3 An industry that contributes to value creation and jobs

The data centre industry can contribute to value creation and jobs both locally and nationally in Norway. The Government has set the following goal:

It should be attractive to establish data centres in Norway, and the data centres that are established should create ripple effects in the form of jobs and local value creation.

Status

Data centre establishments can help strengthen value creation both locally and nationally, forming the basis for new and improved services for the population. Access to data centre capacity and services is essential because all data-based value creation, research and development depend on data being organised, processed and stored. In some cases, geographical distance to the data centre also plays an important role, for example, when using real-time data, which often requires what is referred to as an edge data centre, cf. section 2.1. In several of the critical regional industries, including aquaculture and agriculture, the use of technology is becoming increasingly important, and businesses are becoming increasingly adept at using the data they generate.

Many of the data centres in Norway are currently situated in rural areas, with several located in smaller local communities. The construction, establishment and operation of a new data centre could contribute to employment among a wide range of local suppliers and subcontractors. Data centre establishments can also help attract key competence to local communities, which in turn can lead to the development of new clusters of competence in rural areas.

Rising use of AI is anticipated to drive significant growth in demand for data centre capacity and data centre services. In a written submission to the Ministry of Digitalisation and Public Governance in January 2025, the Norwegian Data Centre Industry (NDI) emphasised that data centres on Norwegian soil can represent a “strategic opportunity for Norway” and serve as “a driving force for the establishment and development of a global supplier industry”. NDI draws parallels with the petroleum industry, highlighting the emergence of a robust supplier sector connected to data centres in areas such as electricity distribution, cooling technology, backup power, physical security, and autonomous building systems. Norway has robust industries in the energy, marine and maritime sectors, as well as in building and construction. By harnessing competence across sectors, we can stimulate innovation and, in time, the export of innovative solutions, such as businesses that design and build data centres or business models and equipment that optimise the interaction between data centres and the power grid.

The way forward

As the demand for data storage and processing grows and new data centres are established, the use of power, land, and natural resources in the data centre industry will also increase. Enabling technologies, such as AI, will establish the data centre industry as a key industry in the digital and green transition, as data centres are a vital part of the infrastructure on which these technologies depend. The growth, design criteria, and net footprint of data centres will mainly be influenced by or connected to the development, expansion, and utilisation of such enabling technologies.

The data centre industry is a market-driven and commercially developed industry. The framework conditions for the industry, such as taxes, fees and regulations, are crucial to the goal of a future-oriented data centre industry that grows in step with data storage and processing demands and contributes to private and public value creation and good local synergies. The Government wants the framework conditions for the data centre industry to support market-driven development, allowing potential underlying sectors and value chains linked to data centres to emerge. How Norway positions itself in terms of developing the infrastructure for enabling digital technologies will, among other things, determine how Norway can assert itself in the global AI race. By utilising our power for data centres in Norway rather than selling it abroad, we are laying the foundation for Norwegian value creation and for the establishment and development of a global supplier industry. We shall generate value and competitiveness while safeguarding the climate and nature. The public sector plays a vital role in this context (see section 5.2).

3.1 Digital infrastructure and enabling technologies

The Government will facilitate the green and digital transition of the business sector. Norwegian businesses should utilise artificial intelligence (AI) to unlock the potential for greater efficiency, enhanced quality, and new opportunities for innovation. In the public sector, there is significant potential to adopt AI to work in novel ways and create better, more user-friendly services for citizens. The Government wants all public enterprises to have begun using AI by 2030 and is working to establish a national AI infrastructure by 2030, cf. the National Digitalisation Strategy 2024–2030: The Digital Norway of the Future . A central element of the AI infrastructure will be a national compute infrastructure, which the Government is actively working to develop, cf. the white paper on a plan to strengthen Norway’s research system (Meld. St. 14 (2024–2025)). Data centres and access to capacity for data storage, data processing, and related services are an essential part of the goal and are necessary for operating computing power and cloud services to support Norwegian AI, including training Norwegian language models.

AI demands substantial computing power for training and use, leading to increased data traffic and electronic waste, and consuming more energy than traditional data centre operations. Resource and energy efficiency are therefore crucial for climate-friendly AI, known as green AI . Because AI has great potential to benefit society, Norway has joined an international coalition for sustainable AI, the Coalition for Sustainable AI, which was initiated by the Government of France in collaboration with the United Nations Environment Programme (UNEP) and the International Telecommunication Union (ITU).

AI can support the green transition by enhancing efficiency in industry and facilitating improvements and optimisation in areas such as production processes and the energy system. AI and other enabling technologies are central to the development of the Industry 4.0 concept, which involves the integration of digital technologies and automation in industrial production with smart factories and integrated systems. The EU is focused on climate and environmental issues in this context, and describes the optimisation of production processes, reuse, and circularity as “Industry 5.0”. The fourth industrial revolution is not yet complete, and this fifth industrial revolution advances it further by integrating climate and environmental concerns.

Blockchain technology enables decentralised networks that can, among other things, enhance efficiency, trust, and transparency in value chains and financial transactions. The Internet of Things (IoT) helps to collect data and connect billions of devices. In the long term, the growing number of data-driven and autonomous processes will heighten the demand for processing near the user through edge computing and more distributed data centres.

Quantum computers – even though they are in an early stage of development – represent a potential technological revolution that will require specialised data centres with unique infrastructure. Norway shall have a strategy for quantum technology in place by 2026. Such enabling technologies lay the foundation for technological breakthroughs with considerable potential to transform society, the economy, and working life. They enable advanced digital services and innovative solutions across sectors. It is about modern industrial development and value creation.

Box 3.1 Lefdal Mine Data Centre – a stronghold for Norway’s first supercomputer and essential research data

Sigma2 AS, the state-owned company responsible for the national e-infrastructure for computational science (heavy computing) and storage of scientific data in Norway, has placed its data centre within the Lefdal Mine Data Centre facility, which is located inside the old Lefdal mine outside Måløy.

Sigma2 is funded by the Ministry of Education and Research through the Research Council of Norway, and receives funding from and collaborates with the Norwegian University of Science and Technology (NTNU) and the universities of Bergen, Oslo, and Tromsø to operate the national services known as NRIS (Norwegian research infrastructure services). Today, Sigma2 has users who conduct research across a wide range of fields, from language and language models to climate, the ocean, health, and notably the natural sciences of physics, chemistry, and biology. The Norwegian Institute of Public Health employed Sigma2’s services to determine the epidemiological reproduction number (R number) and vaccine effectiveness during the COVID-19 pandemic.

The mountain hall provides a safe and secure environment for the operation of the critical infrastructure managed by Sigma2. The company provides Norwegian researchers and research institutions with access to some of the world’s most powerful supercomputers, and the national supercomputer is now being installed in Sigma2’s data centre, with operations scheduled to commence in 2025.

3.2 Data centre establishments and the role of local authorities

The Government aims for the data centre industry to have favourable conditions for growth and value creation, and for data centre establishments to be carried out in a way that generates positive synergy effects in the host municipalities. The Government wants data centre establishments to strengthen local communities. It is essential that the planning of data centre establishments balances consideration for business development with consideration for the power system and the impact on the local environment, other local activities or other planned establishments. It will continue to be up to the municipalities themselves to decide whether to establish data centres in their areas.

Rural areas are appealing sites for data centre establishments, both because of their access to land and because Norway has several large energy-producing counties with a stable renewable power system that is internationally competitive in terms of price. Both municipalities and county authorities play a key role in the realisation of data centre establishments. It is the municipalities that receive and process applications for data centre establishment. In their role as planning authorities, they can decide whether and where data centres can be built. It is therefore essential that municipalities have a comprehensive understanding of data centres and the data centre industry, so that they are well-equipped to identify and assess the various aspects of applications for data centre establishments. In this context, it may be helpful for municipalities to exchange experiences from processes they have had with data centre establishments.

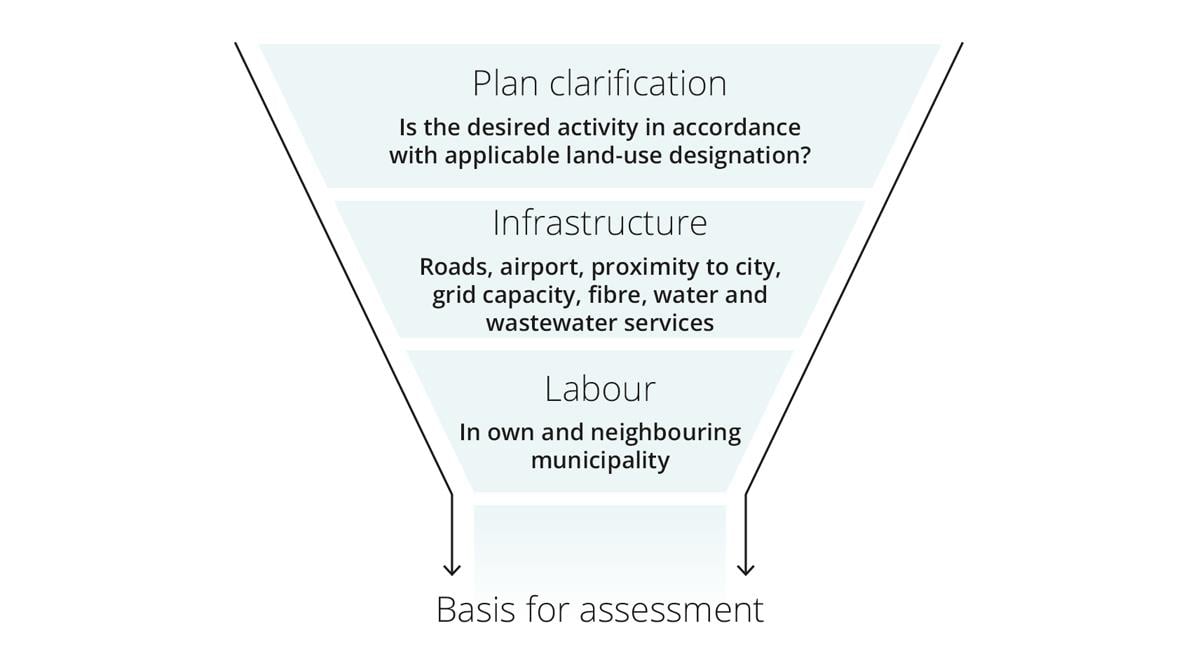

Box 3.2 Basic elements for assessing applications for data centre establishment

Some key points (non-exhaustive list):

- Who is responsible for initiating contact?

- What requirements should be imposed on the developer?

- Does the municipality have the resources to support the implementation of the planned establishment?

- Has the project undergone adequate quality assurance?

- What potential ripple effects could the project have in the municipality? (Is there existing industry or other commercial activity in the municipality that could strengthen or benefit from this establishment? How will the establishment contribute to the local labour market?)

In April 2023, the Ministry of Local Government and Regional Development published a guide for municipalities in connection with the establishment of data centres. The guide offers information on the precautions they should take and the options available to them when they receive enquiries from interested parties about establishing a data centre or if they wish to establish one themselves. Additionally, the guide outlines common features of cryptocurrency data centres. The guide states that the area designated for data centre establishments shall be allocated for commercial buildings in the land-use element of the municipal master plan and regulated for the land use purpose “other industry” in detailed zoning plans. The Ministry of Local Government and Regional Development has also decided that data centres are to constitute a separate sub-purpose under the main purpose of development and construction at the zoning plan level in the new Map and Planning Regulations, which entered into force on the 1 of July this year. The purpose is to allow municipalities to control their land for data centres if they wish.

There are several important issues and priorities that municipalities must consider if they wish to facilitate the establishment of data centres, including access to power and infrastructure, and whether the desired land use may conflict with important soil conservation, environmental and social considerations. The establishment of energy-intensive industries should be considered from a regional perspective. Regional plans are a good tool for viewing industrial areas in relation to, among other things, energy needs, power production and the capacity of the power grid and other infrastructure. If the county authority develops a regional plan, it shall serve as the basis for municipal planning. The municipality should also consider whether there is existing industry or business activity that can benefit from the establishment of a data centre, whether the establishment is in accordance with current municipal plans, and how the establishment will contribute to the local labour market.

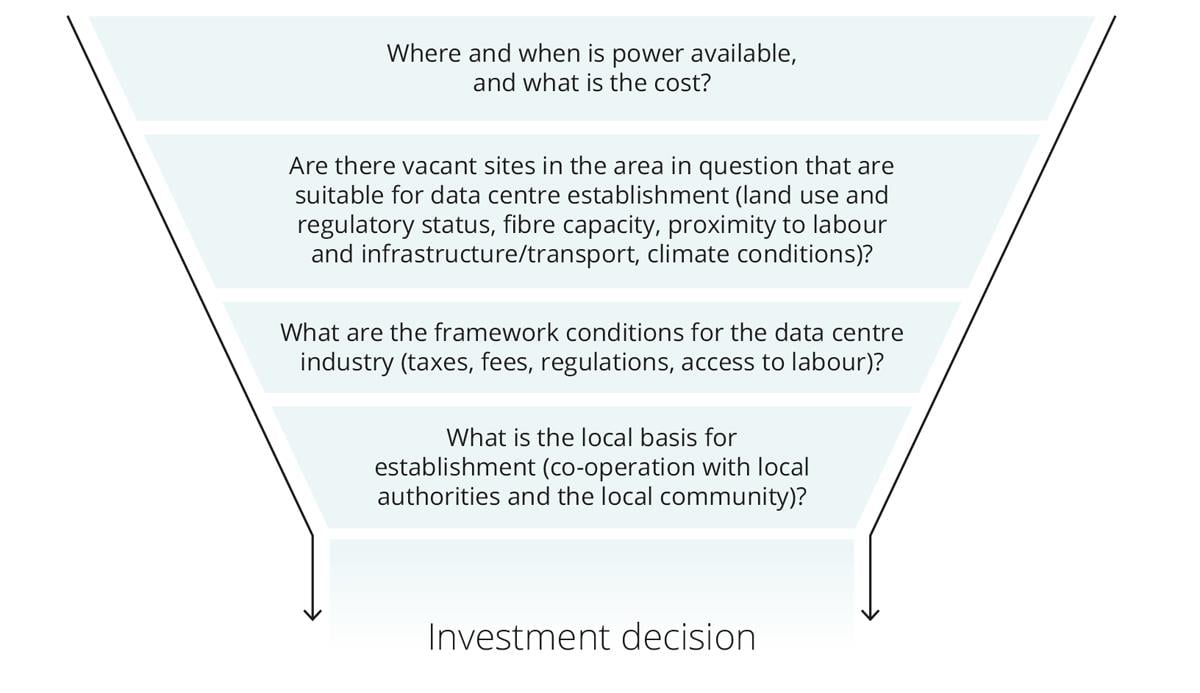

Box 3.3 The process of applying to establish a data centre – what does a data centre operator typically emphasise?

(The priorities of individual actors may vary.)

3.3 Development opportunities, employment and potential ripple effects locally and nationally

Norway requires new, profitable businesses and industries that generate new jobs and boost value creation. The Government aims to increase Norwegian exports outside oil and gas by 50 per cent by 2030. At the same time, it is important to safeguard the opportunities offered by digitalisation to further develop existing industries and jobs. Data storage and processing capacity constitutes critical infrastructure both nationally and locally, and the establishment of data centres in rural areas can provide regional opportunities with positive value creation effects. The data centre industry and related value chains can also strengthen Norwegian exports. The policy instrument system, including Innovation Norway, will play a crucial role in achieving the goal of increasing exports.

Several municipalities have found that establishing a data centre has not had the positive ripple effects and impacts on the local community that they had anticipated. This is especially the case for establishments that have been found to be involved in cryptocurrency mining. In several such cases, the establishment has led to frustration, dissatisfaction, and difficult local debates, as the data centre consumes substantial resources but has little or no impact on the local community or creates little to no value locally. This is undesirable, and the Government wants data centre establishments that use essential resources to strengthen local communities and promote sustainable value creation both locally and nationally.

Employment connected to the data centre industry relies on access to competent labour. The Government wants the Norwegian data centre industry to be a competence-based industry offering opportunities across all levels of education, while contributing to fair practice in the labour market.

Box 3.4 Value chains that create growth, employment and opportunities throughout the country

An analysis of the ripple effects of completed and potential data centre establishments in Norway, prepared by Implement Consulting on behalf of the Ministry of Local Government and Regional Development in 2020, shows that data centres contribute to employment and jobs both directly and indirectly. 1 Data centre establishments vary in size, but in some cases, the construction of a data centre can create several hundred jobs. The jobs are often distributed among various local subcontractors. Once a data centre is operational, it boosts employment by creating jobs at the data centre and related activities, as well as through private consumption by those directly and indirectly employed. Any consumption from business activities connected to the data centre also contributes.

At the same time, the data centre indirectly contributes to employment and jobs throughout the country. Cloud services, sensor technology and the Internet of Things (IoT), big data analysis, artificial intelligence and high-performance computing (HPC) are some of the most essential technological drivers in the data economy. All of these technologies are dependent on a data centre. Wik Consult has assessed the Norwegian data economy on behalf of the Norwegian Communications Authority (Nkom). 2 The assessment estimates that the data economy will account for 5.4 per cent of Norway’s GDP in 2025. In addition, the operation of data centres contributes to tax revenues for society.

Norwegian Data Centre Industry (NDI), which represents a total of 80 different actors in the data centre industry in Norway, has commissioned Samfunnsøkonomisk Analyse to estimate the development in full-time equivalents and value creation, both directly and indirectly linked to the data centre industry, up to 2034. In 2024, the estimates were presented in a report. 3 According to the report, data centre operators in Norway have several data centres in operation. However, most operators are still in an establishment and development phase, partly because many data centres are established and expanded in multiple stages. A significant portion of today’s activity is therefore likely related to the construction and installation of physical capital. In the long term, the industry will progressively shift into an operational phase.

The report also showed that NDI members employed 730 full-time equivalents, including contracted full-time equivalents, as of September 2024, and that a total of 3,686 full-time equivalents with subcontractors were involved in projects. This means that around 4,400 full-time equivalents were associated with the activities of NDI members in 2024. This is almost twice as many as the 2,300 full-time equivalents reported by members in 2023. The growth is connected to the substantial investments by data centre operators in expanding existing facilities and building new ones.

Considering that most data centre operators are registered in industry group 63.110 Data processing, hosting and related services, and comparing this with the total value added in mainland Norway, the report estimates that the data centre industry contributed 0.14 per cent of the total value added in Norway in 2024. The report estimates that Norwegian data centres could generate NOK 28 billion in value creation and employment, equivalent to 25,000 full-time equivalents in 2031. The most significant effects will stem from the establishment of data centres. The number of full-time equivalents will decrease after 2031, when the data centres enter an operational phase and investments are expected to decline. The projections are uncertain. The economic impact analysis commissioned by the Ministry of Local Government and Regional Development in 2020 estimates that the industry could potentially contribute NOK 30.9 billion to Norway’s GDP and employ just under 25,000 people in 2030, based on a scenario with 25 per cent annual growth in the data centre industry.

Data centre establishments can also contribute to the development of important local ecosystems for digital development and value creation. This can occur when data centres attract sought-after cutting-edge competence and form partnerships with other businesses and local commercial activities, but also through their contributions to developing other key infrastructure, such as fibre-optic cables or road infrastructure.

Box 3.5 World-leading technology in Vennesla

In Vennesla, Bulk is in the process of upgrading its data centre park, NO1 Campus. Ten years after Bulk, which has Norwegian majority owners, opened its data centre at Støleheia, the company is expanding with a new data centre building specially designed for AI. The new building will complement the two existing data centre buildings. In addition to providing data processing services for Norwegian and international companies, Bulk has positioned itself in data processing infrastructure as a step in the industrialisation of the AI industry.

Bulk collaborates with the U.S. multinational company Nvidia, which designs processors for AI servers. It has been included in their global network of data centres that are considered to have optimal conditions for rolling out AI on Nvidia’s DGX platform. Bulk also has a partnership with the global technology company CoreWeave, which is installing world-leading technology at Støleheia in what will be one of the largest AI clusters in Europe.

Vennesla identifies itself as “the green urban village”. Vennesla has ample access to hydropower, and the municipality is eager to explore how international technological innovations can generate opportunities for local development and employment by combining external power sources with internal power resources. Statnett’s transformer station at Stølen is among the largest in Europe, featuring twelve separate transmission routes that provide a highly reliable power supply.

Since 2014, Bulk has invested approximately NOK 5 billion in the data centre park in Southern Norway, and the construction of the new AI data centre will involve further investments of several billion more. Currently, more than 50 people are permanently employed by Bulk at Støleheia, and several hundred have been or are being contracted during periods of building and expansion of the data centre park. In 2024, a maximum of 550 people was working at the NO1 Campus. Additionally, there are local and regional subcontractors working on projects outside the area where the data centre park is situated. A total of 370,000 project hours were carried out at N01 Campus in 2024.

Agder hosts one of Norway’s foremost IT clusters, Digin, where Bulk and approximately 130 other member businesses collaborate to promote innovation and knowledge development in IT, digitalisation, and technology. In collaboration with Meta, Google and Amazon, Bulk has also built a submarine fibre-optic cable from New Jersey in the United States to Støleheia in Vennesla, with branches to Denmark and Ireland.

To utilise the energy twice, active efforts are underway with local and regional partners from the energy sector on reusing excess heat from data centres. This includes investigating the establishment of district heating facilities capable of supplying heat to other industries that may establish themselves in the vicinity of N01. Bulk is also in the process of assessing the role that data centres play in the power system and identifying opportunities where data centres can help relieve pressure on the grid in the future.

Box 3.6 A data centre revitalised a former NATO ammunition depot and is supporting the transition of a town with a long industrial heritage

|

On Rennesøy island in Boknafjorden, Green Mountain operates the SVG-Rennesøy data centre in what was once a NATO ammunition depot. The facility, acquired by the former Rennesøy municipality (now Stavanger Municipality), has a nuclear-secure design, proximity to the fjord, and the possibility of seawater cooling. This makes it well-suited for a data centre. |

|||

|

Since its establishment in 2011, the data centre has supported a total of

|

Green Mountain has invested NOK 1.3 billion in the establishment and expansion of the data centre in the period 2011–2024. |

In 2024, 80 people had SVG-Rennesøy as their permanent workplace:

|

|

|

SVG-Rennesøy and the economic activity associated with the data centre have supported around NOK 210 million in tax revenue during the operational phase since 2013:

|

||

|

Green Mountain also has a data centre in Rjukan, TEL-Rjukan. During a period of transition for the region, after Hydro scaled down its production in Rjukan in the early 1990s, the construction and expansion of the data centre has generated investments of over NOK 1 billion. |

|||

|

Since its establishment in 2014, the data centre has supported

|

Green Mountain has invested over NOK 1 billion in the establishment and expansion of the data centre since its inception in 2014. |

In 2024, 77 people had TEL-Rjukan as their permanent workplace:

|

|

|

TEL-Rjukan and the economic activity associated with the data centre have generated tax revenues totalling NOK 80 million in the operational phase since 2014:

|

||

|

Source: Ringvirkninger av Green Mountain sitt datasenter på Rennesøy [Ripple effects of Green Mountain’s data centre in Rennesøy. Available in Norwegian only] (Menon publication no. 145/2024) and Ringvirkninger av Green Mountain sitt datasenter på Rjukan [Ripple effects of Green Mountain’s data centre in Rjukan. Available in Norwegian only] (Menon publication no. 102/2024) |

|||

The Government

- will strengthen Norway’s position as an attractive data centre nation to attract data centre establishments that meet national needs

- wants data centre establishments in Norway to contribute to local value creation

- will ensure predictable framework conditions that provide good growth conditions for data centres in Norway

- will facilitate investments in data centres that strengthen Norwegian digital infrastructure and support innovation and growth throughout the country

- will contribute to a robust and sustainable ecosystem connected to the data centre industry, generating new and attractive jobs across different parts of the country

- wants the development in the data centre industry to be market-driven and enable the emergence of potential new underlying industries and value chains

- wants the data centre industry to contribute to the increased emergence of a market-driven supplier industry connected to data centres in Norway

- wants the data centre industry in Norway, with associated value chains, to support the Government’s target of a 50 per cent increase in exports

- wants the growth in the data centre industry to contribute to increased employment in Norway

- wants the Norwegian data centre industry to be attractive partners for the development and use of AI

- will support municipalities in their role as planning authorities for data centre establishments, and establish an arena where they can receive guidance and exchange experiences in connection with data centre establishments

- will work with the Norwegian Association of Local and Regional Authorities (KS) to implement measures to increase knowledge about data centres and the data centre industry among Norwegian municipalities, based on the municipal guidelines for data centre establishments

- wants data centre development to contribute to fair practice in the labour market and to be carried out in accordance with relevant industry standards, such as the fair practice rules for building and construction contracts

- will assess the competence needs in the data centre industry in collaboration with the industry and facilitate adequate and adapted educational pathways

- will work to ensure that the data centre industry is a competence-based industry that facilitates the use of skilled workers and apprentices

- will utilise information derived from the registration obligation for data centre operators in the work on future-oriented framework conditions that contribute to the development of the data centre industry in Norway