Part 1

Why the State is an owner

2 Historical background

Business activities initiated by the State, existing business activities that were taken over by the State, and the production of goods and services by state-owned undertakings are the background to the State’s present-day direct ownership of companies.

Business activities initiated by the State

Political objectives relating to industrial development, civil protection and emergency preparedness, and ownership of natural resources have been the primary motives behind the State’s involvement in new business activities.

Many European countries established business activities during the post-war years. The international and domestic capital markets were subject to stringent regulations, and access to private capital was limited. In Norway, the State provided capital to achieve industrial development that was desirable for political reasons. The State’s role between the 1940s and the 1960s in companies such as Årdal and Sunndal Verk, Norsk Jernverk, Norsk Koksverk and SAS can be viewed in light of this. When oil and gas production started on the Norwegian continental shelf in the 1970s, there was a clear political ambition to develop a Norwegian oil industry and to ensure control of these substantial resources. Den norske stats oljeselskap (later Statoil and then Equinor) was established in 1972. The then Ministry of Industry emphasised1 that this would both provide better opportunities for maintaining ownership of the oil resources and that it could «play a key role in realising the State’s policy in the establishment of an integrated Norwegian oil community».

Another rationale for state ownership has been civil protection and emergency preparedness. Defence materiel was manufactured by the state-owned undertakings Kongsberg Våpenfabrikk, Horten Verft and Raufoss Ammunisjonsfabrikker. These undertakings were established in the 19th century and were organised under the Norwegian Armed Forces before they were split off into separate companies in 1947. The companies also later ventured into other industrial production. The State has continued its ownership of the munitions activities through Nammo, and of the production of other military materiel through Kongsberg Gruppen. Horten Verft went into compulsory liquidation in 1987.

Textbox 2.1 Equinor – 50 years of industrial development

Equinor is an international technology and energy company whose main activity is the production of oil and gas. The company also has downstream operations and activities in renewable energy, such as offshore wind farms and solar energy. The company is a major seller of crude oil, condensate and natural gas on a global scale.

Equinor was established as a company wholly-owned by the Norwegian State in 1972 under the name Den norske stats oljeselskap AS and will celebrate the 50th anniversary of its founding in 2022. The petroleum resources on the Norwegian continental shelf provide a basis for creating substantial value for society, and Equinor has interests in many licences on the Norwegian continental shelf. The company was listed on the stock exchange in 2001. Since its establishment, Equinor ASA has become a key player in the Norwegian petroleum industry, and has made a significant contribution to developing Norway into a modern industrial country. Norway is today one of the world’s most productive petroleum producers, which has also proven well-suited to developing technology for offshore oil and gas activities.

Equinor markets and sells the State’s oil and gas from the SDFI portfolio together with its own volumes, a task that was stipulated in the company’s articles of association prior to the company being listed in 2001. The company was merged with Norsk Hydro’s oil and gas division in 2007.

Equinor has prepared a plan for energy transition at the company in 2022. The plan describes Equinor’s strategy for the transition to a more diverse energy company, which will continue with significant petroleum activities, but will place increasingly greater emphasis on renewable energy and low carbon solutions. The plan is based on the Group’s overarching strategy with three pillars: An optimized oil and gas portfolio, high value growth within renewable energy and establishing new market opportunities within low carbon solutions. Among other things, the company has ambitions to increase the percentage of investments in renewable energy and low-carbon solutions from 4 per cent in 2020 to 50 percent in 2030. The company aims to achieve net zero greenhouse gas emissions by 2050.

Equinor and the State Ownership Report for 2021.

The State has had various policy instruments at its disposal for channelling capital into the business sector. State loan schemes such as Noregs Småbruk- og Bustadbank (the Norwegian smallholdings and housing bank), Fiskarbanken (the national fisheries bank) and Industribanken (the industry bank) were established already before the Second World War. Even more were established in the post-war years, and in 1992, several of the loan schemes were merged into the Norwegian Industrial and Regional Development Fund. In 2003, the fund was merged with other business-oriented institutions to create Innovasjon Norge, which the State owns together with the county authorities. The credit markets were gradually liberalised in the 1980s; however, there are several areas in which the State has seen need to support access to capital for newly established companies or specific industries. This was part of the rationale behind the establishment of Argentum Fondsinvesteringer, Investinor and Nysnø Klimainvesteringer.

Existing business activities that were taken over by the State

The State acquired a major stake in Norsk Hydro following the Second World War. Yara International was divested from Norsk Hydro in 2004.

During the banking crisis of the 1990s, the State took over the shares in a number of Norwegian banks as a result of the State having infused fresh capital to enable the banks to continue to operate. The State thereby gained ownership of large parts of the Norwegian banking system. The banks were later privatised; however, the State has maintained an ownership interest in DNB Bank.

Production of goods and services by state-owned undertakings

Goods and services have been produced by state-owned undertakings, which have later been hived off into separate companies.

Based on the recommendation of the Hermansen Committee,2 several government agencies were granted greater operational autonomy in the 1990s and 2000s. A number of government corporations were also converted into companies. This often coincided with the introduction of regulatory reforms that facilitated the establishment of new markets. Examples include the conversion of Statskraftverkene into Statkraft and Statnett and Televerket into Telenor in the 1990s. The State has since also converted state-owned undertakings into companies, such as Entra in 2000 and Mesta in 2003.

Since the 2000s, several comprehensive reforms have been introduced that have led to the establishment of companies for which the State has set public policy goals. One example is the regional health authorities, which were established when the State took over the specialist health services from the county authorities and delegated these to companies with greater operational autonomy. A number of companies have also been established in the transport sector. Among other things, the government agency the Civil Aviation Authority was converted into Avinor, the majority of Bane NOR was split from the former Norwegian National Rail Administration, and Nye Veier took over some of the Norwegian Public Roads Administration’s development tasks. The railway reform led to the establishment of several companies under direct state ownership in 2017, when Entur, Mantena and Norske tog were hived off from the then NSB Group (now Vygruppen). The Government has announced that it will review the organisation and corporate structure of the railway sector in order to contribute to easier everyday life for passengers, and to enable the railway service to increase its competitiveness in relation to other forms of transport. If the review involves changes to the State’s rationale for ownership or the State’s goal as an owner for one or more of the companies in the railway sector, the Government will return to the Storting regarding this.

Development in the scope and exercise of state ownership

The current system of state ownership is the result of pragmatic choices made in a number of individual cases. In the post-war years and into the 1970s and 1980s, considerations such as national production, employment and regional development were often prioritised over the companies operating efficiently and profitably. The State also infused capital to save companies from crises and covered substantial financial losses. Necessary improvements in efficiency and restructuring were postponed or never carried out. This contributed to weak commercial orientation on the part of the board and management and reduced value creation for both the companies and the State.3

Textbox 2.2 Mo industripark (Mo Industrial Park)

On 10 July 1946, the Storting agreed to the construction of a Norwegian ironworks in order to make Norway more self-sufficient in steel following the Second World War. Construction of the ironworks took nine years and operations at Norsk Jernverk commenced in April 1955. World steel production rose steadily until 1975 and in line with economic growth; however, the demand for steel slowed from the mid-1970s. It gradually became clear that operations at Norsk Jernverk were not profitable and had to be wound up, and in 1988 the Storting therefore decided to discontinue the State’s ownership of Norsk Jernverk, as part of a comprehensive restructuring of state-owned industry in Mo i Rana. The Storting allocated a total of NOK 983 million for the restructuring of the ironworks. Mo Industripark AS took over most of the building stock following the restructuring process that occurred between 1989 and 1992. Originating from the former state-owned ironworks, the industrial park currently has over 100 companies which employ approximately 2,600 people. There are also several billion kroner in investment decisions being made that will create new jobs and significant export revenues. Mo Industrial Park is an example of restructuring in societies that were previously more unilaterally dependent on a cornerstone company.

Mo Industripark AS (Annual Report 2020 and website).

Many countries around the world reduced the scope of their state ownership in the 1980s and 1990s. This did not happen on the same scale in Norway. There are several reasons for this, one of them being that Norway did not have the same need as many other countries to reduce its national debt. However, companies with state ownership were not shielded from structural changes during this period. For example, the Storting approved the restructuring and downsizing at Norsk Jernverk in Mo i Rana in 1988.4

Based on previous experience of, among other things, weak commercial orientation and reduced value creation, several steps were taken to strengthen the Norwegian state’s exercise of ownership from the end of the 1990s. Submission of the first white paper on ownership policy to the Storting in 2002, which set out an overall policy for the State’s ownership based on generally accepted corporate governance principles, should be viewed in connection with the need for ownership decisions being made on a solid, professional basis, that there is a high degree of transparency surrounding ownership and that the State does not act in an arbitrary manner.5 The central principles underlying the State’s exercise of ownership, and the distinction between the State’s role as owner and its other roles, have remained in force through changing governments.

In recent years, the State has regularly considered whether it should continue to own companies, and if so, what the ownership interests should be. Several changes were made to the State’s ownership in the 2000s.6 The State has reduced its ownership interest in some companies, for example through the listing of Telenor and Equinor. In several other companies, the State has sold all its shares. For example, in Arcus, BaneTele, Cermaq, SAS, Veterinærmedisinsk Oppdragssenter, Entra and Ambita. At the same time, the State has also provided new equity to some companies to support their development, for example, Kongsberg Gruppe.7 In addition, for some of the companies, the reorganisation of the State’s use of policy instruments has led to adjustments in the State’s rationale for ownership and the State’s goal as an owner.

3 Social development and trends

There are a number of developments and trends that impact how industrial and business actors in Norway organise their activities. The same developments and trends may also have consequences for how the State should organise its exercise of ownership. Among these developments are increased societal expectations of how companies and other actors can contribute to solving major societal challenges. Climate change, energy transition, international unrest, increasing inequality, urbanisation and the consequences of the coronavirus pandemic have influenced social development in recent years, while digitalisation and the development of new technology are still important factors. Macroeconomic changes, developments in the capital market and demographic changes may also affect companies to a greater or lesser extent. Investors, customers, employees and society at large also express expectations that companies need to balance financial, social and environmental considerations to enable returns to be achieved over time within sustainable limits. Trust from the companies’ stakeholders is an important competitive parameter.

How companies adapt to changes in the outside world and stakeholder expectations impacts the opportunities and ability of companies to create value. The development and need for continuous further development of the companies’ ambitions, goals and strategies place greater demands on the work carried out by the boards. Competent owners and boards with the ability to understand a company’s situation, challenges and opportunities can influence the company’s ability to realise its potential for value creation.

As an owner, the State emphasises that companies with state ownership work to achieve the State’s goals as an owner, see chapter 5. Good goal attainment means that the companies are profitable and sustainable, and are given sufficient latitude for being able to adapt to changing environments and to manage changes to risk. This is reflected in the further development of the State’s expectations of the companies (Chapter 11) and how the State exercises its ownership (Chapter 12).

Globalization in reverse and international unrest

Several years of increased global trade has given Norwegian companies access to larger markets, stronger competition and access to ideas, new technology, capital and input factors. The business sector’s ability to restructure has been decisive to efficient resource allocation and hence economic growth. However, in recent years, the movement towards a more globalised world has slowed, with protectionist measures in several countries and increased rivalry between the great powers. The global economic centre of gravity has shifted to the south and east. China, India and other emerging economies are becoming increasingly more important to world trade, and the emergence of China as an economic superpower has altered the geopolitical balance.8

Russia’s war of aggression against Ukraine and the sanctions imposed against Russia have impacted economies and business sectors both globally and in Norway. There has been a reduction in trade between the affected countries and the rest of the world. Russia’s belligerent actions have also created increased uncertainty in a number of areas. This can weaken the trust of consumers and companies, which in turn can reduce consumption and investment.

The coronavirus pandemic in recent years has also contributed to major challenges in global supply lines, and may have contributed to reinforcing protectionist tendencies. Prices for a number of commodities have also been impacted by the situation, which has contributed to higher global inflation and higher interest rates.

The protectionism that is emerging across the globe affects Norway, which is a small, open economy. The integration of countries with access to a large supply of labour, such as China and India, into the world economy, combined with technological developments, has exerted pressure on wage levels in large parts of the Western world. The positive gains from international trade and technological development have not been evenly distributed among the populations of these countries. Norway benefits from binding cooperation, which in international terms, entails rule-based rather than power-based relationships. Strong global economic growth over the past 20-30 years, particularly in Asia, has contributed to a strong demand for energy and for extended periods this has resulted in high oil and gas prices that are of importance to the Norwegian economy.

Norway is among the countries with the lowest inequality; however, like most other countries, income inequality has increased over the past 30 years. A stronger concentration of capital income, a somewhat more skewed distribution of salary income and demographic changes are factors that have contributed to more uneven income distribution.9 Studies that make use of a more complete metric for income10 than official statistics indicate there is a significantly higher level of income inequality and distribution of the tax burden in Norway. This is due both to the large share of gross incomes that accrue among the top 1 per cent with the highest incomes and the fact that the tax rate among the top 1 per cent is sharply declining in relation to increased income.11 International megatrends such as globalisation and digitalisation also have an impact on income distribution. If economic inequality becomes too excessive, this can create challenges. For example, major economic inequality can impair individual opportunities, create social unrest and weaken trust between people and important social institutions.12 Greater inequality can also be detrimental to economic growth for countries in the long term.13

Textbox 3.1 The Norwegian Model

The Nordic countries are characterised by parties in the labour market, the government, the national assembly and important institutions working together to contribute to a sustainable welfare society. In Norway, this means of cooperation is referred to as the Norwegian Model. Key features of the model are economic governance, public welfare policy, strong parties in the labour market and an organised labour market. The intention is that this will collectively contribute to economic growth, employment, coordinated wage bargaining, universal welfare schemes and cooperation between the parties in the labour market. The model has contributed to combining efficiency and equality.

A key part of the Norwegian model is the tripartite cooperation between the parties in the labour market (the organisations that represent employers and employees) and the State regarding matters pertaining to the labour market, including wage bargaining. Through coordinated wage bargaining, the parties shall contribute to preventing the business sector from having a cost level that makes it challenging to compete internationally. Coordinated wage bargaining also contributes to wage developments that preserve minor differences and reduce inequality.

The Norwegian model (NHO), The Norwegian model (LO), The Nordic model (FAFO).

Climate change and loss of biodiversity

Climate change is among the greatest global challenges of our time. Many are already noticing the negative consequences of global warming; however, the biggest costs and consequences are still some decades into the future. This timeframe differentiates climate change from other more immediate challenges, and makes the problem particularly difficult to manage.14

The Paris Agreement’s goal of limiting the increase in temperatures will require global CO2 emissions to be reduced to net zero by 2050. An orderly and sufficiently rapid restructuring process following such a scenario can contribute to lower risk and costs for companies and society as a whole when compared with other scenarios. Over time, climate policy will shift demand more strongly towards goods and services with low greenhouse gas emissions, and will also strengthen incentives for the innovation of emission reduction technology and the development of new business models and markets. The energy transition and the transition to a more circular economy are examples of developments that may influence whether a company will succeed in creating value in the long term.

Through the Paris Agreement, Norway has committed to reducing greenhouse gas emissions by at least 50 per cent and up to 55 per cent by 2030 compared with 1990. The climate goal is enshrined in the Climate Change Act and will be achieved in cooperation with the EU. As a sub-goal on the road to net zero emissions and a low-carbon society, the Government has set a restructuring goal for the economy by 2030. This is formulated in the Government platform as a goal of cutting Norwegian emissions by 55 per cent compared with 1990. This means that the Government has a national goal of restructuring both the quota and non-quota sector. The purpose is for the entire Norwegian business sector to transition to a low-emission society.

The failure to implement and coordinate climate-related measures on a global scale could lead to increased levels of conflict such as trade wars, changing migration patterns, unrest in energy markets and shortages of input factors. At the same time, climate-related measures have also contributed to resistance in several countries and local communities. In Norway, there are conflicts related to the development of wind power and the introduction of climate-based taxes. Climate change and more heightened levels of conflict will increase both the direct and indirect risks for companies. Predictable and gradually stricter climate policy can reduce the climate risk that companies face.

Biodiversity is declining faster than at any point in human history. Human activity has resulted in changes to 75 per cent of the natural environment on land and the loss of more than 85 per cent of the world’s wetlands. These changes have serious consequences for 66 per cent of the marine environment.15 The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) estimates that half of the world’s gross domestic product is wholly or partly dependent on services provided by nature, and that land degradation costs the world more than ten per cent of gross domestic product annually.

While the overall status of Norwegian ecosystems is relatively good when compared with the rest of the world, Norway also faces challenges. Land-use encroachment and land-use change are the most important factors that are impacting ecosystems and biodiversity both globally and in Norway.

There is a clear link between climate and biodiversity challenges. Climate change is gradually becoming a significant explanatory factor behind the loss of biodiversity. At the same time, ecosystems store large quantities of carbon, and well-preserved biodiversity is important for climate adaptation in order to make nature and society more resilient to climate change. Nature-based solutions that are beneficial for both the climate and nature are therefore crucial for reducing emissions and strengthening the ability of society to adapt to climate change.

Negotiations for a new global framework for nature under the Convention on Biological Diversity (Biodiversity Convention) are presently taking place.16 Norway is working to ensure that the framework includes specific and ambitious targets for the protection and sustainable use of biodiversity, and a new mechanism for better achieving these targets. Stricter regulations represent a restructuring risk and should be taken into consideration by companies that are largely dependent on natural resources.

Increased expectations of sustainability, responsible business conduct and reporting

In order to contribute to global sustainable development, in 2015 the United Nations General Assembly adopted new sustainable development goals up to 2030. The 2030 Agenda is the world’s action plan for sustainable development. The 2030 Agenda has been established through 17 Sustainable Development Goals and 169 targets. The goals apply to most areas of society. The goals view the environment, economy and social development in context. The goals have gained global acceptance as a common reference and framework. The Sustainable Development Goals call for joint efforts by governments, civil society, academia and companies. The business sector is crucial for achieving the Sustainable Development Goals, and the goals can act as a framework for companies to meet societal expectations. The Sustainable Development Goals represent the main political pathway for solving the greatest national and global challenges of our time. Report to the Storting (White Paper) No. 40 (2020—2021) Goals with meaning – Norway’s action plan to achieve the sustainability goals by 2030, was considered by the Storting in spring 2022, cf. Recommendation 218 S (2021–2022).

There is an increasing expectation for companies to reduce the negative external effects that their operations have on people, society and the environment. International normative guidelines and principles such as the United Nations Guiding Principles on Business and Human Rights (UNGP), and the OECD Guidelines for Multinational Enterprises, contribute to providing a common understanding of what companies are expected to do. However, the development has been slow, and there has thus been greater legal regulation in this area in recent years. Several countries, including Norway, have introduced legislation relating to responsible business conduct, which is relevant for companies with international operations or global supply chains. An example of this is the Norwegian Transparency Act, which entered into force on 1 July 2022. The purpose of the Act is to promote enterprises’ respect for fundamental human rights and decent working conditions and ensure that the general public has access to information.17 The Act requires companies of a certain size to conduct due diligence assessments, and imposes a duty to disclose information regarding the company’s work on due diligence assessments. Read more about the Transparency Act in Chapter 11.2. A number of other countries are also exploring legislation in this area, and the European Commission recently presented a proposal for a directive on due diligence for sustainability in companies.

Many companies operate globally, while tax rules are national and not necessarily harmonised between countries. This may entail a risk of tax base erosion in many countries and allow for the transfer of profits to low-tax jurisdictions. At the same time, the digitalisation of the economy means that it is no longer as clear as to which country has the right to tax multinational companies. The challenges associated with taxing multinational enterprises are issues that many countries face and that require international solutions. International tax cooperation has yielded significant results in recent years, including the extensive sharing of information between countries.18 The tax behaviour and tax policies of companies is therefore an area that has received greater attention.

There is an increased expectation in society that companies need to create value in a sustainable manner. Several investors who describe themselves as responsible integrate consideration for people, society, climate and the environment into their investment activities. Many investors, consumers, employees and other stakeholders have greater expectations that companies will contribute to resolving economic, social and environmental challenges that society is facing. Among other things, several international investors have called on companies to more clearly define their roles beyond creating shareholder value, citing that this is closely linked to the company’s ability to supply products that society demands, recruit committed employees and create value over time. Several stakeholders have undertaken various initiatives to define what constitutes sustainable investments and how this can be reported.

In 2019, the EU presented a strategy for green energy (European Green Deal) that will create a more sustainable and competitive business sector in Europe. The goal is climate neutrality by 2050, and a 55 per cent cut in greenhouse gas emissions by 2030 when compared to 1990 levels. As part of this strategy, the EU has launched the regulatory package «Fit for 55» with proposed amendments to many of the EU’s directives and regulations in the areas of climate, transport and energy. In recent years, the EU has adopted or proposed a number of regulatory amendments with the aim of making capital markets better able to finance sustainable projects and activities. A key measure is the classification system for sustainable economic activity (taxonomy). The Taxonomy Regulation establishes criteria for what can be considered sustainable activities that contribute to achieving the EU’s environmental goals. The regulation requires large companies to submit annual reports on the extent to which they engage in or finance activities that satisfy these criteria. The system will contribute to preventing «greenwashing» and serve as a tool for making it easier for investors to assess whether investments are in line with long-term European climate and environmental goals and provide companies with incentives to restructure.

Another measure in the EU’s work on sustainable finance includes new requirements for sustainability reporting. In June 2022, a provisional political agreement was reached between the European Parliament and the European Council on a new Corporate Sustainability Reporting Directive (CSRD). The Directive replaces the EU Non-Financial Reporting Directive (NFRD) and amends several EU directives in the accounting, reporting and auditing areas. In the Directive, the reporting obligation is expanded significantly to apply to all enterprises that are considered large under the EU definition and all listed companies with the exception of so-called micro-enterprises.19 The reporting requirements will be introduced in stages. The purpose of the Directive is to improve sustainability reporting from companies and thereby facilitate restructuring in line with the EU’s Green Deal. The Directive shall be complemented by reporting standards.

Regulatory changes as a result of «Fit for 55» and the EU’s strategies for sustainable finance will have significance for Norwegian companies and the Norwegian business sector.

Digitalisation and major technological changes

Technological developments involving increased digitalisation are creating far-reaching changes in the economy and society. New technology and digitally driven innovation mean that machines can increasingly perform tasks more reliably and at a lower cost than humans, and in doing so replace manpower. New goods and services with their associated work tasks that require other types of labour are also being developed. This development is expected to continue at a rapid pace, and will necessitate restructuring of the labour market. If the companies are to remain competitive over time, this requires further development and renewal of employee competence in line with technological developments, innovation and new working methods.

Technologies such as advanced robots and artificial intelligence can reduce the need for physical trade and investment in traditional fixed assets. Technological changes provide opportunities for increased value creation; however, they also bring with them changes in risk that companies should address. Examples of the latter may be shorter lifetimes for goods and services, the increasing dominance of certain companies, privacy challenges, cyber-crime and the need for rapid adjustments to business models. The rapid technological development means that companies should regularly assess the strategic direction that can provide the highest probability of future value creation. In some situations, it may be most profitable to be an early mover, while in other contexts it may be sensible to await developments.

Digitalisation has made it easier for companies to sell directly to customers in other countries without establishing a physical presence in the country. This has resulted in increased competition in a number of industries, and intensified certain competitive challenges. Among other things, economies of scale and network effects have resulted in high market shares for a small number of large, global companies. As mentioned, this has also resulted in an increased focus on the taxation of these types of companies, because they do not always pay tax at the location where earnings occur, which can play a part in distorting competition.

Civil protection, including cyber security, is impacted both by developments in our own society and by global trends. There has been increased awareness in recent years concerning foreign investment and how some countries use this and other economic policy instruments to achieve strategic and political objectives at the expense of other countries’ national security interests. The digitalisation of society creates new solutions, but also creates dependencies and vulnerabilities that cut across sectors, areas of responsibility and national borders and which impact companies. Critical societal functions such as energy supply, electronic communications and financial services depend on long digital value chains, which create vulnerabilities; however, companies in other sectors should also pay close attention to cyber security.

Technological development is about more than just digitalisation. A great deal is also occurring in the energy sector in areas such as offshore wind and solar, carbon capture and storage, and battery technology. A «technology race» may develop between the major powers to secure the dominant position in certain technological areas that will be expected to have a major impact on value creation and matters related to civil protection.

Macroeconomics and developments in the capital market

The coronavirus pandemic has triggered extensive and expansionary monetary and fiscal measures around the globe, and several countries have high levels of government debt. Many central banks have raised their policy rates, and we are presently seeing rising inflation and a heightened risk of stagflation. Bond yields have been low for a long time; however, they are now rising. Macroeconomic drivers can change rapidly, and it is therefore uncertain as to how monetary policy will develop in the period ahead.

Macroeconomic developments and developments in capital markets impact companies’ cost of capital when concerning both the cost of debt and equity. It is difficult to predict the long-term real interest rates, the market risk premium, companies’ systematic risk and optimal capital structure. In terms of companies’ strategic development, capital allocation, investments and capital costs will be key variables when assessing earnings prospects. A complicated question is how sustainability factors influence the cost of capital for the company as a whole or for the individual business areas. These are important questions for the companies’ owners and boards.

Demographic changes

Population development, migration, urbanisation, aging of the population, low birth rates in the Western world, changing attitudes and life patterns between generations and public health are key aspects of societal development.

Global population growth is expected to continue, which could significantly exacerbate climate challenges and a number of other challenges. However, the population is expected to decline in parts of the Western world. Continued urbanisation may alter the political balance of power between urban and rural areas.

Climate change, regional conflicts and disputes, wars and economic development often trigger migration. If the climate challenges are not solved and sea levels rise, many parts of the world could become uninhabitable. When economic prosperity reaches a certain level, more people will have the financial means to relocate. Integrating people with different backgrounds and cultures can be a difficult task and may create new challenges; however, diversity is also positive and can create opportunities.

Many countries are also experiencing a change in the population composition due to an ageing population. This entails an increased need for services for the elderly, something which may require significant societal resources. Increased life expectancy also creates increased opportunities for utilising the resources that older people possess.

Younger generations live and work in new ways. Digital technology means more for everyday life. These generations may also have different expectations regarding the type of work, work-life balance, gender equality and sustainability.

Companies may experience a fight to attract and retain talent. The type of work, skills development and continuing education will be of key importance. Flexible working methods may also be an attractive advantage, and the coronavirus pandemic has demonstrated that home offices are becoming more important for many employees.

Consequences for the State’s exercise of ownership

The State follows up the aforementioned developments in its owner dialogue with the companies and endeavours to understand how changes in the outside world impact the companies and how the companies work to remain informed and take these factors into account in their operations. It is also important for the State to understand whether the developments indicate a change in the risk to which the companies are exposed, and whether the companies are managing this in an appropriate manner.

Social development is reflected in the State’s goal as an owner, where sustainability considerations are more clearly integrated, see Chapter 5. The State’s expectations of the companies have also been further developed to better reflect these development trends, and this white paper places particular emphasis on considerations pertaining to the areas of ambitions, goals and strategies (Chapter 11.1), responsible business conduct (Chapter 11.2), human rights and decent working conditions (Chapter 11.3), climate (Chapter 11.4), biodiversity and ecosystems (Chapter 11.5), wages and remuneration (Chapter 11.10), risk management (Chapter 11.11) and transparency and reporting (Chapter 11.13).

4 Rationale for state ownership

Why the State should have direct ownership in companies, which companies the State should own and with what ownership interest are key topics when concerning state ownership. The answers to these questions will depend on an assessment of whether there is a need and desire for state measures in a particular area to solve a problem or task, and whether state ownership is the most appropriate measure. Other relevant measures may be regulation, subsidies, taxes, duties, grants, public procurement, purchases of goods and services or the establishment of government agencies (state enterprises), etc. An assessment of whether measures are required and desirable, and which measures are most suitable, will provide answers to whether state ownership is appropriate and what rationale the State has for owning a company.

Transparency about why the State is an owner of companies can contribute to a better understanding of state ownership among the companies, competitors, other shareholders, lenders and other stakeholders. Chapter 4.1 specifies reasons for when state ownership may be an appropriate measure.

4.1 When state ownership may be an appropriate measure

As shown in Chapter 2, there are various reasons for the development of state ownership. The State has increased or reduced its ownership interest over time in line with State objectives. A starting point for why the State has ownership interests in companies is that the market alone does not always provide the best socio-economic result. In this white paper, the reasons for when state ownership can be a beneficial measure have been expanded and further developed. This will also contribute to strengthened national ownership.

This chapter outlines when state ownership may be an appropriate measure. The rationales are relevant both for the companies that primarily operate in competition with others (Category 1) and for the companies that do not primarily operate in competition with others (Category 2). Chapter 7 describes why the State is currently an owner in each of the companies. For some companies, the rationale for ownership may be based on several of the factors discussed below, see Figure 7.1.

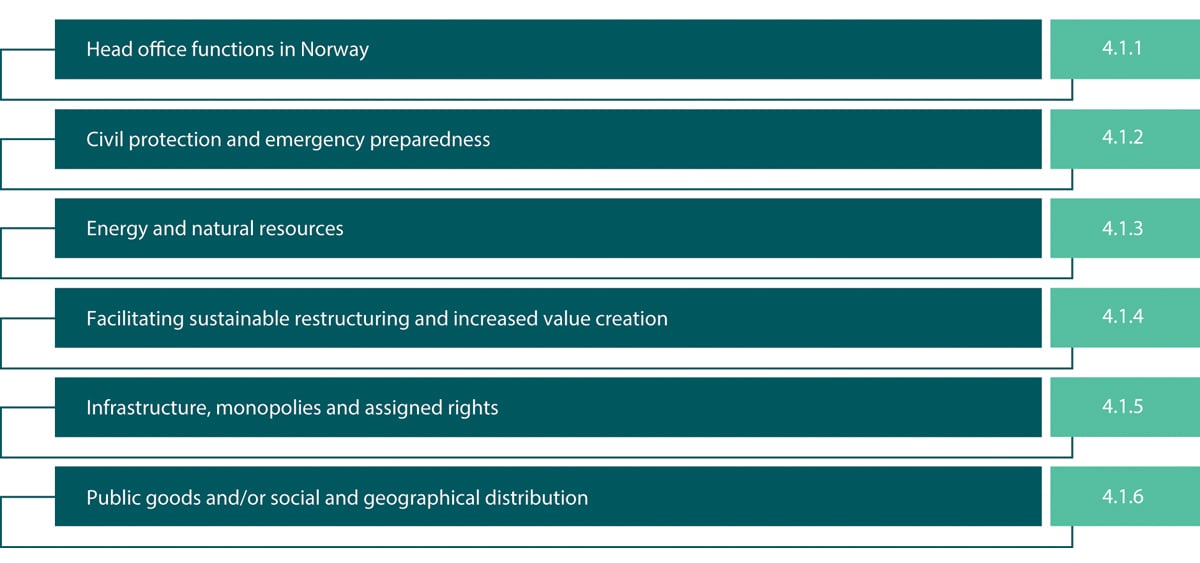

Figure 4.1 Rationales for state ownership.

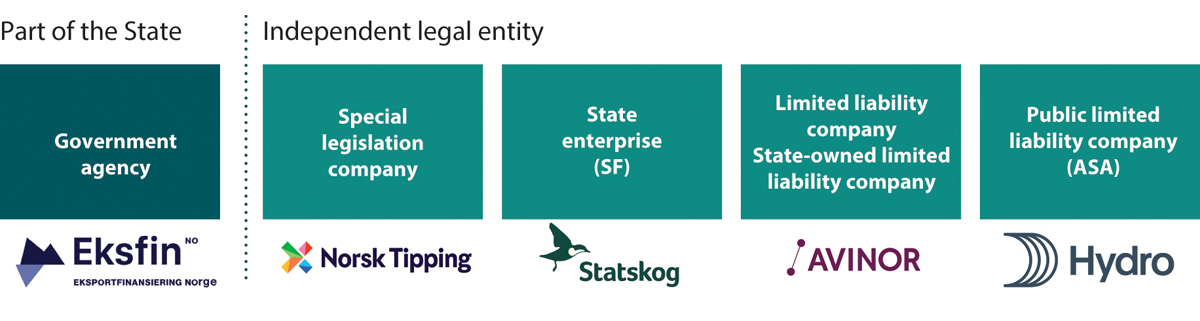

Figure 4.2 Different means in which the State can organise activities, with examples.

4.1.1 Head office functions in Norway

Head office functions of large and internationally leading companies in Norway are thought to have positive effects on the Norwegian economy, and these can thereby contribute to increased overall value creation for society. The decision-makers, specialists, researchers, strategists and staff groups are often located at the head office. These are functions that often require a high level of expertise. Having head offices in Norway can also contribute to increased demand for specialised services and help develop a network of subcontractors and partners both nationally and internationally. This contributes to cooperation and knowledge transfer, which are considered positive for the Norwegian business sector and development throughout the country.

The knowledge that decision-makers possess about investment opportunities and framework conditions is often greater in their home country, which is a factor that could influence investment decisions. Furthermore, companies with activities in multiple countries may wish to prioritise their domestic markets during periods of turbulence and weak international growth, of which there have been signs in, for example, the financial sector. These types of decisions could potentially have positive ripple effects both nationally and locally, which may also have a positive impact on developments in rural areas and contribute to geographical distribution.

Continued long-term State ownership in large and internationally leading companies that are headquartered in Norway can contribute to maintaining and further developing resourceful expert and technology groups in Norway that are of importance to the transition to a low-emission society.

The location of a head office often has a historical context, and it is rare for a head office to be relocated. However, changes in ownership and mergers are important driving forces when concerning head office changes. Retaining state ownership in certain companies may therefore be appropriate for helping to ensure that head offices remain in Norway. The extent to which the Norwegian economy is affected by individual companies having head office functions in Norway is uncertain. If the consequence of state ownership is that the company will not be organised in the most rational possible manner, this may reduce the value of the company. However, for companies where the State’s rationale for ownership is to retain a Norwegian head office, it is assumed that head office functions in Norway have positive effects for the Norwegian economy.

4.1.2 Civil protection and emergency preparedness

Norwegian defence industry capacity in certain technological areas of expertise is vital for developing defence material adapted to Norwegian conditions. Having an adequate defence industry capacity reduces undesirable dependence on other nations and their defence industries. A competent defence industry means that Norway is also able to supply technology and solutions that meet the needs of our allies.

In recent years, social development and the geopolitical situation have contributed to an increased focus on emergency preparedness, for example, food production and emergency storage of infection control equipment, vaccines, medicines and grain. There is also greater focus on securing critical input factors, production, services and infrastructure.

Regulation is the primary policy instrument used for safeguarding considerations relating to national security, civil protection and emergency preparedness. Examples of such regulation are the Business and Industry Preparedness Act, the Power Contingency Regulations, the Security Act and the Electronic Communications Act. State transfers to manufacturers, contracts with private actors or other forms of cooperation with business actors that are administered and managed through the respective sector ministries are examples of other policy instruments.

In special cases, the State may consider it necessary to prevent undesirable interests from obtaining access to information, influence or control over companies that are of importance to national security, civil protection or emergency preparedness. This can be achieved by, among other things, making the companies subject to the Security Act or by owning a specific stake in certain companies.

4.1.3 Energy and natural resources

Norway has significant energy and natural resources. Natural resources are largely localised and normally subject to government regulation. Therefore, irrespective of ownership, the State will have some control over the resources and has various means of regulating the management of these resources. As a general rule, revenues that the community receives from energy and natural resources are collected through the tax system. Auctions are also used in some areas. State ownership is also used to collect a larger share of the revenues from energy and natural resources for the community and for greater control over these resources, with a view towards long-term development in the best interests of the country.

4.1.4 Facilitating sustainable restructuring and increased value creation

There may be a number of barriers and market failures that hinder restructuring and value creation in the Norwegian economy. Examples of this may be insufficient research and innovation, few high-growth start-ups and early-stage companies, the need for a transition to sustainable value creation, a lack of investment expertise and capital market failure. Some of these can be counteracted with direct state involvement through various measures, for example, grants, advice, provision of infrastructure and investment instruments. In some instances, state ownership may be the most appropriate measure. Rural areas may, more so than in central areas, experience barriers and market failures that hinder restructuring and value creation. The State can, both through adapted policy instruments and ownership, contribute to counteracting these types of barriers and market failures, and in so doing, contribute to value creation and ripple effects throughout all of Norway.

4.1.5 Infrastructure, monopolies and assigned rights

Contributing to good national infrastructure is a key task of the public sector. State ownership can enable the socio-economically profitable development and operation of infrastructure.

Parts of infrastructure and services are often natural monopolies or have features of monopolies. Monopolistic infrastructure includes, for example, roads, railways, airports, power grids and various forms of physical and digital networks. Infrastructure, monopolies or monopolistic activities will normally only form part of, or parts of, a value chain.

Socially justified monopolies have also been established to limit the availability and consumption of certain products, such as alcoholic beverages and gambling.

The regulation of monopolies can contribute to a better supply of goods and services to society. It can be difficult to adequately regulate private monopolies, and it may therefore be appropriate in some instances for the State to own these forms of businesses.

In order to safeguard various social considerations in certain sectors, the State has granted rights to companies through legislation, agreements, licences or letters of assignment. Some companies with these rights are natural monopolies, have monopolistic features and/or operate in markets that do not function in an optimal manner. These companies can exercise considerable market power, and state ownership may be appropriate in some cases as a supplement to regulation.

4.1.6 Public goods and/or social and geographical distribution

In some cases, the social benefit may be increased by the State contributing to activities or a broader supply of goods and services than would have occurred in a free market. For example, this applies to healthcare, research, culture and aid/development. These types of goods and services often have the feature of being public goods for which social and geographical distribution are desirable; moreover, they have positive ripple effects beyond the individual.

The most important state initiative for contributing to the better supply and distribution of public goods is through publicly financed measures such as grant schemes, state purchases or other appropriations via the national budget. It is often appropriate for activities that are wholly, or to a large extent, financed by the State, to be organised in the form of a government agency or, if relevant, as a company owned by the State.

4.2 Different rationales mean different ownership interests

The State’s rationale for its ownership is fulfilled by the State owning a specific percentage of the company, often through provisions in the articles of association. For each of the companies, the State considers what ownership interest is appropriate for fulfilling the State’s rationale for ownership.

Maintaining head office functions in Norway usually requires the State to own more than one-third of the company. This gives the State negative control of the company’s articles of association, including the location of the head office.20

State ownership based on civil protection and emergency preparedness normally suggests that the State should own more than half the company. This helps to prevent outside interests from acquiring majority shareholding or gaining influencing through positions on the board.

In many instances, the considerations constituting the rationale for state ownership suggest a need to have provisions pertaining to the company’s activities in the articles of association without needing to take into account the support of other shareholders. In such cases, it is expedient that the company is wholly-owned by the State.

In all the cases mentioned above, special circumstances can make other ownership interests relevant.

If the State changes the rationale for the ownership in a company, it may necessitate a change in the State’s ownership interest so that the ownership interest is appropriate for fulfilling the rationale. Changes in the rationale may also necessitate amendments to the company’s articles of association.

4.3 Organising State tasks in companies

The performance of state tasks can be organised as part of the public administration, and then often as a government agency, or as an independent legal entity, typically a form of company, cf. Figure 4.2. The choice of organisation may be linked to how closely the State wishes to manage the activities.

When the State uses the company form of organisation as a policy instrument, it entails a different set of framework conditions for the management than if the tasks were performed by a government agency. A government agency makes decisions on behalf of the State, and based on the minister’s authority. In principle, the minister has direct constitutional and parliamentary responsibility for all decisions that are made by a government agency. An independent legal entity, on the other hand, has the authority to make decisions in its own name and at its own risk. The relationship between the State as owner and a company follows from the legislation governing the applicable corporate form. The different corporate forms used for state ownership and the legal framework conditions that apply to these are described in Chapter 9.2.21

There are also other ways in which companies differ from government agencies. One difference is that the companies’ revenues normally come from the sale of goods or services in a market, while most government agencies generally have these expenses covered by appropriations via the national budget. When a company receives revenues from the State, the arrangement between the State and the company is either organised as a contractual relationship or in the form of an assignment that the State orders from the company, and not as a relationship between a superior and a subordinate government agency. Another difference is that a company must have its own capital base, equity and, if relevant, external financing (loans) to finance the company’s assets. Ordinary government agencies do not have equity.22 Furthermore, a company can normally become insolvent23, which is not something that is applicable for government agencies, since they are part of the State.

One consequence of organising activities as a company is a greater distance between the company’s activities and the State. The need for detailed political control of an enterprise therefore warrants the use of government agencies.

As a result of reduced control, organisation in a company can also allow the activities to have greater operational, strategic and financial independence than in a government agency. For that reason, several reforms have resulted in the establishment of new companies. One example is the establishment of the regional health authorities.

The need for professional independence from political control may also be an argument in favour of the enterprise taking the form of a company. In light of this, several enterprises engaged in cultural and asset management are organised as companies, including a number of dramatic art companies and the Norwegian Broadcasting Corporation (Norsk rikskringkasting – NRK). The corporate form restricts access to political control, which may be desirable in order to clarify that decisions of a professional, editorial or artistic nature are independent. Professional independence can also be desirable for enterprises that administer grants or support schemes and that engage in research and development. In these instances, formal independence may discourage (the perception of) inappropriate political handling or interference. One method of doing this is to establish a company, which is something the State has done in the case of, for example, the Enova and Simula Research Laboratory. Professional independence can also be achieved through other forms of organisation. For example, for a period during the 1990s, NRK was organised as a foundation. Another alternative is to continue to allow the activity to be performed by a government agency, but to enshrine independence on certain matters into law, which is a solution used for, among others, the university and university college sector.

The company form of organisation is also used for activities with exclusive rights to sell to customers. A company can more flexibly adapt its activities to, among other things, customer needs, however without the requirement of generating a return. This applies to, for example, Vinmonopolet and Norsk Tipping, both of which have an exclusive right to sell products that are subject to restrictions based on public health considerations. The latter consideration is achieved in part through taxes and marketing restrictions; however, the State also owns the companies to avoid the desire of private actors to make a profit from stimulating increased sales.

The company form of organisation may also be expedient if the business involves an element of market-oriented activities, for example, due to it investing in commercial markets or offering products in a market in competition with others. In such instances, the rules governing state aid in the EEA Agreement will normally provide guidelines for the financing of this part of the activities, cf. Chapter 9.4.

Furthermore, the desire to limit the State’s liability can be an additional consideration when the State organises an activity as an independent legal entity. By choosing the company form of organisation, the State is, in principle, only liable for the capital invested in the company.

4.4 Other potential benefits and challenges for the State as owner

Chapter 4.1 lists the instances in which state ownership may be an appropriate measure. The interaction between an adaptable, innovative and competitive business sector and an actively participating state is a characteristic of the Norwegian social model. Norway has had more success than many other countries where the state has a more hands-off approach.

As a long-term and financially strong owner, the State can make a significant contribution towards strengthening long-term ownership in Norway. The State can, both alone or together with other long-term owners, contribute to ownership stability and work to develop Norwegian companies and expertise in Norway over time. State ownership must be managed in an active and professional manner, whereby a long-term perspective, predictability and responsibility are the characteristics of the State’s exercise of ownership. When state ownership is exercised in a professional and competent manner, the State can be a good, long-term and value-creating owner.

State ownership is significant and the State’s rationale for ownership is not purely motivated by interests relating to asset management or savings. This can also bring with it potential challenges. To avoid possible challenges relating to this, the State has gradually become more professional in how it exercises ownership, and the Norwegian State’s exercise of ownership has garnered international recognition.24

The following is an overview of possible challenges associated with state ownership. The State places an emphasis on managing these challenges as best as possible by exercising good and professional ownership, cf. Part III of the white paper.

More roles and considerations that do not promote the State’s goal as owner

The State has various roles that allow for potential conflicts between these roles25, and uncertainty may arise as to whether the State’s other functions are exercised with the aim of providing benefits to its own companies. The State has many goals and tasks through the different roles that it plays, and often has to strike a balance between conflicting interests when implementing policies. Active exercise of ownership based on political guidelines that do not promote the State’s goal as an owner can lead to misallocation of resources in the company, inefficient operations and weakened competition, and thereby impair goal attainment and destroy value. It can also contribute to reducing confidence in the Norwegian capital market, where the State is a major player through its ownership interest.

To avoid such conflicts between roles, the State distinguishes between its role as an owner and other roles that govern the company’s activities. Since the late 1990s, management of the State’s ownership in the companies has gradually been strengthened, and companies that primarily operate in competition with others have largely been concentrated in the Central Ownership Unit at the Ministry of Trade, Industry and Fisheries. This has helped to reduce the risk and suspicion of conflicting roles and management of the companies according to goals other than the State’s goal as owner through its ownership. A clear understanding of roles and a high level of awareness in the ministries regarding the State’s different roles are essential, and the exercise of ownership must continue to be organised to avoid conflicting roles and ensure that the State’s goal as the owner is the guiding principle.

At the same time, through its other roles such as policy maker and administrative authority, the State exercises potentially great power over citizens. Substantial state ownership increases the risk of concentration of power in the hands of the State at the expense of ordinary citizens.

Prerequisites for exercising value-creating ownership

Most private owners with large ownership interests take an active role through positions on the board. As a major owner, the State has significant influence over the election of board members, expresses clear expectations of the companies and follows up the companies through the owner dialogue and general meeting. However, based on its different roles and in order to avoid political interference in and responsibility for the company’s decisions, the State has opted not to be represented on the companies’ boards.

The absence of active ownership can result in management-controlled companies that prioritise considerations other than the interests of the owner.

Traditional literature on ownership discusses theories on the challenges associated with delegating responsibility from the owners to the board and management.26 This is based on what is known as the principal–agent problem. The problem arises when an agent, for example the board and management, manages assets and makes decisions on behalf of a principal (the owner), but the interests of the actors differ and the agent possesses relevant information that the principal does not have. This can be intensified in connection with state ownership as a result of the distance between the real owner (the people), the party exercising ownership (the ministries) and the company’s board and management. The State’s ownership policy and exercise of ownership seek to counteract principal-agent problems through, cf. among other things, clarity regarding the State’s goals as an owner, the State’s expectations of the companies and their follow-up, as well as the State’s guidelines for executive remuneration.

Access to external capital

A company’s assets are normally financed through a combination of equity and debt. When a company raises capital from the markets, the price of capital will reflect the investors’ and lenders’ assessment of the company’s future outlook and risk. The capital market thereby contributes to ensuring that the capital is allocated where it yields the highest return in relation to the risk.

It is unfortunate if lenders have an expectation that the State as owner will implicitly guarantee the companies and infuse new capital if the companies default on their loans. Companies with state ownership will then incur lower financing costs than would otherwise have been the case, which may lead to resources being diverted away from companies and sectors where these would have contributed to greater returns. The State is therefore clear that it is only liable for the capital invested in the company to the same extent as any other owner.

For companies that do not primarily operate in competition with others and that perform tasks that are of critical importance to society, it can sometimes be potentially challenging to establish full credibility for the claim that the State will allow creditors to seize control of the company’s assets if the company experiences payment difficulties. If, as a result of this, the market prices loans to these companies at a lower cost, this may adversely affect the investments made in the company. This could mean that projects which would not be considered profitable with financing at market costs will nonetheless be realised. The companies can then expand their activities without this necessarily being socio-economically profitable. The State has chosen to impose lending restrictions on several companies, cf. Chapter 12.4.

5 The State’s goal as owner

The State is a responsible and active owner with a long-term perspective. The State places emphasis on ensuring that public assets are managed in a way that contributes to generating a return and inspires confidence among the general public.

When assessing the companies’ goal attainment, owners and other stakeholders are now more focussed than they were before on how the companies create value. It is important for the State that the company is managed responsibly, which entails acting in an ethical manner and identifying and managing the company’s impact on people, society and the environment. A company will generally not be able to generate returns and remain competitive over time without balancing economic, social and environmental factors.

5.1 The highest possible return over time in a sustainable manner

The State’s goal as owner in the companies that primarily operate in competition with others is the highest possible return over time in a sustainable manner. The State’s goal shall be attained in accordance with the provisions stipulated in the articles of association.27

Highest possible means that the return must be maximised by the company seeking to generate the highest possible value from the equity. The goal of maximising returns is a prerequisite for good resource allocation in each of the companies. In principle, a company cannot create value and remain competitive if its ownership and operation are not based on the goal of the highest possible return over time within an acceptable level of risk. It is the company’s total return, including dividends, that forms the basis for assessing goal attainment.

Over time means that the State is an owner with a long-term perspective and assesses the companies’ goal attainment in the short and long term.

In a sustainable manner presupposes that the companies balance economic, social and environmental factors in a manner that contributes to the highest possible return over time without reducing the ability of future generations to meet their own needs.

5.2 Sustainable and most efficient possible attainment of public policy goals

The State’s goal as owner in the companies that do not primarily operate in competition with others is sustainable and the most efficient possible attainment of public policy goals. The State’s public policy goals vary between the companies, and are specified in Chapter 7.2. For all companies, the goal has to be attained in a sustainable manner and as efficiently as possible.

Sustainable presupposes that the companies balance economic, social and environmental factors in a manner that contributes to long-term goal attainment without reducing the ability of future generations to meet their own needs.

The most efficient possible attainment of public policy goals means that resources are allocated to activities that result in both the highest possible public policy goal attainment and that the activities are carried out as cost-effectively as possible. For example, this can entail that the company works to achieve the highest possible goal attainment with the available resources, or delivers on a given goal with as few resources as possible within an acceptable risk.

Clearly defined goals are generally a prerequisite for good resource allocation in each of the companies. For most companies, it will be relevant that the public policy goal can be maximised.

For the wholly-owned companies, the State’s rationale for ownership and the State’s public policy goal as an owner will normally be reflected in the provision stipulating the companies’ activities (object) and any other provisions in the companies’ articles of association.28 In the partly-owned companies, the State cooperates with other shareholders on the drafting of the company’s articles of association. The State’s rationale for ownership is fulfilled by the State owning a certain percentage of the company, and usually through provisions in the company’s articles of association.

Some of the companies may also engage in activities that are in competition with others. For these activities, the State normally has the goal of the highest possible return over time in a sustainable manner.29 The rules relating to state aid also set limits for this.30 See also chapter 9.6 regarding special framework conditions for companies that perform assignments for the State

5.3 Categorisation of companies with state ownership

Since 2006, the companies in the State’s portfolio have been categorised based on the State’s goal as owner and partly based on the rationale for ownership. In this white paper, the companies have been placed into two categories based on the State’s goal as owner.31 The companies in the present Category 1 were previously divided into two categories based on whether or not the State had a special rationale for its ownership. The Government does not consider it appropriate to categorise the companies in this manner, because the most important aspect when categorising the companies is clarity regarding the State’s goal as an owner of the companies. This simplification in the categorisation of the companies does not entail changes to the State’s exercise of ownership.

Category 1 – Goal of the highest possible return over time in a sustainable manner

This category comprises the companies for which the State’s goal as owner is the highest possible return over time in a sustainable manner. The companies in this category primarily operate in competition with others. The State’s rationale for ownership in each company is presented in Chapter 7.1 and fulfilled by the State owning a certain percentage of the company, and potentially through provisions in the articles of association.

Category 2 – Goal of sustainable and the most efficient possible attainment of public policy goals

This category comprises the companies where the State’s goal is sustainable and the most efficient possible attainment of public policy goals. The companies in this category do not primarily operate in competition with others. The State’s rationale for ownership and the State’s goal as owner in each company are presented in Chapter 7.2 and fulfilled by the State owning a certain percentage of the company, most often through provisions in the articles of association.

Some of the companies in Category 2 may also engage in some activities in which they operate in competition with others. In such cases, the State’s goal is normally the highest possible return over time in a sustainable manner for this limited part of the company’s activities, cf. Chapter 5.2

5.4 Why the State is an owner and the State’s goal as owner are regularly assessed32

Regular assessments of why the State is an owner and the State’s goal as owner in each company contribute to ensuring that the ownership is up-to-date and relevant, and enable the State to effectively address different needs. Such an assessment is carried out for all of the companies in the State’s portfolio in connection with each white paper on ownership policy. The Government normally presents a white paper on ownership policy to the Storting during each parliamentary term. The State’s ownership in individual companies can also be assessed in other contexts as required.

The normal starting point for the assessments is the needs that the State must safeguard and whether state ownership is an appropriate measure, cf. Chapter 4. These assessments, and whether or not the company primarily operates in competition with others, determine what goal the State as owner should have and what constitutes an appropriate ownership interest. As a starting point, the above assessments are also made if the State is considering establishing a new company.33

Companies that primarily operate in competition with others

For companies that primarily operate in competition with others, the State considers whether changes should be made to the State’s rationale for ownership in the company, or potentially whether the ownership interest should be changed. There is also an assessment of whether the State’s needs can be met more effectively by using other measures.

Any changes to the rationale for state ownership will usually take place over time, for example, as a result of developments and competition in a market. It may therefore be applicable to reduce or increase state ownership in existing and new companies.

The companies that do not primarily operate in competition with others

For companies that primarily do not operate in competition with others, the State considers whether there is still a need for a state measure in this area. The State also assesses whether it is still appropriate to have a company rather than organise the enterprise as a government agency, or alternatively whether, for example, regulation, subsidies, taxes, public purchases of goods and services, either alone or in combination, are more suitable measures.

Footnotes

Proposition No. 113 (1971–72) to the Storting: On the establishment of the Norwegian Petroleum Directorate and a state-owned oil company, etc.

Norwegian Official Report (NOU) 1989: 5 A better organised State.

Norwegian Official Report (NOU) 1989: 5 A better organised State.

Proposition No. 113 (1987–88) Relating to Rana and Norsk Jernverk AS.

Report to the Storting No. 22 (2001–2002) Reduced and Improved State Ownership.

See the Government’s website on state ownership for an overview of changes in the State’s ownership interests, including companies established after 2000.

Proposition 118 S (2017–2018) Adjustments to the national budget for 2018 under the Ministry of Trade, Industry and Fisheries (Kongsberg Gruppen ASA – the State’s participation in the rights issue.

Report to the Storting (White Paper) No. 14 (2020–2021) Long-term Perspectives on the Norwegian Economy 2021.

Report to the Storting (White Paper) No. 14 (2020–2021) Long-term Perspectives on the Norwegian Economy 2021.

Including personal owners’ share of retained earnings in private companies, the value of housing services and capital gains on real estate and securities (Statistics Norway Report 2021/33 – Economic inequality in Norway in the twenty-first century).

Statistics Norway Report 2021/33 – Economic inequality in Norway in the twenty-first century.

Report to the Storting (White Paper) No. 14 (2020–2021) Long-term Perspectives on the Norwegian Economy 2021.

OECD 2015: In It Together: Why Less Inequality Benefits All.

Climate risk and the Government Pension Fund Global – Managing risks associated with climate change and the green transition (Report from an expert group appointed by the Ministry of Finance).

Global Assessment Report on Biodiversity and Ecosystem Services (IPBES Secretariat).

The Convention on Biological Diversity (cbd.int).

Act relating to enterprises’ transparency and work on fundamental human rights and decent working conditions (Transparency Act).

Report to the Storting (White Paper) No. 14 (2020–2021) Long-term Perspectives on the Norwegian Economy 2021.

Report to the Storting (White Paper) No. 12 (2021–2022) Financial Market Report 2022.

The current Limited Liability Companies Act does not require limited companies to specify in their articles of association where the head office is located. This was previously a statutory requirement in the Limited Liability Companies Act.

In official statistics, some of the companies are classified as part of the public administration. Statistics Norway classifies the companies’ sector affiliation based on multiple criteria, including whether a material part of the company’s revenues stem directly from appropriations via the national budget. This applies to, for example, the regional health authorities, Nye Veier and the theatres. The companies are nonetheless independent legal entities.

The accounts of government agencies whose financial statements are based on the central government’s accounting standards will present a balance sheet that formally includes an equity element (the State’s capital). Among other things, the purpose of presenting a balance sheet is to provide better information and a better overview and management of large investments.

The exception is the regional health authorities, where the owner has unlimited liability for the company’s obligations, see Section 7 of Act No. 93 of 15 June 2011 relating to health authorities and health trusts, etc., and Petoro, where the State is directly liable for any obligation incurred by the company, and where insolvency and debt settlement proceedings cannot be instituted against the company, see Section 11-3 of Act No. 72 of 29 November 1996 relating to petroleum activities.

See, for example, OECD (2018): Economic Surveys: Norway 2018.

The State is responsible for regulating markets, and may also be a major purchaser while also owning companies that operate in the market. The State can also be responsible for awarding licences and for making various individual decisions that determine what a company can and cannot do.

The board is responsible for managing the company in accordance with the interests of the company, within the framework of the law and decision by the general meeting. The interests of the company concern what is best for the company as an independent legal entity in the short and long term, cf. Proposition 135 L (2018–2019) pages 94–95. The interests of the company usually align with the interests of the shareholders.

See Chapters 5.4 and 9.3.4.

For special legislation companies, the company’s activities (object) are also defined in statutes.

When the State acts as a market operator, it is obligated to act in accordance with the «market economy operator principle» in EEA law. In instances when this is appropriate and in line with EEA legislation, the State may have goals other than the highest possible return over time in a sustainable manner for these types of financial activities.