5 Business sector investments

5.1 Business sector investments in developing countries and poverty reduction

From a historical perspective, one of the most important sources of economic development and the reduction of poverty has been access to capital. At the same time, poor countries have only had a small part of the world’s investments. It is therefore important to address the question of why the global capital flows between countries are directed as they are and what can be done to improve the access to capital for poor countries.

In addition to the scope of investments in the developing countries, the quality and spin-off effects from the investments are vital in a development perspective. There are three main challenges that need to be met if investments are to have the greatest possible effect on development and poverty reduction. First, the investment must contribute to increased value creation and growth. Next, it must ensure that the greatest possible share of the value creation remains in the country. This can be done through various mechanisms, via direct money transfer to the Government such as taxation or royalties, and by using local suppliers and labour, which creates economic spin-off effects. Finally, it is important that the use of revenues in the host country goes towards development-promoting purposes.

Figure 5.1 The agricultural sector is one of the most profitable for investments in developing countries.

The share of private international capital continues to grow in relation to the volume of multilateral and bilateral aid. In 2006, foreign direct investments (FDI) to developing countries totalled USD 379 billion, compared with USD 104 billion in total aid grants. 1 Despite this increase there are still major disparities between countries’ capacity to attract private capital. Since 1970, 2/3 of direct foreign investments outside the OECD area has gone to only 10 countries, including China, Hong Kong, Singapore and Russia. Among the low-income countries, four oil-producing countries – Angola, Equatorial Guinea, Sudan and Yemen – have had almost half of the investments.

Part of the increase in the global flow of capital is due to the increase of foreign direct investments between developing countries. These increased from USD 63 billion in 2005 to USD 110 billion in 2006, which corresponds to 16 per cent of all foreign investments. Among developing countries that have become major investors, we find that India now exports more capital to the UK than it imports from the UK. The steadily stronger political and economic connections between China and Africa are another example of this development. Through investments in the extractive industries and aid for health, education and infrastructure, China’s influence on the investment climate on the continent has increased and Chinese capital has become a particularly crucial source of income for many countries. For Western aid donors, this means that their dialogue with the recipient countries on political development is increasingly affected by new players such as South Africa, India, China and Brazil.

Textbox 5.1 Investments seen from the South

«It is often highlighted that FDI can bring about positive development outcomes. This is indeed true, but with the caveat that this is not a foregone conclusion but can only happen under certain conditions.

Unfortunately, the caveat is often ignored and it is not unusual to see FDI represented as development finance pure and simple. It is this mischaracterization, which has been actively facilitated by several major development actors who should know better, that has been partly responsible for developing countries trying to outdo each other in trying to maximise the volume of investments they attract.

This is at least partly responsible for the race to the bottom we sometimes see in

tax concessions,

labour,

environmental

and social standards

However, it is clear that all FDI and private capital flows do not contribute to financing for development or indeed development. Private capital flows are for profit transfers not gratuitous flows. This means that for the most part for every $100 million invested, $150 million (or more) would be taken out, perhaps over a period of a few years.

The main potential benefits of private investment lie then not in the money it brings in but in its indirect spill-overs. FDI has the potential to generate development benefits by bringing in

new technologies

managerial know how which can help upgrade local skills

better social, environmental, gender equality and labour standards

by creating decent work, well paid jobs

through inter-linkages with the local economy

and by paying taxes and royalties which the Government can then use to finance development

For the most part, this has not happened.»

Sony Kapoor, Director,

International Finance, Environment & Development Consultant (India, UK, Norway)

Measuring the development effect of foreign investments is complicated as it is difficult to separate it from other key factors such as domestic investments and national and regional political interventions. Attempts are often made, therefore, to estimate the positive economic spin-off effects of the investments, and then study the effect of these on the reduction of poverty.

Foreign companies often pay higher wages than local companies, thereby increasing the income basis for the host country through tax and royalties. In countries with a good social income distribution policy, the poor benefit from this. Companies that also produce for local markets in the developing countries often contribute to lower price levels through increased competition between suppliers. Such investments can also link local suppliers to international markets and give access to new technology and knowledge.

However, foreign investments can also have negative economic and political spin-off effects. Investments in extractive industries in countries with a poor governance, are for example often associated with corruption and violation of human rights. Similarly, working conditions that are extremely open to criticism are often found in the so-called free economic zones where foreign companies can produce and export tax-free with cheap labour and the spin-off effects for the host country are very limited. Neither do foreign companies that pay low or no tax and duties to the Government contribute to revenues that could be used to finance a good social distribution policy.

Based on these different experiences, there are various points of view on the significance of foreign investments in the development policy. On the one hand, many claim that foreign direct investment is vital to development because it gives poor countries access to capital and advanced technology, introduces new knowledge and results in better connections to international markets. Poor countries can also secure themselves a place in the global production chain in this way. On this basis, investment agreements that provide extensive freedom for foreign investors are normally recommended for poor countries.

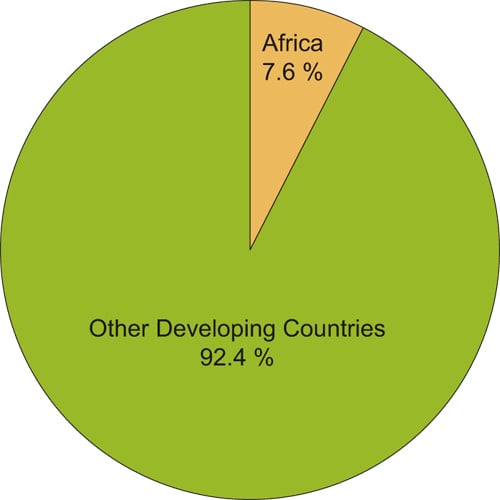

Figure 5.2 Africa’s share of the FDI to developing countries. 1970 – 2006

Source UNCTAD, FDISTAT (http://stats.unctad.org/FDI/ TableViewer/tableView.aspx?ReportId=899)

On the other hand, critics of the emphasising of such investments believe that they often lead to a concentration of power in the hands of large, foreign companies and that multi-national companies can avoid taxation through what is known as transfer pricing. Another argument that is given is that foreign investments can impede local investments because the country’s own companies are not strong enough to compete with the foreign companies. Advocates of this point of view like to claim that direct foreign investments must be part of a national development strategy, in which the authorities have the freedom to regulate conditions and what sectors of the economy should be opened to external investment.

Although short-term, indirect investments can contribute to increased access to capital for local capital markets and thereby for national companies. In order to be able to command real investment opportunities and become a good alternative to loan financing, however, the financial markets in the south must be developed. Large cash flows can also have a destabilising effect on financial markets in developing countries. Non-regulated capital flow enables speculation and large, short-term movements of capital in and out of the individual economies. In the worst case scenario, this can trigger finance crises that can have major economic and political bearing on vulnerable developing countries. This problem also has a democratic dimension; democratically elected Governments can restrict or defer political changes out of fear of reactions in the financial markets.

5.1.1 The marginalisation of the Least Developed Countries

Most of the Least Developed Countries have so far had limited access to foreign direct investments, with the exception of the extractive industries. Since the start of the millennium, the large capital flows have transferred from Latin America to various parts of Asia, while the figures for the other regions have largely remained stable. In 2006, 42 per cent of all private investments in developing countries went to East Europe and Central Asia, and 28 per cent to East Asia. Africa accounted for only 6 per cent and in relation to all foreign direct investment, Africa’s share in 2006 was a modest 2.7 per cent, down from 3.1 per cent in the previous year. The bulk of this went towards the extraction and export of oil, gas and minerals.

One reason why the poorest countries are marginalised is that private investors mainly make their investment decisions based on analyses of risk, returns and security. The political and economic conditions in many of the least developed countries with political instability and uncertainty, poorly developed financial markets and infrastructure, lack of legal safeguards, wars and conflicts, are very widespread and results in the investments going to other countries. Other factors that are often mentioned are a lack of infrastructure, lack of an educated workforce and a lack of local markets. Low taxes, however, seldom appear to be the main reason for companies setting up in a country. On the other hand, it can be a deciding factor when the choice is between locations in two countries with otherwise relatively similar conditions.

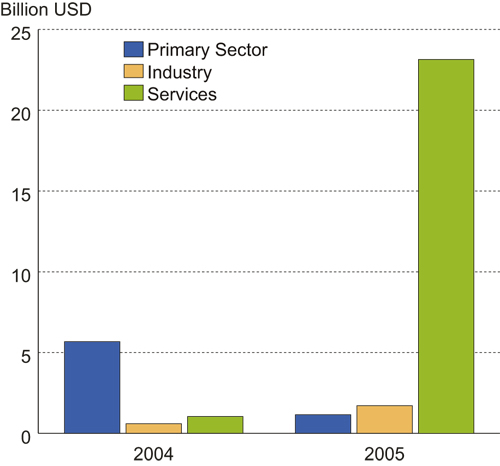

Figure 5.3 Foreign direct investments1 in Africa, by sector. 2004 and 2005. USD billion

Source World Investment Report 2006, UNCTAD.

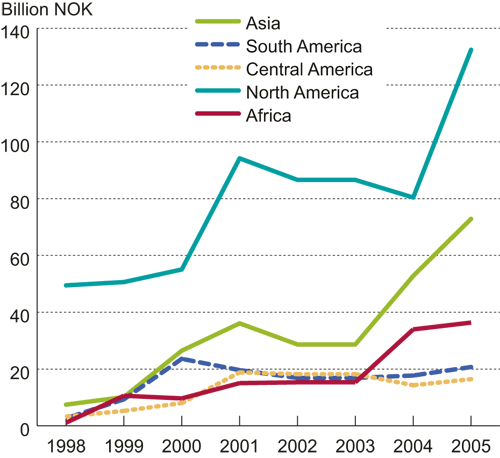

5.1.2 Norwegian investments in developing countries

Norwegian investments account for a very small part of the total foreign investment in developing countries, but constitute a major part of Norwegian financial flows to the same countries. The pattern in Norwegian foreign investments is relatively similar to the pattern in investments from other industrialised countries. Norwegian public financial flows to developing countries concentrate on the major emerging markets such as China, Russia and Chile, as well as various countries in central Asia. The investment pattern reflects the degree of relative investment risk between different countries, and the sectors in which the Norwegian business sector has a particular advantage, especially energy.

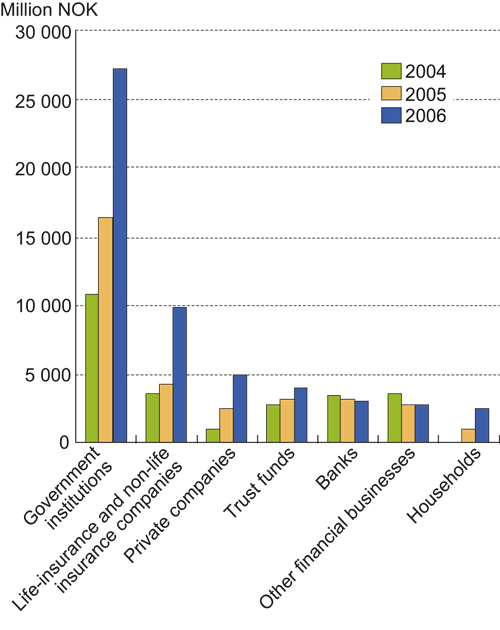

StatoilHydro, Telenor, Jotun and Statkraft are among the largest players in Norway with regard to direct investments. In 2006, direct investments from Norway to developing countries totalled NOK 115 billion. 2 Indirect investments, such as placements in shares and bonds are made through both private and public funds, particularly insurance funds and the Government Pension Fund – Global. In 2006, investments of this type in developing countries amounted to NOK 216 billion, compared with total aid from Norway of almost NOK 19 billion. 3

Figure 5.4 Norwegian investments in developing countries. NOK billion

Source Statistics Norway

With regard to portfolio investments (shares and securities), the main challenge is that the share markets and stock exchanges in many poor countries are not well developed. Norwegian funds can invest in companies that operate in these countries but it is difficult to find many interesting investment objects that are registered on the stock exchange. The stock exchanges in developing countries that are of interest for Norwegian funds are normally in relatively well-developed countries, such as Brazil, India and South Africa, where it is easier and safer to meet the rate of return requirements. It is difficult, in the short to medium term, to envisage portfolio investments, for example through the Government Pension Fund – Global, becoming an important tool for reducing poverty in the poorest countries. In this case, these countries must first get help to develop competitive stock exchanges. In addition to these capital flows, Norwegian development aid funding is channelled through Norfund to development projects and development-oriented investment funds, while GIEK offers guarantee and credit schemes for Norwegian companies wishing to invest in developing countries.

Considerations of the Commission

Access to capital has historically been an important source of economic development. Capital brings with it many opportunities for the transfer of knowledge and market access, which are crucial for gaining momentum in economic development. Although foreign investments in Africa have grown from USD 9 billion in 2000 to USD 36 billion in 2007, the general picture is that Africa is lagging behind. The foreign investments there are also concentrated around oil, gas and the mining industry, and are very unevenly distributed both between and within countries. It is normally sectors with a large degree of profitability that attract investments. Countries with poor framework conditions often end up in a negative spiral in which they often compensate for this by offering investors extremely favourable terms with regard to tax, ownership of resources and alterations to regulations.

The key factor for ensuring that foreign direct investments make a positive contribution to development lies in the recipient country’s own regulations, and in how the community surrounding the investment object is organised. Fiscal policy is one such vital prerequisite. If the investment leads to tax revenues of significance it will also lead to more funds being used to develop welfare and combating poverty. Whether foreign investments create economic spin-off effects can also be dependent on the degree to which local subcontractors are given work linked to the investment, and of the wage level of locally-employed personnel. The degree of knowledge transfer is also determined by the degree to which, and at what level, local employees and collaboration partners are linked to the activity. All of these factors are affected by the framework conditions that political authorities set for foreign investments.

With the exception of Julie Christiansen and Kristian Norheim, the Commission believes that international, regional and bilateral agreements on trade and investments can contribute to the authorities’ policy space being restricted. The majority of the Commission consider it to be vital for countries wishing to exploit foreign investments as a part of their development strategy to retain the possibility to set requirements for international investors in areas such as local deliveries, local employment and technology transfers.

The distribution policy in the country receiving investments is also vital in relation to whether it contributes to the fight against poverty. There are a number of examples in countries that receive a high volume of foreign investments but where the revenues from these are concentrated on so few hands that they do not help the fight against poverty. Not only fiscal policy but also a society’s degree of political and professional organisation is a determining factor for the distribution of wealth. A strong trade union is therefore of great importance to ensure that revenues are spread and spin-off effects occur, both for foreign investments and when a country gets increased export revenues. A high degree of unionisation is generally a prerequisite for an active distribution policy. This is vital to ensuring that revenues from foreign investments benefit the host country. A strong trade union movement means that the potential is greater for local employees securing decent wages, which in turn can create local economic spin-off effects. Additionally, the trade union movement is often a driving force for establishing a fiscal policy that can lay the foundation for welfare development and focus on health and education.

With the exception of Malin Stensønes, Kristian Norheim and Julie Christiansen, the Commission draws attention to the fact that according to the Bank of International Settlements, more than USD 1,900 billion is traded in the international foreign exchange market on a daily basis. Since the foreign exchange market was deregulated in the 1980s, the world has experienced more and greater foreign exchange crises, with the most serious of these being the Asian crisis. Unrestricted and short-term currency trading intensifies such crises and deprives the affected countries of the opportunity to protect their economy. The foreign exchange crises hit the poorest the hardest and have serious consequences for economic and social development. The Commission majority believes that such crises can be lessened by introducing a duty on currency trading, often referred to as the Tobin tax. The revenues from this taxation can also be used to provide stable and predictable financing for initiatives aimed at fighting poverty through the UN.

Commission member Kristian Norheim believes that economic freedom is a basic human right that must be respected in the same way as other human rights. The propagation of the market economy has been the source of the fastest growing reduction of poverty and famine that the world has ever seen. Since 1981, the share of the population living in absolute poverty in developing countries has fallen from 40 per cent to 21 per cent. Almost 500 million people have escaped from poverty during this time. This is the greatest reduction in poverty that the world has ever seen. During the past 30 years, chronic starvation has been halved, as has child labour. Since 1950, illiteracy has fallen from 70 per cent to 23 per cent and the infant mortality rate has fallen by two thirds. During the past 50 years, the material development has led to the world being populated by more than 3 billion more people living outside poverty. The world has never witnessed anything like this before. The UN development programme (UNDP) has demonstrated that the number of poor in the world has fallen more in the past 50 years than in the past 500 years put together. The experiences from the reconstruction in Eastern Europe show a clear correlation between consolidation of democracy and progress for the market. The EBRD (European Bank for Reconstruction and Development), which was established in order to support the new system in the east, has also highlighted this. The market also contributes to strengthening democracy as the market is vital to developing a robust «civil society», which in turn is a prerequisite for democracy. Ownership is the foundation of such a structure. The Financial Times editor, Martin Wolf, points out that the most important difference between the societies that have become affluent and those that have not, was probably the potential the people in the first society had to enter into long-term and contractual agreements. This requires a high degree of faith among the people, and not least in relation to the political authorities. People will only enter into such agreements if they know that there is no great risk of the fruits of their labour being taken from them by the political authorities, or by other individuals because the political authorities cannot guarantee protection against intervention or injustice. Affluent societies have become affluent for the precise reason that freedom is guaranteed, and it is guaranteed based on the laws of its society. The developing countries are unfortunately heavily characterised by the opposite. As a strong defender of human rights, Norway should also therefore take a lead role with regard to actively working for and supporting economic freedom on a global basis, not least for the poorest in the world, in a human rights perspective. Norway cannot therefore support initiatives that are aimed at strengthening the political authorities’ policy space where this has negative consequences on the individual citizen’s economic space. Norway should therefore, in a human rights perspective, support economic policy reforms and initiatives that make it easier for the poor to make use of their economic freedom, such as deregulation, debureaucratisation, tax reductions, strengthening of the private right of ownership regime and establishing a financial infrastructure.

5.2 The Norwegian Government’s role as an investor and international political player

The Norwegian Government administers a number of funds with different mandates and objectives. Some are explicitly aimed at fighting poverty and others don’t have this either in their mandate or as a secondary goal. The Government Pension Fund – Global is the largest fund, and mainly invests in listed companies in Western countries, with a mandate to ensure long-term returns for future generations. Norfund is the most development-oriented fund, and undertakes both project financing and fund investments to support sustainable industrial development in developing countries. The Norwegian Guarantee Institute for Export Credits (GIEK) facilitates investments and trade by providing credit and guarantees to Norwegian exporters wishing to establish business activity in developing countries. The Government has generally considerable potential influence on Norwegian direct investments abroad in its role as shareholder in some large Norwegian companies. The Government’s involvement in international organisations and schemes is potentially and genuinely crucial to Norway’s efforts to exercise influence on business development and fighting poverty in developing countries.

5.2.1 The Government Pension Fund – Global

In April 2008, the Government presented a white paper on the future management of the Government Pension Fund – Global (White paper no. 16). Central in the white paper were the goals that the fund shall be the world’s best managed and follow the best international practice. According to the Ministry of Finance, this means that the fund should spread the risk further in order to improve the ratio between risk and return. The white paper suggested enabling investments in a further 18 emerging markets, including China and Russia. One of the motives was for a better dispersion of the fund’s risk and to reflect the development in international financial markets. A proposal was also submitted to develop a portfolio with investments in property in the fund (up to 5 per cent), primarily business premises in OECD countries. It was also proposed that the ownership limit for investments in listed companies be increased from 5 to 10 per cent, without this changing the fund’s role as financial investor. These are mainly changes that are not considered to affect poor countries.

The Government Pension Fund – Global regards the use of active ownership in companies as the most important instrument for facilitating various development goals. For companies in which the Government Pension Fund – Global has investments (more than 7,000 in 2007), the ethical standard shall be protected through Norges Bank’s rights as a shareholder. One of the ways this is done is by voting at general meetings (38,862 votes in 4,202 general meetings in 2007), by informing the companies of the bank’s principles for exercising ownership, direct company contact where there is reason to believe that the ethical principles are not being adhered to, and by cooperation with other institutional investors. 4 In this context, the UN’s Global Compact and the OECD’s guidelines for multi-national companies have been used as a basis. Norges Bank has indicated six focus areas up to 2010, and two of these focus on future social and environmental sustainability; children’s rights within the value chain of multi-national companies, and how companies act towards national and supranational authorities on questions related to long-term environmental changes. The other four focus areas deal with ownership rights in the company’s management. According to its annual report, Norges Bank contacted more than 90 companies in 2007, and these were selected based on six criteria. Four of these relate to basic financial ownership interests, and the other two entail a focus on eradicating child labour and strengthening children’s rights, and an assessment of how companies involve the authorities on questions relating to long-term environmental changes, and especially climate change.

5.2.2 More poverty-oriented management of the oil resources

Although it can be difficult for the Government Pension Fund – Global to invest in developing countries, it can invest in companies that operate in developing countries and ensure that these contribute to development in these locations. There are three main instruments that investment managers can use to affect the geographic and quality-related distribution of investments; active exercising of ownership, negative screening and positive screening. By using these, there will often, but not always, be a trade-off between new investment priorities, risk and return. Both public and private investment managers have shown that responsible investment activity is compatible with commercial sustainability. Using instruments to increase the development effect of investments will not necessarily therefore conflict with the return targets of the Government Pension Fund – Global.

Investment funds can also try to select the best companies. Positive screening of this nature can, for instance, be done with regard to companies that made a special contribution to sustainable development, such as in the fields of clean energy and microfinancing. In principle, positive screening can also be used to help reduce poverty. No positive screening has been introduced to date in the Government Pension Fund – Global, as it is argued that it can entail a higher investment risk. The most commonly used method is the «Best-in-Class» rankings, which identify the most responsible companies within various sectors whereby the risk profile in the fund is maintained without increasing investments in some sectors at the expense of others. Another method is to select the best companies according to a ranking based on special criteria such as the management of natural resources. A third method is to focus on sectors that produce public goods and thereby create something positive for society regardless of what else they do. Various ethical-oriented funds have done this in order to increase the share of companies that are involved in clean energy and energy efficiency, recirculation and recycling, education and health and public transport.

This instrument is particularly used to prevent deterioration of the climate. California Public Employees Retirement System (CalPERS) uses positive screening to direct its involvement in energy companies in a more environmentally friendly direction by including more companies that develop and sell renewable energy and green technology. The Dutch pension funds ABP and PGGM have invested in a climate fund administered by Climate Change Capital in London, which invests in projects in developing countries that reduce climate emissions.

5.2.3 Exercising ownership in public companies

The Norwegian Government is a significant player in Norwegian industry. It is a major and controlling owner in the three largest companies in Norway and also the sixth largest companies listed on the stock exchange – StatoilHydro, Telenor (telephone and multimedia services), DnB NOR (banking and financial services) and Yara (fertilizer and other chemical products). The total value of Government ownership in industry is 28 per cent of the share values on the Oslo Stock Exchange. The Government also has significant values in unlisted companies. The ministries manage ownership interests in 80 companies, with more than 280,000 employees. 5 Norwegian government-owned companies such as StatoilHydro and Statkraft (energy production) are for the most part involved in the extraction of natural resources. The exceptions are Telenor, which is based on the export of technology where the investments are more driven by market access than access to natural resources, and DnB Nor. There are also a number of smaller Norwegian companies that have set-up operations in the least developed countries, but compared with other European countries, the number is low. One reason for this is that Norwegian industry has the most expertise and resources within sectors that carry a high political risk in developing countries, such as petroleum extraction and hydropower. Since the so-called mixed credits for developing countries where contracts earmarked for Norwegian companies were stepped down and reorganised, they do not have the same risk profile as before.

One premise for the Statoil privatisation in 2001 was that the company should have a national base, with the head office, research and strategic decision-making in Norway. In addition to this, a partly-privatised Statoil should have commercial freedom. Such guides are not unusual in cases where the Government remains a significant shareholder after privatisation. The White Paper to the Storting on Government ownership (no. 13 (2006 – 2007)) describes the principles used as a basis to exercise «active and long-term ownership». One of these is that exercising ownership shall be practiced in accordance with the OECD’s guidelines on ownership. In addition, a long-term perspective entails considerations to the environment, adaptations, diversity, ethics, research and development being included in the assessments of the boards. The ownership report also states that government-owned companies shall be among the best with regard to corporate social responsibility. However, a number of cases have put the exercising of ownership in government-owned companies on the agenda in recent years. The corruption scandal that hit Statoil’s activity in Iran, where the company was found guilty of bribing an Iranian civil servant, is perhaps the most serious of these. In the end, the company had to pay NOK 120 million in fines and costs after admitting guilt. The Telenor-Grameen Phone case also shows what other problems government-owned companies operating in developing countries may face. In May 2008, it became known that some of Grameen Phone’s subcontractors that produce telecom masts for the mobile network in Bangladesh employed local labour under shameful working conditions, clearly breaching safety regulations. Telenor claims to have given the relevant steelworkers HSE (health, safety and environment) training, but the disclosure shows that the company’s internal guidelines were not adhered to.

Considerations of the Commission

The Norwegian Government does not appear to have an overarching policy with clear guidelines and requirements on management foundation or effective routines for how government-owned companies should take ethical considerations in its business activity in developing countries. Typical policy instruments in Norway are licensing, public procurement rules and taxation. However, such frameworks are often extremely lacking and insufficient to protect crucial social considerations beyond Norway’s borders. The Policy Coherence Commission’s view is that, through its ownership in companies with activity in developing countries, the Norwegian Government must take special responsibility for the activity not bringing about negative consequences for the country in which it operates. As owner, the Government should have a clear policy and use its ownership interests actively to facilitate socially responsible conduct for companies with activity in developing countries.

The primary aim of the Government Pension Fund – Global is to safeguard the national pension basis for future generations. The Commission supports aiming the geographic reference portfolio more towards emerging markets as this helps to increase the capital flows to developing countries. However, the Commission believes that the change in the geographic reference portfolio combined with the proposal to increase the ownership limit for investments in listed companies from 5 to 10 per cent requires a strengthening of the capacity of active exercising of ownership. The fund has considerable market power, and has already made its mark in the international capital markets. As a financial investor, the Government Pension Fund – Global can, upon exercising ownership, make a positive contribution to important changes in areas such as the environment, human rights, transparency and the fight against corruption. The Commission further believes it is important that the Government Pension Fund – Global is used more actively to facilitate sustainable development by means of positive screening, among other things. The fact that the revenues from the oil activity are generated from non-renewable sources and contribute to global warming is also relevant in this context.

Commission member Kristian Norheim notes that free trade and market economies through the years have helped hundreds of millions of people escape poverty. Rigid political governance has, without exception, led to the opposite. Poor countries need foreign investment. On the whole, investments contribute to positive spin-off effects such as the transfer of knowledge and expertise, jobs and the opening of market access, and one of the goals of the Norwegian authorities should therefore be to help increase foreign investment in poor countries. The problem is not that there are too many investments in developing countries. There are not enough. Norway should therefore help to make more capital available. By introducing and practicing ethical guidelines that are too rigid and selective, one runs the risk both of overly politicizing investments and of getting less investments in poor countries. Such an outcome would not make a positive contribution to lifting more people out of poverty, but would instead mean less growth and prosperity in the affected countries. There is therefore reason to warn against what has been referred to as «ethical imperialism», which results in companies that must make their decisions in light of their global responsibility being instructed to follow the west’s subjective and selective view of what are ethically superior guidelines. Very few believe that child labour, breaches of basic human rights in employment, slave contracts in relation to the working environment and wage terms are acceptable, but neither is this a correct description of the massive majority of foreign companies’ investments and presence in poor countries, which have poorly developed judicial institutions to react against such breaches. Improvements in the working environment and working conditions follow a country’s level of prosperity and institutional development level. The investments should not, of course, directly or indirectly contribute to systematic breaches of human rights, and should not be alms, but be managed according to healthy business principles, even although the risk exposure will be higher and the return less than on investments in developed countries in the short term.

5.3 Government support for investment, guarantees and exports to developing countries

Whether export subsidies in the OECD countries are compatible with the aim of fighting poverty in developing countries has been discussed internationally for decades. Because such benefits have, according to the OECD, shown to increase project costs by up to 25 per cent, the OECD has recommended that aid-financed business schemes are untied so that companies in the donor countries are not advantaged at the expense of others, particularly in the South. Untying entails contracts being put out to open tender. The OECD’s recommendation reflects a general trend in the global development policy, where the authorities, business sector and local population in the recipient countries shall have more influence and more latitude to shape the country’s own development.

Norway untied its private sector development schemes in 2002. This also included Norfund. However, the decision has been met with some criticism from Norwegian industry and GIEK because untied credits reduce Norwegian companies’ chances of winning contracts if they are not competitive. In such cases, they therefore lose crucial incentives to invest in developing countries. This shows what conflicts can arise between the aim of stimulating Norwegian exports and the desire to facilitate equal competition terms and reduce the costs for the recipient countries.

5.3.1 Norwegian industry and the role of Norwegian authorities

A long-standing political goal has been to increase the cooperation between the Government and Norwegian companies operating abroad. Together with Norad, Norfund created an information centre in 2007 in order to give Norwegian companies easier access to advice and guidance on financial support and the financing of activities in poor countries. The Information Office for Private Sector Development in the South aims to inform companies of support schemes for business development in developing countries, and provide advice and guidance on business plans and other preliminary work.

There are currently various support schemes for Norwegian companies wishing to invest in developing countries. In addition to Norfund and GIEK, as referred to below, Norad has a dedicated department for private sector investments. FK Norway (The Norwegian Peace Corps), under the Ministry of Foreign Affairs, cooperates with organisations and companies that run partnership and exchange programmes for experts. According to the frameworks, at least half of the funds must go to the least developed countries. Innovation Norway helps Norwegian companies find good partners in developing countries, and also offers expertise on various markets. It also focuses on promoting Norwegian deliveries for relief and disaster projects.

Investinor AS was founded in February 2008 as a subsidiary of Innovation Norway. The purpose is to contribute to investments in forward-looking sectors in which Norway has special advantages. Norfund’s and Norad’s Information Office for Private Sector Development also offers guidance on how Norwegian companies can work with international financial institutions such as the World Bank and regional development banks. A great deal of expertise and experience is required to take part in international tender rounds and model projects in accordance with the specified criteria. The Information Office can also provide advice on this.

Despite a number of support schemes being in existence, Norwegian private sector investments in developing countries, particularly in the poorest countries, have nevertheless not increased much in recent years. Industry representatives claim regularly that the general grants for the schemes are not sufficient or should be adjusted so that the support to individual projects is increased. Others believe that support schemes and advice should be specialised, in accordance with possibilities and challenges within various sectors. Reference is also made to the fact that the embassies in the poorest countries, where support from the Norwegian authorities is most crucial, do not provide expertise on business development to a sufficient degree.

Figure 5.5 «Investments can contribute to economic growth and social development»

Demand by the developing countries for foreign investment in the energy sector and telecommunications has increased in recent times, and Norwegian companies have proven to be competitive within these sectors. The development of the energy sector is a field that the Government has also supported via aid-financed investment and guarantee schemes. Investments in energy infrastructure are absolutely vital for creating growth in developing countries. However, at the same time, they also create challenges in so far as the energy prices paid by people who already have limited ability to pay often increase considerably. Additionally, manmade dams often lead to extensive local damage to the environment and inhabitants alongside riverbanks being forced to leave. An oil pipe in the tropics can have a similar effect on an indigenous population and increase the risk of a serious oil spill. It is therefore vital that Norwegian players are responsible and that the companies comply with international standards for responsible business management.

5.3.2 Guarantee Institute for Export Credit (GIEK)

GIEK’s mandate is to facilitate Norwegian exports and foreign investments through financial guarantees. GIEK and other guarantee institutes enable export to and investments in markets that are perceived to be very risky, including in developing countries. Since the guarantee scheme is governed by Norwegian exports, GIEK’s geographic and sector-related focus will have to reflect the strategic interests of the Norwegian export sector. The annual report from 2006 shows that the Norwegian maritime industry accounts for 2/3 of the demand for guarantees through GIEK’s general schemes, compared with 50 per cent a few years ago.

An increase of the investment volume, however, is not necessarily synonymous with a reduction of poverty. In order for guaranteed investments to benefit the poor and not have a negative effect on the environment, it is important for GIEK to have effective internal systems to quality assure investment decisions, and follow up the projects after initiation. Guidelines on how guarantee institutes ensure they do not support projects and transactions that are corrupt, harm the environment, cultural heritage or economic basis for the local population, or which incur debt for the recipient state that it will find difficult to honour, are extremely important.

Textbox 5.2 The Ship Export Campaign

The shipbuilding industry in Norway was in a deep recession in 1976, and many of the 50,000 jobs in the sector were in jeopardy. The authorities’ solution was a campaign for the export of ships and drilling rigs, known as the Ship Export Campaign. The then Norwegian Labour Party was responsible, but all Storting resolutions in connection with the campaign were unanimous. The idea was conceived to facilitate the ordering of Norwegian ships from foreign buyers, and particularly buyers from developing countries. The ships were therefore offered together with a loan. The repayment period was generally 15 years, of which the first three were interest free, and the interest rate was approximately 5 per cent.

The sales contract had to be approved by a number of bodies in order to ensure that the intention of the Ship Export Campaign was upheld. The Guarantee Institute for Export Credit (GIEK) and the Ministry of Trade and Industry assessed the risk, guarantee and payment terms, Norad checked the development-related effects of the agreement and the specially-appointed Ship Export Committee also had to approve everything. The campaign was launched at a time when other countries were also trying to increase ship exports. On this basis, beating the competition was considered to be crucial, and the Storting therefore decided that the condition that the projects had to be approved by Norad and be regarded as promoting development should be dropped.

During the campaign, a total of 156 ships were produced by 36 shipyards in Norway. The recipients of the ships were private shipowners and authorities from 23 countries in the South. Only two of these countries, Turkey and India, have adhered to the payment schedule. In the political showdown after the Ship Export Committee at the end of the 1980s, the then Brudtland Government wrote that the guarantee scheme would thereafter be a unilateral support initiative aimed at the shipbuilding industry. When awarding contracts, the employment situation at each individual shipyard was given more consideration than the shipyards’ expertise. Additionally, not many private shipowners managed to pay back the loans, which under the applicable terms transferred debt to the state in the recipient countries. GIEK, which had guaranteed the export, ended up paying for most of the ships. The developing countries’ liabilities were never written off, despite GIEK receiving money from the Government budget.

Following the Ship Export Campaign, seven countries had a total debt of NOK 2.9 billion, which made up 2/3 of the developing countries’ total debt to Norway. In October 2006, the Government decided to cancel the debt to Ecuador, Egypt, Jamaica, Peru and Sierra Leone, which had a total of NOK 520 million national debt. This was a unilateral initiative carried out outside the guidelines of the Paris Club, and with no conditions, where Norway accepted joint responsibility for the debt’s history. The remaining countries, Burma and Sudan, with NOK 1,580 million and NOK 770 million debt respectively, will be striked off when they qualify for international operations for debt relief.

The OECD has established rules in this area, which bind all of the OECD countries’ guarantee institutes. These rules specify requirements and reporting obligations provided for in agreements that are subject to ongoing evaluation and follow-up. Norway has been a driving force in establishing these rules through the Ministry of Trade and Industry’s work on the relevant OECD committees. A current challenge is that new countries that are not members of the OECD, have emerged as capital goods exporters. The OECD aims to involve such countries, and China, India, Brazil and South Africa now participate as observers on the committees.

Through sustainable lending, the countries undertake to ensure that due consideration is given to the recipient countries’ development plans and budgets, and that recommendations from the World Bank with regard to how much borrowings the states can handle are adhered to. Dedicated communication channels have been set up to consult and inform the World Bank. Separate consultations already exist for controlling the use of aid in commercial projects in order to prevent the aid from being used to facilitate export.

5.3.3 Norfund

The Government’s investment fund for business activity in developing countries (Norfund) was founded in 1997 and is under the Ministry of Foreign Affairs. The purpose of Norfund is to aid the development of sustainable business activity in developing countries by investing equity and other risk capital such as loans and guarantees. According to its mandate, the fund primarily contributes to development by means of profitable investments in private businesses in developing countries. In this way, they are supporting business development that due to the high risk would not have been initiated in these countries. The fund can support projects in countries that OECD classifies as lower middle-income countries, and countries with a lower income per capita than these. Although Norfund’s investments are market-oriented and aimed at stimulating investments by Norwegian businesses, the fund is also an integrated part of Norwegian development aid activity.

Norfund’s activity is divided into four areas: direct investments, investments in financial institutions, investments in local and regional funds and investments in renewable energy.

To date, Norfund has invested NOK 281 million in 12 individual companies (37 per cent in the least developed countries) where the fund exercises active ownership. This applies to both new start-ups and the expansion of existing operations. In terms of the value of Norfund’s investments, direct investments correspond to 8 per cent of its total portfolio. Included here is the investment in Afrinord Hotels Investment, a Nordic initiative that arranges capital for hotel projects in Africa, and Nicafish, a company in Nicaragua with Norwegian origins, which buys, catches and processes fish for export to the USA.

Norfund’s investments in financial institutions and microfinance institutions are aimed at procuring capital for individuals and small and medium-sized companies, and developing capital markets in developing countries. By the end of 2007, the total value of these investments was NOK 267 million, of which 54 per cent went to the least developed countries. Investments in financial institutions make up 7 per cent of Norfund’s total portfolio. Examples include Banco Terra, a bank in Mozambique that offers commercial banking services to the agriculture sector in the country, and LAAD, a financial institution aimed at farming in Latin America.

Norfund also invests in local and regional funds, often together with other public, bilateral or multilateral financial institutions. At the end of 2007, investments of this nature totalled NOK 1.060 million, which corresponds to around 29 per cent of the value of Norfund’s investments. Of this, 13 per cent went to the least developed countries. The largest of these investments is Aureos Capital, a private funds management company that was founded by Norfund and the British CDC in 2001. Aureos manages funds aimed at regions or sectors, such as Aureos Central America Fund, Aureos Southern Africa Fund and Aureos Infrastructure Fund. Additionally, Norfund has played a key role in setting up the Norwegian Microfinance Initiative (NMI), a fund with private and public partners who will finance existing and new microfinance institutions in developing countries.

Norfund also supports the development of renewable energy, mainly in the form of hydropower projects through its holding in SN Power, but also other renewable energy sources through its role as lender to the power investment company E+Co’s project in Nepal, E+Co being a leading investor in small and medium-sized companies in developing countries. Investments through SN Power totalled NOK 2.052 million in 2007, which corresponds to 56 per cent of Norfund’s total investments in value (more about SN Power in chapter 7). Norfund’s investments through SN Power have gone to seven different projects in Latin America and Asia, including one in one of the least developed countries (the Khimti project in Nepal).

Norfund published its first development report in 2008. This is part of Norfund’s annual dissemination of information to the public sector on the development effects of the fund’s investments. The report was launched after a period of criticism from various quarters on the development effects of Norfund’s investments. According to the report, contributions to increased economic growth are the most important development effect of Norfund’s activity, and sustainable profitability is also therefore a determining factor in the choice of projects. The report notes, however, the risk of short-term financial interests conflicting with broader public interests. For this reason, attempts are made to identify partners with high return targets as well as a goal to create development.

According to the report, conditions that are regarded as material to development play a key part of all project evaluations: jobs, tax revenues to the host country, contributions to business development, training and technology transfers, quality of business management, anti-corruption efforts, effects on women’s status and social and environmental standards. Of these, only employment (both sexes) and tax revenues are quantitative and can be measured/aggregated. In relation to the collaboration with SN Power, the report provides data on electricity production, electricity supplies and CO2 reductions that result from the individual projects. The report also gives details of employment effects and the share of new jobs that women benefit from. Norfund itself says that accurate reporting is a challenge since many of the conditions they are reporting on relate to qualitative conditions.

At the end of 2007, 24 per cent of Norfund’s investments are based on agreements entered into in the least developed countries, a share that equates to 16 per cent if SN Power is included. However, the share appears to be increasing, since a total of 47 per cent of the fund’s principle decisions (excluding energy) on investments in 2007 apply to the least developed countries. Norfund has an express goal of increasing the share of investments in the least developed countries. SN Power and NMI have their own geographic priorities.

Norfund currently invests in microfinance funds both in Latin America and Africa, including Kenya, Mozambique and Uganda. In May 2007, a working group was appointed to investigate the possibility for establishing a Norwegian public/private microfinance fund. This resulted in the Norwegian Microfinance Initiative (NMI) being established in June 2008 in collaboration between DnB NOR, Ferd (finance), Storebrand (insurance), KLP (pension fund), Norfund and the Ministry of Foreign Affairs. The fund has a capital of NOK 600 million.

Considerations of the Commission

Based on the fact there is a lack of capital in countries with poorly-developed markets and insufficient framework conditions, the Commission believes it is important to consider how the authorities in rich countries can stimulate increased investments in the poorest countries. Due to the requirements of the Government Pension Fund – Global for security and return, the degree to which Norway’s surplus income from the petroleum activities contributes to development in poor countries is limited. The Commission views this as a challenge as Norway should use more of the oil profit for investments and business development in poor countries. The Commission notes that Norfund in its new strategy facilitates the strengthening of the company’s ability to make profitable investments in poor countries with particular focus on the poorest, least developed countries and on Sub-Saharan Africa. The focus is on areas where Norway can have specific advantages in order to succeed and where Norfund as an organisation has or can establish relevant expertise. Norfund has also established a separate borrowing window for the least developed countries, with greater risk-taking. Priority has also been given to developing measurement systems as a basis for evaluating the investments along a number of development dimensions. However, the Commission with the exception of Kristian Norheim, would like to point out that there is reason to question the development effect of takeovers of existing power plants and the correctness of using aid money for this. The Commission believes that Norfund has formed the basis for an increase of the investments in both the least developed countries and Africa more generally. The Commission recommends a considerable increase of funds for business development and investments in low-income countries, with the focus on Africa and the least developed countries.

Commission member Camilla Stang disqualified herself in relation to questions connected to Norfund and GIEK, and will not be giving her opinion of the Commission’s considerations in this context.

Developing more projects in the least developed countries, stronger exercising of ownership and closer follow-up are ambitious and important goals but also very resource intensive. In the least developed countries, direct investments are the most realistic investment alternative. At the same time, direct investments are associated with a higher investment risk than fund investments whereby the scope of direct investments in places other than the least developed countries must be limited in order for the fund’s total activity to have an acceptable risk profile. The goal of increasing the share of investments in the least developed countries may affect Norfund’s total returns and risk profile. The balance between these goals is therefore important. Expertise is vital to ensuring that the projects have a positive development effect, and the Commission believes it is important that Norfund strengthens the capacity to safeguard the development effect of the investments.

GIEK’s main objective is to facilitate the export of Norwegian goods, services and investments. GIEK is therefore a key instrument for providing companies in Norway with more opportunities to invest in developing countries. The Commission notes that various representatives have called for better framework conditions to entice Norwegian companies into investing in poor countries. Simultaneous to this, the importance of effective internal systems for quality assurance of projects needs to be highlighted. Where debtors in a developing country are in default of servicing their loans, it is often the Government that takes over the debt burden. It is only within the developing country scheme that NORAD evaluates the development-promoting effect of the projects. The Commission therefore believes it is relevant to consider more instruments in order to improve the quality assurance of Norwegian export support. For instance, export guarantees in the Netherlands are dependent on how the companies safeguard environmental considerations in their investments, and tax benefits are also applied to investments that safeguard social considerations and the environmental friendliness of the projects.

Norwegian embassies in developing countries possess crucial knowledge on the conditions in various countries and also have a dialogue with authorities that the business sector could make use of during a set-up phase. Discussions that the Policy Coherence Commission has had with the business sector, however, give reason to believe that the embassies’ routines are too inflexible to provide sufficient and important knowledge of the conditions in the country companies need prior to and during a set-up phase. In addition, the Commission is under the impression that support for business development has been given lower priority in recent times in place of other policy areas. The Commission also has the impression that the Norwegian diplomatic and consular system abroad with associated organisations could benefit from more interaction with the business sector in order to better understand each other’s possibilities and limitations.

5.4 Bilateral investment agreements

Bilateral investment agreements define the rights and obligations of foreign investors. There are currently more than 2,500 such agreements in the world. In many countries, investors from different countries had various preferences, which has led to a fragmented set of rules. The main purpose of capital-exporting countries entering into investment agreements is to protect their own private sector investments abroad, particularly in countries where the political and economic situation is unstable. It is also therefore standard to add a clause stating that disputes between states and investors shall be resolved within the World Bank’s dispute resolution scheme (ICSID), i.e. outside the host country’s own legal system. Additionally, attempts are normally made to avoid that performance requirements are imposed upon foreign companies that national companies are protected from. Such performance requirements include, but are not limited to, requirements on export shares, repurchase agreements and requirements for the use of national input factors in production, requirements on national ownership interests in investments, requirements for technology transfers, requirements for the reinvestment of profit, requirements for a national workforce and/or board participation.

The dramatic increase in the number of investment agreements is partly due to extreme difficulties in achieving a binding multilateral collaboration on investments due to disagreements between capital-exporting and capital-importing countries. The OECD countries have made several attempts to create a multilateral investment agreement. First, by proposing investments as a topic for negotiation in the WTO, then by attempting to establish the MAI agreement (Multilateral Agreement on Investment in 1997) under the direction of the OECD and then again in the WTO in 2003/4. The resistance from developing countries and civil society organisations, however, has been considerable, and none of the attempts have been successful. The WTO’s existing investment statutory framework (TRIMs) is considered to give much poorer protection for foreign investors than many bilateral investment agreements.

The power relationship between capital-exporting and capital-importing countries is not necessarily equal, and agreements between such parties can restrict the latter’s room to manoeuvre and undermine the competitiveness of national companies whereby foreign companies get the same rights to operate a business as the national companies as well as better protection against the loss of values.

Textbox 5.3 Bilateral Investment Agreements

«I was informed that the context of the Bilateral Investment Treaty (BIT) was the need to maintain Norwegian (and EFTA) industrial and commercial competitiveness in relation to what the EU receives or perceived to receive from the developing countries. If this is so, then this should be clearly stated, and understood as part of Norway’s commercial policy and must not be «marketed» as its «development» policy. From a developmental perspective, the BIT will have serious negative consequences for countries in the South that would sign the Norwegian BIT.»

Yash Tandon

Executive Director,

South Centre

Research into whether investment agreements help developing countries and transitional economies to attract the right quantity and quality of investments has yielded ambiguous results. Studies carried out by the World Bank, 6 among others, cast doubt on whether such agreements have any effect at all on the level of investment. Other studies show that in a best case scenario the correlation is positive for some agreements under certain conditions, but that bilateral investment agreements tend to benefit foreign investors compared with national investors 7. Studies by UNCTAD, among others, show that institutional factors such as market size, economic growth, access to skilled labour, the quality of the legal system, transparency and stability are all factors that have a greater bearing on companies’ investment decisions than whether the country has entered into bilateral investment agreements.

To date, Norway has entered into 14 bilateral investment agreements. In addition, the trade agreement with Singapore from 2002 included provisions on investment protection. Norway has not entered into any new agreements of this type since the mid 1990s. However, the Ministry of Trade and Industry submitted a proposal in January 2008 for a framework for entering into investment agreements. The proposal claimed that the interests of developing countries are protected. 8 However, in line with what has previously been stated, the document recognises that conflicts can arise between investment protection for Norwegian investors and the policy space of national authorities. In relation to environmental problems, it is claimed that the agreements can be formulated in ways that do not weaken the countries’ ability and capacity to implement environmental regulations. In order to ensure that the investments benefit the host country, it is proposed that the agreements shall make it impossible for the host country to reduce important environmental standards in order to attract investments and that they shall refer to fundamental principles for corporate social responsibility.

Considerations of the Commission

Most countries are sceptical to giving the same rights to multinational companies within their borders as those they try to secure for their companies beyond the country’s borders. This inherent asymmetry hits poor countries the hardest. The Commission, with the exeption of Kristian Norheim who does not agree with the views put forward here, is concerned about the tendency to impair national authorities’ opportunities to ensure that the investments they receive serve national development policy goals. One indication of this is that parallel to the increase in the number of bilateral investment agreements, an increase has also taken place in the number of dispute resolution cases (see figure 5.6). The dispute resolution clauses are probably the most controversial aspect of these agreements. Experiences from the financial crisis in Argentina are that when such crises occur, foreign investors, as opposed to national companies, are amazingly well-equipped to get their money out. The population of Argentina was very badly affected by the initiatives aimed at the financial crisis. National companies also made huge losses, while many foreign investors, including ENRON, won their cases in ICSID. In one case, the American energy group CMS was awarded compensation of USD 133 million after ICSID concluded that the authorities could have initiated measures that would have limited the losses for the group.

Figure 5.6 Investor-state-dispute resolutions. No. of cases per annum and aggregate cases

Source UNCTAD, 2005.

With the exception of Kristian Norheim, Malin Stensønes and Julie Christiansen, the Commission also believes that including performance requirements in bilateral investment agreements weakens the policy instruments available for the authorities in developing countries for ensuring that foreign investments make a positive contribution to development. Such performance requirements often set limits for what the authorities can require from foreign companies in relation to requirements for the export share, repurchase agreements, national ownership interests in investments, technology transfers, the reinvestment of profit, as well as requirements for the use of national input factors in the production.

5.5 Corporate social responsibility in developing countries

The term corporate social responsibility (CSR) is often used in different contexts, but the meaning of the term in this report relates to how companies adapt their own values and behaviour to the expectations of different interested parties, such as clients, investors, employees, suppliers, the local community, the authorities, interest groups and society at large.

Corporate social responsibility thus also refers to respect for international standards and conventions in a number of areas such as:

Human rights with a special focus on civil and political rights; torture, inhumane or degrading treatment; the rights of children and indigenous populations; prohibition of discrimination etc.

Workers’ rights with a special focus on the ILO’s core conventions that ratify the basic right to unions, collective bargaining and the abolition of forced labour, discrimination and prohibition against child labour 9

Conflict sensitivity

The environment

Corruption.

The debate on what responsibility the private sector has in society, especially when operating in developing countries, has become considerably broader in recent years. Nowadays, there are few multinational companies that do not have a department for social responsibility and have not developed guidelines and programmes for the different aspects of their social responsibility. Increased focus on corporate social responsibility can help to improve the quality and development effect of direct foreign investments in developing countries.

The authorities can play a key role in coordinating initiatives for social responsibility together with the private sector. Companies are often uncertain as to what ethical obligations they have or how these should be implemented. Requirements from the private sector, particularly multinational companies, to coordinate national regulations on social responsibility have also given international organisations a key role to play.

A central problem is how far voluntary initiatives can help pull the private sector in a more environmentally and development-friendly direction, and whether requirements for corporate social responsibility should to a greater extent be conveyed in legislation and provisions. Disagreement relates to the effectiveness of voluntary frameworks, what type of guidelines the authorities should provide and how strong they should be, and in what areas. In the environmental field, the introduction of formal laws and rules has undoubtedly played a key role in strengthening responsible business activity. Experience from developing countries with good governance demonstrates that it is often necessary to develop national public institutions in order for the companies to initiate and follow up measures to limit negative social and environmental aspects of their activity. The major cuts in urban air pollution and improvements in working conditions would, for example, be difficult to achieve without a stringent set of rules by the authorities.

Voluntary initiatives can give the private sector the necessary flexibility to introduce principles and standards in very different contexts. Such initiatives also make the most of the private sector’s own creativity and resources to support good causes. They can contribute to the exchange of skills-building and opinions, lead to positive competition between companies and encourage them to follow standards beyond the statutory requirements. They also form the basis for a broader and deeper dialogue between the private sector, the authorities and the civil society, and throw light on how the authorities can play a constructive role.

Laws and regulations with legally binding obligations can, however, be necessary when voluntary initiatives and discussions on corporate social responsibility are not part of the core activity of the companies, or when social responsibility initiatives are developed with the companies’ own commercial interests as a premise, and not in accordance with society’s values and priorities. In addition, it is sometimes the case that the requirements are set too low in relation to what is generally regarded as ethically responsible and sustainable business activity.

5.5.1 International and national schemes

The UN’s Global Compact is a voluntary value-based initiative that connects the private sector with various UN organisations, civil society organisations and authorities. The most important goals are laid down in ten principles, which deal with respect for human rights, workers’ rights, the environment and corruption. The scheme focuses on dialogue and the private sector is bound by intentionsof good behaviour more than actual conduct. 10 In 2007, around 5,000 companies had endorsed the intentions in the principles that form the basis of the Global Compact.

The OECD’s guidelines for multinational companiesare an international framework for multinational corporate social responsibility 11 and the only provision that imposes certain obligations on states. The guidelines instruct Governments that have endorsed the guidelines to create a National Contact Point (NCP), i.e. national complaint schemes. Through the NCPs, complaints can be lodged against companies that have breached the guidelines and which can then be asked to provide the NCP with further details concerning the circumstances of the complaint. The wording of the OECD’s guidelines is fairly general, which has resulted in few complaints and thereby relatively little demonstrable change in companies’ practice. The limitations in the guidelines in relation to affecting companies’ behaviour are further enforced by the fact they are guidelines and not a law: adhering to the guidelines is voluntary for companies and decisions of the NCPs cannot be legally enforced 12. Consequently, the guidelines do not impose any explicit responsibility on the companies. At the same time, any negative publicity as a result of treatment in the NCPs will in itself often make companies more willing to make changes. 13

It is perhaps within the reporting field that international standards for corporate social responsibility have developed the most. The Global Reporting Initiative (GRI) is a network for companies, the trade union movement and organisations that, among other things, have developed a common template for reporting that puts documentation from companies into a system, improves the quality and makes it more comparable. Reporting in accordance with GRI’s guidelines meets the reporting requirements in Global Compact, and GRI is working closely with other initiatives and the UN’s Environmental Programme.

With regard to the requirement for transparency and control, corruption has been a particularly important topic internationally. In 1999, Global Witness published a report on the close connections between oil and banking activity and the plundering of state funds in Angola. The report mobilised a number of organisations that formed a network and set requirements for Publish What you Pay.The British Government established The Extractive Industries Transparency Initiative (EITI), which strives for greater transparency in economic conditions surrounding the extraction of natural resources. The UN also published the Business Guide for Conflict Impact Assessment and Risk Management (2002), and a number of expert groups have subsequently been appointed to assess the private sector’s role in various conflict areas.

All of the international initiatives described above are on a voluntary basis for the private sector. The OECD’s guidelines constitute the most binding framework currently in existence, and put obligations on the member states, but not on industry. A number of international organisations and institutions have been working for an internationally binding framework that can ensure that the companies deal with the challenges they face in a responsible manner, at the same time protecting the environment and human rights in the local communities in which they operate.

At a national level, a trend can be seen where some countries have started incorporating the GRI template into a legally-binding set of rules. The audit of the UK’s «Company Act» in 2006 resulted in a duty to report on environmental and social conditions being imposed on British companies, and tax incentives have been developed to facilitate these. France has a law (from 2001) that, among other things, instructs the companies to report on how their foreign subsidiaries live up to the ILO’s core conventions, and listed companies must otherwise report on how they attend to environmental considerations, social considerations and the working environment, both in their operations in France and abroad. Sweden compelled government-owned companies to use the GRI template to report annually on their activity from 2009, and support is also given to information initiatives on corporate social responsibility abroad. Denmark prioritises information initiatives and research on the private sector’s social responsibility and the benefits of sustainable operations. The EU Directive on Annual Accounts includes requirements on the reporting of sustainability. However, this applies almost exclusively to the external environment, and covers only large companies within the EU. The EU directive has, however, led to a number of countries introducing a duty to report in relation to the company’s environmental and social responsibility as a part of the annual report. The OECD reports that at least ten countries are now applying their guidelines for multinational companies as a yardstick for companies that apply for export credits, investment guarantees and support for investment-promoting initiatives. South Africa is one of a few developing countries with a requirement for listed companies to report on social and environmental standards in accordance with GRI.

There are few legal requirements on Norwegian companies with regard to social responsibility. One exception is the statutory prohibition we have had since 2003 for Norwegian companies with regard to contributing to corruption. The companies are legally responsible in Norway for corruption carried out by its employees abroad, even if they are not aware of the prohibition. In addition to the prohibition against corruption, the authorities require companies, via the Limited Liability Companies Act and the Accounting Act, to publish the environmental consequences of the business management and what initiatives have been implemented to limit these (see box 5.4). Other than that, there are few requirements. There are no guidelines or rules that bind Norwegian industry in relation to how working conditions, freedom of association and human rights are practised when conducting business abroad. The potential damage to a company’s reputation in the event of invidious practice is probably regarded as the greatest danger.

Textbox 5.4 Environmental reporting in Norway

In Norway, the Limited Liability Companies Act requires companies to report on all conditions that are important for judging the company’s position and the result of the activity (§ 11-12). In addition, both the Limited Liability Companies Act and the Accounting Act say that annual reports shall report on whether the activity pollutes the external environment and whether measures have been implemented or are planned for counteracting such pollution. (§ 11-12, 5th paragraph of the Limited Liability Companies Act, §21a, 3rd paragraph of the Accounting Act).

A legal imposition on environmental reporting helps to ensure that the environment is dealt with at a high level in the company and that reports are made public. However, research carried out by Prosus has shown that these laws have not so far been an effective instrument for increasing the environmental reporting of Norwegian companies. Follow-ups have been lacking and enforcement by the authorities and requirements have not been precise enough.

It could be envisaged that the aforementioned acts also require Norwegian multinational companies to report regularly in the future on the environmental and social consequences of their activity abroad. The experiences from the environmental reporting requirement mean that a statutory provision of this nature should be precisely defined and enforced by the authorities in order to be effective.