Part 3

The state’s ownership administered directly by the ministries

5 The present state ownership administered directly by the ministries

5.1 Overview

The state administers direct ownership in around 70 companies through ten different ministries1. The ownership varies in size, from large holdings in some of the country’s largest listed companies to wholly owned companies with purely sectoral-policy purposes, and by the sector in which the companies operate. Under company law, these enterprises are organised as limited liability companies, public limited companies, state enterprises, health enterprises and other types of special law companies. The State Ownership Report, issued annually, provides an overview of the state’s direct ownership as administered by the ministries, and includes a review of most of the companies2. Readers are also referred to the company review in chapter 9 of this report, which covers the commercial companies and the key companies with sectoral-policy objectives under direct ownership, 55 companies in all.

Table 5.1 List of the companies reviewed in the report, grouped by which ministry administers ownership

Table 5.1

Ministry of Defence | Holding |

Aerospace Industrial Maintenance Norway SF | 100 % |

Ministry of Health and Care Services | Holding |

AS Vinmonopolet | 100 % |

Central Norway RHA | 100 % |

Northern Norway RHA | 100 % |

Western Norway RHA | 100 % |

South-Eastern Norway RHA | 100 % |

Norsk Helsenett SF | 100 % |

Ministry of Local Government and Modernisation | Holding |

Kommunalbanken AS | 100 % |

Ministry of Culture | Holding |

Norsk Rikskringkasting AS | 100 % |

Norsk Tipping AS | 100 % |

Ministry of Education and Research | Holding |

Norsk samfunnsvitenskapelig datatjeneste AS | 100 % |

Simula Research Laboratory AS | 100 % |

UNINETT AS | 100 % |

Universitetssenteret på Svalbard AS | 100 % |

Ministry of Agriculture and Food | Holding |

Statskog SF | 100 % |

Veterinærmedisinsk Oppdragssenter AS | 34 % |

Ministry of Trade, Industry and Fisheries | Holding |

Aker Kværner Holding AS | 30 % |

Ambita AS | 100 % |

Andøya Space Center AS | 90 % |

Argentum Fondsinvesteringer AS | 100 % |

Bjørnøen AS | 100 % |

Cermaq ASA | 59.17 % |

DNB ASA | 34 % |

Eksportfinans ASA | 15 % |

Eksportkreditt Norge AS | 100 % |

Electronic Chart Centre AS | 100 % |

Entra Holding AS | 100 % |

Flytoget AS | 100 % |

Innovation Norway | 51 % |

Investinor AS | 100 % |

Kings Bay AS | 100 % |

Kongsberg Gruppen ASA | 50.001 % |

Mesta AS | 100 % |

Nammo AS | 50 % |

Nofima AS | 56.84 % |

Norges sjømatråd AS | 100 % |

Norsk Hydro ASA | 34.26 % |

Space Norway AS | 100 % |

SAS AB | 14.3 % |

SIVA SF | 100 % |

Statkraft SF | 100 % |

Store Norske Spitsbergen Kulkompani AS | 99.94 % |

Telenor ASA | 53.97 % |

Yara International ASA | 36.21 % |

Ministry of Petroleum and Energy | Holding |

Gassco AS | 100 % |

Gassnova SF | 100 % |

Petoro AS | 100 % |

Enova SF | 100 % |

Statnett SF | 100 % |

Statoil ASA | 67 % |

Ministry of Transport and Communications | Holding |

Avinor AS | 100 % |

Baneservice AS | 100 % |

NSB AS | 100 % |

Posten Norge AS | 100 % |

Ministry of Foreign Affairs | Holding |

Norfund | 100 % |

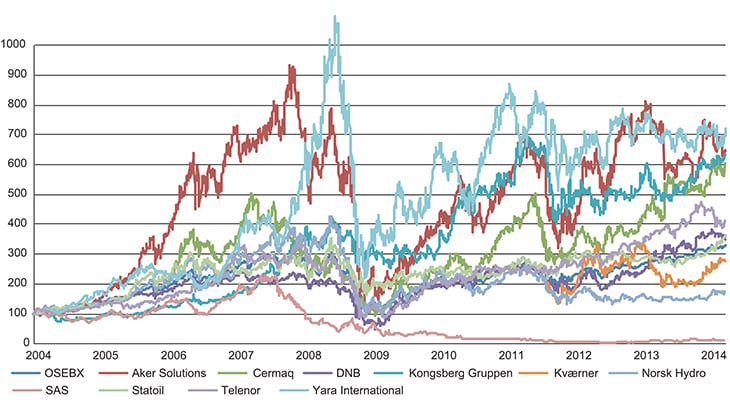

The market value on the Oslo Stock Exchange of the state’s direct ownership was in the region of NOK 552 billion at year-end 2013. Ownership of Statoil constituted more than half of this, followed, in terms of value, by Telenor, DNB, Yara International, Norsk Hydro, Kongsberg Gruppen, Cermaq and SAS. At the same time, the state’s share of the book value of equity in the unlisted companies with commercial operations as their main purpose3, was estimated to be around NOK 113 billion. This comes to a total estimated value of NOK 665 billion for the state’s direct commercial ownership at this time. It should however be noted that the book value of equity may vary considerably from the companies’ actual market values. In addition to this are the investments in the companies with sectoral-policy mandates.

5.2 Historical developments

The justifications and purposes of Norwegian state ownership have changed over time. This fact must be seen in the light of changes in the markets, changes in policy, improved knowledge and economic trends. Historically, companies have often come under state ownership as a result of assessments and decisions made at particular junctures. But a common denominator for state ownership has been the desire to safeguard the public interest. This has led to state ownership, with different time frames, in a range of different enterprises. As the motives and need for state ownership as a policy instrument have changed, a number of liquidations of state holdings have been undertaken. There has been a trend towards sectoral-policy objectives being increasingly separated from the actual exercise of ownership. However, ownership in a number of companies still retains a sectoral-policy grounding.

The post-war era saw the creation of a number of public corporations in the industrial sector. Access to foreign capital was limited, notably due to restrictions on the movement of capital between countries. A limited private capital market in Norway and political aspirations for industrial expansion were instrumental in the state’s contribution of long-term capital for industrial development. The state’s role in companies such as Årdal og Sunndal Verk (1947), Norsk Jernverk (1955) and Norsk Koksverk (1960) must be viewed in this light.

When oil and gas extraction began on the Norwegian Continental Shelf in the 1970s, the aspiration of substantial ownership of the exploitation of natural resources was the rationale for state ownership of Statoil and increased holdings in Norsk Hydro. Ownership also secured public access to large revenues in the form of resource rent.

A political desire to safeguard activities considered to be strategically important has led to state ownership in a number of cases. Security and emergency preparedness concerns lay behind state involvement in Raufoss Ammunisjonsfabrikker (later Raufoss ASA which demerged its ammunition activities in 1998 to create the Nordic ammunition group, Nammo), Kongsberg Våpenfabrikk (wound up in 1987, but the company’s defence activities were continued and are now part of Kongsberg Gruppen) and Horten Verft (insolvency in 1987).

During the banking crisis of the 1990s, the state took over the shares in a number of Norwegian banks, with the purpose of averting a more serious banking crisis with unpredictable and potentially major negative economic consequences. The banks were later privatised through flotations, but the state has retained a 34 per cent holding in DNB.

Many of the companies owned by the state were previously organised as governmental agencies or public sector enterprises. The conversion to companies or independent enterprises has most frequently occurred through extensive regulatory reforms. Examples of this are Statkraft and Statnett (1992, formerly Statkraftverkene) and Telenor (1994, formerly Televerket).

In the 2000s, ownership policy was characterised by reorganisation of ownership through centralisation of major parts of the directly commercial holdings under state administration. Additionally, a number of companies were privatised, such as Arcus (2001/2003), BaneTele (2006/2009) and Secora (2012). The state’s holdings were also reduced through stock-exchange listing of Telenor (2000), Statoil (2001) and Cermaq (2005). Furthermore, structural changes were made both in companies with commercial objectives and those with sectoral-policy mandates.

A number of sectoral-policy companies were created, through separation of activities, or mergers, or as new entities. Some of these enterprises are economic policy instruments, including Enova (created in 2001), Innovation Norway (2004) and Gassnova (2007). Other companies created in order to cater for sectoral-policy concerns are Simula Research Laboratory (2001), Universitetssenteret på Svalbard (2002), Nofima (2008) and Norsk Helsenett (2009). Petoro was founded in 2001 to manage the State’s Direct Financial Interest (SDFI) in petroleum activities on the Norwegian Continental Shelf. At the same time, Gassco was established as an operator of gas pipelines and transport-related gas processing facilities. Eksportkreditt Norge AS was established in 2012 to administer a government export credit scheme.

The regional health enterprises and their subordinate health trusts were set up from 2002 onwards. The intention was to employ the corporate form to achieve more efficient resource utilisation in the hospital sector. The hospitals had previously been linked to the county authorities, but with extensive state financing.

6 Why should the state own?

6.1 Justifications for state ownership

In the government’s view, private ownership should be the main rule in Norwegian business and industry; cf. chapter 4. Direct state ownership should have a special justification.

The state exercises ownership for a number of reasons. These will vary from company to company, from an initial premise that state ownership may help provide economic and social safeguards.

Beyond there being good reasons for state ownership, the state also possesses specific characteristics which may make it a good owner in a broader perspective. These include the fact that the Norwegian state is a long-term and financially strong owner which is able to make a positive contribution to long-term ownership in the Norwegian capital market. Along with other long-term investors, the state can contribute to stability and stimulate growth of Norwegian companies and competence building over time. The state has a keen interest in the financial development of the companies, and has short-term expectations in this regard. Equally though, the state can take a longer term view of its ownership than private stakeholders, and therefore also emphasises the sound development of the companies over time. Where there are investment opportunities with anticipated returns and acceptable risk, the state has the capacity to contribute to the necessary capital increases even in times of financial turbulence. Accordingly, the state’s long-term ownership can act as a stabilising force in the Norwegian capital market.

The following is a review of the justifications on which the government believes state ownership should be founded. The formulations of objectives for the state’s ownership in each individual company are set out in the company review in chapter 9.

Figure 6.1 Through Statnett, the state owns the majority of the central electricity transmission grid in Norway.

6.1.1 Correction of market failures

Market failures are characterised by a discrepancy between private and socio-economic profitability. Such failures can lead to poor functioning markets, lack of useful production of goods and services and financial loss to the economy. Market failures may have different causes, including entry barriers, economies of scale and scope, external impacts on the supply and demand side, deficient competition and deficient or asymmetric information. Market failures may also be due to regulatory omissions (such as a lack of property rights), defective regulation that inhibits market entry and creates adverse incentives and desired regulations (in some areas markets are not desirable or not permitted). State ownership may serve as a viable instrument for correcting market failures.

For a society, it may be the case that some goods and services should or must be produced other than through a freely competitive market. This may be true, for instance, for the production of public goods or production in areas with natural monopolies. The electricity grid is an example where there are considerable benefits of scale creating a natural monopoly. Additionally, the central electricity grid is regarded as critical national infrastructure where state control is desirable. This is achieved through state ownership. Through Statnett, the state owns the majority of the central electricity transmission grid. The central grid connects power producers and consumers in different parts of the country, safeguards central power exchange hubs in all regions and also covers international connections.

External effects arise when one participant’s decisions impact, either positively or negatively, other participants’ costs without this having been taken into account during decision-making. For example, the benefit to society of research and development may be greater than the private financial benefit. Another example is the potential for cluster effects which may affect the profitability of the (geographical) siting of a business. Profitability may be lower for both the individual enterprise and society at large if the individual participant does not take account of overall profitability, but only his own activities. These examples show that there are various forms of market failure where intervention can be used in order to seek to increase the national economic benefit. In cases of market failure, precise and targeted measures should be designed to provide better incentives, help increase the coherence of private and public profit and thereby also contribute to better functioning markets, more efficient resource utilisation and greater value creation. The state has a variety of instruments for stimulating research in business and industry and rectifying other forms of market failure. State ownership should only be used to correct external effects or other forms of market failure when other, more accurate, instruments are unavailable.

6.1.2 Maintaining important companies, head office functions and key competences in Norway

From society’s perspective, it may be desirable to keep certain types of business in Norway. For example, some businesses may be considered or expected to have (external) positive effects on the rest of the economy. State ownership may be one of several means of safeguarding and developing desirable business activity and competence in Norway, and thereby contributing to increased overall value creation for society. The development of Statoil from 1972 until today being a good example.

The knowledge capital represented by employees, owners, organisations and research institutions is important for the competitiveness of Norwegian business and industry over time. Key parts of a company’s competence, including its research and development function, have traditionally been located in connection with its head office. State ownership can be used as a means of keeping head office functions in Norway. This is ensured by owning at least one third of a company, which means that the state, in its ownership role, can oppose changes to the company’s statutes.

Strategic decisions at corporate level will always be taken by the company’s governing bodies, which are normally located at the head office. Maintaining head office functions is therefore desirable both in Norway and in many other countries. For Norwegian business and industry, it is important that many small and large enterprises are run from Norway. Norwegian head offices in important companies can help to safeguard and develop specialised industrial, technological and financial expertise and can also contribute to the development of Norwegian leadership skills. State ownership can contribute to the development of Norwegian business and industry as a whole if it helps Norwegian businesses and technology to be retained in and developed from Norway. A substantial contribution from the state in retaining, attracting and developing such knowledge environments will be through a coherent policy for making Norway an attractive country to conduct business in. This will also help generate tax revenues.

Companies are generally listed on the stock exchange of the country where their head office is located, which is also where most of the trade in the company’s shares will occur. This is one potential positive outcome of making it more attractive for companies to locate their head offices in Norway.

Another reason for state ownership may be to guarantee continued production of goods and services of importance for national security, security of supply or the protection of national sovereignty. Concern regarding strategic production has brought about state ownership involvement in a number of different enterprises. Security and emergency preparedness considerations were behind the state’s involvement in Raufoss Ammunisjonsfabrikker, Kongsberg Våpenfabrikk and Horten Verft. The state retains its ownership involvement in enterprises that emerged from these companies through Kongsberg Gruppen and Nammo, and it is considered appropriate for the primary activities of these companies to be kept in Norway. These companies are now co-owned with private shareholders.

On Svalbard, state ownership will be maintained in companies which make a specific contribution to supporting Norway’s Svalbard policy, with reference to White Paper no. 2 (2008–2009). This applies for example to Store Norske Spitsbergen Kulkompani, which is to be operated on a commercial basis and help maintain and develop the Longyearbyen community in a way which underpins the overall objectives of Norwegian Svalbard policy, and Kings Bay, which is a key player in achieving the objective of developing Svalbard and Ny-Ålesund as a platform for Norwegian and international polar research.

Figure 6.2 Since its establishment in 1972, Statoil has developed into a leading global petroleum company.

6.1.3 Management of common natural resources

There has been broad political consensus for securing for the common good a large share of the wealth creation from the exploitation of natural resources such as fisheries and aquaculture, hydroelectricity and petroleum. Over a long period, frameworks and institutions have been developed in order to achieve this.

In some areas, other public means than state ownership has not been considered suffisient to ensure control over and income from the country’s major natural resources. The necessity of state ownership for achieving these objectives is however subject to debate, since much has changed since these different resources were first exploited. It is not feasible to move location-specific natural resources abroad. Thus, regardless of ownership, the state is able to retain a degree of control over the resources and regulate their management in various ways, as well as secure a reasonable share of the return and economic rent from the resource through taxation. Direct state ownership should therefore be evaluated over time against other options, especially where the preconditions are subject to change.

State ownership has been used as an instrument for securing Norwegian control of a variety of natural resources. Statkraft SF and Statskog SF are examples of state ownership being used as an instrument to safeguard the management of natural resources in line with public demand and the common good. It may be the case, for example, that private commercial exploitation of individual natural resources has a short-term perspective that is at odds with sound national economic exploitation over time. In order for the management of such resources to be for the common good, consideration must be given to future generations. State ownership can be used as an instrument to accommodate such concerns. State ownership may also play a role in ensuring that the revenues from natural resources benefit the common good rather than individual stakeholders.

Figure 6.3 Statkraft is Norway’s largest power producer, with around one third of total national production.

6.1.4 Sectoral-policy and societal considerations

State ownership can, in some cases, be justified on sectoral-policy grounds. This is especially relevant in areas where the state particularly wishes to exercise management and control, including having the option to amend framework conditions rapidly. Private owners may be wary of establishing businesses in such areas, since the potential for changes in framework conditions (the political risk) may be considered too great. State-owned companies may be used as potential instruments in particular policy areas. Specific sectoral-policy objectives may impose requirements on the individual company concerning, for example, its sphere of activity and products, availability, quality, service and prices of goods and services. Vinmonopolet, for example, is used as an instrument in alcohol policy to restrict and control the availability of alcohol. The state also has a special responsibility for safeguarding dependable national infrastructure such as airports and power grids. This is currently achieved through ownership of Avinor and Statnett. There has been a trend towards more differentiation of the state’s different types of responsibility, e.g. responsibility for financing and for production. In some cases, responsibility can be shared, with the state taking on the financing liability, while production is put out to tender and performed through public procurement.

There are, for example, sectoral-policy concerns behind state-owned hospitals. The objective is to lay the foundation for cohesive management of the specialised health service, through, for example, legislation of an explicit governmental responsibility. State ownership also aims at facilitating better utilisation of the resources invested in the sector, thereby securing better health services for the entire population. In parts of the health, education and transport sectors, the objective has been to provide an fair basic service to all citizens, regardless of ability to pay. Through its ownership of, for example, Norsk Rikskringkasting and theatre enterprises, the state has aimed to secure cultural-policy objectives.

State ownership can also be seen in the light of a commitment to equal access and secure provision of certain services regardless of demand, place of residence, willingness and ability to pay and other status. Such justifications for state ownership must be viewed in context with the ambition of meeting sectoral-policy concerns, and a case-by-case assessment must be made of whether state ownership is the most appropriate of the instruments available. Even if the state sees it as its role to safeguard a service, and potentially secure its financing, there may still be alternatives to state ownership. These may include public procurement by tender and public-private partnerships. Technological and societal advances may however alter the preconditions, as has happened in the telecommunications sector, for example.

In the event of certain crises, state ownership might be the only suitable means of protecting the interests of the society. Such interventions will be the exceptions. Any state intervention will have to comply with the provisions concerning state aid under the EEA Agreement. In individual instances of crisis, the state has intervened on the ownership side. During the banking crisis of the early 1990s, the state became the sole owner of the three largest commercial banks, following attempts at solutions using private capital. The purpose was to avert a more serious banking crisis. Shareholdings were subsequently disposed of, two banks were sold, one part-privatised, and the state is currently left with a 34 per cent shareholding in DNB. Other countries have also had to take ownership of banks as a result of various crises. In the wake of the last financial crisis, measures have been implemented, and prepared for implementation, in many countries to enhance the solidity of the financial industry. These measures reduce the risk of finance institutions and the financial markets in general and might reduce the need for last-resort state intervention during crises.

Figure 6.4 Vinmonopolet is used as an instrument in alcohol policy to restrict and control the availability of alcohol.

6.2 Alternative instruments to state ownership

Each case should be individually assessed to determine whether ownership is the most effective instrument for the state in order to achieve the goal in question. Such assessments can be made by weighing benefits and costs against policy objectives. They should be performed regularly, as preconditions may change over time. There has been a trend that safeguarding certain objectives through ownership has been replaced by regulatory instruments such as licensing rules, legal acts and regulations. As sectoral-policy justifications for state ownership can change over time, the pursuit of policy objectives can be differentiated from the actual exercise of ownership. The importance of ownership for regulating the market through management companies is reduced and in some sectors ceased. Licensing provisions can ensure, for example, that requisite services are made available to all, even without public ownership. Incentives, new technology and increased competition in larger and more integrated markets mean that the various objectives can now be achieved more effectively through such avenues as the market, legislation, regulation and licensing terms than through state ownership of the supplier.

Other options include linking subsidies and charges to specific patterns of action, contract management and public procurement. The state can manage its companies by signing agreements in the same way as with private companies. Contract management may entail production of specific types of goods or services, or fixed prices to users, in return for payment from the state. Such agreements can be signed on a commercial basis with commercial companies, concurrently with the state’s pursuit of its sectoral-policy objectives. Tendering regulations can define requirements for tenders, seeking to achieve cost efficiency and efficient allocation of resources. An example of this is a number of air and bus routes being regularly put out to tender to ensure a broad transport service in all parts of the country. This approach provides a clearer distinction between the supplier role (for example, as a sectoral-policy instrument) and the owner role. Furthermore it enables privatisation of companies as the pursuit of the policy concerns is no longer linked to ownership.

6.3 Categorisation of the companies under direct ownership

Since 2006, the state’s portfolio of companies has been categorised into four different categories. The categorisation has been based on the state’s justification and objectives for direct state ownership; cf. chapter 6.1. The government believes that the ownership categorisation system has helped clarify the state’s objective for ownership of the individual company and that the current four categories are appropriate. As such, the government intends to maintain the current categorisation. The specific categorisation and the formulation of the state’s objectives in each company are stated in chapter 9.

The four categories are:

Companies with commercial objectives.

Companies with commercial objectives and objective of maintaining head office functions in Norway.

Companies with commercial objectives and other specifically defined objectives.

Companies with sectoral-policy objectives.

Category 1 – Companies with commercial objectives

This category includes companies where the state’s ownership objective is purely commercial. The administration of ownership of the companies in this category has the sole purpose of maximising the value of the state’s investments, notably through contributing to sound commercial development of the companies. Whether the state should remain an owner of these companies is the subject of continuous commercial assessment.

Category 2 – Companies with commercial objectives and objective of maintaining head office functions in Norway

This category includes companies where the state has a commercial objective with its ownership, and an objective of maintaining the companies’ head offices and associated head office functions in Norway. To achieve this last objective, a shareholding of more than one-third is (normally) sufficient.

Category 3 – Companies with commercial objectives and other specifically defined objectives

This category includes companies where the state has a commercial objective in its ownership, and where there are other societal justifications for state ownership than maintaining the head office in Norway.

A common feature of the companies in category 3, as of the companies in categories 1 and 2, is that they operate in competition with other businesses on a commercial basis4.

For most of the companies in category 3, the situation will be rather similar to category 2, with no need for special follow-up in the administration of ownership in order to achieve the specifically defined objectives. The objectives are achieved through the company running its business on a commercial basis within the sector in question.

Based on the state’s objective for its ownership, individual guidelines for activities may be set out for some companies. To obviate doubt that these companies are operated on a commercial basis, the sectoral-policy administration will primarily be provided through regulations, licensing rules and public procurements from the companies on commercial terms.

Category 4 – Companies with sectoral-policy objectives

The state’s ownership of the companies in category 4 has primarily sectoral-policy objectives. The objectives for these companies should be adapted to the purpose of ownership in the individual company. As an owner, the state will strive to achieve its sectoral-policy objectives as efficiently as possible.

7 What should the state own?

The government aspires to facilitate diversification and value-creation in Norwegian business and industry, and to strengthen private ownership; see chapter 4. This will help improve Norwegian competitiveness. Accordingly, over time, the government wishes to reduce the state’s direct ownership interests. This will particularly apply to companies where the state has no particular reasons for being an owner, but it may also be appropriate to reduce the state’s holdings in other companies, assuming this can be done within a framework that safeguards the objective of the ownership.

The government points to the fact that the ambition of reducing the state’s direct ownership over time is not a budgetary matter, but relates to the factors described in chapters 4.1 and 4.2. The allocation of capital freed up from any reductions in the state’s holdings must be understood on the basis of the frameworks drawn up for the administration of the state’s financial assets.

A desire to secure control of natural resources, maintain the presence of key companies in Norway and safeguard sector-policy interests suggests that the state will retain a substantial portfolio of holdings for the foreseeable future. The government will administer its holdings in a productive and professional manner, and will be open to transactions that may enhance the value of the commercially oriented companies.

The changes that the government wishes to implement over time in the state’s direct ownership are detailed below. Please also refer to the review of companies in chapter 9.

7.1 Changes to the state’s ownership

7.1.1 Reduction in the state’s direct ownership over time

The government believes that the state should not have a long-term ambition of ownership in companies where the state’s objectives are purely commercial. In the government’s opinion, over time, other owners will often be better at developing such companies. On this basis, in the budget proposal to the Storting for 2015, the government will ask the Storting for a mandate to fully or partially divest the state’s ownership of companies in category 1. For some of these companies, the government already has such mandate.

The government emphasises that, even though the state should not have a long-term ambition of owning such companies, any changes in the state’s holdings will be made only if it is considered to be financially beneficial to the state. Furthermore, there may be corporate or market-related factors entailing that the state should delay use of these powers.

The companies in category 2 are commercial companies where the objective of the state’s ownership, beyond a return on invested capital, is to retain head offices in Norway. This is achieved primarily through a holding that ensures negative control, i.e. more than one-third. The government’s premise will therefore be that it will not be appropriate to reduce the state’s holdings in these companies to below 34 per cent. To the extent that the boards or others suggest value-creating industrial solutions that may only be realised through a reduction in the state’s holding to below 34 per cent, this would be subject to a detailed assessment of the commercial benefits and potential for safeguarding the state’s ownership objective. Any matters of this nature will be brought before parliament.

There may be special factors dictating why the lower threshold for the state’s holding in individual companies in category 2 deviates from 34 per cent. This applies to, for example, Statoil ASA, Aker Kværner Holding AS and Nammo AS. The first of these relates to Statoil’s sale of the state’s oil and gas along with its own, while for the other two, the state has signed shareholder agreements with industrial partners. Another relevant factor is also whether or not the companies are listed on a stock exchange. In companies where ownership is not diversified, it may be necessary to have a larger holding to retain sufficient ownership influence.

Category 3 includes companies where the state has a commercial objective in its ownership, and where there are other justifications for state ownership than maintaining head offices in Norway. The government believes that there are sound justifications for the state to have holdings in these companies. Nonetheless, for companies in category 3, there may still be scope for adjustments to and changes in the state’s ownership based on commercial considerations, and in a way that also takes into account the state’s rationale for ownership in these companies. Any specific matters will be brought before parliament.

The state’s holdings in the sectoral-policy companies in category 4 should, as a rule, remain intact. This does not however prevent changes if the sectoral-policy interests no longer apply, or can be fulfilled in another satisfactory manner through the use of instruments other than ownership. Telenor and Statkraft are examples of large businesses that have transitioned from state enterprises to companies subject to commercial competition. A more recent example of a transition from category 4 to category 1 is Ambita (formerly Norsk Eiendomsinformasjon).

7.1.2 Value-increasing transactions

The primary objective of the administration of ownership in the commercial companies is a high return on invested capital over time.

As an owner, in principle, the government will take a positive view of strategic initiatives and transactions that may be expected to contribute to value growth in the companies and that are also implementable within a framework that safeguards the objective of the state’s ownership.

In a global economy where complexity is on the rise and where innovation and advances in technology are fast-paced, it is challenging for companies to maintain and strengthen their competitive positions over time. Successful companies need to be agile and to have a good understanding of strategic and competitive opportunities that arise as the business climate evolves. Such reorganisation may also require participation from the owners, for example, through injection of capital, mergers and acquisitions, or through the addition of new types of expertise on the owner side.

The government emphasises that, as an owner, the state should conduct itself so as to allow the companies to exploit good commercial opportunities, and will therefore actively assess any initiatives proposed by the companies, provided they are judged to be commercially beneficial and take into account the objective of the state’s ownership. On this basis, and in order to reduce the state’s direct ownership over time, the government will be open to possibly reducing the state’s holdings in two of the companies in category 2.

On this basis, in the budget proposal to the Storting for 2015, the government will ask the Storting for a mandate to possibly reduce the state’s holdings in Kongsberg Gruppen ASA and Telenor ASA, down to 34 per cent.

Any changes in the state’s holdings that may increase value to the state and improve the industrial foundations of the companies in category 2 and where there are shareholder agreements regulating the state’s ownership, i.e. Aker Kværner Holding AS and Nammo AS, must be assessed in light of these agreements. It is therefore not proposed to adopt such mandates; see chapter 7.1.1. In DNB ASA, Norsk Hydro ASA and Yara International ASA, the state’s holdings are presently very close to 34 per cent, and it is not considered appropriate to propose having a mandate to reduce the state’s ownership in these companies.

As concerns the government’s assessments relating to the companies in categories 3 and 4, readers are referred to chapter 7.1.1.

Only in very special circumstances will the government assess increasing the state’s holdings in partly owned companies. Nor does the government consider it relevant for the state to be proactive in acquiring new strategic positions in companies subject to competition. The experiences from the state’s attempts at industrial development during the second half of the last century do not indicate that the state is the best actor for furthering economic growth through direct ownership. Only in extraordinary cases will the government consider undertaking new state ownership positions. Such an undertaking would have to be carefully assessed and justified on the basis of economic profitability and broader considerations.

The government would also draw attention to the state’s other instruments and policies for facilitating diverse and value-creating business and industry in Norway.

7.1.3 Demergers and the creation of new state companies

The government is committed to state production activities being carried out efficiently, using an appropriate management and organisational structure. Against this background, the government may consider reorganisations of state enterprises and the establishment of new companies, predicated on new state ownership being established on the basis of economic profitability or certain specified objectives. For example, since the change of government, the Ministry of Transport and Communications has worked to facilitate a number of major reforms in the transport sector. For the roads, the government is working to set up a development company, with the object of undertaking more road projects and making road expansions more efficient. The reform activities also aim to reorganise Jernbaneverket (the Norwegian National Rail Administration) and NSB (Norwegian State Railways) in order to achieve an appropriate administrative structure, a commercial organisation and clear goals.

7.1.4 Factors to be emphasised in the event of changes to the state’s ownership

The government stresses that it is crucial for any changes in state ownership to be carried out in a manner that is professional, commercially justifiable and which protects the value of the state’s assets.

In deciding on changes in the state’s ownership, the government will assess both market-related and company-specific factors. The government will not make any changes to the state’s ownership or support any transactions that are not considered financially beneficial for the state in each individual case. This implies, among other things, that reduction in the state’s direct ownership will take place over time.

The powers that may be given to the government in companies in categories 1 and 2 must also be understood on the basis of the government’s ambition of being amenable to supporting value-creating transactions through adjustments to its holdings in these companies.

When assessing such transactions, the government will normally also employ external advisors.

7.2 Ministerial powers

Under Section 19 of the Constitution, it is not within ministerial powers to alter the state’s capital investments in companies with state ownership, for example through the purchase or sale of shares, participation in rights issues or funding industrial transactions through share settlements that change the state’s holdings. For such actions, the government must hold special mandate from parliament; see the Storting’s discussion of Document no. 7 (1972–1973) in Recommendation no. 277 (1976–1977).

Given the government’s ambition to reduce state ownership and contribute to value-creating transactions, the government will, as mentioned, in connection with the national budget for 2015, ask the Storting for the following mandates:

Mandate to fully or partially divest the state’s holdings in all companies in category 1.

Mandate to possibly reduce the state’s shareholding in Kongsberg Gruppen ASA and Telenor ASA down to 34 per cent.

As mentioned, any use of these powers must be commercially justified. Any use of these powers may also relate to different types of solutions, such as sales of the state’s shares to industrial or financial entities, public offerings or as part of industrial solutions.

The government has also assessed the need for other powers, based in particular on the concept that the state, in commercial companies, should have the opportunity to act in a professional manner in the same way as other good owners do.

As described in chapter 2.3.2, the accelerating pace of change in business and industry means that companies have a greater need to restructure than was previously the case. This may require participation from the owners, for example through the injection of capital, through acquisitions, mergers, divestments, etc.

The government is aware of the increased requirements for rapid and effective decision-making processes, but believes that there are no grounds for diverging from the fundamental division of responsibilities between government and parliament in matters of ownership, and will continue adhering to this policy. In the government’s opinion, this division of responsibilities has worked well and has not prevented companies in which the state has a large holding from exploiting commercial opportunities on an equal footing with other companies.

The government also believes that there are no reasons for departing from the established practice of the state being reticent to grant powers to the board of directors in cases which in law are vested with the annual general meeting.

As described in chapter 8.3.1, the government will also continue supporting the state contributing to buyback programmes (whereby the company buys its own shares on the market in order to annul them, as a supplement to dividends), on condition that the state’s shareholding in the company is not thereby altered.

8 How should the state own?

Through direct ownership exercised by the ministries, the state is patently the largest owner in Norway, and also a major owner in the international arena. Norway and the other Nordic countries are regarded as being exemplary in their exercise of state ownership. This is to a great extent attributable to the political consensus achieved on the main frameworks for the exercise of state ownership, which have been conducive to predictability for the companies and the capital markets. The constraints of these main frameworks entail that state ownership must be exercised professionally in line with corporate and other legislation; in line with generally accepted corporate governance principles; that the state’s influence as an owner must be exercised exclusively at general meetings; and that a clear distinction must be maintained between the state’s role as an owner and its other roles.

The government aims for the Norwegian state’s ownership to be an example of best practice internationally. In exercising its ownership, the state emphasises areas in which the state has positive prerequisites for adding value to its holdings:

Within the established frameworks for corporate governance, including the distribution of roles and responsibilities between the board and owner, as prescribed by corporate legislation, the state will continue to emphasise improving strategic and financial supervision of its portfolio. This will be achieved by means of analytical follow-up, by elaborating on strategic approaches to company performance, and by maintaining explicit expectations regarding company performance. For each company in isolation, there is strength to be drawn from engaging in strategic dialogue with a demanding owner within the scope and constraints outlined above.

The state is not represented on corporate governing bodies. One of the main tasks of the state as an owner is to establish competent boards that are duly capable of dealing with the strategic challenges faced by the companies they oversee. As an owner, the state must have clear understanding of the need for board expertise in each individual company, and has in recent years strengthened its efforts in relation to board member recruitment and evaluation. These efforts will be continued.

Effective corporate governance strengthens market confidence in companies and boosts value creation over time. The state will place emphasis on being a leading owner when it comes to promoting good corporate governance.

The following discusses the state’s exercise of ownership.

8.1 Framework for the state’s ownership administration

8.1.1 Constitutional framework

Article 3 of the Constitution of the Kingdom of Norway prescribes that executive power is vested in the King, which, in practice, means the government. However, the Storting (Parliament) may issue general guidelines and instruct the government in individual cases by means of plenary resolutions of the Storting or passing of bills.

State ownership of enterprises is also regulated by Article 19 of the Constitution: «The King shall ensure that the properties and regalia of the state are utilised and administered in the manner determined by the Storting and in the best interests of the general public.» It is thus the government that administers the state’s shares and ownership in state-owned enterprises, and special law companies etc. This provision vests the Storting with express legal authority to instruct the government in matters pertaining to state ownership.

Administration of state ownership is delegated to the ministry under which the company sorts, in accordance with Article 12(2) of the Constitution. The Minister’s administration of ownership is exercised under constitutional and parliamentary responsibility.

The Storting’s funding mandate entails that the consent of the Storting must be obtained in the event of changes in the state’s holdings in a company (acquisition and divestment of holdings) and resolutions regarding capital injections entailing disbursements by the state.

Companies in which the State has ownership will usually be able to purchase and divest shares in other companies and acquire or dispose of parts of business operations where this is a natural step in the realignment of the company’s object-specific operations, without the approval of the Storting being required. For companies where the state is the sole shareholder, the consent of the Storting must be obtained regarding decisions which would significantly alter the state’s commitment or the nature of the business; see p. 18, Recommendation no. 277 to the Storting (1976–1977). When the State is a joint shareholder, the question of whether the case should be prediscussed in the Storting arise for matters of such scope that they must be brought before the general meeting (company demergers or mergers, for example). Depending on the State’s holding in the company, it may be necessary to bring such matters before the Storting; see p. 19 Recommendation to the Storting no. 277 (1976–1977), but the main rule is that matters concerning acquisition and divestment of shares, including acquisition and divestment of subsidiaries, sort under the company’s management.

The Office of the Auditor General of Norway conducts audits of the minister’s (the ministry’s) administration of the state’s ownership, and reports to the Storting accordingly.

8.1.2 The minister’s authority within the company

The legal basis for ministerial ownership authority in a limited liability company is laid down in Section 5–1 of the Limited Liability Companies Act which states: «Through the general meeting the shareholders exercise the supreme authority in the company.» A similar provision applies to public limited liability companies, state enterprises and the majority of special law companies5. As regards the state-owned enterprises, the term «general meeting» is replaced with «enterprise meeting» but effectively denotes the same. In the following, the term «general meeting» is used as a common term to refer to both forms of meetings.

A general meeting is a meeting conducted in compliance with detailed rules laid down in Norwegian corporate law. A company’s general manager, board members, members of the corporate assembly and the company’s auditor shall be summoned to attend and are entitled to be present and to voice their opinions at the general meeting. Attendance by the chair of the board and the general manager is mandatory. In addition, the Office of the Auditor General of Norway shall be notified of general meetings and has the right to attend. Minutes shall be taken of the general meeting. A general manager or member of the board of directors or corporate assembly member who disagrees with the resolution adopted by the representative of the company’s shares may have his dissenting vote entered in the minutes.

The rules regarding minutes-taking and notification of the Office of the Auditor General of Norway provide the basis for constitutional supervision of the administration of state ownership.

The provision in Section 5–1 of the Limited Liability Companies Act entails that the minister via the general meeting assumes supremacy over the board in state limited liability companies and may issue instructions which the board has a duty to comply with. These might be general instructions or special instructions on individual matters. By tradition, the state has exercised caution in instructing the enterprises on individual matters. This is due firstly to the fact that it conflicts with, and undermines, the strict separation of roles and responsibilities laid down in corporate law; see chapter 8.1.3. An instruction issued at a general meeting might cause the board to resign from office rather than accede to the instruction. Secondly, active use of the instructing mandate at a general meeting may affect the constitutional responsibility vested in the minister vis-à-vis the Storting in the event that the minister assumes responsibility, through a resolution of the general meeting, for actions that are customarily the preserve of the board. Active use of the instructing mandate might also carry implications as regards third-party damage liability.

Another consequence of Section 5–1 of the Limited Liability Companies Act is that the ministry in its role as owner, has no authority within the company in the absence of the general meeting structure6.

In jointly owned companies, in addition to the constraints described above, further limitations are placed on ministerial authority out of regard for the other shareholders and in conformance with the limited liability companies legislation’s parity principle; see Section 5–21 of the Limited Liability Companies Act/Public Limited Liability Companies Act. This means that the state, even as a majority shareholder, is not permitted to favour its own interests at the expense of the other shareholders in the company. The requirement for shareholder parity has the effect, for example, of limiting the scope for free exchange of information between the company and the ministry. The public limited liability companies legislation also lays down explicit guidelines regarding the state’s supervisory interaction with listed companies. This, however, does not prevent matters of wider societal relevance from being addressed by the state in supplement to its ordinary ownership dialogue with companies in line with what is exercised by other shareholders and stakeholders.

8.1.3 Administration of the company

Company management is composed of the board of directors and the general manager. The limited liability company form and other company forms employed for state companies are based on a strict separation of roles between the company’s owner and its management. Pursuant to Section 6–12 of the limited companies legislation and corresponding provisions in the other company acts, management of a company pertains to the board of directors and the general manager. This entails that day-to-day commercial management of a company and responsibility for it rests with company management. Management shall be exercised by the board of directors and the general manager in the best interests of the company and its owners. Within the general and specific frameworks determined for the company by the Storting, the state as an owner pursues its interests through the general meeting. By virtue of their management of the company, the members of the board and the general manager are subject to personal and criminal liability as laid down in the limited liability companies legislation.

8.1.4 Specifically concerning management of companies wholly owned by the state

Ownership in companies in which the state owns all the shares (state limited liability companies7, state enterprises or special law companies8) is exercised as it is for other companies, by means of general meetings or trust/enterprise meetings9. One exception is Vinmonopolet, which does not hold a general meeting10.

By law, for state enterprises, matters assumed to be of material significance for the company’s objectives or which to a significant degree would alter the nature of the undertaking shall be put to the owner before a decision is made11. A similar rule applies to the health enterprises12. For certain state limited companies, rules have been incorporated in the articles of association requiring the board to bring before the owner any matters assumed to be substantive, setting a precedent or having political or societal implications for the owner. According to this same rule in the articles of association, some companies also have a duty to regularly present the owner with a plan for the company’s activities. Such plans form the basis for ministerial ownership reports to the Storting on the activities of these companies. However, this does not alter the fact that the state exercises its authority as an owner at the general meeting or enterprise general meeting.

For state-owned enterprises and state limited liability companies, certain rules accord greater powers to the enterprise meeting and the general meeting than is otherwise laid down in law for other types of limited liability companies, such as the right to set a higher dividend than that proposed by the board of directors or corporate assembly13.

8.1.5 Other frameworks

Apart from the frameworks ensuing from the Constitution, the law of public administration and corporate law, it is mainly competition law and stock exchange trading and securities law which impose legal requirements on the State’s corporate governance. Other principal legal frameworks ensue from EEA regulations such as the rules regarding state aid.

8.1.5.1 Public-sector ownership and the EEA Agreement

The EEA Agreement is essentially neutral as regards public and private ownership; see Articles 125 and 59 (2). The prohibition against state aid in Article 61 (1) of the EEA Agreement thus also applies to undertakings held by the State or other public instances. This restricts the government’s scope for favouring non-commercial interests in the exercise of ownership. In determining whether public funds furnished to an enterprise constitute state aid, the European Court and European Commission have elaborated the Market Economy Investor Principle. If a public authority injects capital on terms other than those that would be acceptable to a comparable private investor, the investment might be construed as holding a financial advantage for the enterprise and as such contravenes the rules regarding state aid. This entails that the state must demand normal market-rate returns on capital invested in an enterprise operating in competition with others. The EFTA Supervisory Authority (ESA) supervises Norwegian compliance with the state aid regulations.

8.1.5.2 Competition rules

In principle, any changes in state ownership will also comprise circumstances that are supervised by Norwegian or other competition authorities. These would include enterprise mergers and acquisitions, which the competition authorities, pursuant to the competition rules applicable to enterprises, are to monitor. In such matters, the government will propose to the Storting that reservations be made regarding the supervisory procedure of such bodies to ensure that the matters are not treated differently on account of the state ownership14.

8.1.5.3 Regulations for financial management within the state

One decisive constraint on the state’s exercise of ownership derives from the «Regulations on Financial Management in Central Government»15. The Regulations apply to matters such as management and follow-up of the state’s ownership interests in state limited companies, state-owned enterprises, special law companies or independent legal entities wholly or partially owned by the central government, including the purpose that central government assets shall be properly managed.

Section 10 of the Regulations on Financial Management in Central Government state that: «Agencies with overall responsibility for state limited companies, state-owned enterprises, companies established by special statute or other independent legal entities wholly or partially owned by the central government, shall draw up written guidelines on how management and control powers shall be executed for each individual company or for groups of companies. A copy of the guidelines shall be sent to the Office of the Auditor General.

The central government shall, within the framework of applicable laws and rules, manage its ownerships in accordance with general principles of corporate governance with special emphasis on:

a) that the chosen organisation of the company, the company’s articles of association, the financing and the composition of the management board are appropriate given the company’s purpose and ownership

b) that the execution of ownership ensures equal treatment of all owners and supports explicit distribution of authority and responsibility between the owners and the management board

c) that the objectives established for the company are achieved

d) the proper functioning of the board

Governance, monitoring and control including appropriate guidelines shall be adjusted to the size of the central government shareholding, the distinctive characteristics of the company, risk profile and significance.»

Section 16 goes on to state that: «Governance, monitoring and control including appropriate guidelines, shall be adjusted to the size of the central government shareholding, the distinctive characteristics of the company, risk profile and significance. The evaluations shall focus on the appropriateness of for instance ownership, organisation and instruments, including grant schemes. The frequency and scope of the evaluations shall be based on the agency’s distinctive characteristics, its risk profile and its significance.»

A central principle in limited liability companies, state-owned enterprises and special law companies is that the state’s financial liability is limited to its invested capital.

8.1.5.4 Norwegian Code of Practice for Corporate Governance

The Norwegian Corporate Governance Board (NUES) is composed of different interest groups representing, owners, the issuers of shares and Oslo Stock Exchange16. The objective of NUES is to prepare and update the Norwegian Code of Practice for Corporate Governance to promote maximum value creation within listed companies in the best interests of shareholders, employees, other stakeholders and the wider public interest. The Code shall contribute to enhancing confidence in Norwegian companies and the Norwegian stock market. On 21 December 2012, NUES published a revised version of the Code. The Norwegian Code of Practice for Corporate Governance supplements the state’s own principles of good corporate governance; see chapter 8.3.

Oslo Stock Exchange requires companies listed on its exchange to prepare an annual consolidated report on their corporate governance. Under the same rules, an explanation shall be provided of any deviation from the Norwegian Code of Practice for Corporate Governance. Section 3–3b of the Accounting Act also requires reporting by companies on their corporate governance principles and practices.

8.1.5.5 OECD Guidelines on Corporate Governance of State-Owned Enterprises

In 2005, the OECD published a set of guidelines17 for management of state-owned companies, complementing the OECD principles of corporate governance18. The then Norwegian Ministry of Trade and Industry (now the Ministry of Trade, Industry and Fisheries) contributed actively to the drafting of the guidelines. The rationale for the guidelines is that good corporate governance of state-owned enterprises results in better financial development and the expedience of applying a common standard of best practice for corporate governance by the state. In 2010, the OECD published a practical guide to the guidelines in selected areas19. Both the OECD Guidelines and the OECD Principles for corporate governance are currently undergoing review and new versions are expected to be adopted by the OECD in 201520.

The main purpose of the guidelines has been to provide advice that contribute to state-owned enterprises attaining a clearer legal status and a form of governance equal to that of equivalent private-sector enterprises. Further, the guidelines recommend the strict division of the state’s different roles as a political authority, regulatory body and its role as a corporate owner. A third aim is to strengthen the role of the board of state-owned enterprises, in which competence and integrity are central. Transparency surrounding the ownership, and its principles and policies and respect for minority shareholders are likewise key areas addressed by the Guidelines.

The Norwegian state’s ownership practices and the state’s principles for good corporate governance (see chapter 8.3) essentially correspond with the recommendations of the OECD Guidelines on Corporate Governance of State-Owned Enterprises. The board and management of companies with state ownership also benefit from actively applying the recommendations in the OECD Guidelines.

8.1.5.6 How owner control is affected by differing shareholdings

Once the Storting has decided that the state is to engage as an owner in a company with the status of an independent legal entity, this then has implications for how political policies and other objectives are communicated and how and to what extent the state may intervene in the running of the company.

The management of a state-owned enterprise, limited liability company or special law company is distinct from the management of agencies within the public administration system. The owners (including the state as a shareholder) are required to comply with the statutory division of roles between the general meeting, the board and general management. In organising undertakings as independent legal persons, as state-owned enterprises, special law companies or limited liability companies, from the outset, the state waives its opportunity to directly influence day-to-day activities.

However, by participating in nomination processes and election to governing bodies, determining the company’s objectives and other clauses in the articles of association, and by setting out the frameworks for the enterprise at the general meeting, the state may still exert influence on the company’s activities. The state’s influence will depend on the size of its shareholding.

The following discusses what an owner achieves in the way of influence in a company with different typical shareholdings, and how this affects corporate governance.

Wholly owned companies

Limited liability companies wholly owned by the state are referred to as state limited liability companies (or state public limited liability companies)21. The ordinary rules in the limited liability companies legislation also apply to the state limited liability companies. In addition, certain special rules provide the state with extended control of its ownership; see Sections 20–4 to 20–7 of the Limited Liability Company Act/Public Limited Liability Company Act. Certain wholly owned state undertakings are also organised as state-owned enterprises or special law companies. To all intents and purposes, the state-owned enterprises are governed in the same way as state limited liability companies.

The main differences for state limited liability companies, as compared with ordinary limited companies, are firstly that the general meeting elects the shareholder-elected members to the board, even if the company has a corporate assembly; see Section 20–4 no. 122 of the limited companies legislation. In addition, the King in Council of State may overrule resolutions of the corporate assembly or resolutions of the board if major social considerations so indicate; see 20–4 no. 2 of the Limited Liability Company Act/Public Limited Liability Company Act. In state limited liability companies, the general meeting is also not bound by any proposal by the board of directors or corporate assembly on the distribution of dividends; see 20–4 no. 4 of the Limited Liability Company Act/Public Limited Liability Company Act.

There is an obligation for both genders to be represented on the board of directors of state limited liability companies and their wholly-owned subsidiaries; see Section 20–6 of the Limited Liability Companies Act. The same applies to state-owned enterprises and public limited liability companies generally; see Section 19 of the State-Owned Enterprises Act and Sections 6–11a and 20–6 of the Public Limited Liability Companies Act. The Office of the Auditor General also has an extended right to exert control over the minister’s management of state holdings; see Section 20–7 of the Limited Liability Companies Act/Public Limited Liability Companies Act.

In wholly-owned companies, the owner may, through resolutions adopted at the general meeting, impose obligations on the company that might lower the company’s financial performance without contravening Section 5–21 of the Limited Liability Companies Act/Public Limited Liability Companies Act (Abuse of the general meeting’s authority); see also Section 6–28 of the Limited Liability Companies Act/Public Limited Liability Companies Act (Abuse of position in the company etc.).

The state’s financial liability in limited liability companies, state-owned enterprises and special law companies is in principle limited to its invested capital. However, if an owner transgresses in instructing the company in business matters, creditors might claim damages from the state pursuant to the law of tort or the doctrine of corporate law concerning piercing of the corporate veil. For this reason among others, the principle is that companies are to be compensated if they are ordered to make investments or undertake other activities which the board does not find commercially prudent; see chapter 8.2.4. This must be accomplished within the constraints imposed by relevant statutes and other regulations.

Jointly owned companies

Where the state is the joint owner of a company, the Limited Liability Companies Act/Public Limited Liability Companies Act impose restrictions on the types of resolutions that may be adopted by the general meeting; see Section 5–21 of the limited companies legislation on abuse of the general meeting’s authority. The purpose of this provision is to protect the rights of minority shareholders versus majority shareholders. This provision prohibits the general meeting from adopting resolutions that are likely to give certain shareholders or others an unfair advantage to the detriment of other shareholders or the company. This is especially pertinent in companies where state ownership may be justified by interests other than purely commercial ones, but also where the state imposes undertakings on a company that are not in that company’s ordinary line of business. Strict limitations thus apply regarding which political objectives may be pursued by means of corporate governance of jointly owned companies.

However, depending on the size of the state’s holding in a company, a number of objectives may nonetheless be pursued, such as retention of a head office in Norway. The following limit-values are key in the limited liability companies legislation:

9/10

A holding of more than nine tenths of the shares and a corresponding proportion of the voting rights in a limited liability company entitles the majority shareholder to acquire the remaining shares by way of a compulsory buyout of the other shareholders in the company23.

2/3

A holding of more than two thirds of the shares and a corresponding proportion of the voting rights in a limited liability company guarantees control over decisions requiring a corresponding majority under the limited liability companies legislation. A resolution to amend a company’s articles of association requires at least two thirds of the votes and the share capital. The same applies to resolutions regarding mergers or demergers, decisions to raise or reduce the share capital, the raising of convertible loans, resolutions to convert the company and resolutions to wind up companies.

1/2

A shareholding of more than half of the share capital in a limited liability company ensures control over resolutions requiring an ordinary majority of the votes cast at the general meeting. These resolutions include approving the annual accounts and resolutions regarding the distribution of dividends. Election of members to the board or corporate assembly also requires an ordinary majority. The board, however, is elected by the corporate assembly if such a body exists.

1/3

A holding of more than one third of the shares and a corresponding proportion of the voting rights in a limited company provides negative control over resolutions requiring a two-thirds majority. This size of shareholding enables the owner to oppose major decisions such as relocation of the company’s head office, a change in share capital, amendments to the articles of association etc.; see the section on two-thirds majority.

Mandatory bid obligation

Under Section 6–1 (1) of the Securities Trading Act24, any person who through acquisition becomes the owner of shares representing more than one third of the voting rights in a Norwegian listed company is obliged to make a bid for the purchase of the remaining shares in the company. A recurrent mandatory bid obligation applies for any person who through acquisition gains a holding representing 40 per cent or more of the company, and similarly 50 per cent or more25. This means that a decision to increase the state’s holding above these threshold values is subject to the mandatory bid obligation, thus entailing that the state might acquire a larger shareholding than intended.

8.2 The Norwegian state’s principles of corporate governance

The state’s conduct as an owner has great influence on public and investor confidence in Norwegian companies under state ownership and in the Norwegian capital market. Broad political consensus prevails that state ownership shall be exercised professionally within the constraints of Norwegian corporate law and based on generally accepted principles of corporate governance26, including that companies in which the state’s ownership is largely driven by commercial interests shall be operated in the same way and subject to the same constraints as well-run private-sector enterprises.

In 2002, the Bondevik II Government developed ten principles of good corporate governance defining how the government will conduct ownership and what it expects of the companies. These principles have provided a predictability in the state’s exercise of ownership that has been welcomed by participants in the Norwegian capital market.

The state’s principles of corporate governance have not been amended since 2002. In the present report, the government has made certain amendments to the original principles to ensure, as far as possible, that they are aligned with current practices and generally accepted corporate governance principles. The most important amendments are as follows: Principle 2 specifies that the requirement for transparency also applies to the company’s activities; see the discussion of the requirements for transparency in previous state ownership reports and the recommendations of the OECD Guidelines on Corporate Governance of State-Owned Enterprises. Principle 4 specifies that the board is responsible for setting explicit objectives and strategies for the company within the constraints of its articles of association. Principle 5 specifies that the capital structure shall be aligned with the company’s objectives (as stated in the articles of association) and not only with the state’s objectives for its ownership. Principle 7 (formerly Principle 8) specifies that the role of the board of directors comprises more than supervision of the company’s management by specifying that the board holds executive responsibility for administration of the company. Mention of the board’s evaluation in Principle 8 (formerly Principle 9) is limited to solely apply to the board’s evaluation of its own performance and not the owner’s evaluation of board members (the latter is commented on in reference to Principle 6). In Principle 10 on corporate social responsibility, the wording has been amended to emphasise the state’s expectation that companies shall work systematically to safeguard their corporate social responsibility. In addition, technical adjustments have been made to Principle 1 and Principle 3, and the order of some of the principles has been changed so that the former Principle 7 is the new Principle 9, the former Principle 8 is the new Principle 7 and the former Principle 9 is the new Principle 8.

As was done by the Bondevik II Government in Report to the Storting no. 22 (2001–2002) (White Paper) Reduced and improved state ownership, a supplementary commentary is provided for each of the principles in turn. An introduction has also been included as part of the commentary on the principles. The state’s expectations of the companies have in some areas been elaborated on in chapter 8.3. As and where relevant, the manner in which the principles apply to wholly-owned companies and companies with sectoral-policy objectives has been clarified.

8.2.1 Introduction to the principles

State ownership shall be exercised professionally and predictably within the constraints of Norwegian corporate legislation and other law, based on generally accepted corporate governance principles and in observance of the strict separation of the role as owner from other roles assumed by the state27. The state’s principles of corporate governance are aimed at all companies in which the state has a holding, whether wholly or jointly owned by the state, and encompass both companies where the activities are commercial in nature and companies in which the state is seeking to realise various sectoral-policy and societal objectives.

For commercial undertakings in which the state has a holding, the state’s principal objective is to maximise the value of its investments. For state-owned companies with sectoral-policy objectives, the principal aim is for the objectives to be achieved in a manner that ensures efficient use of resources.

Textbox 8.1 The Norwegian state’s principles of corporate governance

All shareholders shall be treated equally.

There shall be transparency in the state’s ownership of companies.

Ownership decisions and resolutions shall be made at the general meeting.

The board is responsible for elaborating explicit objectives and strategies for the company within the constraints of its articles of association; the state sets performance targets for each company.

The capital structure of the company shall be appropriate given the objective and situation of the company.

The composition of the board shall be characterised by competence, capacity and diversity and shall reflect the distinctive characteristics of each company.

The board assumes executive responsibility for administration of the company, including performing an independent supervisory function vis-à-vis the company’s management on behalf of the owners.

The board should adopt a plan for its own work, and work actively to develop its own competencies and evaluate its own activities.

Compensation and incentive schemes shall promote value creation within the companies and be generally regarded as reasonable.

The company shall work systematically to safeguard its corporate social responsibility.

8.2.2 Principle 1. All shareholders shall be treated equally.

A company’s ability to attract capital is dependent on investor confidence that other shareholders are not given unfair opportunities to promote their interests at the expense of investors. As a majority shareholder in several companies, it is imperative that the state, in its capacity as owner, seeks to ensure the parity of shareholders in companies in which the state is one of multiple shareholders.