London, 6. April 2018:

Speech at Finance Norway’s Capital Markets Day 2018

Historisk arkiv

Publisert under: Regjeringen Solberg

Utgiver: Finansdepartementet

Tale/innlegg | Dato: 06.04.2018

– International co-operation on regulation of financial markets is in the interest of all countries, said Minister of Finance Siv Jensen (Progress Party) in her speech at Finance Norway’s Capital Markets Day 2018 today.

Check against delivery

Financial stability in a European environment – a cross policy approach

Thank you for the opportunity to join you here today. Today I will focus on how we apply European rules and regulation and use a combination of different instruments to promote financial stability in Norway.

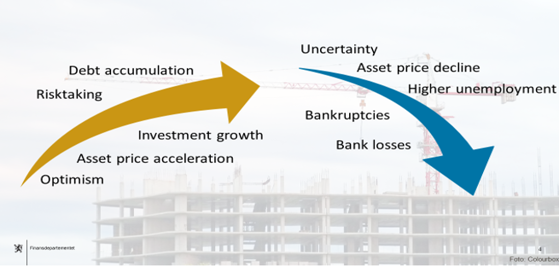

Asset prices and debt tend to move hand in hand. Periods of rapid economic growth are often accompanied by exuberance on the part of firms, households, as well as the financial sector. The result is often a debt-financed investment boom and rising asset prices. When the cycle turns, we see the opposite: a sharp fall in asset prices, tighter lending conditions and potentially harsh downturns with high unemployment.

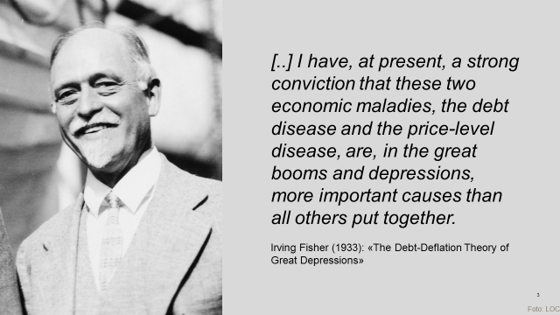

This basic insight is not new: In 1933, the American economist Irving Fisher used strong words when describing the relationship between debt accumulation, asset prices and economic cycles. He argued that asset price booms and high levels of debt were economic maladies and the most important causes of severe economic downturns. This was after he was hardly hit himself by the 1929 stock market crash. A sense of bitterness can be seen in his writing. He was at the time infamous for his claim, just prior the crash, that the stock market had reached a new permanently higher level.

We have experienced the same pattern several times: recessions that follow periods of rapid debt accumulation and strong asset price inflation tend to be deep and long lasting. The Norwegian banking crisis in the late 1980s, one of the worst financial crises in advanced economies in modern times according to Carmen Reinhart and Kenneth Rogoff, is an example of this. Real house prices declined by 40 percent and did not return to pre-crisis levels for more than 12 years, the number of unemployed tripled, and the three largest banks in the country collapsed. Similarly, many European economies caught up in the global financial crisis have only recently returned to their pre-crisis GDP levels.

This taught us the value of good regulation and supervision of the financial sector, which has been an important policy objective for all Norwegian governments since the late 1980s.

As a politician coming from a libertarian political tradition, I believe in freedom of choice and a limited government that empowers people and businesses to achieve their goals. I generally believe that the free market will find the best outcome, and I therefore prefer to avoid regulation whenever I can.

However, the knowledge that strong growth in house prices and debt can cause much harm to the economy, and also the important role of banks, implies that regulating the financial sector is necessary to safeguard financial stability and to ensure a safe housing market. As the minister of finance I also have to keep an eye on state expenditures, as it is often the Government that has to come in when big banks fail.

We need to strike a balance. We have to accept that there is a need to regulate the financial sector but we should never forget that the “art of banking” is better handled by bankers than by politicians.

Today’s economic landscape is characterized by highly integrated financial markets, increasingly sophisticated financial institutions operating in several jurisdictions, and a rapidly changing global regulatory environment. When risks materialize, they can spread fast between institutions and countries.

There is always a risk that financial services will be provided from jurisdictions with weaker regulation. Harmonized financial regulation is beneficial for the efficiency and stability of our financial markets, allowing for well-functioning cross border operations.

More integrated financial markets, and in particular the international financial crisis in 2008, have led to an effort by the G-20, the Financial Stability Board and the IMF, to develop a set of common international standards and rules for the regulation and supervision of the financial sector. The Basel Committee on Banking Supervision has formalized these efforts into broadly accepted standards and guidelines.

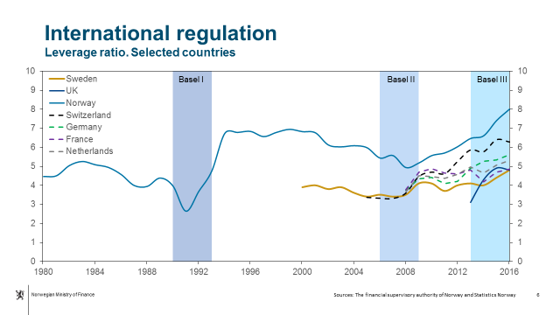

The first set of common standards for banks – the first Basel Capital Accord - was introduced in 1988, and has since been supplemented by two accords – the Basel II and Basel III. Most advanced jurisdictions, for example the US and the EU, have transposed these standards into legislation.

I understand those who argue that international common standards for governing the financial sector have become too large and complex. The chief economist at the Bank of England, Andrew Haldane, made this point succinctly simply by counting the pages of the different vintages of the Basel accords. I am also well aware that some of the regulation that has emerged after the financial crisis resembles “old wine in new bottles”. More generally, we must not forget the reasons why we abandoned the intrusive regulatory environment of the 1950s and 60s and we must strive to avoid unnecessary regulation.

The global financial crisis demonstrates clearly, however, the need to impose sensible regulations on the financial sector. It is my firm belief that if Basel III is successfully implemented throughout the world, the global financial system will be better able to weather the next financial crisis. However, it is critical that we work together.

Region-wide regulatory frameworks, like in the EU, ensure a good degree of harmonization of rules across countries. As a member of the European Economic Area, Norway has an obligation to implement most of the financial regulations adopted in the EU. The UK’s neighbouring countries, including Norway, have an interest in the UK continuing to implement the Basel accords and other important standards, also post-Brexit. And we have an interest in the UK continuing to endorse the idea of common rules and a level playing field.

Countries with highly integrated banking sectors may also benefit from cooperation among supervisors to get a common understanding of risks and regulatory needs. In the Nordic and Baltic region we have established meeting places and foras for discussion and cooperation, since several Nordic banks operate across the whole region. On the regulatory side, these foras make it possible to discuss local needs within a regional context and have in several instances resulted in voluntary reciprocity of prudential requirements within the region. On the supervisory side, we have agreements about information sharing.

The cooperation within the Nordic-Baltic region on bank supervision has served us well and facilitated the transition to a new regulatory regime after the financial crisis.

While the rest of Europe was deleveraging after the global financial crisis, household debt in Norway continued to rise. This both allowed and required Norwegian authorities to be proactive in addressing financial risks. At times we have chosen to implement the new regulations earlier than in the EU, and we have often used any available flexibility in the EU frameworks to tighten regulations further.

We have strongly promoted the build-up of own funds in the banking sector, and we can now see the results in international comparisons of leverage ratios. Norwegian banks are already fully compliant with Basel III requirements, while many other European banks still have a way to go.

Some parts of the financial market regulation has a macroprudential focus, and is more tailored to national needs and conditions. In particular, the use of macroprudential measures must acknowledge that countries may be at different stages of the financial cycle. At times it may even seem as if there is an inherent conflict between the notion of common international standards and macroprudential measures that are set at an individual country level.

We should continue along both paths – fighting loopholes in supervision and regulatory arbitrage, as well as emphasising host-country regulation and supervision.

The Head of our Supervisory Authority, Mr Morten Baltzersen, will explain more about the regulation later today.

But let me explain one particular regulatory issue in more detail.

There is a strong public interest in the housing market. Around 80 per cent of norwegians own the house they live in, and the majority of households’ assets are tied up in their home. Hence it is of great importance to have a well-functioning and efficient housing market.

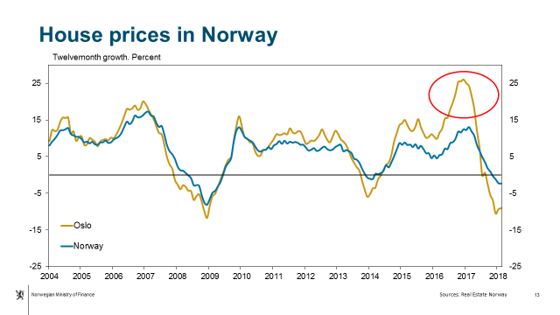

Up until a year ago, Norway experienced strong and accelerating growth in house prices. Household debt was – and still are - growing steadily faster than income. As a result we have found it necessary to take several measures to address this increasing vulnerability in the household sector and especially the housing market frenzy.

A simple rule of thumb could be that double-digit growth in housing prices should raise concern. After several years of brisk growth, house prices in Oslo approached an annual growth rate of 25 percent at the end of 2016. In such a situation, the warning lights should flash.

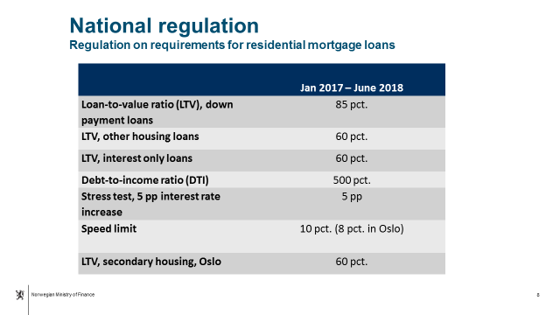

We have introduced a regulation on mortgage lending to contribute to a more sustainable residential mortgage market, first in 2015 and again in a somewhat stricter form in 2017.

So far, the measures seem to have worked well. The share of new mortgages that are very large relative to income and house value, has been reduced. Also- housing prices have stopped growing and even declined moderately through 2017, as you might have noticed from the previous graph.

The regulation included a limit on the loan-to-value ratio of 85 percent, a maximum debt level of 5 times your gross annual income, and an amortization requirement on mortgages with a high loan-to-value ratio.

Banks have flexibility to provide loans that do not satisfy all requirements, a so-called “speed limit” of 10 percent. In Oslo, where house prices have risen considerably faster than in the rest of the country, we introduced a more restrictive limit on the loan-to-value ratio for secondary homes, and a lower speed limit.

The flexibility for banks to do a proper credit assessment was an important part of the regulation, and that is why we included the speed-limit. Other countries that have introduced mortgage lending requirements have also set a speed-limit, including the UK.

I believe this is where we depart from the regulatory doctrine of the post-war period – we acknowledge the need for regulation, but we are cautious not to regulate banks so heavily that we effectively take over the responsibility for their business. Regulation should be crafted in a way that leaves banks with responsibility for running their businesses.

The current regulation expires in late June this year. We are in a process of evaluating its effects and the need to keep it in place. A public consultation is soon to be completed. In general, requirements that respond to transitory events, should also be transitory. However, to keep some limitations on the size of mortgages, for example related to home value and income, may be sensible regardless of the state of the economy.

A cross policy perspective

The traditional policy tools aimed at promoting financial stability are mostly geared toward building capital and liquidity buffers in banks, households, and firms. Their ability to address the underlying accumulation of risks, however, is less clear.

We have ample evidence that a more solid capital base makes banks less vulnerable to negative shocks, but we have little evidence that higher capital requirements are effective at preventing the build-up of financial imbalances. Similarly, requirements on mortgage lending can reduce the number of vulnerable households, but their effect on overall debt accumulation is less clear.

A cross policy-approach is therefore warranted. Fiscal policy, monetary policy, structural policy and financial market regulation need to work together to deliver a stable financial system that can contribute to societies’ broader economic and social objectives.

Both monetary policy and fiscal policy have important roles to play in counteracting the build-up of financial imbalances. Contractionary macro policies during an upturn can help prevent the build- up of vulnerabilities. Similarly, expansionary macro policies during a slowdown can help prevent the rapid deleveraging of balance sheets that can amplify a downturn.

The tax system also has an impact on financial stability. In recent years, the Norwegian Government has introduced several measures that aim to make speculative behaviour in the housing market less profitable. These measures include a higher valuation of secondary homes for the purpose of determining the wealth tax.

The supply side of the housing market is important for housing market developments. We have launched a comprehensive housing initiative to increase the supply of new houses, including an overhaul of building standards. The results of that policy are clear. Housing construction has picked up and has contributed to end the accelerating house price growth.

Now let me come back to monetary policy – as the level of the interest rate is an important factor behind the growth of house prices and accumulation of debt.

Norges Bank has over some time put some weight on preventing the build-up of financial imbalances in setting the policy rate.

In the recent update of Norges Bank’s monetary policy mandate, which was announced on March 2nd, the Government decided to explicitly include financial stability considerations into the statutory objectives for monetary policy.

Stabilizing inflation around the inflation target remains the primary objective for monetary policy, but we also explicitly stated that monetary policy should be forward-looking and flexible so that it can contribute to high and stable output and employment and counteract the build-up of financial imbalances.

The new monetary policy regulation also lowered the inflation target from 2,5 to 2 percent. The motivation behind this was mainly to align our target with targets in comparable countries.

This new regulation represents a change in the statutory mandate for monetary policy. However, it is unlikely to alter how the policy rate is set, as it is largely a formalization of how Norges Bank has been conducting monetary policy.

Norges Bank has supported the new regulation, and I am sure Governor Øystein Olsen will touch upon this in his speech.

Summing up

Let me sum up.

Our broad approach to financial stability has proved useful to mitigate the build-up of risks in the housing market in recent years. Building buffers in our financial system is the best way to make our economies less vulnerable to the consequences of financial disruptions. In an international environment where banks’ activities no longer are limited to domestic markets, and where financial unrest quickly affects multiple countries, we need international solutions. International co-operation on regulation of financial markets is in the interest of all countries. This includes Norway as a small open economy with close ties to the rest of Europe, and the UK as the world’s leading financial center with close ties to the rest of Europe.

The UK has played an important role in developing the European single market for financial services. Norwegian and British views have often been aligned. [We will miss the British voice in the EU.] Independent of Brexit there will be a need for close cooperation and coordination on financial market issues in Europe also in the future.

I am sure the UK will continue its efforts to promote sound and safe financial institutions and work toward a level playing field internationally for the financial sector in the years to come.

Thank you very much for listening!

Printer friendly version (pdf)

Finance Norway’s Capital Markets Day 2018 - invitation and programme