2 The work of the Council on Ethics

The Council on Ethics for the Norwegian Government Pension Fund Global is an independent body that makes recommendations to Norges Bank to either exclude companies from the GPFG or place them under observation. The Council’s assessments are based on ethical guidelines for the GPFGs investments, determined by the Norwegian Ministry of Finance. The guidelines contain both product-based exclusion criteria, targeting the production of tobacco, cannabis, coal or certain types of weapons, and conduct-based exclusion criteria, such as serious financial crime, the sale of weapons to certain states, human rights abuses and environmental damage. The threshold for exclusion is intentionally high. The guidelines are forward-looking and apply to unacceptable conditions that are ongoing or may occur in the future. They are not meant to be a mechanism through which to punish companies for past actions. All the Council’s recommendations are published on its website as soon as Norges Bank has announced its decision.

Portfolio monitoring and information gathering

The Council constantly monitors whether companies in which the GPFG has invested engage in operations which fall within the scope of the Guidelines for Observation and Exclusion of companies from the Government Pension Fund Global. The Council works on many cases and issues in parallel. Several consultants have been commissioned to identify companies whose operations may be covered by the exclusion criteria. In addition, the Council monitors a number of databases and websites containing information on, for example, corruption, weapons sales or companies’ human rights abuses. The Council is also approached by organisations and individuals who call on it to consider specific cases. These contacts may be made directly to the Council or forwarded from Norges Bank.

While all relevant product-based cases are investigated, the Council must prioritise which cases to examine in more detail under the conduct-based criteria. In this context, the Council gives weight to the violation’s scope and seriousness, its consequences, the company’s responsibility for or contribution to the matter concerned, what the company is doing to prevent or mitigate the harm caused, and the risk of similar incidents occurring in the future.

Access to information varies significantly from country to country. To compensate for the fact that not all serious cases are picked up on through day-to-day portfolio monitoring, the Council undertakes its own inquiries into areas of high risk. When the Council has selected a particular issue for further investigation, it generally follows this up over several years. For example, the Council has focused on companies whose working conditions verge on forced labour since 2016 and has kept a keen eye on the extraction of natural resources from Western Sahara since 2005.

The Council obtains information from research environments as well as national and international organisations, and often commissions third-party consultants to specific cases. The Council frequently engages in dialogues with company officials during the assessment process.

As a result of a public inquiry into the ethical framework for the GPFG, the Guidelines for Observation and Exclusion of Companies from the Government Pension Fund Global were adjusted in 2021. These changes have had a major impact on the Council’s work in 2022. Two new exclusion criteria were introduced – one product-based and one conduct-based – while the scope of other criteria was expanded. As a result, the Council’s secretariat was permitted to add two new positions to its headcount. Under the new arrangements, Norges Bank and the Council are required to coordinate their efforts more closely. In 2022, this has been the case with respect to a number of companies and topics, particularly in connection with the implementation of the new guidelines.

Tabell 2.1 The Council on Ethics’ activities in the period 2020–2022

Year | 2020 | 2021 | 2022 |

|---|---|---|---|

No. of limited companies in the GPFG at year-end | 9150 | 9340 | 9228 |

No. of companies excluded at the recommendation of the Council on Ethics at year-end | 71 | 80 | 91 |

No. of companies placed under observation at the recommendation of the Council on Ethics | 6 | 9 | 9 |

No. of companies on which the Council on Ethics issued a recommendation during the year | 12 | 21 | 21 |

No. of companies excluded during the year at the recommendation of the Council on Ethics | 10 | 12 | 13 |

No. of companies placed under observation during the year | 0 | 3 | 4 |

No. of observations concluded during the year | 1 | 0 | 4 |

No. of exclusions revoked during the year | 2 | 3 | 2 |

No. of new cases accepted for assessment during the year | 120 | 91 | 81 |

No. of cases concluded during the year | 104 | 86 | 79 |

Total no. of companies under assessment during the year | 206 | 195 | 193 |

No. of companies the Council has been in contact with | 77 | 66 | 71 |

No. of companies the Council has met with | 16 | 12 | 14 |

No. of Council meetings | 10 | 14 | 10 |

Secretariat (no. of staff) | 8 | 8 | 9 |

Budget (NOK million) | 18.7 | 18 | 20.2* |

The table summarises the scope of the Council’s inquiries into companies in 2022, compared with in 2021 and 2020. Companies excluded by Norges Bank under the coal criterion, without the Council’s recommendation, are not included in the table. Companies that have been delisted from a stock exchange are removed from the list of excluded companies as and when delisting occurs.

* The budget increase is due to the allocation of two new secretariat positions with budgetary effect from, respectively, 1 January and 1 July 2022.

Summary of the Council’s activities in 2022

Table 2.1 provides a summary of the Council’s activities in the past three years. The companies in which the GPFG has invested form the starting point for the Council’s work. In 2021, it was decided to substantially reduce the number of companies in the GPFG’s benchmark index. Despite this, the share portfolio has for the most part comprised more than 9,000 companies, headquartered in over 60 countries.

At the close of 2022, 91 companies were excluded from investment by the GPFG at the recommendation of the Council, while nine were under observation. In addition, Norges Bank had, at its own initiative, excluded 72 companies under the coal criterion and placed 13 under observation. This was the first year in which Norges Bank was able to assess companies under the climate criterion without first receiving a recommendation from the Council. However, the Bank has not so far published any such decisions.

The Council issues its recommendations to Norges Bank, which then makes a decision on the case. In 2022, the Council issued recommendations on a total of 21 companies. Of these, 17 related to exclusion, one to the revocation of exclusion, two to observation and one to the termination of observation. Nine of the recommendations to exclude were prompted by the changes in the GPFG’s ethical guidelines introduced in 2021.

Since Norges Bank undertakes a thorough assessment of all the Council’s recommendations and also needs time to divest its shareholdings in companies, some of the decisions published in 2022 were based on recommendations issued by the Council in 2021. For the same reason, not all the Council’s recommendations from 2022 have yet been published. All recommendations are published when Norges Bank announces its decision after the shareholding concerned has been sold. Summaries of the recommendations published in 2022 may be found in Chapter 12.

The Council always has many cases in progress, and it is common to have cases under assessment in relation to the majority of exclusion criteria. It is not unusual for a company to be the subject of several different cases. We also have cases involving more than one company. In 2022, the Council worked on a total of 206 cases, relating to 193 different companies. Of these, 81 were opened during the year, while 57 were opened in 2021. The assessment of 79 cases was concluded during the year. This includes cases on which a recommendation was issued to the Bank, cases where no grounds for exclusion or observation were found, and cases relating to companies in which the GPFG was no longer invested. The Council investigated eight companies which left the GPFG without a recommendation being issued.

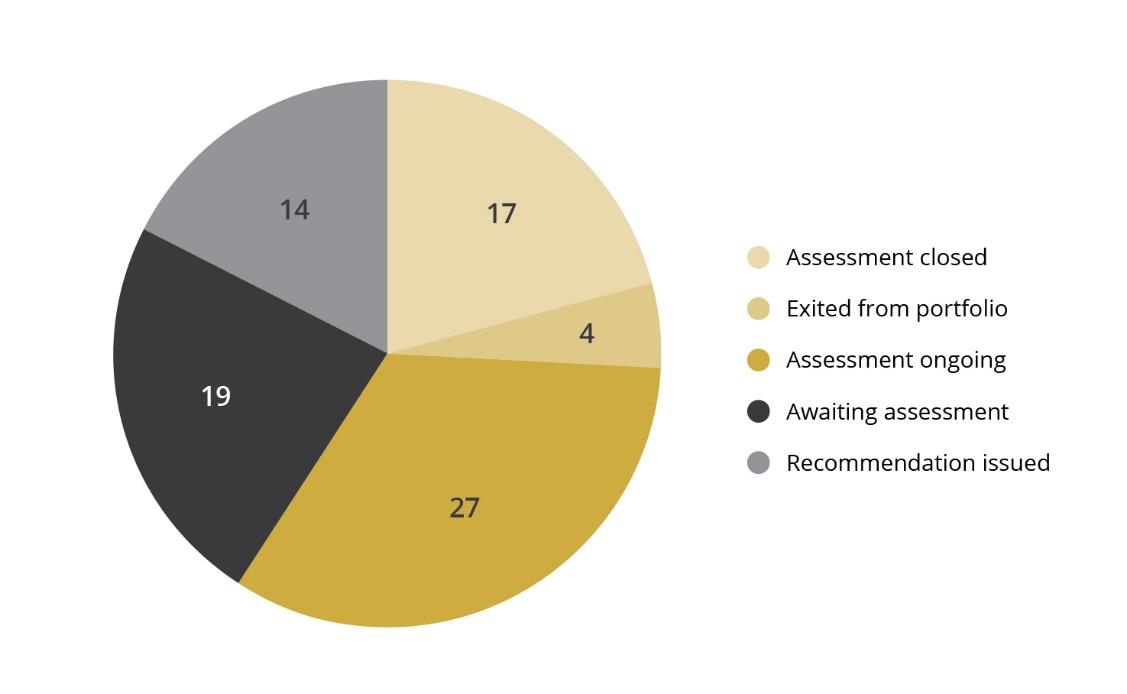

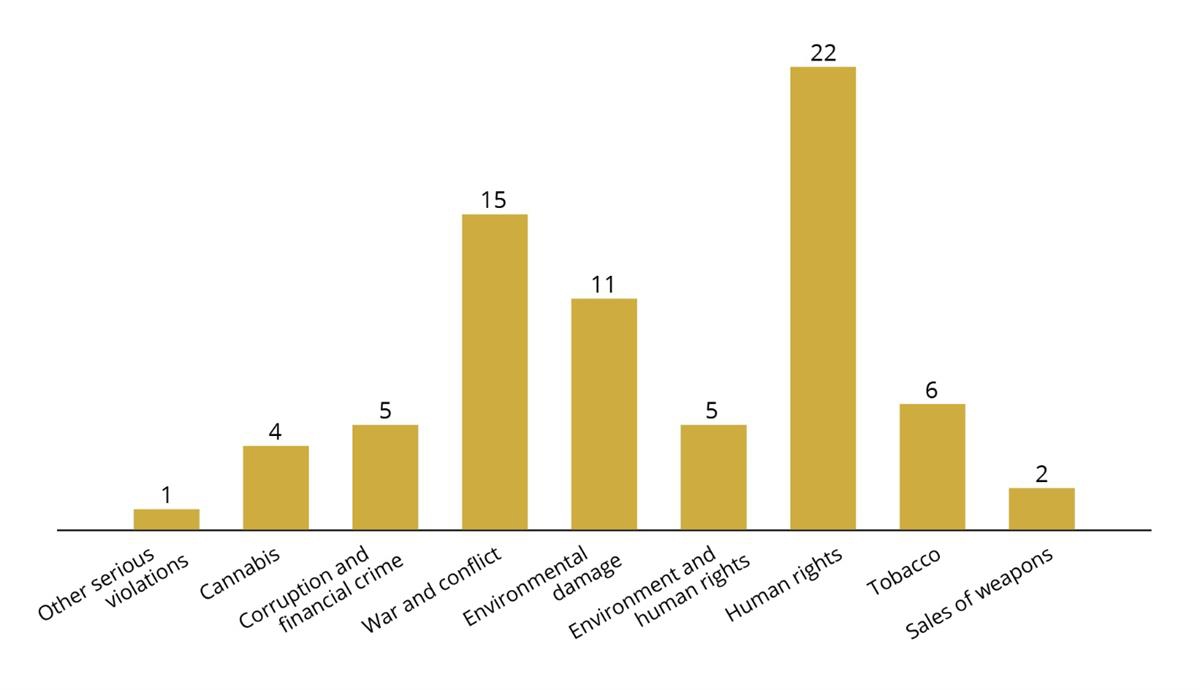

Figur 2.1 New cases in 2022

Figure 2.1 shows what happened to the 81 cases that the Council opened in 2022. The majority did not end in a recommendation to exclude a company or place it under observation, but were clsoed at an early stage in the assessment process. A recommendation to exclude a company or place it under observation, or to revoke a previous exclusion or observation decision, was issued in 14 of the 81 new cases opened in 2022, while 17 were shelved. The assessment of four of the new cases was terminated because the companies were no longer part of the GPFG portfolio. Assessment of 22 of the cases remains ongoing, while 19 cases are still waiting for assessment to commence.

The risk of gross corruption was the assessment topic for 15 of the new cases opened in 2022, while financial partnership with the armed forces in Myanmar was the topic in 10 cases. Other common topics include loss of biodiversity and contribution to human rights violations through the sale of mass surveillance technology.

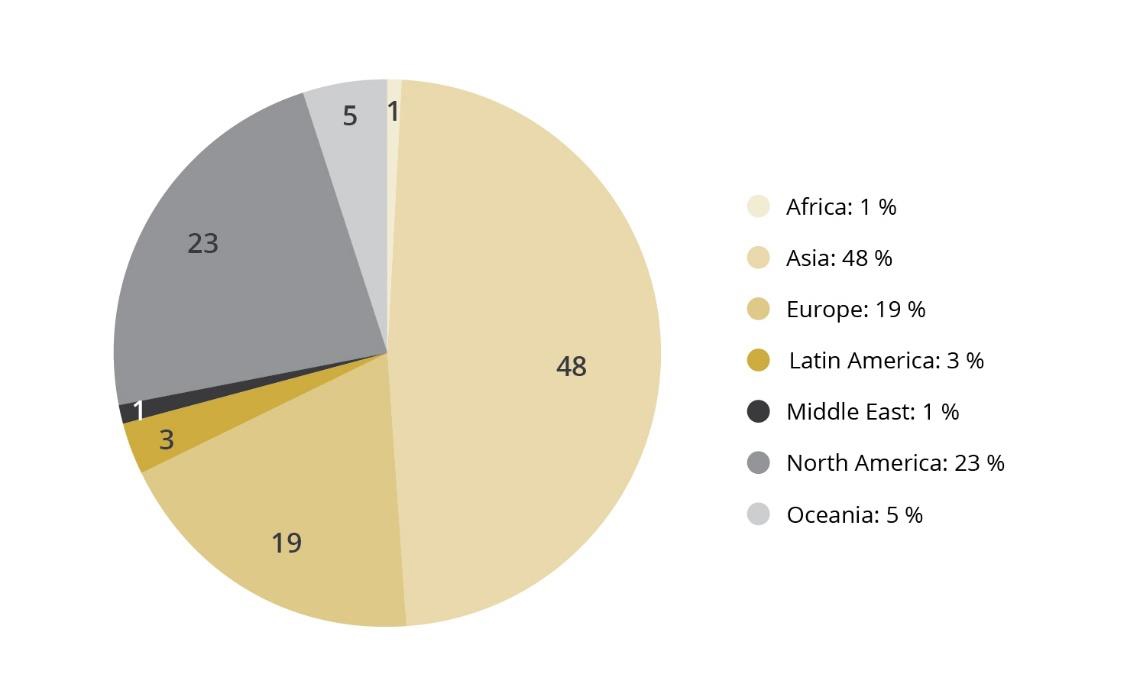

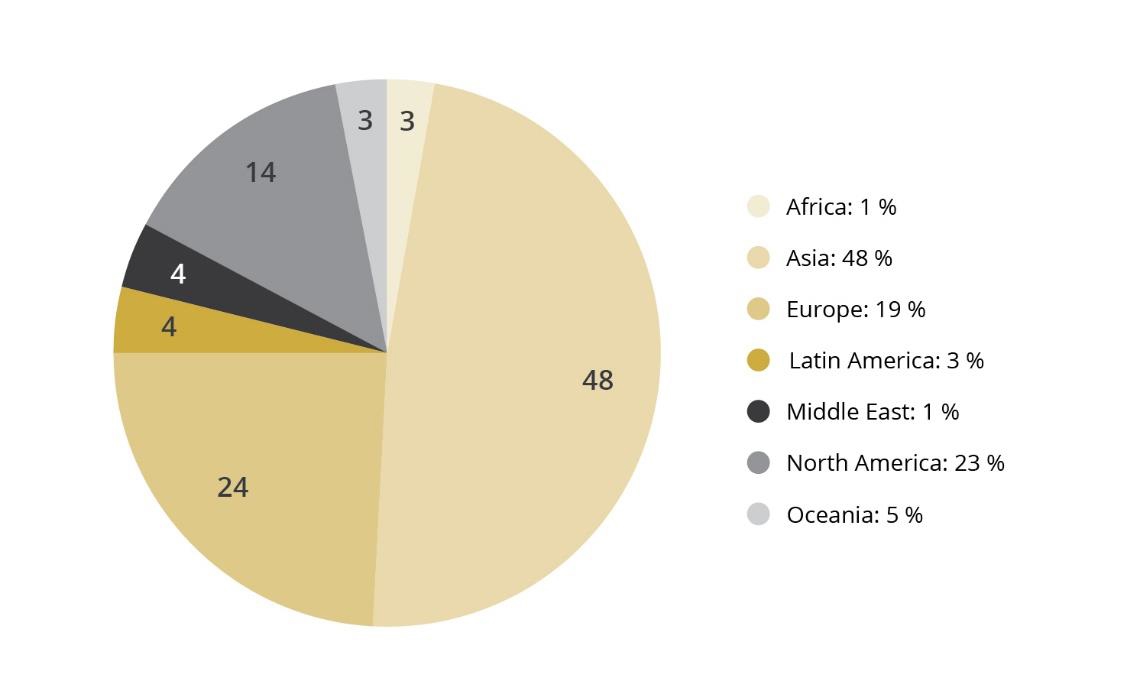

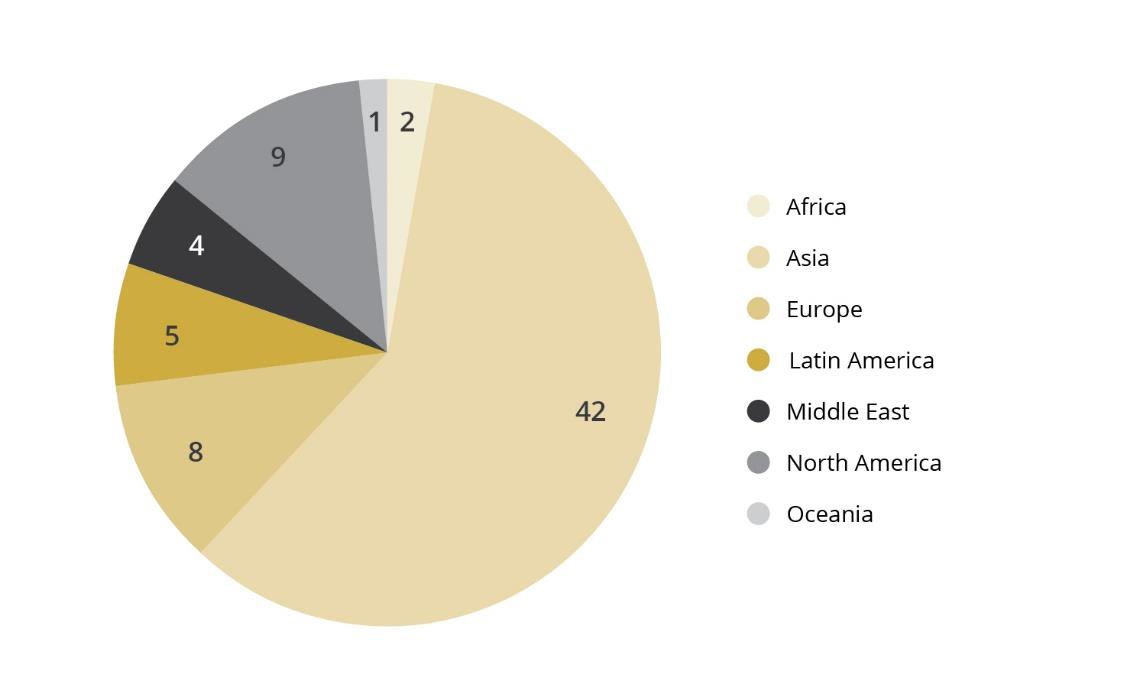

Figur 2.2 Regional breakdown of the GPFG’s shareholdings

Figur 2.3 Regional breakdown of the companies assessed by the Council

Figure 2.2 shows a regional breakdown of the GPFG’s shareholdings at the close of 2022, while Figure 2.3 shows a regional breakdown of the companies assessed by the Council during the year. The geographic distribution of companies assessed by the Council varies from year to year. In 2022, there was a greater correlation than in previous years between the regional distribution of companies in the GPFG and those assessed by the Council. An important reason for this is that the bulk of the companies which came up for assessment as a result of the changes in the ethical guidelines in 2021 were from Europe and the USA.

Most of the almost 100 Asian companies that the Council assessed in 2022 were scrutinised on the basis of their financial partnerships with the armed forces in Myanmar, the break-up of ships for scrap by means of beaching, and forced labour. Asian companies are often investigated as part of a review of topics which the Council monitors especially closely because the ethical risk is high. Nevertheless, some companies are picked up on through the general portfolio monitoring process. Ten of the companies on which the Council issued recommendations in 2022 are from Asia.

In 2022, the Council assessed approx. 50 companies from 14 different countries in Europe. As in 2021, the majority of these cases related to the risk of corruption and various human rights abuses. The human rights cases related to mass surveillance, forced relocation and violations of the rights of indigenous peoples, for example.

Around a third of the almost 40 companies domiciled in North America were assessed in relation to human rights abuses, while the remaining cases are evenly distributed with respect to the majority of criteria. All the companies excluded for production of cannabis are from North America.

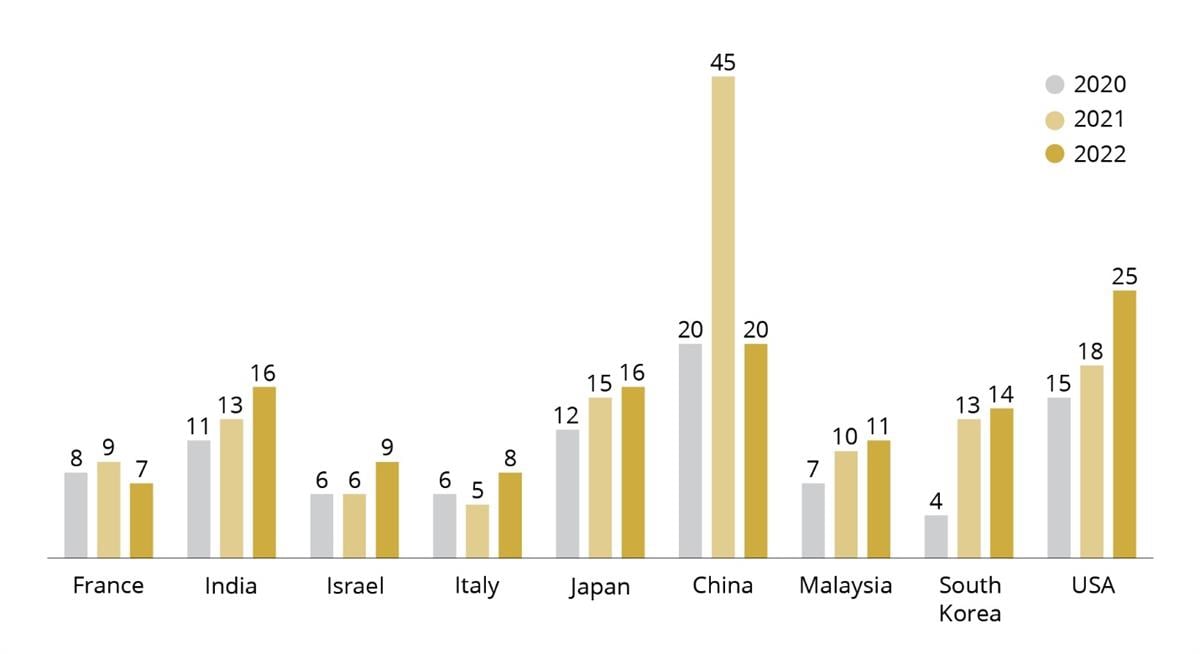

Figur 2.4 Countries with most companies under investigation

Figure 2.4 shows the number of companies under investigation in 2020, 2021 and 2022 from the nine countries from which most companies under assessment in 2022 were drawn. In 2021, Thailand and the UK were included in a similar presentation.

The increase in the number of companies from the USA, which had the most companies under assessment in 2022, is due in part to the changes in the ethical guidelines introduced in 2021. This is because the USA has more companies producing tobacco or cannabis, and many large weapons manufacturers. In 2021, there was a sharp increase in the number of Chinese companies under assessment. This was, in part, linked to investigations into human rights violations relating to the internment of Uyghurs in the Xinjiang Uyghur Autonomous Region, and to the assessment of companies using body parts from endangered animal species in the production of medicines. A good many of these cases were also concluded in 2021, though work relating to forced labour in Xinjiang remains ongoing.

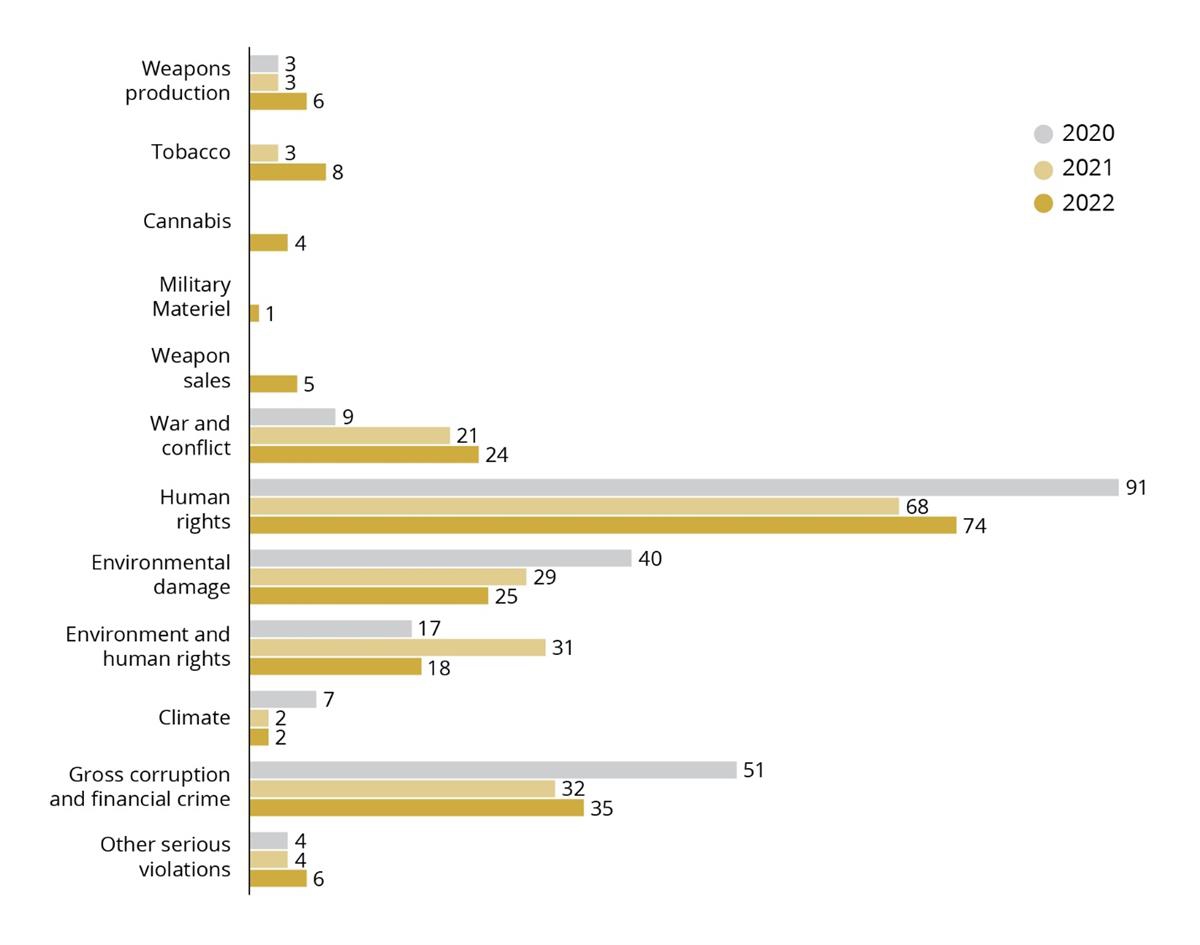

Figur 2.5 Breakdown of the Council’s work by criterion

Work under the various criteria

Figure 2.5 shows a breakdown of the cases on which the Council has worked in 2022, by exclusion criteria. There was a sharp increase in the number of cases assessed under product-based criteria, due to the changes in the ethical guidelines. Production of cannabis and tobacco account for the bulk of these cases, though there are also some weapons-related cases.

Nevertheless, human rights-related cases continue to dominate. Many cases have their starting point in inquiries the Council itself has initiated. Such inquiries may, for example, be prompted by suspicions that labour-intensive sectors in some countries may be using forced labour. This then leads to a large number of companies undergoing a preliminary assessment. The Council first identifies all companies whose operations may be exposed to such a risk. It then contacts relevant companies to obtain information that can confirm or refute the Council’s suspicions. Based on the companies’ responses and information from other sources, the Council decides which companies to examine in more detail.

Some cases that are assessed under the human rights criterion may also fall within the scope of additional exclusion criteria, even though it is the human rights abuses on which the Council focuses. For example, an activity may impact an area in which indigenous people live and materially impair their livelihoods, without them having been adequately consulted, at the same time as the project being undertaken will cause serious environmental harm. Indigenous peoples’ sympathetic use of nature means that many of the areas in which they live are of high conservation value and contain resources that have not previously been exploited.

Under the war and conflict criterion, the Council has assessed numerous cases where companies in the GPFGs portfolio engage in financial cooperation with companies controlled by the armed forces in Myanmar. Some cases have also related to business activities in the West Bank.

Under the environment criterion, the Council has continued to work on pollution from mining and industrial activity, damage to conservation areas and loss of biodiversity. Much of this work is part of a systematic assessment of selected risk areas. However, two of the three recommendations issued in 2022 under this criterion applied to companies picked up on through news monitoring.

It has been important for the Council to establish a good foundation for the work prompted by the expansion of the corruption criterion to also cover other serious financial crime. Currently, the Council has several companies under investigation for money laundering. A number of the new cases from 2022 are linked to corruption in the telecoms sector.

Under the criterion relating to other serious violations of fundamental ethical norms, the Council has examined the risk of damage to cultural heritage sites, as well as the extraction of resources in Western Sahara.

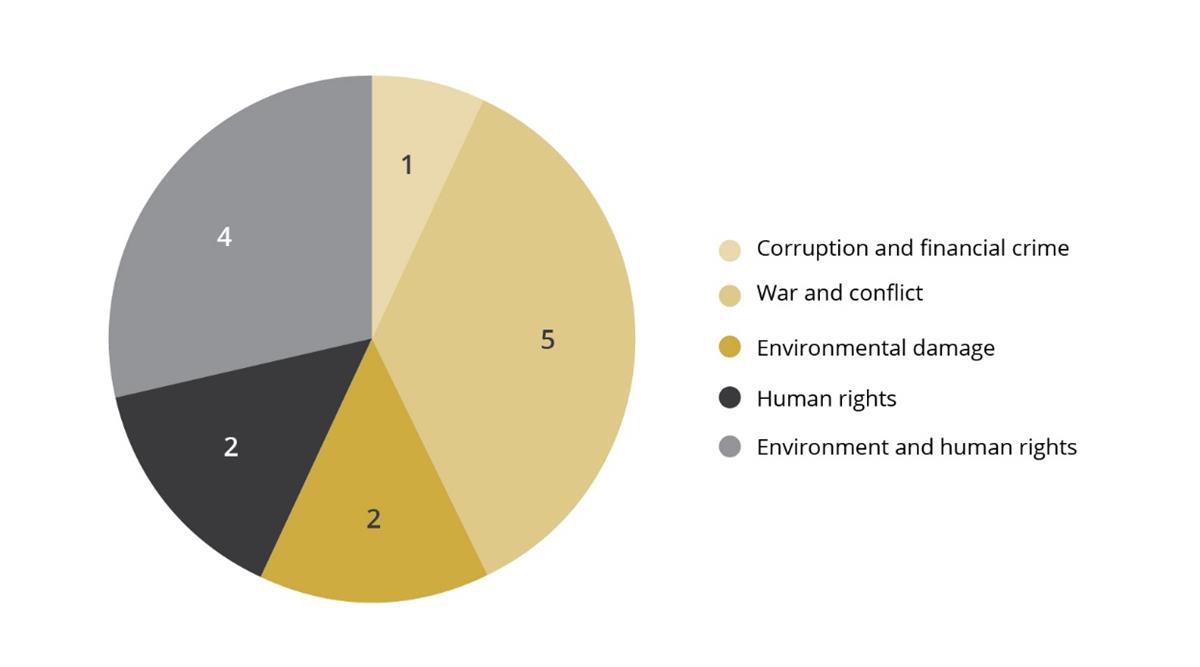

Contact with companies

Figure 2.6 shows a regional breakdown of the companies the Council has been in contact with, while figure 2.7 shows a breakdown of the same companies by exclusion criterion. The Council has been in contact with 71 companies and met with 14 of them. The Council contacts companies which it wishes to examine in more detail after a preliminary investigation. The Council first asks the companies for information that can provide a better foundation for an assessment of their operations. Every company assessed under the conduct-based criteria is given an opportunity to comment on a draft of the Council’s recommendation before a final version is forwarded to Norges Bank.

Figur 2.6 Breakdown of contact with companies by criterion

Figur 2.7 Breakdown of contact with companies by region of domicile

The Council attaches importance to the information provided by companies. In line with the Ethics Commission’s conclusions, a lack of response on the part of a company may help to increase the ethical risk associated with it. The majority of companies reply, though some do not. Of the 71 companies with which the Council was in contact in 2022, 23 companies did not reply. Some of these were contacted late in the year, so a response may yet be forthcoming. In 2022, recommendations were issued to exclude 10 companies that had declined to reply to the Council’s inquiries. Seven of these were excluded on the grounds of their tobacco or cannabis production.

When the Council meets with companies, it is often late in the assessment process, usually as a result of a draft recommendation to exclude the company, or in connection with observation. Figure 2.8 shows a breakdown of the companies the Council met with in 2022 and the criteria they were assessed under. Three of the companies the Council met with in 2022 are under observation.

Figur 2.8 No. of meetings with companies, by criterion

Reassessment of excluded companies

Companies are not excluded for a specific period of time, and their exclusion may be revoked as soon as the grounds therefor no longer exist. Each year, the Council checks whether or not companies still engage in the activity for which they were excluded. For some companies, a more in-depth investigation is carried out. This may be at a company’s request, for example, or if there are indications of a major change in its operations. If a company has implemented measures that have led to sufficient improvement in the conditions on which exclusion was based, the Council issues a recommendation to revoke its exclusion. Such improvements must be observable in practice and not simply be stated in the company’s plans and strategies. One common reason for a recommendation to revoke an exclusion is that the company has discontinued or disposed of that part of its business that constituted the grounds on which it was based.

In 2022, the Council recommended that the exclusion of one company be revoked. Norges Bank also revoked the exclusion of a company on the basis of a recommendation issued by the Council in 2021. Companies that have been delisted from a stock exchange are removed from the list of excluded companies without the Council’s recommendation being rescinded.