelf has changed considerably over the last 15 years. This is partially the result of active policies from the authorities to bring in more and different players on the shelf, and partially an effect of consolidation in the industry. The development is described in more detail in Chapter 2.6 of the report.

4.4.1 Petoro and SDFI

The player composition and competitive situation is also a topic in the expert committee’s report. The majority of the committee suggests that Petoro should be strengthened through changes in the company’s current financing scheme. Furthermore, the committee believes that the authorities and licensees should to a greater extent carry out portfolio adaptations so that decisions that are crucial for improved recovery and value creation are more likely to be made, and also that the authorities must facilitate increased activity in the field transaction market.

On behalf of the State, Petoro is the administrator of the State’s direct financial involvement in the petroleum activities (SDFI). As a licensee, Petoro plays an important role as a licensee in the fields where the State has direct ownership.

The large mature fields make up the core of SDFI’s value creation. In 2009 and 2010, the company has increased its efforts to contribute to improved recovery from the mature fields. The Ministry finds it very important that this work be continued. An amplified effort from Petoro will also contribute to more measures for improved recovery being identified and implemented. Implementation of measures for improved recovery will have great significance as regards value for the State’s ownership interests. The financial lifetimes of the facilities are challenged through uncertainty in reserve bases and increasing costs. It is therefore important that the correct decisions are made at the right time to ensure maximum recovery and the best possible utilisation of existing infrastructure. The issues faced by the partnerships are complex, which requires Petoro to carry out considerable work for the contributions to be relevant. Petoro has pointed out certain fields which they will follow-up in particular. This is discussed in more detail in Chapter 9.

The Ministry is concerned with providing Petoro with sufficient resources so the company can contribute increased value creation to the State. The Ministry furthermore believes that the State’s budgeting system ensures a unified and comprehensive assessment of the State’s expenses for different purposes. The financing of Petoro should, along the lines of other purposes in the State budget, be subject to this important principle. The State budget system is not an obstacle for strengthening Petoro for the future through increased allocations or by varying the allocations from year to year as needed.

The Ministry believes that a well-functioning second-hand market for field interests will contribute to ensuring that companies which see the greatest value creation potential in a field become owners. The company that sees the greatest potential in a field will be willing to pay the most for an interest in the field. A functioning second-hand market is therefore positive and desirable from a resource management perspective.

Along with the tax and fee system, SDFI will secure the State a high percentage of value creation on the Norwegian Shelf. SDFI is not an instrument for facilitating increased activity in the second-hand market. Certain adjustments in the SDFI portfolio could become relevant, e.g. to promote cost-effective coordinated solutions for fields.

The Government will:

Strengthen Petoro’s expertise for following up mature fields.

4.4.2 Tax treatment of exploration costs

The expert committee notes that the increase in new companies focusing on exploration may have resulted in a weakened focus on operating fields/improved recovery. They suggest a review of the scheme whereby companies can apply for reimbursement of the tax value of exploration costs, to examine the effect it has had on operating fields.

The petroleum taxation system is built on the rules for normal company taxation. It is designed to have a neutral effect on the companies’ decisions regarding development and operation. This means that decisions that are profitable for the companies before tax must also be profitable after tax. Due to the extraordinary profitability in the recovery activities, the activity has also been subject to an additional special tax. The ordinary tax rate is, as on land, 28 per cent. The special tax rate is 50 per cent. In the basis for ordinary tax and special tax, depreciation and all relevant costs4 are deducted from the taxable income. In order to shield the average rate of return from special tax, an extra investment-related deduction is provided (so-called uplift) in the calculation basis for special tax. There is fiscal consolidation between different fields. Companies that are not in a tax position can carry forward deficits and uplift with interest. In the event of cessation, these elements can be transferred.

From the 2005 income year, a change was implemented in the tax treatment of exploration costs for companies that are not in a tax position. The scheme is based on the companies, instead of carrying forward deficits with interest, can demand reimbursement of the tax value of exploration costs in connection with the tax assessment. This means that companies in and outside tax positions are treated equally as regards exploration costs. The scheme makes it easier for companies that are not in tax position to finance exploration activity.

The Ministry believes that a reimbursement scheme for the tax value of exploration costs has been very important, especially to stimulate timely exploration in mature areas. The equal tax treatment of players in and outside tax positions as regards exploration costs is a policy the Ministry wishes to continue.

4.5 Measures – technology development

The expert committee has proposed several measures within technology areas such as drilling and wells, advanced injection methods, subsea solutions and reservoir mapping. The committee e.g. recommends that the companies should to a greater extent test advanced recovery methods such as injection of surfactants5, low-saline water and CO2. These technologies are particularly important to recover the significant amount of immobile oil, and can contribute significantly to improved recovery on the Norwegian Shelf. Many of the methods have shown a great potential for improved oil recovery from onshore fields in the US and China, for example, but have not been widely used offshore. Several promising technologies have also been developed through laboratory studies and simulations, but they remain to be tested at a larger scale on the fields. CO2 for improved recovery will, in the long-term, be significant for resource utilisation on the Norwegian Shelf. It will therefore be natural to see CO2 storage from Norwegian sources in connection with possible future use of the gas as a recovery measure.

The committee recommends, for instance, that the authorities should establish a forum for cooperating on pilot projects with participation from the most important players and decision-makers on the shelf. The committee also recommends strengthening DEMO2000. In the submissions to the recovery committee’s report, there is general agreement on the need for more pilot testing and technology development on the Norwegian Shelf.

New technology and new solutions will be necessary in many cases to mature new profitable reserves and to realise the great potential from improved recovery on the Norwegian Shelf. The State, as resource owner, has an important role to play as an initiator and facilitator to ensure that all possibilities for improved recovery and increased value creation are considered before the fields are shut down. Through SDFI and the tax system, the State assumes considerable risks, costs and value creation from improved recovery measures.

Since the fields and infrastructure have limited lifetimes, it is crucial that pilot testing starts quickly. Reports from the companies to the Norwegian Petroleum Directorate indicate that a significant number of pilots have been delayed or will not be carried out. There could be several reasons for the downgrade of pilots. For example, the companies seem to prioritise ordinary operations over pilot testing, which often entails higher technical and financial risk. Furthermore, the current development projects are smaller than before, and are not as financially equipped to carry out development and testing of new technology.

State co-financing of pilots could contribute to acceleration and realisation of several socio-economically profitable projects. There is often a transfer value from a pilot on one field to other fields. The owners of individual fields will not take this into account when deciding whether or not to carry out a pilot. Significant resources are at stake for the State as resource owner. If the market is unable to bring about sufficient new technology or pilots, the authorities should implement various measures.

The Ministry agrees with the committee that more production licenses/companies should jointly plan pilots. With more small players and discoveries on the Norwegian Shelf, coordination of new technology testing across the licenses will be even more important than before. Through FORCE, the Norwegian Petroleum Directorate has taken an initiative to facilitate such cooperation. The agency currently consists of 35 oil and gas companies that are willing to explore the possibilities for sharing costs and results in connection with field pilots. Through FORCE, the Ministry will continue to bring forth more pilots and, along with key players on the Norwegian Shelf, work for increased efforts regarding testing new technology on the Norwegian Shelf.

As there are considerable volumes of oil that are difficult to recover with conventional technology, advanced technology that can retrieve these resources must be prioritised and advanced. There will therefore be a special need to propose pilot tests within advanced injection methods to recover more of the difficult oil. These issues are discussed in more detail in Chapter 8.7.

The Government will:

Work for increased efforts on testing new technology together with key players on the Norwegian Shelf.

Consider establishing a research centre within improved recovery.

4.6 Infrastructure – use and further development

This Chapter addresses two elements of the infrastructure on the continental shelf. The first Chapter addresses use and further development of the gas transport system. The other element addressed here is the regulations associated with conditions for using others’ facilities.

4.6.1 The Norwegian gas transport system – organisation and regulation

The Norwegian gas transport system consists of a network of pipelines with a total length of about 8000 km, six landing points in four countries (the UK, Germany, Belgium and France), as well as four Norwegian onshore gas treatment facilities (Kårstø, Kollsnes, Nyhamna and Melkøya). Gas export in the form of liquefied natural gas (LNG) on ships from Melkøya enables Norwegian dry gas to reach markets outside Europe. To date, more than NOK 260 billion has been invested in the network, calculated at current value.

The transport capacity in the Norwegian gas transport system depends on a number of factors, such as pressure and temperature. The total available capacity for Norwegian export of dry gas through pipelines is about 370 million scm per day. This amounts to 120 billion scm per year. In addition, LNG amounting to more than 10 million scm per day is exported from Melkøya. An additional 9 million scm is used per day in this country for power and heating, for methanol production at Tjeldbergodden or transported to the Grane or Tyrihans fields as injection gas to increase oil production. Gas is also used for injection on other fields on the Norwegian Shelf to increase oil production.

The operator of the gas transport system, Gassco, prepares a transport plan every year which analyses the total need for gas transport up to 15 years into the future. Future production is uncertain. Unlike previous years, last year’s transport plan represented a clear change in that new discoveries are not replacing reduced production from existing fields, even when prognoses from all discoveries on the shelf are included. Part of the reason for this is that the resource estimates in certain discoveries and fields have been reduced.

The infrastructure for gas transportation from the Norwegian Shelf has been gradually further developed in connection with development of new fields. These have been fields with significant amounts of gas which have warranted major investments in dedicated transport solutions. Building pipelines is a costly endeavour, and investments in the transport system provide considerable scale advantages. The gas transport system can be characterised as a natural monopoly with major basic investments. There is need for regulated access and tariffs in the system to ensure equal access to the system for everyone with gas transport needs.

The gas infrastructure is utilised by multiple users and organised in an integrated manner with a joint ownership structure through Gassled. The operating responsibility for the gas pipelines and transport-related gas treatment facilities lies with Gassco, a limited company wholly-owned by the State. This organisation results in efficient use of the gas transport system and reduces operating costs. The goal is efficient utilisation of the gas transport capacity, as well as ensuring easy access to available capacity for the users and at the tariffs stipulated by the authorities.

The gas transport system is neutral for all players with a need to transport natural gas. Natural gas companies and qualified users have a right to access on non-discriminating, objective and transparent conditions. These users have access to capacity in the system based on their need for gas transport. Gassco is responsible for capacity allocations and for ensuring that transport rights are transferred between users as needs change.

The returns from the gas transport infrastructure are regulated by the authorities. This ensures the earnings are extracted on the fields and not in the transport system. Tariffs in newer pipelines are stipulated so the owners can expect real returns of about seven per cent before tax on the total capital, with a possibility of minor additional income to stimulate increased utilisation and cost-effective operations. The tariffs provide the owners with reasonable returns while also preventing additional profits from being taken out in pipelines and treatment facilities.

The Ministry determines the main principles for access to the transport system and stipulates tariffs for its utilisation. In 2008, the Ministry initiated an extensive review of the access regime. So-called interruptible capacity will be introduced. The current rules giving pipeline owners priority when reserving available capacity will be revoked. This will ensure more efficient utilisation of the gas transport system and equal treatment of all companies that produce natural gas on the Norwegian Shelf. The Ministry will establish an expert board to independently resolve disputes in individual cases where there is disagreement regarding access to the gas transport system.

The majority of the gas transport system on the Norwegian Shelf is owned by the Gassled partnership. The Gassled owners have traditionally been companies that produce gas on the Norwegian Shelf. As an operator, Gassco carries out activities on behalf of the partnership at the participants’ cost and risk. Thus, Gassco has no earnings. Companies wishing to transport gas pay transport tariffs designed to cover the direct costs of operating the transport system, as well as provide the owners with reasonable returns on the transport system investments.

The authorities’ goal is for third-party use of gas pipelines and associated facilities to take place based on tariffs and conditions stipulated by the Ministry and laid down in the tariff regulations. In instances where third-party use of gas pipelines and associated facilities that are not already included in the tariff regulations is considered, the Ministry will include these facilities in the regulations. The issue of operator responsibility for the relevant facility will also be considered in such cases.

Gassled includes all rich and dry gas infrastructure currently in use, as well as so-called third-party use, i.e. where plans include transport of gas in the infrastructure by a party other than the owner. The system accommodates incorporation of new pipelines and transport-related facilities in Gassled from the time third-party use becomes relevant, and new facilities can thus become a part of the central upstream gas transport system. Joint ownership of the entire transport system ensures the gas is transported as efficiently as possible, thus providing maximum value creation. This is due, in part, to the fact that it allows to avoid conflicts of interest as regards which pipeline the gas will be transported through.

The users pay for the operation of the transport system through tariffs. The users also make a significant contribution to further development of the transport system through participation in various investment groups. There has been a need to strengthen the users’ opportunities for voicing their views on how the system should be operated and developed. The Ministry has therefore asked Gassco to strengthen the existing user forum in the system. The forum will provide recommendations to Gassco in matters related to technical operation, use and further development of the system. The user forum will also endorse the part of Gassco’s budget which deals with operations and further development. The forum does not have a mandate to make decisions.

Through introduction of regulated tariffs, third party access and establishment of an independent operator, the owners’ influence over the transport system has been reduced. This has led to a reduced interest in participation in Gassled on the part of some of the traditional owners. ExxonMobil recently sold out of Gassled. Several other owners have started sales processes. The company which ExxonMobil sold its share to, Njord Infrastructure AS, represents a new type of owner in Gassled because this company is primarily entering the owner side for financial reasons. The Ministry has consented to this transfer, but has stipulated requirements as regards certain aspects of the buyer’s financing and organisation. It is important to the Ministry to have a diversified ownership in Gassled in the years to come, e.g. to distribute the financial responsibility among more participants.

Licensees must have the necessary qualifications to carry out their tasks in a responsible manner. Which specific qualifications are necessary depends on what type of tasks will be carried out. Different qualifications are required for owners in a transport system such as Gassled than for owners in production licenses. The fact that Gassled has a competent and independent operator (Gassco), that the activity regulates returns, that new infrastructure can be developed and financed outside Gassled and that there is open, non-discriminatory access to the system, all contribute to define the role and tasks of an owner in Gassled. This framework will be reflected when determining the necessary qualifications and financial capacity for an owner of the system.

Considerable investments have been made in the gas infrastructure on the Norwegian Shelf. Significant gas volumes are needed for new gas infrastructure to be realised. Given the large investments required to build new gas infrastructure and the relatively low transportation costs in existing systems, the oil and gas companies will have incentives to use existing gas infrastructure when considering different transport alternatives for new gas. In the event of full capacity utilisation in transport and/or gas treatment facilities, the companies will face the choice of delaying gas evacuation until capacity becomes available in the existing infrastructure, injecting gas in reservoirs which could contribute to improving oil recovery, or building new gas infrastructure. The most important elements in such an analysis are:

When capacity will become available in the existing infrastructure

Costs of new gas infrastructure

How the gas evacuation solution impacts oil production

It is therefore advantageous for the development of the gas transport system to have a regular activity level on the shelf, continuously adding resources both from improved recovery, development of new discoveries and new resources from the exploration activity.

There are two characteristics of the Norwegian Shelf that will impact the development of the gas infrastructure in the future. Development of new areas located north of existing pipeline grids will require new gas infrastructure, while production from existing gas fields is also declining.

The trend towards smaller discoveries will make it more challenging to justify strengthening and further development of existing infrastructure. It could also be necessary to consider phase-out of the infrastructure unless new major discoveries are made within a reasonable time. When dismantling and phasing out parts of the gas infrastructure have started, this will make a potential need for transport capacity for subsequent discoveries more expensive. It could be challenging to reinstate pipelines and process facilities that have not been operating for a period of time due to lack of competence, deficient maintenance and technically-outdated equipment.

A comprehensive further development of the gas infrastructure is an important tool to ensure efficient resource management on the Norwegian Shelf. Various forms of market failure could lead to a disparity between the companies’ view on efficient infrastructure development and the authorities’ view. Sources of market failure could include coordination problems between the different partnerships and the licensees or different strategic interests.

Boks 4.2 New gas infrastructure in the Norwegian Sea

Due to the responsibility for comprehensive further development of the gas transport system, Gassco has the authority to finance studies on new infrastructure until the relevant concept is defined and found feasible. Then Gassco must promote the project to find companies willing to invest in further realisation of the project. The final investment decision is made at a later time during the process.

The rich gas pipeline from Åsgard to Kårstø (Åsgard transport) will for a period in the future be a bottleneck for gas transport out of the Norwegian Sea. So far, new discoveries have not been made in the Norwegian Sea of a size which would justify a new, larger infrastructure development consisting of a landing pipeline, gas treatment facility and export pipeline. However, multiple discoveries in the Norwegian Sea could require transport solutions as early as 2016-2017, depending on a development decision. Åsgard transport does not have the capacity to transport new gas until after 2021. If these discoveries are to be developed according to the licensees’ plans, existing infrastructure must be used, or new infrastructure must be developed.

Gassco has worked on studies regarding increased transport capacity for new volumes out of the Norwegian Sea. These studies have been carried out in close cooperation with Statoil and Shell, who are the operators of Luva and Linnorm, respectively. These two discoveries form the primary basis, but other possible gas volumes in the Norwegian Sea have been considered.

The main topic of the studies has been to research a new pipeline for Nyhamna, as well as consider how to increase the capacity in Langeled and Nyhamna. Furthermore, possibilities for a pipeline connection between existing infrastructure around Åsgard transport and a new pipeline for Nyhamna have been considered. Gassco has also researched landing to Nordland and LNG transport, but these alternatives have been rejected due to high costs.

There are several challenges associated with a gas evacuation solution from the Norwegian Sea. In addition to technological challenges associated with e.g. deep water, wave height, high temperatures and pressure in the reservoirs, there are significant distances between the gas discoveries. Some of the discoveries also have a higher CO2 content than the prevailing specification requirements for the gas recipients. This means that the CO2-rich gas must be mixed with more CO2-poor gas and/or dedicated technical solutions to separate CO2 must be established.

Several companies with shut-in gas volumes in the Norwegian Sea have reported an interest in financing further studies of gas transport capacity out of the Norwegian Sea.

As the shelf matures and fields being developed become smaller, coordinating infrastructure projects across production licenses will become increasingly important. The authorities have therefore emphasised playing an active role in the development of gas infrastructure on the Norwegian Shelf. Gassco is a key player in this effort. The company possesses extensive knowledge about gas transport and unique familiarity with the system the company is operating. This, in combination with Gassco’s position as an independent player without ownership in production licenses or transport systems, makes the company suited to coordinate interests across production licenses and thus safeguard overall shelf considerations. Since its start in 2001, Gassco has had a regulatory responsibility to further develop the gas transport system on the Norwegian Shelf. This responsibility has been clarified further through regulatory amendments.

The Ministry receives sufficient information regarding new infrastructure projects early on. The Ministry is then able to ensure that the studies deemed necessary by the authorities are carried out. This ensures the best possible basis for making decisions when the authorities process plans for installation and operation of new infrastructure projects. Gassco’s assessments will be one of several important contributions to the authorities’ comprehensive assessment of a submitted plan for installation and operation. The decision to apply for permission for installation and operation, and choice of the development solution to be included in such an application, must still be made by the licensees.

In the years to come, further development of infrastructure will consist of smaller, but still relatively extensive projects, such as removing bottlenecks in the gas transport system and making it more robust. In addition, the infrastructure must be able to receive gas with a different composition than before, for instance, with higher H2S and CO2 content.

Gassco will contribute to a comprehensive further development of Norwegian gas infrastructure. In instances where larger developments are considered, it is therefore important to have an area perspective so that smaller discoveries are also included in the assessments. A further development of the gas infrastructure must also take place in a manner which serves the existing gas infrastructure.

Norwegian gas activities make up an important part of the petroleum sector and generate considerable value for the Norwegian society. It is important that the infrastructure operation is cost-effective, as this could contribute to ensuring that new discoveries are attractive.

The Government will:

Regulate access to and tariffs in the gas transport system and ensure equal access for everyone with gas transport needs.

Establish an expert board to resolve disputes in individual cases where there is disagreement regarding access to the gas transport system.

Strengthen the existing Gassled user forum to ensure that the users’ views on how the system is operated and developed are voiced.

4.6.2 Third-party use of facilities

A more mature continental shelf sets strict requirements for efficient use of infrastructure as regards resource management. It is the authorities’ responsibility to facilitate predictable and reasonable conditions for use of facilities by others, as well as contributing to efficient negotiations. The Ministry laid down the Regulations relating to use of facilities by others (TPA Regulations) in 2005. Based on the consideration for good resource management, the purpose of the regulations is to ensure good incentives for exploration, new field development and improved recovery through efficient negotiation processes and appropriate profit sharing in connection with use of existing facilities. The introduction of the regulations has contributed to easier realisation of time-critical resources near planned and existing infrastructure.

This will be achieved through providing a clear framework for the negotiation process and the design of tariffs and conditions in agreements relating to the use of facilities by others. With smaller developments, use of existing facilities will often be a prerequisite in order to achieve acceptable profitability. In this phase, it is very important that the infrastructure owners allow third-party use of available capacity.