2 The role and responsibilities of the authorities

Figure 2.1

The Norwegian authorities play an important role as owner, investor and procurer. The public administration and other public authorities have a substantial ownership interest in the Norwegian private sector through publicly-owned companies and through ownership interests in listed companies. Norwegian companies abroad are often equated with Norway, particularly those in which the state has an ownership interest. These companies must therefore be expected and required to observe particularly high standards for social responsibility.

Through the Government Pension Fund – Global, the Norwegian state manages substantial assets on behalf of present and future generations. It is essential that these funds are managed in an ethically responsible manner.

As a purchaser, the Government can influence the private sector by setting requirements for its suppliers.

The authorities stipulate the framework conditions for companies’ activities by adopting and implementing national legislation, regulations and guidelines. Examples of this are regulations and requirements relating to the health, safety and environment (HSE) field and to the natural environment. The authorities can also use positive incentives to stimulate innovation in the private sector and thereby produce new or better solutions to social challenges.

The framework for corporate social responsibility (CSR) is determined through international cooperation at governmental level. This applies, for example, to agreements and conventions concerning human rights, labour standards, the environment, sustainable resource management, taxation, corruption and trade. The Government’s role is primarily to enter into international agreements, incorporate international provisions into Norwegian legislation, and to follow up and enforce the requirements. At the same time, however, international cooperation at governmental level has insufficient tools at its disposal to ensure that rights established by law or agreement are respected in all sovereign states at all times. CSR is therefore both important and necessary.

Through bilateral cooperation, the Norwegian authorities seek to promote CSR in partner countries. The Norwegian authorities can raise matters with the authorities of other countries at a political level and through dialogue and cooperation that it would not be natural or possible for an individual company to engage in. For example, Norway cooperates with countries such as Brazil and China on environmental issues, and it conducts human rights dialogues with China, Indonesia and Vietnam. International cooperation and international initiatives and measures are discussed in more detail in Chapters 6 and 7.

The authorities can contribute to information sharing and competence-building in the CSR context in cooperation with other actors. Public agencies and state investment funds must base their engagement on high environmental and social standards, cf. Chapter 9. This applies, for instance, to Innovation Norway, the Norwegian Agency for Development Cooperation (Norad), the Norwegian Investment Fund for Developing Countries (Norfund), the Norwegian Guarantee Institute for Export Credits (GIEK), Eksportfinans ASA, the Research Council of Norway, the Industrial Development Corporation of Norway (SIVA) and Investinor.

The public administration is also responsible for maintaining high ethical and environmental standards in its own activities. This is reflected, for example, in the Platform for Leadership in the Civil Service and the ethical guidelines for civil servants.

2.1 The state’s role as owner

The Norwegian state has a direct ownership interest in a large number of Norwegian enterprises. The state has a major ownership interest in Norway’s largest listed companies, in addition to a number of wholly state-owned companies in Norway that have been established for sector-specific policy purposes, such as Vinmonopolet (the Norwegian wine and spirits monopoly), the airport operator Avinor and the Norwegian Broadcasting Corporation. Others have purely commercial objectives.

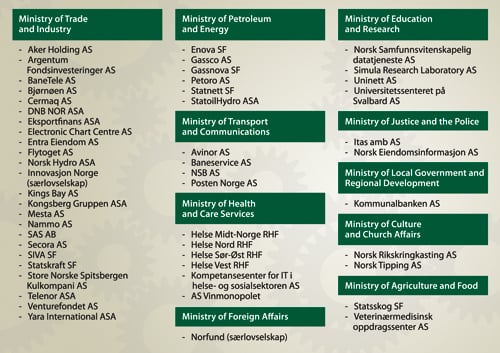

Figure 2.2 Companies broken down by the ministry responsible for their administration

Source The Government’s Ownership Policy (2008)

The state has acquired ownership interests in such companies for a number of different reasons. Some companies are the result of a decision to hive off state production or service functions into separate companies. In certain cases, private parties have been brought in as co-owners through the sale of shares, the issuing of new shares and/or listing on the stock exchange. The purpose of transforming state enterprises into commercial companies and opening up for private ownership has, among other things, been to increase efficiency and acquire capital and expertise. Kongsberg Gruppen, Telenor, StatoilHydro and Cermaq are examples of previously wholly state-owned companies that have been partially privatised. In other cases, the state has acquired ownership interests in companies that were previously privately owned, for example in connection with a post-war settlement (Norsk Hydro) or as the result of a crisis (DnB NOR).

2.1.1 Framework for the management of state ownership

When the state hives off enterprises as private limited companies, public limited companies or state-owned enterprises, they are no longer part of the public administration. This means that the state cannot manage these enterprises by administrative decision. There is a clear division of roles between shareholders and company management in limited companies and in the other organisational forms used for state-owned companies.

According to section 6–12 of the Public Limited Companies Act and corresponding provisions in other company legislation, the board of directors and the general manager are responsible for the management of a company. This means that any decisions concerning the commercial management of the company and responsibility for day-to-day operations are to be made by the company’s management.

According to company legislation, the state as owner is responsible for follow-up and control of companies at a general level. The board of directors has a particular responsibility for ensuring that the company is organised in an appropriate manner and for ensuring that the company’s assets are managed responsibly and in accordance with the company’s and shareholders’ interests. One of the reasons why certain activities are hived off into separate companies, and why the division of roles between shareholders, the board and the general manager laid down in company legislation is followed, is to ensure that the minister concerned cannot be held accountable for the company’s business decisions.

In Recommendation S. No. 91 (1969–70), the Storting set out guidelines, which have since been followed, for appointing senior officials and civil servants to boards of state-owned companies. According to the guidelines, no senior official or civil servant who, within his or her area of responsibility, has regulatory or supervisory authority over a company, or who deals with matters of material importance to the company, may be appointed or nominated as a member of the board of that company. As worded, this provision covers more than just companies in which the state has ownership interests. The purpose is to prevent any conflict of interest or problems relating to regulatory authority and to ensure that confidence in decisions made by the public administration is not undermined. Another important purpose is to ensure that the minister in question cannot be held accountable for a company’s decisions, which could be the case if ministry employees are members of a company’s governing body.

The requirement regarding equal treatment of shareholders limits the possibility of exchanging information between the company and the ministry in the case of listed companies. This does not, however, prevent the ministry from raising matters of general public interest in the ownership dialogue between the state and the company, on a par with other shareholders. Given its substantial ownership interests in Norwegian listed companies, it is important that the state conducts itself as and is perceived to be a predictable and professional owner.

The current framework for the Norwegian state’s exercise of ownership rights is set out in Report No. 13 (2006–2007) to the Storting, An Active and Long-Term State Ownership. Following the Storting’s consideration of this white paper, the Ministry of Trade and Industry summed up the main framework for the state’s exercise of ownership rights in the document The Government’s Ownership Policy. This document was last revised in September 2008.

2.1.2 Principles for state ownership

It has been important to draw a clear distinction between the state’s exercise of authority, sector policy and the administration of ownership. Endeavours are made to assign ownership of companies that operate on a purely commercial basis to an entity in one of the ministries that does not have sector responsibility or competence. The Ownership Department at the Ministry of Trade and Industry was established in 2001 in order to attend to this task. Other ministries also administer ownership interests in commercial companies.

The state has adopted its own principles for good ownership, which were approved by the Storting in connection with its consideration of the white paper on state ownership. The principles apply to all state enterprises, both wholly and partially owned. They are also reproduced in the Government’s ownership policy document for 2007 and 2008.

The state’s principles for good ownership are:

Shareholders shall be treated equally.

There shall be transparency in relation to the state’s ownership of the companies.

Decisions and resolutions by the owner shall be made/passed at the general meeting.

The state will, if applicable together with other owners, set performance objectives for the companies; the board of directors is responsible for the objectives being attained.

The capital structure of the companies shall be adapted to the objective of the ownership and the company’s situation.

The composition of boards of directors shall be characterised by competence, capacity and diversity based on the distinctive nature of each company.

Renumeration and incentive arrangements should be designed so that they promote value creation in the companies and are perceived as being reasonable.

On behalf of the owners, the board of directors shall have an independent control function vis-à-vis the company’s management.

The board should have a plan for its work and should work actively on building its own competence. The board’s work shall be evaluated.

The company shall be conscious of its social responsibilities.

2.1.3 Social responsibility in companies in which the state has an ownership interest

The Government expects enterprises in which the state has ownership interests to actively follow up social responsibility in their activities. In its report (NOU 2004:7), the Committee on State Ownership concluded that companies in which the state has ownership interests should take the lead in exercising social responsibility. The committee also pointed out that the state’s legitimacy could be weakened, for example as legislator and in matters concerning foreign policy, if, in its role as owner, it failed to comply with high standards in this area. The Government endorsed this view in the white paper on state ownership and followed it up in The Government’s Ownership Policy. The ownership policy document describes the importance of demonstrating corporate social responsibility as follows:

«The state’s long-term objectives for the state’s ownership mean that the companies’ boards of directors must take due account of considerations such as a good environment, restructuring, diversity, ethics and research and development in order to promote development in the long term. Displaying active social responsibility means combining financial and ethical considerations in all areas of operation, ranging from a company’s choice of partners to its investment in, for example, employees’ working conditions, locally and globally. Socially responsible management of companies means that companies must endeavour to demonstrate a consistently good practice towards all its stakeholders. Work on social responsibility is not, and should not be seen as, a distinct element unrelated to business strategy and business development.»

In the white paper on state ownership, the Government clarified its expectations of companies in relation to social responsibility in nine areas referred to as sector-independent considerations.

These are considerations that the Government expects companies to take into account in their assessments and that are intended to promote companies’ long-term rate of return and industrial development. Specifically, the following expectations of companies are set out in the white paper on state ownership:

Health, safety and the working environment (HSE): HSE work must also cover companies’ international operations. Cooperation with employees and their organisations must be in place when a company operates in other countries.

The environment: The companies’ work on environmental issues must extend to the enterprise’s entire value chain. Product development, production, distribution and the subsequent use of the company’s products must be adapted to long-term responsible social development with the least possible environmental impact.

Ethics: The companies are expected to have adopted corporate vales and ethical guidelines. In formulating ethical guidelines for their operations, the companies should, among other things, consider the factors on which the Government Pension Fund – Global’s ethical guidelines are based. Such ethical guidelines should be in line with the UN Global Compact and the OECD’s Guidelines for Multinational Enterprises. The guidelines should also be in accordance with the OECD’s Guidelines for Corporate Governance.

Combating corruption: Greater transparency can prevent wrong and ethically dubious decisions. Companies should therefore be open about dilemmas relating to corruption, conflicts of interest and impartiality.

Civil protection: As is the case for private enterprises, companies in which the state has an ownership interest are obliged to protect their own operations, employees and the surrounding environment against accidents.

Gender equality: Open and genuine competition for positions in society promotes both justice and economic efficiency. The Government believes that failure to make better use of the competence and capacity women can bring to companies and society as a whole represents squandering and poor management of society’s resources.

Restructuring: As owner, the state expects companies to take a long-term view and act responsibly in connection with restructuring processes.

Research, development and competence-building: Business and industry should be ambitious with respect to research and development. The Government expects companies in which it has a major ownership interest to have a strategy for increased research and development.

Integration and career opportunities for other groups: The Government is concerned that Norwegian companies should be proactive in their attitude to the recruitment of personnel from minority backgrounds, qualified seniors and people with functional impairments. The companies should also emphasise knowledge of other countries’ cultures in their recruitment policies.

The state’s attitude to social responsibility in companies in which it has ownership interests is expressed in the form of general, sector-independent expectations rather absolute requirements. It is the task of each company’s board of directors and management to adopt guidelines for its operations. Different areas are important for different companies and must be addressed accordingly.

It is fundamental that the state’s expectations in these areas are, in principle, general. As an owner, the state cannot take responsibility for individual companies’ guidelines at a detailed level. That is the companies’ responsibility. On this basis, the state will conduct dialogues with companies about how they deal with these considerations. It is not expedient for the state as owner to consider or approve guidelines and plans. That would entail the state taking on a responsibility that must rest with the board of directors and management. The owner’s responsibility is primarily to follow up and ensure that the company takes these considerations seriously and, if necessary, help to change the composition of the board in companies that do not pay proper attention to corporate social responsibility. In the white paper on state ownership, the Government emphasised that it is the board of directors’ responsibility to strike a balance between the different considerations that are in the collective interests of the shareholders.

The Government is currently mapping companies’ performance in relation to its expectations regarding social responsibility. Companies have been requested to provide information about their work on cross-cutting considerations, cf. Box 2.1. Initially, this applies to companies where state ownership is administered by the Ministry of Trade and Industry, which held meetings with the companies concerned in spring 2008. Other ministries have also held meetings on social responsibility with companies in which they have ownership interests.

Textbox 2.1 Follow-up of CSR in enterprises in which the state has an ownership interest

Companies are requested to provide information about their work on cross-cutting considerations, including the following:

Measures initiated by the companies with a view to promoting cross-cutting considerations

Activities in this connection that the companies define as important to their operations, and how they are followed up

The companies’ ethical guidelines and how they are rooted and implemented in the organisation as a whole

How cross-cutting considerations are dealt with in relation to suppliers, partners and customers

The companies’ procedures for handling any difficult ethical issues

The companies’ whistle-blowing procedures.

On the basis of the information gathered and the experience gained through dialogue with these companies, the Ministry of Trade and Industry will make recommendations for further follow-up. The need for other measures will be considered in order to ensure that these companies demonstrate satisfactory social responsibility. Experience so far is that most of the companies are doing a great deal of good work in these areas and that they have devoted more attention to these issues in recent years:

The vast majority of companies in which the state has ownership interests have now adopted ethical guidelines. The companies that have not done so will be followed up.

Most of the large companies in which the state has an ownership interest have chosen on their own initiative to report in accordance with the Global Reporting Initiative (GRI – cf. Chapter 6.3). This applies to Statkraft SF, KongsbergGruppen, DnB Nor, Telenor, Norsk Hydro, Yara, SAS and StatoilHydro among others.

Several companies are members of the UN Global Compact.

Many of the companies in which the state has interests issue separate sustainability reports or report specifically on CSR in their annual reports.

In its ownership policy document for 2008, the Government stated that there should be as much transparency as possible with respect to companies’ ethical guidelines and that it expects these guidelines to be published on the companies’ websites. Companies are also expected to provide information about financial matters, social responsibility, environmental issues and the results achieved. Large companies with international operations are urged to consider using the Global Reporting Initiative (GRI) reporting standard.

It may also be expedient for the companies’ boards of directors to consider having their reports quality assured by an independent body, for example the company’s auditor. This could also help to make this kind of control more common in privately-owned companies.

The Government

expects companies in which the state has an ownership interest to play a leading role in exercising social responsibility;

will conduct separate meetings on social responsibility once a year with the companies in which the state has an ownership interest;

will follow up issues of social responsibility at the regular meetings held with the companies;

urges companies to make their ethical guidelines publicly known, for example by publishing them on their websites;

urges large companies with international operations to use the Global Reporting Initiative reporting standard.

2.2 The state as an investor and investment manager

The Government Pension Fund belongs to the Norwegian people and future generations of Norwegian citizens. The prosperity enjoyed by the present population entails obligations. The assets in the Government Pension Fund – Global stem from oil and gas revenues. The oil and gas reserves will run out. Since these resources are limited, it would not be fair if this wealth were only to benefit the few generations that happen to be living at this time. These assets must be safeguarded for posterity. Ensuring good returns on the fund over time is an important way of securing the future of the welfare state.

As an investor, the state also shares the responsibility for how the companies in which the fund invests conduct themselves, what they produce and their impact on the local community. The Government places great emphasis on social responsibility in the management of the Government Pension Fund. This is an important criterion for the evaluation of the ethical guidelines for the Government Pension Fund – Global that is currently being conducted.

The Government Pension Fund – Global had assets of NOK 1 992 billion on 30 June 2008. On the same date, the Government Pension Fund – Norway had assets of NOK 113 billion. The Government Pension Fund thus had combined assets of NOK 2 105 billion.

Since the fund manages a large proportion of the assets belonging to Norwegian society, it is both important and necessary that the Norwegian people have confidence in its management. Trust and legitimacy are largely built on transparency about investments, results and the fund’s strategy.

2.2.1 The ethical guidelines for the Government Pension Fund

In 2004, the Ministry of Finance issued ethical guidelines for the Government Pension Fund – Global. In the same year, Folketrygdfondet’s board adopted ethical guidelines for the management of the Government Pension Fund – Norway. The guidelines for the two funds are largely based on a common ethical platform. At the same time, however, the instruments for integrating ethical considerations differ somewhat because of the difference in the size of the two funds, the differences in investment strategy and the different investment universes in which they operate.

There are two tools for achieving the goals set out in the ethical guidelines: the exercise of ownership rights and the exclusion of companies. Ownership rights are to be exercised in as many companies as possible with a view to securing good rates of return in the long-term by promoting sustainable development. Exclusion is a last resort to prevent the fund from being complicit in serious violations of ethical norms.

The Government has initiated an evaluation of the ethical guidelines for the Government Pension Fund – Global, which will be based on a broad consultation process. The result of the evaluation will be presented to the Storting in the annual report on the management of the Government Pension Fund in spring 2009.

The main objectives of the evaluation are to assess whether the guidelines have worked as intended, to ensure continued broad political support for the guidelines, and to solicit input that can help to strengthen the fund’s profile as a socially responsible investor.

In spring 2008, the Ministry of Finance sent a consultation document on the evaluation of the ethical guidelines to a broad selection of entities in Norway and abroad. Around 50 recipients have made comments. One of the questions raised by the consultation document is whether the fund’s current tools – the exercise of ownership rights and the exclusion of companies from the fund’s investment universe – should be changed or adjusted. It also raises the question of whether changes should be made in way these tools, which are currently handled by Norges Bank, and the Council on Ethics for the Government Pension Fund – Global, are coordinated. As announced in the white paper on the management of the Government Pension Fund in 2007 (Report No. 16 (2007–2008) to the Storting), the Ministry is examining whether a small part of the fund should be earmarked for investments in specific areas such as environmental technology or developing countries.

As part of the evaluation process, the Ministry of Finance held a large international conference in Oslo in January 2008 entitled «Investing for the Future» in cooperation with Norges Bank and the Council on Ethics for the Government Pension Fund – Global. The conference brought together representatives from the academic community, financial institutions, NGOs, companies and investors to discuss the challenges that arise for investors who seek to take considerations of good corporate governance and environmental and social factors into account in their investments.

2.2.2 Promoting social responsibility

The ethical guidelines for the Government Pension Fund – Global set out obligations concerning responsibility towards future generations of Norwegian citizens and co-responsibility for the people and the environments affected by the companies in which the fund invests worldwide. There are many problems that cannot be solved through the management of the fund, but that are best dealt with through foreign policy, development policy and environmental policy channels.

Increasing attention is being directed to investor responsibility in general, and to the ethical guidelines for the Government Pension Fund – Global in particular. This means that the ethical guidelines could have an effect over and above the work done through the Government Pension Fund. This may not have been intended, but it is nonetheless very positive. Raising awareness is a first important step in the direction of making investors and companies broadly accountable.

As a financial investor, it is natural to seek the best possible access to information about matters that can have a bearing on the short-term or long-term development of a company’s shares. Information about the environmental impact of a company’s operations may be relevant in that context. In 2008, Norges Bank became a signatory investor in the Carbon Disclosure Project (CDP), an independent organisation that collects and publishes information about companies’ greenhouse gas emissions, cf. Box 3.7. As a signatory, Norges Bank urges the companies it invests in to be transparent in their environmental reporting and to act as driving forces in the efforts to reduce emissions of greenhouse gases. Likewise, cooperation with other large pension funds worldwide can be an effective way of promoting social responsibility.

In November 2008, Norges Bank announced that the it is taking part in a campaign launched by 135 funds calling on rich countries to cut their greenhouse gas emissions by 25 % to 40 % per cent compared with 1990 by 2020, in accordance with the recommendations of the UN Intergovernmental Panel on Climate Change.

Norges Bank also takes part in other forms of cooperation and contact with other investors. Norges Bank participated in the formulation of the UN Principles for Responsible Investment (UNPRI), to which it is a signatory, cf. Chapter 3.

2.2.3 Exercise of ownership rights in the management of the Government Pension Fund

Responsibility for exercising ownership rights relating to the Government Pension Fund’s equity investments rests with Norges Bank and Folketrygdfondet. The overriding goal for the exercise of ownership is to safeguard the pension fund’s financial interests. The management of the fund is based on the assumption that good, long-term financial returns can only be achieved on the basis of sustainable development. This means that, in the long term, the Government Pension Fund will benefit from the companies respecting fundamental ethical principles and guidelines. This is in line with the basic idea enshrined in the UN Global Compact, the OECD Guidelines for Multinational Enterprises and the OECD Guidelines for Corporate Governance, cf. Chapter 6. In both funds, ownership is largely exercised on the basis of these international principles. Norges Bank and Folketrygdfondet will seek to ensure that the companies in which they have invested respect fundamental ethical norms.

Different investors work under different institutional frameworks, which, in turn, determines which methods and tools are best suited to dealing with ethical issues. In the management of the Government Pension Fund – Norway, the emphasis is largely on selecting sound companies and maintaining a close dialogue with these companies after investments have been made. This is possible because the fund has invested in a limited number of Norwegian companies, roughly 50, and because the fund’s ownership interests in – and thereby its ability to influence – individual companies are relatively large.

Exercising ownership rights of the Government Pension Fund – Global

Norges Bank has sought to identify a few specific priority areas. In exercising the fund’s ownership rights, Norges Bank assumes that it is better and more effective to concentrate on a few central issues than to do a little in all areas. It emphasises that these issues must be relevant to investors in general and the fund’s portfolio in particular, that it must be possible to enter into dialogue with the companies invested in and/or regulatory authorities on these issues, and that there is a real chance of exercising influence. It must also be possible to justify focusing on these issues in terms of financial considerations. These priority issues are:

good corporate governance with emphasis on the right to nominate and elect board members, the right to exercise voting rights, the right to trade its shares and to participate in decisions on anti-takeover mechanisms, and the right to open and timely information

children’s rights and health, including combating child labour, with the particular emphasis on the value chain of multinational companies

companies’ lobbying activities in connection with long-term environmental problems, including climate change.

Good corporate governance is important in order to secure the fund’s long-term rate of return, and it is essential for ensuring that the owners have close dialogue with and can exert a real influence on the companies invested in. It is also vital for work on social and environmental issues. It is natural, therefore, to view these factors in relation to each other. By the end of 2007, Norges Bank had established contact with around 18 companies on matters relating to good corporate governance.

Norges Bank has published the NBIM Investor Expectations on Children’s Rights in order to make its expectations as investor clear to companies. The document is aimed in particular at companies that operate in areas or sectors where there is a high risk of violations of children’s. By the end of 2007, Norges Bank had established contact with around 60 companies on matters relating to social conditions, with particular emphasis on child labour and children’s rights.

For a long-term investor such as Norges Bank, it is important that companies do not engage in lobbying to obstruct legislation that could substantially reduce greenhouse gas emissions. The Bank therefore seeks to ensure that companies in its portfolio that could be relevant in this context, for example in the energy and energy-intensive sectors, adopt strategies that are compatible with sustainable development. In 2007, Norges Bank analysed more than 100 companies in the fund’s portfolio in order to identify the companies that are lobbying most actively with regard to climate efforts. The bank has initiated contact with 20 companies and has held meetings with 15 of them. 1

Exercising ownership rights of the Government Pension Fund – Norway

The overriding goal of the Folketrygdfondet in the exercise of its ownership rights is to safeguard the interests of the Government Pension Fund – Norway. In order to ensure that the fund’s portfolio contributes as far as possible to long-term value creation, Folketrygdfondet has defined ethical principles for its investment activities that are integrated into its guidelines for exercising ownership rights.

Good corporate governance aims to safeguard the interests of owners and other stakeholders in relation to the companies concerned, and to ensure that these companies’ management and control mechanisms work as intended. Important principles for Folketrygdfondet’s exercise of ownership rights are:

ensuring that a clear value base and ethical guidelines are established;

ensuring equal treatment for all shareholders;

safeguarding shareholder rights, including the opportunity to exercise ownership rights;

ensuring that directors are elected following proper processes, on the basic of clearly defined requirements, and have the support of shareholders;

ensuring that compensation models are established that are goal-oriented and reasonable, and that do not undermine shareholder value.

In December 2007, the board of Folketrygdfondet adopted new ethical guidelines for the management of the Government Pension Fund – Norway. The guidelines are based on the ethical principles adopted in 2004. The evaluations carried out by Folketrygdfondet are based on publicly available information and information provided by the companies themselves.

As part of its exercise of ownership rights and dialogue with companies, Folketrygdfondet uses questionnaires to shed light on the individual companies’ overarching principles and guidelines for their work on ethical issues, including accountability and communication. The attitudes of senior management regarding environmental issues, human rights, corruption and unethical behaviour are also mapped. Good corporate governance is seen as an interplay between attitudes, principles and guidelines within a framework of clear divisions of responsibility and management and control systems.

2.2.4 The importance of transparency

The Government Pension Fund is managed with a high degree of transparency. The Ministry of Finance presents an annual report to the Storting on the management of the fund.

Norges Bank also submits an annual report on its management of the Government Pension Fund – Global, including its exercise of ownership rights. It has more than 7,000 companies in its portfolio and information is provided about specific investments in individual companies. Norges Bank also publishes information on how it votes in different companies, down to individual share level. 2

This must be regarded as a high degree of transparency compared with many other investors. Dialogues with individual companies or groups of companies are also reported as far as possible. While a process is ongoing, the greatest possible influence can often be achieved if those involved are confident that details from the dialogue will not be made public.

As of 2007, Folketrygdfondet publishes a separate annual ownership report in connection with the expanded reporting on the exercise of ownership rights in the Government Pension Fund – Norway.

The management of the Government Pension Fund – Global includes a mechanism for excluding individual companies. The threshold for applying this mechanism is high. According to the criteria for exclusion, grossly unethical activity must be involved. This applies to companies that produce inhumane weapons, companies that are complicit in serious or systematic human rights violations, serious violations of individual rights in wars and other conflict situations, serious environmental damage, gross corruption and other particularly serious violations of fundamental ethical norms. The Council on Ethics for the Government Pension Fund – Global makes recommendations concerning screening and exclusion. The Ministry of Finance decides whether to exclude a company from the fund’s investment universe on the basis of these recommendations.

There is high level of transparency in the work of the Council on Ethics for the Government Pension Fund – Global and its recommendations to the Ministry of Finance, cf. the annual report currently under preparation. The Ministry of Finance announces decisions to exclude companies on the basis of the Council on Ethics’ recommendations. As of December 2008, 29 companies had been excluded from the investment universe of the Government Pension Fund – Global, most of them as a result of involvement in the production of nuclear weapons, cluster munitions or landmines. Two companies have been excluded because of the risk of complicity in serious or systematic human rights violations and seven because of the risk of complicity in serious environmental damage.

Textbox 2.2 An example of exclusion from the Government Pension Fund – Global

On 6 November 2007, the Ministry of Finance announced that the British company Vedanta Resources Plc. (Vedanta) had been excluded from the Government Pension Fund – Global on the recommendation of the Council on Ethics. In the Council on Ethics’ view, the fund was running an unacceptable risk of being complicit in serious environmental damage and gross and systematic violations of human rights by continuing to invest in the company.

«The Council finds that the allegations made against the company about complicity in serious environmental damage and human rights violations, including abuse and forced movement of tribal peoples, are well founded. In the Council’s view, the company appears not to be interested in or willing to do anything about the serious and prolonged harmful impacts of the its operations on people and the environment. The breaches of norms uncovered in relation to the environment and human rights have taken place in all the subsidiaries investigated, repeatedly and over a period of several years (...). In the Council’s opinion, this indicates a pattern of behaviour on the part of the company where such breaches of norms are accepted and are an established part of its business activity. This pattern of behaviour constitutes an unacceptable risk that the company’s unethical practice will continue in future. Based on an overall assessment, the Council finds that the criteria for serious environmental damage and systematic human rights violations are met in this case.»

The Government notes that the activities of the Government Pension Fund – Global are regarded by several parties as international best practice as regards ethical guidelines for investments and transparency, and that other actors are increasingly being measured in relation to this practice. The Government strongly emphasises continued transparency with regard to the fund’s activities and is satisfied that this appears to be a trend among an growing number of funds and investment managers, both in Norway and abroad. Transparency will also help to provide civil society, research institutions and the media with the best possible basis for their work. In connection with the evaluation of the ethical guidelines for the Government Pension Fund – Global, they will therefore consider measures that can contribute to even greater transparency.

2.2.5 Sovereign Wealth Funds

The management of sovereign wealth funds (SWF) is subject to increasing international attention. Several of the funds have huge assets at their disposal. The Government Pension Fund – Global is one of the largest, together with funds from China, Kuwait, Russia, Singapore and the United Arab Emirates. Given the increasing importance of sovereign wealth funds in international capital markets, concern has been expressed that such funds may have political rather than financial goals. It has also been argued that the size and lack of transparency of these funds can lead to instability in the financial markets.

After several SWFs helped to stabilise the international financial markets in 2007–2008 by investing capital in hard-pressed financial institutions, their positive role has been highlighted. Norway’s experience shows that such funds can support domestic fiscal policy if they enjoy broad political and popular support. Clear and robust rules for the management of the fund’s assets are also important. A long-term investment horizon can help to stabilise international financial markets.

Several countries with non-renewable resources are showing an interest in the Norwegian experience of managing its petroleum wealth and how the Government Pension Fund – Global is structured and integrated with economic policy. In the international context, much reference is made to the Norwegian model for sovereign wealth funds. The EU has identified the activities of the Government Pension Fund – Global as a benchmark for how transparency can be exercised in sovereign wealth funds.

In light of the international focus on sovereign wealth funds, a working group including most of the SWF countries was appointed in May 2008 to draw up guidelines for the management of such funds. The work was coordinated and facilitated by the IMF. The objective was to raise awareness about the funds, promote stable financial markets and reduce the pressure for protectionist measures. In October 2008, the working group submitted a unanimous proposal for Generally Accepted Principles and Practices (GAPP), also known as the Santiago Principles – voluntary principles regarding an institutional framework, fund management and investment activities. Representatives from the Ministry of Finance and Norges Bank participated on behalf of Norway.

In the Government’s view, the GAPP are based on sensible principles, and give funds a political obligation to ensure transparency in key areas in order to build trust and meet expectations in important recipient countries. Norway has therefore endorsed the principles.

The Government

has initiated a review of the ethical guidelines for the Government Pension Fund – Global, which, together with the fund’s other activities, will be discussed on a broad basis in the annual report to the Storting on the management of the Government Pension Fund, which will be submitted in spring 2009;

takes a positive view of active and open exercise of ownership rights in connection with the activities of the Government Pension Fund in order to safeguard the fund’s long-term financial interests;

takes a positive view of Norges Bank’s emphasis on exercising its ownership rights, and considers children’s rights and protection of the environment to be fundamental ethical norms that should be safeguarded through the exercise of ownership rights.

2.3 The public sector as procurer

The Government wants the consumption and production of goods and services to be as sustainable as possible. The public sector must take the lead by purchasing goods that have been manufactured in accordance with the highest ethical and environmental standards. The public sector must use resources efficiently and build confidence in its procurement processes.

Today, public sector procurement in Norway amounts to roughly NOK 250 billion a year. By setting demands and taking a constructive approach to procurement, the public sector can, due to its size, significantly influence companies to adopt ethical and environmentally friendly practices. Moreover, companies that are used to meeting stringent requirements will be better equipped to meet competition from abroad and to offer good solutions in international markets.

Textbox 2.3 Environmental requirements to suppliers

Bærum municipality has stipulated environmental requirements in connection with the procurement of hotel and conference services. The municipality has used the new environmental criteria for hotels that were drawn up in response to the Government’s action plan for environmental and social responsibility in public procurements. It requires suppliers to have a system for measuring and monitoring energy consumption, waste management, including sorting at source, the use of chemicals and water consumption.

Tenderers compete on the criteria relating to energy consumption, waste production, chemical consumption, water consumption and the provision of organic food.

Experience showed that these criteria did not restrict competition and worked well in relation to the market. As a result, one of the hotels involved will now be eco-labelled.

Requirements set by the public sector also give a clear signal that the authorities expect the private sector to take an active approach to this area. Public sector demand for a more sustainable production of goods will also increase the opportunities for other consumers to choose such products. Increased emphasis on ethics, the environment and life cycle costs can also foster better and more sustainable public procurement.

On 1 January 2007, the Government introduced new and improved regulations for public procurement. Public procurers are now required to turn down suppliers who have been convicted of corruption, organised crime, fraud or money laundering, and they are also entitled to turn down suppliers who have been convicted of criminal offences involving business malpractice, such as failure to comply with environmental legislation and requirements for the equal treatment of workers.

Since the new Public Information Act entered into force on 1 January 2009, all registers of tenders have been publicly available. Suppliers, the media and the general public thereby have a better opportunity to check that extraneous factors are not taken into account and that corruption or conduct resembling corruption does not occur.

In June 2007, the Government presented an action plan for environmental and social responsibility in public procurement. In this connection, a specific environmental policy was drawn up for public procurement. All government agencies must comply with the specific requirements in the action plan. The head of each agency has been made responsible for ensuring environmentally sound procurement, and tools have been made available for training and competence-building in this area.

Environmentally sound public procurement is highly prioritised in the international arena, and new policies are being developed in a number of countries. The European Commission has recently drawn up an action plan for more sustainable production and consumption, including a proposal for using public procurement actively to achieve environmental benefits. The Commission has proposed that 50 % of public procurement should be green by 2010. Initially, this target applies to ten product areas for which common environmental criteria have been drawn up. A task force has been established under the UN Marrakech Process to develop toolkits to promote sustainable public procurement.

In Norway, Innkjøpspanelet, a national panel on environmentally responsible procurement, has developed common environmental criteria for a number of product groups. These are intended for use by the central and local authorities, but they could also be used by the private sector in developing greener supply chains.

A centre will be established in every county/region to provide public agencies with the assistance they need to implement the Government’s action plan for environmental and social responsibility. These centres will act as driving forces and centres of expertise for networks of purchasers. The new Agency for Public Management and e-Government is responsible for the development of tools and competence-building initiatives, and is thus playing a key role in this work. These efforts will be coordinated with equivalent efforts aimed at the private sector.

In its role as client, the public sector has a particular responsibility for combating social dumping. The action plan for environmental and social responsibility in the public sector emphasises that it is important that the public sector stipulates labour and working environment standards in its contracts. On 1 March 2008, the regulations on pay and working conditions in public contracts entered into force. The regulations, which incorporate ILO Convention No 94 on labour clauses in public contracts, is intended to ensure that pay and working conditions for employees in construction companies that carry out work for public clients are not poorer than those set out in national collective agreements or otherwise normal for the place and trade in question. The regulations apply to central government, municipal and county authorities and bodies governed by public law, and are applicable to contracts over a certain threshold value. They also apply to work performed abroad.

Textbox 2.4 Ethical requirements in contractual terms and conditions

The City of Bergen has included «compliance with ILO core conventions throughout the production chain» as a contractual condition in selected tender processes. During the contract period, suppliers undertake to carry out self-reporting in relation to the eight conventions concerning child labour, forced labour, freedom of association and discrimination. On entering into an agreement, suppliers must give an account of their status in relation to each of the conventions, and seek to improve steadily in relation to this starting point. The goal is to make the production chain more transparent – a precondition for ethical procurement – through openness and dialogue between client and supplier.

The Government also believes that the public sector should require suppliers to comply with fundamental ethical requirements, for example with regard to the working environment, child labour, forced labour and corruption. Requirements should be stipulated and followed up for the whole production chain. In accordance with the action plan, the Government has established that it is legitimate to stipulate ethical requirements in connection with public procurements. As a next step, it will consider whether to require purchasers in the government administration to set social and ethical requirements for their suppliers.

The Ethical Trading Initiative (see Box 3.11) has been commissioned by the Ministry of Children and Equality to produce a guide for how such requirements should be formulated and followed up in practice. This guide was completed in January 2009. A support and advisory function will be established to help the public sector to utilise these tools in connection with public procurements.

The Government has also decided to prepare a white paper on public procurement, which will include strategies and measures aimed at improving public procurement practice.

The Government

will provide guidelines, competence-building and practical advice in line with the action plan for environmental and social responsibility in public procurement;

will require all central government agencies to follow up the action plan;

will establish a support and advisory service on public procurement;

will establish an environmental policy for central government procurement, including concrete requirements for central government agencies in relation to prioritised product groups;

will cooperate closely with the EU and others on ambitious programmes for developing standards and criteria for greener procurement and supply chains.

2.4 A comprehensive policy

The authorities’ responsibilities are wide-ranging. Norway has achieved international recognition for the Government Pension Fund’s ethical guidelines. However, progress has not been as significant in other areas. The Government will seek to develop a comprehensive policy that ensures that social and environmental concerns are taken into account in all public sector activities.

Questions have been raised about whether the ethical guidelines for the Government Pension Fund should also apply to enterprises in which the state has ownership interests. It is not, however, clear whether it would be right or expedient for the state to do so.

The ethical guidelines for the Government Pension Fund – Global are tailored to the fund’s role as a financial investor and minority shareholder in thousands of companies worldwide. The state, in its role as a major, strategic owner of a number of Norwegian companies, faces a different situation. The differences in these situations affect both the way ethical considerations can be taken into account and the instruments available. For example, in the case of the Government Pension Fund – Global, it is far easier to sell, or simply not acquire, ownership interests in unsuitable companies than is the case in direct, strategic ownership of Norwegian companies. Direct state ownership is exercised in accordance with established principles for corporate governance, cf. the discussion in Chapter 2.1.

The public sector and the private sector are facing many similar challenges regarding social responsibility. This calls for consistency between the conduct of the public sector and the expectations that apply to the private sector.