9 State revenues

The resources on the Norwegian Shelf belong to the greater community and provide a significant contribution towards financing our welfare system. The petroleum activities provide higher return than a normal return. These higher revenues are the main reason why the Norwegian State takes a substantial share of the revenues from the petroleum activity on the Norwegian Shelf through taxes, fees and the SDFI scheme.

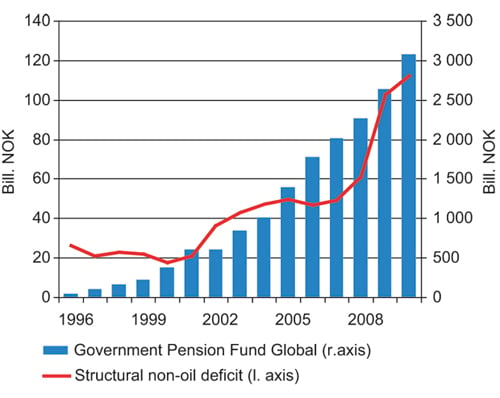

The State’s revenues from the petroleum sector constitute about 25 per cent of the State’s total income. The cash flow from the petroleum activities is transferred in its entirety to the Government Pension Fund Global, previously known as the Norwegian Government Petroleum Fund. The purpose of the Government Pension Fund is to support government savings to finance the pension expenditure of the National Insurance scheme and long-term considerations in the spending of government petroleum revenues. Over time, the central Government structural non-oil budget deficit shall correspond to the expected real return on the Government Pension Fund Global, estimated at 4 per cent. This fiscal policy guideline is not exercised mechanically, however, and considerable emphasis is placed on stabilising economic fluctuations. The guideline thus entails a gradual increase in use of the petroleum revenues up to a level that can be sustained over the longer term, cf. Figure 9.1. The Government Pension Fund Global invests in financial assets outside Norway. The guideline and the administration of the Government Pension Fund Global is explained in more detail in the annual national budgets and in the report to the Storting on the Government Pension fund.

Figur 9.1 Structural non-oil adjusted budget deficit and the market value of the Government Pension Fund – Global. The non-oil adjusted budget deficit is a target for use of petroleum revenues via the fiscal budget.

Kilde: Ministry of Finance.

The income base from the petroleum production is undergoing considerable change. Since 2001, oil production on the Norwegian Shelf has been gradually reduced, while gas production has increased. 2010 was the first year ever in which there was more gas than oil produced and sold, measured in oil equivalents this trend is expected to continue.

The realised oil prices have been higher than realised gas prices. Cash flow from the petroleum activity is affected by the combination of reduced oil production and increased gas production, and by the lower sales value for gas compared with oil. Therefore, revenues from the sector will most likely fall faster than indicated by overall production decline alone.

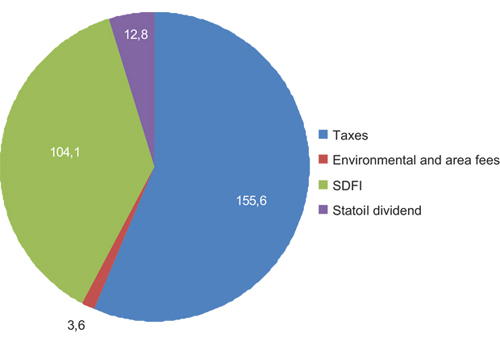

Figur 9.2 Net cash flow to the State from the petroleum activities, 2010 (billion NOK).

Kilde: Ministry of Finance.

The petroleum activities on the Norwegian Continental Shelf are taxed through ordinary tax on profits, special tax and various fees. Great emphasis is placed on ensuring that the tax system does not affect operational and investment related decisions on the Norwegian Shelf, i.e. that the tax system is as neutral as possible. Therefore, the Norwegian petroleum tax system currently consists of profit-based elements outside of the area fee and environmental taxes.

Net cash flow from the petroleum activities amounted to NOK 276 billion in 2010. Of this amount, ordinary tax on profits and special tax from the companies operating on the Norwegian Shelf amounted to about NOK 156 billion. As taxation is based on profit, there is a close correlation between oil and gas prices and tax revenues.

In addition to tax, the companies also pay environmental taxes and area fees,. Environmental taxes and area fees amounted to about NOK 3.6 billion in 2010.

In addition to taxes and fees, the State Direct Financial Interest (SDFI) ensures that a high percentage of the value creation on the Norwegian Shelf goes to the State. In 2010, the net cash flow from SDFI amounted to NOK 104.1 billion.

9.1 EITI

Extractive Industry Transparency Initiative (EITI) is an international initiative aimed at increasing transparency surrounding cash flows within the petroleum and mining industries (extractive industries). An estimated 3.5 billion people live in countries rich on natural resources such as oil, gas and minerals. Nevertheless, many of these countries are poor, and often troubled by war and conflicts. Greater openness regarding cash flows from companies in the petroleum and mining industries to the authorities can contribute to better governance, less corruption, and help to form a foundation for economic and social development in these countries. This is EITI’s purpose.

Over many years, Norway has provided political and financial support to the EITI effort. Among other things, EITI’s international secretariat is in Norway. In addition, Norway, as the only OECD country so far, has carried out the processes and measures required to be certified as an EITI country. By implementing EITI in Norway, the goal is to influence countries where there is a considerable need for openness and better governance.

In accordance with the EITI criteria’s, companies and authorities are required to report paid and received amounts, respectively, to an independent unit tasked with verifying whether the reported payments correspond to the received amounts. The figures are to be published. In Norway, the consultancy firm Deloitte has been responsible for this work. The results are published in a separate report, which provides information regarding each individual company’s payments of tax, CO2 tax, NOx tax and area fees to the State. Correspondingly, the report shows net payments from SDFI.

So far, Norway has produced EITI reports for 2008 and 2009. Since 2005, a total of 23 countries have produced similar reports. For the citizens of many of these countries, access to information regarding the state’s revenues is something new, and can make a big difference. In the long term, transparency and better governance can contribute to economic and social development and a better standard of living. For Norway, the reporting and balancing has confirmed figures that are already published elsewhere, including in the State accounts. The EITI effort in Norway also aims to inform about and increase understanding of the importance of the petroleum sector in the Norwegian economy.

9.2 The petroleum tax system

Petroleum taxation is based on the rules for ordinary company taxation. Due to the extraordinary profitability associated with production of petroleum resources, a special tax is added. The ordinary tax rate is 28 per cent, as for other companies, while the special tax rate is 50 per cent.

Sales revenues for crude oil are calculated on the basis of administratively stipulated prices (norm price). The norm price shall correspond to what the oil could have been sold for between independent parties in a free market. For dry and NGL, the actual sale price is used, with the exception of propane from Kårstø, for which a norm price will be stipulated starting from the second quarter of 2011.

Investments in operations equipment can be written off according to the straight line method over six years, calculated from the year of the investment. All relevant costs can be deducted, including costs associated with exploration, research and development, financing (debt interest), operations and removal. To help ensure that the normal returns are not subject to special tax, an extra deduction, uplift, is provided in the calculation basis for special tax. The uplift is stipulated at 7.5 per cent of the cost price of the operations equipment. The deduction is given for four years, from and including the year the investment is made.

Companies that are not in a tax position can carry forward both deficits and unused uplift with interest. In addition, companies that are not in a tax position have since 2005 been allowed to claim reimbursement of the tax value of exploration costs in the tax assessment for the year the costs are incurred.

The petroleum tax system is company-based, in contrast to field-by-field taxation. This means that the companies can deduct expenses from one field against revenue from another field. A company is therefore not taxed until it has attained an overall profit.

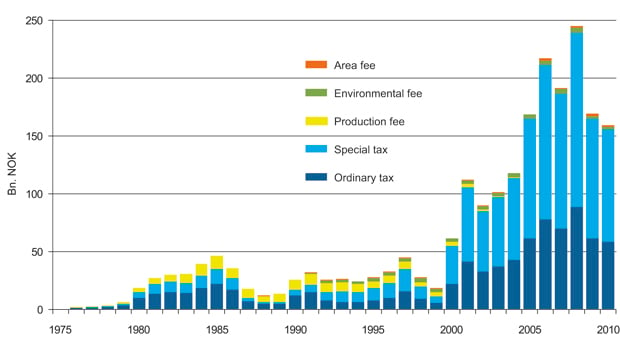

Tax revenues from the oil companies have been considerably higher over the last decade than previously, cf. Figure 9.3. The historically high oil and gas prices, together with a high production level, are the primary causes for this.

Figur 9.3 Payment of taxes and fees during the period 1976–2010.

Kilde: Ministry of Finance.

9.3 Fees

Area fees

The area fee is paid for holding a license to conduct exploration for and production of petroleum resources on the Norwegian Continental Shelf. The fee is paid per km2 of awarded area. Area fees are not paid during the license’s exploration period. At the end of this period the fee is escalated over a period of ten years. The area fee is deductible against taxable income. The area fee is intended to contribute towards efficient exploration of awarded areas.

CO2 tax

The CO2 tax was introduced in 1991 and is an environmental tax with the aim of reducing CO2 emissions from the petroleum activities. The CO2 tax in the petroleum industry is charged per standard cubic metre of gas combusted or emitted and per litre of petroleum combusted. For 2011 the rate is NOK 0.48 per litre of petroleum or standard cubic metre of gas. As of 2008, CO2 emissions from the petroleum activities are also included in the quota system.

NOX tax

Pursuant to the Gothenburg protocol of 1999, Norway is obligated to reduce its annual emissions of nitrogen oxide (NOx). As a consequence of this, a NOx-tax was introduced on 1. January 2007. For 2011 the rate is NOK 16.43 per kilogram of NOx.

In 2007, an agreement was reached between a number of industry organisations regarding a temporary tax exemption for NOx. In return, the companies covered by the agreement would allocate means to a fund set up to finance emission-reducing measures for NOx. The parties have agreed to continue the NOx agreement for 2011.

9.4 Dividend from Statoil ASA

The State owns 67 per cent of the shares in Statoil ASA. Statoil annually pays a cash dividend to its shareholders and the State’s dividend is included in the revenue from the petroleum activities to the Government Pension Fund - Global.

In total, including buyback of shares, the State has received NOK 111.18 billion since the stock exchange listing in 2001. This includes dividend from the accounting years 2001–2010, which is disbursed and entered in the State accounts the following year.

In 2010, the company revised its dividend policy. The new dividend policy is as follows:

«It is Statoil's ambition to grow the annual cash dividend, measured in NOK per share, in line with long-term underlying earnings. When deciding the annual dividend level, the board will take into consideration expected cash flow, capital expenditure plans, financing requirements and appropriate financial flexibility. In addition to cash dividend, Statoil may buy back shares as part of its total distribution of capital to the shareholders.»

On 19 May 2011, Statoil ASA’s general meeting approved a dividend of NOK 6.25 per share for the accounting year 2010. This means that the State received a dividend of NOK 13.4 billion in 2010 for its shareholding in the company.

9.5 The State’s Direct Financial Interest

The SDFI was established with effect from 19851. The scheme entails that the State, just as other players on the Norwegian Shelf, pays a share of all investments and costs in projects corresponding to the direct financial interest. The State receives a corresponding share of the revenues from sale of the production and other revenues. Every year, the Storting approves the budget framework for SDFI. The net revenues are transferred directly to the Government Pension Fund - Global.

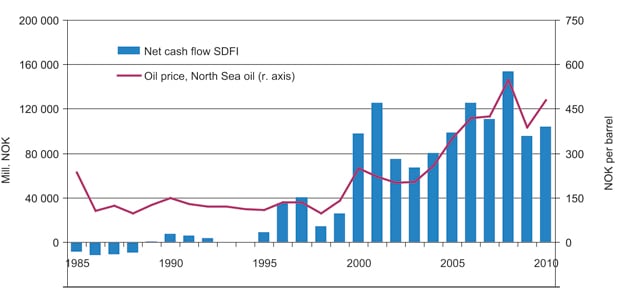

The first years were characterised by large investments and a negative net cash flow. From 1989, the net cash flow has been positive. Up to the end of 2010, SDFI has contributed a total of NOK 1 237 billion to the Treasury.

The net revenues from SDFI have increased over time as a result of more fields starting production, cf. Figure 9.4. The annual net revenues are highly correlated with product prices and investment activity.

Figur 9.4 Net cash flow from SDFI and oil price (Nominal NOK).

Kilde: Ministry of Finance, BP, Platts, Central Bank of Norway.

A large and complex portfolio

The paramount long-term goal for the management of the SDFI portfolio is to maximise the State’s revenues from the direct ownership on the Norwegian Shelf. It is important for the Ministry that the portfolio is managed and developed in the best possible manner.

The portfolio is composed of production licenses in the exploration phase, fields under development and fields in production. Furthermore, the State is a major owner of pipelines and onshore facilities. The State’s ownership interest in Gassled is about 46 per cent. At the end of 2010, the portfolio’s oil, condensate, NGL and gas reserves were estimated at 6.5 billion barrels of oil equivalents. This is presumed to constitute about one third of the remaining petroleum reserves on the shelf.

The value of SDFI was calculated to be NOK 865 billion2 as at the beginning of 2010, which was an increase of approx. NOK 150 billion since 2008. The increase is mainly due to higher future price assumptions for oil and gas.

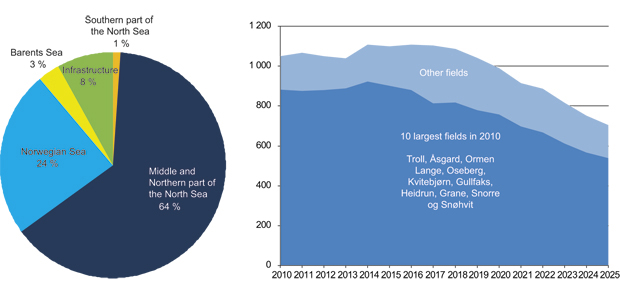

At the beginning of the year, the State had ownership interests in 146 production licenses, as well as in 13 joint ventures for pipelines and onshore facilities. The portfolio consists of 38 producing fields, many fields under development and several production licenses in the exploration phase. The portfolio’s value is centred on the North Sea, but there are also considerable values in the Norwegian Sea, cf. Figure 9.5.

Figur 9.5 Distribution of the different geographical area’s contributions to the SDFI portfolio’s estimated value. Estimates of the SDFI production distributed by field in thousands of barrels of oil equivalents per day.

Kilde: Wood Mackenzie and Petoro AS.

In the North Sea there are SDFI interests on large fields such as Troll, Kvitebjørn, Visund, Ekofisk, Gjøa, Oseberg, Gullfaks, Snorre and Grane. In the Norwegian Sea the State has interests in the producing fields Åsgard, Ormen Lange, Heidrun, Draugen, Norne and Kristin. In the Barents Sea the State has an ownership interest in Snøhvit.

In 2010, production from the portfolio was 1,08 million barrels of o.e. per day, or about 27 per cent of the total production from the Norwegian Shelf. Liquids production accounted for 44 per cent of the total SDFI production.

There is currently a high level of activity on the Norwegian Shelf, and large investments are expected in the coming years. SDFI investments totalling about NOK 25 billion are expected in 2011. The largest investments will be for drilling on Troll, Åsgard subsea compression, further development of Ormen Lange, as well as drilling and rig upgrades on Oseberg and Gullfaks. Furthermore, it is expected that investment decisions will be made on some 20 developments with an SDFI ownership over the next two years. The new, smaller fields are complex with regards to development, and are expected to be less profitable than previous, large developments.

Future portfolio developments

The Norwegian Shelf is changing, and thus, also the SDFI portfolio. The future of the SDFI portfolio depends on factors such as the development of the mature oil fields, gas marketing and new discoveries. Continued operation of the large fields is important for profitable development of many new, small discoveries.

The State has kept large ownership interests in currently profitable fields with substantial production. The majority, about 85 per cent, of the production in 2010 came from the ten fields Troll, Åsgard, Ormen Lange, Oseberg, Kvitebjørn, Gullfaks, Heidrun, Grane, Snorre and Snøhvit. It is estimated that these fields will still account for 75 per cent of production in fifteen years’ time, cf. Figure 9.5.

Due to the fact that the portfolio is dominated by large ownership interests in the mature fields, the effect of expected production decline on the Norwegian Shelf will be greater for the SDFI portfolio than for the shelf in general. Many of the fields will be in their tail phase in 2025. Falling production on these fields will have a considerable effect on the total production.

Over the last decade, oil production from the portfolio has been halved, and it will continue to decline. The gas production is, however, expected to increase, so the total production will remain at the current level for the next ten years. Gas production in the SDFI portfolio is dominated by the Troll, Ormen Lange and Åsgard fields. These fields currently account for about 70 per cent of the gas production from the SDFI portfolio. In the longer term, gas production is also expected to decline. Petoro expects that the total production towards 2025 from fields currently in operation and fields under development will decline by 22 per cent for gas and 87 per cent for oil, compared to current production.

In spite of declining oil production, SDFI production will still constitute a considerable share of the total production from the Norwegian Shelf in the future. The large mature fields are expected to have long lifetimes, new fields are planned for development with direct State ownership and the State will continue to keep participation interests when awarding new production licenses. In 2025, SDFI production is still expected to be high; around 0.8 million barrels of oil equivalents per day.

Petoro AS

Since its establishment in 2001, Petoro AS has managed the SDFI on the State’s behalf. Petoro is responsible for managing the business interests related to the State’s direct financial participation in the petroleum activity on the Norwegian Shelf. The objective is to ensure the best possible management of the resources and the highest possible value creation. Petoro is different from other companies in the petroleum industry. The company is a licensee, but does not have ownership interests on the Norwegian Shelf. Further, the company does not act as operator.

On the basis of the framework and the guidelines for Petoro’s activities that follow from Chapter 11 of the Petroleum Act, the company’s articles of association and relevant Storting documents, the Ministry has defined the following primary tasks for the company:

Management of the State’s direct participating interests in all partnerships in which the State is involved at any given time.

Monitoring of Statoil’s marketing and sales of the petroleum produced from the State’s direct participating interests, in line with the instruction given to Statoil by the Ministry of Petroleum and Energy.

Financial management, including keeping accounts, for the State’s direct participating interests.

As part of the State’s joint ownership strategy, Statoil ASA is marketing and selling the State’s petroleum together with its own. The objective of the instruction given to Statoil is to achieve the greatest possible value creation and fair distribution between Statoil and the State. The revenue generated by selling SDFI petroleum is directly allocated from Statoil to the State.

The number of production licenses in which the State has an ownership interest has increased from about 80 in 2001 to 146 as at the end of 2010. Petoro continuously prioritises which fields and production licenses that will receive particular hands-on follow-up. Challenging issues, a high level of activity and important decisions are reasons why Petoro in 2011 will pay close attention to the Heidrun, Åsgard, Ormen Lange, Troll, Gullfaks and Snorre fields, in addition to the Gassled joint venture. For other fields and production licenses, Petoro’s efforts in 2011 will focus on selected issues and decisions. When deciding on which fields and production licenses to prioritise, emphasis is placed on the value potential for SDFI, as well as where the company sees issues and value creation opportunities that the company believes are not adequately addressed by other players, and where the company could have substantial influence.

Petoro has entered into business management agreements with various licensees for 14 of the fields in operation, as well as for 16 other partnerships. The bulk of these management agreements have been signed with Statoil. The business manager is authorised to act on behalf of Petoro in these production licenses. The company is still required to be involved in important decisions in the fields and production licenses that have been selected for follow-up. Petoro’s use of business managers has increased, which must be seen in connection with the fact that the number of production licenses in the portfolio has increased considerably since 2001.

The company’s strategy was adjusted in 2010, when a decision was made to devote more resources to further developing the mature fields, exploration and maturing of discoveries, as well as further development of the gas value chain. In 2011, Petoro has adapted the organisation to strengthen execution accordingly.

Realising the potential in and around mature fields

There are still significant remaining reserves in existing fields. As the State has considerable ownership interests in mature fields, it is important for Petoro to work actively to implement measures that can, primarily, ensure recovery of these reserves and, secondarily, increase the rate of recovery, reduce costs and extend the lifetime of aging facilities. The large, mature fields are now facing several important decisions, for example recovery strategy, new wells, rig upgrades and long-term infrastructure development, decisions which have a considerable impact on how much can be produced from the fields. The economic lifetime is challenged by the fields’ age, lower production and increasing costs. Furthermore, projects are time-critical if available process and transport capacity is to be utilised within the facility’s lifetime.

The oil production in 2010 from the six largest fields in the portfolio (Troll, Åsgard, Heidrun, Oseberg, Gullfaks and Snorre) constituted approx. 60 per cent of the total oil production from the SDFI portfolio. It is estimated that about 20 per cent of the oil reserves in these fields is yet to be produced To realise remaining reserves and additional resources, a considerable effort is required on the part of the licensees. At the end of 2010, remaining reserves in the fields are estimated at approx. 240 million scm of oil. Furthermore, work is underway in the partnerships on maturing additional resources totalling 287 million scm, where about 155 million scm is considered probable. If all the additional resources are matured and realised, this will, according to Petoro, increase the recovery rate for these fields from about 46 per cent to about 54 per cent. An increased recovery rate will result in a considerable increase in values for the State.

Petoro’s efforts to realising the potential in and around large fields are directed towards extending the lifetime of prioritised facilities through technology choices, effective drainage methods and an increased drilling rate to complete more wells per year. The company strives to achieve \comprehensive area solutions through prioritising selected facilities for field centres and timely phase-in of discoveries. Reference is also made to Chapter 4 concerning improved recovery.

Further development of the gas value chain

The relative importance of gas for the value creation potential in the portfolio is increasing.

Understanding the global market for natural gas, production and sales strategy, proving and phasing in gas discoveries, as well as increased production flexibility on the fields adapted to the business opportunities in the gas market will have a considerable impact on the opportunity to realise the value potential in the SDFI portfolio. Statoil’s and the State’s gas portfolios are different and thus develop differently. It is therefore important for Petoro to safeguard the State’s interests. Furthermore, the company plays an important part within infrastructure development as the largest participant in Gassled. Expected production development and the facilities’ technical integrity will entail important decisions associated with the process facilities in Gassled over the coming years. The scope and complexity of these decision processes will require thorough technical work by Petoro.

Seeking business opportunities in Barents Sea South and Vøring

The southern parts of the Barents Sea and Vøring stand out as the most important frontier areas in the SDFI portfolio. To ensure an optimal development of these areas, there is need for parallel exploration and maturing of resources in an area perspective. Petoro will work to ensure continued high exploration activity and the maturing of resources through prioritisation of exploration rigs.

9.5.1 SDFI interests in the licensing rounds

The production licenses on the Norwegian Shelf are normally awarded through numbered licensing rounds or through awards in predefined areas (APA), cf. Chapter 5. Based on applications received, the Ministry awards production licenses to individual companies or to a group of companies. It is normal for the State to keep ownership interests in certain production licenses. Primarily, the State will keep ownership interests in production licenses that, based on information available at the time of award, have high expected profitability, and in production licenses with a high volume upside. The State will also participate in additional awards of production licenses where the SDFI already has interests. In the most recent APA rounds, the State has, in accordance with the criteria, retained ownership interests of between 13 and 26 per cent of the production licenses. In the 20th and 21st licensing rounds, the resulting SDFI interests were 30 per cent and 29 per cent of the awarded licenses respectively. In the latest licensing rounds, the State has kept smaller ownership interests than previously due to fewer production licenses with a large expected present value and/or volume upside having been made available.

9.5.2 The Ministry’s assessment

Managing an increasing number of production licenses, as well as the further development of multiple fields in production requires considerable work on Petoro’s part. Since the establishment of Petoro in 2001, the number of production licenses in the SDFI portfolio has increased by 82 per cent; from 80 to 146 production licenses. The number of producing fields has increased by 23 per cent, from 31 to 38.

The scope and complexity of the issues, for example related to improved recovery from the mature fields, require Petoro to have the resources and the expertise needed to be able to contribute effectively with tangible input to the partnerships. Petoro’s estimates indicate that an efficient execution of measures on the mature fields will be of considerable importance for the positive development of the States value. An assessment made by The Norwegian Petroleum Directorate’s supports this.

To follow up these challenges in an efficient manner, particularly on the mature fields, the company requires adequate resources for carrying out independent analysis, establishing alternative suggestions, quality-assurance of the operators’ work and carrying out its own work associated with selected strategic issues.

The Ministry assumes that Petoro will continue to have an efficient organisation. The company’s role and mandate are unchanged. It will continue to contribute to the highest possible values from the State’s direct ownership interests on the Norwegian Shelf, through active participation in the partnerships. Within this framework, the Ministry will assess the use of resources to ensure the most efficient follow-up of the SDFI portfolio.

The Government will:

Ensure the greatest possible value-creation through efficient management of the SDFI portfolio.

Strengthen Petoro’s competence in following up of mature fields.

Reserve participation interests when awarding new production licenses.