1 Summary

1.1 Introduction

Reliable and simple housing transactions are important for consumers. For the vast majority of people, purchasing a home will be the most important transaction and investment they will make in their lives. Each year, around one in twenty homes is sold in the market, and the average purchase price for a home in 2020 was around NOK 4 million. Residential property transactions transfer approximately NOK 500 billion between sellers and buyers on an annual basis. A large proportion of the purchases are partly financed by loans with mortgages in the home. Residential property sales can therefore have major consequences for both individual households and the economy as a whole. Most free market sales of residential and holiday properties, i.e. outside of inheritance, donation etc., are handled by an estate agent. In addition to this are sales of commercial property and property rentals.

The purpose of the Estate Agency Act is to ensure that property transactions handled via estate agents take place in a secure, orderly and efficient manner. The Act requires estate agents to provide professional and impartial assistance, ensure that the transaction is secure for both the seller and buyer, and to arrange an efficient process. For these reasons, a licence is required to operate as an estate agent. The Financial Supervisory Authority of Norway supervises estate agency activities.

Consumers must be assured that they are engaging in a secure transaction in which both parties receive correct and adequate information regarding the property’s location, features, quality, market price etc. The estate agent has a duty to obtain, verify and report all relevant information pertaining to the property. Estate agency services represent a significant cost in a residential property transaction and it is therefore important to have effective competition between estate agency undertakings. This requires consumers to have a free choice of estate agent, which in turn presupposes that the terms are not linked to the purchase of other services or that the choice of estate agent will influence the provision of another service.

It is possible to sell one’s own home without using an estate agent, however very few choose to sell on their own. Residential property sales are complicated and involve large amounts of money for the individual. By conducting the sale oneself, the seller alone is responsible for possible errors in the sales process, and cannot entrust the marketing, prospectus, bidding round, contract signing, etc. to the estate agent. In recent years, various services targeting sellers of residential properties have been launched, which enable the sellers themselves to perform one or more of the tasks that the estate agent would otherwise attend to. The offer of new services raises questions about the scope of the Estate Agency Act and consumer protection in relation to For Sale By Owner (FSBO) services.

In recent years, the Storting (Norwegian Parliament) has approved several requests for measures to strengthen consumer rights in connection with residential property transactions. As part of their political platform, the parties in the Solberg Government announced a review of the Estate Agency Act with a view to simplification and protection for consumers. Based on this, the Government appointed a committee to evaluate the Estate Agency Act and propose forward-looking regulations (the Committee on Estate Agency Services). The Committee was appointed on 11 October 2019. The Committee members were from academia, the estate agency sector, technology groups, consumer organisations and supervisory authorities.

The mandate for the report was extensive. The current Estate Agency Act is from 2007, and has not previously been subject to a comprehensive evaluation or review. The purpose of the report was to provide an overall review of experiences with the current Estate Agency Act and Regulations. The evaluation was intended to serve as the basis for the Committee’s assessment of and proposals for new or amended legal regulations and possibly other measures. The mandate also permitted the opportunity to assess whether there is a need for amendments to other acts or regulations that are of significance to the function of brokers in property sales. The Committee submitted its recommendations on 4 June 2021.

1.2 Evaluation of the Estate Agency Act

An evaluation of the current Estate Agency Act and Regulations is of key importance to the mandate. The Committee has generally assessed whether prevailing law should be continued or whether there are grounds for making amendments or proposing other measures. On this basis, the entire report is an evaluation of the Estate Agency Act. A large part of the discussion was based on experiences and impressions from the authorities and the industry of a qualitative nature. However, for some issues it was possible to rely on observations of a more systematic and methodical nature, particularly when analysing consumer protection, bidding and the development of the estate agency industry. The analysis of these issues enabled the Committee to extract data which sums up important results and the development of estate agency services over time.

The present Act relating to estate agents was adopted in 2007 and entered into force on 1 January 2008. The 2007 Act introduced a requirement for a specific person having to be appointed as responsible for each assignment (responsible broker), while qualification requirements were introduced for several of the employees at an estate agency undertaking. There is a widespread view, which the Committee supports, that the stricter qualification requirements were the most important change instituted by the 2007 Act. Therefore, a key question in the evaluation is how the qualification requirements have worked, and whether it is possible to detect differences between a previous situation with lower requirements and a current situation with increased requirements for education, training and competency.

The Estate Agency Act of 1989 had no provisions regarding responsible brokers. There was a requirement to have a professional manager at the estate agency undertaking and qualification requirements for being the professional manager, but otherwise no statutory qualification requirements for performing tasks relating to estate agency assignments. However, the professional manager was responsible for ensuring that the other employees at the undertaking had the necessary qualifications and practical experience to perform the tasks they were assigned. Qualification requirements for the responsible broker, trainee estate agent and assistant to the responsible broker were introduced upon the adoption of the 2007 Act and entered into force from 1 January 2011. A transitional arrangement was also introduced, which has enabled experienced estate agents to continue to work without having to complete the entire educational and training programme under the new requirements if they sit a less comprehensive transitional exam.

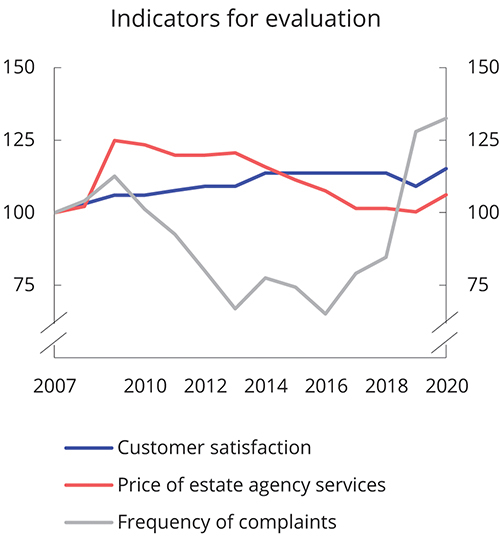

The consequences of the amendments to the Estate Agency Act must be measured in relation to the purpose of the Act «to ensure that the sale of real estate when using an intermediary takes place in a secure, orderly and efficient manner», cf. Section 1-1. The Act covers all estate agency services, however can be largely waived outside of consumer arrangements and in commercial brokerage assignments. The provisions were primarily formulated to protect the consumer, and the preparatory works to the Act clearly state that the primary purpose is to safeguard the interests of consumers in property transactions. It is therefore reasonable to evaluate the Estate Agency Act in relation to the consequences for consumers and the Committee has not undertaken a specific assessment of how the Act functions in terms of commercial brokerage. Figure 1.1 shows developments since 2007 for indicators which, in the view of the Committee, can provide some information about the consequences of the Estate Agency Act, i.e. customer satisfaction, frequency of complaints and price of estate agency services.

The terms «secure» and «orderly» refer to the purpose of the Act in terms of the execution and result of estate agency services. The intention of the Act is to ensure that the transaction is carried out in a manner that is to the satisfaction of both parties and without there being conflict regarding the assistance or conduct of the estate agent. Customer satisfaction can be an indicator of whether consumers are satisfied with the estate agency undertaking. The index in the figure is based on Norsk Kundebarometer (Norwegian Customer Barometer), and the value in 2007 is set at 100. Customer satisfaction with estate agency undertakings gradually increased until 2014, and then levelled off. The overall impression is gradually higher scores during the period when new qualification requirements were being phased in, then continual and relatively high customer satisfaction. The survey only measured seller satisfaction, and did not ask homebuyers for their opinions on the estate agency undertaking. Furthermore, the survey only included the three to four largest estate agency companies or chains each year and is therefore not representative of the entire industry. The survey will be expanded to include more companies from 2021.

Figure 1.1 Indicators for evaluating the Estate Agency Act, 2007=100

Source The Committee on Estate Agency Services (based on data from Barcode Intelligence, Complaints Board for Estate Agency Services, Financial Supervisory Authority of Norway and Statistics Norway).

Consumers who believe that the estate agent made mistakes or acted negligently, and are unable to resolve the issue with the estate agency undertaking directly, can take the matter to the Complaints Board for Estate Agency Services. The development in the number of complaints can therefore be an indicator of the level of conflict when involving estate agency services. The Complaints Board was established on 1 January 2005, and has therefore been in operation during the entire period in which the 2007 Act has been in force. Complaints about estate agents are from both buyers and sellers, however there is a clear predominance of complaints from buyers. In this sense, complaints can be interpreted as more of an indicator of how homebuyers perceive the estate agent, while customer satisfaction is more an expression of the views of the seller. The figure shows the development in the frequency of complaints, i.e. the number of complaints as a proportion of transactions (in the previous year). The frequency of complaints has been converted to an index of reductions in complaints and the level for 2007 was set at 100. A lower frequency of complaints gives a lower index figure, which means that a reduction is a positive development. There was a significant decrease in the frequency of complaints until 2013, which may indicate that the new qualification requirements had a positive effect, both before they were implemented and in the years immediately after. This observation may correlate with the fact that more people qualified to become estate agents or sat the transitional exam in anticipation that the new requirements would enter into force. However, since 2017 there has been an increase in the frequency of complaints (higher index figures), and there were significantly more complaints in 2019 and 2020 than in the preceding years. The development in recent years may indicate a certain increase in the level of conflict, albeit from a very low level. However, particular circumstances over the past two years may have contributed to more disputes being brought before the Complaints Board for Estate Agency Services. It is thus too early to draw conclusions on whether the trend may have moved in an undesirable direction.

The sale of properties through an estate agent must take place in an efficient manner. This also includes consumer protection, but a different aspect of consumer protection than the sale having to be secure and orderly. As mentioned, «secure» and «orderly» imply quality in the execution of the services,

while efficient must be understood as the estate agency services having to be cost-efficient. There are also consumer protection and societal considerations associated with keeping costs down when producing estate agency services. Possible indicators of efficiency can be the price of estate agency services (brokerage commission) or productivity. The figures show the developments in the brokerage commission per transaction. The price is measured as the average share of the sales price (commission rate), where the percentage in 2007 is set at 100. It is advantageous for both the consumer and society to have a lower price at a certain level of quality for the services, and lower index figures therefore describe a desired development. There was a large fall in residential property prices (the denominator) during the financial crisis, which contributed to an increase in the commission rate. Residential property prices have since increased, while the average price per transaction has remained relatively stable and the commission rate has therefore been gradually reduced. However, the average price as a share of the sales price increased in 2020.

The productivity of estate agency services, measured as residential property transactions per full-time equivalent (FTE), fell markedly during the financial crisis, but picked up relatively quickly in the aftermath of this. When assessed using this indicator, productivity did not fully return to pre-crisis levels, and subsequently remained relatively stable at a somewhat lower level until 2019. However, productivity gains in the form of increased quality do not appear in the indicator of transactions per FTE. Productivity gains could be expected from an increased level of education, training and competency in the industry, as well as the introduction of new technology, however this could not be seen in measurable amounts until 2020, when both productivity and the commission rate increased. Since this involved a number of special circumstances, excessive emphasis should not be placed on developments during this year in isolation. Due to the coronavirus situation, estate agents had to quickly make changes to the sales process, and this was followed by a sharp upswing in property sales. It is too early to state whether the productivity growth that emerged in 2020 may be a result of investments in expertise and new technology over several years, or whether the market conditions during this particular year had such a major effect on the indicators.

1.3 The Committee’s main proposals and recommendations

The Committee is generally of the view that the Estate Agency Act of 2007, with regulations and subsequent amendments, has functioned in a positive manner. The Committee therefore does not see the need for major amendments to the current act and emphasises the importance of key provisions being continued. However, factors such as the development of new technology, changes in the housing market and the preferences of the population will affect the basis and need for the regulation of estate agency services and how regulations should be formulated. The regulations should therefore be forward-looking and flexible enough to be adapted to changes in supply and demand for services relating to the sale of residential property.

The Storting’s request to secure the home buyers’ need for more time in the housing transaction was a key part of the Committee’s mandate. As a direct follow-up of this, the Committee proposes a legal basis in the Estate Agency Act to regulate the acceptance deadline (i.e. how long a bid must be effective), and recommends that the minimum deadline is set at 30 minutes. At the same time, the Committee emphasises that the current provisions which are intended to give the parties more time until bidding commences should be continued. This particularly entails that the estate agent can still not convey bids with an acceptance deadline shorter than 12 noon on the first working day after the final advertised viewing (prohibition on conveying bids to the seller).

The Committee was particularly requested to address whether changes should be made to the rules for bidding rounds, and possibly propose any such changes. The vast majority of residential property transactions involve the estate agent conducting the sale by inviting potential buyers to a bidding round with open, increasingly higher bids. This is a form of sale which ensures that all interested parties can participate on equal terms, because the individual bidders continually receive information about other bids and have the opportunity to adjust their own bids based on this. However, there may be cases where open and increasingly higher bids is not possible and the Committee does not see the need to legally regulate this form of sale.

However, when homes have been put on the market with an advertised viewing and the opportunity to submit a bid, it is unfortunate if there is still no open competitive bidding process. Interested parties that agree to a sale with the seller directly (bypassing the estate agent) or submit a bid on condition that the bid or terms must not be reported to other bidders (secret bid) may be able to buy the property at the expense of other potential buyers. There may not only have been others who were willing to bid higher if they had been given the chance, but this type of buyer behaviour can lead to perceptions that the sale was not correctly carried out and thus result in more people wanting to find means of avoiding competitive bidding processes. The Committee proposes a new provision in the Estate Agency Act stipulating that the estate agent cannot convey secret bids. The Committee is of the view that stronger means than those currently in place are required to prevent such bypassing of the estate agent. In the first stage, the Committee proposes that the extent to which such bypassing occurs is surveyed through the estate agency undertakings displaying this in their half-yearly reports to the Financial Supervisory Authority of Norway. A majority of the Committee members are of the opinion that amendments to the Alienation Act should be considered that can discourage direct sales that bypass an agreed estate agency assignment, however will not rule out other solutions that may reduce the prevalence of this. There are differing views regarding the time perspective for a potential assessment, and a minority of the Committee has general concerns about intervening in the freedom of contract. At the same time, the Committee would emphasise that estate agents already have a duty to discourage sellers from accepting bids directly from bidders, and that they should refer the potential «bypasser» to the estate agent. The Committee proposes that key provisions relating to bidding are transferred from the Regulations to the Act. Among other things, this would contribute to highlighting this duty.

Estate agency services include different types of services – both sales and rentals, which can apply to either residential or commercial property. The risks and need for qualifications are different for the various types of services. All types of estate agency services now require a licence. However, it is possible to derogate from certain provisions in the Act and Regulations which regulate the execution of estate agency activities in commercial brokerage, rental brokerage and foreign brokerage. Among other things, the qualification requirement for the responsible broker may be waived for commercial brokerage assignments. The Committee also proposes that differentiated licencing requirements be permitted depending on the type of estate agency activities the individual companies will engage in. A majority of the Committee is of the view that this should be arranged by introducing more types of licences, whereby less comprehensive licence requirements are imposed on undertakings that will only engage in commercial brokerage or rental brokerage, as opposed to other estate agency services.

The protection provided to consumers in residential property transactions is comprehensive, and includes well-established arrangements which the Committee believes should be continued. Since a large number of the provisions in the Estate Agency Act are motivated by the consideration of protecting the consumer, there are few rules that can be removed or relaxed without weakening consumer protection. Among other things, the Committee wants to continue the prohibition on progressive remuneration, i.e. the commission rate cannot increase in line with a higher sales price. Nevertheless, the Committee believes that there can and ought to be improvements. The amendments to the Alienation Act which are intended to provide incentives for greater use of technical status reports, and educational, training and competency requirements for those who prepare the reports should be implemented as soon as possible. The Committee also proposes measures that strengthen consumer protection under the Estate Agency Act, including that all estate agency services must take place through licenced undertakings, that the professional manager must complete an additional course, and that a suitability assessment of more occupational groups than at present is introduced. Among other things, this entails that the right of solicitors to provide estate agency services by virtue of their licence to practice law is revoked. The Committee’s proposals relating to bidding will also contribute to strengthening consumer protection.

Based on the mandate, the Committee has also been asked to consider whether the legislation should be expanded to regulate the use of new solutions and ensure equal treatment of different types of stakeholders that facilitate property sales. For Sale By Owner (FSBO) services target consumers who want to sell their homes without involving estate agents, and the Committee is of the view that it would be inappropriate to expand the regulation of estate agency services to include these types of services. This does not mean that any service that defines itself as an «FSBO service» automatically falls outside the Estate Agency Act. On the contrary, the Committee has defined different elements that should be included in a specific overall assessment of whether the service is to be deemed an estate agency service. There are differing views among the Committee as to how artificial intelligence and machine learning should be understood based on the criteria. A minority of the Committee is also of the opinion that providers of FSBO services should be regulated separately, either in the same act as estate agency services or in a separate act.

1.4 The housing market

Chapter 4 provides an overview of developments in the housing market. In order to examine the Norwegian housing market in a broader context, there are also some figures which show the situation or developments in several countries. Sales of properties and units in housing cooperatives have increased from about 180,000 in 2000 to over 250,000 in 2020. Residential and holiday properties account for all of this growth over the period.

Most households in Norway own their own home. This is partly due to housing policy that was initiated following the Second World War, income developments and tax policy. The rate of home ownership is high when compared with other countries in the northern part of Europe, while a larger sample of countries shows that there are some countries with a higher rate of home ownership than Norway.

Housing prices have risen sharply over many years and are at a high level when compared with household income. The rise in prices has been driven by factors such as housing construction not keeping pace with population growth, relatively high income growth and low interest rates. Since the introduction of the Residential Mortgage Lending Regulations in 2015 (now part of the Lending Regulations), bank lending practices have been regulated with a view to contributing to sustainable developments in the mortgage market. A sharp rise in housing prices has resulted in a high level of household debt in Norway. The high household debt ratio is also a vulnerability for the Norwegian economy.

Developments in the housing market are important for estate agency services as an industry. The brokering of residential and holiday properties accounts for around 85 per cent of sales from estate agency services. The growth in the industry has been based on the increased number of residential property sales, and not the higher prices for the homes that are sold. Major fluctuations in the housing market are unfortunate for both estate agents and the average consumer. A more stable development in residential property sales contributes to both consumer protection and the healthy development of the industry.

1.5 Economic theory

Chapter 5 provides a brief description of the economic theory that may be relevant for analysing estate agency services. The following chapter on residential property transactions and bidding describes how the theory is applied.

Studies of estate agency services have not had a strong position in economic research and modelling in either Norway or other countries. This may be due to several factors, including that it has been common practice in economic analyses to view supply and demand as determined by sellers and buyers who find each other without a third party, and that many countries lack adequate data for being able to conduct quantitative analyses of residential property transactions. Residential properties are very different and vary according to a number of different characteristics, and there are also major differences in terms of consumer preferences. For these reasons, housing markets deviate in many ways from the conditions for perfect competition.

Of particular relevance to studies of estate agency services is economic theory and analyses of how transaction costs affect housing markets. The significance of the transaction is that there is a relatively small part of the housing stock available for sale at any given time, and that consumers have incomplete information when moving home or establishing themselves in the housing market. Economic models which include search costs show that aspects of the sales process can affect the market price of residential properties. Another result is that households conduct fewer searches themselves than what is optimal for society.

Market failure can justify intervention by the authorities in the form of regulation or economic policy instruments. Common causes of market failure are the absence of markets for certain goods (typically the environment and health), market players who can exploit market power, and information bias between market players. Information bias in particular can provide grounds for regulation through the Estate Agency Act. In a market with products of varying quality that buyers are not (fully) familiar with, which is typical for second-hand homes, the socioeconomic problem of information bias is that quality products can be pushed out of the market. One solution for sellers is to attach terms to the transaction that send signals to the buyer that the product is of high quality. The Estate Agency Act can be understood as a form of ex ante signalling by the estate agent. By using an estate agent, the seller commits to all relevant information about the property being revealed in return for a high quality residential property being sold at a good price.

In auction theory, which is an established and extensive field of economics, it is possible to find many results that are directly relevant to residential property sales and rules for bidding rounds. It is normal to sell second-hand homes through a bidding round with open, increasingly higher bids. This form of sale is similar to an English auction, however there are some differences, including secret bids being permitted, and the seller not being obligated to accept the highest bid. In an English auction, bidders continually receive information about all other bids. When there are no higher bids, one winner is left to purchase the item being sold at the auction. Risk aversion will not influence the result of an English auction, while in a closed auction, the hammer price will be higher than with bidders who are risk-neutral. In an English auction, bidders receive information about the valuations made by other parties during the bidding round, which enables winning bids to be made based on better information than in a closed bidding round. This suggests that English auctions are preferable if bidders are influenced by other bids, which can particularly be the case in an overheated market where more people purchase a home with the intention of resale.

Many features associated with the regulation and practice of estate agency services in Norway can be understood by and find support in economic theory. An open auction with increasingly higher bids, which is the process by which most residential property sales are conducted, has solid support in economic theory as being an effective method for executing

transactions when there is imperfect competition. However, there may be reason to further examine the deviations from an English auction in terms of how residential property sales are currently carried out, for example, that the bidding round may be cancelled due to the buyer agreeing to a sale directly with the seller (bypassing the estate agent), or, if the bidding round is held, the participants are not guaranteed of receiving complete and updated information about other bids.

The housing market and technology used for transactions have changed considerably over the past few decades. In order to understand the changes and what these entail for the regulation of estate agency services, it is necessary to conduct an analysis based on, among other things, economic theory. It is also important to understand how the regulations can influence transactions, which in turn can have an impact on the housing market and financial stability. While there are many similarities, regulation in Norway differs from other countries in important areas. The Committee is of the view that there is a major need to analyse the regulation of estate agency services and transactions within housing economics and regulatory economics.

1.6 Housing transactions and bidding

The topic of Chapter 6 is the part of the sales process that links the seller and buyer of a residential property. The chapter is largely based on an analysis of Norwegian bidding data, which was carried out by Samfunnsøkonomisk analyse (Socio-Economic Analysis). Information on residential property sales in other countries which is based on, among other things, an analysis by Oslo Economics, has also been included. Both analyses have been included as digital attachments to the report.

The system of rules currently gives considerable leeway in terms of how estate agents arrange the sale process and bidding. Despite most residential property sales that are handled through estate agents now taking place through open and increasingly higher bids, the Committee is of the view that there is no need to legislate this form of sale. The estate agent should still be free to agree to the form of sale with the seller. One exception, where the Act directly intervenes in its implementation, is the so-called prohibition on conveying bids to the seller, which states that the estate agent cannot convey bids with an acceptance deadline shorter than 12 noon on the first working day after the final advertised viewing. The prohibition on conveying bids to the seller was introduced to give the parties more time until the bidding round starts, however there is still a widespread perception that the parties are not given sufficient time during the actual bidding round. While the analysis of bidding data does not provide a clear result as to whether or not bidders require more time, the Committee has considered it probable that a specific acceptance deadline may contribute to providing more time during the bidding rounds and more uniform practices between estate agents. On this basis, the Committee proposes that a legal basis be introduced in the Estate Agency Act to regulate the acceptance deadline set by bidders, and recommends that the minimum deadline is set at 30 minutes.

For some residential property sales that are advertised through estate agents, interested buyers may try to circumvent an open bidding round by either reaching an agreement on the purchase with the seller directly or submitting bids on the condition that these are not to be conveyed to other bidders. If the seller accepts a bid that bypasses the estate agent, this means that no bidding round will be held, which could have revealed the actual market value of the property. Secret bids will not prevent the bidding rounds from being carried out, however there will be one or more bids submitted on condition that the bid is not disclosed to other bidders.

Bypassing the estate agent can have a socio-economic cost both in the form of other interested parties not being able to participate in the bidding process, and that they incur unnecessary search costs by travelling to a cancelled viewing, preparing a possible purchase, etc. However, bypassing the estate agent is not exclusively negative. If the buyer who bypasses the estate agent is the party with the highest valuation, others who would have not won the bidding round regardless will have saved on search costs. There may also be an element of insurance for both parties involved in dropping the bidding round. The Committee has no basis for estimating the number of residential properties sold by bypassing the estate agent that are sold to the «correct» buyer, in the sense that the buyer making the direct offer had the highest valuation. Bypassing the estate agent early in the process means that at least some interested parties save on search costs for a property which they would not have won the bidding round for anyway. This may indicate that it is primarily bypassing the estate agent at a late stage of the sales process that should be limited or avoided.

The costs of bypassing the estate agent depend on how widespread this phenomenon is. The analysis of bidding data indicates an average of around five per cent of residential property sales nationwide and over several years. Bypassing the estate agent may be more widespread in local markets and over shorter periods. This was the case in Oslo from July 2020 to January 2021. If bypassing the estate agent was to become more common, there could be a widespread perception among potential buyers that attractive properties will not be available for sale after the first advertised viewing. If this is the case, many may be tempted to bypass the estate agent because they believe other potential buyers will also do the same thing. This is an outcome that would undermine open and increasingly higher bids as a form of sale. The Committee is therefore of the view that it is desirable to use stronger policy instruments than those used at present to prevent direct sales that bypass the estate agent.

An outright prohibition in the Estate Agency Act against the seller entering into an agreement that bypasses the estate agent would not be feasible. The seller will always have the opportunity to withdraw from the agreement in exchange for remuneration to the estate agent. The Committee has assessed whether there may potentially be provisions which focus on the estate agency assignment, but will still entail that the threshold for bypassing the estate agent will be higher for the buyer or seller. However, none of the alternatives considered by the Committee appear to be feasible or will be able to have any noticeable effect.

Bypassing of estate agents is not something that is systematically registered by estate agency undertakings and no statistics are collected showing the number of transactions this applies to. It is therefore uncertain as to the extent of residential property sales that are advertised by estate agents, but are nevertheless agreed to directly between the seller and buyer. The Committee is of the view that statistics for direct agreements that bypass the estate agent are required, and proposes that estate agency undertakings start displaying these types of transactions in their half-yearly reports to the Financial Supervisory Authority of Norway.

Secret bids or conditions in residential property auctions entail that other interested parties do not receive information about whether they have to bid higher in order to remain in the bidding round. The possibility and use of secret bids may result in a growing perception among homebuyers that estate agents do not disclose the leading bid and that it is therefore necessary to bid well-above the price estimate or above other bids that they are aware of. If enough people submit secret bids based on the expectation that others will do the same thing, or possibly submit a higher bid out of concern that there has been a secret bid, the system of open, increasingly higher bids may gradually be undermined. Irrespective of this, a secret bid reduces the information that is available to other bidders, which means that the highest valuation does not necessarily win the bidding round.

The Estate Agency Act does not explicitly prohibit the use of secret bids or conditions. The Committee therefore proposes a new provision in the Estate Agency Act that the estate agent cannot convey bids to the seller that have been made on condition that the bid is kept secret from other bidders and interested parties.

1.7 Estate agency services as an industry

Chapter 7 describes estate agency services as an industry. Estate agency services are important for society. This is principally because they enable properties to be sold in a secure and efficient manner. With approximately 6,000 people employed and an annual turnover of more than NOK 11 billion in 2020, the industry itself is also important for the economy. Over the past fifteen years, estate agency services have experienced growth that, when measured in terms of turnover and employment, has been above average for all industries. Most of the growth can be attributed to increased residential property sales.

Estate agency services and residential property sales are regulated by a number of special rules in addition to the general rules for companies, consumer purchases, etc. Apart from the opportunity solicitors have to undertake estate agency assignments, the regulations ensure that the estate agency services are not subject to competition from other industries or professions. However, the system of rules does not prevent people from putting their own home on the market and effectuating the transaction themselves. For sales of properties that are advertised in the market, the estate agency undertakings have a market share of about 98 per cent for residential homes and over 85 per cent for holiday homes. However, estate agency undertakings have lost much of the market for the sale of commercial properties. Rental brokerage represents a small proportion of total sales in the industry, with the earnings from commercial rentals significantly higher than residential rentals.

The average price for residential property transactions was about the same in 2019 as it was ten years earlier, i.e., between NOK 55,000 and NOK 60,000, excluding VAT, when calculated in 2020 Norwegian krone. The fact that the average price of these assignments did not follow the rise in residential property prices up to 2019 may be an indication of effective competition. However, remuneration per transaction increased significantly in 2020. This was a special year which included the coronavirus situation and strong growth in residential property sales, and it is thus too early to draw conclusions based on the price increase for that year. The Committee is of the opinion that there appears to be a reasonable degree of effective competition in the market for estate agency assignments.

Almost all of the major estate agency undertakings have links to banks through ownership or franchise agreements. There is a great deal to indicate that the bank connections have made a positive contribution to working conditions, the use of new technology and professionalization in the industry. The bank connections also do not appear to have weakened competition in the market for estate agency services. However, there can be negative aspects associated with cooperation between banks and estate agency undertakings. In order to have a free choice of estate agent, customers need to know in advance whether they are selecting the same bank connection as the estate agency undertaking or another bank. The Committee therefore proposes that a new provision is introduced which stipulates that cooperation or other links with enterprises that could be liable to influence the advice provided by the estate agent must appear in the sales prospectus.

The estate agency undertakings and solicitors that provide estate agency services, process and hold client funds to a considerable extent. The holding of client funds that exceeds the current minimum security requirement of NOK 45 million represents a risk of loss for buyers of real estate. In the view of the Committee, it is difficult to estimate the actual risk of loss if the security does not fully cover the client funds. Despite no such incidents having yet occurred, there appear to be vulnerabilities in the system which mean that the possibility of this occurring cannot be discounted. The majority of the Committee is of the opinion that the security should be relative to the amount in client funds held by the undertaking and the risk associated with holding these funds. The majority therefore proposes that differentiated requirements be stipulated in regulations that are in accordance with the undertaking’s sales and risk, however assumes that there is no need for a guarantee that fully covers the largest holdings of client funds at all times. However, a minority of the Committee is of the view that estate agency undertakings that receive client funds from handling sales of residential and holiday properties must provide full security for these funds. Alternatively, settlement must be assigned to another estate agency undertaking, or carried out directly through the banking connections used by the parties.

1.8 Technological change

Chapter 8 describes technological change in estate agency undertakings. As a basis for the description and assessments, the Committee prepared a questionnaire on the use of digital technology, which was answered by 14 companies or chains that provide estate agency services. This includes the largest companies or chains, and thus covers a large part of the estate agency industry. The survey was conducted in May 2020.

A majority of the companies or chains consider new solutions from suppliers and technology groups, and adopt the use of the solutions that create added value without significant changes to the sales concept (followers). Some companies test new sales concepts and develop their own solutions to a significant extent and adapt the software (innovative). A few companies appear reticent about the use of new technology and generally adhere to the current business model (traditional). However, the respondents were not representative of the entire estate agency industry, because the questionnaire was primarily sent to companies or chains that were assumed to be at the forefront when concerning the use of digital technology. The responses indicate that bank-owned companies have a greater degree of self-developed technology, while there were no systematic differences according to business model or geographical coverage.

The results indicate that the Estate Agency Act has not been an obstacle to comprehensive digitalisation in the industry. For the assignments in which digitalisation has fallen relatively short, such as controls of financing and settlement, it is the interaction between systems in different companies that has delayed developments. In other areas, the companies generally offer services to customers on digital platforms, however their use is limited by the fact that some customers are not familiar with or do not want to use this technology in a property transaction.

Digital technology is vital for new business concepts in which the customer performs tasks that are part of a traditional estate agency assignment. This type of business concept is often referred to as hybrid brokerage. There may be different concepts for interaction and dividing tasks between the estate agency and customer. The model for hybrid brokerage that we have seen in Norway, and which also exists in other countries, is that contact with the customer takes place on a digital platform, the assignment has a fixed price, and the sellers themselves are responsible for the viewing. The estate agency undertaking otherwise carries out the sales assignment in the traditional manner.

The responses to the questionnaire show that phases of the estate agency assignment other than the viewing can be automated or at least simplified considerably in the future. Among other things, there is at least one company that is specifically considering offering bidding via a bidding application. When using an application, the highest bid within a deadline or after the acceptance deadline for the previous bid has expired will automatically win. This type of bidding application would ensure transparency and prevent secret bids. Completely assigning the bidding round to the software will also require some form of pre-approval of financing prior to the bidding round, which is something several companies mentioned in their responses to the questionnaire.

Digitalisation can have a variety of effects, including not only that tasks are transferred to the customer, but also cost reductions and improvements in quality for services within the undertaking. Information will be more accessible and interaction easier, and many customers will therefore be able to perform tasks that have traditionally been carried out by the estate agent. However, if the task is first automated, then the primary costs for the company will relate to IT equipment and engineers, and less to the working hours of the estate agent. When developing new estate agency concepts, it may be most expedient in terms of costs that the customer takes over work-intensive tasks rather than the tasks that can be automated.

1.9 Selling a home oneself

Chapter 9 addresses residential property sales that are partly or fully carried out without the use of an estate agent. A number of services have emerged in recent years which enable consumers to carry out more or all of the residential property transaction themselves, however they still receive professional assistance in different forms or phases of the sales process. There are currently four primary alternatives:

Fixed-price sales take place by a property company (i-buyer) making a cash offer and arranging the transfer of the property for the seller within a few days.

Hybrid brokerage is a sales assignment in which the estate agent hands over several of the tasks to the seller within the framework of the Estate Agency Act.

Coming soon listing services are advertising platforms where potential sellers can present their property and gain an indication of buyer interest.

For Sale By Owner (FSBO) services provide access to digital aids and the collection of information, which guide the seller through the sales process until settlement.

Despite the business models being very different, they also have some similarities. The services are largely online and facilitate customer contact through digital portals. Another similarity is that the customer is offered a fixed price either for individual elements, the entire service or for the property.

Consumers may view services that are both within and outside of the Estate Agency Act as being largely the same. The principal difference is that it is possible under the Estate Agency Act to offer advice and tailored solutions that are adapted to each assignment and include the professional expertise and experience of an estate agent.

Consumers who use an FSBO service to sell their homes will have to take greater risks than when using an estate agent. However, if the alternative is that the sellers do everything themselves, an FSBO service may contribute to strengthening consumer protection by assisting the seller in obtaining and disseminating information about the property. Despite the system automatically collecting a great deal of information about the property, the seller alone must decide what information is to be presented and highlighted in the advertisement and sales prospectus. The Committee would emphasise that the automatic collection of information is a benefit. However, it is not automatically the case that relevant information about the property is being communicated to the buyer or that the information is being disseminated in a correct and balanced manner through an FSBO service.

The Committee sees two primary alternatives for regulating FSBO services: The first alternative is to better clarify the delimitation of estate agency services through the preparatory works to the Estate Agency Act and the Financial Supervisory Authority of Norway’s practice. Estate agency services will still be regulated in the Estate Agency Act, while FSBO services will be classified under general consumer law. The second alternative is to expand the scope of the Estate Agency Act to include FSBO services, or possibly introduce a separate act relating to the provision of FSBO services for residential property transactions. The Committee has outlined criteria for delimitating FSBO services. A majority of the Committee is confident that, both through practice and possibly further specifications, the Financial Supervisory Authority of Norway will be able to manage this delimitation, and is of the view that it would not be advantageous to expand the Estate Agency Act to include services that are not considered estate agency services. However, a minority of the Committee wants FSBO services to be covered by the same act as estate agency services, or possibly regulated in a separate act, and has outlined how rules for providers of FSBO services can be formulated.

1.10 Consumer protection in housing transactions

Consumer protection in various contexts is a topic that is addressed in almost all of the chapters in the report. Chapter 10 provides an overall description of consumer protection, including a discussion of the importance of consumer protection, various measures for reducing the risk associated with a transaction, consumer protection in the Estate Agency Act and indicators of consumer protection. A large part of the regulation in the Estate Agency Act is motivated by the desire to protect consumers. The requirements for licences and government supervision, the qualification requirements, the real estate agent’s duty to investigate and disclose information, requirements for bidding and the principle of «reciprocity» in the settlement are particularly important consumer protection rules in the current regulation of estate agency activities.

There may be different approaches to consumer protection, including liability for defects, cooling-off period, insurance, information and professional third parties. Residential property transactions between consumers are covered by several of these approaches: Liability for defects and disclosure requirements for the seller are stipulated in the Alienation Act and apply to all residential property transactions between consumers. The use of insurance or estate agents come in addition to this if individual sellers wish to make use of these. However, unlike in many other countries, the cooling-off period is not part of consumer protection for residential property transactions in Norway. When an offer or acceptance is given, this is binding.

The marketing of residential properties through advertisements and the sales prospectuses are important sources of information for consumers who are considering purchasing a home. The Committee considered whether the Financial Supervisory Authority of Norway should also supervise marketing activities conducted by estate agency undertakings, however, instead recommends closer cooperation on the supervisory work between the Financial Supervisory Authority of Norway and the Consumer Authority.

Consumer protection through the Estate Agency Act is largely preventive, and involves requirements for licences and supervision for both enterprises and persons, and with regard to the content of estate agency assignments. It is not clear that also introducing some form of cooling-off period would strengthen consumer protection. The cooling-off period may give the parties more time to consider and review the agreement (which will then be considered provisional), but will, in many ways, only entail postponing the time in which a decision has to be made. Furthermore, introducing a cooling-off period would open the door to fictitious or rogue bids, which could undermine auctions as a form of sale. The uncertainty created by a cooling-off period also has the effect of introducing an additional element to an already demanding bidding round. It is the view of the Committee that it would be better to continue to build on the current Estate Agency Act and possibly strengthen applicable provisions that are focussed on consumer protection instead of incorporating completely new approaches to current law. However, there may be problems associated with the execution of bidding rounds when a narrow form of cooling-off period could still be considered, which is something the Committee has discussed in Chapter 22 regarding possible amendments to the Alienation Act.

The effects on consumer protection are of vital importance when evaluating the Estate Agency Act. Since the Act is largely aimed at protecting the consumer, consumer protection must be included as a principal factor on the benefit side when assessing the effects of the regulation. However, there is no single statistic or number that accurately or fully encapsulates consumer protection. The rules governing consumer protection in residential property transactions are not only stipulated in the Estate Agency Act, but also in other acts, of which the Alienation Act and the Marketing Control Act are particularly important. There may also have been changes in the housing market that impact on consumer protection. The Committee has adhered to two indicators of qualitative aspects of consumer protection that are updated annually, and can thus provide some information of developments over time. Customer satisfaction with, among others, estate agency undertakings, is measured through an annual survey, Norsk Kundebarometer. The development in complaints to the Complaints Board for Estate Agency Services may be an indicator of the level of conflict. Consumer protection also has a cost aspect, where an indicator can be the price of the estate agency services as a proportion of the average sales price.

1.11 Simplification

Chapter 11 first discusses simplification more generally and how estate agency services are impacted by previous simplification efforts and then provides specific proposals for simplifications. Many of the simplification measures for the business sector in general include estate agency services, particularly measures targeting small businesses. The process of establishing companies has become significantly easier. The introduction of electronic solutions in the Register of Business Enterprises and comprehensive submission and guidance via the Altinn portal have reduced both time and costs. Coordination and digital solutions have made it easier to submit reports to the authorities. Cooperation between the authorities and the industry may facilitate simplifications in relation to consumers, for example, the changes in housing advertisements on the website Finn.no from autumn 2018.

In its review of the Estate Agency Act and discussion of proposed regulatory amendments, the Committee has continuously assessed possible simplifications. Among the proposed amendments to the Estate Agency Act and Regulations, the greatest cost reduction for estate agency companies will be in removing requirements for presenting an invoice based on time used. There are also some savings from removing requirements to quote hourly rates to all customers, because most sellers want a fixed price or commission-based remuneration. The Committee also proposes that the companies are permitted to digitally store purchase contracts with the «original» in paper form. Modifying licence requirements for commercial brokering and rental brokering also entails simplifications in the sense that the enterprises have greater leeway to use different expertise and have more freedom in terms of how they organise their business activities. A majority of the Committee also proposes removing the requirement for a permit for shared professional responsibility within the same undertaking.

The vast majority of provisions in the Estate Agency Act have been laid down with the purpose of protecting the consumer. In the view of the Committee, this provides relatively limited scope for removing or downscaling provisions in Estate Agency Act. The Committee has also considered simplification measures which it does not recommend proceeding with, including restrictions on the estate agent’s duty to investigate and disclose information, the duty to provide price information to the customer, archiving obligation etc.

1.12 Anti-money laundering measures

Chapter 12 starts with a review of the specific risk factors that argue in favour of initiating measures concerning estate agency activities. This is followed by an overview of international guidelines and the overarching framework for the estate agency activities under the money laundering rules. The chapter concludes with the Committee’s assessment of anti-money laundering measures.

Estate agents have been governed by obligations in the money laundering legislation since 1 January 2004. Similarly, solicitors are governed by the Anti-Money Laundering Act when engaging in, among other things, estate agency activities. Briefly summarised, the system of rules sets the requirement for internal facilitation in the form of identifying and assessing the risks of the undertaking being used for money laundering or terrorist financing, the establishment of internal routines for managing risk and ensuring compliance with the rules, and a duty to provide employees with the necessary training. Furthermore, the estate agent must implement various customer due diligence procedures when executing the assignment, and conduct further investigations when suspicious circumstances are uncovered, and possibly report these to the Norwegian National Authority for Investigation and Prosecution of Economic and Environmental Crime (Økokrim).

Norwegian rules relating to measures for combating money laundering and terrorist financing are largely governed by international provisions. This reduces the leeway in terms of being able to potentially weaken the requirements for anti-money laundering measures that currently apply to estate agents and estate agency undertakings. At the same time, there are options for certain areas. The Committee has applied the point in the mandate regarding anti-money laundering, which generally appears to be limited to ensuring that no rules are proposed that contradict requirements in the EU’s Fourth and Fifth Money Laundering Directive.

The Committee has considered whether anti-money laundering measures should be included as an objective in the Estate Agency Act, however concluded that the objective of the Act should not be expanded to include anti-money laundering measures. The money laundering rules are cross-sectoral rules based on obligations in directives (which are subject to frequent revisions), and it would be inappropriate and unnecessary to reiterate the obligations in sectoral legislation. When obligations relating to money laundering are collated in the Anti-Money Laundering Act, this signals equal treatment of various actors and that the measures are implemented where they have the greatest effect.

The sale of real estate between the seller and the buyer directly falls outside the scope of the Estate Agency Act and thus outside of the requirements for estate agency undertakings which enable anti-money laundering measures to be implemented. The provision of FSBO services that make it easier to sell one’s own home without using an estate agent can therefore be a challenge to anti-money laundering efforts. The issue of whether services that facilitate direct sales between the seller and buyer should be covered by anti-money laundering measures may be a factor when assessing the scope of the Estate Agency Act. The introduction of a licence requirement for providers of FSBO services would enable specific obligations to also be imposed on providers of FSBO services. Based on other considerations, a majority of the Committee has concluded that a licence requirement should not be imposed on providers of FSBO services, while a minority proposes the introduction of a licence requirement, either by expanding the Estate Agency Act or in a separate act relating to FSBO services.

The banks play a key role in financial transactions, including in connection with the sale of real estate. The Committee is of the view that effectively combating money laundering and terrorist financing that take place through real estate transactions requires that information – within the framework of the Personal Data Act – is shared to a greater extent between banks and estate agents. This exchange of information should be included as part of the customer due diligence process and investigations carried out in accordance with the Anti-Money Laundering Act. The Committee has also assessed the ability of estate agents to receive confidential information from the National Population Registry, and to obtain information relating to income and wealth in connection with residential property transactions, without disclosing their identities.

1.13 Legal structure

Chapter13 addresses the structure of the legislation that influences property sales in Norway, and the internal structure of the Estate Agency Act, and also provides an overview of the relationship to building experts and the use of technical status reports. Important statutes other that the Estate Agency Act include the Alienation Act, the Residential Construction Act, the Contracts Act, the Marketing Control Act and the Land Registration Act. The Estate Agency Act only regulates the estate agent’s obligations to the seller and buyer in the transaction. The contract signing and legal relationship between seller and buyer are regulated by the Contracts Act and the Alienation Act, the Residential Construction Act or the Sale of Goods Act when transferring flats in equity cooperatives.

The Committee proposes retaining the current legal structure. Although some simplifications may be possible without weakening consumer protection, the regulation will remain relatively extensive, detailed and specialised. Therefore, in the view of the Committee, if parts of the regulation were transferred to other acts this would be liable to make the regulation less readily understood, which would be to the detriment of both consumers and actors in the estate agency industry.

Marketing through estate agency undertakings is regulated in the Marketing Control Act and subject to supervision by the Consumer Authority. The Committee proposes continuing this, however recommends closer cooperation between the Financial Supervisory Authority of Norway and the Consumer Authority.

The Committee also proposes retaining the internal structure of the Estate Agency Act, despite amendments being proposed to certain chapter titles and the relocation of certain provisions. With regard to bidding, the Committee proposes transferring key provisions from the Estate Agency Regulations to the Estate Agency Act.

The Committee has not put forward specific proposals for amendments to the Estate Agency Regulations, however has a number of recommendations that may require amendments to the Regulations. The recommendations that will require regulatory amendments are listed at the end of the chapter on legislative structure.

1.14 Purpose and scope (Chapter 1 of the Act)

Chapter 14 addresses the purpose and scope of the Act. The Committee proposes to continue the purpose provision, albeit with some linguistic amendments, including clarification of the Act’s focus on safeguarding the interests of consumers. The Committee also proposes that the factual and geographical scope of the Act be continued in its current form. This entails that all forms of estate agency activities, including sales brokerage, purchase brokerage, settlement, rental brokerage, commercial brokerage and foreign brokerage, are still covered by the Act, irrespective of whether the seller and buyer are consumers or acting as part of business activities. However, the Committee recommends that modifications are made to the licence requirements for undertakings that will only engage in commercial brokerage or rental brokerage, in addition to the continued exemption from specific provisions in the Estate Agency Act and Regulations that do not concern consumer relations and for certain forms of estate agency activities. The Committee proposes that it also could be permitted to derogate from specific provisions in purchase brokerage assignments.

The Committee proposes to not extend the regulation of estate agency services to include FSBO services. However, the Committee has sought to more clearly delimitate FSBO services by clarifying the elements of assessment that the Committee deems relevant to what are considered estate agency services in a future-oriented regulation. The Committee emphasises that there must always be a specific overall assessment, however in a manner that emphasises the elements of completeness, involvement and presentation. This includes assessing what the service encompasses, how actively the service provider is involved in facilitating a transaction, and how the service is presented to users and through marketing. A minority is of the view that digital services that provide automated advice to the seller or buyer, for example through «chatbots», entail a type of advice which suggests that the service falls under the scope of the Act. However, it is the opinion of the majority that it is not possible to set an absolute limit for when the use of artificial intelligence and machine learning entails the type of involvement that will in fact deem the FSBO service to be an estate agency service, and that, in any case, something more than the automated compilation of data is required.

1.15 Licence requirements (Chapter 2 of the Act)

Chapter 15 applies to requirements for a licence to engage in estate agency activities. The Committee proposes continuing the arrangement of a licence being required at both company and personal level. There are clear advantages in linking the right to engage in estate agency activities to the undertaking, rather than the individual estate agents, when considering the professional quality and efficiency of the estate agency services, as well as supervisory follow-up. The Committee proposes that the right of solicitors to provide estate agency services by virtue of their licence to practise law is revoked, and that solicitors who intend to engage in estate agency activities will also be required to apply to the Financial Supervisory Authority of Norway for a licence to do this in an undertaking. In order to develop the competence of estate agent activities conducted by solicitors, the Committee also proposes the introduction of requirements for specialist estate agent expertise for solicitors who will be the professional manager in an estate agency undertaking. The Committee is of the view that the specific content of the requirement for specialist estate agent expertise should be set down in the Regulations, and has therefore not put forward a specific proposal for what this should include.

The Committee also proposes that differentiated licence requirements be permitted which will depend on the type of estate agency activity the individual undertaking shall engage in. The reason for this is that the need for consumer protection, which is a primary objective of the licencing regulation, is not the same for all forms of estate agency services. This need is virtually non-existent for commercial brokerage, while it is smaller for rental brokerage than for standard estate agency services when selling residential and holiday properties. However, the licence requirements are currently the same for all estate agency undertakings. A majority of the Committee proposes the introduction of multiple types of licences in order to make it a simple process for the Financial Supervisory Authority of Norway to verify compliance with the licence requirements at all times, as well as for the public to be able to access information regarding the type of estate agency assignments each of the undertakings is permitted to enter into. Under the proposal, undertakings that will only engage in commercial brokerage or rental brokerage may apply for a special permit with adapted licence requirements that are less extensive than what are required for a licence to engage in all forms of estate agency activities. In order to provide commercial brokerage services, the Committee proposes that no requirements shall be set for security, a professional manager with specific qualifications or a connection to the Complaints Board. In order to provide rental brokerage services, the Committee proposes that more lenient requirements are set for security and the qualifications of the professional manager. The Committee also recommends that the regulatory provision that permits an exemption from the qualification requirements for the responsible broker in commercial brokerage is continued, and that an equivalent right is granted for rental brokerage services. A minority of the Committee is of the view that there is no need to introduce more types of licences, and that it is unclear whether the desired effect will be achieved. However, the minority does believe that the current legal basis for stipulating further rules and derogating from other rules in the Act for certain forms of estate agency activities is adequate for safeguarding the need for flexibility. The Committee has also considered whether to introduce a separate type of licence for settlement activities, however has concluded that this is not desirable.

For undertakings that will engage in all forms of estate agency services, the Committee proposes stricter requirements for the professional manager in the form of requiring the professional manager to have completed a course that provides training in the role and responsibility that comes with it. A majority also proposes that the requirement for an exemption from the Financial Supervisory Authority of Norway for shared professional responsibility for multiple branches in an undertaking is revoked, while it is retained for shared professional responsibility for multiple undertakings. The reason for this is that the undertaking’s information system and processing and control routines jointly apply for all underlying branches, however this is not necessarily the case for separate undertakings in a chain. A minority is of the view that the exemption requirement should also be continued for branches. The Committee also recommends that, as part of the regulatory work, a renewed assessment is conducted of the content of the police certificate of conduct that is required in connection with a suitability assessment of board members and persons in senior positions in estate agency undertakings, as well as when applying for personal permits.

1.16 Requirements relating to the operation of the undertaking (Chapter 3 of the Act)

Chapter 16 addresses requirements that are set for the operation of the undertaking. In the provision relating to the management and processing of client funds, the Committee proposes that the regulatory basis be expanded to include the securing of client funds. The purpose of this is to make it easier to later introduce requirements for undertakings that manage client funds, which can contribute to better securing these funds.

The Committee further proposes that it is specified in the provision relating to confidentiality that confidential information can still be disclosed when the party entitled to confidentiality consents to this. This currently applies indirectly through the Public Administration Act, which guides the interpretation of the duty of confidentiality pursuant to the Estate Agency Act. The Committee also proposes introducing a legal basis for estate agency undertakings to obtain confidential information from the National Population Registry for use in connection with customer due diligence procedures in accordance with the money laundering rules.

The Committee also proposes amendments to the provision relating to record keeping in order to rectify an oversight in the rules, since the regulation of the duty to keep certain records and obligation to archive appear to lack a statutory basis. The proposal entails that the provision includes a general duty to keep records and store documents in accordance with the regulations. The specific content of the requirement for keeping records and archiving is thus retained in regulations.

1.17 Qualification requirements (Chapter 4 of the Act)

Chapter 17 addresses the qualification requirements for the various roles in estate agency undertakings, including educational, training and competency requirements, as well as regulation of the use of titles and requirements for further education. The Committee proposes that the present qualification requirements for being a responsible broker are continued, however recommends that the right to waive the qualification requirements be continued for commercial brokerage, and that the same be permitted for rental brokerage. This entails personal authorisation being required in the form of an estate agent’s certificate, permit for holders of a law degree, solicitor’s license or a transitional permit, for being a responsible broker for ordinary estate agency activities. The Committee proposes no changes to the requirements for obtaining an estate agent’s certificate and permit for holders of a law degree. When concerning solicitors, unlike what has been proposed for being a professional manager, the Committee has concluded that it is not necessary to set requirements for specialist estate agency expertise in order to become a responsible broker. While neither a legal education nor the practical experience as a trainee solicitor or solicitor will necessarily provide training in estate agency services, the Committee is of the view that this can be sufficiently safeguarded through the undertakings’ risk management processes. An estate agency undertaking that employs a solicitor who has not previously worked as a responsible broker must ensure that the person in question is suited to work as a responsible broker, and possibly provide training before he or she can work independently. The Committee recommends that the Regulations still make exemptions from the qualification requirements for the responsible broker in commercial brokerage, and that an equivalent exemption is permitted for rental brokerage.

The Committee further proposes that the qualification requirements for a trainee estate agent, assistant and settlement assistant be continued, but that suitability requirements are introduced for the positions of trainee estate agent and settlement assistant. Among other things, this entails that people who will function in these roles must present a certificate of good conduct to the Financial Supervisory Authority of Norway before commencing work in the position. The reason for this is that both trainee estate agents and settlement assistants have the right to effectuate settlements and handle client funds. A minority is of the view that suitability requirements should also be introduced for the position of assistant.

The Committee proposes revoking the provision prohibiting the use of the title «state-authorized estate agent», because an explicit prohibition is no longer considered necessary. With regard to requirements for further education, the Committee proposes that these are continued. A majority of the Committee recommends that it is considered in the regulatory work as to whether assistants and settlement assistants should also be subject to requirements for further education, as permitted by the statutory provision, however perhaps not with the same number of hours that applies for the responsible broker. A minority is of the opinion that the Act should be amended such that it is not possible to derogate from the requirement for further education for assistants and settlement assistants in the Regulations, and that the requirement for further education should also apply to trainee estate agents.

1.18 Requirements for independence (Chapter 5 of the Act)

Chapter 18 applies to requirements for independence. The Committee proposes to continue the provisions that restrict the right to conduct other business activities for both the estate agency undertaking and the employees. The Committee provides some general recommendations for the specific regulation of the right of estate agency undertakings to engage in other activities. The Committee recommends continuing the right to engage in rental management and mortgage intermediation, in addition to allowing estate agency undertakings to receive remuneration for facilitating home seller insurance (formerly transfer of ownership insurance) under certain conditions, and for product placement of furniture and interiors.

The Committee proposes that the prohibition against tie-in arrangements and tie-in selling, which is currently in the provision relating to good brokerage practice, is transferred to a separate provision in the chapter in the Act relating to independence which is entitled «prohibition against tie-in arrangements». The purpose of this is to highlight the principle of free choice of agent, and the Committee considers it to be more suited to the chapter in the Act concerning independence. In addition, the Committee proposes amendments to the wording in order for it to be more clearly articulated that the provision concerns tie-in arrangements.