4 Activities, management and value creation in the Barents Sea–Lofoten area

This chapter describes and evaluates the most important industries in the Barents Sea–Lofoten area, in terms of both the value creation and benefits to society they represent, and the pressures and impacts they exert on the environment. Section 4.9 deals in particular with value creation and social benefits related to the waters off the Lofoten and Vesterålen Islands and Senja.

The most important industries in the Barents Sea–Lofoten area today are fisheries, maritime transport and petroleum activities, but other industries, such as tourism, marine bioprospecting and possible future developments in offshore energy and prospecting for minerals on the seabed, are included in this white paper as well. The importance of marine ecosystem services for value creation and Norwegian society is also discussed.

4.1 Fisheries and aquaculture

4.1.1 Trends in fisheries management

At present the major fish stocks in the Barents Sea are in good condition and are harvested within safe biological limits. They are managed in accordance with the principles set out in the Marine Resources Act and in line with the management objectives of the Nature Diversity Act. Cooperation with the Russian fisheries management authorities is extremely important for ensuring the sustainability of harvesting in the Barents Sea. Over the last 10 years the fisheries authorities have made very successful efforts at the national and international level to reduce the illegal, unreported and unregulated fishing (IUU fishing) of cod in these sea areas, and in 2009 no incidents of IUU fishing of cod and haddock were detected. This was the result of close cooperation between the Norwegian and Russian authorities and of the development of new control mechanisms such as the port state control system under the North East Atlantic Fisheries Commission (NEAFC). Control of resources and a harvesting level in line with the quotas that are set are essential for maintaining a sustainable management regime.

Satellite tracking is an important part of Norwegian resource monitoring. All Norwegian fishing vessels with a length of more than 15 m are required to have a tracking device installed on board that automatically transmits data, regardless of where they are. The same applies to foreign vessels operating in Norwegian waters.

Much work is being done on the international rules for bottom fisheries with a view to safeguarding biodiversity, and in Norway there are new regulations relating to bottom fisheries. In addition new fishing gear is continually being developed that reduces the impact of fisheries on the seabed. For example new trawling methods are being developed that reduce the impact on benthic habitats and at the same time reduce fuel consumption and NOx emissions. An important factor in this connection is that the extent of bottom trawling declined from 2005 to 2009.

Textbox 4.1 Regulation of fisheries in the Barents Sea–Lofoten area

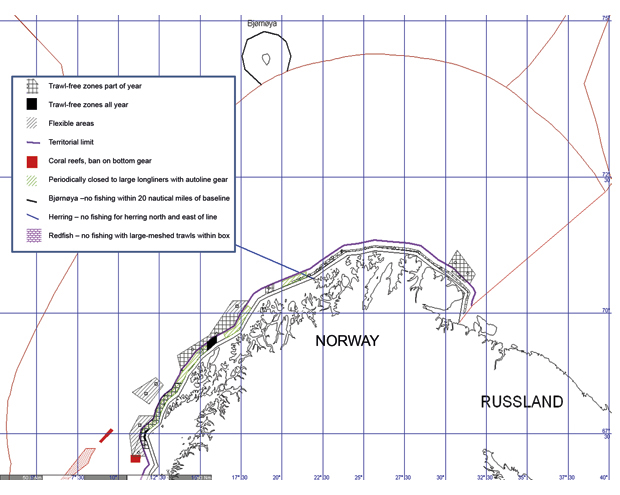

General prohibition on trawling in areas less than 12 nautical miles from the baselines

There is a general prohibition on trawl fishing off the Norwegian mainland in areas less than 12 nautical miles from the baselines. However, there are exceptions to this rule that permit fisheries in areas to within 6 nautical miles of the baselines. The prohibition does not apply to trawling for kelp or Norway lobster, or shrimp trawls without bobbins or rockhopper gear.

Trawl-free zones and flexible areas

In order to protect larvae and vulnerable areas, a number of trawl-free zones (permanently closed to trawling for all or part of the year) and flexible areas outside the 12-mile limit have been established under the Regulations relating to sea-water fisheries. These provisions have also promoted the sharing of sea areas to avoid gear conflicts.

The term «flexible areas» is used to mean delimited areas where fishing is regulated during specific periods by means of restrictions on or a prohibition on fishing with particular gear in the whole area or certain parts of it. In such areas, the number of vessels participating in the fishery may also be limited.

Coastal shrimp trawling

Coastal shrimp trawling is carried out in both the northern and the southern parts of the management plan area. This is conducted in certain particular areas by smaller vessels using lighter gear, and there is no reason to believe that this activity causes significant damage to vulnerable benthic habitats. This type of fishery is strictly regulated by local regulations for different stretches of the coastline.

Figure 4.1 Trawl-free zones and flexible areas in the Barents Sea

Source Directorate of Fisheries

4.1.2 Activities

The most important fisheries in the sea areas from the Lofoten Islands northwards along the coast up to and including the Barents Sea have always been for Norwegian spring-spawning herring, Northeast Arctic cod, Northeast Arctic haddock, Northeast Arctic saithe, and capelin. Generally speaking stocks have increased over the last 10 years, especially cod and haddock, and quotas have increased accordingly. In 2011 the Norwegian quota for cod was 319 000 tonnes, for haddock 148 000 tonnes, for saithe 173 000 tonnes, for Norwegian spring-spawning herring 602 680 tonnes and for capelin 275 000 tonnes.

For some years, Norwegian vessels mainly fished for Norwegian spring-spawning herring in the Vestfjorden area. However, in 2003 the migration pattern of the herring changed, and the younger year classes began to overwinter on the bank areas and in the waters west of the Lofoten and Vesterålen Islands and southern Troms. At the same time the stock increased substantially. In the last few years there has been very little herring in southern Troms. The new migration pattern also means that more seine fishing and trawling is carried out in these areas than previously.

The traditional spawning-season cod fishery in the Vestfjorden area from February to April is now substantially reduced because the migration pattern of the cod has changed. In recent years spawning has begun to take place further out, around the Lofoten Islands as far as Røst, northwards around the Vesterålen Islands and as far north as western Finnmark. This more northerly distribution is not entirely new, since it also occurred in the period 1930–50. Fishing vessels that normally used to fish in the Vestfjorden area have transferred their activities westwards and northwards along the coast.

Changes in the structure of the fishing fleet and fishing grounds

In 2009, 1.17 million tonnes fish were landed in the three northernmost counties, and the structure of the fisheries has been gradually rationalised. The number of vessels has been reduced, which has increased productivity and profitability since it means that the total catch is divided between fewer vessels. The total catch has remained relatively stable from year to year, and any fluctuations have primarily been due to biological variations. There are variations in the migration patterns of Northeast Arctic cod and spring-spawning herring from year to year and over time, which means that fisheries move from one area to another, and it is not always possible to know beforehand where fisheries activity will be highest.

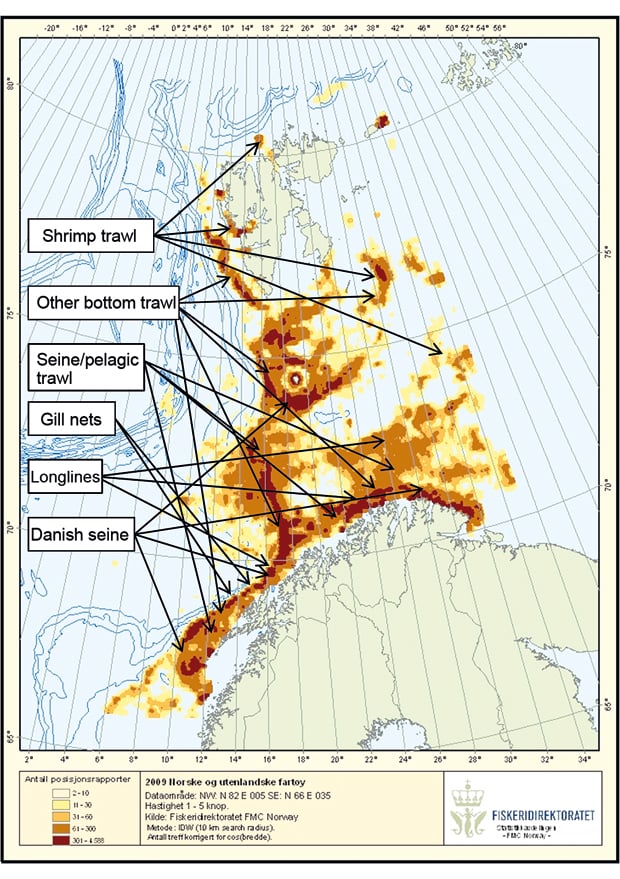

Figure 4.2 Fishing vessel activity for vessels with a length of more than 21 m in 2009. The dark shading shows the greatest activity.

Source Directorate of Fisheries

4.1.3 The importance of fisheries and aquaculture for value creation and Norwegian society

On the basis of figures from Statistics Norway and Nofima, the direct commercial importance of fishing and aquaculture for Norway as a whole, measured in terms of its contribution to GDP, was estimated at NOK 18 billion in 2009. Furthermore, in addition to the core activities (fishing, aquaculture, fish processing and wholesaling), fishing and aquaculture have spin-off effects in other sectors. These include employment in technological sectors, for example jobs in local shipbuilding companies or with suppliers of various types of technical equipment. According to the SINTEF Group, in 2008 every krone generated by core activities in the fisheries and aquaculture sector resulted in NOK 0.96 in value creation in other sectors, which means that the value creation in core activities alone had almost doubled.

The total export value of the fishing and aquaculture industry was NOK 44.7 billion in 2009 and NOK 53.8 billion in 2010.

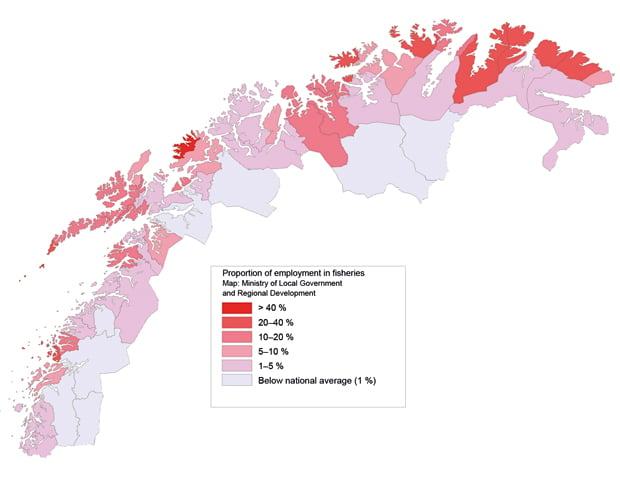

The sector accounts for just under 5 % (around 11 000 persons) of employment in North Norway. In addition it generates a considerable number of jobs in for example the supply, fish processing and transport industries. There are strong links between settlement and access to marine resources in the fisheries sector, but the importance of the sector varies considerably within the region. On some of the islands, such as Træna, Røst, Værøy and Moskenes, the fisheries industry accounts for over 40 % of total employment.

Figure 4.3 Employment in the fisheries sector in North Norway, as a percentage of total employment.

Source Statistics Norway and the Panda Group

Fisheries

According to figures from Statistics Norway, the total landed value of the catch in the Barents Sea–Lofoten area was NOK 6.3 billion in 2009, or 56 % of the total landed value for Norwegian fishing vessels in the same year.

The total catch in the management plan area rose from approximately 750 000 tonnes in 2000 to over 800 000 tonnes in 2009. In the last few decades Norwegian fisheries have developed from a relatively unregulated industry to a strictly regulated one, subject to quotas and licensing requirements. All our most important fish stocks are shared with other nations, which means that international cooperation is vital for the Norwegian management system. Due to sound and sustainable resource management, it has been possible to increase the quotas in the last few years. The coastal fishing fleet plays a vital role in the Barents Sea–Lofoten area, and accounts for just over 40 % of the landed value. In the coastal municipalities from the Lofoten Islands to Norway’s border with Russia, fishing is a full-time occupation for 4 900 persons and a part-time occupation for 1 300. In the same area 90 % of the 3 650 registered fishing vessels are small vessels less than 15 m total length. These vessels generally fish in waters close to home, are less mobile than larger vessels and are used mainly to fish cod. In a number of small communities the fleet of small vessels accounts for a large percentage of employment, and there are few employment alternatives.

Aquaculture

The aquaculture industry operates inside the baselines and thus outside the management plan area. However, the industry is likely to be affected by the general state of the environment and by any accidents in the Barents Sea–Lofoten area.

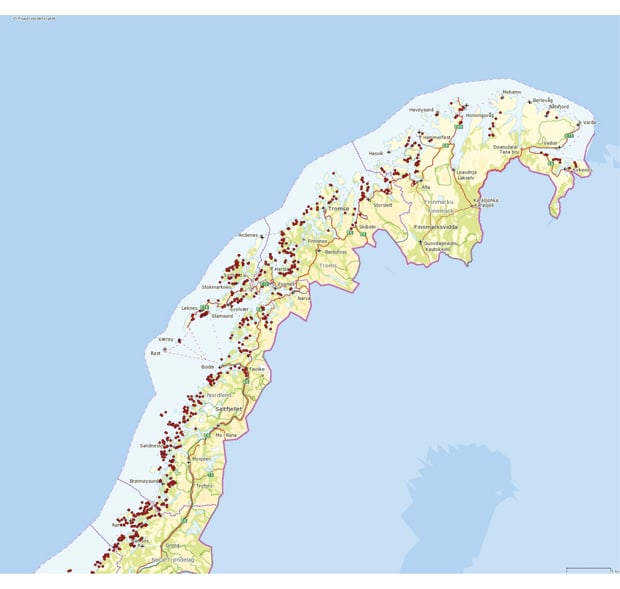

About one-third of aquaculture production in Norway takes place in North Norway. In 2009, 280 000 tonnes of salmon, 23 000 tonnes of trout, 11 500 tonnes of cod, around 500 tonnes of other marine species and 500 tonnes of shellfish were produced in the three northernmost counties. The landed value in these three counties was NOK 7.5 billion in 2009, most of which was exported. The industry alone generated around 1 600 jobs in North Norway in 2009.

There has been substantial growth in aquaculture production in Troms and Nordland in recent years. In Troms it has doubled since 2005 and in Nordland it has increased by 35 %. Production in Finnmark has been stable. There are large accessible areas of coastline in North Norway, which means that there is great potential for further development of this industry in the region. In the 2009 allocation round, about half of the 65 new licences were granted for salmon, trout and rainbow trout farms in North Norway. In addition the Government permitted a production increase of up to 5 % for salmon and trout farms in Troms and Finnmark in 2011.

Figure 4.4 Aquaculture sites in North Norway

Source Directorate of Fisheries/Norway Digital

Safe seafood – the importance of a good reputation

Value creation in the seafood industry depends on ensuring that Norwegian seafood products are safe to eat and have a high national and international reputation. Transparency and information are also important. To ensure this, the authorities should have a monitoring system for:

levels of known hazardous substances in seafood,

parasites that reduce seafood quality or that may cause disease in humans,

naturally occurring toxins in shellfish,

hygiene indicators,

screening for new hazardous substances.

Such knowledge helps to ensure that Norwegian seafood is safe to eat and preserves its high reputation in markets at home and abroad. At present monitoring of contaminants in wild fish stocks is conducted through baseline studies and sampling, and by mapping contaminants in fish feed and farmed fish.

Another factor that contributes to the high reputation of seafood is that Norway follows international rules in the field of food safety, and effectively monitors compliance by the industry. The Norwegian Food Safety Authority has a variety of measures it can call on when violations of the rules are detected, and increases the severity of the measures taken in the event of serious and repeated violations.

In the event of an accident resulting in pollution that could compromise seafood safety, the authorities must be able to monitor and control seafood safety in the area concerned. Previous experience of oil spills and of cases where a product has attracted negative attention has shown that in the short term it is difficult to sell products from the polluted area, including those that are obviously not contaminated and even products from other industries with links to the area. However, no clear impacts on prices have been found over the long term.

Future developments in value creation

Climate change, new developments affecting the resource base, new technology and new framework conditions will all have impacts on future commercial activity based on marine resources. The most important fish stocks in the Barents Sea are in good condition and the fisheries management regime is effective. However, natural migration and other factors cause the composition and size of stocks to vary. The impacts of climate change are uncertain, for example with regard to ocean acidification, and it is difficult to predict how this will affect the growing conditions for farmed fish. It is also possible that the composition of wild fish stocks will be altered and that this will have consequences for the fisheries. However, this is very uncertain.

Environmental sustainability, competing uses of the same area and the state of the market influence the growth and development of the seafood industry. If the current trend continues, employment and value creation in the industry will increase. The structure of the fisheries has been undergoing gradual rationalisation for a long time. The number of vessels has been reduced and this has increased productivity and profitability. If the present trend in the management regime continues, employment in the fisheries industry will gradually decline and value creation will increase over the long term.

Taken together, these factors indicate that value creation in the fisheries and aquaculture sector will increase in the period up to 2025.

4.1.4 Evaluation of the pressures and impacts associated with the fisheries

The fisheries represent a considerable pressure on the ecosystems in the Barents Sea–Lofoten area. Harvesting a fish stock is bound to have an effect on it, and under normal circumstances is the most important anthropogenic pressure. However, an ecosystem is in a constant state of flux due to variations in natural conditions such as predation, migration (in response to changes in temperature and food supply) and disease. Sustainable management of fish stocks means that it is the surplus production of the stock that is harvested. At present the harvest of the most important commercial fish stocks (capelin, herring and cod) is within safe biological limits, but fishing pressure is considered to be too high for certain smaller stocks such as blue ling, golden redfish and beaked redfish. Steps are still being taken to rebuild these stocks, and new measures are considered annually.

More thorough mapping of the seabed in recent years has shown that fisheries activity, especially bottom trawling, has had greater impacts on benthic ecosystems than was previously believed. In this connection the Institute of Marine Research has conducted a number of experiments with pelagic trawls and surveyed the impacts of different types of trawls on different benthic habitats. The results have provided new knowledge that can be used to further develop pelagic trawls and to design gear that exerts less pressure on benthic ecosystems.

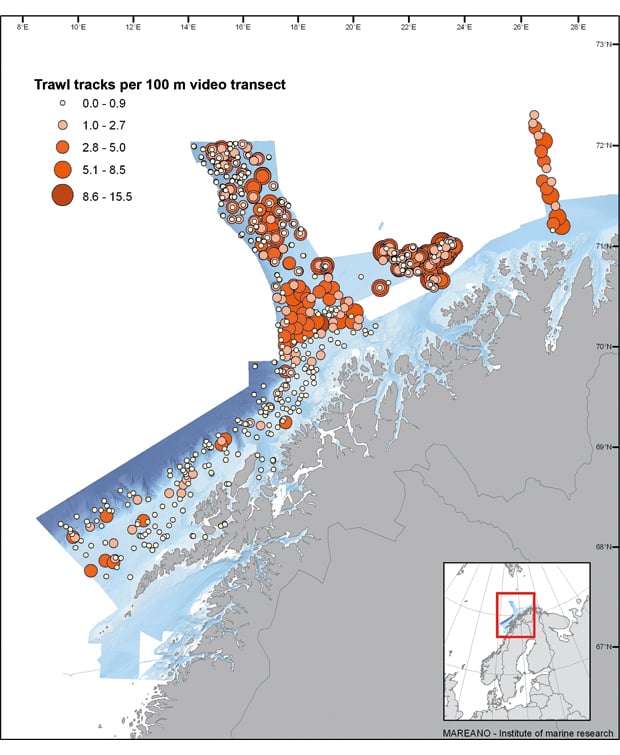

There is considerable fisheries activity in the Tromsøflaket area, and as one would expect, there is relatively serious damage to coral reefs and sponge communities. Fisheries have also been shown to have impacts along the edge of the continental shelf and in some places at greater depths in Nordland VII. MAREANO surveys conducted along the edge of the continental shelf have shown that trawl tracks are very common; they were found in 51 of the 76 localities investigated. In the areas with the greatest density of tracks, 42 tracks per km seabed were found, or one track for every 25 m. Very few traces of human activity other than fisheries have been detected. To summarise, in the localities investigated about two of 10 coral reefs had suffered damage to a greater or lesser extent and about 6 % of all investigated reefs in the management plan area had been destroyed. There is considerably less trawling that there was a few decades ago, and many of the observed instances of damage go back many years.

Locally, areas that have been trawled repeatedly over time will be populated by opportunist, short-lived species. Recolonisation and recovery are affected, and such areas tend to remain at an early successional stage. In the long term this could result in permanent changes. In areas that have been bottom trawled it is often only possible to find small specimens of sponges.

Figure 4.5 Density of trawl tracks on the seabed in areas mapped by MAREANO up to the 2009/2010 season.

Source MAREANO/Institute of Marine Research

Fisheries also put pressure on seabirds and marine mammals, in the form of impacts on food supplies, unintentional bycatches in fishing gear and marine litter from fishing vessels. Our knowledge of the scale of unintentional bycatches of seabirds and marine mammals is limited, and studies are being conducted. As from 2011, bycatches of seabirds and marine mammals have to be included in the information recorded in electronic catch logbooks. No changes have been registered for the impact on seabirds, but for marine mammals in general bycatches have declined, although as a result of greater knowledge the estimated figures for bycatches of common porpoise in certain areas have risen.

4.2 Shipping

A number of measures have been implemented to strengthen maritime safety and governmental preparedness and response to acute pollution, including further development of knowledge and technology and measures to reduce the probability of accidents. This subject is discussed in more detail in Chapter 5 in the section on risk. In the present chapter, value creation by shipping and the pressures exerted by normal operations are discussed.

4.2.1 Activities

Trends in maritime traffic 2005–09

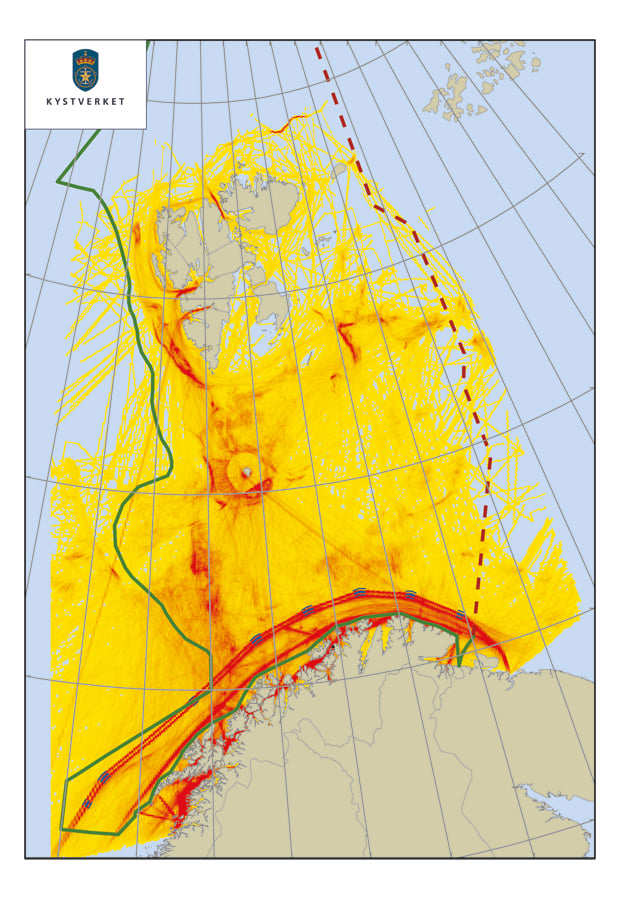

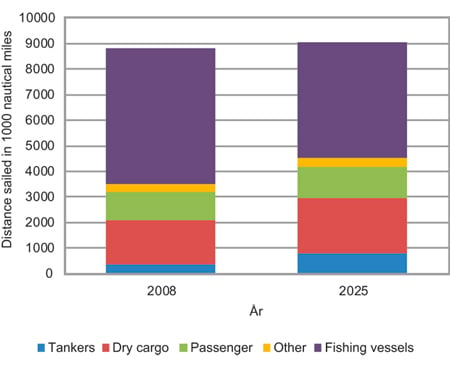

The volume of traffic of seismic survey vessels, offshore supply vessels and tankers has shown a considerably greater increase than that of other vessel types, but from relatively low levels. Tanker size has also increased. In 2008 fishing vessels accounted for the largest number of ship movements and about 58 % of the total distance sailed in the management plan area.

More than 80 % of the total distance sailed in the Barents Sea–Lofoten area by vessels of gross tonnage over 10 000 now lies within the areas covered by the traffic separation schemes between Vardø and Røst, and this includes almost 100 % of all tanker traffic. The remaining traffic in the area is dominated by cargo vessels of gross tonnage 1 000–5 000, but there is also some traffic of other cargo vessels and offshore and other service vessels.

Figure 4.6 Traffic density in the management plan area, the traffic separation schemes between Vardø and Røst (thick red line) and nearcoast areas in the second half of 2010. The highest traffic density is indicated by the red shading.

Source National Coastal Administration

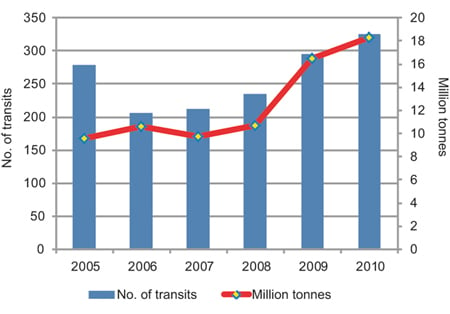

The transit traffic consists of large tankers and bulk carriers sailing to and from Russian ports. Up to 2008, the volume of traffic was relatively stable in terms of both cargo volume and number of ships. The cargo volume was an estimated 10–12 million tonnes per year, carried on 200–240 fully loaded ships. However, in 2009, the volume rose considerably (see Figure 4.7). There are many indications that transit cargo volume will continue to rise in the years ahead. The average size of oil tankers is also expected to rise.

Figure 4.7 Numbers of vessel transits by fully loaded tankers, and millions of tonnes of oil and petroleum products transported along the Norwegian coast from northwestern Russia

Source Norwegian Defence Forces

The volume of maritime traffic to and around Svalbard has fluctuated over the last 10 years. The traffic consists of large foreign cruise ships, expedition vessels, goods traffic, research vessels, fisheries traffic along the coast and in certain fjords, and transport of coal mined in Svalbard.

Ship-to-ship transfers of Russian crude oil take place in winter in the Bøkfjorden at Kirkenes and in the Sarnesfjorden at Honningsvåg. During the winters of 2005/06–2008/09 there were an average of nine transfers each winter, but there have been none during the last two winters (2009/10 and 2010/11). This activity alters the local level of risk because it means that the tankers sail closer to land. There are special emergency preparedness requirements for ship-to-ship transfers.

The number of calls at the largest ports relevant to the management plan area has declined somewhat since the peak year 2005. The volume of goods for different ports in the region fluctuates and does not correspond to the trends in the number of calls. Narvik is still much the largest port, and the volume of goods consists almost entirely of iron ore transports from the mining company LKAB. Development of the Snøhvit field has resulted in a large increase in goods transports to and from Hammerfest.

Projected trends in maritime traffic up to 2025

There is less activity in the Barents Sea–Lofoten area than in the sea areas further south. Projections for the area indicate a small increase (about 3 %) in the total distance sailed in the period 2008–25 and a general increase in the distance sailed for most types of ships (see Figure 4.8), with most of the increase occurring towards the end of the period. For fishing vessels, on the other hand, a marked decrease in the distance sailed is expected. In 2008 fishing vessels accounted for around 58 % of total distance sailed in the area, while in 2025 the figure is expected to be around 50 %. Tanker activity in the area is likely to increase by more than 100 %, especially for large oil and gas tankers.

Figure 4.8 Projected trends in distance sailed for various types of ships in the period 2008–25

Source National Coastal Administration

Projected maritime traffic across the Arctic Ocean during ice-free periods

The rapid ice-melt in the last few years has led to increased interest in maritime traffic across the Arctic Ocean, including the Northeast Passage. The Arctic summer ice is retreating so rapidly that in periods all or part of the traffic lanes north of Russia and Canada/the US are open until the ice re-forms. The ice-melt also means that increasing areas of the Arctic Basin are covered by first-year ice, which is thinner, making it easier for ships to force their way through. At present the volume of traffic in the Arctic Ocean itself is small and ships with destinations in the area are expected to continue to dominate maritime traffic for the next few years.

As a follow-up to its 2009 report, the Arctic Marine Shipping Assessment, the Arctic Council’s working group on the Protection of the Arctic Marine Environment (PAME) is now considering which sea areas in the Arctic are likely to require special protection against the environmental impacts of future maritime traffic across the Arctic Ocean. The group’s conclusions will form the basis for the Norwegian authorities’ assessment of the need for measures to strengthen maritime safety, such as proposals to the International Maritime Organization (IMO) for new sea areas that should be designated as Special Areas or Particularly Sensitive Sea Areas (PSSA).

4.2.2 Importance of maritime transport for value creation and Norwegian society

Maritime transport is important for coastal communities in the management plan area since the largest proportion of goods and passengers within the region is transported by ship. However, the domestic and international maritime transport industry accounts for less than 2 % (3 700 persons) of employment in the three northernmost counties. The Government’s goal is for a larger share of goods transport to be transferred to water.

At the national level, the maritime industry is a large and important sector that employs around 100 000 persons and resulted in value creation of NOK 85 billion in 2008. The figures for the management plan area have become more reliable since 2006. In North Norway and Nord-Trøndelag there are around 700 businesses related to the maritime industry, with about 10 000 employees and a total turnover of around NOK 15 billion (2007). The fisheries industry accounts for 25 % of employment. Value creation in Nordland amounts to NOK 3 billion, in Finnmark just under NOK 1 billion and in Troms approximately the same. Subcontractors include about 40 operative shipyards in North Norway. These deal with modification and maintenance, especially for the fishing fleet and high-speed and other ferries.

The maritime industry in North Norway is built on two cornerstones. These are the fisheries, which encompass a wide range of large and small vessels, and coastal passenger transport under contract to the state sector. There are 150–200 shipowners in the local transport and cruise traffic sector, mostly small businesses but also a number of major companies such as Torghatten trafikkselskap, Veolia Nord and Hurtigruten. The Coast Guard is another important actor. Shipowners form a larger proportion of the maritime industry in North Norway than in the rest of the country.

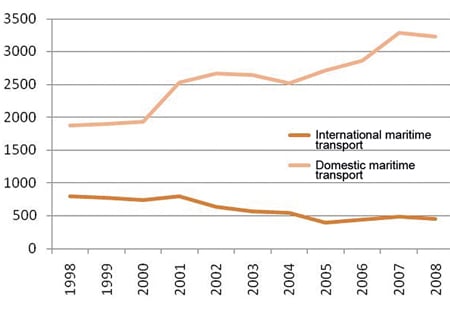

There has been a marked shift from international to domestic maritime transport (see Figure 4.9). The decline in the number of Norwegian seamen employed in international shipping is related to changes in the conditions of competition and the use of foreign seamen. The increase in the number of persons employed in domestic shipping is related to the decline in those employed in the fisheries sector. This is due to the better employment conditions in the domestic maritime transport sector, where the wages are higher due to the tax refund scheme for seafarers.

Figure 4.9 Employment in maritime transport in North Norway, 1998–2008

Source Statistics Norway and the Panda Group

Projected trends up to 2025

Developments in maritime transport in the management plan area will affect the demand for other goods and services, for example for port services. Maritime traffic passing through the area is not expected to influence value creation or social conditions to any great extent. Projections for the effects of petroleum activities on the demand for maritime transport and services up to 2025 are uncertain. Petroleum activities in a sea area increase the need for maritime transport, and experience from other areas on the Norwegian continental shelf indicates that these activities increase the demand for services that require supply ships, which in turn will require greater resources and capacity on land.

4.2.3 Evaluation of the pressures and impacts associated with maritime traffic

Shipping may have negative environmental impacts in the management plan area through spills of petroleum products and other chemicals, operational discharges to water and air, releases of pollutants from anti-fouling systems, noise, the introduction of alien species via ballast water or attached to hulls, and local discharges from zinc anodes in ballast tanks. In spite of this, ships are on the whole a relatively green form of transport.

The traffic separation schemes between Vardø and Røst have significantly reduced the risk of ship accidents in this sea area. The government emergency tugboat service, together with traffic surveillance by the Vardø vessel traffic service centre, has also helped to reduce the risk. The risk of acute pollution from ships, and preventive measures to enhance safety at sea are discussed in Chapter 5.1.1.

Operational releases from ships have been estimated on the basis of the volume of traffic in 2008 and projections for 2025. CO2 emissions are expected to increase as a result of the larger number of ships with larger engines, while NOx and SOx emissions are expected to decrease as a result of new rules and technological developments. However, it is not possible to quantify operational discharges to the sea or to calculate their impacts.

Maritime transport can result in the unintentional introduction of alien species into the ecosystems of the management plan area. The risk will increase with the growth in ship traffic, especially traffic from areas with a similar marine climate. A warmer climate could increase the likelihood that species introduced from further south will be able to establish themselves in Norwegian waters, and if the Northeast Passage is opened for traffic, this may increase the risk of introductions from more distant areas with a similar marine climate.

The impacts of maritime transport on seabirds are related to discharges of oil and litter. Illegal operational discharges from ships may result in oil on the surface, leading to higher mortality in adult seabirds. We know that small quantities of oil are discharged illegally, but not to what extent. It is not possible at present to quantify operational discharges of this kind or to calculate their impacts. Although littering by ships has been banned since 1998, plastic waste is still being found in the marine environment. It seems likely that illegally discarded marine litter, particularly plastic objects and particles, has negative impacts on many species in the management plan area. Marine litter is harmful to species that feed on the sea surface such as black-legged kittiwake, fulmar and marine mammals because they can become entangled in the waste or eat the plastic, which can injure the digestive organs. No changes have been registered in the level of impact from marine litter since 2006.

Noise, especially from propellers, has now been discovered to be a greater problem for marine mammals that was previously believed. Apart from major spills of chemicals and petroleum products, no negative impacts from shipping on fish stocks and seafood are known or documented.

The possibility of a greater volume of maritime traffic in the Arctic Ocean, much of which will be sailing through Norwegian sea areas, is attracting considerable attention. In the Barents Sea, the volume of Russian oil transports has risen since 2006, and in the next few years this type of traffic, which is based on transport of resources from the Arctic, will increase in the peripheral seas of the Arctic Ocean. There is already some intercontinental transit traffic, and if the routes across the Arctic Ocean become more profitable than land transport and other sea routes, and if they are considered sufficiently reliable and safe, this type of traffic could increase.

4.3 Petroleum activity

4.3.1 Current framework

Seismic surveys and exploration drilling for oil and gas began in the Barents Sea in 1980. Parts of the Tromsøflaket (in Troms I) were opened for petroleum activity in 1979 and further areas in the southern part of the Barents Sea were opened in the first half of the 1980s (Bjørnøya South, Troms I Northwest and the northern part of Finnmark West). The southern part of the Barents Sea was formally opened for exploration in 1989 (Report No. 40 (1988–1989) to the Storting) on the basis of an impact assessment of the area. The assessment concluded that Troms II should not be opened.

In 2001 all petroleum activities in the Barents Sea apart from the development of the Snøhvit field were suspended pending completion of the impact assessment of year-round activities in the Barents Sea–Lofoten area. In December 2003 the Bondevik II Government decided that year-round activities in the area could be resumed, apart from the coastal areas in Nordland VI and off Troms and Finnmark, and the polar front, the marginal ice zone, Bjørnøya and Tromsøflaket, which have been identified as particularly valuable areas.

The decision in 2003 imposed the requirement that there were to be no discharges to the sea during normal operations (see Box 4.2). In practice this is a requirement for zero discharges except for cuttings from the tophole section. The reasons for this precautionary approach were the fact that the sea area was relatively clean and under little pressure from human activity, the presence of vulnerable species and habitats, and uncertainty about the long-term impacts of discharges. Furthermore, there was no technology available to remove hazardous and radioactive substances from produced water, and injection of produced water, drill cuttings and drilling fluids was believed to be geologically and technologically possible. Thus the rules relating to discharges from petroleum activities are stricter for the Barents Sea than for other parts of the Norwegian continental shelf (see Box 4.3).

Textbox 4.2 Stricter requirements for oil and gas activities in the Barents Sea

The requirements for activities in the Barents Sea–Lofoten area were set out in a white paper on petroleum activities (Report No. 38 (2003–2004) to the Storting) and are listed below:

Injection or another suitable technology must be used to prevent discharges of produced water.

A maximum of 5 % of the produced water may be discharged during operational deviations provided that it is treated before discharge. Precise requirements for treatment will be set by the licensing authorities in each case.

Drill cuttings and drilling mud must be reinjected or taken ashore for treatment.

Drill cuttings and drilling mud from the tophole section may be discharged provided they do not contain substances with unacceptable properties, i.e. environmentally hazardous substances or other substances that may have a negative impact on the environment. However, such discharges are only permitted in areas where assessments indicate that damage to vulnerable components of the environment is unlikely. Such assessments must be based on thorough surveys of vulnerable components of the environment (spawning grounds, coral reefs, other vulnerable benthic animals). Operators will be required to apply for permits for such discharges.

Petroleum activities in the area must not result in damage to vulnerable flora and fauna. Areas that might be affected must be surveyed before any activities are started.

There must be no discharges to the sea in connection with well testing.

Oil spill preparedness must be at least as effective as on other parts of the continental shelf.

The requirement for zero discharges of drill cuttings and produced water to the sea is considerably stricter than the standards that apply on other parts of the Norwegian continental shelf.

Licensees who have been awarded licences for blocks within the Barents Sea-Lofoten area will not be permitted to engage in year-round petroleum operations unless they can substantiate that their operations will meet the requirement for zero discharges to the sea.

4.3.2 Activities

Exploration drilling and production

From the start of petroleum activities in the southern part of the Barents Sea in 1980 and up to the end of 2010, 79 exploration licences had been awarded and 85 exploration and appraisal wells had been drilled, 21 of which were begun in 2005 or later. About half of these wells have indicated the presence of hydrocarbon deposits. A number of small and medium-sized discoveries have been made, mainly of gas, and since 2006 additional exploration and appraisal wells have been drilled to investigate these discoveries further. Several of them are believed to be of interest, including Tornerose and Nucula.

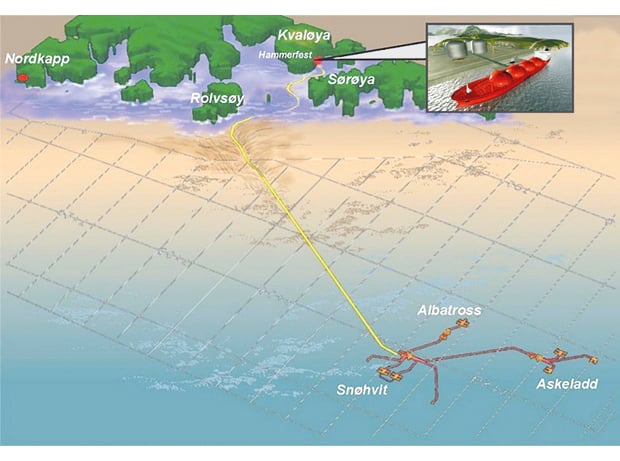

Figure 4.10 Snøhvit. The three discoveries Snøhvit, Askeladd and Albatross have been developed together as the Snøhvit field, with remotely operated subsea installations at depths of 250–345 m. Gas and condensate are transported by pipelines to the LNG (liquefied natural gas) processing plant on Melkøya. Liquid gas is then transported onwards by LNG carrier. (The processing plant and the carrier are shown in the insert.)

Source Statoil

From discovery to production is a long process. At present only one field is on stream in the Barents Sea, and another is under development. The Snøhvit gas field is located in the Hammerfest Basin off Finnmark (Troms I) and consists of the Askeladd West, Askeladd Central, Askeladd, Albatross, Snøhvit North, Beta and Albatross South discoveries (Figure 4.10). Production started in August 2007 and the field will continue to produce gas for at least the next 30 years. Since there are no surface installations, the gas is piped over a distance of 160 km to be liquefied at the LNG processing plant on Melkøya. CO2 is separated from the wellstream and then pumped back into the formation below the reservoir in the Snøhvit field. Recoverable resources when production started were 160.6 billion Sm3 gas, 6.4 million tonnes natural gas liquid (NGL) and 18.1 million Sm3 condensate.

Textbox 4.3 General zero-discharge targets for the oil and gas industry

Zero-discharge targets were adopted in the white paper on an environmental policy for sustainable development (Report No. 58 (1996–1997) to the Storting). The targets and the measures for reaching them have been further specified in a number of later white papers, most recently in the white paper on the Government’s environmental policy and the state of the environment in Norway (Report No. 26 (2006–2007) to the Storting).

Environmentally hazardous substances

Zero discharges or minimal discharges of naturally-occurring environmentally hazardous substances that are also priority substances.

Zero discharges of chemical additives that are black-category (use and discharges prohibited as a general rule) or red-category substances (high priority given to their replacement with less hazardous substances), cf. the Activities Regulations for the petroleum industry.

Other substances

Zero discharges or minimal discharges of the following if they may cause environmental damage:

oil (components that are not environmentally hazardous),

yellow-category substances (not defined as belonging to the black or red categories, but not on the PLONOR list drawn up by OSPAR, meaning that they are considered to pose little or no risk to the environment), and green-category substances (included on the PLONOR list), cf. the Activities Regulations for the petroleum industry,

drill cuttings,

other substances that may cause environmental damage.

Radioactive substances

Discharges of naturally occurring radioactive substances to be gradually reduced until, by 2020, the concentrations in the environment are close to the natural background levels.

The following is a more detailed list of the targets and measures:

As a rule, oil and substances that may be environmentally hazardous may not be discharged to the sea. This applies both to substances added as part of the production process and to naturally-occurring substances. The precautionary principle is to be used as the basis for assessing the potentially damaging impacts of the discharges.

Environmentally hazardous chemicals (red- or black-category) may only be discharged if serious technical or safety considerations make this necessary.

Replacement of environmentally hazardous substances must be given high priority. Operators must draw up plans for replacing environmentally hazardous chemical additives and report them annually to the authorities, cf. the Activities Regulations for the petroleum industry.

The steps taken to replace environmentally hazardous additives must be based on an overall assessment. This means that for example if the use of a small amount of a red-category substance would reduce releases of other components and thereby reduce the overall environmental risk, this should be taken into consideration.

Releases of red-category substances must have been eliminated by 2005 in cases where there are adequate substitutes.

Injection or reinjection of produced water is the most effective method of achieving the zero-discharge targets for naturally-occurring environmentally hazardous substances.

The chosen solution must be based on an overall, field-specific assessment that includes the environmental impacts, overall safety issues, reservoir engineering factors and cost issues.

If there are weighty reasons for doing so, provision may be made on the basis of an overall, field-specific assessment for minimal releases of naturally-occurring environmentally hazardous substances on the priority list.

Economic cost-benefit analyses will be conducted for new and old fields that include overall environmental assessments of measures to prevent discharges of produced water and/or drill cuttings and drilling mud.

The Goliat field, 85 km north-west of Hammerfest, is the first oil field to be developed in the Barents Sea. A plan for development and operation of the field was approved by the Storting in 2009, and production is expected to start in 2013. The field, which will have a floating production, storage and offloading unit, is being developed by the operator Eni. Oil will be loaded onto oil tankers for transport to the markets. Total investment in the development project is expected to be almost NOK 30 billion. Proven recoverable resources amount to about 28 million Sm3 oil and about 8 billion Sm3 gas.

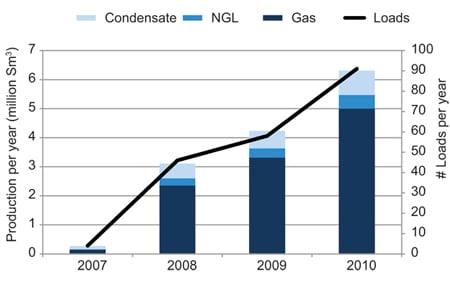

Figure 4.11 Production of hydrocarbons (in Sm3 oil equivalents) and number of transports from Snøhvit since the field came on stream.

Source Ministry of Petroleum and Energy

Award of licences

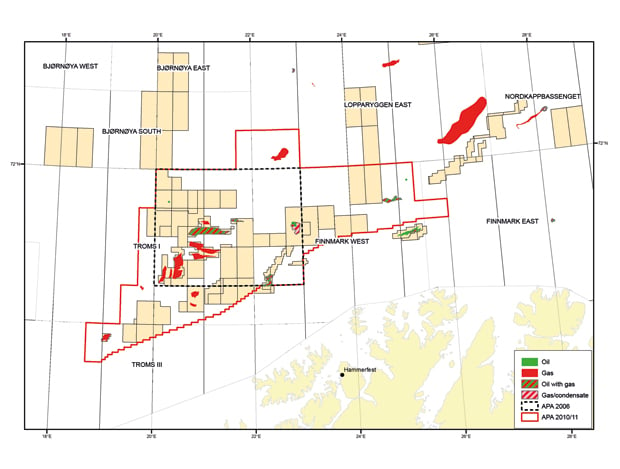

Since the publication of the first management plan for the Barents Sea–Lofoten area in 2006, acreage has been allocated through ordinary licensing rounds, which are normally held every other year, and through annual awards in predefined areas (APAs). The APA system, which was established in 2003, is the annual licensing round for allocation of blocks in more mature areas. The mature areas are the most thoroughly explored areas on the continental shelf, where the geology is known and where there are fewer technical challenges and a well developed or planned infrastructure. The overall framework for oil and gas activities (areas, restrictions on when drilling is permitted, other considerations) is established in management plans for each individual sea area, which are based on the existing knowledge about ecosystems and fisheries. These management plans apply to all new licences awarded in an area, regardless of whether they are announced through the APA system or in a numbered licensing round. The APA system has been evaluated, and the Government will discuss the evaluation in more detail in the forthcoming white paper on petroleum activities.

In APA 2007, seven new production licences were awarded, and in APA 2008, APA 2009 and APA 2010, two, three and two new production licences respectively were awarded in the Barents Sea. Six new production licences were awarded in the 19th licensing round, in 2006, and nine new licences were awarded in this area in the 20th round, in 2009. In the 21st licensing round, in autumn 2010, 51 blocks in the management plan area were announced. Further production licences were awarded in spring 2011.

Assignment of licences in APAs has resulted in greater and more stable activity in the management plan area. Since 2006 the total APA area has been almost doubled (Figure 4.12). The APA system will be evaluated in the white paper on oil and gas policy to be presented in spring 2011.

Figure 4.12 The awards in predefined areas (APA) system in the Barents Sea. The black dotted line shows the border of the APA in 2006. The red line shows the extent of the area in 2010/11.

Source Norwegian Petroleum Directorate

4.3.3 Surveys of oil and gas resources

The Barents Sea is the least explored petroleum province on the Norwegian continental shelf. However, together with the deep-water areas in the Norwegian Sea and the areas off the Lofoten and Vesterålen Islands, it is believed to be the province where the probability of future large discoveries is highest. In the Norwegian part of the Barents Sea outside the area covered by the maritime delimitation treaty between Norway and Russia, the statistical expected value of undiscovered resources is 945 million Sm3 o.e., which corresponds to 37 % of the total undiscovered resources on the Norwegian continental shelf.

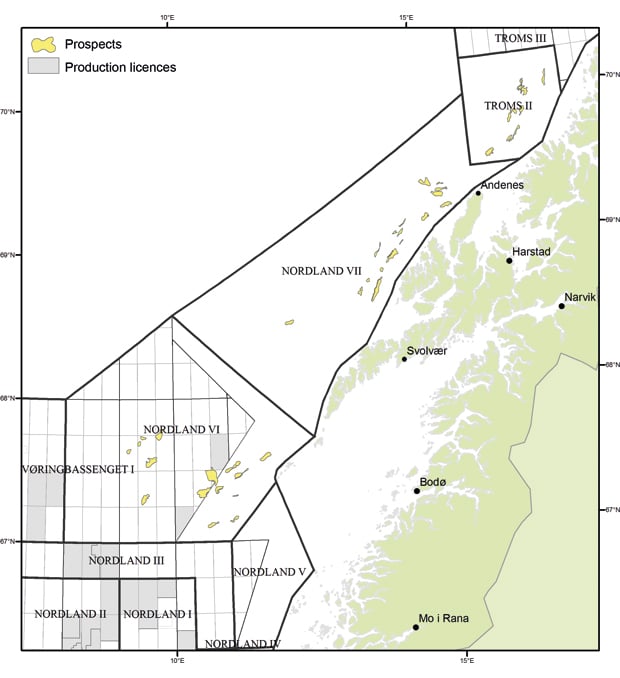

When the Storting debated the integrated management plan for the Barents Sea–Lofoten area, the Norwegian Petroleum Directorate was given the task of surveying the geology of Nordland VII and Troms II in connection with the possibility that there were petroleum resources in these areas. During the period 2007–09, the Directorate collected geological, seismic, electromagnetic and gravimetric data in the waters off the Lofoten and Vesterålen Islands and Troms (Nordland VII and Troms II) (see Figure 4.12).

Following up the management plan for the Norwegian Sea, which concludes that the possibility of initiating an opening process for the northern part of the coastal zone in Nordland will be considered, the Petroleum Directorate also estimated, on the basis of existing data, the resource potential in the Vestfjorden, the unopened part of Nordland V, Nordland VI and the Eggakanten area along the edge of the continental shelf. With the exception of Nordland VI, knowledge of these areas is limited and no prospects have been identified, but the Directorate considers that the presence of hydrocarbons in these areas cannot be excluded.

The waters off Nordland and Troms have varied and interesting geological features. The geological continental shelf is at its narrowest here, in some places narrower than 20 km. After sloping down to a depth of about 400 m, it drops sharply to the deep sea plains more than 2 500 m below the sea surface. In the context of petroleum deposits, these areas are expected to show continuations of geological trends from the north and further south. Some of the most important types of reservoir rock in Nordland VI are likely to be similar to those in the discovered reservoirs of the same age further south in the Norwegian Sea. The northern parts of Nordland VII and Troms II, on the other hand, are expected to show more similarities with the geology of the Barents Sea. The main type of source rock for oil and gas in the area is organically rich claystone from the late Jurassic period. The types of reservoir rock with the greatest petroleum potential in the surveyed areas are sandstones laid down in the Triassic, Jurassic, Cretaceous and Palaeogene periods, with the greatest potential in the Triassic and Jurassic layers. Most of the petroleum prospects lie close to the coast.

Figure 4.13 Mapped prospects in Nordland VI, Nordland VII and Troms II, 2007–09

Source Norwegian Petroleum Directorate

The main conclusions from the seismic surveys are that, on the basis of existing knowledge:

202 million Sm3 o.e. is expected to be discovered (with an uncertainty range of 76–371 million Sm3 o.e.) in the surveyed area.

Nordland VI appears to be the area with the greatest petroleum prospectivity.

The total expected resources in Nordland VII and Troms II are at the same level as the expected resources in Nordland VI.

The probability of finding oil is greatest in Nordland VI and VII, and that of finding gas is greatest in Troms II.

In its report, the Petroleum Directorate concluded that the seismic data for Nordland VII and Troms II are now adequate, but that knowledge of the geology of the areas off the Lofoten and Vesterålen Islands and Senja is still limited, and the estimates of undiscovered resources are very uncertain. However, the level of uncertainty can be reduced by further processing of the data and exploration drilling.

4.3.4 The importance of petroleum activities for value creation and Norwegian society

The petroleum resources on the Norwegian continental shelf have laid the foundation for the development of a substantial oil and gas industry in Norway. The petroleum sector includes oil companies, supplier industries and petroleum-related research and education institutions. It accounts for a substantial proportion of Norwegian value creation and provides employment in all parts of the country.

In 2009, the petroleum sector accounted for 22 % of Norway’s GDP, and in the same year the value of petroleum exports was almost NOK 480 billion. The sector also accounts for over one-quarter of state revenues and total investment. During the 40 years of oil and gas production on the Norwegian continental shelf, the value created by the industry has amounted to around NOK 8 000 billion at the current monetary value.

The demands created by the petroleum industry generate a large number of jobs. Statistics Norway has estimated that in 2009 the industry was responsible, directly or indirectly, for around 206 000 jobs.

Since petroleum activities have only recently been started in the north and have so far been limited, employment resulting from the industry in the region has been far below the national average. The industry employs just over 2 000 people in North Norway, which is less than 1 % of all employment in the region. However, the growth in petroleum activity is resulting in rising employment, and the increase is higher than the national average in all the counties in North Norway. This applies especially to Finnmark, due to the development and operation of the Snøhvit field.

Development of the Snøhvit field in 2002 was the first gas development in the Barents Sea, and the plant at Melkøya near Hammerfest was the first LNG processing plant to be established in Norway. Up to 2 500 people were employed in the construction phase up to the start of production in 2007. Operation, maintenance, modification and support services for the field have created over 300 permanent jobs in North Norway and led to large investments in the regional business sector. Almost NOK 3 billion of total deliveries to the Snøhvit field are supplied by businesses registered in North Norway.

Case studies show that Snøhvit has reversed the negative population and employment trends in Hammerfest. New companies are being established, and there is now a shortage of manpower in the region. Housing construction is expanding considerably, and a substantial increase in municipal revenues is expected. Substantial investments have been made in upgrading school buildings and infrastructure and in developing cultural facilities. The higher level of competence in the region resulting from the Snøhvit development has also benefitted other industries.

The Goliat development will be able to build further on this industrial expansion and increased expertise. The regional office responsible for operations will be situated in Hammerfest and the helicopter and supply base in the surrounding area. Together they will create 150–200 jobs in the operational phase, and the spin-off effects will generate additional jobs in supply industries and in the region as a whole. The operational phase for Goliat is estimated at a minimum of 15 years, and the operator will be cooperating with the supplier network.

As a result of cooperation with the fisheries industry, fishing vessels can now be used in oil spill response, both along the coast and on the continental shelf, in order to strengthen preparedness and response and make it more flexible. From now on types of vessels such as tugboats, aquaculture vessels and search and rescue vessels can also be used in oil spill response.

For almost 25 years Helgelandsbase in Sandnessjøen has supplied exploration rigs and oil fields, such as Norne on the Nordland area of the Norwegian continental shelf, with goods and equipment for activities off the Helgeland coast. Around 50 persons are employed at Helgelandsbase, which in 2007 purchased goods and services worth about NOK 280 million from businesses in Nordland. In the same year almost 390 ships called at the base. The Skarv and Idun oil and gas fields are equipped with production ships, and Helgelandsbase in Sandnessjøen serves as their supply base. From 2006 to 2008 Sandnessjøen doubled its petroleum-related turnover, showing how proximity to the Norne, Skarv and Idun fields has promoted growth in the region.

In Nordland more than 20 % of the industrial turnover, amounting to over NOK 1.5 billion, was petroleum-related in 2008. This was an increase of 50 % from 2006.

Future scenario

Petroleum activities provide jobs at both the local and the regional level. The number of jobs depends primarily on whether discoveries are made, the size of the discovery and the type of development.

In cooperation with the Nordland Research Institute, Asplan Viak has carried out a study examining the possible spin-off effects of the potential expansion of petroleum activities in the Barents Sea and the northeastern part of the Norwegian Sea. The conclusions of the report that apply to oil and gas activities in the waters off the Lofoten and Vesterålen Islands and Senja are discussed in more detail in section 4.9 below.

The analysis was based on a resource scenario developed by the Norwegian Petroleum Directorate that includes the sea area from the coastal zone in the Norwegian Sea up to and including opened areas in the southern part of the Barents Sea. The study provides a basis for estimating spin-off effects with different resource outcomes. It includes 18 different fields with an overall resource estimate of nearly 600 million Sm3 o.e. The expected recoverable resources in the northeastern part of the Norwegian Sea and the Barents Sea are considerably larger than those on which the 2009 prognosis was based.

The Asplan Viak study estimated that development of the 18 fields could provide increased employment in North Norway of between 4 000 and 6 000 full-time jobs from 2016 to 2043. Until 2016 employment will rise gradually, while after 2043 it will gradually decline. According to these estimates, activity will be greatest in the northern part of the region, mainly because larger resources are expected to be found in the sea areas bordering on this region. According to the report, further development of the Snøhvit field would result in an employment peak of almost 2 800 jobs in the development phase, and in the operational phase well over 1 000 new jobs. A large proportion of these employees are expected to come from northern Troms and Finnmark.

4.3.5 Evaluation of the pressures and impacts associated with petroleum activities

Produced water

Produced water contains residues of chemicals introduced during drilling and production, and environmentally hazardous substances that occur naturally in the reservoir (for example alkyl phenols, polycyclic aromatic hydrocarbons (PAHs), heavy metals and radioactive substances). The volume of produced water increases with the age of the well. Produced water occurs primarily in oil extraction and only to a lesser extent in gas production.

The acute impacts of operational discharges of produced water and drill cuttings are assessed as insignificant since they will generally be local and short-term and will not have effects at population level. Nor have any long-term effects at this level been demonstrated by monitoring. However, further studies are being done on the long-term impacts of exposure to low concentrations of environmentally hazardous substances in produced water.

Norwegian waters are in general subject to strict discharge requirements, and zero-discharge targets were adopted in the white paper on an environmental policy for sustainable development (Report No. 58 (1996–1997) to the Storting). This means that as a general rule, no oil or environmentally hazardous substances, whether naturally occurring chemicals or chemicals added during the production process, may be discharged to the sea (see Box 4.3). In addition stricter requirements have been imposed in the management plan area, where discharges of produced water and/or drill cuttings are not permitted (see Box 4.2).

The Norwegian Sea and the North Sea

Although produced water is treated before discharge, not all the environmentally hazardous substances from the reservoir can be removed with existing treatment technology. According to the Climate and Pollution Agency’s 2010 evaluation of the status of the work on zero discharges, injection of produced water is the only method that can eliminate discharges of naturally occurring chemicals. Treatment can substantially reduce the content of oil and oil-related components such as PAHs and alkyl phenols, but has no effect on the content of heavy metals or radioactive substances.

The general zero-discharge targets for environmentally hazardous chemical additives for the continental shelf are considered to have been reached since 2005, but not the targets for certain naturally occurring chemicals. In 2008 new requirements for discharges to sea in the North Sea and the Norwegian Sea were considered, but a report from the Pollution Control Authority (now the Climate and Pollution Agency), the Petroleum Directorate and the Radiation Protection Authority concluded that general requirements for zero discharges of produced water and/or drill cuttings and drilling mud should not be introduced for the Norwegian continental shelf.

The Barents Sea

Petroleum activities in the Barents Sea–Lofoten area are subject to the general requirement of zero discharges to the sea during normal operations (see Box 4.2). However, this only applies to new developments. The requirement applied to the Snøhvit field is that the planned operations should not harm the environment, which means that no harmful substances may be discharged during operations. Discharges of small amounts of produced water are permitted, which can be treated at the onshore biological treatment plant for discharges to sea. All discharges to sea require a permit from the Climate and Pollution Agency. Water from treatment plants is released at a depth of 40 metres in an area with a strong current on the north side of Melkøya. The impacts of these discharges are considered to be small and very local. The development of the Goliat field has been designed to allow injection of produced water that can also be used as pressure support for enhanced oil recovery.

The impacts of oil spills are discussed in more detail in Chapter 5.2 on environmental risk.

Discharges of drill cuttings and drilling mud

Drill cuttings are sand and gravel that are removed from the bore hole as the well is being drilled, and contain chemicals from drilling fluids. Discharges of drill cuttings can affect benthic fauna such as corals and sponge communities by smothering them with sediment in small areas close to the bore hole. In the Barents Sea–Lofoten area the requirements for treatment of drill cuttings are stricter than those for the rest of the continental shelf, and it is a general requirement that drill cuttings must be reinjected or treated on land. Drill cuttings and drilling mud from the tophole section may be discharged, but only in areas where damage to vulnerable components of the environment is considered unlikely. Such assessments must be based on thorough surveys of such components.

In connection with exploration drilling in the Barents Sea, the discharge permits issued to the operators under the Pollution Control Act have included specific requirements on reporting to the Climate and Pollution Agency for each exploration well. Operators are required to conduct environmental monitoring after the wells have been drilled and monitor the treatment of landed drill cuttings.

The operators (Statoil and Eni) have reported their experience of treating drill cuttings to the Climate and Pollution Agency. A total of 7 673 tonnes drill cuttings have been discharged as a result of drilling in the Barents Sea, 5 525 tonnes of which have been taken ashore for disposal and/or re-use (Table 4.1).

Table 4.1 Quantities of drill cuttings discharged, or taken ashore for disposal and/or re-use, in the Barents Sea, 2005–09

Operator | Discharges from the tophole section (tonnes) | Slurrified/ re-used (tonnes) | Onshore disposal (tonnes) |

|---|---|---|---|

Eni (3 wells) | 1 824 | 1 134 | |

Statoil (13 wells) | 5 849 | 652 | 3 739 |

Total | 7 673 | 652 | 4 873 |

Source Climate and Pollution Agency

A number of different chemicals are used in the drilling process, including drilling fluids, cement chemicals, utility chemicals and pipe dope. Chemicals used in drilling account for about 90 % of the total consumption and discharge of chemicals. Seawater and potassium chloride (which also occurs naturally in seawater) are generally used in drilling the tophole section and pilot hole. The discharges consist mainly of water and green-category chemicals. Discharges of yellow-category chemicals amount to 0.04 % of total discharges, and the use and discharge of red-category chemicals are minimal (Table 4.2). No black-category chemicals are used or discharged (their use and discharge are as a rule prohibited).

Table 4.2 Use and release of chemicals in drilling for wells in the Barents Sea, 2006–09. Green category: presumed not to have a significant impact on the environment. Yellow category: not environmentally hazardous and not classified as green. Red category: environmentally hazardous, high priority given to their replacement.

Category | Use | Released |

|---|---|---|

Green | 15 222 tonnes | 5 444 tonnes |

Yellow | 176 tonnes | 2.4 tonnes |

Red | 18 kg | 1 kg |

Source Climate and Pollution Agency

No significantly elevated levels of hydrocarbons have been found in the sediment samples taken around any of the investigated exploration wells. Barium, which may indicate the discharge of drill cuttings, has been found around some of the wells.

The operators’ investigations of the seabed after drilling showed that drill cuttings were deposited on the sediments within a radius of 50 m around the well. Outside this area sediment was partly covered out to a radius of 100 m. Statoil’s investigations after drilling in the Snøhvit field indicate that the area where the cuttings have impacts on the fauna shrinks over time and that the fauna in the area returns to normal levels. These findings have been supported by studies conducted by Statoil at the Morvin field in the Norwegian Sea, which showed that after three years the fauna were returning to normal levels.

Transporting drill cuttings to land, treating them for disposal and re-using them increases pressure on the environment. Transport uses large amounts of energy, resulting in large emissions to air (about 305 kg CO2 per tonne cuttings). The Climate and Pollution Agency has estimated that CO2 emissions from the transport of drill cuttings to land account for about 3 % of total CO2 emissions generated by exploration drilling.

Cuttings from drilling with water-based mud must be treated before disposal on land in order to reduce the content of salt and dissolved organic carbon. The benefits of re-using drill cuttings in drilling other wells have been found to be smaller than expected because of the high transport costs and the need to add more chemicals. At present we do not know enough about the possibilities of re-using drill cuttings, but this alternative should be further explored, since re-use is normally a better solution than disposal. However, tests have shown that cuttings from drilling with water-based mud can be re-used as a raw material in the manufacture of concrete.

Ordinary hose systems for transferring cuttings from the rig to the ship cannot be used for drill cuttings containing water-based drilling mud. Thus at present cuttings are transferred from the rig to the ship in containers by means of cranes, which involves a risk to the personnel. However, better technology is being developed.

Acquisition of seismic data

In 2009 the Petroleum Directorate, the Directorate of Fisheries and the Pollution Control Authority (now the Climate and Pollution Agency) drew up a report on acoustic disturbance and other negative impacts on fish and marine mammals caused by seismic activity, with recommendations for testing. With regard to the scare effect on fish, it was not possible to ascertain how far away from the source of the noise the effect made itself felt, with the result that no recommended minimum distance from fishing activities, etc. could be established. This was mainly due to the fact that relatively little research had been done on scare effects, and that the commercial interests could not agree. It should be noted that the way sound waves travel and the distance travelled under water depends on hydrographic conditions, which vary through the year and often from area to area. The Institute of Marine Research conducted a seismic survey in the waters off the Lofoten and Vesterålen Islands in the period 29 June–9 August 2009 in order to obtain better documentation on the effects of noise from seismic surveys on several commercial fish species and thus on catch opportunities for fishermen.

The main conclusions of the study were that seismic surveys had not been found to harm marine life, but that the noise affected the behaviour of the fish and there were changes (increases or decreases) in the size of catches while the surveys were being conducted. Gillnet catches of Greenland halibut and redfish increased during and after the surveys, while longline catches of Greenland halibut and haddock declined but increased again after the surveys had been completed. Swimming activity increased, which can be a sign of stress. However, no significant changes in feeding by the fish were found. During the surveys the density of saithe in the area declined, but there were no changes in the distribution of the other species. With regard to direct damage to fish larvae, previous research has shown that only larvae within a maximum radius of 5 m from the sound source suffer any damage. On the basis of these studies it has been concluded that seismic surveys do not cause damage at the population level.

4.4 Tourism

4.4.1 Management

In the Government’s High North Strategy of 2006 and the updated strategy of 2009, it was pointed out that the tourist industry in the region has a particularly strong competitive advantage. Encouraging tourist industries promotes development in coastal communities and creates new jobs that can halt or limit the depopulation that is depleting many coastal municipalities.

The High North and the Sami areas are given special mention in the Government’s tourism strategy of 2007. The strategy states that there is a need for greater coordination across the borders of the three northernmost counties and that the region would benefit from a joint, focused marketing strategy for the foreign market. In 2009 the three northernmost counties established a joint marketing organisation, Nordnorsk Reiseliv AS, to promote the image of the region abroad. The organisation became operative in January 2010.

4.4.2 The importance of tourism for value creation and Norwegian society

The tourist industry depends on and helps to maintain viable coastal communities along the Norwegian coast. Few countries have as long and varied a coastline as Norway, and the coastal environment, the fjords and the open sea have great potential in terms of tourism. The industry comprises a wide range of activities and sectors, a large proportion of which involve sales to travellers. They include transport, accommodation and restaurant services, travel and tour companies, and companies offering attractions and activities of various kinds. Growth in the number of tourists has spin-off effects, especially in the retail sector, in addition to direct value creation by travel and tour companies.

Statistics Norway has published a report on tourism and its economic importance, which showed that the industry accounts for a larger proportion of total production in the three northernmost counties than in the rest of the country, apart from Akershus, where it accounted for 9.7 %. In 2006 tourism accounted for 6.7 % of total production in Nordland and 6 % of total production in Troms and Finnmark. The average figure for mainland Norway as a whole was 5.5 %. Total consumption by Norwegian and foreign visitors and tourists in North Norway in 2009 was estimated at NOK 19 billion, divided as follows between the three counties: Nordland NOK 8.6 billion, Troms NOK 6.6 billion and Finnmark NOK 3.8 billion.

The tourism sector in North Norway employs about 17 970 persons in the three northernmost counties. Half of these work in Nordland, one-third in Troms and one-sixth in Finnmark. The industry is relatively speaking a more important creator of jobs in Nordland, where 8.6 % of the total number of employed persons work in the industry, than in Troms or Finnmark, where the corresponding figures are 5.7 % and 6.9 %.

Figure 4.14 Whale safari

Source Norwegian Polar Institute

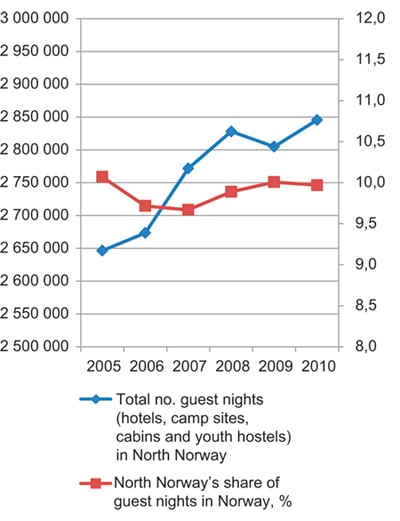

The number of commercial guest nights in the three northernmost counties in the period 2005–09 rose by 5.9 % (Figure 4.15). North Norway’s share of the total Norwegian market for guest nights decreased from 2003 to 2007, but since then the share has shown a considerable increase.

Figure 4.15 Number and market share of guest nights for North Norway in the period 2005–10

Source Statistics Norway

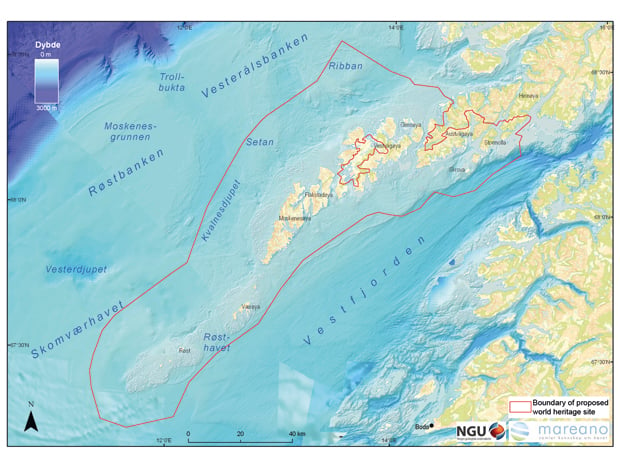

Some of the regions bordering on the management plan area have experienced particularly strong growth in the last few years. This applies particularly to the Lofoten Islands, where the number of guest nights has risen by 34.6 %. If parts of the natural and cultural landscape in the islands are inscribed on UNESCO’s World Heritage List, this will also have a positive effect on the already rapidly growing tourist industry in the area. Inscription on the World Heritage List normally has a significant impact on tourism, and increasing attention is being paid within UNESCO to the possibilities and challenges of world heritage tourism. In some areas the number of visitors has increased by several hundred per cent, although in others the increase has been considerably smaller. The number of visitors to the Vega Archipelago increased sixfold from 2004, when it was inscribed on the List, to 2009.

The spectacular scenery, the exoticism of the Arctic and the viable coastal communities form the main foundation for the tourist industry in the High North, and occupy a key place in promoting Norway’s image abroad. The coast and coastal culture, and Arctic Norway are two of the four key elements in Innovation Norway’s branding strategy for Norway as a tourist destination.

The Lofoten Islands, the North Cape and Hurtigruten are among the best known tourist products in Norway. The cruise sector is growing rapidly along the entire coast, and in North Norway the Lofoten Islands, Tromsø and the North Cape area experienced particularly strong growth in the period 2006–10.

Six of the 18 national tourist roads that are being developed or planned are in the vicinity of the management plan area (Helgelandskysten Nord, Lofoten, Andøya, Senja, Havøysund and Varanger). Norway’s national tourist roads have attracted international attention, and are expected to continue to play a central role in the promotion of North Norway. They will also encourage the development of tourist products in the areas through which they pass.

Tourism in Svalbard has grown substantially in the last 10 years, and the number of guest nights rose from 61 277 in 2000 to 81 718 in 2010, with a peak of 92 000 in 2008. From 2003 to 2009 the number of person-years in direct employment in the tourist industry rose from 165 in 2003 to 179 in 2009, having reached a peak of 227 in 2008. In addition to the 179 persons directly employed, tourism accounted for 73 person-years in tourism-derived industries in 2009. In the same period (2003–09) the turnover in the tourist industry increased from NOK 215 million to NOK 371 million, in addition to the turnover in local businesses, which amounted to around NOK 104 million. The most recent white paper on Svalbard (Report No. 22 (2008–2009) to the Storting) stated that tourism is one of the three main industries in the archipelago, and that the Government is in favour of further development of the industry as a basis for additional value creation in the area and to promote settlement in Longyearbyen. Experiencing the attractions of Svalbard mainly requires traffic in and close to the islands’ vulnerable, untouched nature, and this makes it imperative that further development of tourism in the area should take place within a safe and environmentally sound framework.

Whether to nominate parts of the Svalbard archipelago for inscription on the World Heritage List is being considered, and is discussed in more detail in the white paper on Svalbard.

Sea-fishing tourism

This form of tourism has grown considerably in the last 10–15 years in Norway. In several coastal communities it has contributed substantially to value creation and employment, especially during the summer season, when tourism is an important source of income.

Total value creation in Norway by the 434 fishing tourism enterprises is estimated at NOK 222 million a year, of which NOK 100 million is created in North Norway.

In order to help ensure the sustainability of sea fishing, the Ministry of Fisheries and Coastal Affairs has appointed a working group to examine the need to regulate commercial activities based on sea fishing tourism and suggest management measures. The members include representatives of the industry itself, relevant research communities and management authorities.

The group will present a final report on its work with proposals for new measures.

4.5 Environmental management

The environmental authorities have several important tools at their disposal in connection with activities in the Barents Sea–Lofoten area. For Norway’s territorial waters these are mainly based on the Nature Diversity Act, while for Norway’s exclusive economic zone and the Norwegian continental shelf, the most important tools are based on the Pollution Control Act, political action plans and strategies.

4.5.1 Management and measures

Marine protected areas

It is a national target to establish a representative network of marine protected areas (MPAs) in the different biogeographical regions in Norway’s coastal and marine areas by 2012. Protection of selected marine areas is a key element of ecosystem-based management, and is intended to play a part in halting the loss of biodiversity, safeguarding the natural resource base and maintaining a representative selection of marine environments as reference areas for research and monitoring. Establishing MPAs will meet some of Norway’s international commitments, including the target under the Convention on Biological Diversity that at least 10 % of coastal and marine areas are to be protected by 2020.

The fisheries authorities have already introduced various forms of protection for several areas as part of the management regime for living marine resources. In the white paper Integrated Management of the Marine Environment of the Norwegian Sea (Report No. 37 (2008–2009) to the Storting), the Government decided to draw up a marine protection plan. The first phase will cover 36 MPAs, and the planning process for the first 17 began in September 2009. Four of these (Lopphavet, Ytre Karlsøy, Rystraumen and Rossfjordstraumen) are in the coastal zone or just inside the Barents Sea–Lofoten area. The planning process for the remaining 19 MPAs will begin in 2011. Four of these (Tanafjorden transect, Indre Porsangerfjord, Andfjorden transect and Røstrevet) are also situated in the coastal zone or just inside the Barents Sea–Lofoten area.

In addition 87 % of the territorial waters around Svalbard, including Bjørnøya, lie inside nature reserves and national parks that are protected under the Svalbard Environmental Protection Act.

Protection of seabirds

An important part of seabird management is protecting their habitats. All Norwegian counties with a coastline have their own conservation plans for preserving important seabird colonies.

Hunting seasons for seabirds

The Directorate for Nature Management regulates which bird species may be hunted, the hunting season for each species and the areas where they may be hunted. The regulations apply for five years at a time. The current regulations apply until 31 March 2012, and will be revised by then.

Priority species