2 Why a national charging strategy?

Image: Olav Heggø

2.1 Climate goals and climate agreements – major reductions required in the transport sector

The agreement to reduce emissions signed in Paris in 2015 – the Paris Agreement – is the first global climate agreement that is legally binding and actually mandatory for all countries. Norway has registered an obligation under the Paris Agreement to reduce greenhouse gas emissions by a minimum of 50 percent and up to 55 percent before 2030, compared to 1990.

Norway has also entered into agreements with the EU concerning emission reductions. The agreement concerning the non-ETS emissions (EU Emission Trading System), which includes transport emissions (apart from most of aviation), states that emissions must be reduced by 40 percent in 2030 compared to 2005. The target for 2030 is translated into an emissions budget with emission ceilings for each year in the period 2021–2030.

Emissions from the transport sector amounts to around 60 percent of the non-ETS emissions. Around half of these emissions stems from road traffic. If Norway is to meet its obligations according to the Paris Agreement and the agreement with the EU, emissions from road transport must be greatly reduced. This can take place through less transport or by a transition to transport methods giving lower emissions compared to the transport involved. A transition from petrol and diesel vehicles to zero-emission vehicles is an example of the latter.

2.2 Developments in emissions, vehicle population and charging infrastructure

Through considerable taxation and user incentives, Norway has stimulated the phasing-in of EVs for several years. However, it was first around 2017 that passenger EVs could compete with traditional cars regarding comfort and driving characteristics and sales increased rapidly. In 2021, 63 percent of new passenger cars and around 16 percent of the passenger car population were electric. At the end of November 2022, over 77 percent of passenger car sales were EVs, and the number of passenger EVs amounts to almost 20 percent of all passenger cars.

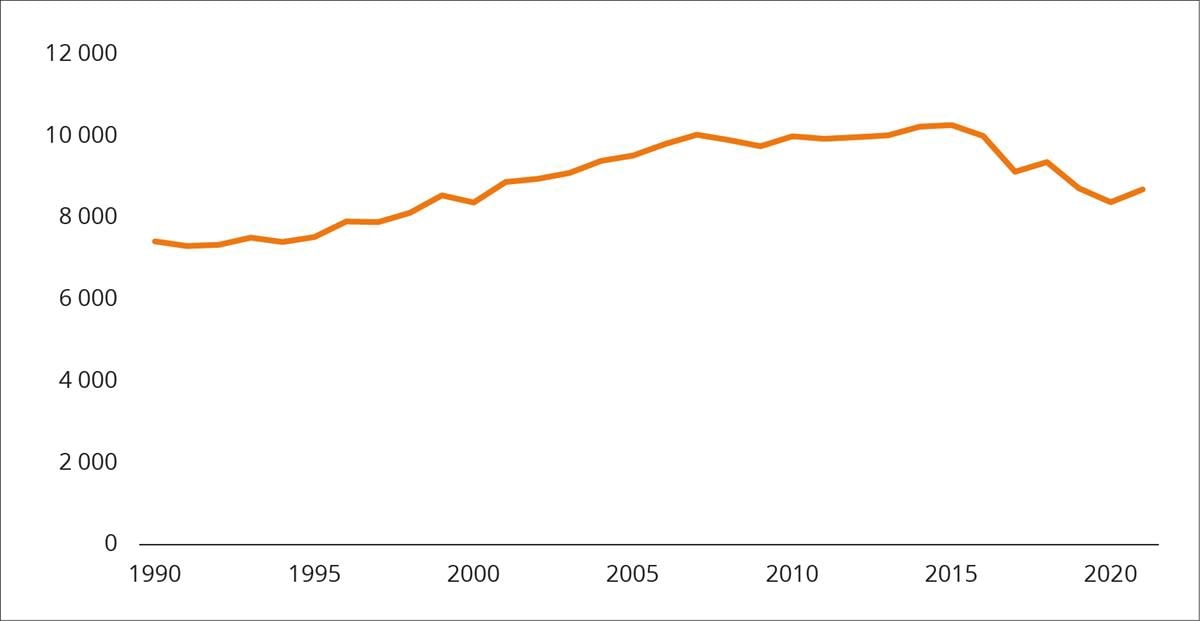

The breakthrough of the EVs has in recent years become evident in the figures for emissions from road transport, which have fallen from 10.3 million tonnes of CO2- equivalent in 2015 to 8.7 million tonnes in 2021, ref. Figure 2.1. According to Statistics Norway, CO2 emissions from road transport would have been around 13 percent higher in 2021 if all driving on electricity was replaced with driving using petrol or diesel1.

Figur 2.1 Emissions from road transport 1990–2021.

Source: Statistics Norway

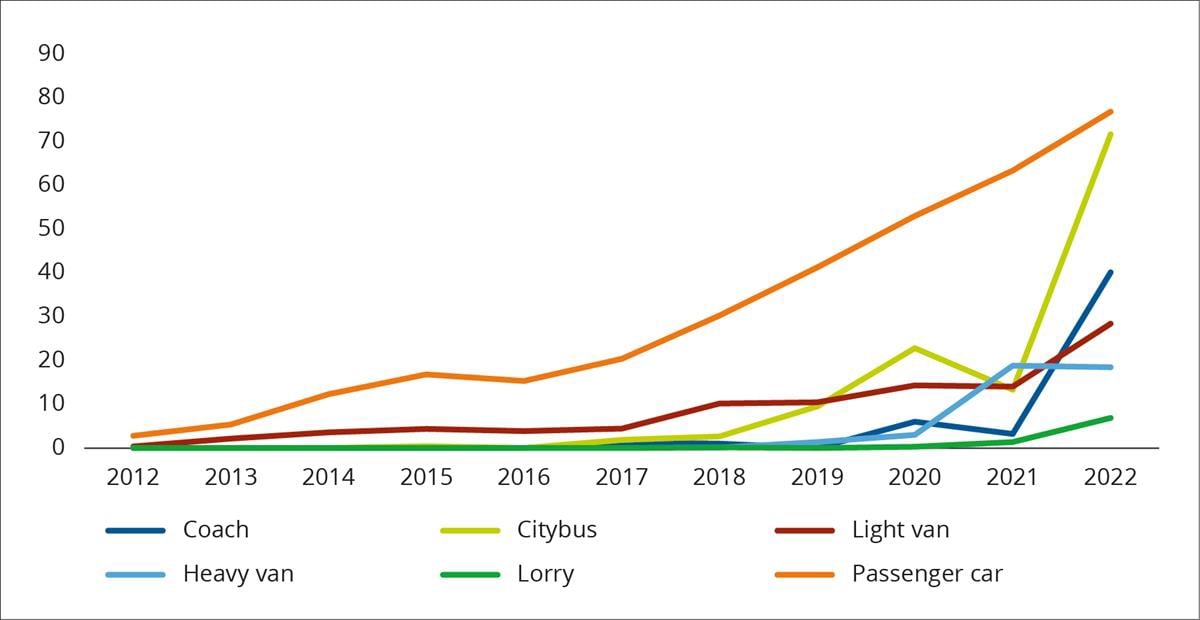

In addition to passenger cars, a good number of both light and heavy electric vans have been sold, respectively 29 and 19 percent of new van sales as of 30 November 2022, ref. Figure 2.2. Many new city buses are electric as well – 72 percent of bus sales at the end of November. Coaches are operated differently than city busses, and up to recently sales have been much lower However, at the end of November, 40 percent of new coaches were electric. Sales of electric lorries are increasing significantly compared to previous years and this year 7 percent of new lorries are electric. The differences between the vehicle groups are largely due to technological maturity – whilst many new private EVs with approximately the same driving characteristics and comfort as new petrol and diesel vehicles have gradually been launched, there are still few electric heavy vehicles on the market and prices remain high. Vans and to some degree buses have for some time been in an intermediate position. Tax advantages are also significantly less attractive for vehicles used by the business sector than for private cars, as businesses can deduct VAT and have lower vehicle excise duty to begin with. Driving patterns also play a role – the longer the daily mileage, the greater the demand on battery capacity and technological maturity. The fact that electric city buses have such a major presence is in particular due to frequent demands for zero emissions or biogas when procuring public transport in larger towns/cities. From 2025 this requirement will become statutory.

Figur 2.2 Proportion of electric vehicles in new vehicle sales 2012 – December 2022.

Source: Public Roads Administration

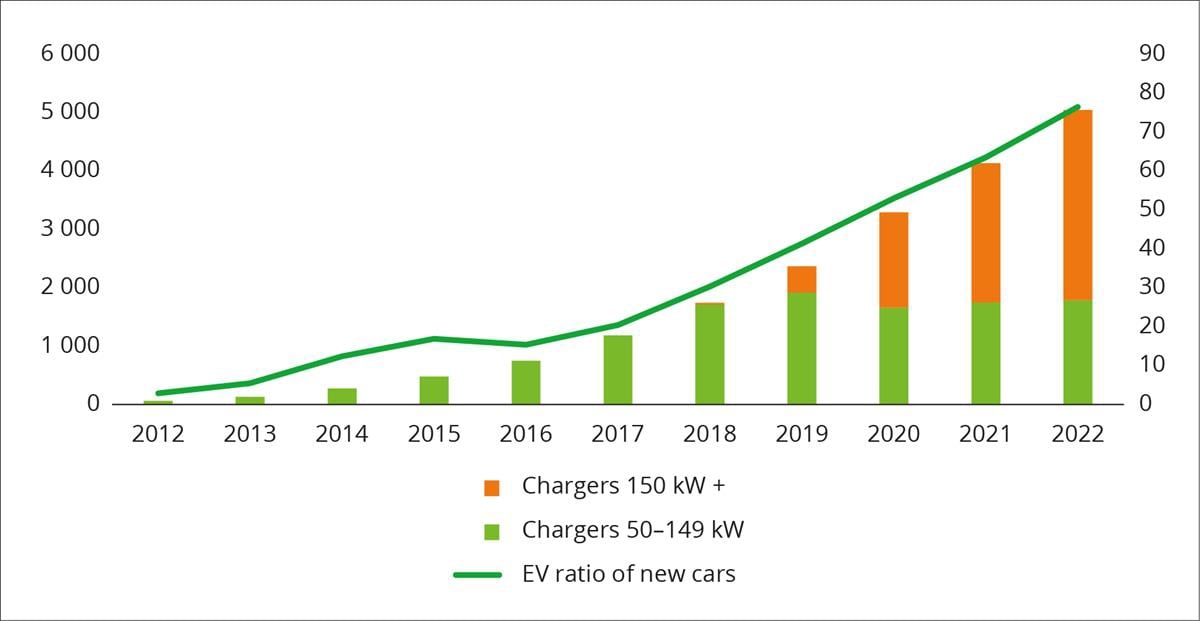

Most of those who purchase private EVs can charge them at home, whilst commercial vehicles and city buses charge at a depot. The developments in the EV population had however not been possible without publicly accessible chargers along road routes. The growth in rapid charging services have been parallel with the growth in EVs, ref. Figure 2.3. From being non-existent 10 years ago, there were 5041 publicly accessible rapid chargers (over 50 kW) for light vehicles (passenger cars and vans) in Norway as of the end of September 20222. Of these, as many as 910 have been set up in 2022. Only around 700 of all rapid chargers have been set up with public subsidies. The vast majority have been set up by commercial companies without subsidies. Vans can use the same charging infrastructure as passenger cars. The first and – by November 2022 – only publicly accessible rapid charging station for heavy vehicles (lorries, buses and larger commercial vehicles) was opened in Filipstad in Oslo in October 2022, with financial support from Oslo municipality.

Figur 2.3 Rapid chargers with an output of 50-149 kW and over 150 kW and EVs proportion of new cars.

Source: EV Association based on Nobil, Public Roads Administration

In the technical basis drafted by the Public Roads Administration and the Norwegian Environment Agency in advance of the strategy (“Knowledge Base”), developments in the number of electric vehicles and charging infrastructure are described and explained in greater detail, and reference is made to this document for additional information (in Norwegian only)3.

2.3 Future developments – major need for charging infrastructure

As highlighted above, to fulfil the Paris Agreement and the agreement with the EU, transport emissions must be reduced, which can only take place if transport is reduced, or by the transition to transport with lower emissions, e.g. zero-emission vehicles. In the National Transport Plan 2018–20294 (NTP) sales targets were presented for zero-emission vehicles:

- New passenger cars and light vans shall be zero-emission vehicles from 2025.

- New heavy vans shall be zero-emission vehicles from 2030.

- New city buses shall use zero-emission technology or biogas from 2025.

- Before 2030, 75 percent of new coaches and 50 percent of new lorries shall utilise zero-emission technology.

The sales goals are also part of the Climate Plan 2021–20305 and are continued in the National Transport Plan (2022–2033)6. It is these sales targets that form the starting point for estimates of the need for rapid chargers in the Knowledge Base from the Public Roads Administration and the Norwegian Environment Agency, on which the strategy is based. The table below shows the number of EVs in various vehicle groups as of the end of November 2022 and the number of publicly accessible rapid chargers as of the end of September 2022. The one rapid charger for heavy vehicles was set up in October 2022. The table also shows the Knowledge Base’s estimate for the number of EVs in 2030 and the estimates for how many publicly accessible rapid chargers should be set up so that demand can be met and charging services do not hinder developments in the EV population.

Tabell 2.1 Electric vehicle population December 2022 and rapid chargers September 2022, estimates for 2030

01.12.2022 | 2030 | |

|---|---|---|

Vehicle population | ||

Passenger cars | 564 720 | 1 700 000 |

Vans | 20 260 | 230 000 |

Lorries | 387 | 23 000 |

City buses | 640 | 9 000 |

Coaches | 176 | 2 000 |

Rapid chargers | ||

For passenger cars and vans | 5 0411 | 10 000–14 000 |

For heavy vehicles | 1 | 1 500–2 500 |

1 As of 31.09.2022

Source: Knowledge Base for rapid charger infrastructure for road transport, EV Association and Public Roads Administration

Both the estimate for the EV population and the estimate of the need for rapid chargers are subject to significant uncertainty. Uncertainty factors and the premises applied as a basis for the calculations are thoroughly presented in the Knowledge Base, and here we only provide a brief review.

The EV population is calculated given that NTP targets are achieved. In addition, the following assumptions have been applied:

- Battery electric power will be the dominant technology for road transport, with hydrogen systems as a niche technology. If hydrogen becomes more competitive, the number of EVs will be reduced, as will the need for electric rapid charging.

- The number of electric cars and vans is already at such a high level that NTP targets should be able to be achieved. The estimate for the vehicle population in 2030 is thereby relatively reliable. For lorries and coaches however, there is greater uncertainty.

- Dependent on continued technological development

- The NTP goal relates to 75 percent of coaches and 50 percent of lorries. Electrification can be much quicker than this.

- The lack of charging capacity will reduce the rate of electrification. In the heavy vehicle market in particular, the absence of customers can hamper the development of commercial charging services, whilst the lack of charging services can hinder the phasing in of EVs and restrict growth in the number of customers.

Given the number of EVs, the need for publicly accessible rapid chargers is particularly dependent on the following uncertain factors:

- Battery packs. The larger the battery pack, the longer the range of the vehicle, and in turn, charging is required less often. The Knowledge Base applies as a basis that the average battery capacity will increase. Battery packs in new light vehicles are presently around 60 kWh, and the Knowledge Base estimates that 80-90 kWh will eventually become the norm. For heavy vehicles, the estimate is battery packs of around 600–700 kWh.

- Charging speed. The faster a battery can be charged, the fewer charging stations are required in order to serve a given number of vehicles. It is assumed that charging speeds will increase in the coming years. At present, most new light vehicles have an anticipated charging capacity of around 100 kW. It is expected that the charging capacity will increase to around 200 kW from approximately 2025. For heavy vehicles, current chargers are between 100 and 300 kW and in the future, it is expected that these will be of a minimum of 1000 kW.

- Patterns of use. Given present patterns of use, it is assumed that most private car drivers will fulfil the charging requirements at home in their own parking space or at their workplace and that the need for publicly accessible rapid charging becomes particularly evident during recreational journeys. Many heavy vehicle drivers will not have the need for rapid charging during their working day and will only require normal charging overnight. Improved charging facilities close to housing, workplaces, shopping centres, tourist attractions and other destinations reduce the need for publicly accessible rapid charging for light vehicles. Additionally, heavy vehicles used for local/regional transport and for mass transport have a daily mileage that largely does not exceed the anticipated range heavy EVs will have in a few years, and the need for charging can be met based on depot charging only. As the sales goal is 50 percent of new lorries in 2030, it is possible to electrify the proportion of the lorries that are most suitable, and still achieve the goal without publicly accessible rapid charging. According to the Knowledge Base, there will however be a certain need as early as 2025 for charging stations for heavy vehicles used for long-distance transport, partly because the vehicles are likely to be frequently used, to cover the high investment costs. The extent of private, dedicated chargers for heavy vehicles will reduce the need for publicly accessible charging. City buses largely have their own dedicated charging infrastructure.

- User-friendliness. Access to real-time information from chargers, simple payment solutions etc. can improve the utilisation of existing chargers and reduce the need for new installations. For coaches and lorries, the opportunity to book charging time will increase the utilisation of individual charging stations and affect the need for rapid chargers.

- Alternative and/or supplementary technologies. If alternative and/or supplementary charging technologies become the norm, the need for traditional rapid chargers will be reduced. This may include

- Wireless charging via charging plates incorporated in road surfaces (inductive charging)

- Battery exchange stations

- Deployment of battery containers

- Electric roads/dynamic charging

- The EU’s revised directive for infrastructure for alternative fuels, ref. Box 2.1 will stipulate requirements regarding charging services for both heavy and light vehicles.

2.4 Summary – what is the charging strategy intended to address?

There is considerable uncertainty regarding the estimates of the need for rapid charging in the future. However, there is no doubt that rapid charging services must expand if sales goals as presented in several government papers are to be reached.

Apart from the first few years with relatively few electric cars, the demand for rapid charging for cars and vans has been high enough to make it commercially profitable to develop charging services. Supply and demand have developed in line on a commercial basis. Access to suitable sites and adequate grid capacity can however become more limiting factors in the future.

Regarding heavy vehicles, development is still in the early phase. There are few vehicles available, they are expensive to buy and the supply of publicly accessible charging services is very limited. It is not commercially profitable to provide such services before the number of vehicles increases. The charging infrastructure for heavy vehicles presents a greater challenge in respect of grid capacity and area required – high energy consumption and larger batteries mean there is a need for high-output rapid charging, and the size of the vehicles and traffic considerations mean the area required is larger.

With this strategy, the government will contribute to the continued commercial development of charging services for passenger cars and vans, and the start-up of commercial development of charging services for heavy EVs. This requires appropriate terms and conditions for the use of land areas and grid capacity. The strategy also includes initiatives that will make the charging infrastructure more user-friendly. Simple charging is an absolute premise for EVs to become a satisfactory alternative to traditional vehicles.

The strategy is also relevant for Norwegian follow-up of the EU Alternative Fuels Directive (AFI) which is expected to be adopted by the EU during the first half of 2023. The directive will stipulate several requirements, regarding the number and location of charging infrastructure, user-friendliness, universal design and technical standards, ref. Box 2.1.

Boks 2.1 Revision of the EU Alternative Fuels Directive (AFIR)

The current EU Alternative Fuels Directive 2014/94 was adopted by the EU in 2014 and embodied in the EEA agreement in 2018. The European Commission has proposed extensive changes to the current directive and that the directive should be replaced by a regulation. Both the Council and the European Parliament have processed the Commission’s proposal and made their respective recommendations.

The overarching objective of the regulation is to ensure an accessible and well-functioning infrastructure for alternative fuels throughout the EU. Electric passenger cars and electric heavy vehicles must be equally easy to use throughout the entire EU and as easy to use as conventional vehicles. The regulation shall also apply to sea and air transport and include the requirement for a provision of hydrogen and LPG in addition to electricity.

The proposal for the regulation stipulates a requirement for a total installed output in charging capacity in relation to the number of battery electric and hybrid light vehicles in the country, in the form of a total kW requirement per vehicle (1 kW per electric car and 0.66 kW per plug-in hybrid). The Council proposes that countries should be able to request an exemption from the requirement when 20 percent of the car population is comprised of EVs – a threshold that Norway is about to achieve – and if the requirement can hinder private investments and is no longer justified. For its part, the European Parliament wishes to differentiate the requirement according to the country’s EV population.

Additionally, the proposal contains a minimum requirement for distances between charging stations on the TEN-T core network and TEN-T road network. In Norway this applies to the highways E6, E18, E39 and E16. The proposed requirement is a maximum of 60 km between charging stations in each direction for light vehicles and the requirement of a minimum output at charging points and stations at various milestones towards 2030. For heavy vehicles, the Council proposes requirements for a gradual deployment of charging stations at distances of 60-100 km in both directions towards 2030. There is also a proposal for charging facilities at overnight rest areas and city intersections. The Parliament wishes to have stricter minimum requirements and more rapid implementation than those proposed by the Commission, whilst the Council proposes a slower pace in the phasing in of requirements for heavy vehicles. Both the Council and the Parliament believe however that less strict requirements should be applied for distances between stations and charging facilities in both directions in areas with little traffic and where the infrastructure cannot be justified from a cost-benefit perspective. The Council also proposes to half the output requirement on these stretches of road compared to the Commission’s proposals. All amendments must be approved in advance by the Commission.

The proposal also includes requirements for user-friendliness, ref. Chapter 6.

The Commission proposes that the regulation should be evaluated, and if applicable amended, at the latest by 31 December 2026. The Council believes that the regulations on charging infrastructure for heavy vehicles must be evaluated, and if applicable amended, as early as by 31 December 2024. Negotiations between the Commission, Council and Parliament are ongoing, and a final regulation is expected during the first half of 2023.

Implementation of the regulation in Norwegian law will be managed through separate processes, which will include an appraisal of economic and administrative consequences. This will among other things require an amendment to the law on infrastructure for alternative fuels, or a new law and a new regulation, as the amendments proposed in the regulation are extensive with a far greater range of application than the current directive.