7 Recommendations

7.1 Introduction

The specific recommendations we will present in this chapter, on climate-related threats and opportunities in the management of the GPFG, are based on three pillars:

- The discussion in the previous chapters, in which Box 7.1 summarises the most important conclusions.

- The GPFG’s climate risk management from an international perspective, which is described in section 7.2.

- Our basic assessments, which are based on our view that the level of ambition in climate risk management should be raised, are described in section 7.3.

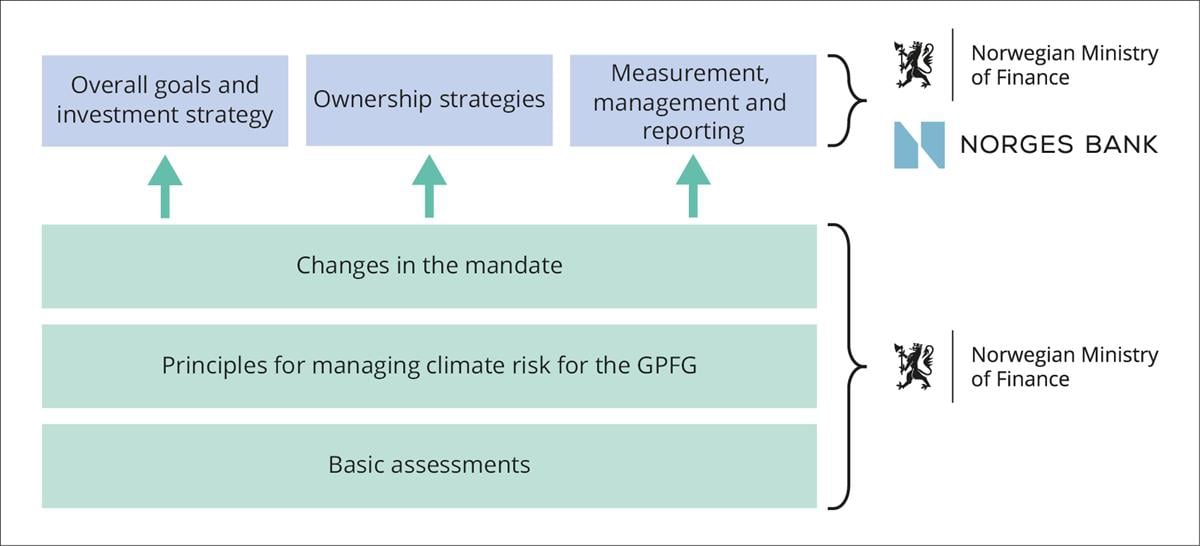

Based on these general assessments, we then present our specific recommendations, cf. Figure 7.1:

- We propose a set of principles for managing the GPFG’s climate risk (section 7.4).

- We propose that the work on climate risk be anchored in the mandate issued by the Ministry of Finance for the management of the GPFG, with an overall long-term goal of zero emissions from the companies in which the fund has invested (section 7.5).

- We recommend further development of Norges Bank’s ownership activities (section 7.6).

- We propose separate provisions on measuring, managing and reporting climate risk and developing standards for this (section 7.7).

- We have also outlined changes in the mandate for the management of the fund that reflect these recommendations (Box 7.3). A summary of the tools for addressing the GPFG’s climate risk is given in Box 7.4.

Figure 7.1 Our recommendations

Our recommendations are primarily aimed at the Ministry of Finance’s management of the GPFG, and to a lesser extent at Norges Bank’s operational management. This reflects that the assignment we were given requests a report that will lay the foundation for assessments the Ministry will make. This is also where we have identified the greatest need for changes. In addition, we have wanted to write a report that will stand for some time, and it is then natural to focus on general guidelines and management mandates that are less dynamic than the operational management.

Box 7.1 Important conclusions from chapters 2–6

We drew the following conclusions in chapters 2–6:

- Physical climate risk arises because there is uncertainty about future climate change, while transition risk arises because there is uncertainty associated with future social developments, climate policy and technological development.

- Considerable uncertainty at many levels gives rise to significant climate risk, and dramatic outcomes cannot be ruled out.

- From a climate perspective, it can in principle be the same if climate measures come early and are implemented gradually in a predictable way, or if they come late and abruptly. However, abrupt changes in climate policy and forceful use of policy instruments can lead to changes that destabilise the financial markets.

- Climate risk is created when companies make investments that are exposed to physical risk or transition risk.

- The Task Force for Climate-related Financial Disclosures (TCFD) framework for climate risk reporting entails that companies should stress test their business models against reasonable climate policy scenarios, and especially against a scenario where the temperature increase is limited in line with the ambitions of the Paris Agreement. In this way, the companies will have to show how they will be able to be profitable if the ambitions for climate policy are fulfilled.

- Further development of methods and standards for such analyses is now a key challenge for companies and investors jointly.

- Climate risk associated with companies’ investments in underlying projects is distributed among the companies’ owners through the financial market.

- Climate risk can play out over time in the form of unproductive investments, but the risk can also hit the financial market abruptly and sharply through financial crises and economic downturns.

- Financial markets are characterised by strong competition and actors have incentives to take advantage of new information and knowledge. There is still a lot of work to be done to understand and measure climate risk in a sound manner, and companies can be mispriced for a period of time, but there is little basis for assuming systematic mispricing of climate risk in the financial market over a long period of time.

- New insights and new market standards can give rise to large capital movements, significant effects on the valuation of companies, and changes in expected returns for investors.

- Climate risk is different from other issues investors have to deal with, since it unfolds over a very long horizon, raises fundamental ethical questions, and is characterised by potentially dramatic consequences and great uncertainty that is difficult to quantify.

- An important task for investors is to ensure that companies have underlying projects that are resilient to climate-related threats and benefit from climate-related opportunities related to the green transition.

- Some investors can manage climate risk by changing the composition of investments, while broadly diversified investors focus on exercising ownership to contribute to well-run companies with better reporting, which provides the basis for well-functioning financial markets with more accurate pricing and efficient capital allocation.

- A lot of climate risk is probably systematic with global consequences, which means that there are no places a large, long-term and broadly invested fund like the GPFG can hide.

- Given its diversified investment strategy, the GPFG appears to be relatively resilient to moderate climate change and a predictable climate policy. However, dramatic climate change or abrupt policy changes will represent significantly greater challenges for the planet as well as the world’s financial markets and the GPFG. The fund therefore benefits from an effective and predictable global climate policy.

- Since climate risk can also have serious consequences for the GPFG, it is in the fund’s interest to increase resilience and reduce risk through active ownership, knowledge-based investment choices and to contribute to well-functioning markets.

7.2 The GPFG’s climate risk management from an international perspective

The GPFG’s work on climate risk should be further developed. The GPFG’s framework and management have provided inspiration and had a normative impact on investors in Norway and abroad for several years. However, when it comes to work with climate risk, it is our impression that there are other investors and initiatives that are often referred to when seeking inspiration today about what represents international best practice. At the same time, it must be said that investors’ work on climate risk is an area undergoing rapid development, and there is still no agreement on what specific expectations should be set for a responsible investor in this area.

Best practice climate risk management is not unequivocal. There are different approaches that can be used to map where the Ministry of Finance’s and Norges Bank’s work on climate risk stands in relation to other investors with whom it is relevant to compare oneself. In section 5.6, we discussed some key investor initiatives related to work on climate risk. Principles for Responsible Investment (PRI) has prepared examples of best practice climate risk management related to the TCFD framework for climate risk reporting within the following categories: management, strategy, risk management and reporting. Another alternative, which forms the basis for some further comments below, is the six categories used in the Financial Sector Science-Based Targets Guidance (2020):

- High-level commitment to act: Norges Bank took early steps to address climate issues in its management of the fund compared with other investors, even though work on climate risk is not explicitly anchored in GPFG’s mandate.

- Measurement of greenhouse gas emissions: Norges Bank has been analysing the carbon footprint of the companies in the portfolio since 2015, and its annual report on responsible investment addressed various aspects of the GPFG’s carbon exposure.

- Scenario analyses: Norges Bank is concerned that the companies in which the fund is invested report on scenario analyses in line with the TCFD framework. The bank itself has not yet regularly reported scenario analyses that shed light on climate risk in the portfolio, but is working to develop this.

- Specific targets for the portfolio: No specific targets have been established for the portfolio’s development of, for example, greenhouse gas emissions or emission intensity. Any establishment of such targets should be anchored in guidelines from the fund’s owner.

- Active ownership: The impression is that Norges Bank pays close attention to effective active ownership in order to safeguard its interests as a responsible investor. In practice, the bank has been reluctant to have a formalised ownership partnership with other investors.

- Relevant reporting: In line with the requirements of its management mandate, Norges Bank provides supplementary reporting on various aspects of the GPFG’s exposure. Any establishment of targets for the portfolio’s climate risk will have consequences for the bank’s reporting requirements.

7.3 Basic assessments

Based on the discussions in this report, we have drawn the following conclusions:

- Climate risk is a relevant and potentially significant risk for the fund, and this should be reflected in its management.

- The Ministry of Finance’s and Norges Bank’s framework and process for analysing and managing the GPFG’s climate risk should be further developed and have the ambition of being world leading.

- Incorrect pricing of greenhouse gas emissions means that an economic system has been built up that challenges planetary boundaries. However, the fact that there is too much carbon risk in the financial system does not prevent the market from distributing the carbon risk in an efficient manner to those who have the best ability to bear it.

- While incorrect pricing of individual assets may occur in the short term, there is no basis for believing that the climate risk will be systematically mispriced in the financial market over the long time horizon that forms the basis for setting the benchmark index for the fund. The investment strategy for the fund is based on the fact that the financial markets are marked by strong competition, and that risk diversification makes the fund robust.

- The principle of the broadest possible diversification of investments in the benchmark index should therefore remain in place concurrently with the option of excluding certain companies for ethical reasons to ensure the fund’s legitimacy.

- The fund is largeand the investments are spread over a very large number of companies in various industries around the world. The general development of the world economy will then serve as the most important driver of the fund’s return over time. Climate risk can affect all sectors of the economy in different ways, and a large fund that is broadly invested has nowhere to hide.

- The fund thus benefits from, and, based on its mandate, should contribute to the achievement of the targets of the Paris Agreement, and that the transition to a zero-emission society takes place in an orderly manner. Norway has supported international climate goals, and the management of the GPFG should be consistent with the Paris Agreement’s obligations. An ambitious and successful international climate policy reduces the physical climate risk for the fund. A predictable climate policy and an orderly, gradual decarbonisation of the economic system reduce the risk of sudden changes in the value of the fund’s investments and financial instability.

- The fund is a financial investor, with a mandate to provide the highest possible return within the framework set by the Ministry of Finance as owner. Measures to better manage climate risk should be anchored in this role.

- At the same time, there is broad agreement that the fund shall be a responsible investor. It is in the fund’s long-term interest to manage climate risk in a sound manner in the financial markets, in order to ensure that this risk does not contribute to undermining the value creation that, over time, is the basis for the fund’s return. A responsible investor should actively contribute to active ownership, to the development and sharing of insights, and to the establishment of good standards for the identification, management and reporting of climate risk. Over time, sound global standards will also improve how well the financial markets function and serve the fund’s financial interests.

- Given the fund’s role and structure, this indicates that active ownership will have to play a key role in the work of managing climate risk. This is the best way to ensure that companies have underlying projects that are resilient to climate-related threats and take advantage of climate-related opportunities associated with the green transition. Active ownership also contributes to strengthening financial markets’ general ability to price climate risk and channel capital to profitable projects in the transition to a low-carbon economy.

- The fund’s role as a responsible investor also contributes to strengthening the fund’s legitimacy. The fund plays a very important role in economic policy and represents the joint savings of the Norwegian people. It is therefore necessary to have a large degree of transparency regarding the work on climate risk, and the requirements for reporting on such risk must reflect this.

- A fundamental consideration in the management of the fund is to have a clear division of responsibilities between the Ministry of Finance as owner on behalf of the community and Norges Bank as manager. The bank’s work must be clearly anchored in financial goals, so that it can be held responsible for the results achieved. At the same time, the Ministry of Finance as owner must set the framework for the bank’s management of the fund, and requirements and goals for its work on responsible investment.

- The fund should not make investments in companies that are not anchored in the fund’s financial objective. While there may be good reasons why the government wants to stimulate, for example, technological progress or the development of new renewable energy in developing countries, and take a higher risk than that which applies to the GPFG, this is best done through dedicated institutions such as Nysnø and Norfund.1 Adherence to the GPFG’s financial objective also provides a basis for enabling the GPFG’s framework and management to continue to inspire and have a normative impact on other investors in Norway and abroad.

7.4 Principles for managing the GPFG’s climate risk

We propose a set of principles for managing climate risk for the GPFG. The Climate Risk Commission (NOU 2018: 17) proposed a set of general principles for managing climate risk for the private and public sector in Norway, cf. discussion in chapter 3. Such principles can establish some important fence posts that can stand the test of time and ensure that current policy is anchored in a joint starting point. In Box 7.2, we have therefore adapted and focused the Commission’s general principles to a set of principles about how the GPFG’s climate risk should be managed.

Box 7.2 Principles for managing the GPFG’s climate risk

The Climate Risk Commission’s principles for managing climate risk for Norway | Our principles for managing climate risk for the GPFG | |

|---|---|---|

Comprehensiveness | Use an integrated process in analyses of threats, opportunities and risk factors | There should be a broad assessment of climate-related threats and opportunities related to the GPFG |

Framework | Address climate risk in the context of other risks and risk frameworks | Address the GPFG’s climate risk in connection with other financial risk, anchored in the investment mandate and guidelines |

Appetite | The desired level of risk must be based on a broad assessment of benefit, costs and robustness | The desired climate risk and financial risk for the GPFG should be based on the expected return and the GPFG’s risk-bearing capacity |

Resilience | Attach weight to resilience in line with the precautionary principle | Emphasise political anchoring of investment management principles, including the importance of a diversified portfolio, good corporate reporting, scenario analyses and stress testing |

Incentives | Clear links should be established between decisions and implications | The mandate should specify a clear division of responsibilities between the Ministry of Finance and Norges Bank, as well as incentives for the bank to integrate climate risk in a management approach aimed at the highest possible return at an acceptable risk |

Standardisation | Risk assessments should be performed as similarly as possible across various fields | Climate risk assessment and reporting should be harmonised and integrated with financial risk, but adapted to the distinctive characteristics of climate risk |

Communication | Risk management should be based on cooperation, information sharing and transparency | The GPFG should cooperate with other investors in the active ownership, as well as share information and knowledge with the public |

7.5 Overall goals and investment strategy

Climate risk will unfold over a long period of time and can potentially have great significance for the fund. Even if the world succeeds in climate policy, the transition to a zero-emission society will take a long time, and the climate will continue to change for decades to come. Although Norges Bank has taken early steps to address climate issues in its management of the fund compared with other investors, and still invests considerable effort in this, the management of such a long-term risk should in principle be anchored in guidelines from the fund’s owner in order to ensure that the manager acts responsibly in line with the owner’s preferences.

Consequently, general guidelines for work on climate risk should be part of the mandate for the management of the fund. As the owner of the fund, the Ministry should set the level of ambition for analysis and management of climate risk, signal relevant priorities in overall focus areas and policy instruments, and set reporting requirements that enable the owner to assess the scope and development of climate risk over time. Climate risk in financial markets is a field undergoing rapid development and best practice internationally for dealing with such risk is changing quickly. The mandate from the owner should consequently be overriding and principle-based, without micromanaging practices that will in any case have to be further developed as the knowledge base is bolstered. At the same time, we believe that the mandate should lay the foundation for a high level of ambition in climate risk management.

A number of investors have now set a long-term target for a climate-neutral portfolio. We have described such targets in chapter 5, related in part to the work of the so-called Net-Zero Asset Owner Alliance. The Alliance is committed to working for net zero greenhouse gas emissions from the companies they have invested in by 2050, in line with the 1.5-degree target in the Paris Agreement. Investors also undertake to regularly report and use targets that are revised every 5 years in accordance with the update mechanism for the agreement. At the same time, they emphasise that the goal should be achieved by contributing to the decarbonisation of the economy, not by transferring ownership of companies that emit greenhouse gases to other investors through divestment of assets, and point in particular to active ownership as a means to achieve this.

After an overall assessment, we recommend also setting such a target for the responsible investment management in Norges Bank. Such a long-term goal of working towards net zero greenhouse gas emissions in the portfolio companies by 2050 using regularly updated intermediate targets, can help demonstrate consistency between the guidelines for managing the fund and the ambitions in the Paris Agreement to which Norway is a party. At the same time, the target will constitute a natural reference point for assessments of emissions from the companies in which the fund has invested. The fact that this target is aligned with other leading investors internationally facilitates joint development and standardisation of forward-looking indicators for emissions, cf. further discussion in section 7.7 below. As elaborated below, such a target is not intended to set a guideline for the composition of the benchmark index set by the Ministry of Finance, but is intended to strengthen climate risk management in Norges Bank’s management in general and ownership strategies in particular.

We have outlined how such a target could be incorporated into the mandate for the management of the fund. In Box 7.3, we discussed a possible addition to Section 1-3 of the mandate, with reference to a long-term goal of zero greenhouse gas emissions from the companies in the fund’s investment portfolio, in line with international climate agreements to which Norway has acceded. The formulation has been chosen to be able to remain in place even if there are other agreements in the climate area that replace or complement the Paris Agreement, but will for practical purposes mean that a goal of zero emissions by 2050 will be a long-term anchor for the fund’s work on climate.

A long-term goal of zero emissions must be supplemented with regular reporting. It is natural that the reporting is forward-looking and linked to target figures that provide indications of emission development in the companies the fund has invested in relative to decarbonisation pathways compatible with the long-term goal. We discuss this in more detail in section 7.7 below.

We also propose a general provision that the bank’s use of responsible investment tools shall support the objectives of the fund. In Box 7.3 we outlined how such a provision could be formulated. There is currently no explicit provision in the guidelines that links the bank’s work on responsible investments to the fund’s purpose and overall framework, as stated in Section 1 of the mandate. The new provision will clarify the connection between responsible investment practice and the overriding objectives, including the proposed new provision on zero emissions.

A long-term goal of zero emissions from the companies the fund has invested in does not in itself imply changes in the benchmark index for the fund. The strategy for the fund is based on the view that investments that are as broadly diversified as possible across different companies and industries provide the greatest resilience and the best ratio between return and risk in the fund as a whole. Climate risk does not change this. We must continue to assume that markets with strong competition will not systematically misprice risk over the long time horizon that is relevant for determining the GPFG’s benchmark index. This indicates that the main features of the current investment strategy should remain in place. Risk diversification and resilience are important in the face of risks over which we have little control.

Norges Bank has a coherent chain of ownership tools for addressing climate risk. The key tool for managing the GPFG’s climate risk is active ownership, since this is aimed directly at the source of the fund’s climate risk. In addition, Norges Bank may choose a different composition of the portfolio than that which follows from the benchmark index. If active ownership eventually turns out not to be successful, and the assessment is that a company does not have a convincing transition strategy and invests in bad projects rather than paying dividends, the bank can divest from the company. If there is an unacceptable risk that the company is associated with serious environmental damage or leads to greenhouse gas emissions to an unacceptable degree, it is relevant to observe or exclude based on a recommendation from the Council on Ethics. A summary of the tools for addressing the GPFG’s climate risk is given in Box 7.4.

A certain amount of latitude for active management is part of the framework for the fund. This means that Norges Bank is free to deviate from the benchmark index set by the Ministry of Finance, within the framework laid down in the mandate, in order to fulfil the objective of generating the highest possible return after costs. If Norges Bank believes that the market underestimates or overestimates climate-related threats or climate-related opportunities, it is therefore possible for the bank to take advantage of such investment opportunities. At the same time, the Ministry of Finance has planned that the framework for active management be assessed regularly in connection with the assessment of the results and strategies by independent external experts.

Investments in environmental mandates draw on the risk budget for active management. Having a special management focus on selected topics such as the environment can have a learning effect for the management organisation that has a positive impact on the fund’s return and risk over time. At the same time, it can create unclear responsibilities that the owner lays down guidelines in the mandate on how the manager shall deviate from the benchmark index, and it can be difficult to interpret whether the mandate’s range of NOK 30–120 billion should be considered a risk limit for the manager to stay within. It is also somewhat unclear what effect such a regulation of environmental mandates has, since listed shares in companies in the environmental portfolio are also owned by other portfolios in the GPFG. The Ministry of Finance should consider another solution to regulate the environmental mandates and make the environment and sustainability-related investments in the entire Fund more visible. A possible alternative could be to replace said range by introducing a reporting requirement that applies to the entire GPFG for investments in special categories,2 and possibly set target figures for the development if it is deemed desirable. If a more ambitious scheme is established for climate risk management and reporting that permeates the entire fund, it may be natural to assess whether there is still a need for a separate environmental mandate.

Norges Bank considers the sustainability of business models as part of its active investment decisions. The latest strategy plan for the management of the fund and Norges Bank’s letter of 2 July 2021 to the Ministry of Finance3 state that the bank will, among other things, seek to achieve excess returns over time by reducing investments in companies that are considered to have an unsustainable business model. In competitive and well-functioning markets, the price of a security will generally reflect expectations of how sustainable a business model is. Active management based on sustainability assessments is thus not fundamentally different from other active management strategies that seek to utilise what is perceived as incorrect pricing. However, to the extent there are plans to undertake these types of assessments in the management of the fund, it is natural that they are made by the manager at company level as part of the active management, and not by the owner of the fund having an opinion on whether specific companies or sectors are mispriced.

The risk limit for active management must be assessed on a broad basis. We have proposed an expansion of Section 6-1 (2) of the mandate related to reporting on the strategies the bank has for its management of the fund, so that there is explicit reporting on the extent to which the bank seeks to take into account climate-related threats and opportunities in its management. Over time, this will provide better insight into how important climate-related assessments are for the active management strategies. If Norges Bank can demonstrate that climate risk is an important element in its management of the fund, we assume that such information is included in the Ministry of Finance’s regular assessments of what constitutes a suitable framework for responsible active management. However, assessments of the framework for active management must be based on a broader assessment of costs, achieved results and views on the functioning of the markets.

An important starting point for working with climate risk is that the world’s total climate emissions are too high. As we have described in chapter 4, this is because the price of climate emissions for the individual enterprise is far too low compared with the costs the emissions impose on society. This leads to too high emissions, and thus physical risk. At the same time, there is a transition risk when emissions are to be reduced and brought within the planet’s tolerable limits.

This underlying problem cannot be solved by shoving the risk onto other investors. Even if one investor eliminates the risk, the risk will still be in the financial system. For a large, long-term and broadly invested investor, it will still have the capacity to affect us. Poorly managed risk in the portfolio companies can give rise to lower economic growth, thereby lowering returns on the fund over time.

And in any case, the sector in which the climate risk is highest is not obvious, if one were to try to change the composition of the portfolio. The risk of an investment cannot be seen in isolation from how the investment is priced. The fact that a particular sector can be more directly affected by, for example, climate policy measures does not in itself mean that the risk level is highest there. When it is obvious that a sector such as the oil sector could be affected by climate risk, it is also reasonable to assume that this is reflected in the price of assets in that sector. Other sectors – for example the financial sector – may be affected by climate risk in more indirect ways. It can be more challenging for the markets to price this risk when it is not as visible.

Climate risk is also just one of many types of risk to which the fund is exposed. The sale of assets to reduce climate risk leads to a need to invest released funds in other companies. These investments can be exposed to other types of risk that can be just as difficult to handle as climate-related risk.

This issue becomes especially clear if we expand the perspective to look at the assets of the state in a broader context. For example, a large part of the fund is invested in financial companies (as discussed in chapter 6), and this is a sector that is exposed to risk associated with financial crises to which the state is in any case very exposed. We know that financial crises are always linked to crises in the real economy, which in turn have major consequences for public finances.

The consequences of such a sector-based approach would be harmful for the fund’s return. If the price of an asset is lower because it is perceived that the systematic risk is high, the counterpart is that the expected return is higher. Climate-related risk is no different from other risk in the financial market in that respect. Exclusion of certain sectors due to perceptions of sector-specific climate-related risk is a very ineffective tool for risk management and leads to poorer risk diversification. The broadest possible diversification of the fund’s investments has been a cornerstone since its inception. This practice should remain in place.

The Ministry of Finance’s strategy for climate risk management should be regularly updated. Knowledge of climate risk management is an area in rapid development, which indicates that one should be prepared to adjust course over time. Furthermore, we recommended above that zero emissions by 2050 be a long-term anchor for the fund’s work on climate, coupled with regular reporting and use of target figures that are revised every 5 years in accordance with the Paris Agreement’s updating mechanism, which also makes it natural to assess the fund’s strategy for climate risk management on a regular basis.

7.6 Ownership strategies

Active ownership will be the key tool for managing climate risk. As described above, this is a tool that is aimed directly at the source of climate risk in the fund. Through targeted and effective active ownership, the fund can contribute to understanding and influencing the robustness of the business models of the companies in which the fund has invested. Better reporting on climate risk from the companies will make the financial markets more well-functioning, in that information about this risk will be more readily available and consequently can form the basis for more correct pricing. With more robust business models and more correct pricing of risk, the transition risk in the financial system will gradually be reduced.

With a new proposed provision in the mandate, active ownership will also be more clearly anchored in a long-term goal of zero emissions. Emission developments in line with the Paris Agreement should serve as the reference point for the fund’s ownership activities and for the dialogue with the companies in which the fund has invested. The fund should require that the companies they have invested in stress test their business models against various climate policy scenarios, including a scenario where the targets of the Paris Agreement are achieved, in line with the TCFD framework. In this way, it will be easier identify deviations from decarbonisation pathways consistent with the climate targets, and to quantify possible economic consequences of this. This in turn provides a better basis for targeted active ownership.

There is a risk that investors as a whole give too little priority to active ownership. This is partly because this is an area where you have a free-rider problem; the investors who exercise active ownership bear the costs of it, while the profits are shared with all the shareholders. The same applies to activities aimed at more well-functioning markets in general, such as the development of reporting standards and analysis methodology. In the climate area, there is for example a need for further development at company level of methodology related to stress tests and reporting of decarbonisation pathways against relevant reference scenarios.

Investors seek to remedy this problem through closer cooperation. A current example of the climate area is the Climate Action 100+ initiative, which is discussed in more detail in section 5.6. Through collaboration, the costs for each individual investor are reduced by exercising active ownership, and coordination of priorities where a few investors engage with different companies on behalf of the entire group has also been shown to have a greater impact. This initiative has led to significant improvements in the companies’ reporting of climate risk, and more binding plans for emission reductions. Another example is work related to TCFD, where many investors are involved in the process of advancing the framework for climate risk reporting.

This should also be a priority area for the fund. The fund is very long-term and broadly invested, and has a strong self-interest in investors on the whole not under-prioritising this work. The fund is among the world’s largest shareholders – which carries an obligation. We have therefore proposed that this work be anchored separately in the mandate for the fund, cf. Box 7.3.

In practice, the fund has had a somewhat restrictive attitude to formalised cooperation with other investors regarding active ownership. All investors are faced with a trade-off in matters concerning cooperation. On the one hand, collaboration can have a greater impact and utilisation of economies of scale; on the other hand, it requires efforts to coordinate views and priorities in a larger group. The fund is large, and has been able to assume that direct gains from investor cooperation in the form of easier access to the boards of the companies in which investments have been made and greater acceptance of views are probably smaller than they would be for smaller funds. But even though the fund is among the world’s largest shareholders, the holdings in each company are generally not large enough to influence companies’ behaviour unless other investors support the same issue.

Developments in such forms of cooperation may provide reason to reconsider this. Organised investor cooperation, such as Climate Action 100+ discussed above, also changes the norms for investor behaviour. Supporting a development towards more organised cooperation between investors can have value per se, with more cooperation on the development of norms and standards for reporting. The fund is large and has long had a clear voice in sustainability issues. There are therefore very many different investor initiatives that want the fund as a participant, and in practice it will be necessary to prioritise participation in a selection of them. Decisions on this should be left to the manager, but it is reasonable that the reporting on the ownership activities also provides an account of the principles and assessments that form the basis for decisions on participation in such initiatives.

There has been a gradual development in the topics that are addressed in ownership activities internationally. In the climate area, it has been natural for investors to start by addressing issues related to emissions from the most emissions-intensive industries, and the strategies companies in these industries have for adapting their business models to a zero-emission society. Gradually, other issues have also come higher on the agenda. This applies, among other things, to issues related to biological diversity, which are closely linked to climate issues, as discussed in chapter 2.

There have also been changes in the climate-related topics the fund is working on. For example, in 2020 the fund initiated a dialogue with 16 banks on how they manage climate risk in their lending and financing portfolios. Going forward, climate risk in the financial industry will for several reasons have to be a key area for active ownership for investors. We have previously pointed out that a lot of climate risk in the markets may eventually accumulate in the financial system. As pointed out in chapter 6, the financial sector constitutes a large part of the fund’s total investments, and good management of climate risk in this sector is in itself of great importance for the fund’s overall climate risk. However, good management of climate risk is also important beyond this: the financial system plays a key role in channelling capital into investments. A good understanding of climate risk in financial institutions as a basis for lending and financing decisions therefore reduces the risk of capital being locked into unproductive uses, and may in the long run provide less risk of financial instability. If the probability of very negative outcomes decreases, it also provides a basis for higher returns for the financial markets and the fund over time.

Active ownership that prioritises capital discipline can finance new opportunities and ensure a profitable transition. In line with the TCFD framework, the fund may require the board and management of a company to have a business model and strategy that is suitable for generating profitability in a low-carbon economy. For companies that have a weak platform for developing profitable projects, the supply of capital can be reduced, for example through larger dividend payments, so that investors can instead finance companies with better prospects to develop promising projects with better profitability over time.

The fund itself is closest to assessing which areas should be prioritised in the ongoing ownership activities. The priorities must be based in part on their importance for the fund’s financial return and an assessment of the possibility of making an impact. To the extent that the fund cooperates more with other investors, cf. the discussion above, the priorities will to some extent also have to be adapted to other investors’ wishes and needs. Another important consideration is that the priorities can remain in place over some time, as ownership activities often require a long-term commitment to succeed.

At the same time, it is reasonable that the main priorities in the ownership activities are anchored with the fund’s client. Today, the priorities are anchored in that they are reported by Norges Bank and described in the Ministry of Finance’s annual report to the Storting on the management of the fund. It provides an opportunity to provide general guidelines for priorities and represents a reasonable balance between anchoring with the client and delegation to the manager.

Ownership activities should be regularly evaluated. Today, the Ministry of Finance conducts a broad review of the bank’s active management regularly using external, independent expertise in addition to the bank’s own assessments. It is natural that a similar scheme be established for the ownership activities. This work forms the core of the responsible investment activities, and it is the owner of the fund who pays for it through coverage of the fund’s management costs. Regular evaluation will ensure that the work maintains a high international standard, provide input for possible further development of practice and provide a basis for assessing whether the results are in reasonable accordance with resource inputs.

7.7 Measurement, management and reporting

Stress testing of the portfolio against climate risk will increase the understanding of this risk. We propose that Norges Bank be requested to regularly stress test the portfolio against various climate policy pathways, i.e. both transition processes that are aligned with a gradual increase in carbon prices consistent with the goals of the Paris Agreement and transition processes that are more disorderly with abrupt policy changes and higher financial costs.4 This will provide a more complete picture of the fund’s climate risk, and be consistent with the requirements for TCFD reporting the fund itself sets for companies in which they invest. Transparency about stress tests, and the underlying assumptions, can also benefit other investment managers.

For the Ministry of Finance as the owner, such reporting will also contribute to a better understanding of risk related to the national wealth and public finances. The Climate Risk Commission proposed that the Ministry should regularly stress test the national wealth and public finances against climate risk. An overriding goal of economic policy should be to facilitate the highest possible welfare over time within planetary boundaries. A better understanding of climate as a risk factor can lead to better decisions concerning the structure of economic policy, where risk related to the value of both financial assets (primarily the GPFG) and petroleum resources is taken into account. As the fund assumes a steadily increasing role in financing government expenditures, it is desirable that climate risk associated with this source of financing is better understood. Stress testing of the fund against climate risk contributes to this.

We have proposed that climate risk be incorporated separately in the bank’s principles for responsible investment management. The proposed addition to Section 4-2 (3) states that these principles shall reflect the consideration of sound management of climate risk in line with internationally recognised principles and standards. This is an area currently undergoing rapid development. Among other things, work is being done to update the recommendations from TCFD, with expected publication in the autumn of 2021. Norges Bank reports figures for carbon emissions in line with current TCFD recommendations, and the reference to recognised principles and standards will ensure that management is continuously developed as new knowledge and practice provides a basis for it.

We have assumed that this, in practice, means that requirements will be set for forward-looking reporting of decarbonisation pathways. As discussed in section 7.4 above, it is natural that a long-term goal of zero emissions is supplemented with regular reporting that says something about the decarbonisation pathway that the companies the fund has invested in are on. Based on consultation notes from TCFD,5 we assume that this type of forward-looking reporting will eventually become part of the TCFD recommendations. However, a lot of work remains to address methodological issues and to ensure an appropriate design of a reporting standard, cf. the discussion in section 5.4. It is therefore not natural to commit to a specific type of target figure at this time. The proposed addition to Section 4-2 (3) captures that the standards in this area are under development, and will ensure that the fund’s reporting is continuously developed in line with best practice internationally.

At the same time, the bank should actively contribute to the development of such standards in the market. It is therefore proposed that Section 4-3 (1) in the mandate be expanded to specifically point to the development of standards in analysis and management of climate risk.

Development in the reporting framework in adjacent areas is also taking place. This includes efforts to expand and standardise reporting related to natural capital and biological diversity through the Task Force on Nature-related Financial Disclosures initiative,6 which seeks to build on the main features of the TCFD framework. It will be a natural further development of climate reporting that an international standard for reporting related to natural capital and biological diversity is also used as a basis for the fund when the standard is established. As discussed in chapter 2, developments in biological diversity are closely linked to the climate issue.

The overall scheme for reporting from the fund should also be viewed in the light of the EU’s taxonomy. For investment managers, reporting based on the taxonomy will be regulated through the Sustainable Finance Reporting Directive (SFRD), and implemented through special legislation in Norwegian law.7 The fund will not be formally subject to this, but we assume that considerations of consistency and legitimacy may indicate that similar reporting is expected of the fund as far as the regulations are applicable. For example, provisions directly related to consumer protection may be less relevant to the fund.

However, it is too early to assess the possible application of this framework to the fund. When experience has been gained with the implementation of the EU taxonomy, we assume that the Ministry of Finance, as the responsible competent authority for reporting requirements that apply to investment managers in the private sector in Norway, also considers whether and to what extent relevant provisions in the regulations should apply to reporting from the fund.

Box 7.3 Proposed changes to the Management Mandate for the Government Pension Fund Global

The GPFG’s mandate should reflect the importance of climate risk:

- In the overall framework for the management of the fund, it is proposed that Section 1-3 (3) be expanded to read: “Responsible investment management shall form an integral part of the management of the investment portfolio, cf. Chapter 4. A good long-term return is considered to depend on sustainable economic, environmental and social development, as well as on well-functioning, legitimate and efficient markets. Responsible investment management shall be based on a long-term target of zero emissions of greenhouse gases from the companies in the investment portfolio, in line with international climate agreements to which Norway has acceded.”

- A new provision is proposed under “Section 3-3. Measurement and management of climate risk” (which changes the numbering of subsequent provisions), with the following wording: “The bank shall establish principles for the measurement and management of climate risk. The measurements shall seek to capture all relevant climate risk associated with the financial instruments used in the management of the fund. The risk shall be estimated by several different methods. Stress tests shall be conducted on the basis of scenarios for future development.”

- It is proposed that Section 4-1 be expanded to read: “The Bank shall seek to establish a chain of ownership tools as part of its responsible investment management efforts, with the aim that these activities will support the objectives and framework for the general management of the fund, cf. Section 1-2 and Section 1-3.”

- It is proposed that Section 4-2 (3) under the principles for responsible investment management be expanded to read: “The principles shall be based on environmental, social and corporate governance considerations in accordance with internationally recognised principles and standards, such as the UN Global Compact, the OECD Principles of Corporate Governance and the OECD Guidelines for Multinational Enterprises. The principles shall also reflect the consideration of sound management of climate risk in line with internationally recognised principles and standards.”

- It is proposed that Section 4-3 (1) be expanded to read: “The Bank shall contribute to the development of relevant international responsible investment management standards. Development of standards for the analysis and management of climate risk shall be given priority.”

- It is proposed that reporting requirements under Section 6-1 (2) be expanded with a new provision c (which accordingly changes the numbering of subsequent provisions): “The extent to which the management of the fund seeks to exploit climate-related threats and opportunities.”

- It is proposed that reporting requirements under Section 6-1 (4) h be expanded to read: “The responsible investment management efforts, cf. Chapter 4, including the use of tools and the effect of the exercise of ownership rights, as well as how the principles for responsible investment are integrated in the management of the fund. The work on climate risk shall be highlighted separately, and reporting shall be based on internationally recognised standards and methods.”

Box 7.4 Tools to address the GPFG’s climate risk

How the GPFG can best deal with climate risk:

- Risk diversification: Since there is much we do not know about how climate risk will affect the valuation of companies, and there is no place a large fund like the GPFG can hide, the least risky approach is to diversify investments.

- Active ownership: The most important tool for managing the GPFG’s climate risk is active ownership, since this is aimed directly at the origin of the fund’s climate risk.

- Through active ownership, Norges Bank can

- test and influence the robustness of the business models of the companies in which the fund has invested,

- ensure that the companies have capital discipline, which means that capital can be channelled to profitable projects in the transition to a low-carbon economy, and

- strengthen the financial market’s ability to price climate risk, primarily through better corporate reporting.

- Utilisation of the risk budget for active management: Norges Bank may choose a different composition of the portfolio than the benchmark index to take advantage of what the bank believes are climate-related opportunities and threats. The bank can carry out a divestment if the assessment is that a company does not have a convincing restructuring strategy and focuses on bad projects rather than paying dividends.

- Observation and exclusion: If there is an unacceptable risk that a company is associated with serious environmental damage or leads to greenhouse gas emissions to an unacceptable degree, it is relevant to observe or exclude based on a recommendation from the Council on Ethics.

7.8 The way forward

Even if climate policy succeeds, climate risk will be with us for many decades. And although the world’s understanding of climate risk is rapidly increasing, it must still be characterised as being in the making. This is one of the reasons we chose a relatively overarching and principled perspective in our approach, and emphasised the dissemination of general and universal insights, principles and recommendations that may be relevant over time. We emphasise the need for more information, better reporting and a stronger knowledge base, as well as the importance of resilience in the face of risks we do not fully know and understand.

The report does not try to provide detailed answers to all questions, but seeks to lay a foundation in order to continue work on climate risk for the GPFG in a more systematic manner. The Paris Agreement is structured so that climate policy is strengthened every 5 years, and we have recommended that the guidelines for the GPFG’s work on climate risk also be reviewed on a regular basis in line with more ambitious climate goals and increased knowledge about climate risk.