5 Ocean-based industries and value creation in the Norwegian Sea

The Government presented its Ocean Strategy, New Growth, Proud History, on 21 February 2017. The main objective of the strategy is to maximise sustainable value creation and employment in the ocean-based industries. Norwegian ocean-based industries are to be further developed on the basis of already existing industries and in the interactions and interfaces between these industries. The Government will continue to give priority to industries where Norway has competitive advantages, and will stimulate research, innovation and technology development to promote emerging industries. We will seek to provide good framework conditions by continuing and further developing effective, predictable and knowledge-based regulation of these industries. We will also strengthen the international competitiveness of Norwegian ocean-based industries by providing assistance in the fields of market access, internationalisation and image-building.

To clarify the overall framework and encourage closer coordination and clear priorities for management of the Norwegian Sea, it will be necessary to carry out an integrated, updated assessment of the ocean-based industries and value creation associated with the area. This chapter discusses established, emerging and future industries in the area and their contribution to value added, and provides an overview of the management and framework conditions by sector. Together with Chapter 3, it forms a basis for facilitating further value creation and food security, and for maintaining the high environmental value of the Norwegian Sea in line with the purpose of the management plan.

As part of the work on the scientific basis for the management plan, the Forum for Integrated Marine Management obtained figures for value creation in 2014 by county from Statistics Norway, which are presented in Table 5.1. The figures indicate value added and employment in core activities and for the largest companies in the direct supplier industry for each sector, but do not include wider spin-off effects. The sections on individual ocean-based industries also quote some national figures for value added and employment from 2016 that do include spin-off effects.

Table 5.1 Value added and employment in ocean-based industries associated with the Norwegian Sea in 2014 (core activities and largest companies in the direct supplier industry for each of them), not including wider spin-off effects

Value added 2014 | Employment 2014 | |||

|---|---|---|---|---|

Industry | NOK billion | % of total in Norway | 1000 persons | % of total in Norway |

Seafood | 19.9 | 49 % | 14.8 | 46 % |

Petroleum industry | 219.6 | 30 % | 42.2 | 30 % |

Shipping | 4.4 | 11 % | 5.0 | 11 % |

Source Statistics Norway

In terms of both value added and employment, the petroleum industry is by far the largest industry in the Norwegian Sea. The next largest is the seafood industry, which is responsible for almost half the total national value added generated by activities in and along the coast of the Norwegian Sea. Other important activities in the region are shipping and tourism.

Since 2014, value added in the petroleum and maritime industries has declined due to the drop in oil prices, whereas value added in the seafood industry has grown, due among other things to a weaker krone and higher demand. Employment is more stable, but this too changes from year to year. The number of people employed in the petroleum and maritime industries has declined since 2014, but has risen somewhat in the seafood industry.

Work on the figures for value added in the scientific basis for the management plan is ongoing.

5.1 Fisheries and aquaculture

For hundreds of years the fisheries have been a major source of income and played a vital part in the culture of Norway’s coastal communities. Today Norway is one of the world’s largest exporters of seafood from fisheries and aquaculture.

5.1.1 Activity in the Norwegian Sea

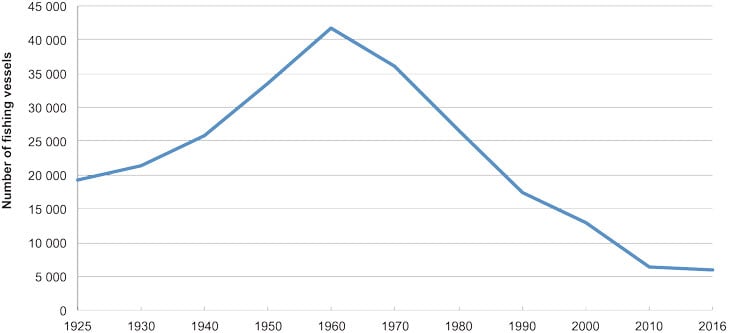

The four counties bordering on the Norwegian Sea account for a major share of Norway’s total activities in the fisheries sector. In 2015, 44 % of all Norwegian fishing vessels were registered in one of these four counties, and in several of the smaller towns and built-up areas along the coast fisheries and aquaculture are the most important industries in terms of settlement and employment. In its broadest sense, the sector includes all areas of the fisheries and aquaculture industries, including everything from fishing operations and fish farming to processing and exports, and also service and supply industries. The number of fishing vessels has declined over the last few decades, but their average size has grown (Figure 5.1). There is still a potential for further restructuring and rationalisation of the industry, but the reduction in the number of vessels has slowed in recent years.

Figure 5.1 Number of Norwegian-registered fishing vessels.

Source Directorate of Fisheries

The largest fishery in the management plan area is the herring fishery, which starts in the first three months of the year off the Møre coast and moves northwards and eastwards to the Barents Sea in the course of the year. There is a good deal of bottom trawling on the Halten and Sklinna banks and along the edge of the continental shelf. In the latter area there is also a considerable amount of fishing with gill nets and longlines. Greater argentine is harvested at the Sklinnadjupet trough. The main fishery around Jan Mayen is for shrimps, but there is also some pelagic fishing.

Under the Aquaculture Act a licence is required to operate a fish farm, and only limited numbers of licences are issued for the commercial production of salmon, trout and rainbow trout in seawater. Since the 2009 round of awards, increasing attention is being paid to environmental considerations, and there is political agreement that further growth in the aquaculture industry must be environmentally sustainable. Awards in the 2013 round (‘green licences’) were granted to the companies with the best plans for dealing with the problems of infection with sea lice and escapes of farmed fish. In 2015 the Government introduced a system of development licences intended to promote the commercialisation of innovative concepts for solving environmental problems and issues relating to spatial management in the aquaculture industry.

On 26 January 2017, there were in all 978 approved locations for seawater salmon farming in the country as a whole. Just under half of them (457) were located along the coastline of Møre og Romsdal, Sør-Trøndelag, Nord-Trøndelag and Nordland counties.

In 2015, the Government published a white paper on predictable and environmentally sustainable growth in Norwegian salmon and trout farming (Meld. St. 16 (2014 – 2015)) describing how it intends to facilitate predictable growth in the fish farming industry. Growth in salmon farming will in future be regulated by means of a new system for adjusting capacity based on defined production areas and environmental indicators. The new system is intended to ensure that growth will only take place where the environmental impact is acceptable.

Considerable advances have been made in aquaculture technology, both in the further development of equipment and in devising innovative concepts. Open net pens in coastal waters have been the main form of production until now, but semi-enclosed systems and offshore systems are being developed (see section 5.5.3).

5.1.2 Value added

The statistics for 2015 show that the landed value of fish and shellfish delivered by Norwegian vessels was NOK 16.9 billion (2.3 million tonnes). The landed value for aquaculture was NOK 46.7 billion (1.4 million tonnes).

The value added generated by the Norwegian seafood industry is assessed regularly. The industry is defined as the sum of the aquaculture- and fisheries-based value chains and all direct and indirect suppliers of goods and services to the various links in the chain. The value chains are made up of four industries: fisheries, aquaculture, fish processing, and export and trade in seafood. An analysis by SINTEF of value added based on 2014 figures showed that the Norwegian seafood industry as a whole, including spin-off effects, generated NOK 65.7 billion in value added, and provided 51 800 person-years of employment, 26 200 of which were directly linked to the industry and 25 600 to associated activities.

In 2014, fisheries and aquaculture along the Norwegian Sea generated NOK 19.9 billion in value added and employed 14 800 people, not including wider spin-off effects (see Table 5.2).

Table 5.2 Value added and employment in the seafood sector in the counties bordering on the Norwegian Sea in 2014

Industry | Value added 2014 | Employment 2014 | ||

|---|---|---|---|---|

NOK billion | % of total in Norway | 1000 persons | % of total in Norway | |

Fisheries | 3.8 | 39 % | 4.0 | 39 % |

Aquaculture | 8.1 | 48 % | 3.2 | 47 % |

Fish processing | 5.9 | 60 % | 5.7 | 53 % |

Production of crude fish oils and fats | 0.0 | 39 % | 0.1 | 39 % |

Wholesale of fish, -crustaceans and molluscs | 0.8 | 44 % | 0.7 | 43 % |

Supply industries | 1.2 | 49 % | 1.2 | 46 % |

Total | 19.9 | 49 % | 14.8 | 46 % |

5.1.3 Pressures and impacts of fisheries and aquaculture on the environment

Fisheries affect both the fish stocks that are harvested and the ecosystem as a whole. The aim of fisheries management is to minimise the negative impacts of harvesting through long-term, sustainable management strategies. Although unintentional bycatches are an unavoidable consequence of fisheries activities, new methods of minimising the impacts are constantly being developed.

Fisheries can also have unintentional impacts on benthic communities, especially in connection with bottom trawling in areas with coral reefs or other valuable benthic fauna. However, the reduction in the number of bottom trawlers and trawling hours in the Norwegian Sea since 2009 (see Table 5.3) indicates that the impact on benthic communities has been lessened.

Table 5.3 Number of bottom trawlers and trawling hours in the Norwegian Sea

Norwegian vessels (over 24 m) | 2009 | 2012 | 2015 |

|---|---|---|---|

Number of bottom trawlers | 60 | 57 | 44 |

Number of trawling hours | 42 720 | 24 914 | 13 469 |

Source Directorate of Fisheries

In 2011, regulations on bottom fishing were introduced for areas under Norwegian jurisdiction. They prohibit bottom fishing in areas over 1000 metres in depth unless the vessel has a special permit for experimental fisheries from the Directorate of Fisheries. Such permits are only issued if the vessel has submitted detailed plans for collecting data on vulnerable benthic habitats and harvesting, including plans for avoiding damage to vulnerable marine ecosystems. The regulations also require all fishing vessels to keep detailed records of any contact with vulnerable habitats regardless of water depth, report such contact to the Directorate of Fisheries and move at least 2 nautical miles away from the area concerned before resuming fishing. Up to 2016, vessels were required to report any catches containing more than 60 kg live coral and 800 kg live sponge. In 2016 these limits were further reduced, and are now 30 kg live coral or 400 kg live sponge per haul or catch.

The regulations relating to sea-water fisheries contain a general requirement to show special care during fishing operations near known coral reefs. Four coral habitats in the Norwegian Sea are closed to bottom trawling: the Iverryggen and Sula reefs, the Træna reef and the Breisunddjupet area. The Iverryggen and Sula reefs have been designated as particularly valuable and vulnerable areas, and Breisunddjupet is situated in the Møre banks area. The Træna reef and Breisunddjupet have been closed to bottom trawling since 2010.

In 2016, all areas that were already closed to bottom trawling were designated as marine protected areas, and a further nine were established in Norway’s exclusive economic zone under the Marine Resources Act. There are now a total of 18 marine protected areas for corals in Norway’s exclusive economic zone.

5.1.4 Management and framework

As a coastal state and steward of living marine resources, Norway has national and international commitments under international law. The following are among the most important international agreements to which Norway is a party:

The 1982 Convention on the Law of the Sea

The 1995 United Nations Fish Stocks Agreement

The 1992 UN Convention on Biological Diversity

The 1995 Code of Conduct for Responsible Fisheries drawn up by the Food and Agriculture Organization (FAO).

It is a guiding principle that management of marine resources should be based on the precautionary approach in accordance with international agreements and guidelines, and on an ecosystem approach that takes into account both habitats and biodiversity. These commitments are emphasised in Norway’s Marine Resources Act.

The Marine Resources Act regulates all harvesting and other utilisation of wild living marine resources and the genetic material derived from them. Under the Act, the authorities must evaluate which management measures are necessary to ensure sustainable management of these resources.

In the years to come, we expect that measures to reduce unregistered mortality in fisheries and at the same time their impacts on ecosystems will be further developed. Knowledge about fish stocks is likely to increase, and scientific advice will be based on more complex ecosystem considerations.

Textbox 5.1 National regulation of fisheries

Once negotiations with other countries have been completed, it is clear how much of each stock Norway can harvest in the subsequent year, and the rules for the Norwegian fisheries can be adopted. The Directorate of Fisheries draws up proposals for quota regulations, which are discussed at an open consultative meeting where a broad range of business associations and interest organisations are represented. On the basis of these processes, the directorate sends draft regulations to the Ministry of Trade, Industry and Fisheries, which adopts the quota regulations unless the directorate itself is authorised to adopt them.

The regulations contain provisions on the allocation of quotas to vessel groups and individual vessels, the allocation of quotas for specific periods, bycatches, and so on. In addition to the annual quota regulations, Norway has a number of permanent national and local regulations. For example, there are regulations on position reporting and electronic transmission of reports for Norwegian fishing vessels, which lay down provisions on tracking and reporting. The regulations relating to sea-water fisheries include provisions on the use of gear, types of gear, mesh sizes, minimum sizes, the ban on discards and requirements to use sorting grids, and the regulations relating to bottom fisheries include provisions on the protection of vulnerable benthic habitats.

The International Council for the Exploration of the Sea (ICES) promotes and coordinates marine research in the North Atlantic area and disseminates the results. ICES provides advice on proposed management strategies and recommends total allowable catches (TACs) for the various fish stocks every year. The Norwegian Institute of Marine Research participates actively in ICES. It provides mapping data and data from scientific cruises, and performs a significant amount of the research on which ICES advice is based.

Almost all the fish stocks harvested in Norway are also found in other countries’ zones, which makes international cooperation on their management essential. There are a number of forums for international cooperation on the Norwegian Sea, the most important of which is the North East Atlantic Fisheries Commission (NEAFC) (see Box 5.2). In addition, Norway has a number of agreements with other coastal states on the distribution and management of stocks of Norwegian spring-spawning herring, mackerel, blue whiting, beaked redfish and capelin off Iceland, Greenland and Jan Mayen.

Textbox 5.2 Management cooperation under the North East Atlantic Fisheries Commission (NEAFC)

The NEAFC promotes long-term conservation and optimum utilisation of the fishery resources of the Convention Area. Its most important function today is to promote the development of good regional control and enforcement schemes and a more ecosystem-based approach to management of the relevant sea areas. The Commission’s primary function with regard to stocks that migrate between different countries’ exclusive economic zones and international waters is to coordinate the regulation of fisheries. These are mackerel, blue whiting, Norwegian spring-spawning herring and beaked redfish.

The parties to the NEAFC are Denmark, representing the Faroe Islands and Greenland, the EU, Iceland, Norway and Russia. The NEAFC Convention applies to all fishery resources in the Convention Area apart from marine mammals and, insofar as they are dealt with by other international agreements, highly migratory species (such as tuna).

The NEAFC has taken active steps to adapt to developments in the Law of the Sea, in accordance with the precautionary principle and the ecosystem approach. The organisation has implemented a comprehensive system for satellite tracking of fishing vessels in the North-East Atlantic and operational rules on the protection of sensitive marine ecosystems.

5.2 Shipping

The Norwegian Sea is an important area for freight traffic in Norway, and several of the country’s largest ports lie along the Norwegian Sea coastline.

5.2.1 Maritime transport in the Norwegian Sea

Six of Norway’s 10 largest dry bulk ports border on the Norwegian Sea. Narvik is Norway’s next largest port and by far the largest dry bulk port, and handles 17.5 million tonnes gross weight of goods every year. Substantial volumes of dry bulk are also shipped from the ports of Rana, Kristiansund, Trondheim, Molde and Brønnøysund (Table 5.4).

Table 5.4 Annual gross weight of goods handled in the largest ports bordering on the Norwegian Sea in 2015, in tonnes

Narvik | 17 558 820 |

Kristiansund | 7 072 499 |

Rana | 4 839 872 |

Molde | 4 735 284 |

Trondheim | 4 128 372 |

Brønnøy | 1 888 653 |

Ålesund | 1 529 325 |

Mosjøen | 1 286 522 |

Source Statistics Norway

Kristiansund, Molde and Bremanger are also major wet bulk (petroleum) ports, and substantial volumes of general cargo are shipped through the ports of Kristiansund, Rana, Trondheim and Ålesund. Ålesund is a particularly important port for the fisheries industry and Bodø and Trondheim are important hubs for goods transport in their regions.

In 2015 the volume of shipping in the Norwegian Sea was just over 13 million nautical miles measured as total distance sailed, which is 31 % of the total volume of shipping in Norwegian sea areas. The volume of shipping is larger than that in the Barents Sea – Lofoten area but smaller than that in the North Sea – Skagerrak area. General cargo ships and passenger ships account for the greatest distance sailed in the Norwegian Sea, and make up 23 % and 32 % of the total respectively. There is also a considerably higher proportion of small vessels in the Norwegian Sea in terms of distance sailed than in other Norwegian sea areas. There has been a considerable improvement in the underlying shipping data since 2009, partly due to the further development of AIS base stations along the coast and the launching of AIS satellites, a factor that makes it difficult to assess the trend in shipping volumes since 2009.

Shipping density is highest in the fairways along the coast and in the southern Norwegian Sea. A relatively large proportion of shipping in the Norwegian Sea is in transit, in other words passing through without calling at any ports.

The volume of shipping in the Northeast Passage may influence shipping density and traffic patterns in the Norwegian Sea. Even though the ice is melting faster than previously expected, and ships can sail north of both Russia (through the Northeast Passage) and Canada/the US in summer, the volume of traffic is so far moderate. In 2013, 71 ships passed through the Northeast Passage, but in 2014 and 2015 the numbers dropped to 31 and 18 ships respectively. It is difficult to predict future traffic volumes through the Northeast Passage, but the recent decline may be a sign that previous predictions about the profitability of using this route were too optimistic.

According to forecasts in a marine safety analysis (2015) by the Norwegian Coastal Administration, distance sailed in the management plan area is expected to increase by 40 – 45 % by 2040.

An increase in activity is expected for most types of vessels apart from offshore and fishing vessels, where a reduction is expected. Gas carriers and container ships are expected to show the strongest percentage growth, and strong growth is also expected for cruise ships.

The expected strong growth in container shipping is based on the assumption that ice melt in the Arctic will continue, and that over the long-term Arctic sea routes will become more commercially viable. The increase in the number of tankers can be largely attributed to petroleum exports from northwestern Russia and the expectation that there will be a general increase in oil and gas activities in the Barents Sea.

It is expected that the increase in activity will be largely along the routes currently used by transit traffic and coastal shipping. The future volume of transpolar traffic and how it will influence the traffic picture are somewhat uncertain.

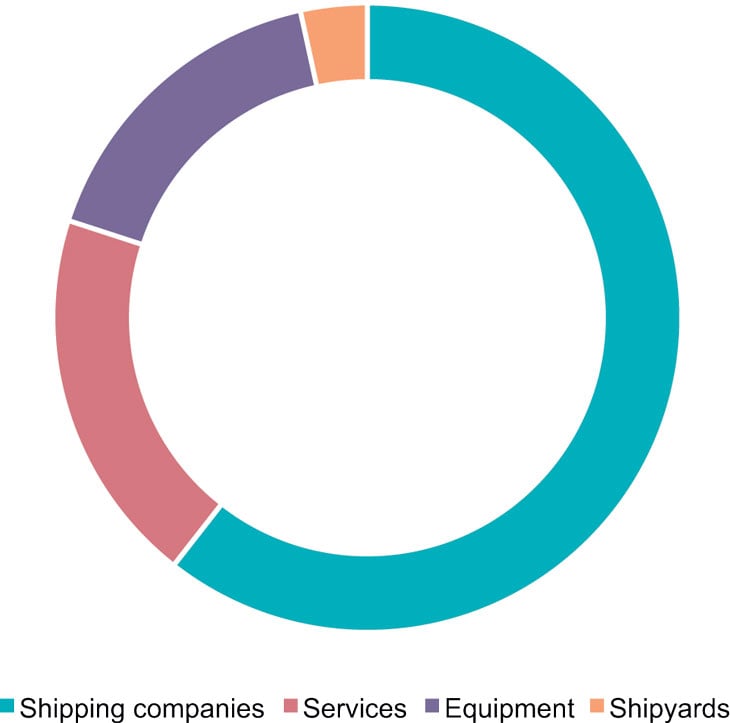

Figure 5.2 Value added in the maritime sector for 2015, divided into four segments. Total value added amounted to NOK 175 billion.

Source Maritime Forum Maritim verdiskaping 2017

5.2.2 Commercial activities and value added

The Norwegian maritime industry is global and knowledge-driven, and occupies a strong position in world markets. It is responsible for almost NOK 175 billion in total value added and employs over 110 000 people in Norway. The term ‘maritime industry’ refers to all enterprises that own, operate, design, build and supply equipment or specialised services to all types of ships and other floating structures. Today Norway is the world’s 11th largest shipping nation in terms of gross registered tonnage, and the sixth largest shipowning nation in terms of fleet value.

The publication Maritim verdiskaping 2017 provides an overview of value added in the maritime industry. It includes all enterprises that supply and develop equipment and services to the industry, and is mainly based on the various companies’ accounts for 2015.

Norway is one of the few high-cost countries that still has a shipbuilding industry. Ships built in Norway are equipped with advanced marine technology, which gives shipyards a major competitive advantage. Although the shipbuilding sector is the smallest segment in the shipping industry in terms of both value added and employment, the value added generated by shipyards has tripled over the last decade.

There are also world-leading Norwegian companies in the maritime supply sector. Suppliers of services occupy a leading place worldwide in the fields of design, insurance, brokerage, classification and finance. This segment has experienced strong growth in the last 10 years and accounts for one-fifth of total value added in the maritime sector. Equipment suppliers deliver three main groups of products: mechanical equipment, electrical and electronic equipment, and other operating equipment. For these companies the Norwegian part of the continental shelf is an important source of clients, and the Federation of Norwegian Industries estimates that around 60 % of equipment deliveries are made to the offshore market.

The maritime industry has been tailored to petroleum activities for many years, and the drop in oil prices and decline in the activity level on the Norwegian shelf have seriously affected the industry. The current situation and the turbulence in the global economy in the last few years are still affecting shipping. A decline in the level of investment in the Norwegian shelf has resulted in many offshore vessels being laid up and employees being laid off, and a reduction in the number of orders to Norwegian shipyards.

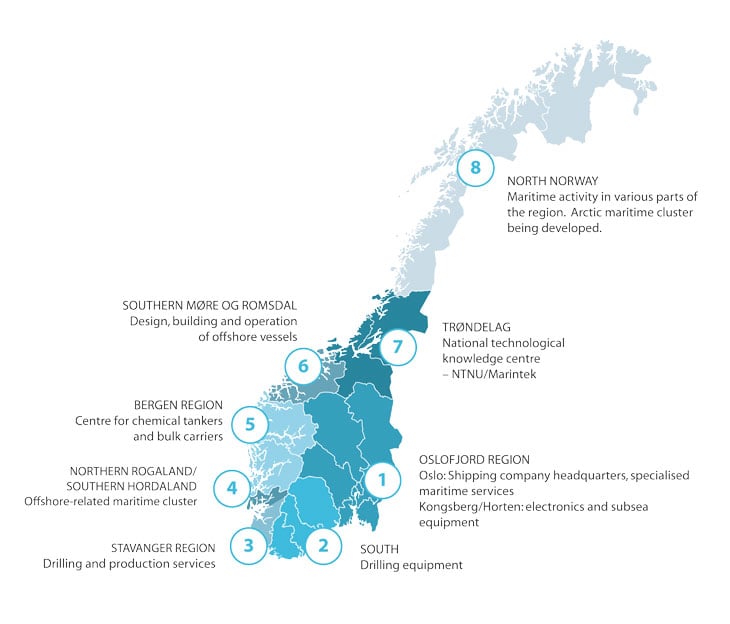

Maritime enterprises are situated all along the Norwegian coast. In the last 10 – 20 years companies have tended to form local specialised clusters (see Figure 5.3). The cluster in Møre og Romsdal county consists of a complete value chain of companies that specialise in maritime equipment and the design and construction of offshore vessels, as well as a large number of offshore shipping companies.

Figure 5.3 Maritime regions and maritime clusters in Norway.

Source Maritime Forum Maritim verdiskaping 2017

In 2014, shipping companies (excluding those in the fisheries, petroleum and tourism sectors) located in the four counties bordering on the Norwegian Sea generated a total of NOK 4.4 billion in value added, and provided employment for 5 000 people, not including wider spin-off effects (see Table 5.5).

Table 5.5 Value added and employment in shipping companies in the four counties bordering on the Norwegian Sea (excluding fisheries, petroleum and tourism) in 2014

Value added 2014 | Employment 2014 | |||

|---|---|---|---|---|

Branch of industry | NOK billion | % of total in Norway | 1000 persons | % of total in Norway |

Foreign shipping, freight | 2.0 | 7 % | 2.3 | 7 % |

Domestic shipping, freight (incl. tugboats) | 0.8 | 34 % | 0.4 | 21 % |

Domestic coastal routes | 0.2 | 34 % | 1.2 | 21 % |

Supply industries | 1.4 | 15 % | 1.1 | 20 % |

Total | 4.4 | 11 % | 5.0 | 11 % |

Source Statistics Norway

5.2.3 Pressures and impacts on the environment

Shipping can put pressure on the marine environment through operational discharges to air and water, illegal releases of pollutants and acute pollution, the spread of alien species and subsea noise.

Releases to air and water

Operational discharges to the sea from shipping consist mainly of oily bilge water, cargo residues, tank washings, ballast water, sewage and food waste. Discharges are regulated internationally by Annexes I, IV and V of MARPOL 73/78 (International Convention for the Prevention of Pollution from Ships), and are considered to have little impact on the Norwegian Sea environment. There is no overview of actual operational discharges to water in either the Norwegian Sea or other sea areas. A study made in 2012 showed that the oil separation systems in use generally comply with the requirement in Annex I of MARPOL that vessels must not discharge water if the oil content exceeds 15 parts per million (ppm), and the majority of the systems examined were able to reduce the oil content to 5 ppm or less.

The provisions of Annex V of MARPOL, on the prevention of pollution by garbage from ships, are being tightened, and this is expected to result in a reduction in operational discharges from ships.

Figures for acute pollution from shipping have been available since 2013 and show that most spills are small. In 2015, 10 spills of various types of oil and oil-based drilling mud from shipping in the Norwegian Sea were registered, with a total volume of around 17 000 litres.

Emissions to air from shipping include greenhouse gases, acidifying substances and nutrients from engines, and fugitive emissions of volatile substances from cargoes (petroleum and petroleum products). As shown in Table 5.6, carbon dioxide emissions are highest. Since the previous management plan was published, further international regulatory measures to reduce emissions to air from ships have been introduced by various organisations, including the International Maritime Organization (IMO). The development and introduction of new technology will also reduce emissions. The external costs of maritime transport are on average lower than those of road transport.

Table 5.6 Calculated emissions to air from shipping in the Norwegian Sea in 2016

Vessel categories | CO2 (tonnes) | CO (tonnes) | NOX (tonnes) | SO2 (tonnes) | PM (tonnes) |

|---|---|---|---|---|---|

Tankers | 279 884 | 633 | 5 603 | 1 005 | 421 |

Dry cargo vessels | 584 642 | 1 341 | 10 485 | 1 373 | 592 |

Passenger ships | 531 413 | 1 187 | 8 994 | 1 076 | 543 |

Fishing vessels | 237 523 | 549 | 3 295 | 135 | 90 |

Offshore vessels | 315 639 | 640 | 4 103 | 302 | 135 |

Other | 187 310 | 397 | 2 419 | 147 | 75 |

Total | 1 367 47 5 | 3 560 | 22 610 | 2 963 | 1 856 |

Source havbase.no

Introduction of alien species

The introduction of alien species is a threat to biodiversity because they can displace native species and disrupt ecosystems. The main causes of the spread of alien species are discharges of ballast water and hull fouling.

There is no systematic monitoring of alien species in Norwegian coastal and marine waters, but a number of ports along the coast of the Norwegian Sea where large volumes of ballast water are discharged are monitored for the presence of alien species.

The discharge, intake and treatment of ballast water are regulated by IMO and the International Convention for the Control and Management of Ships’ Ballast Water and Sediments (Ballast Water Management Convention), which was adopted in 2004. When the convention enters into force on 8 September 2017, all ships will be required to have the necessary treatment technology on board. Norway adopted its own ballast water regulations in 2010, which will be revised to ensure that the whole convention is incorporated into Norwegian law. The introduction of alien species through hull fouling is not regulated internationally, but IMO has issued voluntary guidelines on the management of hull fouling.

Underwater noise

Propeller noise from ships lies within the range of frequencies that can be heard by fish and marine mammals. In 2014 IMO issued guidelines for the reduction of underwater noise. Naval frigates use sonar equipment to detect submarines at great distances, which emit intense sound pulses that are well within the hearing range of marine mammals but less audible to fish. The navy has introduced guidelines for the use of sonar in Norwegian waters. The environmental impacts of underwater noise are described in Chapter 3.3.5.

Risk of acute pollution

A white paper on maritime safety and the preparedness and response system for acute pollution (Meld. St. 35 (2015 – 2016)) was published in 2016 and contains an analysis of maritime accidents, the probability of accidents, and the environmental risks associated with shipping in Norwegian sea areas.

Maritime accidents such as groundings, collisions, structural failure and fire or explosion occur at irregular intervals, but only a small proportion of them result in acute pollution.

The accident statistics show a decline in the number of maritime accidents involving serious damage to vessels. There also seems to be a slight decline in the annual number of maritime accidents leading to acute pollution, and in the total volume of spills. This is partly due to the introduction of a number of preventive measures to improve maritime safety (see below for more details). Thus there are strong indications that the probability of maritime accidents in the Norwegian Sea management plan area has been reduced since 2009.

The probability of maritime accidents is influenced by a number of factors, including the volume of transport, the traffic situation, the technical standard and equipment of vessels, crew qualifications and the preventive measures that have been introduced. The forecast frequency of accidents in the Norwegian Sea is higher than that in the Barents Sea – Lofoten area and lower than that in the North Sea – Skagerrak area. This corresponds to the share of total distance sailed in each of the management plan areas and also the shares of total distance sailed that are close to the coast. Most accidents are expected to be groundings on the landward side of the baseline. Passenger ships, fishing vessels and general cargo vessels account for the longest distances sailed and the highest forecast accident frequency.

The expected frequency of accidents is strongly influenced by the forecast trends in traffic. The Norwegian Coastal Administration has estimated that the number of accidents in the management plan area will rise by around 35 %, to 70 accidents a year by 2040 unless new preventive measures are introduced. The number of accidents involving acute pollution is also expected to rise by around 35 % by 2040.

A risk analysis commissioned by the Norwegian Coastal Administration and carried out by DNV GL identified a number of areas along the Norwegian coast where there is an elevated environmental risk. The analysis also showed that the environmental risk level is generally higher in the North Sea – Skagerrak than in the other management plan areas. This is mainly because the larger volume of shipping along the coast of Southern Norway means that there is a higher probability of spills.

Any environmental consequences of accidents are likely to be greatest in North Norway. However, the relatively low probability of spills means that the overall level of environmental risk is lower in the north than in the south.

An environmental risk and preparedness and response analysis for Svalbard and Jan Mayen made by the Norwegian Coastal Administration (2014) showed that there was a low level of environmental risk in the waters around Jan Mayen, due to the small volume of shipping and low expected frequency of accidents. Furthermore, the preponderance of smaller types of vessels in these waters means that any spills are likely to be small.

Maritime safety measures

Maritime safety measures are intended to reduce the probability of accidents at sea and protect society from incidents that can result in loss of life, personal injury, environmental damage and adverse financial consequences. To prevent accidents, it is important that vessels meet high technical and operational safety standards and that crew members have adequate qualifications. The Norwegian Maritime Authority is the administrative and supervisory authority in matters that include maritime safety for Norwegian vessels and their crews and control of foreign ships in Norwegian waters. Ensuring a high standard of maritime safety is one of its priorities. A number of measures to improve maritime safety have been implemented under the 2007 Maritime Safety Act. Since the adoption of the 2009 management plan for the Norwegian Sea, further measures have been introduced to improve maritime safety and reduce the environmental risk associated with shipping in these waters.

Traffic separation schemes and recommended routes outside territorial waters were established in 2011 between Runde and Utsira and between Egersund and Risør. These and corresponding measures for the Vardø – Røst route, which were adopted in 2007, have moved maritime traffic away from the coast, separated opposing traffic streams and established regular sailing patterns. Although the traffic separation schemes do not formally apply to the whole of the management plan area, the density plot for maritime traffic shows that they have a clear influence on traffic streams in the Norwegian Sea as well. The schemes reduce the probability of collisions, simplify traffic surveillance and give the maritime traffic control centres more time to come to the assistance of vessels when necessary.

Textbox 5.3 Measures set out in the white paper on maritime safety and the preparedness and response system for acute pollution

In June 2016 the Government presented a white paper on maritime safety and the preparedness and response system for acute pollution (Meld. St. No. 35 (2015 – 2016)).

Maritime safety measures:

The Government will consider extending the catchment areas of the vessel traffic service centres (VTS centres). The first step would be to include the waters between Fedje and Kristiansund in the area covered by the VTS centres in Western Norway.

The Government will build land-based AIS base stations in Svalbard to improve maritime traffic surveillance and provide the Vardø VTS and other agencies with up-to-date information on the maritime traffic situation.

The Government will further develop and modernise the existing infrastructure to optimise risk reduction and reduce operational and maintenance costs.

The Government will take steps to facilitate the development and implementation of intelligent transport systems (ITS) for shipping.

Preparedness and response system for acute pollution

The Government will consider measures to improve the preparedness and response system for acute pollution in Svalbard and Jan Mayen.

The introduction of basic training in dealing with acute pollution will be evaluated in connection with the development of a new model for the training of fire and rescue personnel.

The Government will consider establishing governmental chemical dispersion capacity for spills of bunker fuel in coastal waters.

The Government will commission the Coastal Administration to invite tenders for the storage, operation and transport of governmental emergency response equipment.

R&D

The Government will facilitate research and development on maritime safety measures and the preparedness and response system for acute pollution, and will examine the organisation of existing research programmes in consultation with the Research Council of Norway.

Systems for monitoring shipping in Norwegian waters have been strengthened since 2009, particularly through further development of the infrastructure of AIS base stations along the coast, which are operated by the Coastal Administration in cooperation with the Defence Forces. Since 2010 Norway has also operated a satellite-based AIS system. Thus we now have a far more detailed picture of the maritime traffic situation than before.

The mandatory ship reporting system Barents SRS has provided a better overview of shipping and the kinds of cargo that vessels are transporting in the management plan area. The system is operated in cooperation with Russia, and has been approved by IMO. Larger vessels and vessels carrying dangerous or polluting cargo are obliged to report through this system before entering the area between the Lofoten Islands and the Norwegian – Russian border. Although the geographical area where the system applies is largely outside the management plan area, the system has also resulted in better information on high-risk traffic in the Norwegian Sea.

The navigational warning service (NAVCO) operated by the Norwegian Coastal Administration has been strengthened in the management plan area. Navigational warnings inform ships of hazards they are likely to encounter, such as drifting objects or lighthouse lights that are unlit. Since 2010 Norway has been transmitting weather reports and navigational warnings for the waters of the Norwegian Sea, the Barents Sea and as far as the North Pole (NAVAREA XIX).

The Norwegian Coastal Administration has made improvements in several fairways in the management plan area since 2009. These include Måløysundet in Sogn og Fjordane, Lepsøyrevet, Djupflua, Åramsund, the approach to Ålesund in Møre og Romsdal, Torgværleden and the approach to Bodø in Nordland. These measures have improved safety and navigation in narrow channels and hazardous waters. Navigation marks in these waters have also been reviewed and updated.

The governmental preparedness and response system for acute pollution

The Pollution Control Act distinguishes between private, municipal and governmental levels of the preparedness and response system for acute pollution. At operational level, the overall preparedness and response system involves cooperation between these three levels. No major changes in areas of responsibility or the framework for Norway’s preparedness and response system have been made since the adoption of the first management plan for the Norwegian Sea. The white paper on maritime safety and the preparedness and response system provides a broad overview of the system at government level and sets out priorities for the years ahead. The primary objective of the governmental system is to prevent or limit environmental damage and lower the risk of acute pollution.

The governmental preparedness and response system is intended to deal with major incidents of acute pollution that are not covered by municipal or private systems, and the risk of such spills. The private-sector preparedness and response system in the petroleum sector is described in section 5.3. Vessels sailing in Norwegian waters are not required to have their own preparedness and response system to deal with acute pollution. The risk of acute pollution from shipping is primarily related to spills of fuel and petroleum products (cargo). The governmental preparedness and response system is mainly intended to deal with oil spills from ships.

Since the adoption of the 2009 Norwegian Sea management plan, the emergency response equipment in government depots and on Coast Guard vessels has been renewed and replenished.

Three new Coast Guard vessels for areas outside territorial waters (KV Barentshavet, KV Bergen and KV Sortland) are now operating in the management plan area, and are equipped with oil spill response equipment and oil spill detection radar. Since 2012, the Coast Guard’s multi-purpose offshore vessel OV Utvær has been operating in the southernmost part of the management plan area. A similar vessel for the coast of Nordland, OV Skomvær, became operational in 2013. The vessels are normally used for maintenance of navigation infrastructure, but can also be used in oil spill response. The capacity to detect acute pollution in these sea areas has been strengthened by the renewal and upgrading of the Coastal Administration’s surveillance aircraft.

Measures have been introduced to ensure a rapid response in order to isolate any spills from disabled vessels and improve the availability of suitable vessels during governmental response operations in the Norwegian Sea. Equipment has been deployed to the pilot stations in Sandnessjøen and Lødingen and the SAR (search and rescue) stations in Rørvik and Bodø. Contracts have been signed with owners to make three vessels available for response operations at each of the depots in Ålesund, Ørland, Sandnessjøen, Bodø and Lødingen. In order to be prepared for situations where a vessel needs to be brought to a port of refuge, the Norwegian Coastal Administration has evaluated possible sites along the coast in a dialogue with central, regional and local authorities.

The capacity of the intermunicipal acute pollution control committees to provide assistance during governmental oil spill response operations has been increased. The committees have been provided with governmental emergency response equipment and given training in the use of the equipment.

A national preparedness and response system has been developed to deal with chemical spills from ships. Operational preparedness is maintained through agreements between the Norwegian Coastal Administration and the RITS teams (maritime incident response groups) provided by the fire brigades in Oslo and Bergen, who have dedicated equipment and training in combating accidents involving hazardous substances.

The Coastal Administration’s emergency response organisation has been strengthened, among other things by taking on response personnel at the regional offices in Central Norway and Nordland. The number of training courses and exercises has been substantially increased and a national curriculum has been developed for training in dealing with acute pollution.

Preparedness and response plans and the organisation of operations have been reviewed and updated, and a more unified command and organisation of response operations has been developed. The Norwegian Coastal Administration has conducted emergency preparedness analyses of worst-case scenarios, and developed a national plan for an emergency response system for acute pollution. In cooperation with the Norwegian Oil and Gas association and operating companies, plans have been developed for coordinated command in the event of major pollution incidents associated with petroleum activities (see section 5.3).

Thus the emergency preparedness and response system for acute pollution in the Norwegian Sea management plan area has been substantially strengthened since 2009, which has helped to reduce the level of environmental risk in the area.

5.2.4 Framework and management

Shipping is a global industry, and the conditions under which it operates are mainly established at the international level. Through international cooperation at the global, regional and bilateral levels, Norway seeks to achieve global requirements for the industry that are as uniform as possible, together with open markets, free trade and strict requirements for maritime safety, environmental protection and social standards. The United Nations Convention on the Law of the Sea provides the most important international legal framework for the regulation of maritime transport and marine waters. The regulations applicable to shipping are mainly established through international cooperation in IMO, the EU, ILO and the Paris Memorandum of Understanding on Port State Control.

Safety in Norwegian waters depends on binding international cooperation and an international system of rules.

In recent years, shipping has become subject to a stricter international regime, with rules limiting emissions to air and water. The stringent requirements governing discharges, together with a desire to reduce fuel consumption costs, are causing the industry to seek ways of making its operations more energy-efficient. International environmental standards adopted in IMO and the creation of a market for good environmental solutions are the most effective measures for ensuring environmental protection. Norway is a driving force in the development of a sound international framework for a climate-friendly and environmentally sound shipping industry.

Maritime transport is in general an energy-efficient alternative for freight transport. The Government has ambitious environmental objectives for the maritime industry. In its white paper New emission commitment for Norway for 2030 – towards joint fulfilment with the EU (Meld. St. 13 (2014 – 2015)), it identified environmentally sound shipping as a priority area of Norwegian climate policy.

New technology and new solutions for vessel operations, such as the use of greener fuels and energy-efficient vessels, are key factors in the reduction of emissions from shipping.

Maritim21 is an integrated maritime strategy for research, development and innovation, which was submitted to the Government in November 2016. It provides a set of recommendations on how to promote sustainable growth and value creation, improve the competitiveness of the maritime industry and realise the potential for synergy between ocean-based industries. The strategy has identified enabling technologies, smart solutions, digital transformation, promoting greener maritime activities and safety and security at sea as priority areas for the maritime industry.

In its National Transport Plan (2018 – 2029) the Government has set out its goals in this sector: reducing the costs of freight transport, exploiting the advantages of the different means of transport and transferring more freight from road to sea and rail.

5.3 The petroleum industry

Petroleum activity in the Norwegian Sea started in 1980. The first field to start producing in this area was Draugen, in 1993. A total of 2.0 billion standard cubic metres of oil equivalents (Sm3 o.e.) has been proven in the Norwegian Sea, of which 1.1 billion Sm3 o.e. has been sold and delivered. The remaining 0.9 billion Sm3 o.e. consists of reserves and contingent resources in fields and discoveries. There has been some decline in total production from the Norwegian Sea in recent years, but the level is expected to remain relatively stable in the years ahead.

5.3.1 Petroleum activities and resources in the Norwegian Sea

At present the areas on the Halten bank and near the Ormen Lange field are considered mature, with large-scale oil and gas production and well-developed infrastructure. In 2015, total petroleum production in the Norwegian Sea amounted to 66 million Sm3 o.e.

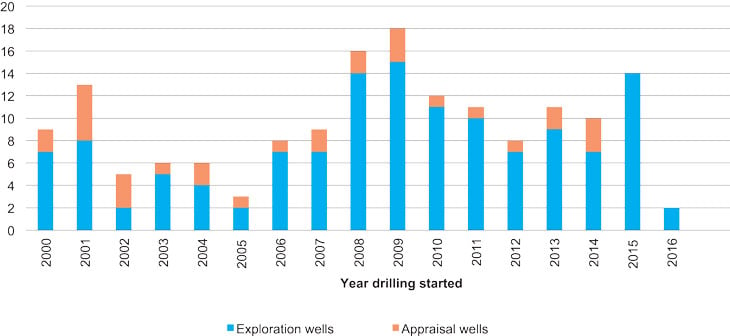

Figure 5.4 Number of exploration wells in the Norwegian Sea.

Source Norwegian Petroleum Directorate

There are currently 16 oil and gas fields in production in the Norwegian Sea. The development concept for Draugen, Heidrun, Åsgard, Skarv and Norne uses platforms and FPSOs (floating production storage and offloading vessels). The remaining fields have subsea installations tied back to Åsgard (Morvin) and Norne (Alve, Marulk and Skuld) installations. The Njord and Hyme fields are currently not producing because the Njord A platform has been shut down for upgrading. The Aasta Hansteen, Maria, Dvalin and Trestakk fields are under development. An investment decision has been made with respect to the Bauge field, and there are plans for investment decisions concerning the Pil&Bue and Snadd discoveries in the course of 2017.

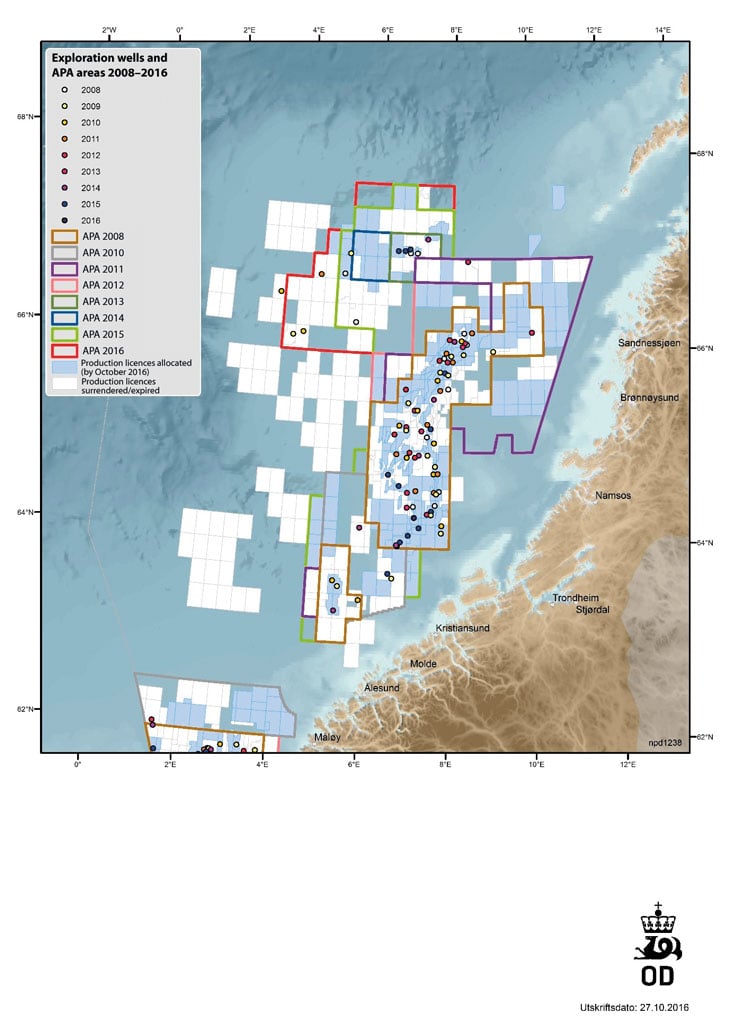

Figure 5.5 Exploration wells and awards in predefined areas (APA) in the Norwegian Sea.

Source Norwegian Petroleum Directorate

The gas pipeline Polarled was completed in 2015 and will link the Aasta Hansteen field to the Norwegian gas pipeline network. Gas from the Norwegian Sea is largely transported by pipeline to various onshore facilities in Norway and onwards to the UK and continental Europe. The oil is loaded directly onto tankers (buoy-loading) and transported to the markets.

From 2008 to 2016, 106 seismic surveys were conducted in the Norwegian Sea, 75 of which were 3D seismic surveys, together with a further 55 electromagnetic surveys. Few surveys were conducted in 2015 and 2016.

Since 2008, 89 completed exploration wells have been drilled, resulting in 51 discoveries.

The greatest activity in the Norwegian Sea has been on the Halten and Dønn Terraces off Sør-Trøndelag, Nord-Trøndelag and Nordland, and most of the discoveries and almost all the developed fields are to be found in this area. This is the most mature area, but is nevertheless the area where a large proportion of the remaining undiscovered resources in the Norwegian Sea are expected to lie.

Parts of the deep-water areas in the western Norwegian Sea are still considered to be frontier areas, where large finds could still be made. Exploration drilling has resulted in a number of finds, but the volumes are smaller than expected and consist mostly of gas resources. In the west, near the Atlantic Margin, obtaining good seismic data from below the basalt layers poses special problems. There has been little exploration in these areas, and resource estimates are therefore very uncertain.

So far, the only developed deep-water field is Ormen Lange. The Aasta Hansteen field in the north of the Norwegian Sea is under development and is expected to come on stream in 2018. A number of smaller gas discoveries have been made in the Vøring Basin in the last few years, which are important additional resources for the Aasta Hansteen field.

Small to medium-sized oil or gas discoveries can be expected on the Halten and Dønn Terraces, and isolated large finds are also possible. Large gas discoveries may still be made in the Møre and Vøring Basins.

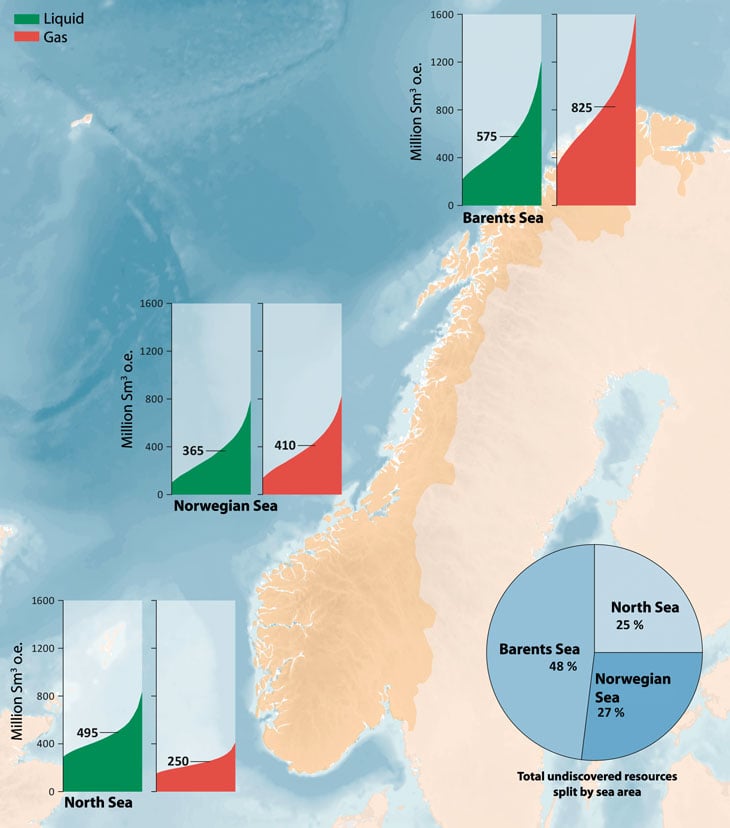

Undiscovered resources in the Norwegian Sea are estimated at almost 0.8 billion Sm3 o.e. (expected value).

Figure 5.6 Resource estimates for the Norwegian part of the continental shelf.

Source Norwegian Petroleum Directorate

The Norwegian Petroleum Directorate estimated total discovered and undiscovered resources on the Norwegian continental shelf at approximately 14.3 billion Sm3 o.e. on 31 December 2016. ‘Resources’ is a collective term for all technically recoverable quantities of petroleum. The resource accounts include all resources on the Norwegian continental shelf, including those in areas that are not currently open for petroleum activities.

Data from seismic surveys and other geological data collected under the auspices of the Norwegian Petroleum Directorate have increased our knowledge of potential petroleum resources in the unopened parts of Nordland IV and V. In summer 2012, 2D seismic data were collected in the area through collaboration with the fishing industry and the fisheries authorities, and some older collections of data were reprocessed.

In the 2009 management plan, the Government then in power announced that it intended to initiate an opening process for the areas around Jan Mayen with a view to granting production licences. This was repeated in the white paper An industry for the future – Norway’s petroleum activities (Meld. St. 38 (2010 – 2011)), together with more details on the opening process. As part of the process, the Petroleum Directorate conducted seismic surveys in the areas around Jan Mayen in 2011 and 2012. In 2013, the directorate published a resource evaluation based on the collected data, and so far there is no reason to revise this. Expected recoverable resources in this area are estimated at 90 million Sm3 o.e., but the figure is very uncertain. An impact assessment has been made for Jan Mayen under the Petroleum Act.

5.3.2 Commercial activity and value added

It is more than 50 years since petroleum activities were first started in Norway, and this is now the country’s largest industry measured in terms of value added, state revenues, export value and investments. The petroleum sector includes oil companies, supply industries and petroleum-related research groups. In 2016 value added from the industry accounted for 12 % of GNP, and it generated over NOK 125 billion in net cash flow to the state. Petroleum activities also create a demand in associated and supporting industries, which often has positive regional spin-off effects. Most of the oil and gas produced on the Norwegian shelf is sold abroad and provides substantial export revenues. Oil and gas accounted for approximately 35 % of total exports in 2016.

The petroleum sector employs around 185 000 people in all parts of the country. In 2016, this accounted for about 7 % of total employment.

Petroleum activities involve major current and future investments that will provide substantial value added and high employment for many decades to come. In 2014, petroleum activities in the Norwegian Sea generated a total of NOK 219.6 billion in value added and direct employment for 42 200 people (see Table 5.7). When people who are indirectly involved in supplying goods and services to the oil and gas industry are included, the figure rises to about 67 500 people.

Table 5.7 Direct value added and employment in petroleum activities in the Norwegian Sea in 2014

Industry | Value added 2014 | Employment 2014 | ||

|---|---|---|---|---|

NOK billion | % of total in Norway | 1000 persons | % of total in Norway | |

Production | 174.6 | 31 % | 9.5 | 30 % |

Pipeline transport | 1.2 | 7 % | < 0.04 | - |

Services | 15.1 | 30 % | 9.9 | 30 % |

Supply industries | 28.6 | 30 % | 22.7 | 30 % |

Total | 219.6 | 30 % | 42.2 | 30 % |

Source Statistics Norway

Established petroleum activities in the Norwegian Sea account for about one-third of all direct employment in the industry in Norway. A large proportion of these people work offshore, but the onshore facilities at Tjeldbergodden and Nyhamna, the main supply bases in Kristiansund and Sandnessjøen, and Statoil’s bases in Stjørdal and Harstad provide a significant proportion of employment and spin-off activities on land as well. The supply industries deliver goods and services to the fields throughout their lifetimes. The largest proportion is supplied during the production stage, followed by the development phase, but the exploration phase also accounts for a significant proportion of deliveries, about 20 %. The large and stable domestic Norwegian market plays an important role in the further development of the world-class supply industries that have grown up in Norway.

Textbox 5.4 Regional spin-off effects of petroleum activities in Nordland

As licences are granted for blocks further and further north on the Norwegian continental shelf, the local and regional spin-off effects are becoming increasingly marked in North Norway. The white paper An industry for the future – Norway’s petroleum activities (Meld. St. 28 (2010 – 2011)) set out the objective of promoting profitable production from new discoveries while at the same time ensuring opportunities for business and industry in North Norway to take part as competitive suppliers to the petroleum industry. BP Norge (now Aker BP) and Statoil have initiated and implemented a number of measures to promote regional ripple effects: large contracts have been split up so that small and medium-sized enterprises are able to compete.

The Skarv field, which is located 210 km west of Sandnessjøen and came on stream in 2012, has had significant spin-off effects in the Helgeland district of Nordland. The operator Aker BP has entered into contracts and options worth NOK 1 billion with local enterprises in the region. Businesses in Mo i Rana, Sandnessjøen and Bodø have supplied equipment to the fields that are on stream and to the Aasta Hansteen field, which is under development, and the gas pipeline Polarled, which will transport gas from Aasta Hansteen to Nyhamna in Møre og Romsdal. By the end of 2014 deliveries to Polarled from companies in North Norway were worth NOK 409 million, 95 % of which came from Helgeland.

The petroleum industry in the north is part of an international market. Low oil prices and the industry’s focus on costs have meant that oil companies have delayed or cancelled a number of projects in recent years, and this strongly affects the supply industries in North Norway. As a result, key supply industries have had to lay off employees or downsize.

5.3.3 Pressures and impacts on the environment

Generally speaking, the petroleum industry can have negative impacts on the environment through operational discharges to the sea and air, acute releases of pollutants, underwater noise from seismic surveys and other pressures such as physical disturbance of the seabed.

Emissions to air

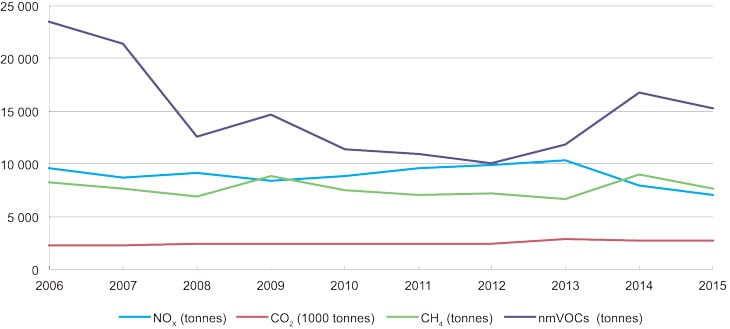

In 2007, projections suggested that emissions to air from petroleum activities would decline up to 2025. However, the emission projections have since been adjusted, and up to 2025 emissions of both carbon dioxide (CO2) and nitrogen oxides (NOX) are expected to remain at about the same level as in 2011. This is because the producing lifetime of installations has been extended as fields continue to produce for longer than was estimated in 2007 and new resources are tied back to new and existing installations. Emissions of volatile organic compounds (methane and NMVOCs) are not very different from the 2007 projections. Figure 5.7 shows the trends in emissions.

Figure 5.7 Trends in emissions to air from petroleum activities in the Norwegian Sea 2006 – 2015.

Source Norwegian Environment Agency

The choice of energy supply is an important part of field development, and is evaluated by the authorities during the process of impact assessment and the subsequent review of the plan for development and operation. Whenever proposals are made for new field developments on the Norwegian shelf, the operator must submit an overview of energy needs and an assessment of the costs of using power from shore rather than gas turbines to supply electricity. This ensures that the option of using power from shore is chosen where appropriate.

The largest proportion of applies to most greenhouse gas emissions from petroleum activities are covered by the emissions trading system. Oil and gas companies operating on the Norwegian shelf are subject to other climate-related policy instruments in addition to emissions trading. During the last 25 years a high carbon tax has been levied on a large proportion of emissions. The tax rate is about NOK 500 per tonne CO2, which gives companies a strong incentive to limit their emissions. Flaring (burning of gas) on the Norwegian shelf is only permitted for safety reasons.

Operational discharges of oil and chemicals to the sea

Norway’s goal is for discharges of the most hazardous added chemicals to be eliminated and that discharges of naturally occurring environmentally hazardous substances that are also priority substances should be eliminated or minimised. For oil and other substances, the target is zero discharges or minimal discharges of substances that may cause environmental damage (see Box 5.5 on the zero-discharge targets).

Textbox 5.5 The zero-discharge targets

The zero-discharge targets for discharges of oil and environmentally hazardous substances to the sea were adopted in a white paper on an environmental policy for sustainable development (Report No. 58 (1996 – 1997) to the Storting). The targets and measures for achieving them were further specified in a number of later white papers and set out in full in the white paper Management plan for the North Sea and Skagerrak (Meld. St. 37 (2012 – 2013)).

Environmentally hazardous substances

Zero discharges or minimal discharges of naturally occurring environmentally hazardous substances that are also priority substances.

Zero discharges of added chemicals in the black category (use and discharges prohibited as a general rule) or red category (high priority given to phasing them out by substitution), cf. the Activities Regulations for the petroleum industry.

Other substances

Zero or minimal discharges of the following if they may cause environmental damage:

oil (components that are not environmentally hazardous),

yellow-category substances (not defined as belonging to the black or red categories, but not on the PLONOR list drawn up by OSPAR), and green-category substances (included on the PLONOR list and considered to pose little or no risk to the environment), cf. the Activities Regulations for the petroleum industry,

drill cuttings,

other substances that may cause environmental damage.

Radioactive substances

Discharges of naturally occurring radioactive substances to be gradually reduced until, by 2020, the concentrations in the environment are close to the natural background levels.

The following is a more detailed list of the targets and measures:

As a rule, oil and environmentally hazardous substances may not be discharged to the sea. This applies both to substances added as part of the production process and to naturally occurring substances. The precautionary principle is to be used as the basis for assessing the potentially damaging impacts of the discharges.

Environmentally hazardous chemicals (red- or black-category) may only be discharged if serious technical or safety considerations make this necessary.

Replacement of added environmentally hazardous substances must be given high priority. Operators must draw up plans for substitution of added environmentally hazardous chemicals and report them annually to the authorities, cf. the Activities Regulations for the petroleum industry.

The steps taken to replace added environmentally hazardous substances must be based on an overall assessment. This means for example that if the use of a small amount of a red-category substance would reduce releases of other components and thereby reduce the overall environmental risk, this should be taken into consideration.

Releases of red- and black-category substances must have been eliminated by 2005 in cases where there are adequate substitutes. Good documentation is required for the authorities to accept continuation of releases.

Injection or reinjection of produced water is the most effective method of achieving the zero-discharge targets for naturally occurring environmentally hazardous substances.

The solution chosen for eliminating discharges of oil and other naturally occurring hazardous substances must be based on an overall, field-specific assessment that includes the environmental impacts, overall safety issues, reservoir engineering factors and cost issues.

Provision may be made on the basis of an overall, field-specific assessment for minimising releases of naturally occurring hazardous substances on the priority list.

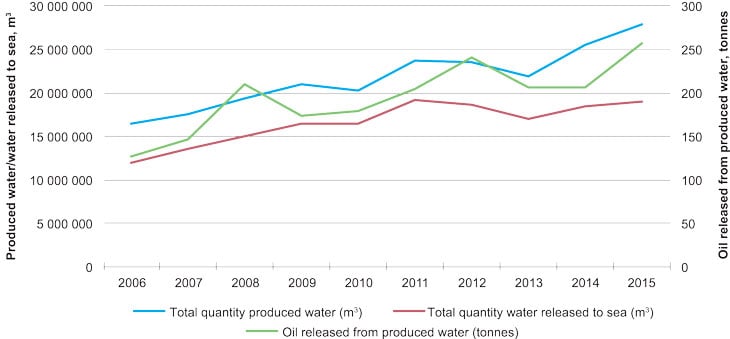

Releases of oil with produced water have increased since 2006, because water production from fields rises as they age and because there has been a small increase in oil concentrations in produced water (see Figure 5.8). The oil content in produced water must be kept as low as possible and may not exceed the OSPAR performance standard of 30 mg/l. In 2015 the average oil content of produced water from the fields in the Norwegian Sea was 13.6 mg/l, but some installations have not managed to keep within the performance standard. The volume of produced water reinjected has also been larger than projected in 2008. The Skarv field came on stream later than expected, which meant that it began discharging produced water at a later date. These factors mean that discharges of produced water have not increased as much as was projected in 2008. Fresh projections indicate that discharges of produced water will drop to about two-thirds of the 2011 level by 2025.

Figure 5.8 Releases of oil with produced water from fields in the Norwegian Sea, 2006 – 2015.

Source Norwegian Environment Agency

The total quantities of the most hazardous added chemicals (black- and red-category) discharged on the Norwegian continental shelf declined steeply up to 2007 and have remained low. The conclusion in the scientific basis for this management plan is that the target for the quantities of the most hazardous added chemicals discharged in connection with petroleum activities has been achieved for the entire Norwegian shelf, including the Norwegian Sea. However, in the last couple of years an increase in discharges of substances in the most hazardous added chemicals has been reported. The apparent increase in black-category substances is mainly because firefighting foam containing perfluorinated substances has been included in the reporting system since 2012. Operators are in the process of changing to foam that contains less hazardous chemicals. The increase in red-category substances is mainly due to changes in classification (from yellow- to red-category), and does not reflect a real increase in discharges. Trends in discharges of the different categories of hazardous added chemicals are shown in Figure 5.9.

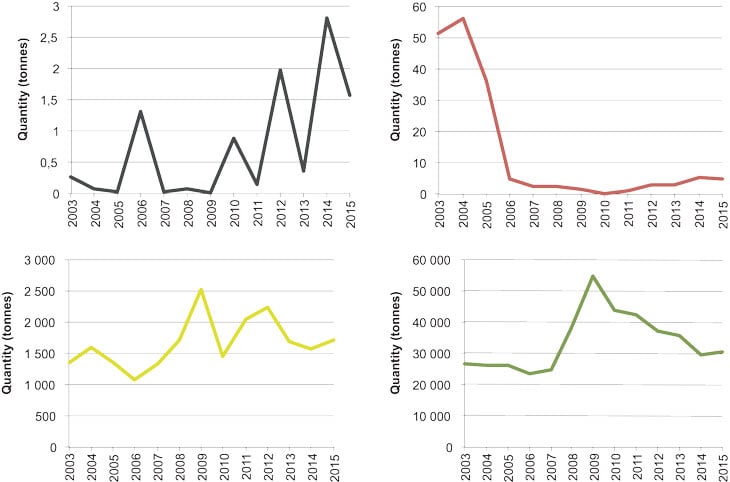

Figure 5.9 Trends in discharges of added chemicals in the Norwegian Sea (black, red, yellow and green categories).

Source Norwegian Environment Agency

For safety and technical reasons it will still be necessary to use a certain quantity of these substances, and there will continue to be some discharges to the sea in the years ahead. However, the latest figures show that efforts to reach the zero-discharge targets are still important.

Discharges of produced water also contain naturally occurring radioactive substances. At present the only way to reduce the discharges is to reinject produced water.

Physical impacts

Petroleum activity can put pressure on vulnerable benthic fauna such as corals and sponges, for example through deposition of drill cuttings. Corals and other benthic fauna can also be damaged when pipes and cables are laid and anchor chains and other installations are placed on the seabed.

Total discharges of drill cuttings containing water-based mud in the Norwegian Sea have increased since the previous management plan was published, and reached a peak in 2010 – 2011 during drilling in the Ormen Lange and Skarv fields.

Table 5.8 Historical discharges of drill cuttings containing water-based mud from fields in the Norwegian Sea

Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|---|---|---|---|---|---|---|---|---|

Total (tonnes) | 10 719 | 16 910 | 60 885 | 49 852 | 15 980 | 17 796 | 11 146 | 25 100 |

Source Norwegian Environment Agency

Environmental monitoring shows that the total contaminated area around petroleum installations in the Norwegian Sea has decreased from 80 km2 in 2006 to around 44 km2 in 2015, and that in recent years the average area where there are impacts on benthic fauna around each installation has decreased from 0.7 km2 to around 0.4 km2 in 2015.

Operators are required to survey any coral reefs and other valuable benthic communities that may be affected by petroleum activities and ensure that they are not damaged. In areas with important coral reefs, special conditions apply that reduce or eliminate discharges that could damage the reefs. In 2015 coral reef surveys were included in the environmental monitoring programme around relevant installations in the Norwegian Sea.

Since the previous management plan was presented, environmental monitoring by operators has increased our knowledge about coral reefs in the Norwegian Sea, including their vulnerability and current status and the impact of petroleum activities. There are a large number of coral reefs and habitats on the continental shelf in the Norwegian Sea, and corals have been recorded in the Eggakanten area. There has been some exploration drilling in coral reef areas where fishing with bottom gear is prohibited, and in these cases special conditions have been imposed to avoid damage.

Reports from the operators’ monitoring programmes after drilling conclude that there has been only limited sediment deposition on corals and no visible damage to corals or other vulnerable benthic animals.

Some damage to corals by anchor chains during the towing of rigs has been reported.

No damage to corals and sponges from discharges of drill cuttings has so far been documented. Since the 2009 management plan was published, a number of research projects have been started to investigate the effects of such discharges on coral reefs and sponge communities. One project has shown indications that the coral Lophelia pertusa has limited capacity to sediment as a result of discharges of drill cuttings, but other studies show that L. pertusa is rather tolerant of deposition of drill cuttings and that it is only killed by large quantities of drilling waste.

To make it possible to draw clearer conclusions about the impacts of petroleum activities on corals and sponge communities, assessments of long-term effects on these species are needed.

Seismic surveys

Seismic surveys are conducted to assess the potential for petroleum deposits, and are an important aid to good decision-making in the exploration and the production phases. Geological surveys of the seabed involve the use of sound pulses generated by airgun arrays. It is these noise pulses in the form of sound waves or oscillations of particles in the water that can have negative impacts on the marine environment. The sound is within the range of frequencies that are audible to fish and marine mammals.

Since 2008, 106 seismic surveys have been conducted in the Norwegian Sea, which is about the same level of activity as that prior to 2008, but the surveyed areas are not always the same. Few surveys have been made in recent years, apart from a more comprehensive survey of nearcoast areas along the southern part of Nordland. The environmental impacts of underwater noise are discussed in Chapter 3.3.5.

Risk of oil spills in connection with petroleum activities

Since the 2009 management plan was presented, the Petroleum Safety Authority Norway has included risk data concerning acute pollution in its annual reports on trends in risk level (also known as RNNP reports). Some key findings from the 2001 – 2015 reports are described below.

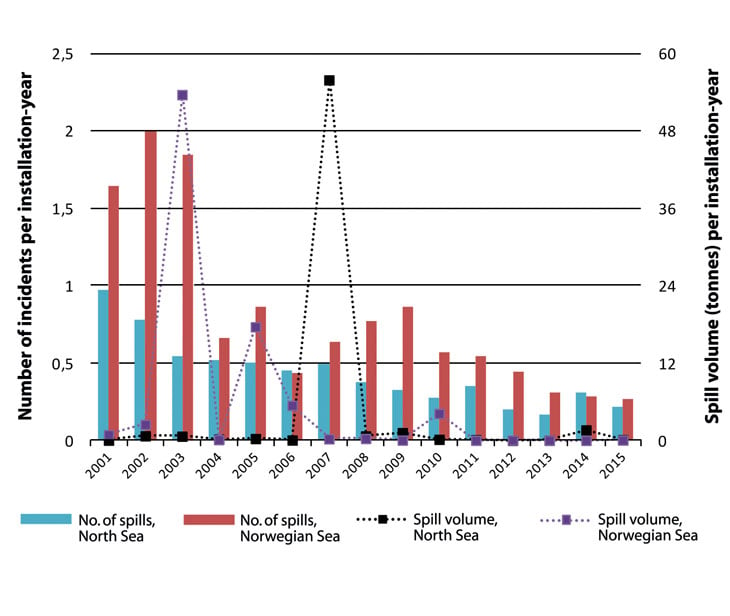

There has been a decline in the number of crude oil spills and near misses that could have resulted in acute pollution if more barriers had failed. None of the spills have been larger than 4 400 m3. Figure 5.10 shows the number of crude oil spills and total spill volumes in the Norwegian Sea for the period 2001 – 2015.

Figure 5.10 Annual numbers of crude oil spills and total spill volumes from petroleum activities in the Norwegian Sea and the North Sea in the period 2001 – 2015.

Source Petroleum Safety Authority Norway (RNNP-AU)

Although the number of crude oil spills has dropped, there has been no similar trend in the annual spill volume. Well control incidents and damage to risers, pipelines and subsea production facilities are considered to pose the greatest risk of a crude oil spill. However, the number of such incidents has remained relatively stable during the period for both the Norwegian continental shelf as a whole and the Norwegian Sea in particular.

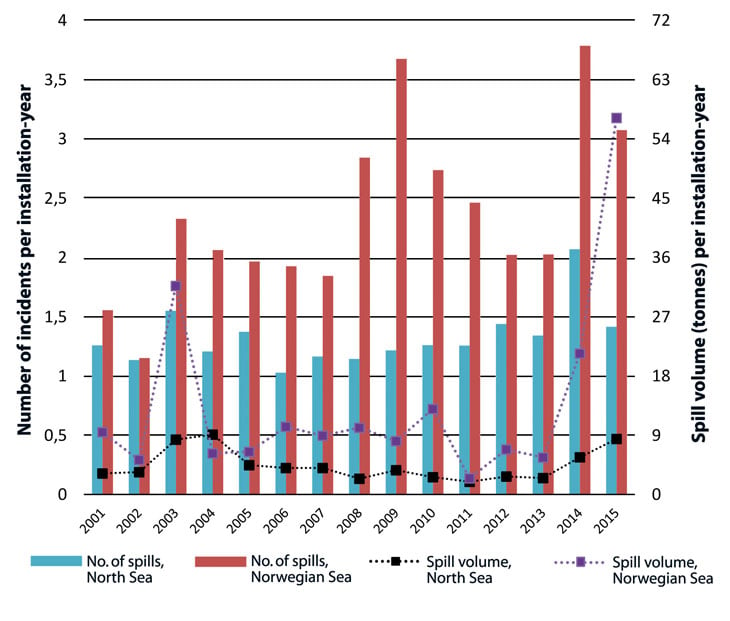

Chemical spills are undoubtedly the dominant type of spill on the Norwegian shelf, and account for 80 % of all spills with a volume of more than 1 m3. The number of incidents and the total volume involved have remained relatively stable over time (see Figure 5.11). There have also been several leaks from injection wells. The increase in the number of chemical incidents in 2014 and 2015 can be explained by the clarification of the reporting rules and subsequent changes in procedures. The increase in annual volume is due to a number of large chemical spills, and not to the changes in reporting.

Figure 5.11 Annual numbers of chemical spills and total spill volumes from petroleum activities in the Norwegian Sea in the period 2001 – 2015.

Source Petroleum Safety Authority Norway (RNNP-AU)

Petroleum activities in the Norwegian Sea involve the extensive use of subsea technology and a large number of subsea installations. The figures for the years 2006 – 2015 show that the number of releases from subsea installations on the Norwegian shelf has been relatively stable.

The results reported in RNNP-AU do not show any improvement in the barriers against acute pollution. More attention needs to be paid to barriers that prevent, signal and contain or stop acute pollution. Priority should be given to technology for the detection of leaks at source and barriers that prevent minor leaks from continuing and resulting in large releases over time.

Accidents have taught us that historical accident trends do not provide enough information to assess the risk of an accident occurring in the future. Assessments of the risk of acute pollution in the Norwegian Sea up to 2025 must also take into consideration other information on petroleum activities on the Norwegian shelf in general and in the Norwegian Sea in particular.

One factor that is likely to influence risk level is that existing surface and subsea installations and infrastructure are ageing, which may affect technical and operational integrity. By systematically collecting data on historical risk trends and factors influencing risk level, it is possible to identify signs of change and take steps to reduce the risk of incidents and accidents.

New analyses of environmental risks and consequences

Since the 2009 management plan was published, new analyses have been made of the environmental risks and consequences of petroleum activities in the Norwegian Sea. These include analyses of the extent and significance of losses of eggs and larvae in a particular year class of fish for future recruitment to the stock. The analyses provide more information on the possible spread of oil and which areas, species and habitats would be affected or damaged by spills in the Norwegian Sea, including areas that have not previously been studied.

The analyses are based on the most recent data and updated models and methods for assessing the environmental consequences of a spill for fish and seabirds. They also give a better picture of current patterns in the Norwegian Sea, particularly in the coastal zone. Current, higher quality data indicate that the Norwegian coastal current has a greater effect than previously believed, and simulations indicate greater spread of oil spills (larger impact areas on the surface), especially in a northerly direction, than has been found in earlier studies.

The analyses show that the probability of a large spill from petroleum activities is generally low, but there is a considerable increase in the potential for serious environmental consequences, especially for coastal seabirds during spring and summer and for seabirds in the open sea. Modelling indicates that the level of risk for fish is generally lower than that for seabirds. For fish, only the largest modelled spills, at certain times of year, are associated with a risk of serious consequences.

Restrictions on when drilling is permitted can considerably reduce the environmental risk associated with exploration drilling. By the time production drilling starts, there is much more information about reservoir conditions and types of oil, and the probability of a blowout is lower than during exploration drilling. A gas blowout is primarily associated with a risk of fire or explosion. Oil spill response measures can reduce the consequences of a spill. There is always a possibility of oil spills and discharges of chemicals during oil production or drilling in oil-bearing formations. It is therefore vital that the industry maintains high safety standards and continues its efforts to reduce the risk of spills.

Preventive safety measures

The best way of preventing incidents that may result in acute pollution is to ensure that all actors in the petroleum industry have the necessary expertise and are accountable for the risks their activities involve.

Since the 2009 management plan was presented, work has continued on maintaining a low level of risk of damage to the environment and living marine resources in the Norwegian Sea resulting from acute pollution. Continual efforts are being made to reduce the risk level even further.