5 The ocean-based industries

Norway is rich in natural resources and has always taken a long-term approach to resource management for the benefit of society as a whole. Ocean industries play a vital part in value creation in Norway, and the oceans provide livelihoods for many coastal communities. Some of the country’s most innovative businesses, jobs and knowledge institutions have their origins in human settlement along the coast and use of the oceans. Close cooperation between knowledge institutions, the business sector, employees and authorities has played an important role in the historical development of Norway as an ocean economy.

There will be substantial opportunities in the future for growth and new jobs in industries that operate in a global market. For the foreseeable future, the oceans will continue to be a vital basis for jobs, value creation and welfare throughout Norway, and they can also be part of the solution to the environmental and climate-related challenges the world must deal with. The Government recognises that marine resources are important for national value creation, and considers it important for exploitation of natural resources to have positive spin-off effects for communities.

As part of the work on the scientific basis for the management plan, the Forum for Integrated Ocean Management obtained figures for value added and employment in the seafood, petroleum, shipping and tourism sectors from Statistics Norway, which are presented in Tables 5.1 and 5.2. After the knowledge base had been compiled, Statistics Norway revised the underlying data and provided updated figures for 2010 and 2016 for the four sectors. It also provided national figures for 2010, 2016 and 2019, with the exception of 2019 figures for the tourism sector.

Table 5.1 Comparison of value added in four ocean industries in each of the management plan areas and the totals for Norway. Value added is shown in NOK billion (in current prices).

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

|---|---|---|---|---|---|---|---|---|---|

Industry | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Seafood | 11.9 | 21.4 | 12.3 | 20.3 | 8.9 | 16.8 | 33.1 | 57.9 | 64.7 |

Petroleum | 21.2 | 25.3 | 143.9 | 112.0 | 431.4 | 341.1 | 596.6 | 478.5 | 566.8 |

Shipping | 1.3 | 1.0 | 4.1 | 4.6 | 26.7 | 35.0 | 32.2 | 40.7 | 39.8 |

Tourism1 | 2.4 | 3.7 | 2.5 | 4.0 | 9.6 | 14.2 | 32.2 | 45.4 | - |

Sum | 36.8 | 51.4 | 162.8 | 140.9 | 476.6 | 407.1 | 694.1 | 622.5 | 671.3 |

1 No figures for tourism are available for 2019.

Source Statistics Norway

Table 5.2 Comparison of employment in the four ocean industries in each of the management plan areas and the totals for Norway. Employment figures in 1 000s.

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

|---|---|---|---|---|---|---|---|---|---|

Industry | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Seafood | 9.4 | 11.3 | 8.4 | 8.5 | 7.1 | 8.0 | 24.9 | 28.0 | 30.7 |

Petroleum | 13.7 | 14.5 | 25.8 | 25.8 | 73.8 | 74.3 | 113.4 | 114.6 | 110.0 |

Shipping | 1.7 | 2.9 | 5.7 | 4.4 | 20.4 | 25.2 | 27.8 | 32.5 | 32.0 |

Tourism1 | 4.8 | 6.1 | 4.8 | 7.1 | 17.1 | 21.0 | 74.2 | 88.4 | - |

Sum | 29.6 | 34.8 | 44.7 | 45.8 | 118.4 | 128.5 | 166.1 | 263.5 | 172.7 |

1 No figures for tourism are available for 2019.

Source Statistics Norway

The figures indicate value added and employment in core activities and for the largest direct supplier companies for each sector. The figures include exports related to core activities but not to supply industries, and do not include wider spin-off effects.

There are major opportunities for blue growth. The OECD estimates that the global ocean economy will double by 2030 from the 2010 level, while providing a total of 40 million jobs. The world population will be close to 10 billion by 2050, and an increasing number of people will enjoy improvements in purchasing power. This will result in growing needs for food, energy, goods and services. There is also potential for further growth in both established and emerging ocean industries in Norway.

Green transformation of the ocean industries in Norway and internationally will also offer rich opportunities, involving both established and emerging industries. Offshore wind, carbon capture and storage under the seabed, and green shipping are among the areas where Norway has much to offer and where sound ocean management can promote the green transition. In 2019, the Government presented an action plan for green shipping as part of the follow-up of its strategy for green competitiveness.

5.1 Food production from the oceans

Norway has a large and profitable fisheries and aquaculture sector, which harvests and produces a total of more than 3 million tonnes of seafood a year, mainly for export. Thus, the importance of Norwegian seafood production reaches far beyond Norway’s borders. In 2019, the value of Norwegian seafood exports amounted to NOK 107.3 billion.

5.1.1 Current status and expected developments in economic activity

Fishing, sealing, whaling and other harvesting are based on wild living marine resources. Wild living marine resources belong to Norwegian society as a whole and are to be managed in a sustainable, economically profitable way that safeguards genetic material derived from them and promotes employment and settlement in coastal communities. Knowledge- and ecosystem-based management of marine resources will make it possible to continue to work towards these goals.

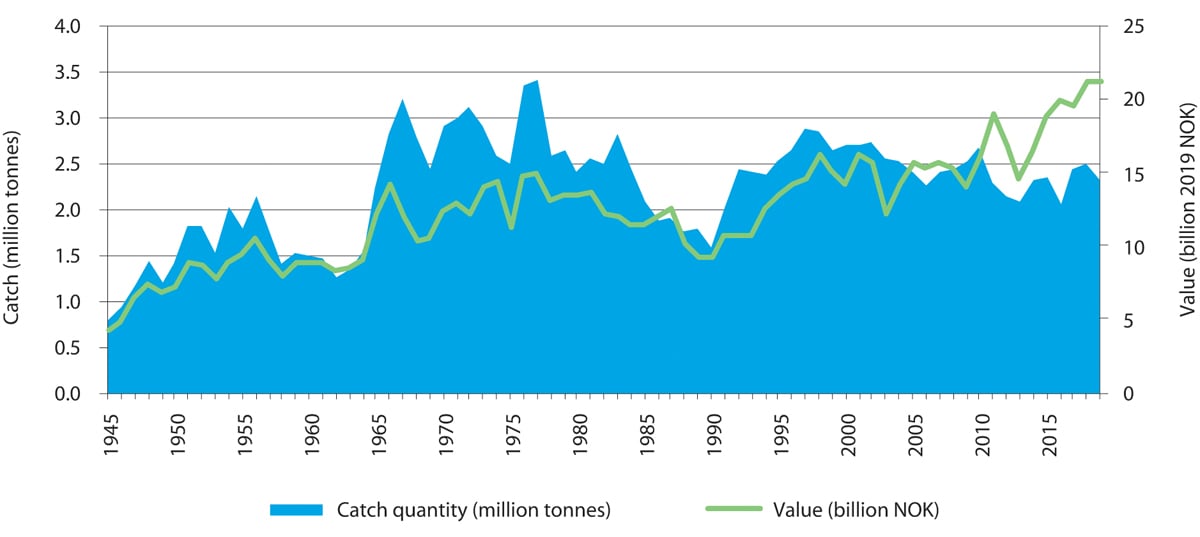

Figure 5.1 Norwegian marine capture fisheries, 1945–2019. The figure shows catch quantity (blue area) and landed value (green line).

Source Directorate of Fisheries

Catches by Norwegian vessels for the country as a whole totalled 2.7 million tonnes in 2010 and 2.2 million tonnes in 2016. The downturn is primarily due to reduced catches of Norwegian spring-spawning herring and capelin in the Barents Sea–Lofoten management plan area. At the same time, the cod harvest has increased from about 280 000 tonnes to 400 000 tonnes, which partly explains the increase in value added from 2010 to 2016.

Over time the number of fishing vessels has declined steeply, from 41 000 in 1960 to just over 17 000 in 1990. Since 2010 there has been little further reduction, and the number of vessels has been more or less constant, with a slight rise in recent years due in part to the expansion of wrasse fishing. The fisheries have also become much more efficient, and catch per person has risen by a factor of twenty since 1945.

Changes in the oceans affect fish stocks, and fisheries are affected by processes of change in the oceans, making it necessary to adjust catch sizes, management regimes and the way stocks are shared with other countries. Climate change and other pressures are expected to result in major changes in the size and distribution of fish stocks in the years ahead, creating challenges for fisheries and fisheries management.

The Northeast Arctic cod fishery is still the most important in Norway, and the stock is being sustainably managed. However, it may be affected by factors such as climate change and ocean acidification in future. The fjord and coastal cod stocks in North Norway are in poorer condition.

In the North Sea–Skagerrak area, total catches of the most important species were stable in the period 2010–2017. The main species are mackerel, herring, sandeels, Norway pout and shrimps. Mackerel catches declined from 129 068 tonnes in 2010 to 51 910 tonnes in 2017. Norway pout catches also declined (from 65 634 tonnes to 21 357 tonnes) while there was an increase in the landed volume of herring and sandeels.

For some years now, a northward shift in the distribution of key fish stocks has been observed. For example, the distribution of mackerel has been changing, and the important North Sea fishery has largely moved northwards to the Norwegian Sea in recent years.

There is considerable commercial interest in lobster trapping along the coast, particularly in Southern Norway. Because of the decline in the stock, stricter harvesting rules were introduced, but this alone has not been enough to improve stock status. In 2014, the Directorate of Fisheries invited municipalities to put forward proposals for areas to be permanently closed to lobster trapping. So far 41 such areas have been established but more are needed to build up the lobster stock. The Directorate’s invitation for municipalities to initiate local processes is therefore still open, and the aim is to establish an area in each relevant municipality that is closed to lobster trapping. A number of processes are already under way and the number of areas will increase.

In the Skagerrak, shrimp trawling is one of the most important fisheries.

In the Norwegian Sea, catches of the main species (herring, mackerel, saithe and cod) totalled 531 802 tonnes in 2013 and 678 803 tonnes in 2017. In both 2013 and 2017, herring accounted for the largest landed catch, 219 758 tonnes and 231 653 tonnes respectively. The increase in landed volume was mainly due to a sharp rise in mackerel catches (from 31 928 tonnes in 2013 to 167 747 tonnes in 2017).

Northeast Arctic cod is currently fished in large parts of the Norwegian Sea and the Barents Sea. If its distribution changes further in a northerly and easterly direction, the Norwegian Sea may become less important for cod fishing.

In the Barents Sea–Lofoten area, there was a sharp reduction in landed catches of the main fish stocks from 2010 to 2016. The most important species in the Barents Sea are cod, haddock, herring and capelin. The overall reduction was primarily due to reductions in landed catches of herring and capelin. The capelin stock fluctuated, and in 2016 the catch was set at zero. At the same time, landed catches of cod have increased somewhat, from 239 247 tonnes in 2010 to 346 361 tonnes in 2016.

Rising sea temperatures and greater inflow of Atlantic water are the main reasons for the northerly shift in the distribution of fish stocks. It appears likely that the focal point for important Norwegian fisheries will shift northwards and eastwards in coming years. As the sea ice melts, previously inaccessible areas are likely to become accessible for fishing. It will be important to carry out specific assessments of which areas can be opened for fisheries, and where the presence of valuable and vulnerable areas indicates that this should not be done.

Red king crabs are harvested only in the Barents Sea. The current management regime for the red king crab is two-pronged, with different management objectives east and west of 26° E. Harvesting is regulated by quotas east of this line, but is unrestricted west of the line to attempt to limit the westward spread of the species. The Norwegian management regime for red king crab is intended to maintain an area for commercial harvesting to support the parts of the fishing industry most seriously affected by the red king crab, while at the same time taking steps to limit its further spread. Management of this species is based on knowledge about its impacts on the ecosystem and about how realistic it is to limit its spread.

There are wrasse fisheries in all three management plan areas. Wrasses are used in controlling sea lice in salmon farms. In recent years, wrasse catches have increased considerably, and this has had major impacts on local stocks. Regulatory measures have been introduced for these species, including quotas and limitations on access.

There has been little change in kelp harvesting technology and the management of kelp harvesting in recent years. Kelp is harvested in the North Sea and the Norwegian Sea. There may be conflicts of interest between the role of kelp as a harvestable resource and its role in providing ecosystem services and as a habitat.

The Norwegian whale catch has remained stable at just over 400 minke whales annually. Minke whales are caught in all three management plan areas.

Aquaculture operations in Norway’s internal waters are outside the scope of the management plans, but form part of the whole picture because they depend on good environmental conditions and can have an impact on the marine environment.

5.1.2 Potential growth in food production from the oceans – new opportunities

Harvesting snow crab

Current knowledge indicates that there is no potential to increase harvesting of wild fisheries resources that are already exploited, with the exception of snow crab. Most stocks are already fully exploited, but it may be possible to target operations to catch fish of optimal size.

Since snow crabs were first recorded near Novaya Zemlya OK in the Barents Sea in 1996, the species has been spreading northwards and westwards, and has now expanded to all suitable habitat on the Norwegian continental shelf. The snow crab population has the potential to grow much larger, and the species could have a major impact on populations of other benthic organisms. So far no negative effects of snow crabs or harvesting of snow crabs on fisheries resources have been registered.

Norwegian vessels began harvesting snow crab in 2012. For 2020, a quota of 4 500 tonnes has been set in the Norwegian zone, equating to a landed value of roughly NOK 400 million. Currently, only part of the Norwegian continental shelf west of the Loophole is of interest for commercial fishing of snow crab. The population has risen significantly since 2010, but there is considerable uncertainty relating to productivity and carrying capacity. In the long term, snow crab may become a resource in the same way as other important stocks, but which areas develop a commercial density of crabs will depend on factors such as depth, temperature and food availability. Trapping of snow crabs may also lead to spatial conflicts with other activities such as shrimp trawling.

Figure 5.2 The copepod Calanus finmarchicus (left) and a mesopelagic lanternfish (right).

Photo: Erling Svensen (left); Institute of Marine Research (right)

The snow crab is in some ways similar to the red king crab, but differs regarding uncertainty as to whether it is an alien species (originally introduced by human activity) or has expanded its range naturally. Red king crabs are found near the coast, but it is unlikely that snow crabs will become established along the coast of mainland Norway.

Harvesting of the copepod Calanus finmarchicus and mesopelagic species

Harvesting of the copepod Calanus finmarchicus and mesopelagic species, i.e. harvesting at lower trophic levels than has been the case until now, may expand considerably in the coming years. Each year since 2003, C. finmarchicus has been harvested under an experimental licence. In 2018, the catch quantity was just over 1 300 tonnes, which is nearly double the quantity in 2017. In future, harvesting will be in accordance with the management plan that has been adopted. Licences for copepod trawling have now been granted, and a total allowable catch (TAC) has been set. C. finmarchicus occurs in all three management plan areas, but mainly in the Norwegian Sea.

A great deal of development work is being done on mesopelagic species, and the potential for harvesting could be large. Mesopelagic is used to describe species that live at depths of 200 to 1 000 metres in the water column. There have only been very limited catches of mesopelagic species by Norwegian vessels up to now, but there is interest in commercial harvesting of these resources. Developments are in progress, and 2019 was the first year when there were significant catches by Norwegian vessels.

Much work remains to be done on both C. finmarchicus and mesopelagic species in order to realise the major potential for harvesting in the form of new profitable fisheries. It is unclear to what extent large-scale harvesting of copepods and mesopelagic species will be developed, for a number of reasons. There is a huge biomass of resources at lower trophic levels, so that there is theoretically a large potential for commercial activity and value creation. There may be many areas of use for these resources, and feed for the aquaculture industry will be particularly important. Knowledge development in a number of areas will be required to realise the potential for harvesting both C. finmarchicus and mesopelagic species, including learning more about their biology and developing catch technology and processing techniques.

There is also a potential for developing harvesting of benthic resources at low trophic levels, such as sea cucumbers and bivalves, but the knowledge base on the harvesting potential, ecosystem effects of harvesting and food safety will have to be strengthened. A precautionary approach must be taken to all new types of harvesting, and more knowledge is needed about the environmental effects and impacts on food chains of such activities.

Offshore aquaculture

Marine aquaculture is the cultivation of marine organisms in both fed and unfed production systems. Production may take place in open or closed systems, and near the coast or offshore. Currently Norwegian aquaculture is heavily dominated by salmonids, which are fed.

Considerable technological innovation is in progress on production of salmon and rainbow trout in the future. The industry could change a great deal in the coming years, particularly with the development of offshore aquaculture. The Government has been using a system of development licences to promote the development of new aquaculture technology, including technology that is better suited to more exposed locations. Offshore aquaculture is not likely to replace existing forms of aquaculture but rather supplement coastal aquaculture production.

The Government is taking steps to facilitate the development of offshore aquaculture. These include the development of legislation, the siting of facilities within areas that are opened for offshore aquaculture, clarification of legislation on the working environment, safety and emergency preparedness, and rules on registration and if appropriate mortgaging of aquaculture installations. Spatial management issues relating to offshore aquaculture are further discussed in Chapter 7.

Textbox 5.1 Kelp cultivation

Since 2012 there has been consistently strong commercial interest in kelp farming. The Ministry of Trade, Industry and Fisheries has issued aquaculture licences for cultivation of macroalgae to almost 50 different companies at over 80 sites from Rogaland to Finnmark counties. More applications are being processed. From 1 June 2019, the authority to grant aquaculture licences for the cultivation of aquatic plants was transferred to the county authorities, so it is now the same administrative agency that is responsible for issuing all ordinary aquaculture licences.

Sugar kelp (Saccharina latissima) and dabberlocks (Alaria esculenta) are the main species currently being cultivated in Norway, but aquaculture licences have been issued for more than 30 different species of macroalgae.

Figure 5.3 Production of sugar kelp (Saccharina latissima) (left). Juvenile sporophytes of dabberlocks (Alaria esculenta) on a seed rope (right).

Photo: Seaweed AS/Audun Oddekalv (left); Silje Forbord/SINTEF Ocean (right)

Kelp is used in a wide range of products, including food, feed, pharmaceuticals, biochemicals, plastics, biofuels, fertiliser and pesticides. Kelp cultivated in Norway is used primarily for human consumption in restaurants and health food products. Kelp farming can have positive environmental effects by 1) replacing products made from fossil raw materials, 2) replacing feed protein derived from areas that were originally rainforest, and 3) helping to recycle nutrients from fish farming (through integrated multi-trophic aquaculture (IMTA)).

Industrial-scale kelp farming will occupy considerable areas, which may create new spatial conflicts and possibly introduce new environmental problems. Good spatial planning is the best way of avoiding conflict. There are also food safety issues, such as the high iodine concentration in certain kelp species. The Norwegian Food Safety Authority and the Institute of Marine Research are obtaining more knowledge about the safe use of algae and algal products.

Kelp farming is still in the research and development phase. Feedback from companies that have started sugar kelp production indicates that they are being successful. However, for the industry to become commercially profitable, it will have to resolve various issues relating to kelp biology, documentation of food safety, development of equipment, product development and markets. Kelp farmers have organised various networks to share knowledge and experience. In 2018, according to statistics from the Directorate of Fisheries, 170 tonnes of kelp was cultivated, primarily sugar kelp.

Cultivation of other species

By November 2017, licences had been issued for cultivation of macroalgae at 47 sites in Norway, covering a total planned area of 465 hectares. A number of companies are interested in combining kelp production with salmon farming, since for example sugar kelp can make use of dissolved nutrients from salmon production. Several research licences have been granted for studying this further. Cultivation of macroalgae needs relatively large sea areas. It is difficult to estimate value added and employment associated with this industry in future.

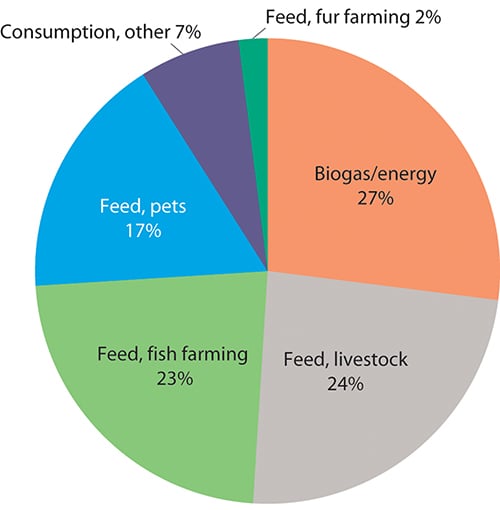

Figure 5.4 Areas of application for residual raw materials from fish and shellfish production.

Source BarentsWatch (Kontali and SINTEF)

Cultivation of organisms that do not require feeding, such as bivalves and kelp, offers considerable potential. Scaling up production will require more knowledge about issues including food safety, environmental impacts, technology and profitability.

Other potential aquaculture activities include production of sea cucumbers, which can consume waste from other aquaculture activities, sea ranching of native species and rearing wild-caught organisms such as sea urchins.

Utilisation of residual raw materials

According to a 2016 analysis by SINTEF, the fisheries and aquaculture sector produces about 914 000 tonnes of residual raw materials from a raw materials base of 3.3 million tonnes of fish and shellfish. About 75 % (689 000 tonnes) of this is used as ingredients (oil, proteins, supplements/premixes) in feed for fish, livestock, fur-bearing animals and pets, or in products for human consumption (seafood products, fish oil and extracts). A large proportion of the residual raw materials from aquaculture and the pelagic sector is utilised, but in the whitefish sector, large volumes are not utilised, and there is room for improvement in the shellfish sector as well.

The pelagic sector could supply even greater quantities of residual raw materials if the fish were to be sold filleted rather than exported whole, as they often are at present. Given the existing catch quantities, it is estimated that the unexploited potential for residual raw materials is 210 000–230 000 tonnes a year, mainly from the Barents Sea–Lofoten management plan area. Assuming that this would give a yield of 5 % fish meal costing NOK 10 per kilogram, the value would be NOK 100 million. This is residual raw material that would primarily be suitable for use in fish feed production. Other residual raw materials could be used domestically if Norway were to export more pelagic fish as fillets.

5.1.3 Value added and employment

Fishing has been an essential basis for settlement all along Norway’s long coastline. Norwegian waters have always provided a rich harvest of fish, which are still a vital natural resource today. More recently, fish farming has emerged as an industry of great economic importance. There are large numbers of aquaculture facilities from the southwestern tip of Norway northwards along the coast, but very few along the Skagerrak coast. Fish processing is also an important industry, with processing plants located along the coast where they can conveniently receive supplies from fisheries and aquaculture.

For the three management plan areas together, the seafood sector generated value added totalling NOK 57.9 billion and provided 28 000 jobs in 2016 (Tables 5.3 and 5.4). Of these, 24 800 were in core activities and 3 200 in supply industries. All three of the largest industries in the seafood sector, namely fishing, aquaculture and fish processing, grew from 2010 to 2016. This was mainly due to higher TACs for cod and higher prices for both wild and farmed fish. National figures for both value added and employment indicate that growth continued from 2016 to 2019.

Table 5.3 Value added in the seafood sector in the management plan areas and the totals for Norway.

Value added, shown in NOK billion (in current prices). | |||||||||

|---|---|---|---|---|---|---|---|---|---|

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

Industry | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Fishing | 5.1 | 8.6 | 2.1 | 3.0 | 2.1 | 2.9 | 9.2 | 14.0 | 15.7 |

Aquaculture | 3.0 | 7.5 | 6.3 | 12.2 | 4.0 | 9.7 | 13.2 | 29.4 | 31.1 |

Fish processing | 2.3 | 3.3 | 2.4 | 3.2 | 1.7 | 2.7 | 6.4 | 9.2 | 12.1 |

Manufacture of crude fish oils and fats | 0.2 | 0.0 | 0.1 | 0.0 | 0.1 | 0.0 | 0.3 | 0.0 | 0.0 |

Wholesale of fish. crustaceans and molluscs | 0.6 | 0.8 | 0.6 | 0.8 | 0.4 | 0.6 | 1.6 | 2.2 | 2.5 |

Sum of core activities | 11.1 | 20.2 | 11.4 | 19.2 | 8.3 | 15.9 | 30.8 | 54.8 | 61.5 |

Supply industries | 0.8 | 1.2 | 0.9 | 1.1 | 0.6 | 0.9 | 2.3 | 3.1 | 3.2 |

Sum of core activities and supply industries | 11.9 | 21.4 | 12.3 | 20.3 | 8.9 | 16.8 | 33.1 | 57.9 | 64.7 |

Source Statistics Norway

Table 5.4 Employment in the seafood sector in the management plan areas and the totals for Norway.

Employment figures in 1 000s. | |||||||||

|---|---|---|---|---|---|---|---|---|---|

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

Industry | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Fishing | 2.6 | 3.1 | 1.0 | 1.1 | 1.1 | 1.1 | 4.7 | 5.0 | 5.5 |

Aquaculture | 1.2 | 1.5 | 2.4 | 2.9 | 1.8 | 2.6 | 5.5 | 7.0 | 9.0 |

Fish processing | 3.7 | 4.6 | 3.4 | 3.2 | 2.9 | 3.0 | 10.0 | 11.1 | 11.5 |

Manufacture of crude fish oils and fats | 0.3 | 0.2 | 0.1 | 0.1 | 0.1 | 0.1 | 0.5 | 0.3 | 0.3 |

Wholesale of fish. crustaceans and molluscs | 0.7 | 0.6 | 0.6 | 0.4 | 0.5 | 0.4 | 1.9 | 1.5 | 1.6 |

Sum of core activities | 8.5 | 10.0 | 7.6 | 7.6 | 6.4 | 7.1 | 22.5 | 24.8 | 27.8 |

Supply industries | 0.9 | 1.3 | 0.8 | 0.9 | 0.7 | 0.9 | 2.4 | 3.2 | 2.9 |

Sum of core activities and supply industries | 9.4 | 11.3 | 8.4 | 8.5 | 7.1 | 8.0 | 24.9 | 28.0 | 30.7 |

Source Statistics Norway

In the North Sea–Skagerrak area, value added in the seafood sector amounted to NOK 16.8 billion in 2016, of which NOK 15.9 billion was from core activities, predominantly aquaculture, and NOK 0.9 billion from supply industries. Value added in the North Sea–Skagerrak area accounted for 29 % of total Norwegian value added in the seafood sector (see Table 5.3).

There were 8 000 employees in the seafood sector in the North Sea–Skagerrak area in 2016, of whom 7 100 were in core activities and 900 in supply industries. Employment in the North Sea–Skagerrak management plan area accounted for 27 % of total employment in the seafood sector in Norway (see Table 5.4).

In the Norwegian Sea, value added totalled NOK 20.3 billion in 2016: NOK 19.2 billion from core activities and NOK 1.1 billion from supply industries. Value added in the Norwegian Sea accounted for 35 % of all Norwegian value added in the seafood sector (see Table 5.3).

In the Barents Sea–Lofoten area, value added in the seafood sector totalled NOK 11.9 billion in 2010 and NOK 21.4 billion in 2016. The share of overall value added from the supply industries attributable to the Barents Sea–Lofoten area was estimated on the basis of the calculated share for core activities. This amounted to NOK 800 million in 2010 and increased to NOK 1.0 billion in 2016.

There were 9 400 employees in the seafood sector in the Barents Sea–Lofoten area in 2010 and 11 300 in 2016, an increase of about 20 %. This was mainly due to higher activity in the cod fishery as a result of higher TACs.

5.1.4 Current status and expected developments for environmental pressures and impacts

Fishing activities have major impacts on ocean ecosystems through harvesting of target species, disturbance of the seabed, unintentional bycatches and marine litter. The greatest impact is caused primarily by the annual removal of a significant proportion of the harvested year classes of commercial fish stocks.

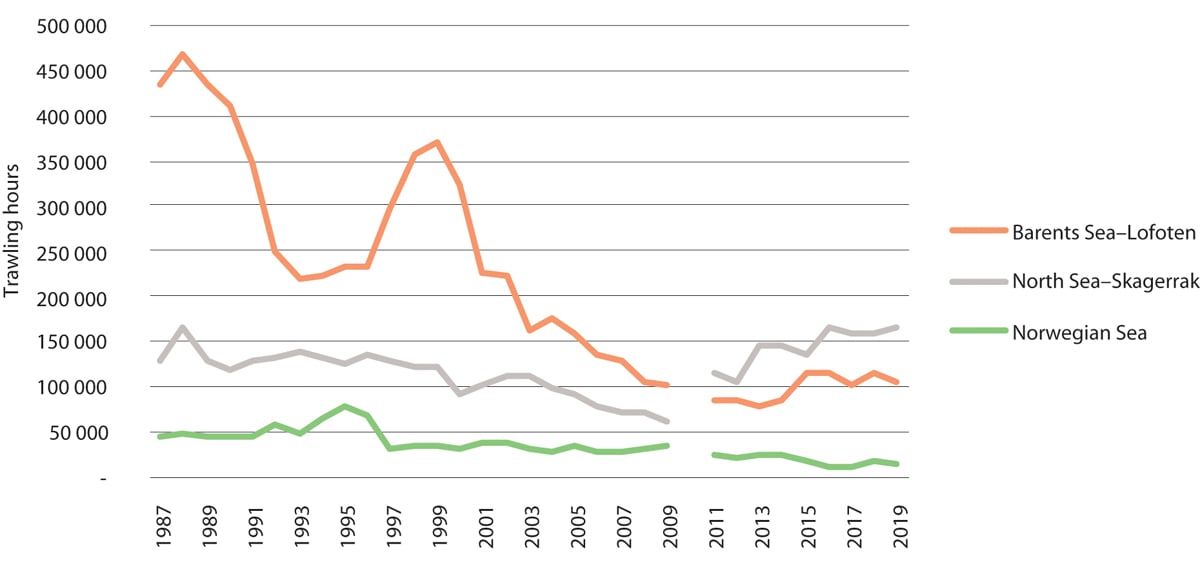

Figure 5.5 Number of trawling hours in bottom trawl fisheries in the management plan areas. There are no data for 2010 because of the changeover to electronic catch logbooks.

Source Directorate of Fisheries

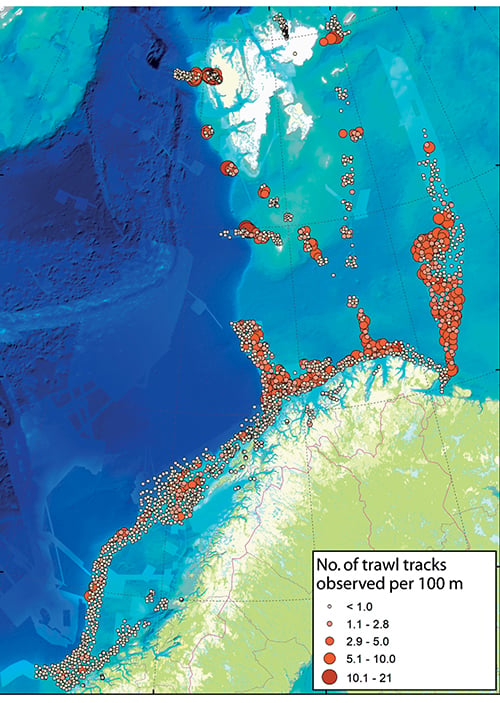

Figure 5.6 Number of trawl tracks observed per 100 metres.

Source MAREANO

The most important commercial stocks in Norwegian waters are generally in good condition. The fisheries management authorities have established a framework for the fisheries that has made it possible to maintain sustainable harvesting of the main commercial stocks in the Norwegian Sea and Barents Sea. However, there are certain exceptions. Of the smaller stocks, Norwegian coastal cod and golden redfish are still in poor condition. Golden redfish have been classified as endangered on the Norwegian Red List since 2015 and have been declining since the 1990s. The spawning stock is still below the precautionary level. It is therefore no longer permitted to fish specifically for this species.

The harvesting of target species also has indirect impacts on the ecosystem through effects on the food chain. This may influence predation pressure on some species, food availability for other species, or competitive relationships between species. Norway has therefore undertaken to pursue an ecosystem-based approach to fisheries management.

It is a general problem that there are relatively few controls on recreational fishing and fishing tourism in Norwegian waters.

Unintentional bycatches

Unintentional bycatches may have impacts on seabirds, marine mammals and benthic organisms such as corals and sponges, depending on the fishing gear used. In the Barents Sea, bycatches are assessed as having no to moderate impacts on seabirds, depending on the fishing gear and seabird group under consideration. Bycatches of certain northern seal species have clear but minor impacts at population level. Apart from this, the impacts of other bycatches, for example common porpoises in gill nets, are uncertain. In the Norwegian Sea, the limited harvest of golden redfish taken as a bycatch is considered to be too high.

Measures to reduce bycatches in Norwegian fisheries are specifically designed to avoid bycatches of undersized fish and fry. The objective is to allow fish to grow to maturity and become part of the spawning stock. The main measures used are the closure of fishing grounds if the intermixture of undersized fish is too high, mesh size requirements for gill nets and trawls, and requirements to use sorting grids in trawls.

Bycatches of fish eggs, larvae and fry could cause complications for harvesting of C. finmarchicus and mesopelagic species in the future.

Bottom trawling

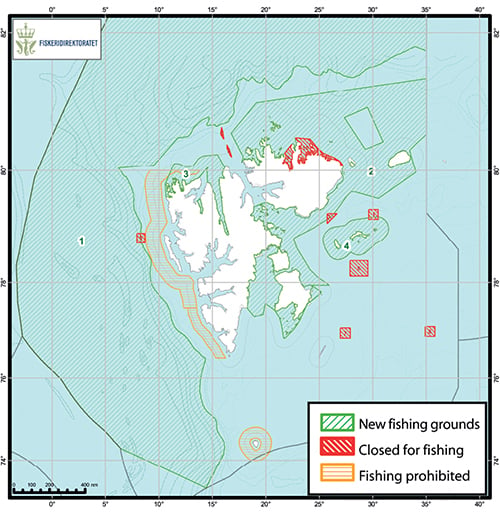

In recent years, particular attention has been focused on the impacts of bottom trawling on benthic ecosystems. In the Barents Sea, the physical impacts of bottom trawling on benthic communities were assessed as minor, but moderate in areas that were trawled frequently. Direct and indirect measures have been implemented that have considerably reduced the impacts of bottom trawling on benthic communities in the last 15–20 years. There is a general prohibition against damaging corals. Regulations have been adopted protecting about twenty clearly delimited coral reef areas against bottom trawling and the use of other towed gear. There are strict restrictions on starting bottom trawling operations in new deep-water areas, and in 2019 new rules were adopted to regulate bottom fishing activities in the northern Barents Sea and the waters around Svalbard. Ten areas are completely closed for fishing operations, and no fishing operations may be started in areas that have not previously been fished without prior mapping (see Figure 5.7).

Figure 5.7 Areas around Svalbard that are closed for fishing operations.

Source Directorate of Fisheries

Marine litter

Much of the waste found in Norwegian waters originates from the fisheries and aquaculture sector, as described in Chapter 3. This waste is a source of plastic pollution, injures marine animals, and increases mortality in various animals, for example through ghost fishing. Lost gear can also cause problems for fishing operations. It is important to deal with this problem to ensure the sector’s overall sustainability, and the Directorate of Fisheries organises an annual retrieval programme for lost fishing gear. The dumping of any kind of waste from Norwegian fishing vessels is prohibited, and various measures have been introduced to reduce marine litter. In recent years there has been more focus on recreational fishing and trapping activities, which are popular along parts of the coast, particularly in the south, where lost lobster traps have become a problem. The requirement to use twine that is readily biodegradable in water can effectively limit ghost fishing if full compliance is achieved, but will not eliminate the litter problem. Both professional and recreational fishermen will need to exercise care to limit the scale of losses of gear in future.

Underwater noise and other pressures

Fishing vessels generate underwater noise from engines, propulsion systems (cavitation noise) and the use of fishing gear (e.g. bottom trawls). The use of echo sounding and sonar also adds to noise levels in the oceans and may have direct impacts on marine mammals and other animals. Noise and emissions to air are further discussed below in the section on shipping.

The fishing fleet also discharges organic (biodegradable) waste to the sea, primarily trimmings and byproducts. Organic waste dumped into the sea from fishing vessels is not an environmental problem in the management plan areas. The long-term trend, however, is for more and more of the residual raw materials to be used.

Impacts of aquaculture

At present, aquaculture activities are restricted to coastal waters, which are outside the management plan areas. However, it is a major industry in Norwegian waters and may in future expand to areas considerably further offshore than the sheltered waters currently used. The main pressures on the surrounding environment from aquaculture facilities are the spread of sea lice, escapes of farmed fish and genetic impacts on wild fish populations, waste such as nutrients and organic material, and discharges of hazardous substances including copper and delousing agents. Moreover, the aquaculture industry needs large quantities of feed, and feed production also has environmental impacts and impacts on global food supplies.

The environmental problems encountered in offshore aquaculture are expected to be the same as those associated with coastal aquaculture activities, but new spatial conflicts may also arise with traditional fisheries, shipping and offshore wind power as well as new issues relating to species and habitats. The scale of environmental problems will depend on factors including technology choices and the types of systems used.

In order to safeguard the natural environment, more knowledge is needed about the migration routes, habitats and feeding grounds of important wild fish species. Methodology adapted to the open sea should also be developed for monitoring environmental impacts on biodiversity and levels of pollutants including organic material and hazardous substances.

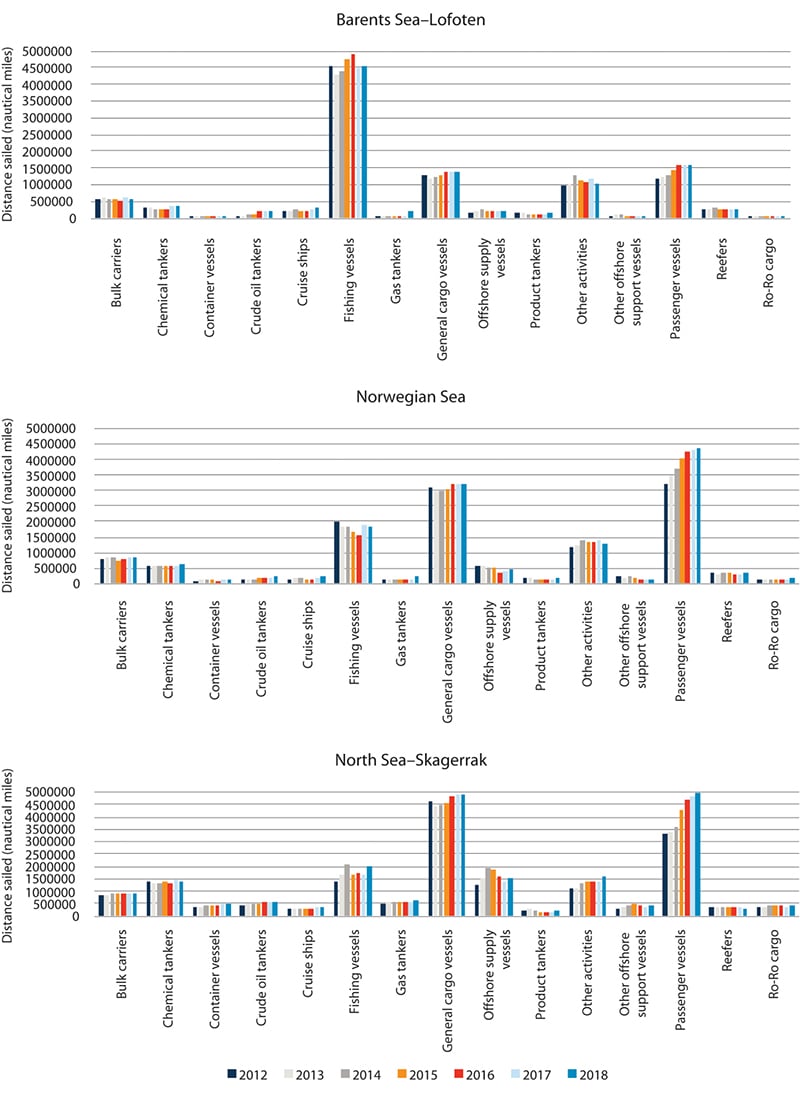

Figure 5.8 Distance sailed for various vessel categories in the period 2011–2017 in each of the management plan areas.

Source Norwegian Coastal Administration

5.2 Maritime transport

5.2.1 Current status and expected developments for economic activity

Shipping in all three management plan areas has risen moderately year by year in the period 2011–2017. This is part of a long-term trend linked to rising transport needs, which in turn are connected to economic developments and globalisation of the economy. Over shorter time periods, market fluctuations can result in changes within certain vessel categories.

The volume of shipping and shipping density differ greatly between the three management plan areas. In 2016, 45 % of total distance sailed was in the North Sea–Skagerrak area, 30 % in the Norwegian Sea and 25 % in the Barents Sea–Lofoten area. The Barents Sea–Lofoten area is nearly six times larger than the North Sea–Skagerrak area, but only accounts for about half as much distance sailed. The distribution of shipping between the management plan areas has remained relatively stable over time.

The volume of shipping is anticipated to increase by a total of 41 % for all three management plan areas combined by 2040. The anticipated increase is largest for the Norwegian Sea (49 %), followed by the North Sea–Skagerrak area (43 %) and the Barents Sea–Lofoten area (around 30 %).

The introduction of traffic separation schemes and recommended routes along the coast have helped to move shipping further out from the coast, separate traffic streams in opposite directions and establish a fixed sailing pattern.

There is a large volume of shipping in the North Sea–Skagerrak area, and there are important traffic streams in coastal areas. General cargo vessels and passenger vessels account for the greatest distance sailed (over half of total distance sailed in 2017). The largest increase since 2011 has been for passenger vessels.

Ships on the landward side of the baseline account for a significant share of distance sailed in the Norwegian Sea. However, the routeing system introduced in 2011 is clearly yielding results.

The Barents Sea–Lofoten area stands out because fishing vessels account for a substantially larger share of shipping than in the other management plan areas. The distance sailed by fishing vessels in the Barents Sea–Lofoten area is greater than in the North Sea–Skagerrak and Norwegian Sea areas combined. International shipping traversing the northernmost Norwegian waters is also on the rise. Nearly half of all maritime traffic (except for fishing vessels) in the Barents Sea–Lofoten area follows the recommended routes. Over 80 % of the largest ships and nearly all tankers follow these routes. This enhances safety and reduces accident risk.

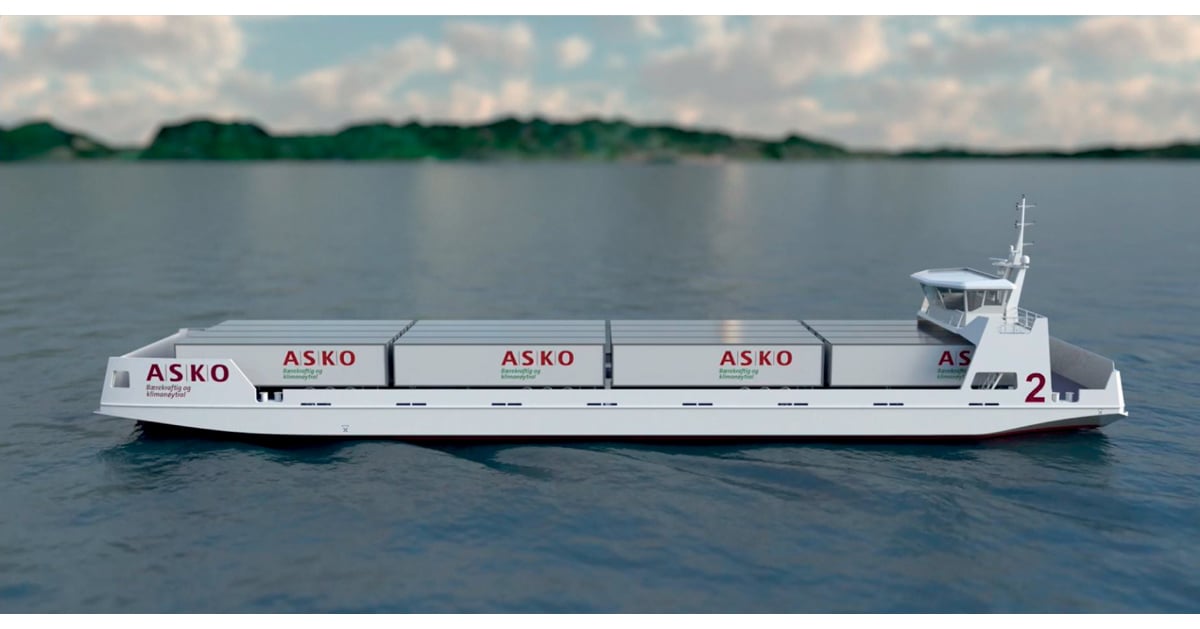

Textbox 5.2 Autonomous electric cargo vessels

The grocery wholesaler ASKO is planning to build two autonomous, electric, emission-free vessels (the AutoBarge design) to transport cargo across the Oslofjord between the towns of Moss and Holmestrand from 2024 onwards. The vessels will cross the fjord, manoeuvre and moor without a crew. A control centre on shore will monitor operations and be able to steer the vessels. The new vessels will have a daily cargo capacity of 128 semi-trailers in each direction across the Oslofjord, replacing 150 lorry trips per day between the east and west sides of the fjord. This will reduce annual energy consumption by 11.0 GWh at full operation as a result of shorter driving distances and the greater energy efficiency of the cargo vessels. In addition, 8.3 GWh of diesel will be replaced by electricity. The net result will be a reduction of 5 095 tonnes in CO2 emissions and a reduction in road transport of up to 2.2 million kilometres annually. The project has received NOK 119 million in investment support from Enova.

Figure 5.9 Autonomous cargo vessel.

Source ASKO

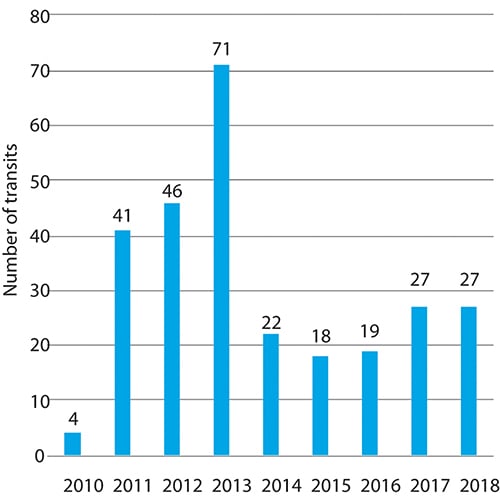

Figure 5.10 Vessels transiting the Northern Sea Route in the period 2010–2018.

Source Norwegian Coastal Administration

Automation and autonomous coastal navigation

Automated, and eventually autonomous, vessels will become increasingly important in the shipping industry. More autonomous ships will generally have various positive climate and environmental effects. Improvements in energy efficiency and optimisation of operations are some of the main benefits. The design of autonomous, unmanned vessels can also be made more aero- and hydrodynamic to reduce wind and water resistance. In combination, these factors will allow autonomous vessels to be highly energy-efficient and have low fuel consumption. This will make it possible for example to electrify more ships, and they will be able to operate for longer distances using electric propulsion.

The Government has been encouraging the development of autonomous technology and its use in ships for a number of years. Enova has provided grants of NOK 133 million for the construction of the Yara Birkeland, an autonomous electric container ship, and has granted NOK 119 million for development of the AutoBarge design for the grocery wholesaler ASKO (see Box 5.2).

Norway’s Act relating to ports and navigable waters was amended in 2019 to provide for autonomous navigation in coastal waters without the need to use a pilot. The Norwegian Maritime Authority takes part in all relevant projects at national level that involve autonomous ships and require certification of these vessels. The Maritime Authority and the Coastal Administration are both important partners for the industry.

Northeast Passage and Northern Sea Route

The reduced ice cover in the Arctic has to some extent opened up opportunities for maritime traffic between the Atlantic Ocean and the Pacific Ocean, both north of Canada via the Northwest Passage and north of Russia via the Northeast Passage and the Northern Sea Route (the part of the Northeast Passage in Russian waters). The prospect of cost savings motivates shipowners to consider using the Northeast Passage. Ships can potentially save 15–20 days at sea and reduce the distance sailed by two-thirds. So far, it is largely cargo vessels and some cruise ships that sail the Arctic route.

Statistics for the number of ships transiting the Northern Sea Route, see Figure 5.10, show that it is still uncertain what role the Northeast Passage will play in shipping between the Atlantic Ocean and the Pacific Ocean in both the short and long term.

5.2.2 Value added and employment

In the scientific basis for the management plans, value added and employment for shipping were calculated for each of the management plan areas, see Tables 5.5 and 5.6. The figures indicate that the bulk of value added and employment in the shipping sector is concentrated in the North Sea–Skagerrak area, while the Barents Sea–Lofoten area accounts for the smallest share. It remains to be seen what impact the anticipated increase in shipping in northern waters will have on value added and employment in North Norway.

Table 5.5 Value added for shipping in each of the management plan areas and the totals for Norway.

Value added, shown in NOK billion (in current prices). | |||||||||

|---|---|---|---|---|---|---|---|---|---|

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

Industry sector | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Foreign shipping, cargo | 0.1 | 0.10 | 1.2 | 1.4 | 18.8 | 24.3 | 20.1 | 25.8 | 24.7 |

Domestic shipping, cargo; tugboats | 0.4 | 0.5 | 0.5 | 1.2 | 0.9 | 1.8 | 1.8 | 3.6 | 3.1 |

Domestic coastal shipping, scheduled | 0.5 | 0.1 | 0.8 | 0.2 | 1.3 | 0.4 | 2.6 | 0.6 | 0.4 |

Sum of core activities | 1.0 | 0.7 | 2.5 | 2.8 | 21.0 | 26.5 | 24.5 | 30.1 | 28.2 |

Sum of supply industries | 0.3 | 0.3 | 1.6 | 1.8 | 5.7 | 8.5 | 7.7 | 10.6 | 11.6 |

Sum of core activities and supply industries | 1.3 | 1.0 | 4.1 | 4.6 | 26.7 | 35.0 | 32.2 | 40.7 | 39.8 |

Source Statistics Norway

Table 5.6 Employment in each of the management plan areas and the totals for Norway.

Employment figures in 1 000s | |||||||||

|---|---|---|---|---|---|---|---|---|---|

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

Industry sector | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Foreign shipping, cargo | 0.1 | 0.2 | 0.8 | 1.3 | 12.6 | 17.3 | 13.5 | 18.8 | 18.2 |

Domestic shipping, cargo; tugboats | 0.2 | 0.6 | 0.8 | 0.5 | 1.1 | 1.1 | 2.1 | 2.2 | 2.4 |

Domestic coastal shipping, scheduled | 1.0 | 1.6 | 2.5 | 1.4 | 2.7 | 3.3 | 6.2 | 6.4 | 6.4 |

Sum of core activities | 1.3 | 2.5 | 4.2 | 3.2 | 16.3 | 21.8 | 21.8 | 27.5 | 27.0 |

Sum of supply industries | 0.4 | 0.4 | 1.5 | 1.2 | 4.1 | 3.4 | 6.0 | 5.0 | 5.0 |

Sum of core activities and supply industries | 1.7 | 2.9 | 5.7 | 4.4 | 20.4 | 25.2 | 27.8 | 32.5 | 32.0 |

Source Statistics Norway

Norway has an internationally leading maritime industry, including shipping companies, maritime services, shipyards and equipment suppliers. The maritime industry is crucially important for settlement, value creation and employment, particularly in rural parts of Norway. There are maritime companies and strong clusters all along the coast from north to south. The sector is strongly specialised in high-tech market segments.

In 2018, the Norwegian maritime industry employed around 85 000 people, and the sector generated value added of NOK 142 billion. This means that the maritime industry accounted for 8 % of value added in Norway and 17 % of total Norwegian exports.

Norway is in a leading position globally as regards the deployment of zero- and low-emission technology in the maritime sector. Green shipping is opening up new opportunities for the Norwegian maritime industry. In autumn 2019, Menon Economics published a report on green value creation in the Norwegian maritime industry. According to Menon, green revenues in the maritime industry in 2018 totalled roughly NOK 28 billion. In addition, the industry made green investments of more than NOK 5 billion. Both revenues and investments have roughly tripled in the past few years. To follow up the strategy adopted by the International Maritime Organization (IMO) in 2018, including the ambition of cutting emissions from international shipping by at least 50 % by 2050, both green revenues and green investments will need to increase substantially in the years ahead. Norwegian companies are already supplying zero- and low-emission technology to the world market.

5.2.3 Current status and expected developments for environmental pressures and impacts

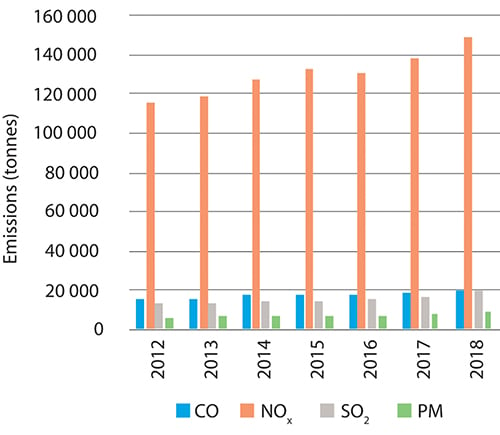

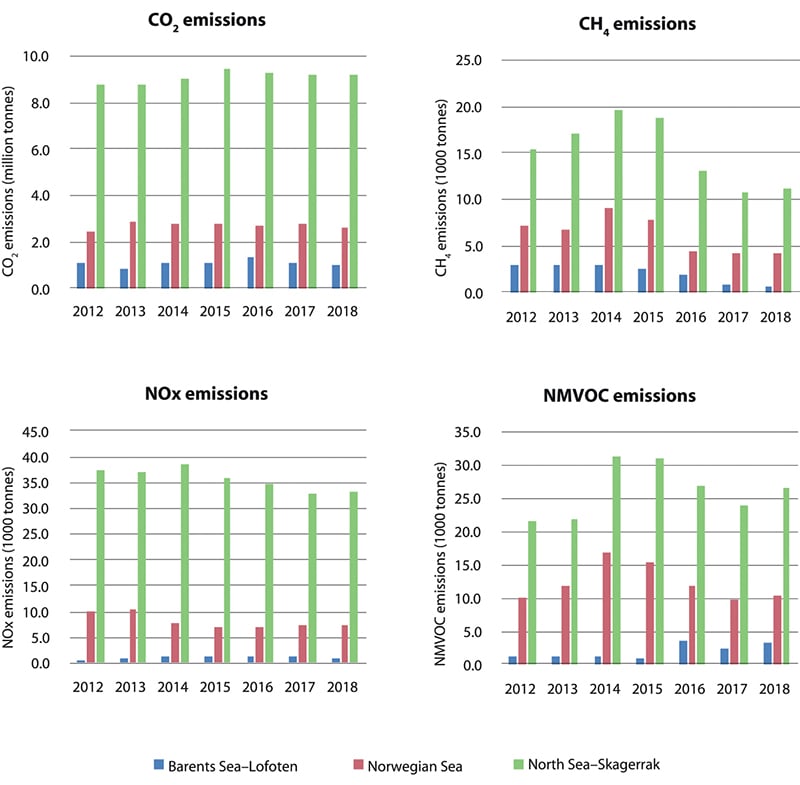

Emissions to air from shipping have increased in the three management plan areas in the period 2011–2017. The trend towards larger ships may partly explain why growth in emissions has been greater than growth in distance sailed in the same period. Another explanation may be the increase in the average speed of ships, particularly large ones, in recent years.

Greenhouse gas emissions from domestic shipping in 2017 have been estimated at 4.8 million tonnes CO2 equivalent using AIS data as a basis (the AIS system provides real-time information on vessel movements). This indicates a certain rise in emissions in recent years. On the other hand, Statistics Norway estimated 2017 emissions from domestic shipping and fishing at 2.95 million tonnes CO2 equivalent, based on registered sales of fuel in Norway for use in domestic shipping. The figures from Statistics Norway are included in Norway’s emission inventory, which is used as a basis for its emission reduction commitments.

A reduction in the carbon footprint of Norwegian shipping per tonne-kilometre is expected in the years ahead, partly due to stricter emission requirements and policy objectives designed to fulfil Norway’s emission reduction commitments. The Government’s ambition is to reduce emissions from domestic shipping and fishing vessels by half by 2030.

Cruise traffic results in substantial emissions to air of pollutants such as nitrogen oxides (NOx) and sulphur oxides (SOx), which have a negative impact on local air quality. From 1 March 2019, Norway introduced stricter requirements for releases to air and water from ships in the West Norwegian Fjords World Heritage Site.

Figure 5.11 Releases to air from shipping in the management plan areas: particulate matter (PM), sulphur dioxide (SO2), carbon monoxide (CO) and nitrogen oxides (NOx).

Source Norwegian Coastal Administration

The introduction and spread of invasive alien species through ballast water or biofouling of ship’s hulls constitute one of the most serious ecological threats in fjords and oceans.

The Ballast Water Management Convention entered into force in September 2017, and is an essential tool for preventing the spread of alien species with international shipping. Under the convention, ships must now manage their ballast water so that potentially harmful aquatic organisms are removed or rendered harmless before ballast water is released.

Currently there are no binding national or international requirements intended to prevent or limit the transfer of harmful organisms through hull fouling. However, IMO has issued voluntary guidelines on the control and management of hull fouling to minimise the transfer of harmful aquatic organisms. The guidelines apply globally.

Noise from shipping is the most widespread source of low-frequency noise in the marine environment. Noise levels and frequencies will vary depending on ship size, speed and the type of propulsion system. The largest ships produce the highest noise levels at source and the lowest frequencies.

Long time series of measurements indicate that in certain areas, ambient noise has more than doubled each decade over the last 30–40 years. The increase in the volume of commercial shipping is probably the primary cause of this. Increased ambient noise can raise physiological stress levels in marine animals and interfere with their abilities to communicate with one another, find food and navigate. International studies show that noise from shipping can also influence the behaviour of marine animals and other organisms. It is unlikely that noise from shipping directly harms fish and marine mammals.

5.3 Petroleum activities

The petroleum industry is Norway’s largest, measured in terms of value added, state revenues, investment and export value. The industry contributes substantially to financing the welfare state. All across the country, the petroleum industry provides employment, accounts for much activity, and stimulates business, technological and societal development. The resource accounts indicate that after 50 years, about half of the total petroleum resources on the Norwegian continental shelf had been extracted, and the proportion was higher for oil resources than for gas resources.

5.3.1 Current status and forecasts of economic activity

At the beginning of 2020, 87 fields on the Norwegian continental shelf were producing oil and gas: 66 in the North Sea, 19 in the Norwegian Sea and two in the Barents Sea. Production in 2019 totalled 214 million standard cubic metres of oil equivalents (Sm3 o.e.). The start-up of the Johan Sverdrup field means that production will increase over the next few years.

At the beginning of 2020, some 85 discoveries were being considered for development. Most of these are small and will be developed as satellites with subsea installations tied back to existing infrastructure. However, it should be noted that even small development projects on the continental shelf would be considered to be major industrial projects if carried out onshore. Independent development is planned for the largest discoveries, but a number of smaller fields may also collaborate on building new infrastructure.

Exploration, development and production activity levels on the Norwegian shelf are high, and are expected to remain high in the years ahead. In the longer term, the number and size of new discoveries and developments, as well as how quickly production drops from existing fields as they are depleted, will be crucial in determining production and activity levels. Future prices will also have an impact. Most existing fields are resilient even when demand is declining and the price range is sinking. Norwegian production is a relatively low-cost way to bring new production to market, and new discoveries can be expected to be profitable even in these circumstances.

There is considerable potential for improved oil recovery from many on-stream fields beyond what is currently planned. Since 2000, various steps have been taken to improve recovery from fields in production. This has significantly increased the reserves.

The North Sea accounts for the largest proportion of production from the Norwegian continental shelf, and the province still holds considerable resource potential. The North Sea will continue to generate substantial value added for many years to come. New gas infrastructure has been established in the northern part of the Norwegian Sea: the Aasta Hansteen field, which started production in 2018, and the gas pipeline Polarled. These developments will also facilitate further new developments and exploration activities in this part of the Norwegian Sea.

Petroleum activities began in the Barents Sea South in 1979, and the area is an important petroleum province. There are currently two fields in production in the Barents Sea: Snøhvit and Goliat. The Snøhvit gas field began production in 2007. The natural gas is transported by pipeline to the onshore facility at Melkøya for processing, liquefaction and transport by ship to the market. In autumn 2019, cargo number 1 000 of LNG was shipped from Melkøya. The Goliat field began production in 2016 and is the first oil field in the Barents Sea, including the first installation in the Barents Sea that projects above the sea surface.

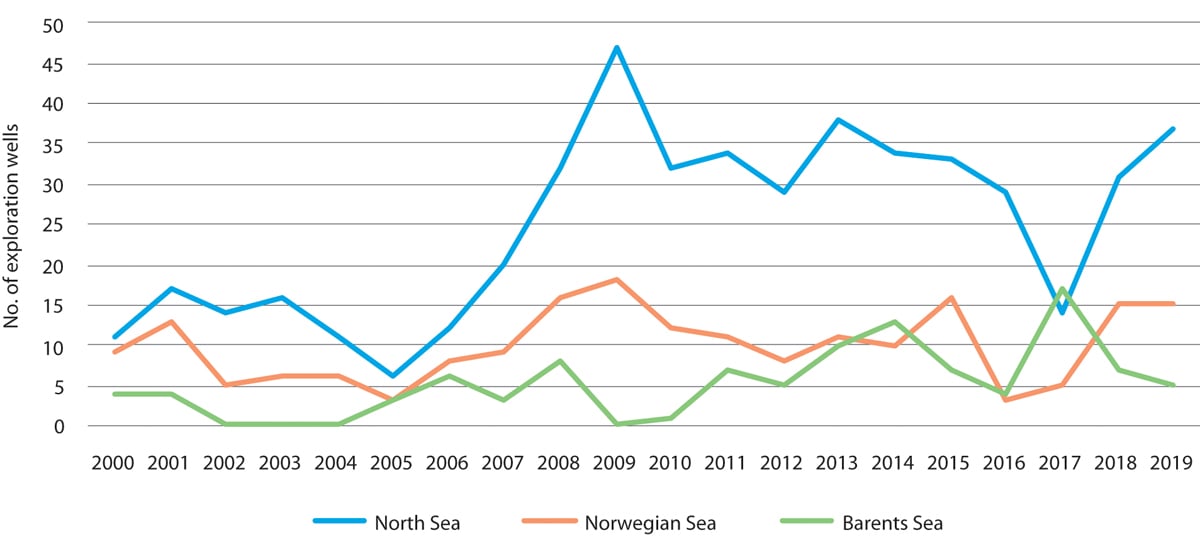

Figure 5.12 Overview of exploration wells drilled in the management plan areas, 2010–2019.

Source Norwegian Petroleum Directorate

The third field in the Barents Sea will be the Johan Castberg field, which is under development with production scheduled to start in 2022. This is the largest oil field found in the Barents Sea so far and consists of the three discoveries Skrugard, Havis and Drivis. The plan for development and operation (PDO) was approved in June 2018. Developments in the Barents Sea must deal with the area’s natural conditions such as extreme cold and icing of facilities. Several countries have been carrying out petroleum activities in the Arctic for several decades. The Norwegian Petroleum Directorate published a report on petroleum activities in the Arctic which provides an overview of these activities. Petroleum activities in the Arctic were also discussed in a proposition to the Storting on the Johan Sverdrup field and the status of Norway’s oil and gas activities published in 2015 (Prop. 114 S (2014–2015)).

Further discoveries have also been made in the Barents Sea, and the petroleum companies are working on possible development concepts with a view to making investment decisions. The Wisting discovery, currently the largest undeveloped discovery on the Norwegian continental shelf, is in the clarification phase.

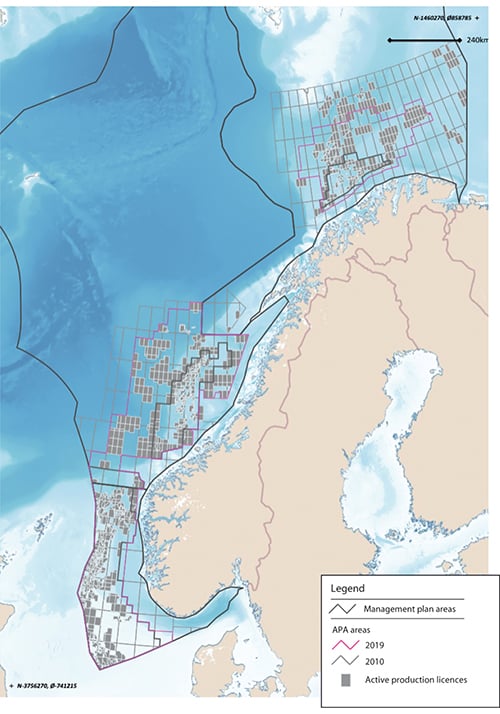

The petroleum companies are showing great interest in the licensing rounds for the Norwegian continental shelf. In the latest licensing round for awards in predefined areas (APA 2019), 69 production licences were offered on the Norwegian shelf, with 33 in the North Sea, 23 in the Norwegian Sea and 13 in the Barents Sea. Nineteen different companies were offered status as designated operators.

Figure 5.13 Map showing active production licences and expansion of the acreage covered by the system of awards in predefined areas (APA), from APA 2010 to APA 2019.

Source Norwegian Petroleum Directorate/Marine spatial management tool

Exploration activity on the Norwegian continental shelf has varied over the years, but has remained stable at a high level in recent years. On average, just under 50 exploration wells have been drilled on the Norwegian shelf every year since 2000. The North Sea has the highest overall number of exploration wells but in 2017, for the first time, more exploration wells were drilled in the Barents Sea than in the North Sea. In 2017, 17 exploration wells were spudded in the Barents Sea, as compared with five in 2016 and seven in 2018. In 2019, 57 exploration wells were spudded and 17 discoveries made on the Norwegian shelf, with a total estimated volume of 70 million Sm3 o.e.

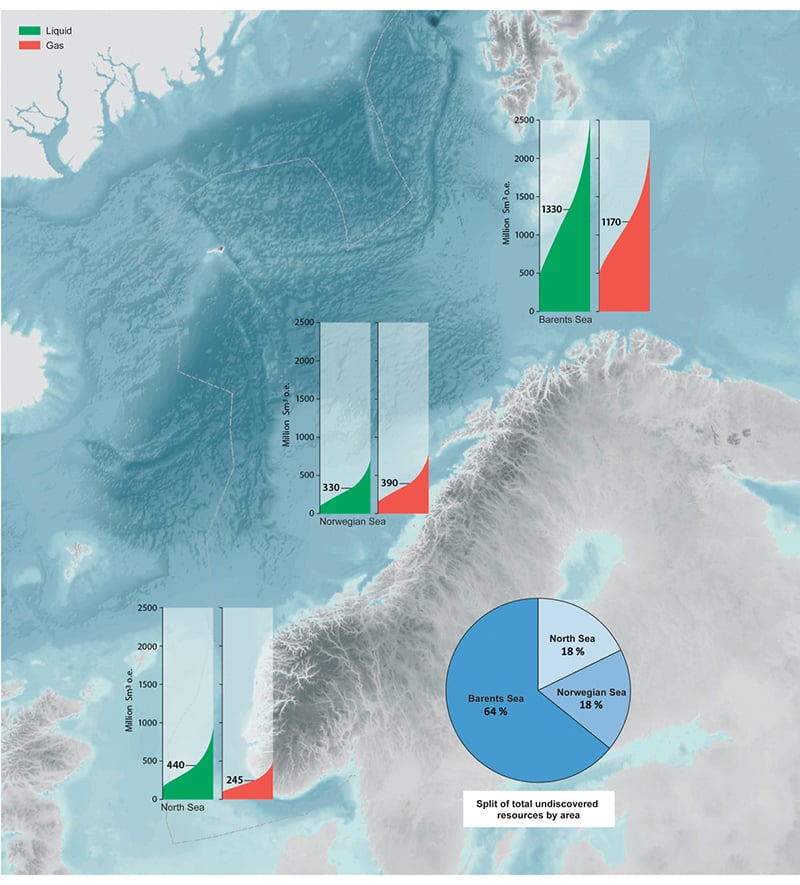

There are large remaining oil and gas resources on the Norwegian continental shelf. Currently, the fields on the Norwegian shelf supply 2–3 % of global demand for oil and gas. The Norwegian Petroleum Directorate estimates that total discovered and undiscovered resources on the Norwegian shelf were approximately 15.7 billion Sm3 o.e. on 31 December 2018. ‘Resources’ is a collective term for all technically recoverable quantities of petroleum. Undiscovered resources are estimated at close to 4 billion Sm3 o.e., equivalent to roughly 40 Johan Castberg fields. The Petroleum Directorate expects approximately one-third of these undiscovered resources to be in the North Sea and the Norwegian Sea, and two-thirds in the Barents Sea. Knowledge about the Barents Sea is particularly limited, so that uncertainty regarding resource volumes is highest here. The actual resources could be either less than or substantially more than the current estimate from the Petroleum Directorate. The resource accounts include all resources on the Norwegian continental shelf, including those in areas that are not currently open for petroleum activities.

Figure 5.14 Resource estimate for undiscovered resources on the Norwegian continental shelf.

Source Norwegian Petroleum Directorate

Knowledge is an essential basis for sound resource management. In areas that are not currently open for petroleum activities, only the authorities are permitted to collect data and conduct surveys. As part of its long-term data acquisition in northern waters, the Norwegian Petroleum Directorate conducted a seismic survey in the northern Barents Sea that will provide important information on the geology of the area and a better resource estimate. Undiscovered resources on the Norwegian continental shelf could represent major assets for Norway.

For 2019, the allocation for geological surveys was increased by NOK 50 million so that knowledge acquisition could continue through mapping of petroleum resources in the Barents Sea North. This will be a continuation of the geological surveys carried out by the Norwegian Petroleum Directorate in recent years to advance the knowledge base on Barents Sea geology. Further geological data is needed to learn more about petroleum resources. Newer and better data gives the authorities greater understanding of petroleum systems as a whole, which is important both for sound resource management and for national economic interests relating to transboundary petroleum deposits.

Further information on regulation of petroleum activities

Petroleum activities may take place in areas opened by the Storting (Norwegian parliament) in accordance with the framework for specific geographical areas set out in the ocean management plans. The framework for petroleum activities is set out in Chapter 9.2.4.

Acreage for petroleum activities is allocated through two equally important types of licensing rounds. New acreage in frontier areas is allocated in numbered licensing rounds, which are normally held every other year. In more mature areas, where more is known about the geology and that are closer to planned or existing production and transport infrastructure, licences are issued every year through the system of awards in predefined areas (APA). The licensing process involves a number of steps. Numbered licensing rounds are opened by inviting companies to nominate blocks. The authorities assess the nominations, and a proposed announcement is submitted for public consultation. After this, the Ministry of Petroleum and Energy announces the round. After the applications have been processed and after negotiations with the companies on licensing conditions, the government makes the final decision on which areas are to be covered by production licences and the mandatory work programme for each licence.

It has been decided to continue the APA system as an annual licensing round on the Norwegian continental shelf. The APA system includes areas opened for oil and gas activities at least since 1994, and a significant proportion has been open since 1965. Fundamental features of the APA system are that APA areas are is expanded as the continental shelf is explored, and that it is predictable because no acreage is withdrawn once it has been included in the APA system. This is important for the system’s effectiveness. All areas that are open and therefore available for petroleum activities may be announced in numbered licensing rounds or through the APA system. The parts of the shelf to be included in each of the two types of rounds are determined on the basis of expert assessments of the maturity of different areas, particularly in relation to the need for stepwise exploration and utilisation of time-critical resources.

A predictable framework is important for the petroleum industry. The Government will continue to facilitate profitable production of oil and gas by maintaining a such a framework. This will include continuing the regular licensing rounds on the Norwegian continental shelf, in order to give the industry access to new exploration areas. To maintain employment, value added and state revenues over time, both large and small discoveries are needed at regular intervals.

Most of the Norwegian continental shelf was opened for exploration activity decades ago. Large discoveries are most often made early in the exploration phase, although there are exceptions. Thorough exploration of areas while the necessary expertise is available is vital to increase the likelihood of finding large, commercially viable discoveries.

Petroleum activities are subject to strict requirements and standards for health, environment and safety, which include safeguarding the natural environment. Approval from the authorities is required for all phases of activity, including exploration, development, operations and decommissioning. This also includes permits under the Pollution Control Act and consent under the health, safety and working environment legislation. The legislation is designed in such a way that the requirements are stricter when activities are taking place in areas where the safety and environmental situation is particularly challenging. It is also considered important to facilitate coexistence with other industries.

Textbox 5.3 Development of the Johan Castberg field

The Johan Castberg field, about 240 km northwest of Hammerfest, is the third field development project in the Barents Sea. When scheduled production starts, this will be the world’s northernmost offshore development, but the operational challenges here do not differ substantially from those in fields further south on the Norwegian continental shelf. New factors that will need to be dealt with include polar lows, challenges relating to preparedness and response because of the remoteness of the field, and the possible occurrence of drift ice in extreme years. The development concept takes these into consideration. The load-bearing structures and anchoring systems of the floating production, storage and offloading vessel (FPSO) are designed to withstand drift ice. Statistically, it is estimated that drift ice will reach the Johan Castberg field once every 10 000 years. A system will be developed for continuous monitoring of ice conditions. If drift ice approaches to approximately 60 km north of the FPSO (73° N) and is forecast to drift further southwards, production will be halted and not resumed until there is a safe distance between the ice and the FPSO again.

The Government and the Storting can decide that there may be conditions for, or restrictions on, activities in specific geographical areas. These are indicated when a licensing round is announced and are specified in the production licences. Restrictions on the times of year when seismic surveys or drilling in oil-bearing formations are permitted are spatial management tools that are used to regulate the petroleum industry (see also Chapter 9). The purpose of such restrictions is to avoid the risk of environmental damage at times when natural resources are particularly vulnerable, for example during spawning or spawning migration and during the breeding season for seabirds, while still allowing petroleum activities to be carried out. Spatial management tools such as seasonal restrictions on exploration drilling provide a framework for value creation while at the same time ensuring that important environmental considerations are taken into account. Moreover, licensees are required to carry out necessary seabed surveys to ensure that any coral reefs or other valuable benthic communities, including sandeel habitats, are not damaged by petroleum activities.

5.3.2 Value added and employment

The main goal of the Government’s petroleum policy is to facilitate long-term profitable production of oil and gas. A predictable framework is important for the petroleum industry. The Government will therefore continue the regular licensing rounds on the Norwegian continental shelf in order to give the industry access to new exploration areas. To maintain employment, value added and state revenues, both large and small discoveries are needed at regular intervals.

A large share of the value added from the petroleum sector accrues to the state, so that it can benefit society as a whole. The oil and gas industry plays a key role in the Norwegian economy, and it will continue to make a major contribution to financing the Norwegian welfare society.

The petroleum resources on the Norwegian continental shelf have laid the foundation for the development of a substantial oil and gas industry in Norway. The petroleum industry includes oil companies, supplier industries and petroleum-related research and education institutions. It accounts for a substantial proportion of Norwegian value added and provides employment in all parts of the country.

Table 5.7 Value added in the petroleum sector in the management plan areas and the totals for Norway. Figures do not include value added from supply industry exports.

Value added, shown in NOK billion (in current prices). | |||||||||

|---|---|---|---|---|---|---|---|---|---|

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

Industry | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Sum of core activities | 19.0 | 21.9 | 128.5 | 96.8 | 385.2 | 294.8 | 532.8 | 413.6 | 497.2 |

Supply industries | 2.2 | 3.4 | 15.4 | 15.2 | 46.2 | 46.3 | 63.8 | 64.9 | 69.6 |

Sum of core activities and supply industries | 21.2 | 25.3 | 143.9 | 112.0 | 431.4 | 341.1 | 596.6 | 478.5 | 566.8 |

Source Statistics Norway

In 2019 the petroleum industry generated NOK 566.8 billion in value added (see Table 5.7). Most of the oil and gas produced on the Norwegian shelf is sold abroad and provides substantial export revenues. In 2018, the petroleum sector accounted for 17 % of Norway’s overall value added and approximately 43 % of export revenues. The sector also accounts for roughly 20 % of state revenues and Norway’s total investments. Value added per person directly employed in the petroleum industry in 2018 was approximately NOK 25 million, compared to roughly NOK 1 million in the Norwegian mainland economy as a whole. In 2019, total employment associated with the management plan areas in the petroleum sector, including core activities and the largest companies in the direct supplier industry for each of these, but not including wider spin-off effects, was about 110 000 persons (see Table 5.8). Total Norwegian employment related to the petroleum sector was approximately 139 900 persons in 2018, or about 5.1 % of total employment. Another roughly 70 000 persons were in employment directly or indirectly related to export activities of the petroleum supplier industry. In total, therefore, more than 210 000 Norwegian jobs were directly or indirectly related to petroleum activities on the Norwegian continental shelf and the export markets.

Table 5.8 Employment in the petroleum sector in the management plan areas and the totals for Norway. Figures do not include employment relating to supply industry exports.

Employment figures in 1 000s. | |||||||||

|---|---|---|---|---|---|---|---|---|---|

Barents Sea–Lofoten | Norwegian Sea | North Sea–Skagerrak | Norway, total | ||||||

Industry | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2010 | 2016 | 2019 |

Sum of core activities | 6.6 | 6.9 | 12.3 | 12.2 | 35.2 | 35.2 | 54.1 | 54.3 | 55.6 |

Supply industries | 7.1 | 7.6 | 13.5 | 13.6 | 38.6 | 39.1 | 59.3 | 60.3 | 54.4 |

Sum of core activities and supply industries | 13.7 | 14.5 | 25.8 | 25.8 | 73.8 | 74.3 | 113.4 | 114.6 | 110.0 |

Source Statistics Norway

The Norwegian continental shelf is one of the world’s largest offshore markets and is important for the development of the Norwegian supply industry. The petroleum companies, oil and gas suppliers and wider value chain effects provide employment throughout the country.

Activity on the Norwegian continental shelf offers great potential for further development of the Norwegian supply industry, which would have positive productivity effects on other onshore industries. Recent research indicates that activity related to oil and gas exploration and extraction generates positive learning effects, not only between supply companies within the industry but also between companies in the petroleum industry and in other segments of the economy. The supply industry is thus an engine of growth and a source of revenue generation for the entire economy. In this way, interactions between the supply industry and traditional onshore industries that are exposed to competition promote a broader-based, resilient and knowledge-rich business structure. This in turn will support viable, knowledge-based jobs in all parts of Norway.

Textbox 5.4 Spin-off effects of petroleum activities in North Norway

In keeping with Norway’s policy objective, offshore petroleum activities also have clear spin-off effects onshore both regionally and nationally. The Aasta Hansteen gas field in the northern Norwegian Sea, 300 km west of Bodø, came on stream in 2018. Its operator, Equinor, is running the field from Harstad in North Norway, with the supply base in Sandnessjøen and the helicopter base in Brønnøysund. Although the substructure and topside structure for the floating platform were built abroad, there were substantial deliveries from firms in North Norway during the development phase. These totalled more than NOK 1 billion by the end of 2018, according to a study by Bodø Science Park. For example, businesses in Mo i Rana, Sandnessjøen and Bodø supplied the suction anchors that keep the Aasta Hansteen platform in place, the subsea templates, and the platform’s fire doors. Geographical proximity is a particularly important competitive advantage for suppliers during the operation phase. The main employment effects of Aasta Hansteen will be related to activities at the supply and helicopter bases, but there will also be positive spin-off effects for other manufacturing, retail trade, hotels and restaurants, and business services.

Farther north, in the Barents Sea, the Johan Castberg field is scheduled to start production in 2022. So far in the development phase, a number of the subsea templates and the flare boom for the floating production, storage and offloading unit (FPSO) have been produced in Sandnessjøen. The overall regional effect of the development phase on employment is estimated at close to 1 750 person-years in the region (including over 700 person-years in northern Troms and Finnmark county. In the operational phase, the effect is expected to be around 470 person-years in the region in a normal year, including 265 person-years in northern Troms and Finnmark. Johan Castberg will have an operations organisation in Harstad, which will further enhance operational expertise there. There is already greater activity at NorSea Polarbase in Hammerfest municipality as a result of the development of Johan Castberg, which is providing a basis for continued establishment of supply companies at the supply base and in Hammerfest town. This is a good example of how offshore activity can boost onshore employment, population growth and revenues. Businesses in Hammerfest also supply the Snøhvit and Goliat fields and the exploration rigs operating in the Barents Sea.

5.3.3 Current status and expected developments for environmental pressures and impacts

The petroleum industry can have negative impacts on the environment through operational discharges to the sea and air, underwater noise from seismic surveys and physical disturbance of the seabed. There have been few major crude oil spills on the Norwegian continental shelf, and no oil spills on the Norwegian continental shelf have reached the coast in the more than 50 years since petroleum activities began. No damage to the marine environment has been demonstrated as a result of the spills that have occurred during this period. Acute pollution is further discussed in Chapter 6. Safeguarding the natural environment has always been an integral part of Norway’s approach to managing its oil and gas resources in all phases of petroleum activities, from exploration to development, operations and field closure. There is a strict regulatory framework for discharges to air and sea from the petroleum industry.

A permit under the Pollution Control Act is required for operational discharges during petroleum activities. Permits are issued and administered by the Norwegian Environment Agency. The Petroleum Safety Authority is the supervisory authority for efforts by the petroleum companies to prevent oil and chemical spills to the sea. Permits do not apply to acute pollution, which is the result of unforeseen incidents. The impacts of operational discharges during petroleum activities in the Barents Sea are currently insignificant, as they were in 2011. The quantities of chemicals and drill cuttings discharged to the sea and of pollutants emitted to air generally tend to vary with the level of drilling activity. Major oil spills may cause environmental impacts, but historical data indicate the probability of a spill is very low. In the years ahead, some increase in activity levels in the management plan areas is expected in the petroleum industry, shipping and more generally.

Operational discharges of oil and chemicals to the sea

Discharges of chemicals to the sea tend to vary with drilling activity and the quantity of produced water, and are highest during drilling. The largest discharges of oil during normal operations are with produced water. The zero-discharge targets for discharges of oil and environmentally hazardous substances to the sea apply to discharges from petroleum activities. These targets were adopted in a white paper on an environmental policy for sustainable development (Report No. 58 (1996–1997) to the Storting). They apply to oil, added chemicals and naturally occurring substances discharged with produced water, including radioactive substances. Norway’s goal is for discharges of the most hazardous added chemicals (black and red categories) to be eliminated and that discharges of naturally occurring environmentally hazardous substances should be eliminated or minimised. For oil and other substances, the target is zero or minimal discharges of substances that may cause environmental damage. The targets were reproduced in full in the 2017 update of the Norwegian Sea management plan (Meld. St. 35 (2016–2017)).

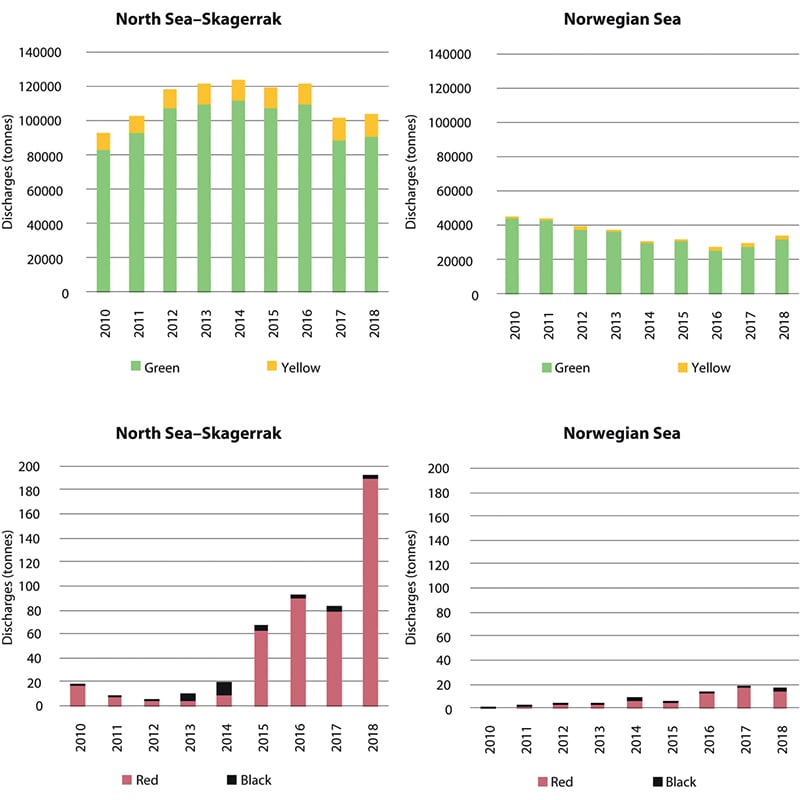

Discharges of oil and chemicals to the Norwegian Sea and the North Sea vary from year to year with drilling activity. There has been a rise in discharges of substances in the red and black categories in these management plan areas, partly because certain substances have been moved to different categories. Drilling and well chemicals account for a large proportion of total discharges.

Figure 5.15 Trends in discharges of added chemicals in the North Sea–Skagerrak and Norwegian Sea management plan areas, by colour category (green, yellow, red, black).

Source Norwegian Environment Agency

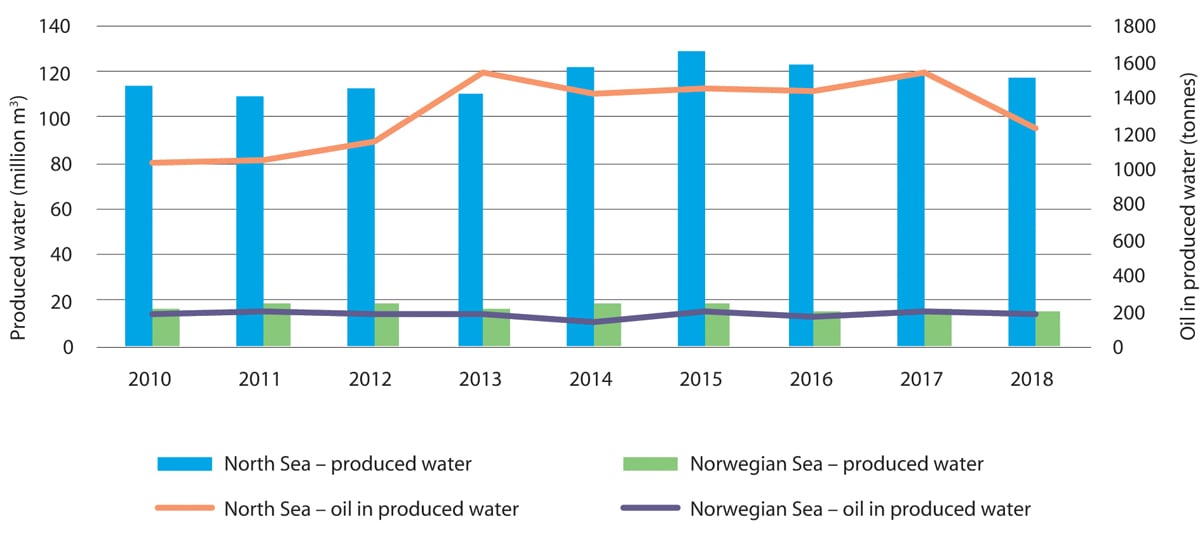

Discharges of produced water to the North Sea and the Norwegian Sea have been variable since the previous scientific basis was published in 2010, but were somewhat lower in 2017 than in 2012. The North Sea fields accounted for 88 % of total discharges of produced water and oil on the Norwegian continental shelf in 2017. Discharges to the Barents Sea are much lower than on the rest of the continental shelf because there is limited activity and only two fields are in production. Discharges to the Barents Sea are largely related to drilling activity and consist mostly of water-based drilling mud (green category chemicals) and drill cuttings. Discharges of chemicals to the Barents Sea have nevertheless increased since the previous scientific basis was published, as a result of increased drilling activity in the area.

Produced water is discharged only from the Melkøya onshore facility, as was the case when the previous scientific basis was published. Discharges of produced water to the Barents Sea are expected to remain low in future, so that there is little reason to expect them to have negative environmental impacts.

Figure 5.16 Trends in discharges of produced water and oil in produced water in the North Sea–Skagerrak and Norwegian Sea management plan areas, 2010–2018.

Source Norwegian Environment Agency