Regulation and decision on systemically important financial institutions

Historical archive

Published under: Solberg's Government

Publisher: Ministry of Finance

Press release | No: 21/2014 | Date: 12/05/2014

The Norwegian Ministry of Finance has today adopted a regulation on the identification of systemically important financial institutions in Norway. This is a follow-up of the capital requirements legislation adopted by the Storting (the Norwegian Parliament) last year.

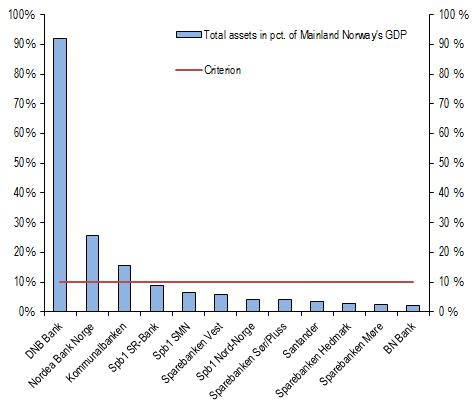

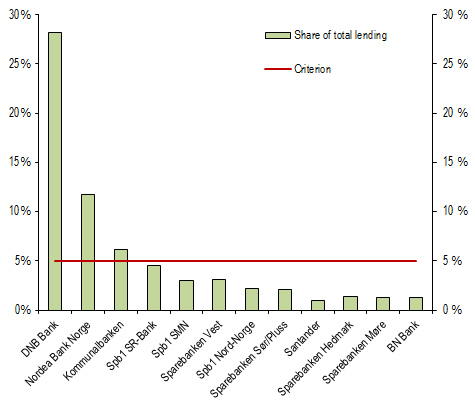

The Norwegian Ministry of Finance has today adopted a regulation on the identification of systemically important financial institutions in Norway. This is a follow-up of the capital requirements legislation adopted by the Storting (the Norwegian Parliament) last year. The regulation stipulates that the Ministry of Finance as a general rule shall designate financial institutions with total assets corresponding to at least 10 per cent of Mainland Norway’s GDP, or a share of the Norwegian lending market of at least 5 per cent, as systemically important. The Ministry has today notified DNB ASA, Nordea Bank Norge ASA and Kommunalbanken AS of the Ministry’s decision to designate these institutions as systemically important in Norway. These three institutions meet the objective criteria specified in the aforementioned regulation, and will therefore be subject to a separate capital buffer requirement for systemically important institutions from 1 July 2015.

– Certain financial institutions are particularly important for the financial system and the economy. Such systemically important institutions shall fulfil a higher capital buffer requirement in order to reduce the probability of financial difficulties that may have serious negative consequences for the financial system and the real economy, says Minister of Finance Siv Jensen.

Pursuant to the capital requirements legislation adopted by the Storting in June last year, systemically important financial institutions shall fulfil a separate capital buffer requirement of 1 per cent CET1 capital from 1 July 2015 and 2 per cent from 1 July 2016. From 1 July 2016, when the new capital and buffer requirements for banks and other financial institutions have been fully phased-in, systemically important institutions shall fulfil a combined CET1 capital and buffer requirement of 12 per cent, while the combined requirement for other institutions will be 10 percent. In addition, all institutions shall fulfil a counter-cyclical capital buffer requirement of 1 per cent from 1 July 2015.

The Ministry of Finance has today adopted a regulation on the procedure and criteria for identifying and designating systemically important financial institutions in Norway. As a general rule, an institution shall be designated as systemically important if it has total assets corresponding to at least 10 per cent of Mainland Norway’s GDP, or a share of the Norwegian lending market of at least 5 per cent. Institutions may also be designated as systemically important on the basis of, among other things, their size, scope of operations in Norway and other countries, complexity, role in the financial infrastructure and their interconnectedness with the rest of the financial system.

The Ministry of Finance shall designate systemically important financial institutions every year, based on advice from the Financial Supervisory Authority of Norway (Finanstilsynet). The Ministry’s decision shall normally enter into force no earlier than 12 months after the decision has been made. The Ministry may, however, in special cases decide earlier implementation.

The regulation on the identification of systemically important institutions is drawn up in line with the EU CRR/CRD IV framework and the Basel Committee on Banking Supervision’s framework for dealing with domestic systemically important banks, and it has clear similarities with solutions adopted in Denmark, Sweden and elsewhere. In addition to the separate capital buffer requirement, Finanstilsynet has proposed that systemically important institutions should be subject to requirements on liquidity coverage, stable funding and recovery plans earlier than other institutions. Rules on such requirements are still under development – both in the EU and Norway – and the Ministry will therefore have to return to these issues later.

DNB ASA, Nordea Bank Norge ASA and Kommunalbanken AS have today been notified that the Ministry of Finance will decide to designate the institutions as systemically important, pursuant to the capital requirements legislation in the Financial Institutions Act and the regulation on the identification of systemically important financial institutions. The purpose is to increase the loss-absorbing ability of the institutions that are designated as systemically important.

DNB ASA, Nordea Bank Norge ASA and Kommunalbanken AS are the three largest financial institutions in Norway, both compared to Mainland GDP and in terms of market shares in the lending market; see charts below. Most of Kommunalbanken AS’s funding is raised in international capital markets.

– The performance of the Norwegian economy has contributed to good results and good earnings for Norwegian financial institutions, particularly for banks. Norwegian banks have strengthened their solvency significantly in recent years, due to both new capital requirements and demands from lenders and other financial markets participants. Many Norwegian banks are important in their regions. The Ministry of Finance has decided not to include a regional criterion for the identification of systemically important institutions. It is nevertheless important that Finanstilsynet follows up on the regional banks’ capital adequacy, to ensure that they are well prepared to meet downturns in the economy. In general, it is important that banks continue to strengthen their solvency, says Minister of Finance Siv Jensen.

Charts: Total assets in per cent of Mainland Norway’s GDP1 and share of total lending to the general public in Norway2 at year-end 2013. Norwegian financial institutions (consolidated group level).

1) For institutions with ownership in covered bond-issuing mortgage companies whose activities are not consolidated into the institution’s annual accounts, the institution’s proportionate share of the mortgage company’s assets is included in the institution's assets.

2) Includes loans transferred to partly-owned covered bond-issuing mortgage companies.

Source: The Financial Supervisory Authority of Norway (Finanstilsynet).