2 An overview of the scope and development in the state ownership of companies

2.1 Scope

Direct state ownership of Norwegian enterprises is extensive. The State’s direct ownership varies from shareholdings in the country’s largest stock exchange listed companies to small wholly-owned companies with purely sector-policy objectives.

The State has just under 50 wholly-owned companies which are legally organised as either private limited companies, State enterprises, health care enterprises or other types of special law companies’ (i.e. State enterprises with special authority). Of the companies wholly-owned by the State, just under ten may be characterised as commercial companies. They are in every respect operated on commercial criteria in competition with other enterprises. The non-commercial enterprises are dominated by the health care enterprises which employ approximately 100,000 individuals and are financed by a national budget allocation of NOK 70 billion per annum. Other examples of enterprises in which the State exercises active sector policy are Norsk Tipping AS (betting) and AS Vinmonopolet (alcohol). Companies such as Posten Norge AS (postal services) and NSB AS (rail services) have intermediate status in that they largely operate in competitive markets, but in certain areas play an important role in sector policy.

The State owns substantial share blocks in the public limited companies Statoil ASA, Norsk Hydro ASA, Yara International ASA, SAS AB, Kongsberg Gruppen ASA, Cermaq ASA, DnB NOR ASA and Telenor ASA. In 2005, these companies had total revenue of approximately NOK 770 billion and made a total net profit of some NOK 69 billion.

At year-end 2005 the market value of the listed companies amounted to a total of NOK 779 billion. The State’s share of these assets was NOK 428 billion. In 2006 the State received NOK 19 billion in dividends from these companies for the financial year 2005.

This Report to the Storting focuses primarily on exercise of ownership in the commercial parts of the State’s direct ownership, i.e. the ownership which is subject to business criteria. In addition, the largest and most important sector policy enterprises are discussed.

The present report does not deal with the extent of the State’s ownership in the cultural sector for example, which pursues objects other than commercial profitability. However, various companies engaged in research and development are discussed in the report. Table 2.1 presents an overview of the companies discussed in detail.

In Report to the Storting no. 3 (National Accounts) each year a complete listing is presented of the State’s direct ownership.

Figure 2.1 Norwegian defence technology has contributed to civil technology development. One example is the development of the business area of dynamic positioning in Kongsberg-Gruppen. The illustration shows the production vessel in the Åsgard A field, deploying dynamic positioning.

The State’s asset management is also performed extensively via the Government Pension Fund. Readers are referred to Report to the Storting no. 1 (2006 – 2007) for a detailed review of the Government Pension Fund.

Table 2.1 State shareholding and ministerial affiliation

| Name of company | Shareholding | Ministry responsible |

|---|---|---|

| Industritjeneste AS | 53.0 | Ministry of Justice and the Police/Ministry of Labour and Social Inclusion |

| The Norwegian Centre for Informatics in Health and Social Care (KITH) | 80.5 | Ministry of Labour and Social Inclusion/Ministry of Health and Care Services |

| Statskonsult AS | 100.0 | Ministry of Government Administration and Reform |

| AS Vinmonopolet | 100.0 | Ministry of Government Administration and Reform |

| Helse Midt-Norge RHF | 100.0 | Ministry of Health and Care Services |

| Helse Nord RHF | 100.0 | Ministry of Health and Care Services |

| Helse Sør RHF | 100.0 | Ministry of Health and Care Services |

| Helse Vest RHF | 100.0 | Ministry of Health and Care Services |

| Helse Øst RHF | 100.0 | Ministry of Health and Care Services |

| Norsk Eiendomsinformasjon AS | 100.0 | Ministry of Justice and the Police |

| Uninett AS | 100.0 | Ministry of Education and Research |

| Universitetssenteret på Svalbard AS | 100.0 | Ministry of Education and Research |

| Norsk Samfunnsvitenskapelige Datatjeneste AS | 100.0 | Ministry of Education and Research |

| Simula Research Laboratory AS | 80.0 | Ministry of Education and Research |

| Norsk Tipping AS | 100.0 | Ministry of Culture and Church Affairs |

| Norsk Rikskringkasting AS | 100.0 | Ministry of Culture and Church Affairs |

| Kommunalbanken AS | 80.0 | Ministry of Local Government and Regional Development |

| Statskog SF | 100.0 | Ministry of Agriculture and Food |

| Veterinærmedisinsk Oppdragssenter AS | 51.0 | Ministry of Agriculture and Food |

| Entra Eiendom AS | 100.0 | Ministry of Trade and Industry |

| Flytoget AS | 100.0 | Ministry of Trade and Industry |

| Venturefondet AS | 100.0 | Ministry of Trade and Industry |

| Mesta AS | 100.0 | Ministry of Trade and Industry |

| Argentum Fondsinvesteringer as | 100.0 | Ministry of Trade and Industry |

| BaneTele AS | 50.0 | Ministry of Trade and Industry |

| Electronic Chart Centre AS | 100.0 | Ministry of Trade and Industry |

| SIVA SF | 100.0 | Ministry of Trade and Industry |

| Statkraft SF | 100.0 | Ministry of Trade and Industry |

| Store Norske Spitsbergen Kulkompani AS | 99.9 | Ministry of Trade and Industry |

| Bjørnøen AS | 100.0 | Ministry of Trade and Industry |

| Kings Bay AS | 100.0 | Ministry of Trade and Industry |

| Telenor ASA | 54.0 | Ministry of Trade and Industry |

| Kongsberg Gruppen ASA | 50.0 | Ministry of Trade and Industry |

| Nammo AS | 50.0 | Ministry of Trade and Industry |

| Norsk Hydro ASA | 43.8 | Ministry of Trade and Industry |

| Cermaq ASA | 43.5 | Ministry of Trade and Industry |

| Yara International ASA | 36.2 | Ministry of Trade and Industry |

| DnB NOR ASA | 34.0 | Ministry of Trade and Industry |

| Eksportfinans AS | 15.0 | Ministry of Trade and Industry |

| SAS AB | 14.3 | Ministry of Trade and Industry |

| Statoil ASA | 70.9 | Ministry of Petroleum and Energy |

| Statnett SF | 100.0 | Ministry of Petroleum and Energy |

| Gassco AS | 100.0 | Ministry of Petroleum and Energy |

| Enova SF | 100.0 | Ministry of Petroleum and Energy |

| Petoro AS | 100.0 | Ministry of Petroleum and Energy |

| Avinor AS | 100.0 | Ministry of Transport and Communications |

| NSB AS | 100.0 | Ministry of Transport and Communications |

| Posten Norge AS | 100.0 | Ministry of Transport and Communications |

| BaneTele AS | 100.0 | Ministry of Transport and Communications |

Source Ministry of Trade and Industry

2.2 Development trends in the State’s ownership

Over the course of history, the Norwegian State has played an important role in the development of Norwegian industry and business activity. The aim of exercising control over natural resources and associated industrial production enterprises, allocation considerations, industry and district development and the need to remedy market failures has been the main reason for the State’s involvement as an owner. After World War II, the Norwegian State contributed capital to ensure the development and sustainability of industry in Norway. The rationale for State involvement was the restricted access to private capital that coincided with the political wish for industrial renewal in Norway. This led to the establishment of businesses such as Årdal og Sunndal Verk and Norsk Jernverk.

Textbox 2.1 State-owned enterprises provided a platform for the emergence of business clusters at Kongsberg and Raufoss

The industrial parks at Kongsberg and Raufoss are examples of successful readjustments in communities that were previously more heavily reliant on a few cornerstone enterprises.

Kongsberg today represents a strong industrial park, with a cluster made up of more than 110 knowledge based enterprises. Several of these are global leaders in subsea, offshore, maritime, automotive, aviation, defence and aerospace technologies. Many of the core enterprises arose out of the former civil divisions of the armaments factory, Kongsberg Våpenfabrikk. Over the last two decades, enterprises in the Kongsberg cluster have doubled their employment level to more than 9,000 people, of which some 5,000 are employed in the Kongsberg region. Annual turnover has increased seven times over and amounts to approx. NOK 17 billion. The export share of the region is in excess of 60 per cent (2005).

The business cluster at Raufoss arose out of Raufoss ASA and is a result of more than a century of experience in international industrial development. The core areas are processing of lightweight materials and automated manufacturing. These are core competencies for all the enterprises in the cluster, and areas in which the cluster is a global leader. The aim is to establish a national centre of competence. The enterprises will retain and strengthen their market position through drives such as joint ventures on targeted R&D projects. Partnerships with educational and competency centres regionally, nationally and internationally will be central. The Raufoss industrial park has developed into a vital business cluster of 40 enterprises with more than 3,000 employees. Annual turnover amounts to NOK 4.5 billion and its export share is 85 per cent.

Nammo AS currently accounts for around 500 jobs in the industrial park and is a very important contributor to further business development in the region. Ragasco AS originated in the defence activities at Raufoss. The company is an example of a newly established company which manufactures gas cylinders in composite materials.

Source Kongsberg Centre of Expertise – Systems Engineering and Raufoss Centre of Expertise – Lightweight materials

Following the discovery of oil on the Norwegian Continental Shelf, the Government saw it as important to ensure national governance and control of the revenue flows from these potentially large natural resources, while also ensuring Norwegian participation in industrial development through its ownership of Statoil and Norsk Hydro.

Security policy and defence interests dictated the State’s involvement in the ammunitions factories of Raufoss Ammunisjonsfabrikker. The State still has a major presence in the defence industry through its shares in Nammo AS and Kongsberg Gruppen ASA.

The State also has assumed ownership in order to ensure specific sector-policy objectives. There are several examples of this type of ownership. The State’s ownership of the Norwegian Broadcasting Corporation is intended to ensure the provision of broadcasting with general public appeal. The health care enterprises were established to provide sound health care provisions for the public, and Avinor AS to provide safe and efficient aviation.

There are further examples of state ownership arising more arbitrarily. The banking crisis in the early 1990s resulted in that the State took over the shares in a number of banks. Through the Government Bank Investment Fund and the Government Bank Insurance Fund, the State ensured that the important role played by the banks in society would be safeguarded for a period of more than five years. All these shareholdings were eventually divested, with the exception of the State’s shares in DnB Holding ASA, which later merged with Gjensidige NOR ASA. The State’s holdings in the merged DnB NOR Group currently amount to 34 percent.

Separation of businesses from State administration

From the 1990s on, the State effected major regulatory reforms in several sectors. As part of these reforms, State production activities were reorganised and subjected to competition. Telenor was divested from State administration in 1994. Other examples of this type of reorganisation of State enterprises occurring in the 1990s are Grødegaard, Norwegian State Railways, Post Norway, Statkorn Holding, Statkraft and Statnett.

Until 1 January 2003, the Civil Aviation Authority was an enterprise under public administration, but was then restructured and split off as a separate limited company under the name of Avinor AS, cf. Bill to the Storting no. 1 Supplement no. 2 (2002 – 2003). The Government is currently evaluating the organisation and corporate affiliation of Avinor AS and will be presenting its findings in the forthcoming Report to the Storting concerning Avinor AS’s activities.

As of 1 January 2003 production activities in the Public Roads Administration (Statens Vegvesen) were split off as a separate private limited company under the name Mesta AS, cf. Bill to the Storting no. 1 Supplement no. 1 (2002 – 2003). Mesta AS is a large-scale provider of services in the operation, maintenance and expansion of the road network in Norway and also operates in other markets. During 2006, all operating and maintenance contracts for the Public Roads Administration will be exposed to competition.

The second Bondevik Government planned to gradually put certain National Rail Administration tasks associated with operation and maintenance out to competitive tender. Further to this programme, parts of the National Rail Administration’s production activities were established as a separate private limited company under the name of Baneservice AS, cf. Bill to the Storting no. 1, Supplement no. 2 (2004 – 2005). However, while the Government has suspended its plans to put all National Rail Administration activities out to tender, Baneservice will be retained as a private limited company under the Ministry of Transport, cf. Bill to the Storting no. 1 (2005 – 2006) concerning amendment to Bill to the Storting no. 1 in the 2006 national budget.

Statskonsult AS was established as a private limited company with accounting effect from 1 January 2004. The rationale for the conversion of Statskonsult into a private limited company is set out in Bill to the Storting no. 1 (2003 – 2004).

Stock exchange listings

Telenor ASA was listed on the stock exchange (Oslo Børs) on 4 December 2000, followed by Statoil ASA on 18 June 2001.

On 25 March 2004 Yara International ASA was demerged from Norsk Hydro ASA and listed on Oslo Børs. Yara International ASA continues Norsk Hydro ASA’s global agricultural business, while Norsk Hydro ASA continues as a company with the main emphasis on energy and aluminium. At the demerger, 80 per cent of the shares in Yara International ASA were distributed proportionally to Norsk Hydro ASA shareholders and 20 per cent were sold on the market. The State’s holding in Yara International ASA is 36.2 percent. The demerger of Yara International ASA is set out in Bill to the Storting no. 33 (2003 – 2004), cf. Recommendation to the Storting no. 97 (2003 – 2004) and Storting Resolution of 18 December 2003.

Cermaq ASA was listed on Oslo Børs on 24 October 2005. The State reduced its shareholding from 79.8 percent to 43.5 per cent through the listing. This was done by the company issuing five million shares and the State selling 29.2 million shares, cf. Bill to the Storting no. 25 (2005 – 2006) and Recommendation to the Storting no. 70 (2005 – 2006).

Sale of shares

In 2001 the State sold 81 per cent of its shares in Norsk Medisinaldepot ASA for NOK 468 million and thereby withdrew fully as a shareholder from this company.

In the same year, the State sold 66 per cent of its shares in Arcus ASA for NOK 340 million. The investment group that acquired these shares had pre-emptive rights to the remaining shares, and acquired these for NOK 210 million in the autumn of 2003.

Grødegaard AS is another company in which the State no longer has any shares. This company, originally operating as Statens Kantiner, was converted in 2001 from a state-owned enterprise into a private limited company. The Ministry of Trade and Industry took over administration of the company from the Ministry of Defence with effect from 1 January 2002. In spring 2003, ISS Norge AS bought into Grødegaard AS through a private placement of NOK 24 million, thereby obtaining a 48 percent stake in the company. In February 2005, the State sold off the remaining 52 percent of the shares in the company to ISS Norge AS for NOK 36 million.

NOAH Holding AS is a company which operate special waste plants. The company was set up in 1991 in order to establish processing capacity in Norway for organic and inorganic special waste. The State owned 70.9 percent of the shares in the company. The remaining shares were held by a number of leading industrial companies. The organic waste processing plant in Brevik was sold to Norcem AS in autumn 2002. In 2004 Gjelsten Holding AS acquired all the shares in NOAH Holding AS for NOK 80 million, of which the State’s shareholding was NOK 56.7 million.

In 2001 and 2003 the State sold shares in A/S Olivin. 49 percent of shares were sold in 2001, while the remaining 51 percent were sold in 2003. North Cape Minerals AS acquired the two share blocks for NOK 400 million and NOK 345 million respectively.

SND Invest AS was an investment company with a portfolio of shares in some 100 relatively small and medium-sized non-listed companies and a few listed ones. The State sold its shares in the company in 2003. The total revenue to the State was somewhat in excess of NOK 1,150 million.

In Telenor ASA the State reduced its shareholding from 77.6 percent to 53.96 percent through two divestments in 2003 and 2004 to Norwegian and foreign institutional investors and private individuals. These divestments brought in NOK 16.5 billion for the State in sales revenue.

In 2004 and 2005, the State reduced its shareholding in Statoil ASA from 81.7 percent to 70.9 percent through the sale of 234 million shares to Norwegian and foreign institutional investors and private individuals. This divestment brought in NOK 22.4 billion for the State in sales revenue.

Share purchases

In 2003 DnB Holding ASA and Gjensidige NOR ASA merged into a single company. This resulted in a reduction in the State’s shareholding in DnB Holding ASA from 47.78 percent to 28.1 percent in the merged DnB NOR Group. In respect of this merger, the Storting decided that it was desirable to ensure continued negative control within a merged DnB NOR. The merger was dealt with in Bill to the Storting no. 59 (2002 – 2003), cf. Recommendation to the Storting no. 212 (2002 – 2003) and Storting Resolution of 4 June 2003. The State purchased shares in the market to obtain a shareholding of 34 percent in 2003. In autumn 2004 and spring 2005 DnB NOR issued shares as part of an options scheme for its employees. This resulted in that the State’s shareholding was reduced once again to less than 34 percent. After both of these share issues, in line with the Storting’s precondition, shares were acquired in the market in order to restore the State’s shareholding to 34 percent. The State thus acquired shares worth a good NOK 561 million. Through these transactions, the State has purchased shares worth a total of NOK 3.9 billion to bring its shareholding up to 34 percent.

Formerly, the State held 45 percent of shares in Nammo AS. The other shareholders in Nammo AS were Swedish Saab AB with a shareholding of 27.5 percent and Finnish Patria Oyj with 27.5 percent. In the autumn of 2005, Patria made a deal with Saab AB to acquire Saab’s shareholding in Nammo. The Norwegian Government opted under the authority of the applicable Storting mandate to exercise its pre-emptive rights under the shareholders’ agreement, and increased the State’s shareholding to 50 percent. The purchase price for 5 percent of the shares came to NOK 61.8 million. The acquisition was transacted in February 2006 and the matter was dealt with in Bill to the Storting no. 25 (2005 – 2006), cf. Recommendation to the Storting no. 70 (2005 – 2006).

Emissions

On 9 December 2003, the Storting resolved to supply Statkraft with equity of NOK 4 billion, cf. Recommendation to the Storting no. 71 (2003 – 2004).

The State assumed direct ownership of Flytoget AS from NSB AS with effect from 1 January 2003. One consequence of this was that Flytoget had to refinance loans made by NSB (Norwegian State Railways) on the private lending market. A long-term loan agreement was made conditioned on increased equity. In December 2003 therefore the Storting granted NOK 300 million in new equity to the company.

Through the issue of 5 million shares on its stock exchange listing in October 2005, Cermaq ASA was supplied with NOK 220 million in new equity. The State did not participate in this emission.

In December 2004 the Government presented a bill to the Storting proposing an injection of equity into BaneTele AS, cf. Bill to the Storting no. 35 (2004 – 2005). The Storting decided to raise share capital by NOK 120 million, cf. Recommendation to the Storting no. 108 (2004 – 2005). On 19 October 2006 the Storting decided to issue a mandate for the reduction of the State’s shareholding in BaneTele AS through a private placing to Bredbåndsalliansen AS, which would supply the company with new equity of NOK 625 million. The private placing was effectuated on 16 November 2006, with Bredbåndsalliansen subscribing to 232,000 shares, thus reducing the State’s shareholding to 50 percent.

Reorganisation at corporate level

In 2004, the SAS Group’s air operations were reorganised according to a decentralised management model, with independent companies in Norway, Sweden and Denmark. Following this, only the intercontinental division of the airline services are part of the parent company, SAS AB.

In autumn 2004 the State established a new corporate model in Statkraft. Most of the activities of Statkraft SF were transferred to underlying companies . Statkraft SF owns all the shares in Statkraft AS, along with leased plants and a few other assets. Statkraft AS now acts as a corporate centre and holding company for most of the Statkraft group’s activities. The reorganisation is dealt with in Bill to the Storting no. 53 (2003 – 2004) and Bill to the Odelsting no. 63 (2003 – 2004), cf. Recommendation to the Storting no. 248 (2003 – 2004), Recommendation to the Odelsting. no. 99 (2003 – 2004) and Storting Resolution of 14 June 2004.

Winding-up proceedings

The State owned 49 percent of the shares in Moxy Trucks AS when the board requested for bankruptcy in February 2002. The bankruptcy proceedings were not completed until the first half of 2006.

Administration of the State’s shares in DnB NOR ASA was transferred from the Government Bank Investment Fund to the Ministry of Trade and Industry in 2004. It was established that there was no need to create a new bank investment fund. The fund was therefore wound up and the Act regarding the Government Bank Investment Fund was abolished.

Raufoss ASA was delisted from Oslo Børs in spring 2004 and the decision to wind up the company was made the same year. Before the decision was made to wind up the company, all existing operating activities were sold to industrial owners who have largely continued Raufoss’ activities.

2.3 Economic development

At the end of 2005, the value of the State’s shareholdings in listed companies amounted to some NOK 430 billion. In addition, the State’s shareholdings in other activities were posted at approximately NOK 130 billion, of which 52 billion derived from the health care enterprises, 30 billion from other sector-policy companies and enterprises together with 50 billion from non-listed commercial companies. The assets, in the listed companies especially, have increased in value substantially in recent years. At the same time, the State has received large amounts in dividends and from the sale of shares.

Table 2.2 Overview of the development in State assets in listed companies 31.12. 2001 – 30.06.2006. (NOK millions)

| Company | State shareholding 30.06.2006 | Value of State’s shareholding 31.12.2001 | Value of State’s shareholding 30.06.06 | Value growth for State | Realised for State in period 1 | Accumulated dividend to State in period 2 | Net value growth for State in period 3 |

|---|---|---|---|---|---|---|---|

| Cermaq ASA4 | 43.54 % | 2,289 | 3,383 | 1,094 | 1,288 | 158 | 2,540 |

| DnB NOR ASA5 | 34.00 % | 14,880 | 35,113 | 20,233 | -3,905 | 5,478 | 21,806 |

| Kongsberg Gruppen ASA | 50.00 % | 1,448 | 2,100 | 652 | 0 | 114 | 766 |

| Norsk Hydro ASA | 43.82 % | 43,925 | 93,624 | 49,699 | 1,897 | 8,355 | 59,951 |

| Raufoss ASA6 | 50.27 % | 158 | 0 | -158 | 0 | 0 | -158 |

| SAS AB | 14.8 % | 1,386 | 1,492 | 106 | 0 | 88 | 194 |

| Statoil ASA | 70.90 % | 110,152 | 273,987 | 163,835 | 22,359 | 35,625 | 221,819 |

| Telenor ASA | 54.00 % | 54,054 | 69,302 | 15,248 | 19,813 | 5,338 | 40,399 |

| Yara International ASA7 | 36.21 % | n.a. | 9,460 | 9,460 | 564 | 528 | 10,552 |

| Total for listed companies | 228,292 | 488,461 | 260,169 | 42,016 | 55,684 | 357,869 |

1 The column indicates the total from the sale of shares, issued shares and/or settlement for deleted shares held by the State. A minus sign indicates acquisition of shares.

2 Including dividend provision for the State for the 2005 accounting year.

3 Column shows net value growth for the State incl. changes in shareholding.

4 Cermaq was floated on 24 October 2005. The value of the company at 31.12.2001 is the State’s share of the posted capital.

5 DnB NOR ASA merged in 2003. The State reduced its shareholding from 47.3 per cent to 34 per cent in the merged company after having bought up shares on the stock exchange.

6 Raufoss ASA was delisted on 27 February 2004. Equity in the company was lost. The company came under administration on 1 July 2004.

7 Yara International ASA was listed on 25 March 2004. The initial values are implicitly entered under Norsk Hydro ASA.

Source Ministry of Trade and Industry/Oslo Børs

Table 2.3 Trend in State assets by selected non-listed companies 31.12.2001 – 30.06.2006. (NOK millions)

| Company | State shareholding 30.06.2006 | Value of State’s shareholding 31.12.2001 | Value of State’s shareholding 30.06.06 | Increase in value for State | Accumulated dividend to State in the period | Accumulated sales proceeds (+), capital injections (–) and share acquisitions (–) | Net value growth for State in the period |

|---|---|---|---|---|---|---|---|

| A/S Olivin | 0 % | 151 | – | (151) | 87 | 345 | 281 |

| Arcus-Gruppen ASA | 0 % | 168 | – | (168) | 15 | 210 | 57 |

| Argentum Fondsinvesteringer AS | 100 % | 2,477 | 2,884 | 407 | 300 | (200) | 507 |

| Avinor AS1 | 100 % | – | 7,640 | 7,640 | 178 | (7,278) | 540 |

| Baneservice AS2 | 100 % | – | 143 | 143 | 4 | (138) | 8 |

| BaneTele AS3 | 100 % | 224 | 128 | (96) | 0 | (120) | (216) |

| Eksportfinans ASA | 15 % | 355 | 404 | 49 | 208 | – | 257 |

| Electronic Chart Centre AS | 100 % | 11 | 13 | 2 | 1 | – | 3 |

| Entra Eiendom AS4 | 100 % | 3,928 | 7,266 | 2,606 | 570 | – | 3,176 |

| Flytoget AS5 | 100 % | – | 793 | 793 | 0 | (729) | 64 |

| Grødegaard AS | 0 % | 24 | – | (24) | 0 | 36 | 13 |

| Moxy Trucks AS6 | 0 % | 120 | – | (120) | 0 | (5) | (125) |

| Kommunalbanken AS | 80 % | 743 | 1,066 | 323 | 110 | (17) | 415 |

| Mesta AS7 | 100 % | – | 2,330 | 2,330 | 285 | (1,900) | 715 |

| Nammo AS | 50 % | 177 | 392 | 215 | 69 | (62) | 222 |

| NOAH AS | 0 % | 180 | – | (180) | 0 | 57 | (123) |

| NSB AS8 | 100 % | 6,078 | 6,189 | 111 | 246 | 898 | 1,255 |

| Posten Norge AS8 | 100 % | 2,193 | 5,288 | 3,095 | 1,057 | (1,605) | 2,547 |

| SIVA SF9 | 100 % | 642 | 605 | (37) | 0 | (143) | (180) |

| SND Invest AS | 0 % | 2,380 | – | (2,380) | 648 | 618 | (1,114) |

| Statkraft SF | 100 % | 27,972 | 38,561 | 10,589 | 15,609 | (4,000) | 22,198 |

| Statnett SF | 100 % | 4,511 | 4,822 | 311 | 1,616 | – | 1,927 |

| Statskog SF | 100 % | 208 | 258 | 51 | 51 | – | 102 |

| Store Norske Spitsbergen Kulkompani AS | 99.9 % | 168 | 395 | 227 | 30 | – | 257 |

| Venturefondet AS | 100 % | – | 100 | 100 | 0 | (113) | (13) |

| Total selected non-listed companies | 53,409 | 79,277 | 25,868 | 21,083 | (14,171) | 32,780 |

1 Avinor AS was separated from the Civil Aviation Authority on 1 January 2003.

2 Baneservice AS was separated from the National Rail Administration as a private limited company on 1 January 2005. Based on book equity as at 31.12.2005.

3 BaneTele AS was separated from the National Rail Administration on 1 July 2001. The shares were transferred to the Ministry of Trade and Industry on 20 December 2002. The figures do not include the finalisation of the transaction with Bredbåndsalliansen AS.

4 Figures for Entra Eiendom AS are based on value-adjusted equity at 31.12.2005 plus profit for first half of 2006.

5 The shares in Flytoget were transferred from the NSB Group to the Ministry of Transport and Communications on 1 January 2003. The shares were transferred to the Ministry of Trade and Industry on 1 July 2004.

6 Moxy Trucks AS went into liquidation. The State’s guarantee of NOK 30 million was utilized by the company in the liquidation proceedings.

7 Mesta AS was separated from the Public Roads Administration and established as a limited liability company on 1 January 2003. The shares were transferred to the Ministry of Trade and Industry on 1 July 2005.

8 NSB AS and Posten Norge AS were converted from their status of special law companies into limited liability companies on 1 July 2002.

9 Figures for SIVA are based on equity at 31.12.2005.

Source Ministry of Trade and Industry

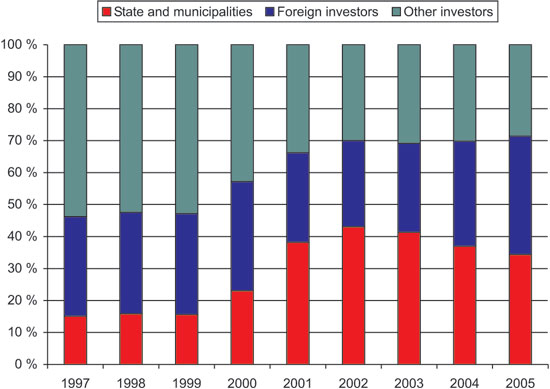

Figure 2.2 Overview of shareholder structure on Oslo Børs 1997–2005

Figure 2.3 State shares in Statoil ASA have the highest value at almost NOK 274 billion as at 30.06.2006.

The State also became a substantial shareholder on Oslo Børs following the listing of Telenor ASA and Statoil ASA in 2000 and 2001. At year-end 2001 the value of shareholdings managed directly by the ministries amounted to NOK 224 billion, representing around 1/3 of the total stock market value. The value of the State’s shares on the stock exchange had increased to NOK 430 billion at year-end 2005, or by NOK 206 billion over the period 2001 – 2005. Of this, 11 billion derived from Yara International ASA, which was split off from Norsk Hydro ASA in 2001 and listed as an independent company. The increase in value is due to a heavy increase in the market value of the State’s shares on the exchange, which corresponds to the general trend in the stock market.

Figure 2.4 Of the non-listed enterprises, Statkraft is worth the most. Photo shows one of Norway’s biggest dams, Sysendammen in Hardangervidda

The value of dividends, State share purchases and sales have amounted to approx. NOK 78 billion over the last four years. This is equivalent to direct revenue of 35 percent of the value at year-end 2001. The profit on shares held by the State at year-end 2001 is 127 percent over the four-year period, taking into account changes in value. The State’s investments in listed shares have thus provided a good return during this period.

Table 2.3 presents a selection of other companies with commercial objectives and some of the largest companies with sector policy objectives. The State’s total assets from posted equity in these companies amounted to around NOK 79 billion at the end of the first six months of 2006. This equals net value growth of almost NOK 26 billion since 2001, including the establishment of new companies over the period (Avinor AS, Baneservice AS, Flytoget AS and Mesta AS). If the new start-ups and divested companies are discounted, this value growth amounts to in excess of NOK 18 billion or 37 percent. Growth was strongest in Statkraft SF, Posten Norge AS and Entra Eiendom AS. From these companies the State has received a total dividend of more than NOK 20 billion over the last four years. Of this, NOK 15.6 billion derived from Statkraft SF. Net accumulated State aid over the same period amounted to NOK 7.8 billion. Net accumulated sales revenue, capital contributions and share acquisitions amounted to minus NOK 11.2 billion. Of this, NOK 10 billion were capital contribution in Statkraft SF.

The period 1997 – 2005 saw considerable shifts in shareholder composition on Oslo Børs.

The Norwegian private sector was the largest shareholder grouping on Oslo Børs from 1997 up until the listing of Statoil ASA in June 2001. Telenor ASA was listed in December 2000. Prior to the listing of Telenor ASA, the private sector shareholding amounted to a good 50 percent. This fell to around 33 percent at the end of 2001 once both Telenor ASA and Statoil ASA had been listed. The shareholding has since fallen further to between 28 and 29 percent. Throughout the period, private enterprises have accounted for about half of private Norwegian shareholdings. This shareholding has been increasing, while share funds, pension funds and life insurance have declined significantly.

In recent years, foreign investors have been increasingly active on Oslo Børs, accounting for between 60 and 70 percent of daily turnover. In autumn 2005, foreign investors overtook public investors as the largest shareholder segment, and at year-end 2005, foreign investors owned 37.1 percent of assets on Oslo Børs. Foreign capital on Oslo Børs increased from NOK 165 billion in 1997 to around NOK 545 billion at year-end 2005. For comparison, at the same time, the Norwegian State held shares worth just under NOK 500 billion.