Report on cases of financial irregularities in 2022

Foreign Service Control Unit, Norwegian Ministry of Foreign Affairs

Report | Date: 17/04/2023 | Ministry of Foreign Affairs

1. Zero tolerance

The Ministry practises zero tolerance of financial irregularities and other misuse of Ministry funds. This applies to both operating funds and grant funds. This report deals with financial irregularities related to the use of grant funds in the context of development assistance. Zero tolerance means that the Ministry will respond to any deviation from the rules and conditions established for the use of public funds. This includes inadequate follow-up of suspected sexual exploitation, abuse and harassment (SEAH), see 5.4 below.

This principle must be observed by all Foreign Service employees, suppliers of goods and services, and organisations and others that manage funds allocated by the Ministry.

The principle of zero tolerance of financial irregularities also applies to the use and management of funds that the Ministry has allocated (through an allocation letter or by other means) to third parties, including its subsidiary agencies Norad and Norec. It also applies to grants given by Norfund.

The responsibility for implementing the zero tolerance principle rests with the unit that has budget responsibility for the funds. All grant recipients must also undertake to show zero tolerance of financial irregularities in connection with funds provided by Norway, and to report any deviations from this principle.

The Foreign Service Control Unit has a particular responsibility to follow up reports on deviations from grant agreements and other matters relating to financial irregularities in the Foreign Service. Norad[1], Norec and Norfund have an independent responsibility for following up cases within their areas of responsibility.

The general rule is that misused funds must be repaid. The same applies in cases where it cannot be documented that funds have been used in accordance with an agreement. The Ministry will consider reporting cases of this kind to the police if it is likely that a criminal offence has been committed.

Further details are provided in the policy memorandum Zero tolerance of financial irregularities in practice and the Guidelines for dealing with suspected financial irregularities in the Foreign Service (see annexes.)

2. Dealing with cases of suspected financial irregularities

Most of the cases dealt with by the Foreign Service Control Unit have to do with possible misuse of grant funds. Suspected financial irregularities are normally reported to the Foreign Service Control Unit by the relevant unit in the Foreign Service or by the organisation that has received the funds. Any suspected breaches of legislation, unethical or unacceptable conduct, or other issues of concern may also be reported by others, openly or anonymously, to the Foreign Service Control Unit by email to: s-kontrollenhet@mfa.no or via the Foreign Service’s external reporting channel; Whistleblowing in the Foreign Service - regjeringen.no

If the Foreign Service Control Unit finds reason to investigate a matter more closely, it is registered as a case of suspected financial irregularities.

As a rule, further disbursements to the recipient will be suspended until the case has been investigated and adequate risk-reducing measures have been implemented. An agreement partner (organisation/grant recipient) that has reported suspected irregularities involving a local partner will often initiate its own investigation. In such cases, the Foreign Service Control Unit usually waits until the results of the investigation are available before considering its response. If the agreement partner does not decide to carry out its own investigation, the Foreign Service Control Unit will do so in close cooperation with units involved in the Foreign Service and the agreement partner. In some cases, external experts are engaged to investigate a case or perform a forensic audit. The Ministry of Foreign Affairs has framework agreements with five different companies that provide such services. In addition, the Foreign Service Control Unit has a framework agreement with external legal experts to follow up legally complex cases.

The grant agreements contain provisions on the zero-tolerance principle and on possible sanctions in the event of fraud or other breaches of agreement. In most cases of financial irregularities, the grant recipient agrees to repay the misused funds. If, however, the Foreign Service Control Unit’s claim for repayment is contested, legal proceedings may be initiated to recover the funds.

A case will be closed if the investigation concludes that a response from the Ministry is not required. In cases where the Ministry claims repayment, the case will not be closed until the funds have been repaid.

Information on cases that have required a response from the Ministry before being closed is published on a quarterly basis on the Government website (in Norwegian only); Rapporter om økonomiske mislighetssaker - regjeringen.no

3.1 Trends in the number of cases

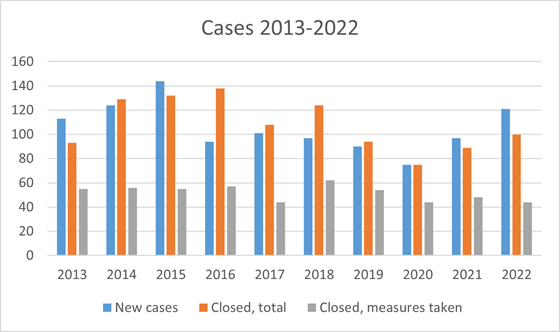

Since 2007, the Foreign Service Control Unit has registered 1 470 cases of financial irregularities and closed 1 329 cases. A response was required in 615 of the closed cases – most often a claim for the repayment of funds. A total of NOK 159.5 million has been repaid. In addition to funds managed by the Ministry, all figures in this report include cases involving funds managed by Norad[2] and Norec.[3]

The number of new cases fell in the period 2015–2020, but has since risen. It is difficult to draw any conclusions regarding the reason for the rise in cases. The stringent criteria for registering a case of suspected financial irregularities likely affect how many cases are registered. It should also be noted that there was a decline in cases during the COVID-19 pandemic, and that the number of cases has subsequently increased. The figures for 2022 also include some of the cases of sexual exploitation, abuse and harassment (SEAH) registered with the Ministry of Foreign Affairs, see 5.4 below. There is naturally some variation in the number of cases from year to year. It is therefore not possible to draw any conclusions regarding other reasons for a decline or rise in the number of new cases.

3.2 Cases dealt with in 2022

In 2022, the Foreign Service Control Unit registered 121 new cases. In the same period, 100 cases were closed. A response was required in 44 of these cases, all of which fell under programme area 03 – international development assistance. A total of NOK 9.8 million was repaid. Losses as a result of financial irregularities or breaches of a grant agreement may under certain conditions be covered by the grant recipient repaying the amount concerned to the project itself. Of the 44 cases in which a response was required, there were three cases of this type in 2022, for a total amount of NOK 288 498.

|

Cases dealt with in 2022 |

|||||

|

Carry-over |

New |

Closed, total |

Closed, |

In progress |

|

|

Ministry |

68 |

55 |

50 |

6 |

73 |

|

Norad |

41 |

62 |

47 |

36 |

56 |

|

Norec |

7 |

4 |

3 |

2 |

8 |

|

116 |

121 |

100 |

44 |

137 |

|

Norad responded in a higher proportion of cases than the Ministry. This is probably largely because Norad and the Ministry have had different practices for registering suspected cases of financial irregularities. The Ministry has tended to register most cases as they are received, whereas Norad conducts some preliminary investigations before registering a case.

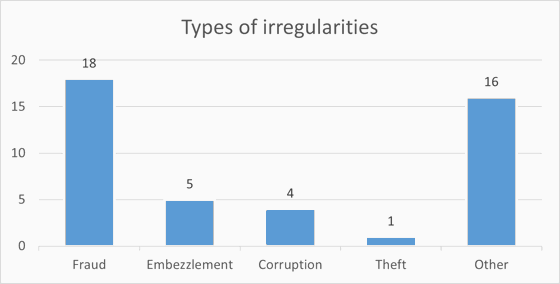

4.1 Types of irregularities

Cases involving financial irregularities are often complex and may involve a number of different elements. A rough classification shows that in 2022, 18 of the 44 cases in which a response was required involved fraud (for example manipulation of accounts), five involved embezzlement, while four involved corruption and one involved theft. The category ‘other’ includes inadequate reporting, undocumented costs and funds used for purposes other than those covered by the agreement in question. There were 16 cases of this kind in 2022.

It should be noted that the figure only shows the number of cases of the various types of irregularities that were brought to light and in which a response was required. However, this is not necessarily a true reflection of the relative prevalence of the various types of irregularities. This is partly because some types of irregularities are easier to detect than others. [4]

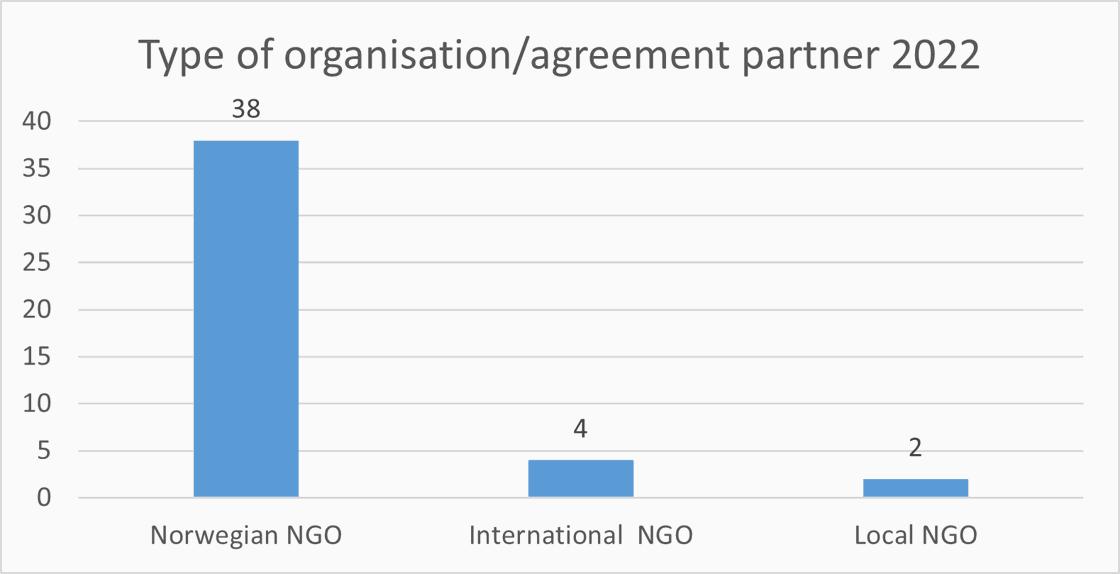

4.2 Type of organisation/agreement partner

In 2022, 38 of the 44 cases in which a response was required involved Norwegian non-governmental organisations (NGOs). In most of these cases, the NGO’s local partner was responsible for the irregularities. Four of the cases involved international NGOs and two cases involved local NGOs that were direct agreement partners.

It cannot be concluded from these figures that Norwegian NGOs are more susceptible to financial irregularities than other NGOs. Experience has shown that the Norwegian NGOs normally have good systems for detecting and reporting possible irregularities. They are required by the Ministry of Foreign Affairs to have such systems in place in order to receive grants. Norway also provides a substantially higher amount of aid through Norwegian NGOs than through international and local NGOs.

The UN, the development banks and other multilateral organisations and funds supported by Norway are expected to show zero tolerance of financial irregularities and follow this up by means of preventive measures, control systems and internal guidelines, and by responding in the event of deviations. This means that the organisations are expected to have, or be affiliated with, an independent internal audit and investigation function with the necessary mandate and capacity to supervise the organisations and carry out investigations in the event of suspected irregularities within the organisations or in the operations of external partners. Norway is working in various ways, for instance by participating in governing bodies, to strengthen the organisations’ financial management, control functions and handling of cases of suspected financial irregularities.

The responsibility for preventing, uncovering and dealing with financial irregularities lies with the organisations themselves. They are also responsible for reporting on irregularities in their annual reports, and in some cases to each donor. Norway is to follow the organisations’ handling of cases of suspected irregularities, and seek to cooperate with other donor countries on a joint response where appropriate. The organisations’ obligations vis-à-vis Norway in cases where Norwegian funds may be involved are regulated by agreements and are followed up in line with these agreements.

The UN system alone investigates several thousand cases a year. Reports are published on the agencies’ websites, for example:

UNDP: Investigations | United Nations Development Programme (undp.org)

The World Bank: Integrity Vice Presidency | World Bank

The Office of the Inspector General - The Global Fund to Fight AIDS, Tuberculosis and Malaria: Audits & Investigations - Office of the Inspector General - The Global Fund to Fight AIDS, Tuberculosis and Malaria

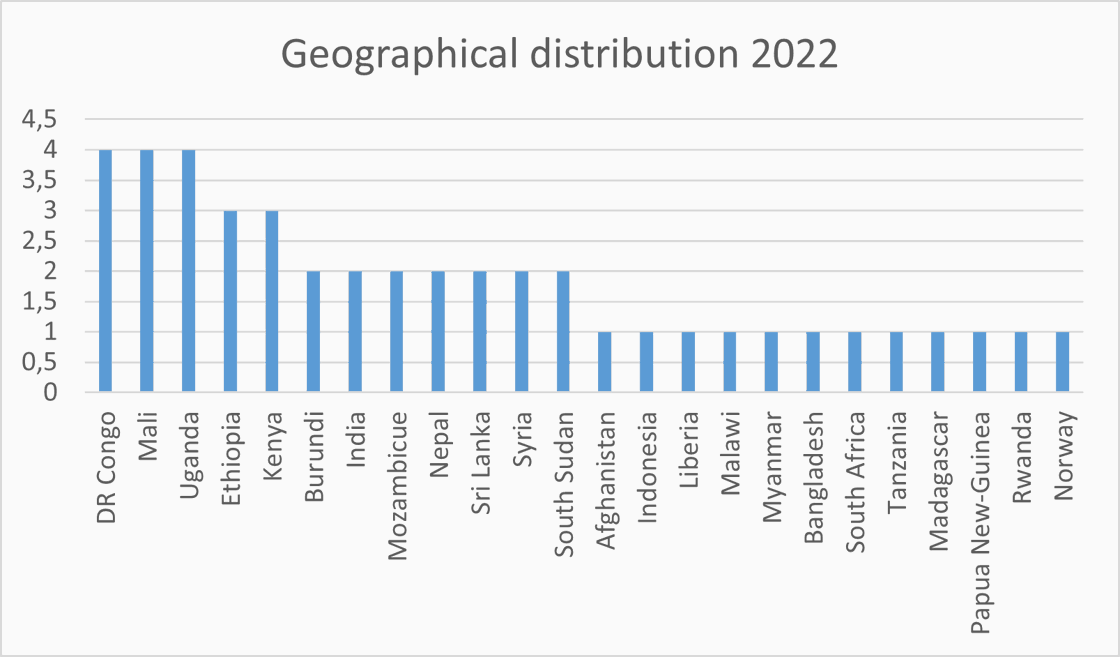

4.3 Geographical distribution

In 2022, the Democratic Republic of the Congo, Mali and Uganda were the countries with the largest number of cases in which a response was required, with four cases each. The number of cases per country can vary greatly from year to year.

The differences between the countries may be due to a number of factors, such as differences in crime levels and other forms of risk. The extent of Norwegian support and the way it is provided is probably also relevant in this context. The degree to which it is possible to control the use of funds is another important factor. It may be particularly difficult to detect financial irregularities in countries affected by crisis and war.

For more information (in Norwegian only) on individual cases in 2022 that required a response before they were closed, see the quarterly reports on the Government website (regjeringen.no); Rapporter om økonomiske mislighetssaker - regjeringen.no

4.4 Cases of suspected sexual exploitation, abuse and harassment (SEAH cases)

The Foreign Service Control Unit (FSCU), Norad and Norec also receives reports of suspected sexual exploitation, abuse and harassment (SEAH) involving partners that receive grant funding. In 2022, the FSCU received 25 cases and closed 21. Norad received nine cases and closed 17, while Norec received and closed one case.

For more information, see Guidelines for dealing with reports of sexual exploitation, abuse and harassment involving grant recipients in the Foreign Service - regjeringen.no

- Zero tolerance of financial irregularities in practice

- Guidelines for dealing with suspected financial irregularities in the foreign service

[1] See the annual reports from Norad’s Internal Audit and Investigations Unit.

[2] Norad also registers and deals with some cases for which the Ministry of Climate and Environment is responsible. These are not included in the figures presented in this report.

[3] Up until 2017, the figures also include cases involving funds managed by Norfund.

[4] In this context, corruption is defined as offering or accepting bribes in the form of money, gifts or services.