7 Climate risk management in the public sector

The public sector plays a key role in Norway’s climate risk management. The State will in many contexts relieve the private sector of risk through, for example, pension and social security schemes, risk sharing in the tax system, state aid and guarantee schemes. This implies that the State’s exposure to, and perspective on, climate risk will differ from those of a private stakeholder. Central and local governments are responsible for societal planning through decisions on land use and the development of physical infrastructure, and are also responsible for macroeconomic management and long-term exploitation of society’s resources. The public sector manages large assets that are exposed to climate risk. The central government holds financial reserves through the Government Pension Fund, direct ownership stakes in petroleum resources and facilities, as well as direct holdings in a number of Norwegian companies. Many municipalities hold large assets related to power companies. Besides, special tax regimes for the petroleum and hydropower sectors channel a large portion of future revenues from the said natural resources into the public sector. A key question is whether physical climate risk and transition risk considerations are accorded sufficient weight in public planning, resource management and ownership follow-up.

An inadequate knowledge base and weaknesses in decision-making processes may result in insufficient attention being paid to climate risk. Climate risk is challenging to manage because there is much we do not know, at the same time as a very long-term and broad perspective is needed. Political and administrative decision-making processes may, on their part, be inherently prone to myopia, it may be difficult to apply a risk perspective suitable to resolving challenges across sectors and disciplines, and a lack of overlap between those making the decisions and those living with the implications thereof may result in insufficient weight being attached to prevention rather than repair.

Effective climate policy is of key importance to climate risk management. An effective climate policy is the sole tool for alleviating the risk of catastrophic climate changes, and is thus of altogether key importance to climate risk management issues.

Climate policy should be effective and predictable to succeed with the restructuring of society and the economy. In order to transition to a low-emission society and adapt ourselves to the effects of climate change, it will probably be necessary to use policy tools more effectively – both in Norway and globally. Late climate policy tightening will mean higher costs and more risk in the transition phase than if climate policy is boosted early, and in a cost effective and predictable manner.

Correction of market failure creates value and eases climate risk management. Lack of correct price signals, lack of information or lack of appropriate incentives on the part of decision makers are examples of market failure that may inhibit our ability to manage climate risk. Too low CO2 price may, for example, cause global overinvestment in fossil-based industries and excess consumption of fossil fuels, whilst suboptimal incentives and responsibility arrangements may result in prevention not being adequately linked to the extent of damage. An important role for policy is to identify and correct such market failure.

Resilience is often an effective defence against risk. Since one will often be faced with risk one has limited scope for managing, whilst there is at the same time high uncertainty with regard to what will be the impact of such risk, the resilience of society is of great importance when it comes to the implications of climate-related events or the implications of a transition to a low-emission society. This suggests that government authorities should attach weight to policy measures that strengthen the resilience of society, for example through increased use of scenario analyses and stress testing to challenge entrenched perceptions and prepare for a greater range of outcomes.

Scenario planning and stress testing may result in more resilient societal planning. It is challenging to capture how climate change affects the risk outlook. Plans and decisions currently adopted at various administrative levels may have implications many decades into the future, and such plans need to accommodate the requirements implied by future climate changes. The Commission is of the view that central government should establish, maintain and publish a set of scenarios for oil prices, gas prices and CO2 prices, including a scenario reflecting the ambitions under the Paris Agreement. Such an initiative can make a positive contribution to stress testing for activities that are exposed to the said prices, and may provide a basis for consistent stress testing of climate risk across the public sector. Publication of the scenarios can support private sector risk management and boost confidence in public sector risk management.

The decision-making basis for public sector investments should be strengthened. The Instructions for Official Studies require estimates of financial and administrative implications of planned investments, and the Ministry of Finance has adopted principles and requirements for the preparation of cost-benefit analyses to advance the quality and comparability of such analyses. This framework requires all significant risk factors to be taken into account, but the special characteristics of climate risk lead the Commission to recommend that additional guidance be prepared to ensure that climate risk is actually integrated properly into the decision-making basis for key public sector investment decisions, as well as in public sector financial and administrative management. The development of scenario analyses, stress testing, price trajectories and uncertainty analysis guidelines form part of this effort. Climate risk is a new discipline and our understanding is advancing rapidly. The development of a specific thematic guidance note on how climate risk should be integrated into cost-benefit analyses may include a survey of international best practice on climate risk assessments, as well as an examination of the scope for applying such practice in Norway.

Public finances are exposed to climate risk through the oil price. In order for the State to be well placed to absorb the risk associated with the extraction of petroleum sector resources upon transition to a low-emission society, public sector budget planning should provide leeway for accommodating a successful climate policy. A strict climate policy will, when taken in isolation, mean lower government revenues than a less ambitious climate policy. However, the risk to public finances posed by oil price changes is held to be manageable, when assessed in isolation and relative to other types of risk faced by the public sector. The oil price assumptions underpinning economic policy in Norway are fairly cautious when compared to forecasts from recognised research centres. Besides, a large portion of the current valuation of petroleum resources relates to revenues over the next decade. Even though an ambitious climate policy targeting the demand side will, when taken in isolation, result in lower producer prices and lower petroleum production volumes than would otherwise be the case, the value of Norway’s petroleum resources will therefore not necessarily be substantially lower than in the assumptions underpinning current fiscal policy. Moreover, the fiscal policy framework is tailored to the special challenges Norway is faced with in the management of high petroleum wealth, in both the short and the long run. The fiscal policy guidelines imply that petroleum revenues are not spent until these have materialised and been transferred to the GPFG.

The climate risk faced by the State should be rendered more visible. In order to enhance the knowledge base for assessing how the future outlook for both petroleum-related and other Norwegian industries depends on petroleum prices, technological development, climate policy and climate changes, central government should at suitable intervals, for example in the white paper on long-term perspectives on the Norwegian economy published every fourth year, present the overall climate risk exposure of Norway and the State. Central government should as part of such exercise use the mentioned set of scenarios for oil prices, gas prices and CO2 prices, including a scenario reflecting the ambitions under the Paris Agreement. Such scenarios may also be used to stress test Norway’s petroleum wealth, and the State’s stake therein, in the ongoing petroleum wealth reporting in the national budget documents. This will render the sources of climate risk more visible. Unlike classic sensitivity analysis showing isolated price trajectory changes, the scenarios may also capture the effects of interactions between changes in prices and volumes. Light may also be shed on climate risk associated with the petroleum wealth by examining Norwegian resources from the perspective of a global supply curve. It may also be useful to show various dimensions of the composition of petroleum wealth, for example how the discounted cash flows are distributed over time and what portion originate from fields that have already been developed.

The effect of climate change on overall national wealth is important to clarify implications for future national consumption opportunities. In the development of macroeconomic models for use in designing policy, it would be advantageous to focus on better integration of the overall effects of climate change on the national wealth than is available at present. Furthermore, it would be useful for projections to pay more heed to how technology development, and various scenarios in relation thereto, affect climate risk, public finances and overall national wealth.

It is also appropriate to render climate risk more visible in connection with new petroleum investments. Analyses of development projects that provide indications of the resilience of such projects to changes in assumptions are already being published. An appropriate enhancement of this framework would be to link such resilience assessments to the scenarios for stress testing of the petroleum wealth as a whole. This will provide central government with more active monitoring of developments in the value of the project portfolio on the Norwegian continental shelf and a clearer impression of the risk exposure in the portfolio. However, the decision-making system for petroleum sector investments should not be modified. The companies will still be best placed to assess relevant risk factors, and climate-related risk is one of a great many risk factors that need to be assessed in development projects. More systematic and comparable information on the resilience of new development projects when confronted with climate change may nonetheless strengthen confidence in the decision-making system, whilst at the same time adding new insight into developments in climate risk for overall petroleum wealth.

A high tax level on the continental shelf results in more exposure to climate risk, whilst also meaning high expected revenues. This is a desired and intended effect of the system: The tax system shall ensure that the extraordinarily high return in the petroleum sector accrues to society. This implies, at the same time, that society will carry the cost of a potential reduction in such return as the result of a successful climate policy.

Within the limits defined by government authorities for their activities, it is important for oil companies to have an incentive, in their ongoing exploration, development and operation, to make those decisions which will maximise the value extracted from the Norwegian continental shelf. One aspect of this is a neutrally designed petroleum tax system. It is outside the scope of the Commission’s mandate to assess modifications to the petroleum tax system, but the Commission notes that increased climate-related risk does not in itself suggest that one should deviate from the principle of neutrality. Climate risk is one of many factors that can influence petroleum product price developments, and the tax system cannot distinguish between different sources of price change.

New hydropower opportunities may reduce Norway’s overall transition risk. The flexibility of Norwegian hydropower may make it well suited for providing spare capacity in a European energy system in which sun and wind account for a large proportion of overall capacity. Regulatory frameworks facilitating investments in dispatchability and transmission capacity vis-à-vis European energy markets, as well as promotion of a well-functioning market mechanism in which the market’s demand for flexibility is reflected in power prices, will serve to reduce transition risk for the Norwegian economy.

Climate risk may give rise to new challenges for macroeconomic stabilisation policy. Accelerating climate change and expanding climate policy measures may increase the incidence of negative supply side shocks, for example in the form of increases in the cost of food, energy or transport. It is generally challenging to address such situations in stabilisation policy, but increased awareness of, and transparency in, various aspects of climate risk will make monetary policy and fiscal policy more resilient. Monetary policy authorities that clarify how they intend to manage new potential supply side shocks can provide the private sector with a better foundation for its climate risk management.

Climate risk may pose challenges to natural disaster insurance and damage prevention. Increased frequency of extreme weather may make it more difficult for non-life insurance providers to diversify risk, which may potentially make it problematic to obtain insurance on market terms for properties located in particularly vulnerable areas. When the legislative commission evaluating certain aspects of the natural disaster insurance scheme has submitted its report, it would be appropriate to follow up on this by also assessing whether other aspects of the natural disaster insurance scheme are optimally structured, for example whether the principle of uniform premium level irrespective of the risk of natural disaster should be re-examined to provide stronger incentives to invest in damage-prevention measures. Another measure that may strengthen damage prevention is increased information sharing between non-life insurance providers and government authorities. If the industry itself does not agree on a uniform standard for the reporting of damage, government authorities should seek to find data sharing solutions that promote competition between insurance providers, whilst at the same time enabling central and local government to use such data in an appropriate manner.

The important role of municipal administrations in ensuring a climate-ready society should be strengthened. The local nature of climate change puts municipal administrations at the «frontline» of climate change response. Climate change affects many of the responsibilities of municipal administrations, such as where to build, what type of infrastructure should be developed, as well as how to safeguard the life and health of inhabitants. The responsibility of municipal administrations for ensuring a sufficient basis for decision making before plans are adopted thus necessitates suitable impact assessments, as well as risk and vulnerability analyses. Addressing climate change and climate risk is a cross-sectoral effort, encompassing municipalities, counties, cities and directorates. The Norwegian Directorate for Civil Protection (DSB) shall ensure integrated and coordinated natural disaster preparedness. The Norwegian Water Resources and Energy Directorate (NVE) shall assist in relation to flooding and landslips, and provides assistance with land use planning, mapping, safety measures, warning/monitoring systems and contingency planning. Every fourth year, the Government shall prepare a set of national expectations for regional and local planning. Government authorities should in that context assess whether the quality of municipal land use planning, as well as risk and vulnerability analyses, is adequate, and also whether warning systems are sufficiently rapid and effective.

A climate risk information portal may facilitate climate risk management. It can be difficult to manage climate risk if the information on what climate risk one is confronted with is fragmented or not readily accessible. The public sector can strengthen the climate risk management capacity of both the private and the public sector by making relevant climate risk information readily accessible through a web-based knowledge hub, encompassing both general and detailed climate risk information, specified by geographical areas and individual industries.

Climate risk disclosure for the Norwegian economy should be further enhanced. There is currently an extensive system for calculation and reporting of greenhouse gas emissions accounts and follow-up of international climate commitments under the UN Framework Convention on Climate Change and the Kyoto Protocol. Besides, the Government is required to report annually to the Storting on the status of national climate targets under the Climate Act. It is important to devote more attention to the risk perspective, and the Commission proposes a more comprehensive and systematic reporting on climate risk.

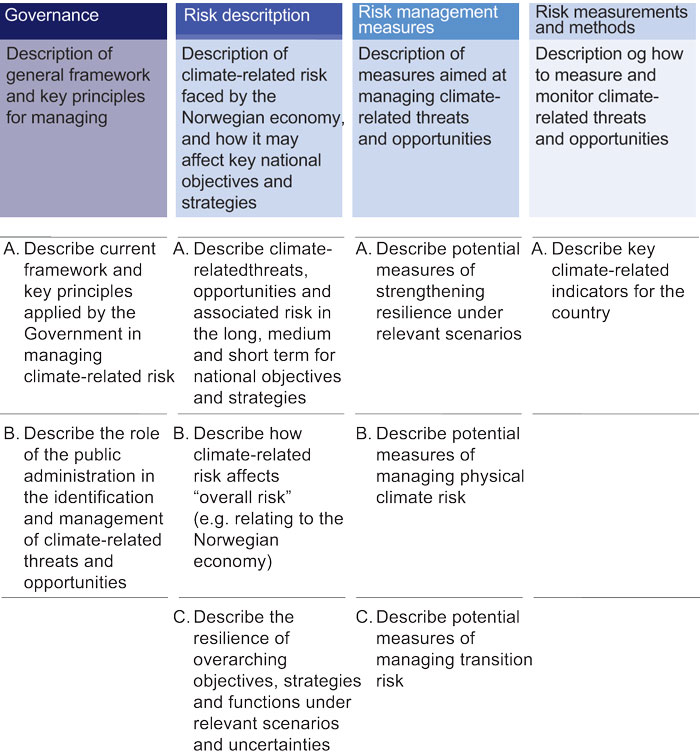

The TCFD framework may also be of relevance in this regard. The TCFD framework appears to be in the process of becoming an internationally recognised reporting standard for companies, and it is appropriate to assess whether that framework can also be adapted and applied to public-sector entities and to the Norwegian economy. This may facilitate more comparable reporting across sectors and countries. We are in Figure 7.1 outlining a potential systematic climate risk disclosure framework for the Norwegian economy, inspired by the TCFD framework. It is proposed to report on a regular basis on how climate-related risk is identified and managed. Such reporting will serve to enhance the knowledge base established through the present report over time, as well as transparency concerning the principles and processes underpinning climate risk management. This can contribute to an improved decision making basis for the sound management of such risk, in both the private and the public sector.

Figure 7.1 Suggested framework for national reporting on climate change.

The framework proposes reporting on climate risk management framework and principles, description of various climate risk factors, measures to manage climate risk, as well as how the risk is measured.

Source Climate Risk Commission.

This report lays a foundation which others will have to add to. Climate risk thinking is in an early phase. In view of the time at the disposal of the Commission for completing its report, we have focused on creating a shared understanding of climate risk at a general level and on facilitating knowledge sharing and knowledge building. We emphasise the need for more information, improved reporting and a stronger knowledge base, and we have focused on conveying general and universal insights, principles and recommendations. This means, at the same time, that there is a need for others to take this further, both by evolving the appreciation of climate risk in general and by assessing climate risk in various sectors. Prioritising research on climate risk is one aspect of this. It is our hope that this report can establish a sound basis for more systematic thinking on climate risk in both the private and the public sector.

Textbox 7.1 Recommendations for public sector climate risk management

Avert catastrophic climate change:

a) Government authorities should promote an ambitious and effective global climate policy to avert catastrophic climate change

More information, improved reporting and an expanded knowledge base:

b) Climate risk knowledge and skill should be developed, with a focus on scenario thinking and stress testing. Government authorities should keep abreast of developments in international climate risk thinking, including assessments of geopolitical risk in relation to climate change and transition to a low-emission society

c) The TCFD principles on disclosure and reporting should be endorsed. The Commission proposes a TCFD-inspired framework for climate risk disclosure in the public sector and at the national level

d) Central government should establish and maintain a designated set of scenarios for oil prices, gas prices and CO2 prices. Central government should conduct stress testing of public finances in relation to climate risk and ensure that fiscal policy is resilient with regard to climate-related shocks and disruptions. Central government should conduct stress testing of Norway’s national wealth in relation to climate risk, and should focus on better integration of the overall effects of climate risk on national wealth in the development of macroeconomic analyses and models

e) Central government should advance the development of a web-based knowledge hub to improve access to climate risk information

Correct market failure and create appropriate incentives:

f) Central government should correct market failure in order to improve the scope of markets for managing climate risk, as well as facilitate a versatile economy with well-functioning labour market. Central government should conduct an effective and predictable climate policy

g) Central government should facilitate new hydropower opportunities, which may reduce Norway’s overall transition risk

h) Central government should consider a comprehensive review of the natural disaster insurance scheme to highlight the link between prevention and the extent of damage

i) Stimulate businesses to integrate long-term climate risk in the strategic planning

Sound decision making processes with an integrated perspective:

j) Weight should be attached to general climate risk management principles

k) Central government should prepare a specific thematic guidance note on climate risk to strengthen the public sector decision making system

l) Government authorities should stimulate high quality central and local government planning which accommodates climate risk

Appendix: Mandate and proceedings of the Commission

The proceedings of the Commission have been conducted pursuant to a Royal Decree of 6 October 2017, whereby the Solberg Government appointed an Expert Commission to assess climate-related risk factors and their significance for the Norwegian economy. The mandate of the Commission is worded as follows:

«The world’s annual greenhouse gas emissions have doubled since 1970, and the stock of such gases in the atmosphere has increased. Norway has ratified the International Climate Change Convention agreed at COP 21 in Paris, whose purpose is to keep the average temperature increase well below 2°C compared with pre-industrial levels, and to strive to limit the temperature increase to 1.5°C. To support the long-term temperature target, the Paris Agreement set a collective emissions target with the aim of reversing the increase in global greenhouse gas emissions as soon as possible in order to achieve balance between man-made emissions and the absorption of greenhouse gases in forests and seas during the second half of this century (climate neutrality).

Both climate change and measures to counter it affect conditions for and risks associated with economic activity:

Higher average temperatures, changes in rainfall patterns, less alkaline seas and higher sea levels may have consequences for water supply, agriculture and settlement, and for production and consumption opportunities in a broader sense. More extreme weather may also alter physical impact patterns.

Measures to counter climate change also have consequences. Technological development, carbon pricing and regulation may alter global market conditions for carbon-intensive goods and services. Transitioning away from fossil energy may trigger a fall in the value of capital and fossil fuel reserves, which in turn may disrupt the activities of enterprises and financial institutions. Revenue and asset valuations may also change in other areas as a result of new policies or the development of new technologies to address climate change. Major changes over a short period of time may present banking and insurance businesses with challenges, and threaten financial stability.

This recognition has led to increased demand for decision-relevant information on the exposure of financial institutions and other businesses to climate-related risk. Among other things, a task force appointed by the Financial Stability Board has made recommendations including voluntary reporting of climate-related financial risk in businesses and measures to strengthen the capacity of investors and others to assess and price climate-related risks and opportunities. G20 has taken note of the report. Increased knowledge about a country’s overall exposure to climate risk can support such voluntary assessment and reporting, and strengthen the informational foundation for aligning policy and instruments to reduce national climate-risk vulnerability and safeguard long-term value creation.

Different countries are affected differently by climate risk, reflecting variations in geography, industry structure, consumption patterns and adaptability. Developments in oil and gas prices and demand are important factors for Norway, and great emphasis has therefore been given to the uncertainty of future oil revenues in the formulation of economic policy. This is one reason why the state’s petroleum revenues are channelled directly into the Government Pension Fund Global and invested in a broadly diversified global portfolio of equities, bonds and real estate. Only the expected real return on the fund capital, estimated at 3 per cent, is spent annually through the fiscal budget. This policy increases the robustness of the fiscal budget and welfare-scheme funding in the face of potential falls in oil and gas prices.

The decline in oil prices since the summer of 2014, and the subsequent downturn in the Norwegian economy, illustrate that oil prices also affect the Norwegian economy through demand for products from the supply industry. This issue was analysed in the Government’s white paper on Long-term Perspectives on the Norwegian Economy 2017. An insight gained in recent years is that the adaptive capacity of individual industries has a considerable influence on the socioeconomic consequences of changing market conditions. Nevertheless, further knowledge is needed to enable evaluation of the links between the outlook for petroleum-related and other Norwegian industries and petroleum prices, technological development, climate policy and climate change.

The commission will assess climate-related risk factors and their significance for the Norwegian economy, including financial stability. The commission is asked to:

Assess how national-level climate risk can be most effectively analysed and described.

Identify key global climate-related risk factors, and consider their importance for the Norwegian economy and financial stability.

Consider a possible methodology for giving private and public entities, including financial institutions, a technical basis for analysing and managing climate risk in the best possible way.

In its work, the commission must take into account that the consequences of likely climate change and of the global community’s efforts to counteract or adapt to such change may have different timeframes. Where appropriate, the commission should take into account that the Norwegian economy also faces risks linked to factors other than climate change and changes in climate policy. The commission is asked to emphasise the distinctive characteristics of the Norwegian economy and Norway’s industry structure, but also to recognise that such characteristics change over time. It will be natural to investigate how selected other countries approach issues raised by climate-related risk factors. In its work, the commission may also seek specialist input from relevant national and international experts.

The guidelines on fiscal policy and the investment strategy for the Government Pension Fund Global have recently been assessed by other public commissions, and therefore fall outside the scope of this mandate. Further, the commission is not tasked with proposing measures to reduce greenhouse gas emissions, specific measures to facilitate adaptation to climate change, or changes to the petroleum tax system or Norwegian petroleum policy.

The commission is asked to deliver its recommendation by 14 December 2018.»

The Commission has comprised the following members:

Martin Skancke, MSc (Econ) (Chair)

Professor Terje Aven

Research Director Nalân Koç

Professor Klaus Mohn

Trude Myklebust, PhD candidate

Professor Linda Nøstbakken

Professor Ragnar Torvik

The proceedings of the Commission have been supported by a secretariat. The secretariat has been chaired by Thomas Ekeli of Folketrygdfondet, with the other members being Hege Eliassen, Herbert Kristoffersen and Andreas Marienborg of the Ministry of Finance, Hanne Birgitte Laird and Bent Arne Sæther of the Ministry of Climate and Environment, Carl Gjersem of the Ministry of Trade, Industry and Fisheries, Line Sunniva Flottorp Østhagen of the Ministry of Petroleum and Energy, as well as Katinka Holtsmark of the University of Oslo.

Nine meetings of the Commission have been held. A number of individuals have provided the Commission with valuable knowledge on key issues. The Commission has met with Borgar Aamaas, Asbjørn Aaheim, Christa Clapp and Kristin Halvorsen of Cicero, Mirella E. Wassiluk of DNB, Inger Hanssen-Bauer and Cecilie Mauritzen of the Norwegian Meteorological Institute, Patrick du Plessis of NBIM, Stein Lier-Hansen and Øystein Dørum of the Confederation of Norwegian Enterprise (NHO), Anders Bjartnes of the Norwegian Climate Foundation, Per Sanderud of the Norwegian Water Resources and Energy Directorate (NVE), Lars Eirik Nicolaisen and Jo Huseby of Rystad Energy, Jon Vatnaland and Henrik Nissen Sætness of Statkraft, Eirik Wærness of Equinor, Bård Harstad of the University of Oslo, Rick van der Ploeg of the University of Oxford, Per Krusell of the University of Stockholm, Carlo Aall of the Western Norway Research Institute, as well as Haakon Vennemo of Vista Analyse.

In order to solicit additional knowledge and perspectives, the Commission Chair has in addition to the above attended a number of public seminars and conferences, and held meetings with representatives of the Norwegian Directorate for Civil Protection (DSB), DNB, Energy Norway, the Ministry of Finance, the Financial Supervisory Authority of Norway, Finance Norway, the Ministry of Local Government and Modernisation, the Norwegian Association of Local and Regional Authorities, the Agricultural Cooperatives in Norway, the Norwegian Confederation of Trade Unions (LO), McKinsey, the Norwegian Oil and Gas Association, the Confederation of Norwegian Enterprise (NHO), the Norwegian Institute of International Affairs (NUPI), the Norwegian Water Resources and Energy Directorate (NVE), the Ministry of Petroleum and Energy, Oslo Economics, the Office of the Attorney General, the Ministry of Transport and Communications, Statkraft, Statnett, as well as the Ministry of Foreign Affairs.

Besides, the Commission has received written input from a number of stakeholders, which is available on the Commission’s website «nettsteder.regjeringen.no/klimarisikoutvalget».

The Commission would like to thank everyone who has contributed to our proceedings with their observations and professional assessments. Moreover, the Commission would like to thank the members of the secretariat for their effort and patience.