The General Purpose Grant Scheme

The General Purpose Grant Scheme contributes to an equal standard of services

Norwegian counties and municipalities vary greatly in terms of geography, demographics, and social characteristics. Some municipalities have a high number of school-aged children, while others have low population density, long distances and/or many elderly residents requiring care. This means that the cost of providing public services, such as schools, nurseries and elderly care, also varies greatly among municipalities. An important goal of the General Purpose Grant Scheme is to ensure that, through a compensation of such involuntary cost differences, all local governments have the means to provide equal standard of public welfare services to their residents.

Tax revenues vary significantly between municipalities. Municipalities have, therefore, a different basis from which to offer an equal standard of services to their residents. In order to achieve the goal that the General Purpose Grant Scheme evens out the conditions of municipalities, the municipalities' tax revenues are partially redistributed.

The elements of the General Purpose Grant Scheme

Funds redistributed through the General Purpose Grant Scheme in order to even out differences among municipalities and counties include the general grant and tax revenues.

Tax revenues that are redistributed are income and wealth tax from individual taxpayers and natural resource tax from power companies. These are redistributed through the mechanism of income equalisation.

The largest part of the general grant is made up of the per capita grant, which is redistributed through the equalisation of expenditure needs. In addition, the general grant includes regional policy grants and the discretionary grant.

Redistribution of involuntary cost differences through the equalisation of expenditure needs

The per capita grant constitutes the main part of the general grant. To start with, it is divided up by an equal amount per resident. Since municipalities and counties vary according to factors such as geography, demography, and social circumstances, the grant is redistributed so that all expenses are covered. Municipalities and counties are compensated through the equalisation of expenditure needs for involuntary differences in costs and demands. The equalisation of expenditure needs functions similarly for both municipalities and counties.

For the equalisation of expenditure needs a cost matrix is used. The cost matrix consists of a series of criteria that seek to explain the involuntary cost differences for the provision of services between municipalities. The number of school-aged children, the number of elderly residents, and settlement patterns are examples for such criteria. The cost matrix ensures that the per capita grant is redistributed from municipalities that are cheaper to operate than the national average, to municipalities that are more expensive to operate than the national average.

Data used in the equalisation of expenditure needs

To calculate how expensive each municipality is to operate, data is entered into the General Purpose Grant Scheme for each criterion. With the help of the cost matrix, each criterion is indexed, and the overall expenditure need is calculated for each municipality by combining all criteria indices in the cost matrix. The Ministry of Local Government and and Regional Development collects data from Statistics Norway, the Ministry of Education and Research, the Ministry of Transport, the Norwegian Directorate of Health, and the Norwegian Labour and Welfare Administration. These are based mainly on data collected from the national population register and on data reported by municipalities. The criteria values are updated every year, and the Ministry informs the municipalities about the data used for their municipality in advance of the calculation of the state budget.

Regional policy grants

The general grant also contains grants based on regional policy. These grants take care of various considerations, such as regional and district policy goals, high population growth and challenges related to urban areas. Regional policy grants to municipalities are the Grant for Municipalities in Northern Norway, the Grant for Peripheral Municipalities in the South of Norway, the Urban Grant, the Regional Centre Grant and the Grant for Municipalities with High Population Growth.

The allocation of the Grant for Municipalities in Northern Norway and the Grant for Peripheral Municipalities in the South of Norway is based on the peripherality index which is an indication of the grade to which a municipality faces challenges associated with rural and outlying areas.

The discretionary grant

The discretionary grant is part of the general grant. It compensates municipalities for special local conditions that are not otherwise compensated for by the General Purpose Grant Scheme.

The Ministry of Local Government and and Regional Development determines the distribution of municipalities' discretionary grant by county. The county governors further distribute the discretionary grant to municipalities, based on guidelines provided by the Ministry of Local Government and and Regional Development. The guidelines ensure equal treatment of municipalities in every county.

The only regional grant to counties is the Northern Norway County Grant.

The redistribution of tax revenues

Tax revenues make up approx. 40 per cent of the total revenues of the local government sector and just over half of the sector's "free" revenues. Tax revenue is, therefore, an important source of income for Norwegian municipalities. There are large differences in tax revenue between municipalities. Through a separate income equalisation, tax revenue is partially redistributed from those municipalities that have higher-than-average tax revenues per capita, to those with lower-than-average tax revenues per capita.

Income equalisation means that municipalities and counties that have tax revenues per capita below a given level of the national average ("reference level"), receive a compensation to a certain share of the difference between their own level and the reference level. This share between a municipality's (or county's) level and the reference level is the compensation ratio.

At the same time, municipalities and counties that have a tax revenue per capita above a given level of the national average ("deduction level") receive a deduction to a certain share of the tax revenue that exceeds the deduction level. The share of tax revenue that is deducted from a municipality or a county is called the deduction ratio. Income equalisation is different for municipalities and counties.

Municipalities

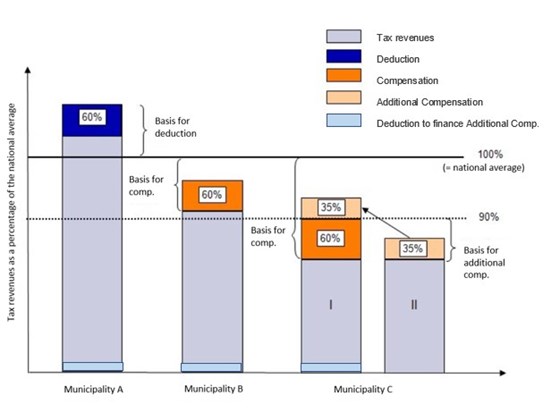

Tax revenues that are redistributed are income and wealth tax from individual taxpayers and natural resource tax from power companies. Since 2005, municipalities have had a symmetrical income equalisation. Symmetrical equalisation means that the reference level is the national per capita average of tax revenues, i.e. 100 per cent of the national average, and that the compensation and deduction ratios are equal. There is a 60 per cent symmetrical equalisation in the current system. This means that municipalities with tax revenue levels below the national per capita average receive compensation that is equal to 60 percent of the difference between their actual revenues and the national average. See municipality B in the figure below. Municipalities with tax revenues above the national average receive a deduction equal to 60 percent of the difference between their actual revenues and the national average. See municipality A in the same figure.

In order to take further care of municipalities with low tax revenues, an additional compensation is given to municipalities with tax revenues below 90 per cent of the per capita average in addition to the symmetrical compensation. These municipalities receive an additional compensation equal to 35 percent of the difference between their own revenue level and 90 percent of the national average. See municipality C. This additional compensation is funded by all of the municipalities through a per capita deduction from the pre-redistribution tax revenues.

The additional compensation means that not all municipalities with tax revenues below the national average receive funding through income equalisation. Only municipalities that receive a compensation that is higher than what they must contribute to the financing of the additional compensation, receive a net gain from income equalisation.

Income equalisation for each municipality can be calculated as follows:

Symmetrical income equalisation

+ Additional compensation

- Financing of the additional compensation

= Net income equalisation

Counties

Tax revenues that are redistributed are income and wealth tax from individual taxpayers and natural resource tax from power companies. Counties have had symmetrical income equalisation since 2015. Symmetrical equalisation means that the reference level is the national per capita average of tax revenues, i.e. 100 per cent of the national average, and that the compensation and deduction ratios are equal. There is an 87.5 per cent equalisation in the current system.

Counties with tax revenues below the national per capita average receive compensation that is equal to 87.5 percent of the difference between their own revenue level and the national average, while counties with tax revenues above the national average receive a deduction equal to 87.5 percent of the difference between their own revenue level and the national average. There is no additional compensation for counties.