Strategic Benchmark Index

Government Pension Fund Global (GPFG)

Article | Last updated: 18/04/2023 | Ministry of Finance

The mandate issued by the Ministry of Finance to Norges Bank expresses the long-term investment strategy for the Fund, including the strategic benchmark index and appurtenant provisions on the execution of the management assignment.

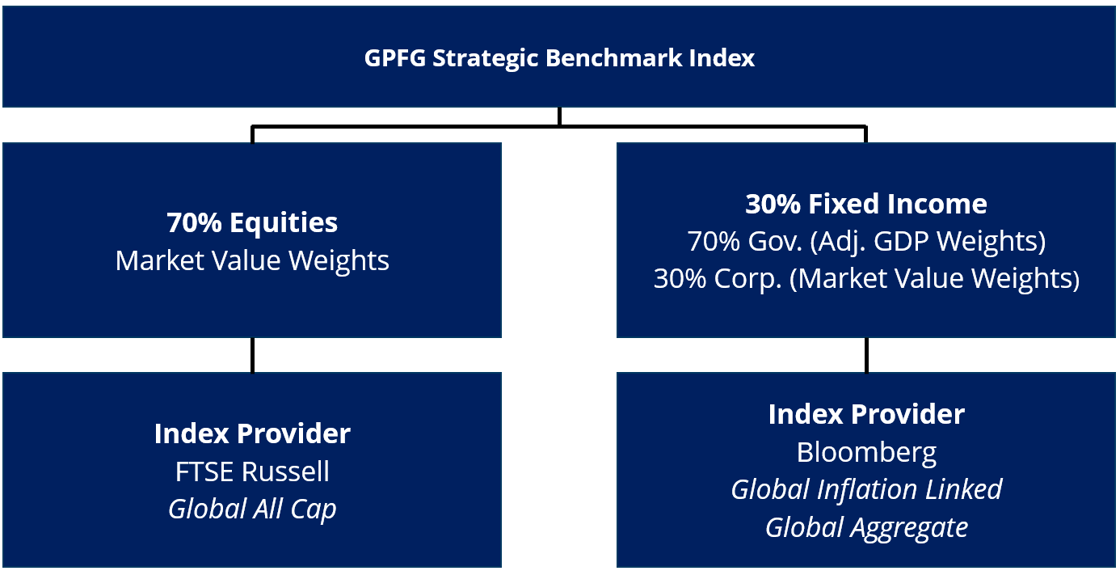

The strategic benchmark index comprises separate indices for the equity and fixed income portfolio. Equities account for 70 percent of the strategic benchmark index, whilst fixed income securities make up the rest. The equity portion has been selected on the basis of the long-term trade-off between expected risk and return.

The benchmark index is based on broad, global indices from leading providers, which largely reflect the investment opportunities in the global equity and fixed income markets. The management of the Fund is therefore based on the total risk of the Fund chiefly being a result of the developments in the benchmark index set by the Ministry.

The management framework also entails a moderate scope for deviations from the benchmark index. The purpose of such deviations is to facilitate a cost-effective execution of the management assignment and to improve the performance of the Fund.

The mandate further allows some scope for investments in unlisted real estate and unlisted renewable energy infrastructure. Norges Bank decides the scope and scale of such investments, within the management framework stipulated by the Ministry.