5 Discovering more in opened areas

The objective of Norwegian exploration policy is to make new discoveries that are necessary to ensure a stable activity level, the highest possible value creation and State income over the medium and long term. This can best be achieved through an efficient and timely exploration of the Norwegian Shelf.

The areas of the Norwegian Shelf that are opened for petroleum activity include large parts of the North Sea, the Norwegian Sea and the southern part of the Barents Sea. Significant undiscovered resources are still expected in the unopened areas, which could provide a basis for activity for years to come. New area has not been opened to the petroleum industry since 1994. What were initially considered to be the most promising parts of the opened area have now been mapped.

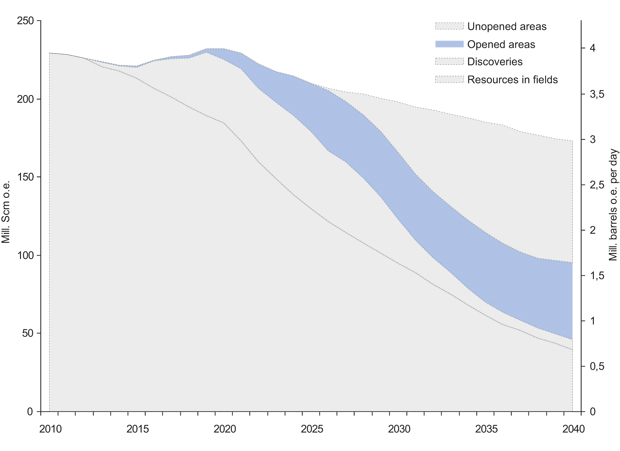

Figur 5.1 Possible production course on the Norwegian Shelf.

Kilde: Ministry of Petroleum and Energy and the Norwegian Petroleum Directorate.

Activity has been underway on large parts of the Norwegian Shelf for many years. These areas contain familiar geology and well-developed infrastructure, and the areas are deemed mature. Other parts of the shelf are characterised by less knowledge of the geology, a greater degree of technical challenges and a lack of infrastructure. These areas are called frontier areas. To achieve a suitable exploration of both mature and frontier areas, two equal licensing rounds have been established: awards in predefined areas (APA) for mature areas and numbered rounds for frontier areas.

As a petroleum province matures, the challenges and opportunities change. To ensure efficient exploration and development of potential discoveries, changes were undertaken in the petroleum policy ten years ago to attract players with a strong focus on the more mature areas of the Norwegian Shelf. The current player scenario is well-balanced, and consists of companies that focus on new, larger and more risky projects and companies that focus on smaller projects with lower risk.

The Government wants to maintain exploration activity. The most important instrument for achieving this is awarding area in licensing rounds. Extensive awards both in mature and frontier areas are important in maintaining a high level of exploration activity. It is necessary to maintain exploration activity so as to curb the decline in petroleum production. The Government will therefore continue a predictable award policy in relation to numbered rounds and APA rounds.

The Government will:

Award production licenses in mature and frontier areas to curtail the decline in petroleum production.

5.1 Undiscovered resources in opened areas

Considerable volumes of recoverable resources are still expected on the Norwegian Shelf. The Norwegian Petroleum Directorate’s estimate for the expected undiscovered resources is 2570 million scm o.e. The estimate’s range of uncertainty is from 1020 scm o.e. to 4800 scm million o.e. The expected undiscovered resources are distributed between the three marine areas with 33 per cent expected in the North Sea, 30 per cent in the Norwegian Sea and 37 per cent in the Barents Sea.

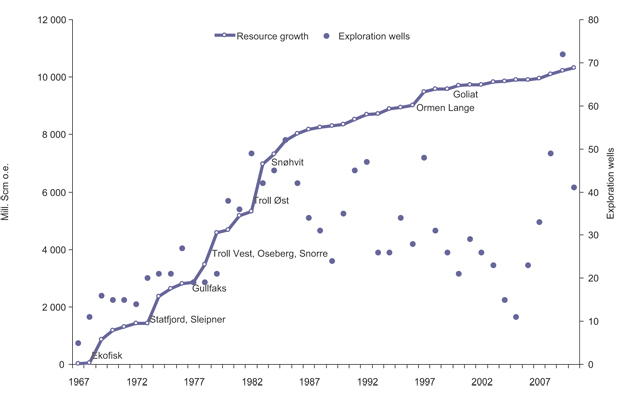

Average discovery size declines as petroleum provinces mature, and this is also true of the areas on the Norwegian Continental Shelf. During the first 20 years, many particularly large discoveries were made on the Norwegian Shelf, and many of these fields are still producing significant volumes. Since the mid-1980s, reserve growth has not been as large. With the exception of Ormen Lange, the largest discoveries were proven during the period from 1969 to 1984. In the 1990s, discovery size and number of exploration wells decreased, cf. Figure 5.2.

Figur 5.2 Cumulative resource growth over time, and the number of exploration wells drilled per year.

Kilde: Norwegian Petroleum Directorate.

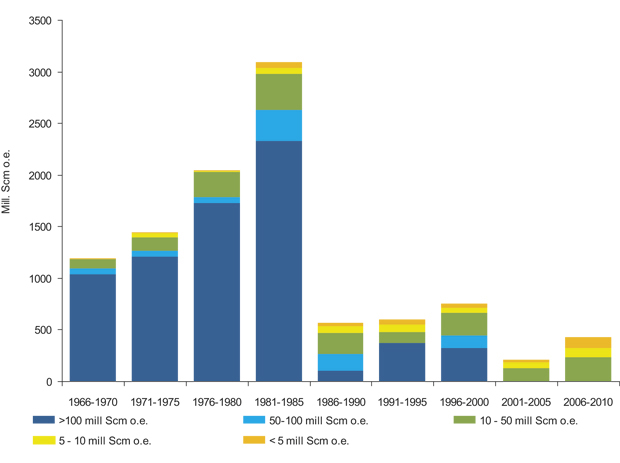

In the 2000s and since, the size of discoveries has been considerably smaller than the largest discoveries made until the mid-1980s, cf. Figures 5.2 and 5.3. This reflects the fact that the opened areas have become more mature. At the same time, the discovery rate has increased during this period and some of the discoveries are still of considerable size, providing good income for the State and the companies. Furthermore, many discoveries are close to infrastructure, which makes them less cost-intensive and quicker to develop.

Figur 5.3 Resource growth and discovery size, 1966–2010.

Kilde: Norwegian Petroleum Directorate.

In the future, large parts of the production are expected to be from discoveries that are not yet proven. As of 2020, the importance of resources that have yet to be found will gradually increase and become dominant. Profitable discoveries are an essential precondition for maintaining the production level. This assumes that we are able to sustain the level of exploration in open areas.

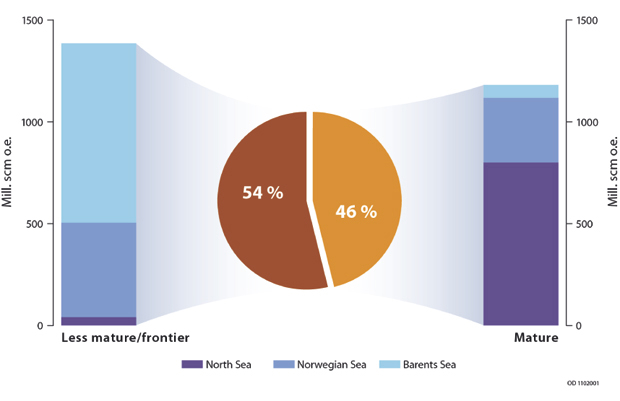

Large volumes and values are still present in mature areas. The Norwegian Petroleum Directorate estimates that nearly half of the undiscovered resources will be found in mature areas, cf. Figure 5.4. Most of these resources are expected to consist of small discoveries in the North Sea. The majority of the North Sea is covered by the APA area and is thus defined as a mature area. The potential in frontier areas of the North Sea is therefore limited. The largest potential in frontier areas is found in the Barents Sea, followed by the Norwegian Sea. This is also reflected in the recently completed 21st licensing round, where all awarded area is in the Norwegian Sea and the Barents Sea.

Figur 5.4 Undiscovered resources in mature and frontier areas.

Kilde: Norwegian Petroleum Directorate.

Boks 5.1 Definition of mature and frontier areas

There is considerable variation in the challenges associated with realising the potential for undiscovered resources on the Norwegian Shelf. The variation coincides with the degree of maturity in the different areas. Mature and frontier petroleum areas were described in Storting White Paper No. 38 (2003–2004), The Petroleum Activities.

Mature areas are characterised by familiar geology, smaller technical challenges and well-developed or planned infrastructure. This results in a relatively high probability of discoveries, but at the same time, the probability of making new, large discoveries is low.

Frontier areas are characterised by little geological knowledge, significant technical challenges and lack of infrastructure. The uncertainty associated with the exploration activity is greater here, but new, large discoveries are still possible.

5.2 Exploration activity within comprehensive marine management

5.2.1 Integrated management plans and exploration policy

Norway’s ambitions have always been high as regards environmentally friendly petroleum activities. Joint regulations have been created within health, safety and the environment, and they are administered by, among others, the environmental, petroleum and safety authorities. So as to safeguard the external environment and maintain consideration for other industries, the relevant management plans are used as a basis in stipulating environmental and fishery terms for both types of licensing rounds.

Storting White Paper No. 12 (2001–2002), Clean and rich seas, established that integrated management plans shall be prepared for Norwegian waters. The purpose of the management plans is to facilitate value creation through sustainable utilisation of resources and ecosystem services in the waters, while also maintaining the ecosystems’ structure, function, productivity and biological diversity. The management plans are a tool for both facilitating value creation, and maintaining the environmental values in these waters. The management plans shall contribute to a comprehensive and ecosystem-based management of Norwegian waters.

The first management plan was presented in 2006, and covered the Norwegian part of the Barents Sea and the waters off Lofoten. This management plan was updated and presented to the Storting in the spring of 2011. The management plan for the Norwegian Sea was presented to the Storting in the spring of 2009. The Government is currently working on a management plan for the North Sea and Skagerrak.

The responsible agencies gather extensive knowledge concerning these waters in the work to establish the comprehensive management plans. In addition, views on the technical basis are gathered through involvement of interest groups in public consultations and conferences. Impact assessments of industry activities based on available knowledge are used as a basis for assessments and decisions in the management plans. In connection with updating the plans, new knowledge is gathered where gaps have been identified. The management plans will be updated regularly, normally after 4–5 years. Considerable work is done by the authorities’ responsible agencies, as well as consultant and research environments, to maintain and further gather knowledge concerning the sea. This is in agreement with the requirement for knowledge-based management. The management plans ensure both a sound foundation for responsible management, as well as predictability surrounding the framework and conditions for the petroleum activities and other business activities.

The integrated management plans for the various marine areas states where petroleum activity may take place in the open area, and where the activity is prohibited during specific time periods. Area-specific conditions can also be imposed on the petroleum activity. Seasonal restrictions for exploration drilling and acquisition of seismic data are examples of such area-specific restrictions.

All areas that have been opened for petroleum activity and not excluded from petroleum activity in the management plans can be announced in numbered licensing rounds, or included in the APA area. Within the framework of the management plans, an expert petroleum assessment determines when new areas are added to the APA area. The consideration for sequential exploration of frontier areas is important in the numbered rounds, while the need to prove and produce time-critical resources is important in the APA rounds. In connection with the consideration of the management plans for the Norwegian Sea and the Barents Sea-Lofoten, it was determined that, in connection with licensing rounds, the area-specific environmental and fishery requirements for petroleum activity as laid down in the management plans, will be used as a basis. No additional environmental or fishery demands will be made.

However, to clarify whether significant new information has emerged between the revisions and updates of the management plans, a public consultation process will be held in connection with APA rounds and announcement of blocks through the numbered licensing rounds. This consultation will only solicit input connected with significant new information that may have emerged after the relevant management plan was adopted. The Government will thus have a good technical basis for making comprehensive and balanced decisions on the framework for the petroleum industry, also in the period of time between updates of the management plans. This will safeguard the consideration for good resource management, along with considerations for health, safety and the environment and coordination with other industries.

The Government will:

In areas with established managements plans, use the environmental and fishery requirements from the relevant management plan as a basis. No further environmental or fishery demands will be imposed for new production licenses in the area.

Within the framework of the management plans, use expert petroleum evaluations as a basis for which areas are included in the APA area and which areas are announced through numbered licensing rounds.

5.2.2 Coordination with the fishery industry

Norwegian maritime areas are rich in natural resources, and they play a very important role in Norway. The resources in the sea and under the seabed must be soundly managed in a way that ensures value creation and welfare in a long-term perspective. Norway’s coastal and sea areas are important for commercial activities such as the petroleum sector, fishing, shipping and tourism. Increased activity and more users demand good coordination so that different industries can co-exist.

The fishery industry is important to Norway. Today, fish is the third most important export article after petroleum and metal. More than 10 000 people have fishing as their primary occupation, and there are about 6 800 fishing vessels in Norway.

Ever since the petroleum activities on the shelf started nearly 50 years ago, the authorities have maintained that petroleum activities must be carried out side by side and in cooperation with other industries, particularly the fisheries. This has laid the foundation for value creation based on both oil and gas resources, as well as the fishery resources. The extensive system of impact assessments in all phases of the petroleum activity is an important element in achieving this.

The Petroleum Act requires the authorities to carry out comprehensive impact assessments prior to opening an area. In this connection, evaluations are made of e.g. the environmental, financial and societal consequences for other industries, including the fisheries. The Petroleum Act also requires impact assessments as a part of plans for development and operation, and as a part of plans for disposal of facilities after production ceases.

The management plans are important in the processes to ensure good coordination. Area-specific conditions were established in connection with the consideration of the management plans for the Norwegian Sea and for the Barents Sea – Lofoten in order to protect environmental assets in particularly valuable areas. These conditions replaced the license-specific conditions in the Barents Sea. In the Norwegian Sea, the area-specific conditions from the management plan apply to new licenses. The conditions in the management plan can also be imposed on existing production licenses, subject to application. License-specific requirements apply in the North Sea until a management plan is submitted.

Ever since the 1980s, special environmental and fishery conditions have been stipulated in connection with announcement and award of new areas on the Norwegian Shelf. These conditions entail that consideration must be given to the fisheries and fishery resources, both in connection with seismic data acquisition and with drilling. In the most vulnerable areas, time limitations have been set for acquisition of seismic data and drilling of exploration wells. Prior to exploration drilling and acquisition of seismic data, measures must be implemented to inform affected interested parties.

The Norwegian Petroleum Directorate and the Directorate of Fisheries established a working group in the autumn of 2007 to consider issues related to acquisition of seismic data and electromagnetic surveys. In 2009, the Norwegian Petroleum Directorate, the Directorate of Fisheries and the State Pollution Control Agency, now the Climate and Pollution Agency, presented a report entitled “Report on startle response and other harmful effects from seismic sound waves – recommendations concerning test activity”. With regard to the startle response in fish, the report did not reach a conclusion regarding the distance at which such a response occurs. The desire on the part of some for stipulation of a general minimum distance for the startle response was thus not accommodated. This is mainly due to the fact that there was relatively little research on the startle response, and that the viewpoints of the commercial interests were incompatible. In this context, reference can be made to the fact that how and how far the sound waves travel in the sea at any given time depends on the hydrographic conditions, which vary throughout the year as well as from area to area.

In the wake of this work, a cooperative group has been established between the petroleum authorities, the petroleum industry, fishery organisations/fishery authorities and the Climate and Pollution Agency. This work has resulted in a number of measures, with regulatory changes in both the Resource Regulations as well as in the Petroleum Act and Petroleum Regulations. Measures have also been initiated regarding communication, coordination and expertise.

The changes in the Resource Regulations include a requirement for courses for fishery experts regarding seismic data acquisition, with clarification of the fishery expert’s role and required expertise, along with requirements for keeping and reporting of log books after end of voyage. The changes also encompass further coordination of requirements relating to reporting surveys and requirements for tracking equipment for seismic vessels. The Norwegian Petroleum Directorate has established a web-based reporting and announcement system for survey activity, including an option for interactive information searches for information on reported surveys and announcement of surveys. A cooperation agreement has been signed between the Coast Guard, the Directorate of Fisheries and the Norwegian Petroleum Directorate, where the Coast Guard is the primary contact for the fishery expert.

For a number of years, the Norwegian Oil Industry Association has carried out annual “fish and seismic” seminars, a forum for exchanging experience and knowledge between the industry, authorities and the fishery industry. Both the Norwegian Petroleum Directorate and the Directorate of Fisheries have been active participants in these seminars.

Several measures have been implemented to obtain more knowledge about the effect of seismic surveys on the fisheries. While there is general agreement that seismic surveys have little direct harmful effect and do not harm fish at a population level, there is considerably more disagreement as regards behavioural changes in fish in connection with acquisition of seismic data and as regards introduction of a minimum distance from fish.

In connection with the acquisition of seismic data outside Lofoten/Vesterålen in the summer of 2009, a follow-up research project was conducted to obtain better documentation of how the sound from seismic surveys affects certain species of fish that are subject to commercial fishing, and thus potential catches for fishers. The cost frame for the project was NOK 25 million, and it is one of the largest projects ever carried out. The study was financed by the Norwegian Petroleum Directorate and conducted by the Institute of Marine Research.

The main conclusions from this study were that the seismic surveys had no proven harmful effect on marine life, but that the sound affected fish behaviour, and that there was a change in catches (increase or decrease) in the period during which seismic data acquisition took place. Net catches of Greenland halibut and haddock were reduced, but grew in the period after the acquisition activity. The fish exhibited increased swimming activity, which can be symptomatic of a stress reaction. However, the fish showed no clear changes in food intake. Lower density of pollock was measured during the seismic acquisition activity, but no change was proven in the distribution of other species. With regard to direct harm to fish larvae, previous research has revealed that harm only occurs within the very immediate area, maximum five metres around the sound source. On this basis, it was concluded that the seismic surveys do not entail harm at the population level.

In connection with the petroleum activity in the north, the petroleum industry has taken the initiative for vessels in the fishing fleet to be qualified and to secure expertise for operating oil spill equipment. The Maritime Directorate has stipulated new regulations making it easier to utilise fishing vessels and other suitable vessels in oil spill preparedness. In connection with the Goliat development, the licensees and the Norwegian Clean Seas Association for Operating Companies (NOFO), in cooperation with the northern fishermen’s association (Fiskarlaget Nord) have drawn up a comprehensive emergency preparedness concept for use of fishing and other vessels in coastal oil spill response. The intention is to establish a permanent emergency preparedness fleet consisting of 30-40 vessels for coastal response in Finnmark county. According to the companies and NOFO, the fleet will make up part of the permanent oil spill preparedness for the Goliat field, but can also safeguard the preparedness needs of other activity in the area.

The cooperation between the two industries is important in strengthening preparedness in coastal waters. Using the fishing fleet will enable the oil companies to benefit from local maritime expertise and increase emergency preparedness capacity. At the same time, the initiative can yield additional financial resources for the involved fishers, and spin-off effects for the local environment. The knowledge and capacity that are built up will also be useful for the Norwegian Coastal Administration as regards oil spill preparedness considerations associated with e.g. discharges from ship traffic.

The petroleum activity also entails significant reinforcement of the general preparedness to respond to potential accidents. This provides security for all users of the sea. The emergency preparedness includes e.g. both land and sea helicopters, as well as upgrading of the fishing fleet with towing capabilities. Establishment of petroleum activities can result in better general preparedness and greater security than would have been the case without the activity. This enhanced preparedness could be very important in connection with various types of accidents at sea and along the coast that are not related to the petroleum activity. One specific example is when an search and rescue (SAR) helicopter from the Heidrun platform contributed in the rescue work when a chemical tanker collided with a fishing boat off the coast of Fræna municipality in Møre og Romsdal county in October 2007.

Although the authorities have implemented a number of measures to ensure the best possible interaction between the petroleum activity and the fisheries, both through regulatory change, improved communication and enhanced expertise, it will continue to be important in the future to focus on work and processes that can promote cooperation between the fishery and petroleum industries. Research work has brought considerable new knowledge, and constitutes important work that we must continue to build on. The objective is to find balanced solutions that promote long-term, sustainable management of our ocean-based resources, and ensure good cooperation in the years to come.

The Government will:

Promote good cooperation between the fishery and petroleum industries by placing restrictions on exploration and drilling activity based on knowledge from the work on comprehensive management plans.

Utilise the fishery industry’s resources and expertise in oil spill preparedness.

5.3 Exploration policy

The purpose of the exploration activity is to contribute to resource growth, and thus pave the way for development and production of the undiscovered resources. Exploration activity is designed to achieve this in an efficient manner. The award system for new licenses and the player scenario are key elements in our exploration policy.

It is important that interesting exploration acreage in mature areas is explored in a timely manner so that time-critical resources can be proven and produced. In frontier areas, it is important that regular licensing rounds give access to interesting area while safeguarding the consideration for socio-economic efficiency through stepwise exploration.

The system of awards in predefined areas (APA) is an important measure in achieving our exploration policy objectives. The system is a further development of the numbered licensing round system that facilitates timely exploration through annual awards, and predictable area through the predefined areas. Predictable addition of acreage to mature areas, and which companies can apply for, are important for the efficiency of the APA system. The companies do extensive geological work in these areas when they know that they are available in an annual round of awards. This predictability is a key feature of the APA system.

A variety of companies contributes to stronger competition for acreage, and ensures that new ideas emerge and are tested. The increased diversity among the licensees on the shelf has contributed to good exploration results in mature areas in recent years.

The Office of the Auditor General has carried out an administrative audit of administrative practices in connection with license awards1. They reviewed the award process in APA 2007 and APA 2008, as well as in the 19th and 20th licensing rounds. No significant deviations were identified in relation to the Storting’s resolution and assumptions. The survey reveals that:

«Overall, the survey shows that administrative practices in connection with the award of production licenses in the petroleum sector consistently complies with all reasonable requirements based on general requirements for sound case processing and generally accepted public administration principles.»

5.3.1 Mature areas – APA

The mature areas are characterised by familiar geology and well-developed infrastructure. The likelihood of making discoveries is often relatively high, while at the same time there is less chance of making large discoveries. These areas often include fields in the later stages of their lifetime, or fields that are shut down. Most new projects in mature areas are expected to be relatively small, often necessitating tie-in to existing fields to ensure profitability. At the same time, phasing in these discoveries can help extend the lifetimes of the fields they are tied in to. Central challenges for the mature part of the shelf therefore include achieving rapid project progress for many small discoveries, as well as achieving the highest possible production from established fields within their technical and economic lifetimes. How time-critical these resources actually are depends on the planned shutdown of nearby infrastructure.

Today, the mature areas include large parts of the North Sea, the eastern and southern parts of the Norwegian Sea and most of the Barents Sea South.

Exploration in mature areas

Since their introduction in 2003, the APA rounds have contributed to a considerable number of new licenses on the Norwegian Shelf. A total of 324 production licenses have been awarded since the APA system was established, cf. Table 5.1. This is more than one-third of all production licenses awarded since awards commenced in 1965. The North Sea Awards were the predecessor of the APA scheme, and comprised selected mature areas in the North Sea. Forty production licenses were awarded under this scheme from 2000-2003. The awards are and have been necessary in order to curb production decline and maintain activity.

Tabell 5.1 Number of awards in APA rounds and the North Sea Awards (NSA).

NSA 1999 | 14 | APA 2003 | 19 | |

NSA 2000 | 5 | APA 2004 | 28 | |

NSA 2001 | 10 | APA 2005 | 45 | |

NSA 2002 | 11 | APA 2006 | 58 | |

APA 2007 | 52 | |||

APA 2008 | 34 | |||

APA 2009 | 38 | |||

APA 2010 | 49 |

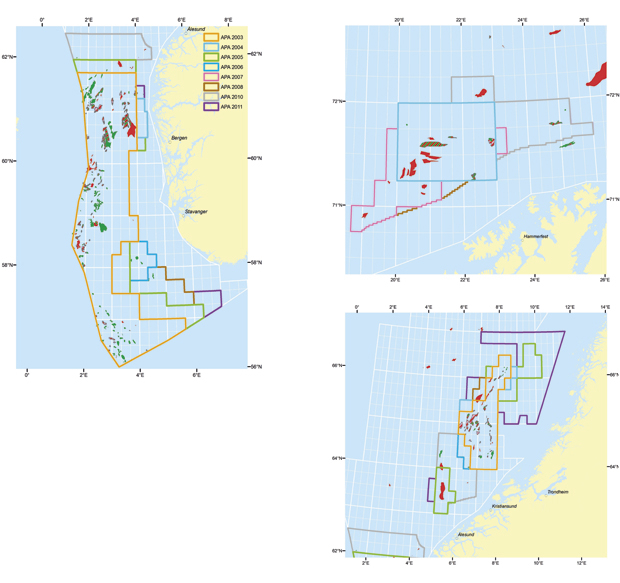

In line with Storting White Paper No. 38 (2003–2004), The petroleum activities, the APA area is gradually expanded as new areas mature. Such a gradual expansion has been carried out since 2003, cf. Figure 5.5. The first APA round, APA 2003, primarily included area in the North Sea and on Haltenbanken in the Norwegian Sea. The areas around Snøhvit in the Barents Sea were included starting with APA 2004. The APA area has been expanded every year since the system was established, with the exception of 2009.

Figur 5.5 Expansion of the APA area since the APA scheme was established.

Kilde: Norwegian Petroleum Directorate.

It is important that the awarded acreage is explored quickly and efficiently to ensure maximum utilisation of existing infrastructure. This is also important because it takes time from acreage is awarded until production can start. The average lead time on the Norwegian Shelf is 11 years from discovery to production start-up. Small discoveries made near infrastructure can often be quickly phased in to existing infrastructure, assuming capacity is available. This could result in shorter than average lead time.

Well-developed or planned infrastructure means lower investments for developing new discoveries. Even small discoveries can yield good profitability if they can be phased in to existing infrastructure with available capacity. Infrastructure has a limited lifetime, which is why it is so important to prove and then produce the resources in the area before the existing infrastructure is shut down. If this cannot be done, profitable resources could be left in the ground because the discoveries are too small to justify necessary infrastructure on their own.

It often takes some time before we can see the results of policy changes. The restructuring that has taken place since 2000 is beginning to yield results in the form of number of wildcat wells, discoveries and proven resources in licenses awarded through the North Sea Awards and the APA rounds.

Tabell 5.2 Wildcat wells, discoveries and proven resources in area awarded in the North Sea Awards and APA licensing rounds from 2000 to 2010.

Year | Number of wildcat wells completed | No. of discoveries | Resources proven in million scm o.e. |

|---|---|---|---|

2000 | 0 | 0 | 0 |

2001 | 1 | 0 | 0 |

2002 | 3 | 0 | 0 |

2003 | 0 | 0 | 0 |

2004 | 2 | 0 | 0 |

2005 | 0 | 0 | 0 |

2006 | 2 | 0 | 0 |

2007 | 9 | 6 | 31.2 |

2008 | 12 | 7 | 32.7 |

2009 | 23 | 9 | 45.3 |

2010 | 23 | 10 | 91.8 |

The exploration that has taken place as a consequence of licenses awarded in the North Sea Awards and the APA rounds has yielded results. A total of 32 discoveries have been made in this area over the last four years. Overall, the resources from these discoveries make up more than 200 million scm o.e. Several of the licensees linked to the major discoveries are already planning developments. Proposed plans for development of one of these discoveries, Knarr, have been submitted for the authorities’ processing in 2011.

Awards through the APA system

The APA licensing rounds are annual. As a general rule, the acreage that can be applied for is announced in the first quarter of the year, with the application deadline for the companies around 15 September. The award of new production licenses normally takes place right after the new year.

The criteria for award of production licenses are published through the announcement. These criteria form the basis for which companies secure awards in the APA rounds. In these awards, significant emphasis is attached to the understanding of the geology that emerges in the application, and the technical expertise that the companies possess. Other award criteria include financial strength and experience with the individual company. HSE requirements are published in the announcement and are used as a basis when new production licenses are awarded. The Ministry of Labour, represented by the Petroleum Safety Authority Norway, undertakes an HSE assessment of the companies in connection with the applications.

Each year, the Government considers whether the APA area should be expanded. The areas can be expanded within the framework that lies in the management plans for the relevant sea area, but the area cannot be reduced. One possible exception to this rule is the emergence of important new information that is relevant for the decision in the management plan as to where petroleum activity can take place, after the relevant management plan was adopted. It is highly unlikely that this will ever actually occur, as knowledge about the petroleum activity and the sea environment is very well known. Potential new acreage will be included in the announcement of the next APA round.

When expanding the predefined area, the authorities propose acreage that is characterised as mature from a technical petroleum perspective. Using the definition of mature petroleum areas and frontier petroleum areas as a point of departure, the authorities have operationalised this into the following technical petroleum criteria, wherein one or more criteria must form the basis for such a proposal:

Area is close to infrastructure. This includes both existing and planned infrastructure. Potential resources in the areas are regarded as time-critical.

Area with exploration history. This includes area that has previously been awarded and relinquished, area with known plays or play models2 and area situated between awarded and relinquished area.

Area that borders on existing predefined areas, but that has not been applied for in numbered licensing rounds.

In the Norwegian Sea and the Norwegian part of the Barents Sea there are management plans that ensure balanced consideration for the external environment and the interests of various users of the sea, including the petroleum activity. Before expanding the APA area, the proposal is submitted to other ministries to ensure that potential new and significant information emerges before an expansion decision is made.

The APA areas can be expanded as new areas mature. Predictability regarding which areas can be applied for, along with a regular addition of new area, is important for the efficiency of the system, and is a key characteristic of the scheme. The companies carry out extensive geological work in these areas. It is therefore important that the areas included in the scheme are not subsequently withdrawn.

Experience with the APA scheme

The companies, particularly the new players on the shelf, have shown great interest in the APA scheme. The scheme has been criticised by environmental organisations and environmental agencies. In light of this, and the fact that the scheme had been in effect for five years, the Government decided to evaluate the scheme in 2008. In November 2008, the Government requested input regarding experiences with the APA scheme. A total of 67 submissions were received. A more detailed description of the evaluation is available to the public as an unprinted appendix to this report.3

The APA scheme has proven to be an important scheme for efficient exploration of mature areas. It has contributed to strengthen diversity and competition within exploration on the Norwegian Shelf. The scheme contributes to predictability for the industry with regular awards through an annual cycle. At the same time, the scheme contributes to maintain exploration activity in mature areas so resources are proven and produced. In the future, the Ministry will continue to emphasise such assessments when expanding the APA area.

Following a balanced assessment where considerations for petroleum activity, HSE, the external environment and fisheries were weighed, the Government has decided to maintain the APA scheme. It is very important for the management of petroleum resources and has contributed to efficient licensing policies and good resource utilisation. The management plans safeguard the considerations for the environment and interaction with other industries along with other regulations. The regulations and management plans are used as a basis for petroleum activity in the APA area in the same manner as for activity in areas awarded in numbered licensing rounds.

The APA scheme will therefore be carried out as an annual licensing round in all mature areas to contribute to maintain activity and production on the continental shelf. All areas opened for petroleum activity, and not exempted from petroleum activity in a management plan, can be included in the APA area. Within the framework of the management plans, a technical petroleum assessment is carried out when new areas are added to the APA area.

For sea areas with an established management plan, the Ministry will use the environmental and fishery conditions from the relevant management plan as a basis in new production licenses. Until the management plan is updated, no further environmental and fishery requirements will be stipulated for petroleum activity in the area.

The Government will introduce public consultations in connection with APA rounds. For areas with a management plan, input is only requested regarding new, significant information that has come to light after the relevant management plan was approved.

Since the establishment of APA, the work programs have been made public. The authorities will continue this practice.

The Government will:

Carry out the APA scheme as an annual licensing round for all mature area on the Norwegian Shelf to contribute to maintaining activity and production.

Within the framework of the management plans, use technical petroleum assessments as a basis for which areas are included in the APA area.

Introduce public consultation in connection with APA rounds. For areas with a management plan, only input regarding new, significant information that has come to light after the relevant management plan was approved is requested.

Continue to publish the work programs in APA licenses.

Fallow areas

From the resource owner’s perspective it is very important that the resources are explored efficiently and in a timely manner, and to prevent area from becoming fallow.

Production licenses can be in an initial period or in the extension period. The Petroleum Act regulates the duration of these periods. The initial period can last a maximum of ten years. The extension period may last up to 50 years. Upon application, the extension period may be extended beyond this.

Currently, strict license conditions and work programs are stipulated to prevent fallow area. In addition, conditions are stipulated for activity though the processing of development plans. Together, this prevents fallow area in newer awards. Therefore, fallow area is mostly a problem in older production licenses. In the early awards there was great uncertainty associated with the resource basis and the framework was not as developed as it is today. Therefore, larger exploration areas were awarded to companies than is the current practice. The companies have retained large areas during the extension period.

The objective of the area fee is to provide companies with incentives to explore and utilise potential resources in the awarded area in an efficient manner. If a company finds that the awarded area does not contain sufficiently interesting commercial possibilities, the area fee will contribute to the area being transferred to others or returned to the State. In 2007, amendments to the Petroleum Regulations’ provisions relating to area fees entered into effect. The purpose of the amendment was to strengthen the fee’s function as a policy instrument in resource management. The main rule is that area fees shall not be paid in areas with production and active exploration activity. Areas without activity, however, will be subject to a higher fee.

The NPD has reviewed existing licenses on the Norwegian Shelf to assess the exploration activity. Area included in a development plan is excluded in the evaluation. The following criteria define an area as fallow:

Exploration drilling has not been carried out and the costs of geophysical or geological surveys are lower than NOK 20 million from 1 January 2008 to 1 January 2010.

Activity has not been budgeted in the form of drilling exploration wells or geophysical or geological surveys in 2010 or 2011.

No significant relinquishment of area since the summer of 2008.

No new licensees since the summer of 2008.

Nearby infrastructure has available capacity or new capacity is planned.

It is expected that potential discoveries in the area will be of a size that could justify the costs of upgrading/developing new capacity.

Licenses with very little area where exploration is not realistic in practice, are excluded from the data basis. The same applies to the licenses where the authorities have granted exemptions from conditions in the licenses.

In order for resources to be proven and produced in a profitable manner, it must be possible to transport petroleum out of the area. There must be available infrastructure which a discovery can be phased in to if it is not large enough to warrant stand-alone development. In the Barents Sea and Norwegian Sea, for example, major discoveries are needed to justify a new development.

Technical problems can arise which delay development. Gudrun is a recent example of fields being developed several decades after the discovery was made, e.g. due to a challenging reservoir. In other instances, there might be high CO2 content in the gas, which could make it difficult to phase-in the resources to existing infrastructure quickly enough.

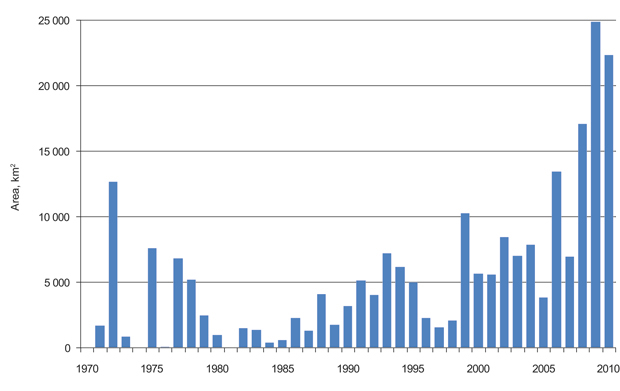

The NPD’s analysis shows that about two per cent of all awarded area is fallow. The scope of fallow area is therefore considered modest. The scope is expected to be reduced further as a result of the area fee. Relinquished area has increased considerably in the last few years, cf. Figure 5.6. This is most likely due to introducing a new area fee in 2007. The authorities want to monitor this development before other potential measures are implemented.

Figur 5.6 Annual relinquished area.

Kilde: Norwegian Petroleum Directorate.

The Norwegian Oil Industry Association (OLF) has issued a statement regarding the need for facilitation for increased circulation of area covered by licenses on the Norwegian Continental Shelf. OLF believes that there is no current need for further initiatives from the authorities to increase the rate of circulation of area covered by licenses on the Norwegian Continental Shelf.

The Government will:

Prevent idle licenses by following up activity in mature areas and using the area fee to achieve good area management.

5.3.2 Frontier areas – numbered rounds

The frontier areas are characterised by limited knowledge about the geology, lack of infrastructure and often considerable technical challenges. The uncertainty associated with the resource basis is greater than in mature areas. At the same time, it is still possible to make new, large discoveries.

In frontier areas, area is announced and awarded through numbered licensing rounds. In the last ten years, numbered licensing rounds have normally taken place every other year.

The number of announced blocks in the most recent numbered licensing rounds has been varied and reflects the interest from the industry, the need for sequential exploration and expected prospectivity in the available areas. From the 17th to the 19th licensing rounds, the percentage of awarded blocks compared with announced blocks has been about 50 per cent. In the 20th licensing round, about 80 per cent of the announced blocks were awarded, while the percentage was somewhat lower in the 21st licensing round with 65 per cent. In total, 80 production licenses have been awarded in the last five licensing rounds in frontier areas on the Norwegian Shelf.

The nomination process for the 21st licensing round shows that there is still considerable interest in the Norwegian Shelf. The Ministry received nominations from 43 companies. 138 blocks were nominated by two or more companies. 94 blocks or parts of blocks were announced, 51 in the Barents Sea and 43 in the Norwegian Sea. The Ministry received applications from 37 companies. During the spring of 2011, 61 blocks in 24 new production licenses were awarded to 29 different companies.

From the 19th licensing round, the focus has mainly been on the western and northern parts of the Norwegian Sea and the southern part of the Barents Sea. These are areas with less familiar geology and technological challenges such as basalt layers and deep waters. There is no infrastructure in large parts of these areas. This means that relatively large resources must be proven, individually or overall, in order to justify new infrastructure. There is greater financial risk associated with exploring in frontier areas. This is often because the geological conditions are less known, in addition to lack of infrastructure and more technologically demanding drilling operations.

Tabell 5.3 Number of blocks announced, awarded and number of production licenses in the 17th – 21st licensing rounds. The number of blocks includes both whole and parts of blocks.

Announced blocks | Awarded blocks | Number of production licenses | |

|---|---|---|---|

17th round | 32 | 18 | 6 |

18th round | 95 | 46 | 16 |

19th round | 64 | 33 | 13 |

20th round | 79 | 63 | 21 |

21st round | 94 | 61 | 24 |

The exploration activity in frontier areas awarded during the period 2000-2010 has varied, cf. Table 5.4. Since 2004, eleven discoveries have been made in production licenses awarded in numbered licensing rounds after the year 2000. In total, about 116 million scm o.e. has been discovered.

The large number of applications in the 20th and 21st licensing rounds shows that there are still great expectations for the Norwegian Shelf. Even though several dry wells have been drilled in frontier areas in recent years, there has also been positive news. During the spring of 2011, Statoil made the largest discovery (Skrugard, 7220/8-1) in the Barents Sea since the Goliat discovery in 2000. The well was drilled about 110 kilometres north of the Snøhvit field and preliminary resource estimates indicate that an independent development could be realistic. Preliminary calculations of the size of the discovery are between 25 and 40 million standard cubic metres of recoverable oil and 2-7 billion standard cubic metres of recoverable gas.

Sequential exploration is still important

The Norwegian Continental Shelf has gradually been opened for petroleum activity. The strategy for licensing rounds in newly opened and frontier areas has mainly adhered to the principle of sequential exploration. This entails that results of wells in certain blocks in an area should be available and evaluated before new blocks are announced in the same area. This approach ensures that large areas can be mapped with relatively few exploration wells. In this manner, available information is used for further exploration and drilling of unnecessary, dry wells can be avoided. Sequential exploration contributes to a rational mapping of areas with less familiar geology. The strategy leads to only announcing and awarding certain key blocks even though large areas are opened. The policy has consisted of opening relatively large areas and then announcing key blocks in subsequent licensing rounds. The announced blocks are considered to be the most prospective and/or to have high information value.

Tabell 5.4 Wildcat wells, discoveries and proven resources in area awarded through numbered licensing rounds from 2000 to 20101.

Year | Number of wildcat wells completed | Number of discoveries | Proven resources, million scm o.e. |

|---|---|---|---|

2000 | 0 | 0 | 0 |

2001 | 4 | 2 | 4.3 |

2002 | 3 | 1 | 2.9 |

2003 | 3 | 3 | 15.3 |

2004 | 1 | 0 | 0 |

2005 | 5 | 4 | 52.8 |

2006 | 2 | 0 | 0 |

2007 | 9 | 2 | 5.2 |

2008 | 4 | 3 | 4.7 |

2009 | 4 | 2 | 30.9 |

2010 | 2 | 0 | 0 |

1 Resource growth from area awarded in numbered licensing rounds before 2000 is not published. There could therefore be a difference in the total reserve growth.

Numbered licensing rounds

Numbered licensing rounds are normally carried out every other year. All areas opened for petroleum activity, and not exempted from petroleum activity in a management plan, can be included in a numbered round4. Within the framework of the management plan, a technical petroleum assessment takes place when new areas are to be included in a numbered round. The numbered rounds start with a nomination process. The authorities invite the companies to nominate blocks to be included in the licensing round. Based on the companies’ nominations and own assessments, the Norwegian Petroleum Directorate recommends which blocks should be announced. Following an assessment of which blocks should be announced, the Ministry submits a proposal for consultation to relevant parties. After the submissions have been summarised and the Government has made an overall and general decision regarding the scope of the announcement, the relevant blocks are announced with an application deadline. The applications are then processed, negotiations take place with the companies regarding license conditions, and the round is completed by awarding new licenses.

The management plans for the sea areas clarify where petroleum activity can take place in open areas and determine potential area-specific conditions for the petroleum activities. Time restrictions for exploration drilling and seismic acquisition within special areas are examples of such conditions. Where a management plan has been established, the Ministry will use the environmental and fishery conditions in the relevant management plan as a basis for new production licenses. Until a management plan is updated, no further environmental and fishery requirements will be stipulated for petroleum activity in the area.

A public consultation before announcing numbered rounds was introduced in the 20th licensing round. During the consultations in the 20th and 21st licensing rounds, no significant new information has emerged according to the Ministry that has not already been considered either in the work with the management plans or which will be addressed by the authorities’ expert agencies.

In the future, the Ministry will continue to carry out public consultations before announcing blocks in numbered licensing rounds. The management plans include an extensive technical process with expert input and involvement of interest groups in consultations and conferences, cf. Chapter 5.2.1. For the sea areas included in a management plan, only input regarding new, significant information that has emerged after the relevant management plan was approved is requested.

A number of smaller new players were applicants in the 20th and 21st licensing rounds. In this connection, a more extensive evaluation of financial strength was carried out before the license awards. The Ministry of Labour, through the Petroleum Safety Authority Norway, carries out an HSE assessment when awarding licenses. The HSE requirements are provided in the announcement and are used as a basis when awarding new production licenses.

During numbered rounds, the work commitments are characterised by being adapted to the production license’s geological challenges. At the same time, the Ministry aims for the most efficient exploration of the areas possible, and wants the work commitments to be strict with decision dates/milestones. The background for this is the desire for efficient progress in the production licenses and preventing fallow areas. From and including the 21st licensing round, the Government has decided to make the work programs public in numbered rounds as well, such as in the APA rounds. The work programs from previous numbered rounds will not be made public without consent from the licensees.

The Government will:

Carry out numbered licensing rounds, usually every other year, on the Norwegian Shelf to contribute to maintaining activity and production.

Within the framework of the management plans, use technical petroleum assessments as a basis for which areas the companies are invited to nominate blocks in.

Carry out public consultation when announcing area in numbered licensing rounds. For areas with a management plan, only input regarding new, significant information that has emerged after the relevant management plan was approved is requested.

Make the work programs public from and including the 21st licensing round to ensure openness in the petroleum activity and equal treatment during the licensing rounds.

5.4 New and different types of companies

One of the measures to increase exploration activity and value creation in petroleum activities was to increase the number and diversity of licensees and operators. In 2000, the shelf was opened so that more oil companies would have access. So far, a considerable number of new companies have entered the shelf. Many licenses have been awarded, and in recent years, many of the new companies have made significant discoveries.

The new companies that are active on the shelf mainly consist of medium-sized international companies (so-called independents), small Norwegian companies, smaller foreign companies and European gas and energy companies. This has resulted in a greater diversity of companies and types of companies than before.

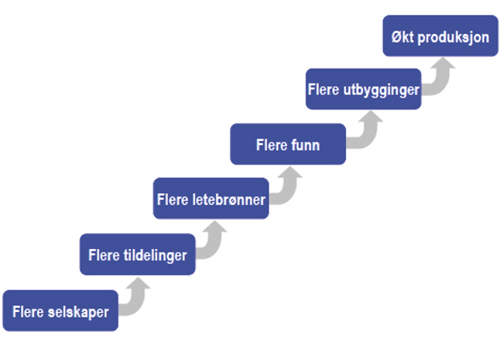

Figur 5.7 Diversity could increase production.

5.4.1 Requirements for companies and prequalification

New companies normally undergo a prequalification process, which includes the stipulation of requirements for companies that want to establish themselves on the Norwegian Continental Shelf. The requirements for a licensee are related to the activity they wish to participate in. What qualifications are necessary depend on what type of tasks will be carried out. Qualifications for owners in a transport system such as Gassled, differ from the qualifications for owners in production licenses. This Chapter addresses participation in production licenses.

The prequalification scheme5 was established to allow the companies to evaluate their suitability for participation on the Norwegian Continental Shelf before they potentially devote resources to considering concrete business opportunities. A prequalification does not entail that the company can be considered qualified to actually carry out activities, but provides an indication of the authorities’ preliminary assessment of the company. In addition, the system is used if the authorities find it necessary to carry out a new review of companies that are currently licensees with a low activity level and that wish to increase activity, or companies that have been prequalified, but have not been active on the shelf for some time.

The paramount requirement for new players is that they must contribute to value creation. This means that the company must be a genuine oil company. During the prequalification process, an assessment of the company is carried out by the Norwegian Petroleum Directorate and by the Ministry of Labour, through the Petroleum Safety Authority Norway, before the Ministry makes an overall assessment and determines whether a company is suited to be prequalified.

In order to be prequalified as a licensee, the companies do not need to have equally good expertise within all relevant disciplines, but must be able to contribute to creating value through cutting-edge expertise. The companies must have a minimum level of expertise within all relevant disciplines in order to be able to analyse, understand and follow-up the operator’s activities in the production license. The licensees must also have sufficient own capacity and expertise to safeguard applicable health, safety and environment requirements. In addition, the companies must document their ability to handle the financial obligations they undertake as licensees. This entails, for instance, that the companies must have a solid foundation of equity and that there is a reasonable ratio of equity and debt. In connection with a prequalification process it may become relevant to require the companies to submit a plan for activities with associated financial obligations and how the companies will meet these obligations during the first years of activity.

Upon receiving a request for prequalification, the Ministry will assess the company as it appears when the company requests this. In certain cases, consideration may be given to prequalifying a company based on a binding plan for improvements and build-up of the organisation. In such instances the companies must, within a given deadline, document that the required improvements are met before a final prequalification can take place. This scheme will only be relevant in instances where the company largely satisfies expertise, capacity and financial requirements, but has certain areas where the company is expected to be able to meet regulatory requirements in the near future. As a main rule, this applies when the parent company has significant expertise and resources, and can for a short period handle production licenses on the Norwegian Shelf from another country. This primarily applies to international oil companies with large, competent organisations abroad that can provide assistance. For small companies without large, competent organisations abroad, requirements for having sufficient organisation and expertise in Norway are stipulated before the company can be prequalified.

The operators have a central role on the Norwegian Shelf. An operator must therefore have sufficient resources and personnel in order to manage and carry out the relevant operations and activities in accordance with the applicable regulations. In addition, the company must be able to document an ability to safeguard financial requirements in connection with the obligations the player has in relation to its ownership interests in the relevant licenses. Operators normally have significant interests in the licenses and have a considerable responsibility for carrying out the work obligations, development and clean-up after operations cease, as well as in the event of accidents. There is therefore a significant difference between being an ordinary licensee and being an operator, as regards requirements placed on the companies.

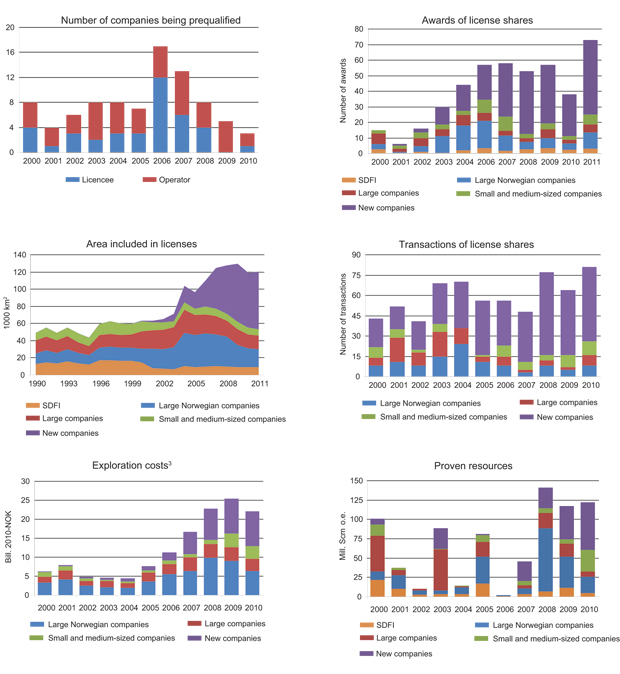

The requirements made during prequalification will be the same as are made for license awards or in connection with consent to a transfer. If a company is not prequalified, the same assessments must be made in a prequalification process before license award or consent for transfer can be granted. Several companies have been prequalified in recent years, cf. Figure 5.8. About 50 current companies have undergone the process and many of these are now also operators. The record year for introducing new players was 2006. It is positive that many companies are now active in the industry.

5.4.2 New players contribute to more exploration

New companies that have arrived after 2000 have gradually received a considerable number of awards in the licensing rounds. Particularly after 2003, the involvement of new companies has increased. From 2007, the majority of the licenses have been awarded to new companies, cf. Figure 5.8.

During the period 2000 to 2011, 241 production licenses have been awarded to new players. Sixty-seven per cent of these are operated by new companies. The new companies have been particularly active in mature areas. From and including APA 2005, the new companies have been awarded more ownership interests than the companies that were established before 2000. The picture is different in frontier areas, where the established companies have taken a significant percentage of the awards. There has also been a gradual increase in the number of awards to new companies. In the 20th licensing round, the new companies received about half of the awarded interests, and this diversity has been maintained in the 21st licensing round.

Figur 5.8 Players and exploration activity1.

1 New companies since 2000: 4Sea Energy, Aker Exploration, Bayerngas Norge, BG Norge, Bridge Energy, Centrica, Concedo, Dana, Det Norske, Discover, DONG, Edison, Endeavour, Faroe, GDF SUEZ, Genesis, Lotos, Lundin, Mærsk, Marathon, Nexen, Noreco, North Energy, PGNIG, Premier, Repsol, Rocksource, E.ON Ruhrgas, Sagex, Skagen 44, Skeie Energy, Spring, Talisman, VNG, Wintershall, Agora Oil & Gas; small and medium-sized companies: AEDC, Hess Norge, Idemitsu, OMV, Petro-Canada, RWE-DEA, Svenska Petroleum; large, international companies: BP, Chevron, ConocoPhillips, Eni, ExxonMobil, Shell and Total; large, Norwegian companies: Hydro and Statoil.

2 There were no awards in 2005.

3 SDFI is included in the group large Norwegian companies for the years 2000 and 2001.

Kilde: Norwegian Petroleum Directorate.

New players now possess about half of all areas covered by licenses, cf. Figure 5.8. The majority of the new companies are operating production licenses in the initial period. The new companies have contributed to competition for areas and have received a large percentage of the licenses in the last decade. Through the work commitments, an increased number of licenses results in increased exploration activity. New companies bring new ideas and new priorities. They thus contribute to areas being considered from different viewpoints and in different ways. They not only assess new areas, but also areas previously relinquished by other companies. Previously awarded area could thus be the object of new assessments. Prospects and discoveries that are not a main priority for the well-established companies might be of interest to other players.

New companies are active in the second-hand license market. Since 2000, new companies have been responsible for a considerable part of ownership interest purchases in active production licenses, cf. Figure 5.8. The percentage of transfers with new companies has increased from 2000 to 2010.

An important aspect of having a second-hand license market is to provide the companies with the possibility of balancing risk and having good portfolio management. It is thus easier for companies to have their desired risk profile and the opportunity to build up a portfolio of exploration activity outside the licensing rounds.

Some companies’ strategy is to only explore, which means that they must be able to sell discoveries and let other companies be responsible for development and operation. Furthermore, there are companies that do not possess the financial ability or do not have sufficient resources to develop discoveries. A second-hand market provides the possibility to sell out and leave the discovery to players that want to develop and then produce the resources. In addition, new companies will have the possibility of taking over area which established companies are not working with actively. In this way, the second-hand market can contribute to ensure exploration activity in older licenses as well.

Assessing the efforts of new companies on the shelf can be seen in light of investments made in exploration activities. The investments include geological and geophysical work such as seismic and drilling. The investment level in exploration activity was relatively regular up to 2005, and then increased considerably, cf. Figure 5.8.

From 2007, the investments in exploration from new companies increased significantly. In 2007, these companies invested nearly NOK 6 billion in exploration. In 2009, this increased to more than NOK 9 billion. In the last three years, new companies have invested a total of nearly NOK 27 billion in exploration. In 2010, the new, small companies were responsible for 40 per cent of the exploration investments. Statoil and the State through SDFI, still make considerable investments in exploration, and this has increased in recent years. The large, established companies have had a relatively steady investment rate in recent years.

373 exploration wells have been spudded during the period from 2000 through 2010. 97 of the wells were drilled by new operators, 87 of these were located in the North Sea and ten in the Norwegian Sea. During the same period, 141 discoveries were made, and 23 of these were made by new operators.

In 2010, new companies discovered about 60 million scm o.e., which was the largest discovery volume since the access regime was changed. During the period 2000 to 2010, these companies have contributed to an overall resource growth of 190 million scm o.e. In comparison, Statoil and Petoro have contributed 233 million scm o.e. and the large international companies have contributed 177 million scm o.e. Experience shows that it takes an average of eleven years from when a discovery is made until a producing field is developed. This means that many of the new companies have not yet been able to start producing their own discoveries.

When the policy was changed in 2000 to open for new companies, the authorities carried out a campaign vis-à-vis companies to inform them about the opportunities on the Norwegian Shelf. Meetings were held with companies and Norwegian authorities were in attendance at central meeting venues. In the subsequent period, many new companies have been established in Norway.

The major international companies established in Norway are a crucial part of the diversity and have played an important role on the Norwegian Shelf. They will continue to do so. They possess unique expertise and knowledge about the Norwegian Shelf, as well as substantial resources in the form of technology, personnel and capital. Recovery of oil and gas on the Norwegian Shelf still presents many challenges suitable for this type of company. There are areas with deep waters and basalt layers, areas requiring deep, costly and complicated wells, and areas in the north with challenges associated with polar night and tough climatic conditions. These areas often require expertise and experience on the part of the companies, as well as considerable resources.

Healthy competition and diversity in all parts of the value chain have been important for good resource utilisation on the Norwegian Shelf. The Government will continue to facilitate this, including actively seeking out interesting oil companies to inform them about the business opportunities on the Norwegian Shelf.

The Government will:

Facilitate the establishment of new, competent companies on the Norwegian Shelf, including actively seeking out interesting oil companies to inform them about the business opportunities on the Norwegian Shelf.

5.5 Exploration is profitable

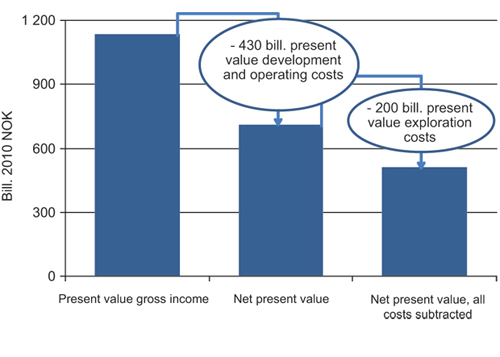

Achieving the highest possible value creation is a paramount goal for the petroleum activities. The NPD has carried out a study of value creation from exploration activity during the period 2000-2010. The study shows that considerable value creation has taken place during the period. The net present value of proven discoveries excluding exploration costs has been calculated at about NOK 700 billion, cf. Figure 5.9. This is the difference between the present value of future sales income for oil and gas and the present value of the future development and operations costs for the discoveries. The present value of sales income for all discoveries has been calculated at about NOK 1150 billion, while the present value of the development and operations costs has been calculated at just under NOK 430 billion. This emphasises that the proven discoveries during the period have considerable value.

Figur 5.9 Value creation from exploration, 2000–20101.

1 The assumptions that form the basis for the calculations are a seven per cent discount rate and the MPE’s price forecasts, in addition to Statistics Norway’s historical export prices. The NPD’s modelling tool has generated the future cash flow from the discoveries.

Kilde: Norwegian Petroleum Directorate.

The present value of all costs associated with exploration on the Norwegian Shelf in the same period is NOK 200 billion. This applies both to successful exploration and exploration that has not proven recoverable resources. If these historical costs are also included in the calculation, value creation from exploration during the period 2000 – 2010 is about NOK 500 billion. This shows that the exploration activity since 2000 has been profitable.

Exploration has been profitable in all sea areas on the shelf. The North Sea has been the most profitable with a present value of about NOK 360 billion.

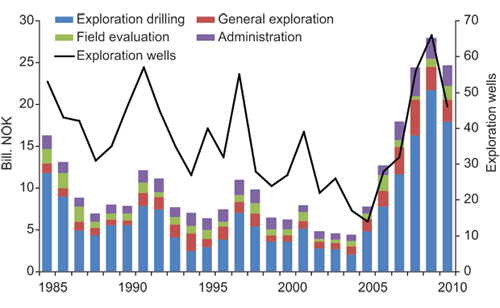

The exploration activity measured in the number of exploration wells has increased considerably in recent years. A record-high number of exploration wells were spudded on the Norwegian Shelf in 2009, with 65 exploration wells, nearly four times more exploration wells than in 2004, when the last petroleum white paper was submitted, cf. Figure 5.10.

Figur 5.10 Exploration costs and number of exploration wells, 1985–2010.

Kilde: Norwegian Petroleum Directorate.

While the exploration activity has created substantial values in recent years, costs have also increased significantly. Exploration costs on the Norwegian Shelf have increased and it is more expensive to explore now than it used to be. The total exploration costs in 2004 were about four billion fixed 2011-NOK. In 2010, the corresponding costs were NOK 25 billion. The cost per exploration well was NOK 260 million in 2004, and it was NOK 500 million in 2010. High costs reduce the values in the activity and can impact exploration activity.

It is important that both the industry and authorities focus on costs and implement measures to curb and potentially change the cost trend. It is possible to implement measures to ensure the best possible resource utilisation while also limiting costs. Even though many of the rigs on the Norwegian Shelf have been adapted to tough conditions in relatively deep waters, much of the drilling activity in Norway takes place in relatively shallow waters. This could indicate that the rig situation on the Norwegian Shelf has led to several rigs carrying out operations for which they are over-specified. This could entail unnecessarily high costs. Several companies have formed cooperative cartels to ensure better utilisation of rig capacity. This will allow players to adapt their rig use based on needs both as regards time and specifications. This topic is also addressed in Chapters 2.5 and 4.3.