4 Policies and measures

4.1 Policymaking process

4.1.1 Overview

Norway’s climate policy is based on the objective of the United Nations Framework Convention on Climate Change, the Kyoto Protocol and the Paris Agreement. The scientific understanding of the greenhouse effect set out in the reports from IPCC is an important factor in developing climate policy. Thus, the policies and measures reported are seen as modifying long-term trends in anthropogenic greenhouse gas emissions and removals.

Climate change and emissions of greenhouse gases have featured on the policy agenda in Norway since the late 1980s. Today, Norway has a comprehensive set of measures covering almost all emissions of greenhouse gases as well as removals.

Norway has ratified the Paris Agreement and is working towards its overall objectives, including by:

- contributing to efforts to hold the increase in the global average temperature to well below 2 °C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5 °C above pre-industrial levels, recognizing that this would significantly reduce the risks and impacts of climate change

- increasing the ability to adapt to the adverse impacts of climate change and foster climate resilience and low greenhouse gas emissions development, in a manner that does not threaten food production

- making finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development

Norway has ambitious climate targets that are set out in various policy documents: the updated cross-party agreement on climate policy from 2012 (published as a recommendation to the Storting (Innst. 390 S (2011–2012)) in response to the white paper on Norwegian climate policy from the same year (Meld. St. 21 (2011–2012)); the white paper New emission commitment for Norway for 2030 – towards joint fulfilment with the EU (Meld. St. 13 (2014–2015)) and a subsequent recommendation to the Storting (Innst. 211 S (2014–2015)); the documents relating to the Norwegian Parliaments consent to ratification of the Paris Agreement (Innst. 407 S (2015–2016) and Prop. 115 S (2015–2016)); and the Climate Change Act that the Norwegian Parliament adopted in June 2017. The previous government’s strategy for fulfilling the 2030 climate target (Meld. St. 41 (2016–2017) was issued in June 2017 and a climate action plan for 2021–2030 was issued in January 2021 (Meld. St. 13 (2020–2021). The Støre Government presented a climate status and plan for the 2030 climate target in a separate attachment to Prop. 1 S (2022–2023) in October 2022.

Box 4.1 Norway’s climate targets

- Under the Paris Agreement, reduce emissions by at least 55 per cent by 2030 compared to 1990.

- As an interim goal on the road to net zero emissions and the low-emission society, the government has set a transition target for the entire economy in 2030. This is formulated in the government platform as a target to cut Norwegian emissions by 55 per cent compared to 1990.

- Be climate neutral from 2030.

- Become a low-emission society by 2050 and reduce emissions by 90–95 per cent compared to 1990.

4.1.1.1 NDC for 2030

Following the decision 1/CMA.3 Glasgow Climate Pact paragraph 29, Norway revisited the 2030 target in its Nationally Determined Contribution (NDC). In November 2022, Norway communicated its updated NDC to reduce emissions by at least 55 per cent by 2030, compared to 1990 levels. Norway’s NDC is economy wide, covering all sectors and greenhouse gases. Norway’s intention is to fulfil this target in cooperation with the EU. The updated 2030 target of at least 55 per cent has not yet been updated in the Norwegian Climate Change Act, but the Government will make a proposal to Parliament in order to amend the Act to update the target in line with this NDC.

Iceland and Norway entered into an agreement with the EU in October 2019 to cooperate to fulfil their respective climate targets. Under the agreement, Norway will take part in EU climate legislation from 2021 to 2030. The legislation is designed to achieve emission reductions of at least 40 per cent compared with the 1990 level. This is an overall target for all EU member states, Iceland and Norway and for all sectors.

The EU’s climate policy has three main pillars. The first pillar of EU climate policy deals with ETS emissions. The EU Emissions Trading System applies to the largest emission sources within Norwegian manufacturing industries and the petroleum industry. The cap, or number of emission allowances in the system, is being gradually reduced to achieve a reduction of 43 per cent in emissions in 2030 compared with 2005. This is an overall reduction for all installations covered by the EU ETS. Emissions from European aviation have been included in the EU ETS since 2012.

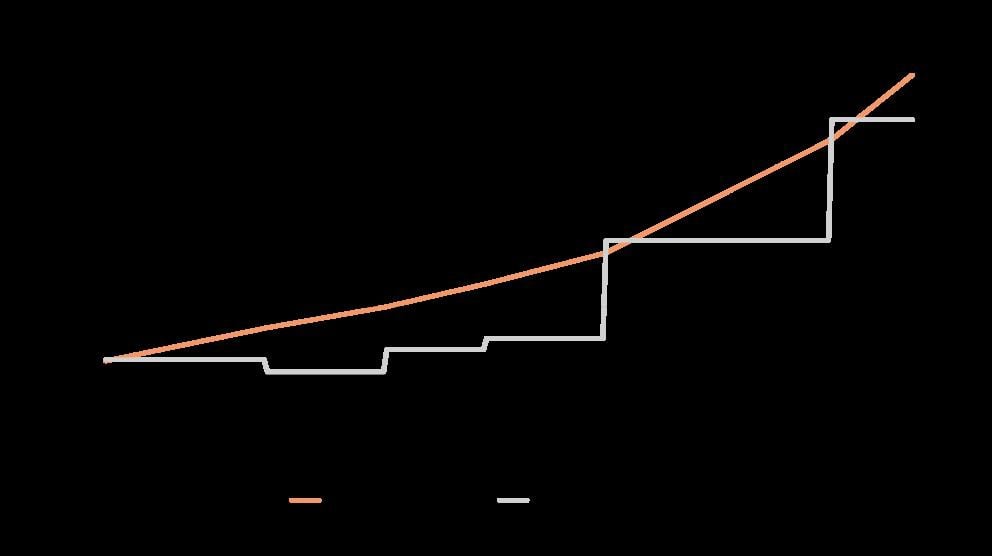

The second pillar of EU climate policy deals with emissions not covered by the EU ETS, but by the effort sharing regulation (ESR). Norway’s target for the ESR emissions under its agreement with the EU is a 40 per cent reduction by 2030 compared with the 2005 level. This has been translated into a binding emission budget with emission ceilings for each year in the period 2021–2030. The legislation allows for each country’s emission budget to be met through a combination of emission reductions within the country and transfers of emission units from other European countries.

The third pillar of EU climate policy deals with the Land Use, Land Use Change and Forestry (LULUCF) sector. This includes anthropogenic emissions and removals of greenhouse gases from land use, land use change and forestry. The factors that particularly influence emissions and removals are the level of harvesting (relative to harvest level modelled in the forest reference level FRL), land-use change such as deforestation and afforestation, and the natural spread of forest and scrub. The EU’s climate legislation includes accounting rules for emissions and removals in the LULUCF sector. Norway has an obligation to ensure that overall greenhouse gas emissions from the LULUCF sector do not exceed removals (this is known as the ‘no debit’ rule). According to the regulation, the obligation can be fulfilled by implementing measures in the national LULUCF, and/or through extra national reductions in non-ETS emissions, for example in the transport and agriculture sectors, and/or through purchasing buy emission units from EU countries or Iceland.

When Norway and the EU concluded their agreement, the target both parties had communicated to the UN was still a 40 per cent reduction in emissions by 2030 compared with the 1990 level. The EU will be making necessary amendments to its the legislation to ensure that the new and enhanced 2030 climate target is achieved. Once the legislation has been adopted by the EU, Norway will need to consider whether the updated legislation should also be made applicable in Norway, and if so on what conditions. The legislation will not apply in Norway until the Storting has given its consent.

Norway is not mentioned in the proposed amendments to the EU legislation. From the proposed targets for ESR emissions for comparable countries, it is likely that Norway can get a reduction target of 50 per cent compared to 2005 should the climate agreement with the EU be updated. Such a target will translated into a binding emission budget with emission ceilings for each year in the period 2021–2030. For information on the climate status and plan for the 2030 climate target, see Box 4.2

Norway seeks to fulfil the updated NDC of least 55 per cent reductions through the climate cooperation with the European Union. Final accounting towards the target may depend on any further arrangements in Norway’s cooperation with the European Union and Iceland, including in the European Trading System. If necessary, Norway will use voluntary cooperation under Article 6 of the Paris Agreement to fulfil the part that goes beyond what is achieved through the climate cooperation with the European Union.

Box 4.2 Annual climate status and plan

The Støre Government presented a climate status and plan in a separate attachment to Prop. 1 S (2022–2023) in October 2022. The climate status and plan will be updated annually and summarises the government’s climate policy. The climate status and plan has not yet been debated by the Norwegian Parliament.

Norway will report on its progress made and implementing its NDC in its first Biennial Transparency Report in 2024. Since Norway and the EU both have individual NDCs/targets under the Paris Agreement, the cooperation is envisaged to include transfers and acquisitions of ITMOs and follow the guidance under Article 6 of the Paris Agreement. See box 4.3 for further information.

ESR emissions

Chapter 5 of this National Communication presents updated projections of GHG emissions. Table 5.2 shows that the projections for the ESR emissions are estimated to decrease from 24.8 million tonnes CO2 equivalents in 2020 to 20.5 million tonnes CO2 equivalents in 2030. The projections for the period 2021–2030 are about 13 million tonnes CO2 equivalents higher than the given emission budget under the current EU legislation for the ESR sector (40 per cent reduction in 2030 compared to 2005).

Correspondingly, the emissions are about 21 million tonnes CO2 equivalents higher than the estimated emission budget Norway may get should the climate agreement with the EU be updated and Norway gets a reduction target of 50 per cent compared to 2005, based on the proposal from the EU Commission. The Støre-government is therefore making provisions for, and is planning to, reduce the ESR emissions by 50 per cent by 2030.

In the budget proposal for 2023, the Støre-government proposes climate measures that can reduce the GHG emissions. It is estimated that measures proposed in the budget in aggregate can reduce the non-ETS emissions by 9.3–9.9 million tonnes of CO2 equivalents in the period 2021–2030. The majority of this, about 5.6 million tonnes CO2 equivalents can come from increased climate taxes. 3.3 million tonnes CO2 equivalents can come from increased mandatory biofuels turnover for road traffic and the introduction of mandatory biofuels turnover for non-road machinery. The government has also decided to establish Bionova, a financial mechanism for supporting climate measures in the agricultural sector. It is estimated that Bionova could reduce the emissions within the agricultural sector by 0–0.6 million tonnes CO2 equivalents and a further 0.4 million tonnes CO2 equivalents could come as a result of strengthening Enova (see chapter 4.3.3.2).

A further 10.4 to 11 million tonnes of CO2 equivalents in the period 2021–2030 can come from policies and measures that are under consideration The estimates are uncertain, but further increases in the mandatory biofuels turnover for road traffic and non-road machinery combined with the introduction of mandatory biofuels turnover for domestic shipping and fisheries could result in emission reductions of 4.5 million tonnes of CO2 equivalents Further measures in the agricultural sector can reduce the emissions by 3.4–4.0 million tonnes CO2 equivalents An additional 2.5 million tonnes CO2 equivalents can come from several public procurement processes to promote the development and deployment of zero- and low-emission solutions in the transport sector.

In total, the upper estimates of proposes climate measures and policies and measures that are under consideration could add up to 20.3 million tonnes of CO2 equivalents With these measures the estimated emission reductions for ESR emissions would be close to 50 per cent by 2030.

These policies and measures have not been adopted. The potential effect is visualized in figure 5.3.

Land Use, Land Use Change and Forestry sector (LULUCF)

New projections for the LULUCF sector indicate that Norway is likely to have a total annual net emission (i.e. a gap to the “no debit rule”). The annual gap may be 3.2 million tonnes of CO2 equivalents in the period 2021–2025 if Norway uses the Managed forest land flexibility mechanism which the LULUCF-regulation (2018/841) allows for. Without this mechanism, the total annual emissions gap for the forestry and land use sector may be 6.7 million tonnes of CO2 equivalents

Box 4.3 Pursuing cooperation with the EU on implementing the respective NDCs

Norway pursues cooperation with the EU on implementing their respective NDCs. Norway, Iceland and Liechtenstein have been participating in the EU ETS since 2008. For the period from 1st January 2021 to 31st December 2030, Norway is pursuing its cooperation with the EU on implementing their respective NDCs and have together with Iceland agreed to implement the EU Effort Sharing Regulation (ESR) and LULUCF Regulation in accordance with the EEA Agreement Protocol 31.

Cooperation on implementation of the NDC enables Norway to have a higher level of ambition and thus gives a benefit to the atmosphere. In 2019, the EU, Iceland and Norway agreed on cooperation to fulfil our respective prevailing NDCs. Since then the EU, Iceland and Norway have updated their NDCs and strengthened their respective targets substantially. The EU is updating its legislation to be in line with the updated NDC. This process is ongoing. The main elements of the European legislation will need to be agreed before any cooperation between EU and Norway on implementation of the updated NDCs can be finalised.

Details concerning the possible flow of internationally transferred mitigation outcomes ((ITMOs), any accounting approaches, national arrangements, registries, other reporting requirements including related to adaptation finance and overall mitigation of global emissions, will be addressed in future reporting under the Paris Agreement.4.1.1.2 Transition target for 2030

As an interim goal on the road to net zero emissions and the low-emission society, the government has set a transition target for the entire economy in 2030. This is formulated in the government platform (Hurdal) as a target to cut Norwegian emissions by 55 per cent compared to 1990. This means that the government has a national target to transition both the EU-ETS and the ESR sectors. The purpose is for the entire Norwegian economy to transition in the direction of a low-emission society.

The Norwegian transition goal and our international targets complement each other. The target from the Hurdal platform will not be registered as a NDC under the Paris Agreement, or enshrined in the Climate Act.

The transition target will be achieved through an ambitious and responsible climate policy, and we are dependent on both Norwegian and international technological development to be able to achieve it. Which specific measures are to be implemented will be assessed on an ongoing basis based on what is appropriate in the long term transition perspective, and will be assessed in consultation with the business community. The aim is to promote a sensible long-term transition for the entire economy and promote the technological development on which we depend. Emphasis must be placed on Norwegian business and industry being competitive in the future, and that it is assumed that Norway will still have a surplus in the electric power balance. The goal must not entail an ineffective climate policy or disproportionately expensive measures.

Many technology projects can have a long and unpredictable lead time, but provide significant emission reductions in the long term. In the case of large point sources, for example, it will be possible to get significant contributions to Norwegian emission reductions as old technology is replaced with new. This means that one cannot expect a linear reduction in emissions. Electrification of fossil energy use and new power-intensive industries require sufficient power generation and grid capacity. Electrification projects on the continental shelf will be assessed on a case-by-case basis, and must take into account the consequences for the power system and access to affordable renewable power for other industries and households.

4.1.1.3 Climate neutrality by 2030

In connection with its consent to ratification of the Paris Agreement, the Norwegian Parliament asked the Government to work on the basis that Norway is to achieve climate neutrality from 2030. This means that from 2030, Norway must achieve emission reduction abroad equivalent to remaining Norwegian greenhouse gas emissions. Climate neutrality can be achieved through the EU Emissions Trading System (ETS), international cooperation on emission reductions, emission allowance trading and project-based cooperation. The full operationalization of the target is not yet finalized.

The Paris Agreement provides for cooperation between countries to implement their NDCs and national climate targets. The Government is working on the development of pilots for market cooperation under the Paris Agreement that can be used towards the climate neutrality target. Cooperation of this kind will make it possible to cut emissions more rapidly and at lower cost, and will contribute to a green transition in other countries. This will in turn enable countries to set more ambitious targets.

4.1.1.4 Low-emission society by 2050

In June 2017, the Norwegian Parliament adopted an Act relating to Norway’s climate targets (Climate Change Act), which establishes by law Norway’s target of becoming a low-emission society by 2050. The purpose is to promote the long-term transformation of Norway in a climate-friendly direction. The Act describes a low-emission society as one where greenhouse gas emissions, on the basis of the best available scientific knowledge, global emission trends and national circumstances, have been reduced in order to avert adverse impacts of global warming, as described in the Paris Agreement. In quantitative terms, the target is to achieve emissions reductions of the order of 90–95 per cent from the level in the reference year 1990. The effect of Norway’s participation in the EU ETS is to be taken into account in assessing progress towards this target. As a small open economy, Norway is dependent on a similar shift in other countries if it is to maintain its ability to make full, effective use of labour and other resources and achieve its climate and environmental policy goals.

Norway’s long-term low-emission strategy for 2050 was adopted by the Norwegian Parliament in October 2019. A translation into English was submitted to the UNFCCC in November 2020.

4.1.2 Policy instruments

The polluter pays principle is a cornerstone of the Norwegian policy framework on climate change. Policies should be designed to yield the greatest possible emission reductions relative to cost and should result in emission reductions both in Norway and abroad. Furthermore, our policy will be based on the responsibility to help safeguard the planet and on the precautionary principle.

General policy instruments are a key element of domestic climate policy. Cross-sectoral eco-nomic policy instruments that put a price on emissions (i.e. the taxes on emissions of greenhouse gasses and the EU emission trading system) form the basis for decentralised, cost-effective and informed actions, where the polluter pays. As a main rule, areas subject to general policy instruments, should not be subject to additional regulation. For non-ETS emissions, taxes on greenhouse gases is the main mitigation measure. If the tax is not considered to be an adequate or appropriate instrument, other instruments that reduce emissions will be considered, including direct regulation under the Pollution Control Act and voluntary agreements. Norway also employs biofuel sales mandates as an important policy instrument for reducing ESR emissions.

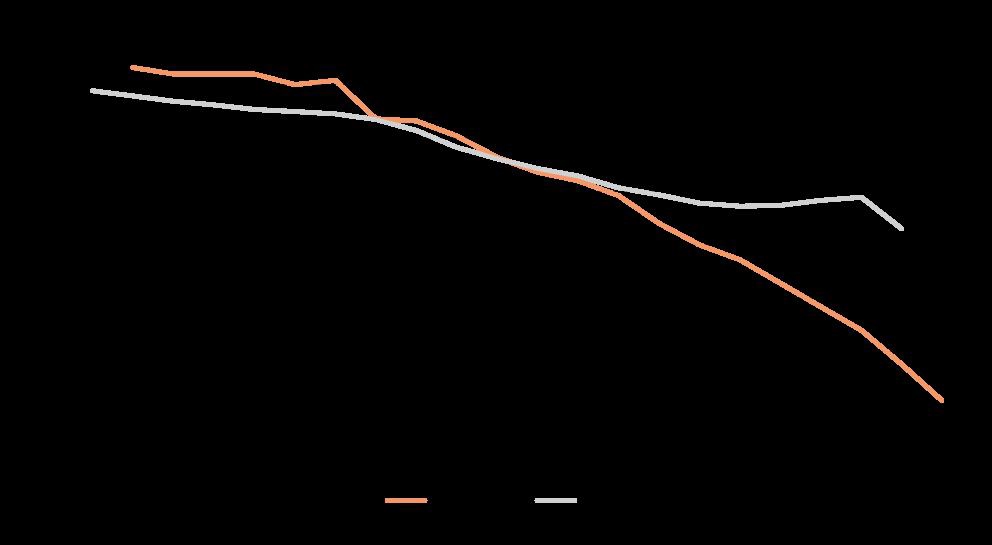

Over the last ten years, the scope of Norwegian carbon pricing has steadily increased. Close to 85 per cent of domestic greenhouse gas emissions are from 2022 either covered by the emissions trading scheme or taxes on greenhouse emissions. The level of carbon pricing is also among the highest in the world, with over 80 per cent of emissions being priced at or above approximately 80 USD in 2022. There is also a broad political consensus on increasing the taxes on ESR emissions to above USD 200 in 2030, and to continue the participation in the EU-ETS.

In addition to the emission trading system and taxes, support to research on and innovation of climate-friendly technologies will provide complementary support where markets do not pro-vide the solutions.

4.1.3 Responsibilities for the different institutions

The overall national climate policy is decided by the Storting, and the government implements and administers the most important policies and measures, such as economic instruments and direct regulations. Most policies and measures in the area of climate policy are developed through interministerial processes before the political proposals are tabled. The Ministry of Climate and Environment has the overarching cross-sectoral responsibility for co-ordination and implementation of the Norwegian climate policy. It also operates the Norwegian carbon credit procurement program. The Ministry of Finance is responsible for the tax schemes. The other ministries are responsible for policies in their respective sectors.

Local governments are responsible for implementing policies and measures at the local level, for example through waste management, local planning and some transport measures. In 2009, guidelines were introduced for climate and energy planning in the municipalities. New guidelines describing how the municipalities and counties can incorporate climate change adaptation work into their planning activities are currently being developed.

The Norwegian Environment Agency is a government agency under the Ministry of Climate and Environment. The Environment Agency implements government pollution and nature management policy. Important fields of work in relation to pollution control include climate, hazardous substances, water and the marine environment, waste management, air quality and noise. The Environment Agency manages and enforces the Pollution Control Act, the Product Control Act and the Greenhouse Gas Emission Trading Act, and the Nature Diversity Act, among others.

The Environment Agency grants permits, establishes requirements and sets emission limits, and carries out inspections to ensure compliance.

The Environment Agency also monitors and informs about the state of the environment. The Environment Agency has an overview of the state of the environment and its development. Together with other expert agencies, the Environment Agency provides environmental information to the public. The main channel is State of Environment Norway: www.environment.no

The Environment Agency supervises and monitors the County Governors’ work on pollution, coordinates the County Governors’ inspection work and organises joint inspections. The Environment Agency provides guidelines for the County Governors and also deals with appeals against decisions made by the County Governors.

The Environment Agency participates in a series of international processes, to promote regional and global agreements that reduce serious environmental problems. Moreover, the Environment Agency also cooperates with the environmental authorities in other countries, sharing competence and furthering environmental improvements.

The Norwegian Water Resources and Energy Directorate (NVE) is a directorate under the Ministry of Petroleum and Energy. NVE’s mandate is to ensure an integrated and environmentally sound management of the country’s water resources, promote efficient energy markets and cost-effective energy systems and promote efficient energy use. For more information, see: www.nve.no/en. Pursuant to changes in the Solberg Government in January 2018, the Minister for Climate and Environment is responsible for the state owned enterprise Enova www.enova.no/about-enova, which contributes towards Norway’s emission reduction commitments and contributes to the transition to a low-emission society.

Norway has actively addressed sustainable development since the World Commission on Environment and Development submitted its report Our Common Future in 1987. In 2015 UN presented new and ambitious sustainable development goals. There are 17 main goals and 169 intermediate objectives. Through Agenda 2030 the international community has made a commitment that no people are left behind in the implementation of the goals. The goals are global, and all countries must do their part. In 2016 Norway was among the first countries to report to the UN on status for their follow up of the goals. A new Norwegian status report (“One Year Closer”) was presented this year.

The Government underscores that the follow-up of the sustainable development goals shall be integrated in the ordinary government decision-making processes. Each of the 17 sustainable development goals has been assigned to one responsible Ministry. All ministries shall report on the follow-up of their responsibilities in the budget documents. The Foreign Ministry coordinates the processes at international level.

4.1.4 Assessment of the economic and social consequences of response measures (and minimisation of adverse impacts)

Norway strives to follow a comprehensive approach to climate change mitigation from policy development started around 1990, addressing all sources as well as sinks, in order to minimise adverse effects of climate policies and measures on the economy.

In developing environmental, as well as the economic and energy policy, Norway endeavours to include the polluter pays principle and to have a market-based approach where prices reflect costs including externalities. As regards emissions of greenhouse gases, costs of externalities are reflected by climate taxes and by participation in the European Emissions Trading Scheme (EU ETS). These instruments place a price on emissions of greenhouse gases. The Norwegian Government contends that the best way to reduce emissions on a global scale, in line with the aims limiting the global average temperature increase to 1.5 °C above pre-industrial levels, would be to establish a global price on emissions. Pursuing a global price on emissions would be an efficient way to ensure cost-effectiveness of mitigation actions between different countries and regions, and secure equal treatment of all emitters and all countries. This will help minimise adverse impacts of mitigation. For more information about climate taxes and the design of the EU ETS, see chapter 4.3.2.

Norway is involved in several international and regional initiatives that contribute to technology development and transfer and enhanced capacity building to developing countries with the aim of contributing to maximize the positive and minimize the negative effects of response measures, including economic diversification and a just transition. One important aspect is to facilitate the shifting of the energy mix away from high emission sources to more renewable energy systems and low-emission sources and diversifying economies. These initiatives are reported here as relevant activities under Article 3.14 of the Kyoto Protocol. In addition, Norway has a member in the Katowice Committee for the Implementation of Response Measures.

The former government presented a national strategy for green competitiveness in October 2017. The aim of the strategy is to provide more predictable framework conditions for a green transition in Norway, while maintaining economic growth and creating new jobs. An expert commission presented its report with an analysis of Norway’s exposure to climate risk in December 2018. The report has a clear recommendation to pursue ambitious and effective climate policies and undertake climate risk analysis to become more robust to effects of climate change.

Carbon capture and storage (CCS) is one of five priority areas for enhanced national climate action. Norway strives to disseminate information and lessons learned from projects in operation in the petroleum sector, new large-scale projects under planning and from research, development and demonstration projects. The information and lessons learned are shared both through international fora, and through bilateral cooperation with developing and developed countries. For further information, see chapter 15.2 of Norway’s National Inventory Report for 2022.

The Norwegian Oil for Development (OfD) programme, which was launched in 2005, aims at assisting developing countries, at their request, in their efforts to manage petroleum resources in a way that generates economic growth and promotes the welfare of the whole population in an environmentally sound way. A description of the OfD program can be found at: https://www.norad.no/en/front/thematic-areas/oil-for-development/. The programme is currently engaged in 8 countries, mainly in Africa.

The operative goal of the program is “economically, environmentally and socially responsible management of petroleum resources which safeguards the needs of future generations.” OfD takes a holistic approach meaning that management of petroleum resources, revenues, environment and safety are addressed in a coherent manner. OfD assistance is tailor-made to the particular needs of each partner country. It may cover the designing and implementing legal frameworks, mapping of resources, environmental impact assessments, handling of licenses, establishing preparedness to handle accidents and oil spills, health, safety and environmental legislation, petroleum fiscal regimes and petroleum sovereign wealth fund issues as well as initiatives related to transparency, anti-corruption, and climate change.

In 2021 the prior government decided to gradually phase out the OfD and discontinue the programme by 2024. This change was conducted to steer the development assistance in a greener direction with focus on climate change and renewable energy. In accordance with the Norwegian development policy with focus on renewable energy, the OfD programme shall be transformed into an Energy for Development (EfD) programme, which is in the process of being developed.

The policy of the Norwegian government is to integrate development and climate, as these major challenges are highly interlinked. Increased access and transition to renewable energy is the main priority. Renewable energy has been part of Norway’s development assistance policy for several years. In addition to extensive support through multilateral and multi-donor funding, several countries, mainly in Sub-Saharan Africa, have received bilateral Norwegian renewable energy funding. The overall objective of Norway’s contribution to renewable energy is to contribute to access SDG 7 and the Paris Agreement. The intervention in renewable energy is also seen as a contribution to reduce further development of coal power. For further information, see chapter 15.4 of Norway’s National Inventory Report for 2022

Norway has issued Instructions for Official Studies and Reports (Utredningsinstruksen), laid down by Royal Decree. These instructions deal with consequence assessments, submissions and review procedures in connection with official studies, regulations, propositions and reports to the Storting. The instructions are intended for use by ministries and their subordinate agencies. The instructions form part of the Government’s internal provisions and deviation may only be allowed pursuant to a special resolution. The provisions make it mandatory to study and clarify financial, administrative and other significant consequences in advance.

In addition, Norway has a legal framework that deals specifically with environmental impact assessments. The purpose is to promote sustainable development for the benefit of the individual, society and future generations. Transparency, predictability and participation for all interest groups and authorities involved are key aims, and it is intended that long-term solutions and awareness of effects on society and the environment will be promoted.

4.2 Domestic and regional programmes and/or legislative arrangements and enforcement and administrative procedures

4.2.1 Domestic and regional legislative arrangements and enforcements

Norway has several legislative arrangements in place in order to help reduce emissions of greenhouse gases, such as the Pollution Control Act, the Greenhouse Gas Emissions Trading Act, the CO2 Tax Act, and the Petroleum Act, as well as requirements under the Planning and Building Act. The relevant arrangements will be discussed in more detail in 4.3.

The Climate Change Act

In June 2017, the Norwegian Parliament adopted the Climate Change Act, which establishes by law Norway’s emission reduction targets for 2030 and 2050. The purpose of the act is to promote the long-term transformation of Norway in a climate-friendly direction. See further description of Norway’s climate targets in 4.1.

The act will have an overarching function in addition to existing environmental legislation. The Climate Change Act introduces a system of five-year reviews of Norway’s climate targets, on the same principle as the Paris Agreement. In addition the act introduces an annual reporting mechanism. The Government shall each year submit to the Parliament updated information on status and progress in achieving the climate targets under the law, and how Norway prepares for and adapts to climate change. Information on the expected effects of the proposed budget on greenhouse gas emissions and projections of emissions and removals are also compulsory elements of the annual reporting mechanism. Since 2018, the Government has annually reported information as required by the Climate Change Act as part of the state budget process in October each year.

4.2.2 Provisions to make information publicly accessible

Norway has undertaken extensive provisions to make climate information publicly available. This issue is discussed further in chapter 9.

4.3 Policies and measures and their effects

4.3.1 Introduction

The main instruments of Norwegian climate policy are cross-sectoral: taxes on greenhouse gas emissions and emissions trading. Use of these instruments will contribute to fulfilment of emission targets at lowest cost to society. In addition to instruments that put a price on emissions, the Government uses other policy instruments to reduce barriers and correct market failures related to technology development, and in specific markets. It can be appropriate to use direct regulation on its own when an alternative technology or a different solution is mature enough to be deployed. Which policy instruments are suitable and where depends partly on which low- and zero emission alternatives are available and how mature they are. Different forms of market failure and barriers require different combinations of policy instruments.

This chapter describes some of the most important policies and measures (PaMs) for reducing greenhouse gas emissions in Norway. The chapter consists of textual descriptions of cross-sectoral and sectoral PaMs, and each sector has a summary table for the PaMs. Through these summary tables, the reporting of the PaMs is clearly subdivided by gases. The summary tables present the effects on greenhouse gas emissions of many PaMs and the total aggregated effects are summed up in chapter 5.6.

4.3.2 The Norwegian system of carbon pricing

4.3.2.1 Introduction

The main instruments of Norwegian climate policy are taxes on greenhouse gas emissions and emissions trading. Both these instruments put a price on emissions and make it more expensive to release greenhouse gases. Taxes provide an incentive to reduce emissions both through immediate action and through investment in research and development that will make it possible to reduce emissions at a later date. General policy instruments are a key part of the domestic climate policy. Cross-sectoral economic policy instruments (climate taxes) form the basis for decentralized, cost-efficient and informed actions, where the polluter pays. In areas subject to general policy instruments, additional regulation should as a main rule be avoided. The Government has implemented instruments in addition to emissions trading and climate taxes in some sectors.

Cost-efficient policy instruments ensure that reductions in emission are implemented in a way

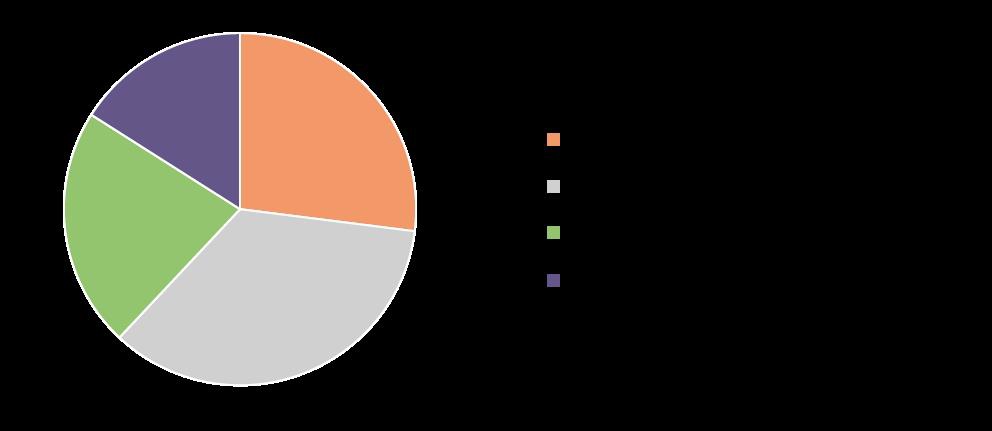

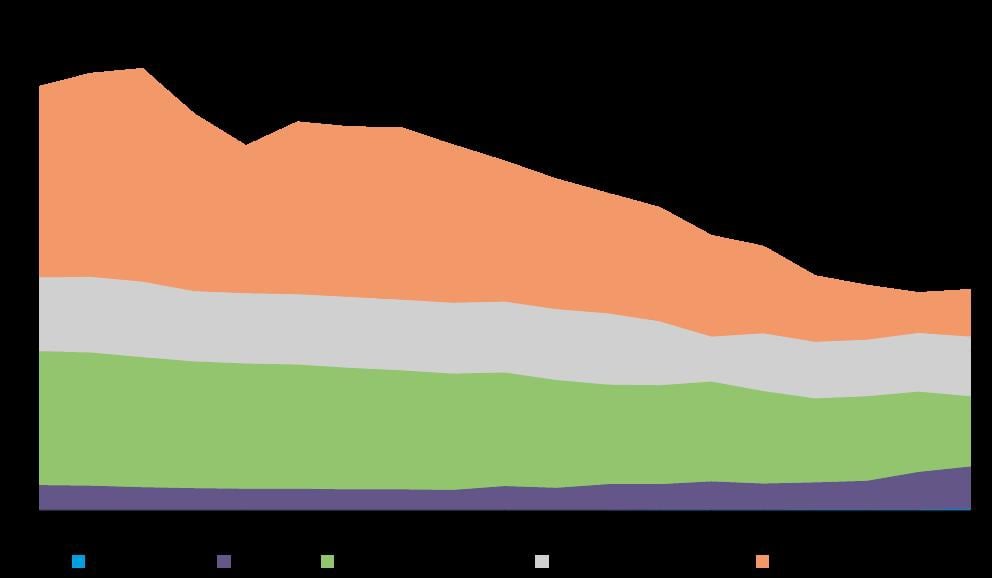

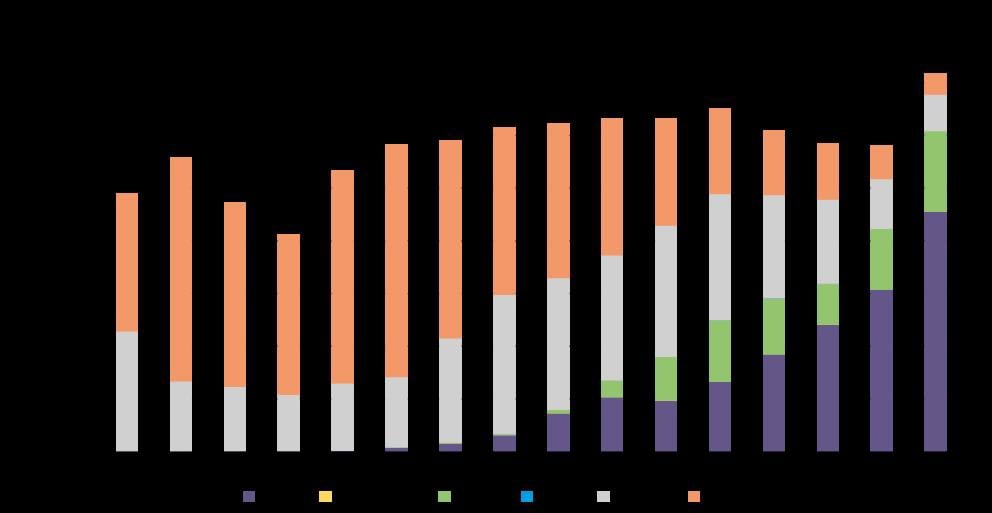

Figure 4.1 Emissions covered by economic measures by instrument type.

that leads to the lowest cost to society as a whole. If policy instruments are not cost-efficient, society must accept an unnecessary loss of welfare in other areas in order to achieve environmental goals. In the assessment of policies and measures, cross-sectoral effects and long-term effects on technology development and deployment should be taken into consideration.

CO2 taxes on mineral oil, petrol and emissions from petroleum extraction on the continental shelf were introduced in 1991 to cost-efficiently limit greenhouse gas emissions. In addition to being subject to CO2 taxes, emission from extraction of petroleum were also included in the European emission trading system (EU ETS) in 2008. CO2 taxes on natural gas and LPG were introduced in 2010.

In Norway, CO2 taxes and quotas (EU ETS) cover close to 85 per cent of greenhouse gas emissions. In 2022, the standard tax rate on non-ETS emissions is 766 NOK per tonne CO2 and is levied on most uses of mineral oils, petrol and diesel, natural gas, LPG and HFC/PFC see Table 4.1 and Table 4.2.

The price on greenhouse gas emissions varies between sectors and sources. The price on emissions is highest in the petroleum sector and in domestic aviation, which are also part of EU ETS. Both sectors are subject to taxes in addition to the EU ETS, and the total price on emissions is about NOK 1 500 in 2022. Agriculture is not a part of the EU ETS, nor is it subject to tax on emissions of methane or nitrous oxide. However, standard rates of CO2 tax and base tax on mineral oils apply to agriculture.

If natural gas and LPG is used in land-based manufacturing covered by EU ETS, the tax rate will either be reduced or the activities may be exempted from the tax. For the time being, other sectors and activities exempted from the CO2 tax on natural gas and LPG include (list not conclusive) fishing in distant waters, chemical reduction or electrolyses, metallurgical and mineralogical processes and international shipping and aviation. EEA state aid regulation will in certain cases prevent Norway from exempting emissions covered by the EU ETS from taxes. The Norwegian parliament has adopted a tax on chemical reduction etc., but the tax will only be put into effect in the case where an exemption for emissions covered by the ETS can be implemented.

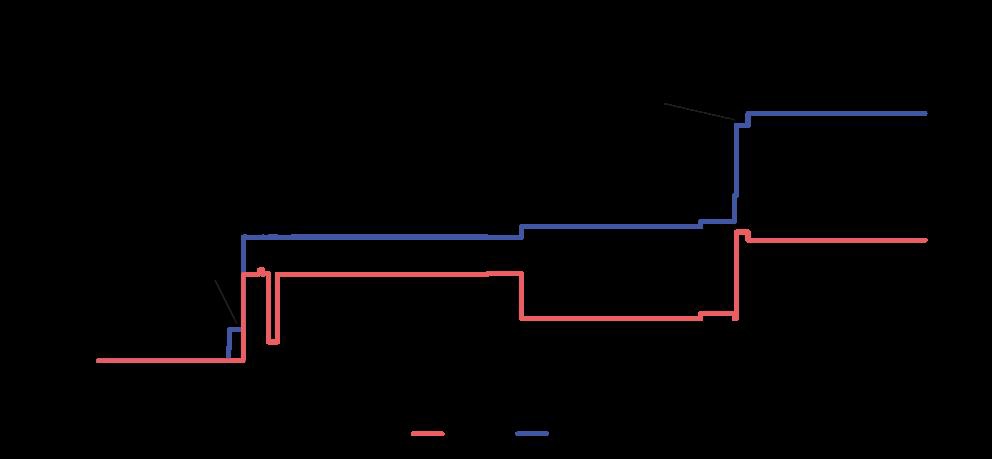

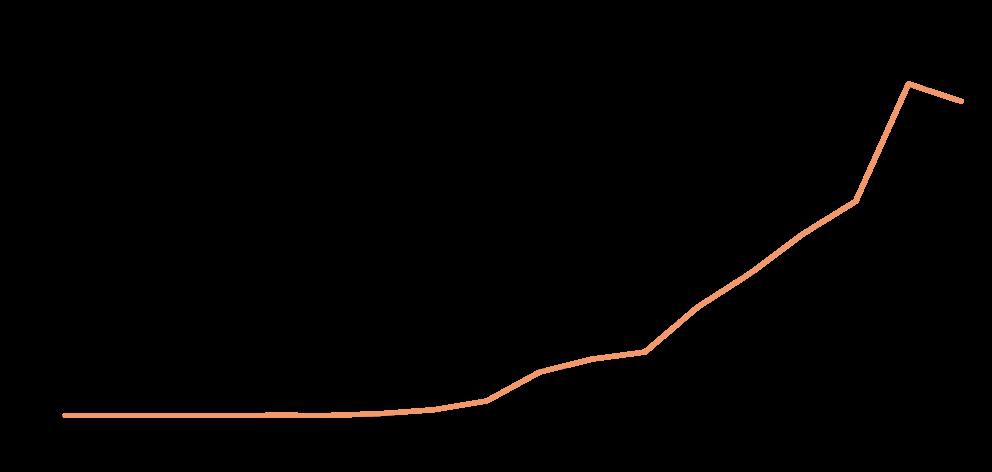

The development in Norwegian taxes on GHGs from our last report is illustrated in figure 4.2. Overall price levels have increased due to increases in the tax rates and the increase in the price of allowances in the EU ETS. Furthermore, the reduced rate for fisheries was abolished in 2020, and a new tax on emissions from waste incinerations was introduced in 2022.

Some taxes that do not target greenhouse gas emissions directly nevertheless increase the total tax on fossil fuels and therefore affect emissions. The road usage tax on fuels is levied to internalise the costs inflicted on the society in terms of accidents, congestion, noise, road wear and tear as well as health and environmentally harmful emissions other than CO2. Moreover, there is a base tax on mineral oil, the purpose of which is to avoid substitution of electricity due to the electricity tax.

Table 4.1 shows all current taxes on emissions of greenhouse gases. Below follows a description of the effect of green taxes on mainland emissions. Chapter 4.2.3 discusses in more detail the CO2 tax on petroleum activities and its effects on emissions offshore.

Table 4.1 Norwegian taxes on emissions of greenhouse gases in 2022.

NOK. per l/Sm3/kg/ ton | NOK. per ton CO2 | |

|---|---|---|

CO2-tax on mineral products | ||

Petrol | 1.78 | 766 |

Mineral oil | ||

Standard rate | 2.05 | 766 |

Domestic aviation (non-ETS) | 1.96 | 766 |

Domestic aviation (ETS)1 | 1.61 | 631 |

Natural gas | ||

Standard rate | 1.52 | 766 |

Use covered by the ETS1 | 0.066 | 33 |

Greenhouse industry | 0.15 | 77 |

LPG | ||

Standard rate | 2.30 | 766 |

Use covered by the ETS1 | 0.00 | 0 |

Greenhouse industry | 0.23 | 77 |

Tax on waste incineration | ||

Non-ETS emissions | 106 | 192 |

ETS emissions1 | 106 | 192 |

Tax on HFC and PFC | - | 766 |

CO2-tax for offshore petroleum | ||

Mineral oil1 | 1.65 | 620 |

Natural gas1 | 1.65 | 705 |

Natural gas emitted to the atmosphere | 10.66 | 766 |

1These emissions are also subject to the EU ETS.

Figure 4.2 Explicit carbon prices in 2019 and 2022. (NOK per ton CO2, 2022 price levels and 2020 emission data)

4.3.2.2 The Norwegian tax scheme on emissions of GHGs under the ESR

The standard tax rate on emissions under the ESR is NOK 766 in 2022, and there is a broad consensus in Norway that this tax rate is to increase to more than NOK 2 000 by 2030. The taxes cover approximately two thirds of emissions under the ESR, and the tax base has been gradually broadened over the last decades. In 2022 a tax on waste incineration was introduced. The most important tax is the CO2-tax on mineral products, which covers close to 100 per cent of all use of fossil fuels covered by the ESR.

The taxes on emissions from petroleum and aviation under the ETS are treated as separate policies and reported under petroleum and transport below.

Estimated effect on national emissions

The Norwegian Ministry of Finance has developed a model to analyse the mitigation effects of changes in the taxes on GHGs. The model combines price data, volume data from the tax authorities, and elasticities from economic literature to predict the mitigation effect of each tax for the different sectors and products that the tax covers. Results from this model indicates that removing the CO2-tax in 2022 would increase annual emissions by roughly 1 million tonnes of CO2. This includes the effects of the tax on waste incineration and the tax and reimbursement scheme on HFC/PFC, as they are part of the taxes on ESR emissions. This does not include the effect of the taxes on road transport. The effects on road transport is included in 4.3.7.2.

4.3.2.3 Tax on waste incineration

Norway introduced a tax on the final disposal of waste (including both landfills and incineration) on 1 January 1999. The tax for incineration was lifted on 1 October 2010 and for landfills in 2015. The purpose of the tax was to place a charge on the environmental costs of emissions from landfills, and thereby provide an incentive to reduce emissions, increase recycling and reduce the quantities of waste. The tax had a specific CO2-component aimed at reducing emissions of CO2 from waste incineration. In 2022, a tax on emissions of CO2 from waste incineration has been reintroduced. The tax rate is currently at NOK 192 per ton CO2, which equals to 25 per cent of the standard tax rate for non-ETS emissions. The tax currently applies to emissions both outside and inside the scope of the ETS.

Estimated effect on national emissions

Using the same model as for the other taxes on GHGs, we find that the recently introduced tax on waste incineration is expected to reduce emissions by 20 000 tonnes of CO2 annually, given the current reduced rate. This effect is included in the PaM the Norwegian tax scheme on emissions of GHGs under the ESR (see chapter 4.3.2.2).

4.3.2.4 Tax and reimbursement scheme on HFC and PFC

To curb the expected growth in HFC emissions due to the phase-out of ozone-depleting substances, a tax on import and production of HFCs was introduced in 2003 (the tax also includes PFCs, but the use of these gases is insignificant). In 2004, this tax was supplemented with a refund scheme, which prescribes a similar refund when gas is destroyed. The tax was initially NOK 180 (appr. 19 Euro) pr. GWP-tonnes. In 2022 the tax is NOK 766 (appr. 76 Euro) per tonne CO2-equivalents, after relatively large increases since 2014. Emissions of HFC/PFC are taxed at the same level as the standard tax rates for CO2, measured in NOK per ton CO2-equivalents. Since the tax is levied on imports of the gases, and not on actual emissions of HFC, the tax- is combined with a refund scheme to target emissions of HFC.

The tax and reimbursement schemes have resulted in better maintenance and improved routines for discarding old equipment. It also provides a strong incentive for choosing HFCs with the lowest GWP possible and has resulted in the increased use of natural refrigerants, such as CO2, ammonia or hydrocarbons and in recent years the use of HFC with very low GWP (HFOs), in new installations. The tax has had very significant effects on new, bigger installations, where low-GWP alternatives are often available, and the tax might represent a significant share of the investment costs. On smaller mass-produced units, such as domestic heat pumps, the international development as regards legislation (such as the EU F-gas regulation and the Montreal Protocol) and commercialization of new technology is likely the main driving force influencing emissions and choice of refrigerant.

Estimated effect on national emissions

The tax has significantly reduced growth in emissions compared with pre-tax scenarios, which forecasted very strong growth due to substitution of CFCs and HCFCs with HFCs. Estimates by a national expert are that the tax may reduce the HFC emissions by 0.6 million tonnes of CO2 equivalents. Due to lack of specific information, estimated effect is held constant over the period. This effect is included in the PaM the Norwegian tax scheme on emissions of GHGs under the ESR (see chapter 4.3.2.2).

The emissions of HFCs increased steadily from 1990 to 2013, when they peaked. Since then, there has been a significant downward trend. This is likely due to the combined effect of the tax- and refund scheme and the implementation of the EU F-gas regulation and Mobile Air Conditioning Directive. Recent commercialization of natural refrigerants in commercial refrigeration and other applications, as well as the switch to HFOs in new cars, has also contributed to this change in emission trend.

4.3.2.5 Emission trading (onshore)

Norway established a national emissions trading scheme in 2005. The scheme closely resembled the EU’s emissions trading scheme (ETS) and covered 11 per cent of total Norwegian greenhouse gas emissions, mainly from industry. Emissions already subject to CO2 tax were not included in the scheme.

From 2008 Norway became part of EU ETS phase II, which broadened the scheme to cover nearly 40 per cent of Norwegian greenhouse gas emissions. The petroleum sector and emissions from industries that had previously been subject to CO2 taxes were included in the EU ETS at that stage. In addition to the sectors included in the EU ETS, Norway decided unilaterally in February 2009 (effective from 1 July 2008) to include nitrous oxide emissions from the production of nitric acid in Norway. Such emissions constituted about 4 per cent of Norwegian greenhouse gas emissions in 2005.

Starting from 2012, the aviation sector was also included in the scope of the EU ETS. From 2013, phase III (2013–2020), the coverage of the EU ETS was further expanded, covering both new sectors (production of aluminium, petrochemical industry, mineral wool, ferroalloys, CCS) and gases (PFCs). From 2013, about 50 per cent of the Norwegian emissions are covered by the EU ETS.

From 2021, phase IV (2021–2030), there is no change in the coverage of sectors and gases compared to phase III for stationary installations. Emissions covered by the EU ETS in this phase amounts to about 50 per cent of the Norwegian emissions. In July 2021, as part of the Fit for 55 legislative package, the European Commission proposed a comprehensive set of changes to Phase IV of the EU ETS, for instance an increased level of ambition and extending the scope of the scheme to cover maritime transport. In addition, the Commission has proposed to create a new, self standing ETS for buildings and road transport.

Cap

Norway participates in the EU ETS. The aggregated future emissions covered by the scheme cannot exceed the EU-wide cap, which was set 21 per cent lower in 2020 compared with the emissions in 2005 from the covered sectors. Norwegian installations represent about 1 per cent of the total emissions. Norway’s participation in the ETS from 2008 led to a tightening of the system, as Norwegian installations have had a higher demand for allowances than the number of allowances added pursuant to this expansion of the system. The reduction rate for the cap was further increased from 2021 so that overall reduction of the cap in 2030 will be 43 per cent compared to 2005.

Legal basis

The legal basis for emissions trading in Norway is the Greenhouse Gas Emissions Trading Act which was adopted on 1 January 2005. The Act has been amended several times, notably in June 2007, February 2009 and May 2012. The amendments in 2007 and 2009 provided the basis for the emissions trading scheme in the Kyoto Protocol first commitment period (2008–2012). In July 2012, Directive 2009/29/EC of the European Parliament and of the Council of 23 April 2009 amending Directive 2003/87/EC so as to improve and extend the EU ETS was incorporated in the EEA Agreement.

Allocation and emissions

In the first (2005–2007) and second (2008–2012) phases of the EU ETS, allowances were allocated based on rules developed nationally (see NC6). The average amount of Norwegian emissions covered by EU ETS was 6 and 19.1 Mt/year in the respective phases. Up to and including 2020, the EU ETS allowed for the use of Kyoto units from the Clean Development Mechanism (CERs) and Joint Implementation (ERUs) for compliance purposes. A total volume of about 15 million CERs and ERUs have been surrendered from the installations for their compliance, and there was also a net transfer of Assigned Amount Units (AAUs) between EU and Norway, which has been used for compliance in the first commitment period under the Kyoto Protocol. A similar clearing mechanism between EU and Norway has been applied for the second commitment period (2013–2020) under the Kyoto Protocol.

Installations in sectors that are considered to be at risk of carbon leakage receive some or all of their allowances free of charge. For phase III (2013–2020), the allocation methodology was harmonized across Europe. The general rule for allocation in phase III was based on performance benchmarks rather than historical emissions levels. The average amount of Norwegian emissions covered by EU ETS in this phase was 22,9 Mt (excluded emissions from aircraft operators covered by the EU ETS). For phase IV (2021–2030), the same principles for allocation as in phase III were applied. In 2021, total free allocation to Norwegian installations represented about 60 per cent of their emissions for the same year.

Another measure aiming at preventing carbon leakage is that specific industries affected by higher electricity prices caused by the allowance price, since 2013 can be granted economic compensation (see chapter 4.2.8.4).

Compliance and reporting requirements

Operators included within the scope of the emissions trading scheme must report their verified emissions yearly to the Norwegian Environment Agency by 31 March the following year. If an operator does not submit an emission report in accordance with the provisions on reporting by the deadline, the Norwegian Environment Agency suspends the operator’s right to transfer allowances to other account holders. From the compliance year 2013, emissions reports from Norwegian installations must be verified by an accredited third party (verifier). Prior to 2013, the Norwegian Environment Agency performed the verification of the reports itself.

The Norwegian Environment Agency may impose coercive fines and even penal measures in the event of serious contravention of the provisions in the Greenhouse Gas Emissions Trading Act. A fine for failure to comply is imposed if an insufficient number of allowances is surrendered by 30 April. In addition, the operator must surrender an amount of allowances equivalent to the deficit the following year.

Starting in 2021, the operators of installations to which free allocation has been given, must report their verified allocation data yearly to the Norwegian Environment Agency by 31 March. Where the report shows that there has been changes in the activity of the installation, the Norwegian Environment Agency adjusts the allocation accordingly.

Estimated effect on emissions

Because emission allowances in the EU ETS can be sold across borders between installations in the scheme, the effect of the scheme on national emissions depends on several factors in addition to the level of ambition of the EU-wide cap. A crucial factor is Norwegian industry’s abatement cost relative to the abatement cost in industry located in other countries covered by the scheme, and relative to the carbon price. For this reason, in contrast to the Europe-wide effect, the scheme’s effect at the national level is difficult to assess and quantify.

There are no national emission targets for ETS emissions as there are for non-ETS emissions. However, earlier estimates made by Statistics Norway show that the emission trading scheme in phase II (2008–2012) may have led to overall national emission reductions of up to 0.3 million tonnes of CO2 equivalents per year.

Norway is an integral member of the EU ETS through the EEA Agreement. Norway’s participation increases the overall tightness of the European scheme. The number of allowances in Europe attributed to Norwegian participation (excluding aviation) was about 18 Mt/year for the trading period 2013–2020, while demand from Norwegian installations was approximately 24 Mt/year. The increased demand due to Norwegian participation will result in additional emission reductions within the scheme. These reductions may take place anywhere in the EU/EEA area, and the effect for the period 2013–2020 is therefore indicated as IE in the table 4.2.

Table 4.2 Summary of policies and measures, cross-sectoral.

Name of policy or measure a | Sector(s) affected b | GHG(s) affected | Objective and/or activity affected | Type of instrument c | Status of implementation d | Brief description e | Start year of implementation | Implementing entity or entities | Estimate of mitigation impact (not cumulative, in kt CO2 equivalents) | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2020 | 2025 f | 2030 f | 2035 f | |||||||||

The Norwegian tax scheme on emissions of GHGs under the ESR (excluding road transport) *g | Cross-cutting | CO2, HFC | Cost-effective reductions of emissions | Fiscal | Implemented | CO2 taxes on mineral oil, petrol and emissions from petroleum extraction on the continental shelf were introduced in 1991 to cost-efficiently limit greenhouse gas emissions | 1991 | Ministry of Finance | 1 000 | 1 000 | 1 000 | 1 000 |

Tax on waste incineration * | Energy | CO2 | Cost-effective reductions of emissions | Fiscal | Implemented | Introduced in 2022. Incentivizes reduced inceneration of fossil materials, increased recycling of plastics and the implementation of CCS technology. | 2022 | Ministry of Finance | NA | IE | IE | IE |

Tax and reimbursement scheme on HFC and PFC * | Industrial processes | HFC | Improved control of fugitive emissions from industrial processes | Economic | Implemented | Has resulted in better maintenance and improved routines during discharge of old equipment. | 2003 | Directorate of Customs and Excise, Norwegian Environmental Agency | IE | IE | IE | IE |

Emissions trading (2008–2012) onshore * | Industrial processes, Energy | CO2, N2O | Reduce emissions | Economic | Implemented | Part of the EU Emissions Trading Scheme, see text for further details. | 2008 | Norwegian Environment Agency | 300 | 300 | 300 | 300 |

Emissions trading (2013–) onshore *h | Industrial processes, Energy | CO2, N2O, PFC | Reduce emissions | Economic | Implemented | Part of the EU Emissions Trading Scheme, see text for further details. | 2013 | Norwegian Environment Agency | IE | IE | IE | IE |

Note: The two final columns specify the year identified by the Party for estimating impacts (based on the status of the measure and whether an ex post or ex ante estimation is available). Abbreviation: GHG = greenhouse gas.

a Parties should use an asterisk (*) to indicate that the policy or measure is included in the ‘with measures’ projection.

b To the extent possible, the following sectors should be used: energy, transport, industry/industrial processes and product use, agriculture, forestry/land use, land-use change and forestry, waste management/waste, other sectors and cross-cutting, as appropriate.

c To the extent possible, the following types of instrument should be referred to: economic, fiscal, voluntary agreement, regulatory, information, education, research and other.

d To the extent possible, the following descriptive terms should be used to report on the status of implementation: implemented, adopted and planned.

e Additional information may be provided on the cost of the policy or measure and the relevant timescale.

f Optional year or years deemed relevant by the Party

g Custom footnote. The effects of the taxes on HFCs and waste incineration are included in the effect of the Norwegian tax scheme on emissions of GHGs under the ESR.

h Custom footnote. The ETS may have contributed to some of the estimated effects reported for industry.

4.3.3 Other Cross-sectoral policies and measures

4.3.3.1 Regulation by the Pollution Control Act

The Pollution Control Act lays down a general prohibition against pollution. Pollution is prohibited unless one has a specific permission to pollute according to law or a decision made by the relevant authority. The Pollution Control Act applies also to greenhouse gas emissions. Greenhouse gas emissions are however to a large extent covered by other specific policy instruments such as the CO2 tax, the EU ETS and specific agreements with the industry on reduction of emissions.

Several provisions have the objective of ensuring efficient enforcement of the Act, or regulations or decisions issued pursuant to the Act. For example, violation of provisions may result in closure, coercive fine or criminal liability.

In the waste sector, regulations under the Pollution Control Act are used to ensure minimum environmental standards of landfills and incineration plants, and to regulate the handling of certain waste fractions. The EU directives on waste are implemented through the Pollution Control Act and through different parts of the Waste Regulation under the Pollution Control Act. The Waste Regulation includes the following measures:

- Requirement to collect methane from landfills (gradually introduced from 1998).

- Prohibition of depositing biodegradable waste (introduced 1 July 2009 with an opening for exemptions until 2013).

- Requirement to utilise energy from incineration from incineration plants.

From 2002 landfilling of wet-organic waste has been prohibited. This prohibition was replaced by the wider prohibition of depositing (2009) that applies to all biodegradable waste.

The Waste Regulation includes a formulation that incineration plants should be designed and operated with a view to utilise energy. This is normally followed up in the concessions of the plants by a condition that at least 50 per cent of the energy from the incineration should be utilised. For the effects of these measures, see 4.2.11.

Estimated effect on emissions

The effect in terms of emission reductions of the Pollution Control Act is not estimated since GHG emissions are to a large extent covered by other specific policy instruments.

4.3.3.2 The Planning and Building Act

The Planning and Building Act sets the framework for the planning and use of land areas and building requirements. Planning pursuant to the Act shall ensure sustainable development for the whole country and requires the participation of all those that are concerned by the decisions made in accordance with the Act.

The Act is a process law, regulating how decisions concerning land use and building must be made, as well as outlining some core topics that must be taken into consideration in decisions made in accordance with the Act. The legislative purpose of the Act is to ensure sustainable development in the interest of individuals, society and future generations. Among the core tasks and considerations required in all planning in accordance with the Act, are reducing climate gas emissions and adaptation to climate change. This is further elaborated in guidelines and the building code (energy requirements in the building code are further elaborated in chapter 4.3.6.4.)

Estimated effect on emissions

The effect ons emissions reduced through the regulations in the Planning and Building Act is difficult to estimate, as the emission reduction potential includes transport, land use change and buildings from all Norwegian municipalities. In addition, the base line is not defined. The Norwegian Ministry of Local Government and Regional Development is currently assessing the possibilities to strengthen the tools for dealing with climate gas emission reductions through the Act, including increased measuring and estimating of emission reduction potential.

4.3.3.3 Enova

Enova (www.enova.no) is a state-owned enterprise, owned by the Ministry of Climate and Environment. Enova is managed by the ministry based on four-year rolling agreements. The Government has given Enova a clearer climate profile for the current four-year period, so that its purpose is to contribute to Norway’s emission reduction commitment and contribute to Norway’s transition to a low-emission society. Enova contributes to the development of technologies necessary towards 2030 and the low emission society in 2050.

Enova provides funding and advice for climate and energy projects, and supports both companies and individual households, as well as local and regional governments. Funding for projects is drawn from the Climate and Energy Fund, which was provided NOK 4.1 billion in 2022. The rolling four-year agreements between Enova and the Ministry and flexible, long-term funding through the Climate and Energy Fund gives Enova a wide degree of freedom and flexibility to respond quickly to new opportunities and to support those projects that offer the greatest opportunities to influence developments. Given uncertainties about how rapid technology development may be in various sectors, freedom and flexibility within the framework of the four-year agreement is important.

Enova’s activities focus on late-phase technology development and early-stage market introduction. Grants for late-phase technology development help to speed up the pace and scale of pilot and demonstration projects and full-scale testing, so that new technologies and solutions reach the market more quickly. Enova’s programs deal with technologies and solutions at various stages of maturity. During the innovation process from technology development to market introduction, the goal is to reduce costs and the level of technological risk. Once a solution is technologically mature and ready for market roll-out, the goal is to achieve widespread deployment and market take-up. It is always necessary to overcome various market barriers as a solution proceeds through technology development and market introduction. Enova seeks to identify the most important of these and designs its programmes for the introduction and deployment of energy and climate solutions to lower such barriers.

New climate and energy technology developed in Norway can also play a part in reducing greenhouse gas emissions at global level when deployed widely enough. Investment in new technology and innovation often carries a high level of investment risk. Using public funding to reduce risk is an important strategy, because a new technology often provides greater benefits for society than for individual investors.

It generally takes time for a new technology or solution to become established and diffuse through the market. The reasons for the delay may vary. Possible barriers to the spread of new technology and products include a lack of information, scepticism to new and relatively untried solutions, and prices. Enova’s programmes for market change are designed to reduce these and other barriers and thus promote permanent market change.

Estimated effect on national emissions

Enova supports projects with an aim to contribute to Norway’s emission reduction commitment and contribute to Norway’s transition to a low-emission society. The technology projects Enova supports are intended to have immediate climate implications, but also long-term effect through dissemination and adoption of the new technologies including outside Norway. It is difficult to calculate these effects, but the potential impacts are substantial also on a global scale. For example, Enova supported the aluminium producer Hydro in developing a more energy efficient aluminium production technology which decreases energy use to 12.3 kWh per kilo aluminium, 15 per cent below the world average. In 2021, Enova supported TiZir Titanium and Iron to carry out a demonstration project that will lead to the use of hydrogen instead of coal to reduce ilmenite in the production of titanium dioxide. If the technology succeeds, and spreads globally, it may contribute to large emission reductions globally. Enova also supported REC Solar in the building of a pilot to increase material recycling in the production of solar silicon, which will reduce the need for the virgin material by 30 per cent. If such technologies become widespread, the impact on national and global greenhouse gas emissions would be significant.

Enova does not support projects in a policy vacuum. There are a variety of other policy instruments in Norway, which directly or indirectly aim to reduce domestic greenhouse gas emissions, support for R&D, taxes, regulations, and various other instruments. In such a context it is hard to say which instrument contributed to which development or reduction. An effect of the signalled steep increase in the carbon tax toward 2030 and onwards may be to reduce the need of financial support from Enova to drive early market diffusion. This illustrates the interplay between different instruments.

Enova estimates the direct reductions from each supported project, but these numbers will not represent the entire effect, nor can they be wholly attributed to Enova because the individual business cases build on and incorporate the incentives provided by other instruments. The reductions Enova calculates reflect the effects compared to the baseline in each project and only take into account the reduction of greenhouse gas emissions due to reduced consumption of fossil fuels such as coal, oil and natural gas. The reductions come as a result of improved efficiency of fossil sources and conversion from fossil to renewable energy.

Only Enova-supported projects with final report delivered in 2017 or later contain direct emission reduction results. Therefore, projects with final report delivered before 2017 are not included in the estimate of Enova’s direct contribution to reducing greenhouse gas emissions.

The estimated effect from Enova’s project portfolio is based on the yearly direct effect from each project on emissions, from the project start (defined as the date where the final report was delivered) and over the project’s expected lifetime. Other instruments such as the CO2 tax also play an important role when it comes to the profitability of the project, but the grant from Enova is assumed to be the factor that triggers the project, and the entire direct effect on emissions is in this case credited to Enova.

In the estimates, a project’s lifetime is assumed to be equal to the average lifetime of projects in the relevant sector. The assumed average lifetime of projects is based only on those applications in each sector where a full profitability analysis is required, and thereby expected lifetime is stated. For example, the expected lifetime of projects in transport, industry and the energy system is assumed to be 9, 13 and 23 years, respectively.

For the years after 2021 some assumptions need to be made when it comes to emission effects from the various sectors. Based on historic projects, we assume the following yearly effect from new projects: 300 000 tons CO2 in total, where 180 000 comes from transport projects, 80 000 from ESR within industry, 30 000 from ETS industry and 10 000 from other sectors. As the time goes by and the carbon price rises, it is likely that the carbon price increasingly will trigger projects in the market introduction phase. This will possibly result in Enova increasing the focus on technology development and decreasing the focus on market introduction. Technology developing projects usually contribute to less direct emission results than projects in the market introduction phase. Therefore, it is assumed a 20 per cent reduction in direct emission result for projects supported during the years 2025–2035, compared to the assumed results from 2022–2024.

Enova reports direct emission results as emissions compared to a fossil alternative. This means that in some cases, the reported emission results are not direct reduction of existing emissions, but rather projects that prevents an increase in emissions. An example is a company without a vehicle, that then buys an electric duty vehicle (supported by Enova) instead of a fossil duty vehicle.

The most important effects of Enova are not the direct emission reductions, but rather technology development and market change that in the longer run contributes to emission reductions. This effect is difficult to estimate and does not show in these estimates.

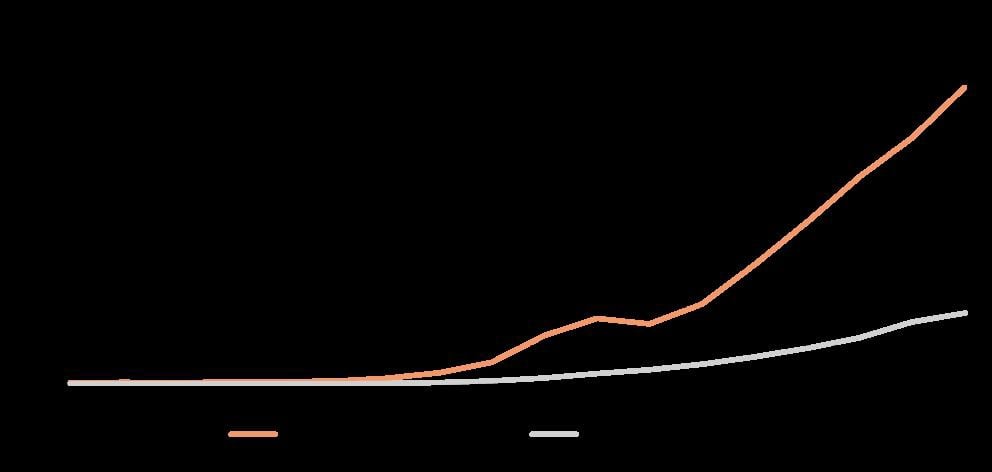

The estimated accumulated contribution to direct greenhouse gas emission reductions from Enova’s project portfolio is about 0.9 million tonnes of CO2 equivalents in 2020 and about 2.4–2.7 million tonnes in 2025, 2030 and 2035, see table 4.4 for details.

As a result of the bottom-up method of calculation and the use of individual baselines there is no direct link between this number and the national environmental accounts. An additional result of the bottom-up method is the partial inclusion of the effects of other policies. It is important also to note that Enova works by reducing the barriers to adoption of energy and climate technologies with an aim to facilitating a lasting market shift towards such technologies. It is not practical to attempt to attribute such wider changes to Enova or any other policy instrument, so it is important to bear this in mind when contemplating the effects of Enova’s support.

Box 4.4 Examples of projects supported by Enova

Fast-charging infrastructure for electric vehicles: NOK 250 million allocated through several rounds of competitive bidding, since 2015. Funding has been provided for a total of 320 charging stations. The first years, Enova focused on developing a basic charging infrastructure network along Norway’s main roads. The latest fundings have focused on the more rural parts of Norway.

Production of ammonia from natural gas with CCS: NOK 482 million to Vår Energi to build the first large-scale production facility for ammonia in Europe based on natural gas with carbon capture and storage. The project will demonstrate a new and energy-efficient technology.

Electrification of industry process: NOK 137.9 million to Inovyn in to electrify their production of vinyl chloride by using a new and world leading technology. The project will reduce emissions by 21 000 CO2 per year and contribute with important technology development in the petrochemical industry.

Fishing boat using hydrogen: NOK 92.5 million to the world’s first sea-going fishing boat using hydrogen. The boat will be out at sea for 4–6 weeks in a row and needs several energy sources to supply its energy consumption. This will be covered by a container-based storage of hydrogen, two fuel cells, a large battery and conventional diesel engines.

4.3.3.4 Klimasats

In 2016, the Solberg Government introduced a financial support scheme to promote emissions reduction projects in Norwegian municipalities and counties. The scheme is called Klimasats and is administered by the Norwegian Environment Agency that assesses and prioritises the applications based on given criteria. The objective of Klimasats is to reduce emissions at the local level and contribute to the transition to a low emission society. Examples of supported projects are the use of climate friendly building materials in public buildings, reduction of food waste in local institutions, zero emission construction sites and reduction of methane emissions from former landfills. The municipalities can also apply for funding to strengthen the climate perspectives in urban planning, where local governments have a key role. Support is also given to networks of four or more municipalities with the aim of capacity building and sharing experiences on emission reduction.

From 2016 to 2021, Klimasats allocated NOK 1064 million to 1589 projects all over Norway. An additional NOK 202 million has been allocated to facilitate the introduction of zero- and low-emission solutions for high-speed vessels in the public transport system, during 2019 – 2021.

Estimated effect on national emissions

The municipalities that have received funding report on the results and effects of the projects as well as their experiences from the implementation. The Environment Agency actively use and spread the reported results and experiences from the projects in order to facilitate the start-up of new projects in other municipalities.

The effects of the support scheme are both immediate emission reductions within areas such as transport, waste handling, buildings and public procurement. In addition, most projects contribute to the transition to a low emission society through increased focus on climate change and climate measures among local politicians, increased climate focus in urban planning, capacity building within the local administrations and cross-sectoral cooperation. The funding also provides a possibility of finding and testing new solutions, which in many cases are more expensive and the results uncertain.

An external evaluation of the Klimasats scheme has concluded that the funding to a large degree is contributing to the realization of local emission reductions projects that would not have been implemented without financial support. According to the evaluation, the support scheme stimulates local governments and administrations in identifying new emission reduction projects, it contributes to capacity building and to the dispersion of project ideas and experiences from projects among municipalities.

The effect in terms of emission reductions of the Klimasats scheme is not estimated since it supports a variety of projects and there is limited data available. All projects can be found at the website of the Norwegian Environment Agency (in Norwegian only).6

The environmental technology scheme – Innovation Norway

The Environmental Technology Scheme was established in 2010. The overall target of the scheme is to encourage the Norwegian industry to introduce new and better products and processes related to environmental technology to the market. The scheme aims at promoting profitable business opportunities and helping to realize Norway’s environmental goals.

In this context, the definition of environmental technology is all technology that directly or indirectly improves the environment, including technology and services that limits pollution through purification processes, more environmentally friendly products and production processes, more efficient handling of resources and technological systems that reduce the impact on the environment.

The Environmental Technology Scheme offers grants and other support for development and investments in pilot and demonstration projects for new Norwegian environmental technology.

It is a nationwide scheme to which all Norwegian companies can apply. The companies apply for grants related to the costs for planning and development of the project, investment costs during the development and pilot phase, and costs relating to start-up and testing after the initial work to establish the pilot. The criteria for receiving grants are related both to the projects’ economic and commercial effects, environmental effect and level of innovation.

In 2021, NOK 677 million was granted from the environmental technology scheme to 110 projects. Total investments in these projects (including the companies’ own funds) are NOK 2.3 billion. The projects are based across a range of different technologies, including metallurgic industry, bio-refinery, renewable energy, water treatment, maritime sector and aquaculture.

Estimated effects on national emissions

The environmental technology scheme supports projects in the demonstration and piloting phase, and it is difficult to quantify the results. The final product or process may not be taken up by the market until several or many years after the support is granted. In their applications, the companies indicate the expected environmental impact of the pilot and the expected effect if the new solution spreads. However, there is no requirement for the effects to be converted into CO2 equivalents and climate-specific reporting.

Table 4.4 Summary policies and measures, other cross-sectoral.

Name of policy or measure a | Sector(s) affected b | GHG(s) affected | Objective and/or activity affected | Type of instrument c | Status of implementation d | Brief description e | Start year of implementation | Implementing entity or entities | Estimate of mitigation impact (not cumulative, in kt CO2 equivalents) | |||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

2020 | 2025 f | 2030 f | 2035 f | |||||||||