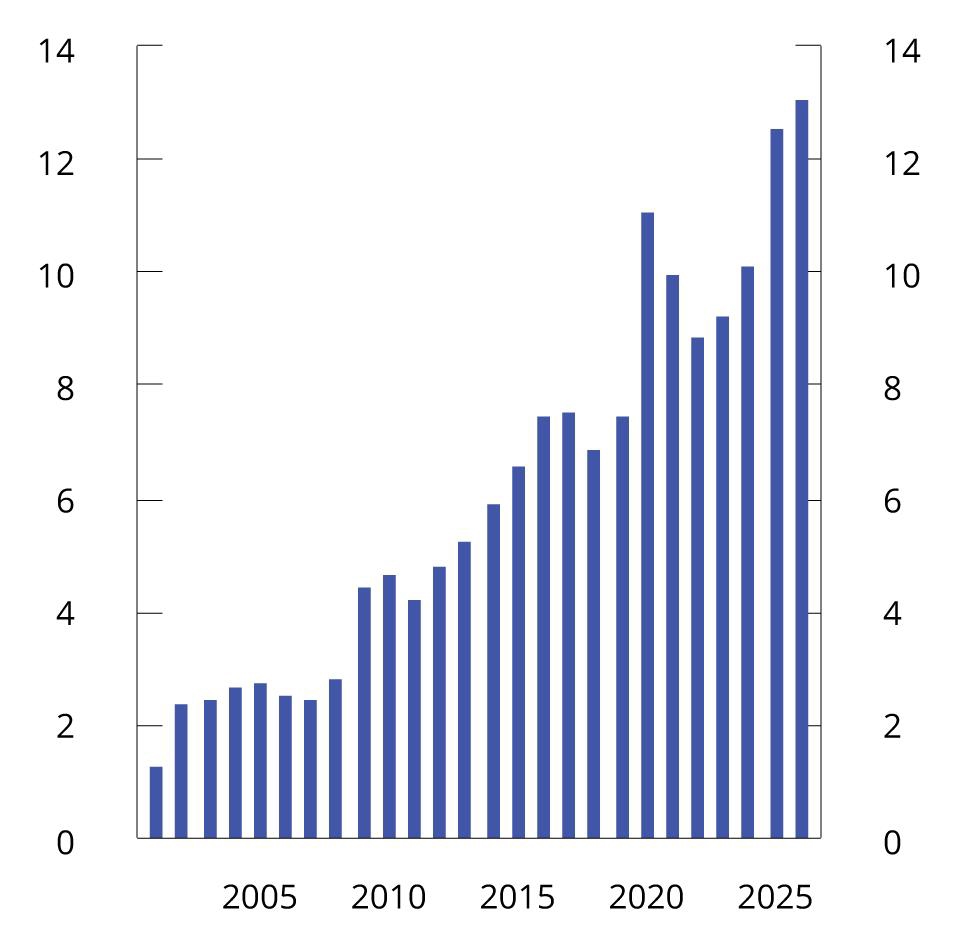

3.1 Fiscal policy in 2026

In the budget for 2026, the Government proposes a fund spending, measured by the structural non-oil budget deficit , of NOK 579.4 billion, equivalent to 13.1 per cent of mainland Norway trend GDP. This is an increase from just above 12.6 percent in 2025 and corresponds to a fiscal impulse of 0.4 percentage points. The fund spending is expected to correspond to 2.8 per cent of the value of the Government Pension Fund Global (GPFG) and 26.8 per cent of fiscal budgets expenditures. See Table 3.1 and Chart 3.1 to 3.4. The Government's proposal includes a continuation of this year's framework for support to Ukraine at NOK 85 billion in 2026.

Table 3.1 Key figures in the national budget. NOK billion and per cent

|

2024 |

2025 |

2026 |

|

|

Structural non-oil fiscal deficit in current prices |

410,3 |

534,2 |

579,4 |

|

Structural non-oil fiscal deficit at constant 2026 prices |

438,0 |

550,6 |

579,4 |

|

Measured in per cent of mainland Norway trend GDP |

10,2 |

12,6 |

13,1 |

|

Change from previous year in percentage points (fiscal impulse) 1 |

0,9 |

2,4 |

0,4 |

|

Measured as a percentage of the Government Pension Fund Global |

2,6 |

2,7 |

2,8 |

|

Measured as a percentage of central government budget expenditure |

21,5 |

25,8 |

26,8 |

1 Change in structural non-oil fiscal deficit measured as a share of mainland Norway trend GDP. The indicator does not consider that different revenue and expenditure items may differ in their effect on economic activity.

Source: Ministry of Finance.

Chart 3.1 Structural non-oil fiscal deficit. Per cent of mainland Norway trend GDP. 2001–2026

Source: Ministry of Finance.

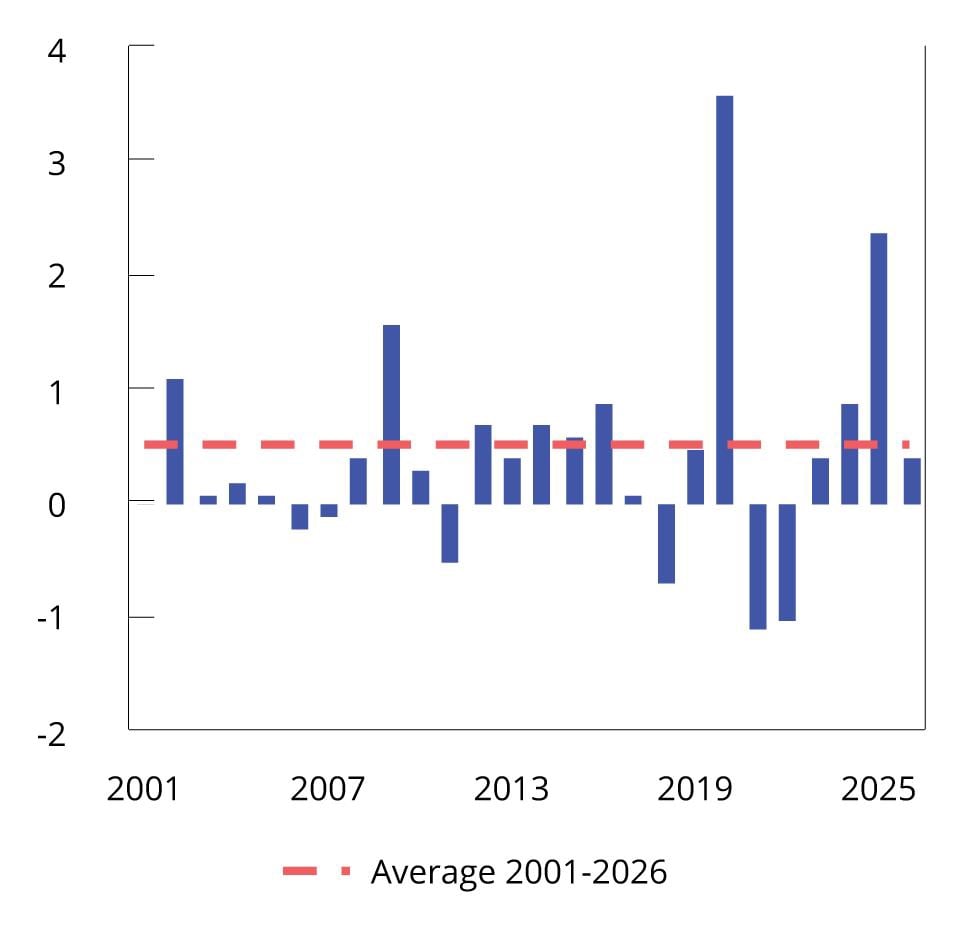

Chart 3.2 Change in the structural non-oil fiscal deficit as a percentage of mainland Norway trend GDP. Change from previous year (fiscal impulse). 2001–2026

Source: Ministry of Finance.

Chart 3.3 Structural non-oil fiscal deficit. Per cent of the Government Pension Fund Global. 2001–2026

The dashed lines show the expected real rate of return on the GPFG. In 2001, the expected real rate of return projection was 4 per cent. With effect from the National Budget 2018, the projection was revised down to 3 percent.

Source: Ministry of Finance.

Chart 3.4 Fund spending as a share of fiscal budget expenditure. Per cent. 2001–2026

Expenditure excluding petroleum activities.

Source: Ministry of Finance.

The fiscal policy stance aims to balance the economic situation with long-term considerations relating to the sustainable development of both public finances and the growth potential of the economy.

Fund spending contributes to more than a quarter of the fiscal budget expenditure. This makes fiscal policy more vulnerable to abrupt and persistent declines in the value of the GPFG than previously. The fiscal guideline implies that adjustments to fund spending in the event of major changes in the GPFG should be made gradually over several years in order for fiscal policy to provide stability in terms of welfare services and economic framework conditions, and not in itself become a source of instability in the economy. Future developments in the economy and in the value of GPFG are uncertain. Fiscal policy must consider the future desirability of increasing fund spending, in the event of major economic setbacks, and gradually adjusting fund spending in the event of a fall in the GPFG. This implies that fund spending should be below the expected real return in good and normal times. In previous analyses, the Ministry of Finance has estimated that spending 2.7 per cent of the fund in normal times, over time results in a fund spending that correspond to the expected real return of 3 percent.

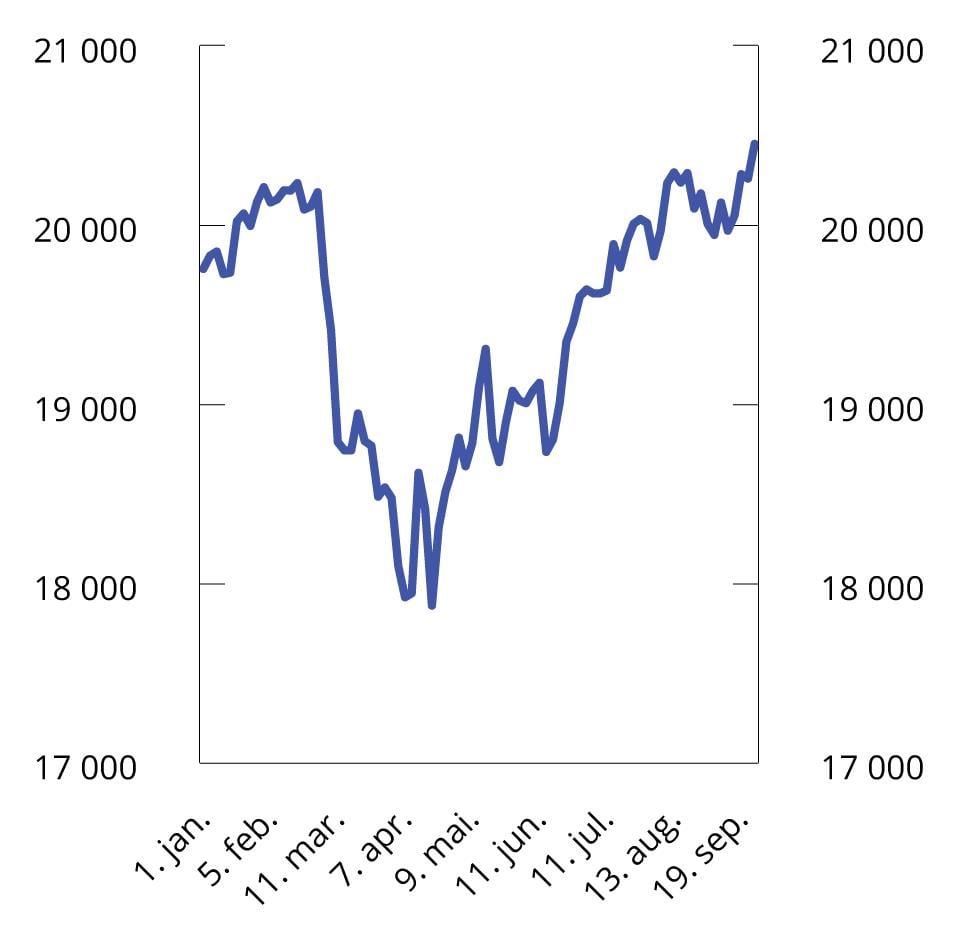

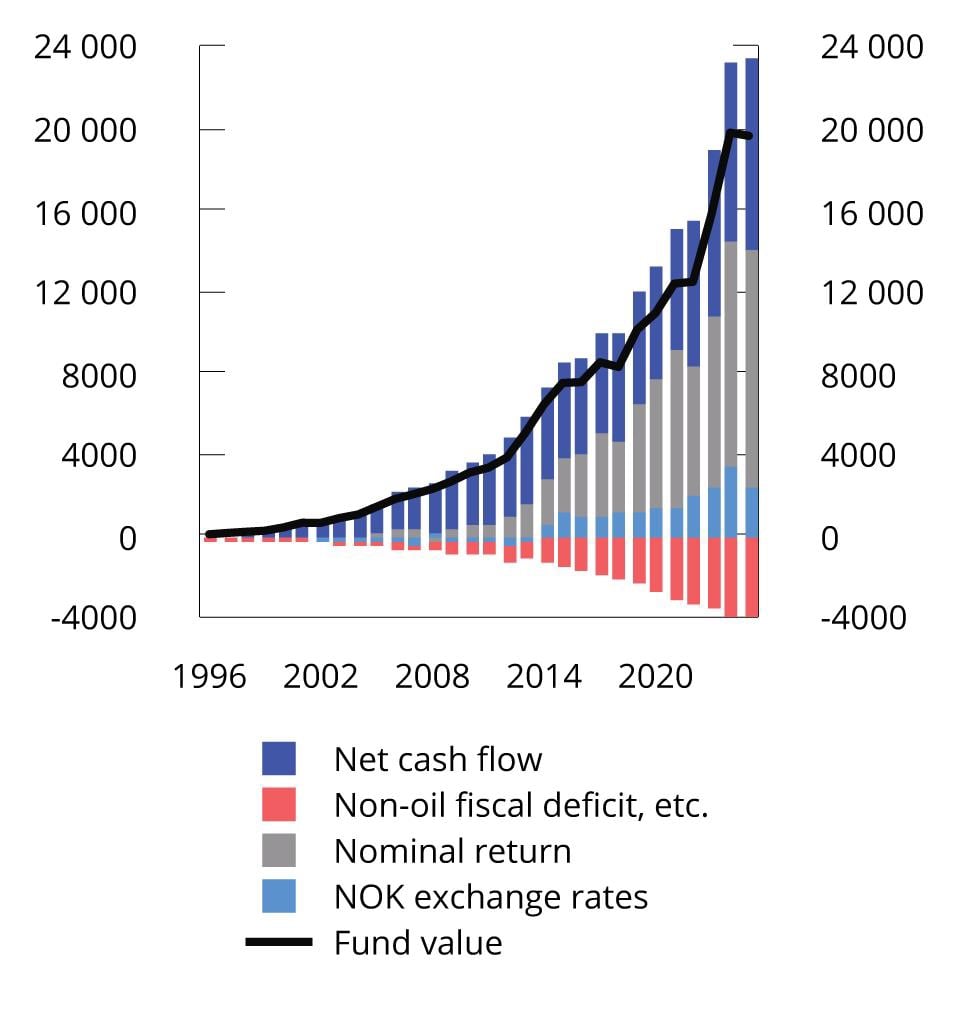

The budget proposal assumes a fund value of NOK 20,500 billion at the beginning of 2026. 1 This is NOK 765 billion more than at the beginning of 2025. At the same time, the value of the GPFG has fluctuated considerably throughout the year, from above NOK 20 000 billion in February to just beneath NOK 18 000 billion in April, before rising again during the summer, see Chart 3.5. In recent years, the value of the GPFG has increased substantially, see Chart 3.6. The value of the fund, measured by its projected value at the beginning of 2026, has more than doubled compared to its value at the beginning of 2020, and has increased by more than NOK 4,700 billion since the beginning of 2024, where about 80 per cent of the increase is due to nominal returns. As a tool in the discretionary exercise of fiscal policy, it may be useful to study alternative ways of operationalising the long-term guideline, especially during periods of major changes in fund value.

Chart 3.5 Market value of the Government Pension Fund Global. NOK billion. Jan. 1–Sept. 30, 2025

Sources: Norges Bank Investment Management and the Ministry of Finance.

Chart 3.6 Contribution to change in the market value of the Government Pension Fund Global. NOK billion. 1996–2025

Fund value as of 31.12. For 2025, the market value is shown as of the first half of the year. The nominal rate of return is net of management costs.

Sources: Norges Bank Investment Management, Statistics Norway and the Ministry of Finance.

The overall economic situation indicates that there is no need for fiscal policy to boost economic activity in 2026. 2 Calculations based on the Ministry of Finance's macroeconomic models KVARTS and NORA indicate that the fiscal policy stance for 2026 will have an approximately neutral effect on activity in the economy in 2026. 3 The budget proposal for 2026 is estimated to increase mainland Norway GDP by 0.1 per cent, see Table 3.2.

Table 3.2 Budget effects on mainland Norway GDP according to KVARTS and NORA. 1 per cent

|

Effects on the level of mainland Norway GDP |

||||

|

2024 |

2025 |

2026 |

2027 |

|

|

KVARTS |

||||

|

Budget proposal for 2024 |

0,5 |

0,8 |

1,1 |

1,3 |

|

Budget proposal for 2025 |

0,2 |

0,3 |

0,4 |

|

|

Budget proposal for 2026 |

0,1 |

0,1 |

||

|

2024-2026 overall2 |

0,5 |

1,0 |

1,4 |

1,8 |

|

NORA |

||||

|

Budget proposal for 2024 |

0,5 |

0,5 |

0,5 |

0,5 |

|

Budget proposal for 2025 |

0,3 |

0,3 |

0,3 |

|

|

Budget proposal for 2026 |

0,1 |

0,1 |

||

|

2024-2026 overall2 |

0,5 |

0,8 |

0,9 |

0,8 |

1 The effect on economic activity is based on how various revenue and expenditure items (accrued) for the public administration as a whole develop compared with trend growth in the economy. The deviation from the baseline scenario is combined with fiscal multipliers. The multipliers are based on the models and describe the extent to which changes in various expenditure and revenue items influence economic activity. The effects of the so-called automatic stabilisers in the budget are taken into account, i.e. that unemployment benefit expenditure increases, and tax revenues fall during a recession, while the reverse happens during a boom.

2 Due to rounding, summation of the individual items above may differ from the sum presented in this row.

Source: Ministry of Finance.

Fiscal policy impacts the economic activity over several years. The fiscal policy stance in 2024 and 2025 will increase the economic activity in 2026. Overall, the fiscal policy stance in 2024–2026 is therefore expected to have an expansionary effect on the economic activity in 2027. The method behind the calculations and differences in estimated budget effects in KVARTS and NORA are described in more detail in Appendix 2.

The non-oil deficit is the actual transfer from the Government Pension Fund Global to the fiscal budget and is estimated to NOK 452.2 billion next year, see Table 3.3. The structural non-oil budget deficit measures the underlying fund spending where adjustments are made for tax revenues, certain expenditure that fluctuates with business cycles, and certain other variables that vary considerably from year to year. In 2026, NOK 94.2 billion of the corrections were related to special accounting conditions. This is mainly due to a temporarily high tax revenue at the beginning of 2026 as a result of the Storting's decision to discontinue the tax deduction account scheme with effect from 1 January 2026. As a result, in 2026 the last instalment of the withholding tax for the 2025 income year under the old scheme will come on top of nearly the entire withholding tax for the 2026 income year.

Table 3.3 The structural non-oil fiscal deficit1. NOK billion

|

2024 |

2025 |

2026 |

|

|

Non-oil fiscal deficit |

331,7 |

487,6 |

452,2 |

|

+ Net interest and transfers from Norges Bank. Deviations from trend |

27,4 |

31,7 |

19,4 |

|

+ Special accounting matters |

17,5 |

9,2 |

94,2 |

|

+ Taxes and unemployment benefits. Deviations from trend |

33,6 |

5,7 |

13,6 |

|

= Structural non-oil fiscal deficit |

410,3 |

534,2 |

579,4 |

1 See Appendix 1 for a more detailed description of how the structural non-oil deficit is calculated.

Source: Ministry of Finance.

Real underlying spending growth in the central government budget is projected to be 1.0 per cent next year, after strong growth this year, see Table 3.4. The relatively low expenditure growth from this year to next year, must be seen in the context with significant increase in expenditure this year in the revised national budget as a result of the agreement in the Storting to increase support to Ukraine. Tax changes adopted in 2025 with budgetary effect in 2026 will also contribute to increasing Fund spending next year.

Table 3.4 Underlying fiscal budget expenditure1. Estimates in NOK million and percentage change

|

2025 |

2026 |

|

|

State budget expenditure |

2 104 011 |

2 200 561 |

|

- Government petroleum activities |

31 354 |

36 100 |

|

- Unemployment benefits for the unemployed |

15 770 |

16 957 |

|

+ Interest expenses |

18 874 |

20 732 |

|

= Expenditure other than petroleum activities, unemployment benefits and interest expenses |

2 037 013 |

2 126 772 |

|

- Refugees in Norway financed through the aid framework |

2 982 |

2 703 |

|

+ Adjustment for pension premiums, etc., health enterprises |

10 783 |

6 244 |

|

= Underlying expenses |

2 045 814 |

2 130 312 |

|

Change in value in per cent. |

4,1 |

|

|

Price change in per cent. |

3,1 |

|

|

Volume change in per cent. |

1,0 |

1 The calculation of underlying expenditure growth excludes central government budget expenditure on government petroleum activities, interest expenses and unemployment benefits. In order to make expenditure comparable over time, adjustments have been made for extraordinary changes and certain accounting considerations in accordance with standard procedures.

Source: Ministry of Finance.

The central government's net cash flow from petroleum activities is estimated to decrease from NOK 664 billion to NOK 521 billion from 2025 to 2026, see Table 3.5. Net allocations to the Government Pension Fund Global will hence fall by about NOK 107 billion from 2025 to 2026.

Table 3.5 Key figures in the National budget and the Government Pension Fund. NOK billion

|

2024 |

2025 |

2026 |

|

|

Total revenue |

2 323,8 |

2 280,0 |

2 269,6 |

|

1 Revenues from petroleum activities |

750,7 |

695,0 |

557,4 |

|

1.1Taxes |

420,3 |

383,8 |

302,5 |

|

1.2Other petroleum revenues |

330,3 |

311,2 |

254,9 |

|

2 Revenues excluding petroleum revenues |

1 573,1 |

1 585,1 |

1 712,2 |

|

2.1Taxes from mainland Norway |

1 397,8 |

1 421,4 |

1 560,2 |

|

2.2Other income |

175,3 |

163,7 |

152,0 |

|

Total expenses |

1 953,3 |

2 104,0 |

2 200,6 |

|

1 Expenditure on petroleum activities |

48,5 |

31,4 |

36,1 |

|

2 Expenditure excluding petroleum activities |

1 904,8 |

2 072,7 |

2 164,5 |

|

Fiscal budget surplus before transfer to the Government Pension Fund Global |

370,5 |

176,0 |

69,1 |

|

- Net cash flow from petroleum activities |

702,2 |

663,6 |

521,3 |

|

= Non-oil surplus |

-331,7 |

-487,6 |

-452,2 |

|

+ Transfer from the Government Pension Fund Global |

346,5 |

487,6 |

452,2 |

|

= Central government budget surplus |

14,7 |

0,0 |

0,0 |

|

+ Net provision for the Government Pension Fund Global |

355,7 |

176,0 |

69,1 |

|

+ Interest and dividend income, etc., in the Government Pension Fund1 |

422,1 |

446,7 |

482,5 |

|

- Transfer from the Government Pension Fund Norway |

0,0 |

11,7 |

12,3 |

|

= Combined surplus in the fiscal budget and the Government Pension Fund1 |

792,6 |

611,0 |

539,3 |

|

Memo: |

|||

|

Interest and dividend income, etc., in the Government Pension Fund Global |

402,8 |

428,1 |

461,0 |

|

Market value of the Government Pension Fund Global2 |

15 761 |

19 735 |

20 500 |

|

Market value of the Government Pension Fund2 |

16 115 |

20 116 |

20 910 |

|

Retirement pension commitments under the National Insurance Scheme2,3 |

10 765 |

11 423 |

11 496 |

1 Does not include capital gains or losses.

2 At the beginning of the year.

3 The net present value of existing accrued rights to future retirement pension payments under the National Insurance Scheme.

Sources: Ministry of Finance and Statistics Norway.