Outlook for the Norwegian Economy

Historisk arkiv

Publisert under: Regjeringen Solberg

Utgiver: Finansdepartementet

Finance Norway’s Capital Markets Day, London

Tale/innlegg | Dato: 10.03.2016

"The large petroleum revenues over the past 15 years, in combination with our fiscal guideline, have implied saving a large part of the petroleum Revenues", Finance minister Siv Jensen said under her speech at the Finance Norway’s Capital Markets Day.

Check against delivery

Ladies and gentlemen,

It is a pleasure for me to be here at Finance Norway’s capital markets day in London. Capital markets are a very efficient and important mechanism for channelling savings into investment. Markets allocate resources by reducing information costs, providing liquidity, mobilising savings and monitoring issuers. Markets support corporate initiatives, finance the exploitation of new ideas and facilitate the managements of financial risks. Since retail investors are placing their money in the securities markets, these markets have become central to individual wealth and retirement planning. Several important policymakers have highlighted the importance of capital markets to the real economy, hereunder the EU.

As a small open economy with large public savings, Norway is highly dependent on international capital markets for several reasons. They enable us to separate the Norwegian government as an investor from the capital needs of Norwegian firms: We can construct the government’s portfolio of financial investments without considering the financing needs of Norwegian enterprises and banks; and Norwegian enterprises and banks can choose their funding structure independent of the government’s financial investments.

A solid legal framework that protects investors in combination with market institutions and networks that promote efficient allocation of financial resources are paramount to ensure confidence in the market place. These structures serve at least two purposes; providing public information that is timely and correct for assessing prices, and setting minimum quality standards for issuers.

Information is essential to make the marketplace work efficiently, and I strongly support the FNO’s initiative today to promote Norwegian capital markets here in London, the most prominent financial centre in Europe.

A robust framework for economic policy

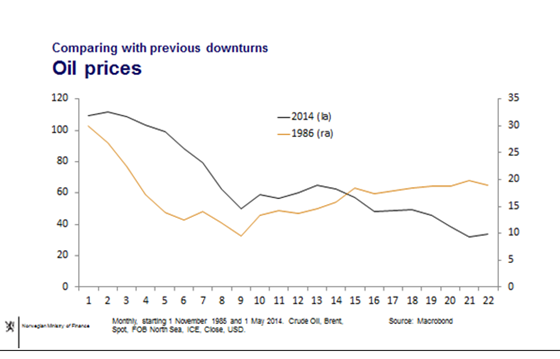

Figure 1 Comparing oil prices

Let me start by shedding some light on recent developments in the Norwegian economy. The steady increase in the oil price from 2005 brought a long-lasting and positive development in Norway’s terms of trade. In contrast, the large fall in the oil price since summer 2014 constitutes a large negative shock to our economy. In size and impact, the shock is comparable to the oil price fall in the latter half of the 1980s.

A comparison of economic developments then and now illustrates that our policy framework today is far better suited to weather economic disturbances. Even though the oil price shocks, as I mentioned, were similar in size, economic developments differ substantially.

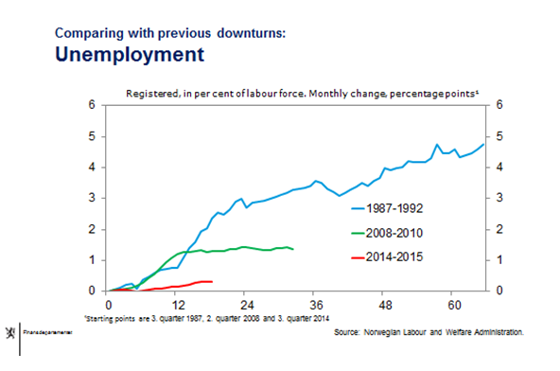

Figure 2 Comparing unemployment rates

The oil price fall in 1986 ushered in a long period of economic turbulence, with a sharp and a lingering increase in unemployment (the blue line in the figure, which shows the development from the peak of the business cycle). This time, the increase in registered unemployment has been more subdued (the red line). And, importantly, this time output and employment have continued to increase, in contrast to the sharp fall in the late 1980s. Recent developments have also been more benign than under the financial crisis in 2008-2009 (the green line in the figure).

I believe that one reason our economy is so far coping fairly well despite the 70 per cent drop in oil prices is the macroeconomic cushions that we have established. Three components of our economic policy framework have proved particularly important:

First, monetary policy is aimed at low and stable inflation with a floating currency

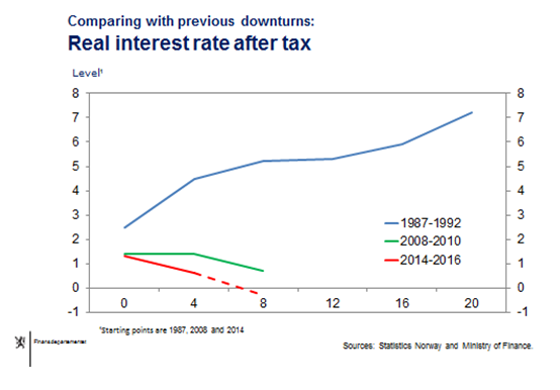

Figure 3 Comparing real interest rates

The central bank today has an objective of low and stable inflation. In pursuing that objective Norges Bank also aims to stabilise output. In good times, with prospects for increasing inflation, interest rates are increased. And in economic slowdowns, with prospects for weak growth and low inflation, interest rates are reduced. Monetary policy acts as an important stabiliser. Thus, interest rates have been reduced over the past years, and real rates have come close to zero (the red line). Also in the financial crisis in 2008, interest rates were decreased and helped to stabilise the economy (the green line). Monetary policy has become our first line of defence in economic stabilisation.

In the late 1980s, a fixed exchange rate was the overriding objective, and the contrast is sharp. The interest rate was increased sharply in response to the oil price shock to defend the currency peg. The increase in the real interest rate clearly reinforced the economic downturn as the household sector was heavily indebted.

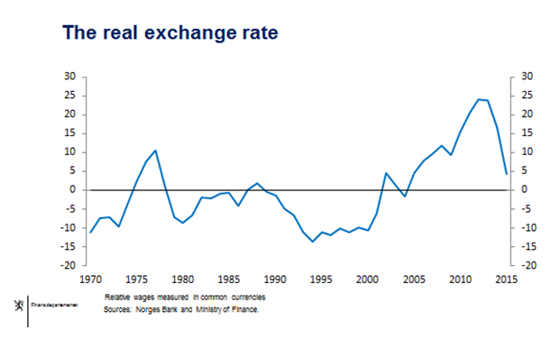

Figure 4 The real exchange rate

By the same token, the movement in the exchange rate has been virtuous this time. The booming years from the beginning of the millennium came with a relatively strong real appreciation and rising cost inflation, as one would expect. Now, we have to reverse that development. In the current international environment of low real wage growth, it would have been quite an ordeal to improve our competitiveness through low wage growth alone, which was the recipe under the fixed-exchange rate regime. Today, a real depreciation has taken place through the nominal exchange rate.

Such a large and swift adjustment in competitiveness is key to stabilising the economy following the downturn in the petroleum sector. It will clearly support the transition of labour to new competitive sectors, even though it may take some time before we see the full impact on domestic activity.

Second, we have strong public finances and a prudent, but flexible fiscal framework.

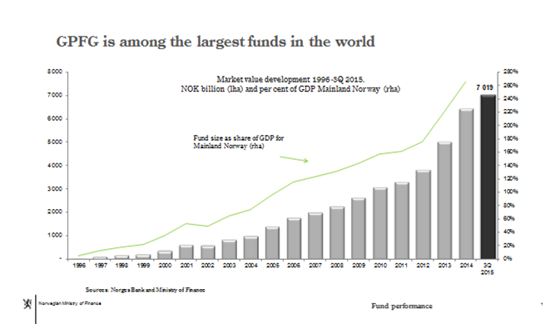

The large petroleum revenues over the past 15 years, in combination with our fiscal guideline, have implied saving a large part of the petroleum revenues. The guideline stipulates that we can spend the expected real return on the fund in addition to domestically collected taxes. Our sovereign wealth fund today amounts to around 7000 billion Norwegian kroner, more than 800 billion US dollars or almost 3 times non-oil GDP (figure 5).

Figure 5 Norway’s sovereign wealth fund

As a consequence, we are not spending oil revenues as such, but the financial return on the fund. As opposed to many other countries that experience economic distress, our solid public finances allow automatic stabilisers to work. In short, we do not need to cut welfare when facing a cyclical shortfall in petroleum revenues.

Fiscal strength is certainly a short-term advantage that can help us smooth the structural shift away from petroleum activities that needs to come. However, expanding the public sector is not the right answer when the challenge by nature is structural. The economy must adapt to a new normal, where the petroleum industry is a less prominent growth engine than it has been over the past 10 to 15 years, and where new private businesses can grow.

The third important cushion has been a robust and well-functioning financial sector.

In the late 1980s, the combination of high interest rates and indebted households, high marginal taxes and deductible interest payments, poorly capitalised banks and bad banking eventually led to the Norwegian banking crisis. The crisis amplified the downturn and was a reminder that a solid and well-capitalised financial sector is a vital insurance against economic instability.

We need strong regulation and supervision to ensure that our banks are robust and that our capital markets are efficient. The international financial crisis has shown the need for good financial market regulation and supervision both nationally and internationally. Norway is a strong supporter of the current efforts to improve regulation and supervision of banks and other financial institutions, and we emphasise the importance of regulatory consistency to ensure equal treatment of exposures in all financial institutions.

Based on our own experience of the banking crisis in the early 1990s we have developed a comprehensive financial market regulation. In this context it has been important to include the whole financial market in the scope of regulation, to prevent regulatory arbitrage, for example through shadow banking. This consistent approach has served us well.

The Norwegian authorities have acted early to phase in the different versions of the Basel and EU banking regulations, and are often a bit stricter than the minimum requirements under these frameworks. Over the past years, more solid banks have been a priority, and the banks have to a large extent used their profits to expand their capital base.

Today, as a result of the increased capital requirements, our banks can enjoy a solid position in the funding market and appear less risky to investors.

For Norwegian banks as a whole, the leverage ratio, measured as the core equity capital relative to the total balance sheet, stood at an average of 7.5 per cent at year-end 2015. This is far above the minimum requirement in the Basel framework [3 per cent] and indeed very high in a Nordic and European context.

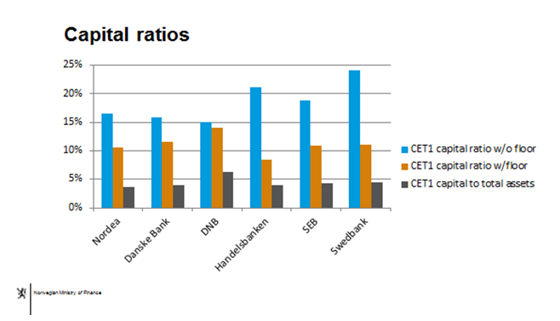

Figure 6 Capital ratios

Figure 6 shows the robustness of the largest financial groups in the Nordic region based on three different measures of solvency. Large financial institutions, including all the large Nordic financial groups, are typically allowed to calculate risk weights using internal models.

In order to prevent the calculated capital requirements from dropping too low, the Basel I transitional floor constitutes an important minimum capital level for banks using internal risk models.

The difference between the risk-weighted measure without the floor and the unweighted measure of solvency is remarkable. Swedish banks, for example, look very robust when considering that their core equity capital ratio, based on their own models, varies between 16 and 24 per cent. This capital ratio is striking given the fact that the unweighted ratio of the same banks is only around 4 per cent. DNB ASA, on the other hand, appears to be the least robust of the Nordic groups based on the risk-weighted capital ratio without the Basel I-floor. However, DNB has the highest capital ratio calculated with the Basel I floor and has a clearly higher unweighted capital ratio than its Scandinavian peers (as shown in the grey bars).

International work is underway to improve the rules on calculation of the denominator in the capital ratio. The Basel Committee is working on elements of Basel III to ensure its overall coherence and to maximise its effects. This is important work to ensure the stability of the overall capital requirements, which we strongly support.

An ambitious reform agenda

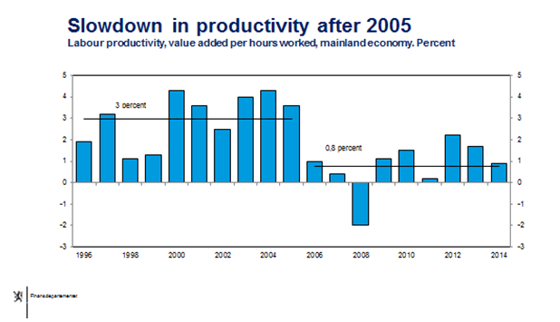

As most advanced economies, we have seen a significant fall in productivity growth in recent years. Trend growth in productivity in Norway is now historically low, at below 1 per cent, compared with an average of about 3 per cent in the previous period. This is an international phenomenon. Norway fares better than many other countries, but the tendency needs to be turned around. We also have to deal with an ageing population and underutilisation of labour resources.

The welfare of our citizens and the sustainability of our public finances in the longer term depend on how we handle these issues.

Figure 7 Slowdown in productivity growth after 2005

The crucial point is productivity growth. To quote Paul Krugman: “Productivity isn’t everything, but in the long run it is almost everything.”

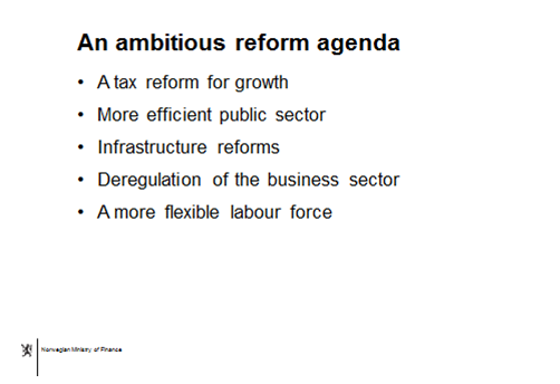

To support economic growth the government has set up an ambitious reform agenda. We have already embarked on several reforms, including a tax reform in order to ensure that working, saving and investing pay off.

We are reducing the overall tax level, for both households and businesses, and improving the design of the tax system to stimulate more environmentally friendly behaviour.

Figure 8 Important reform initiatives

We are implementing reforms to make the public sector more efficient.

This sector is large, occupying 30 per cent of the work force. Benchmarking of institutions indicates a large potential for efficiency gains.

Reforms of the infrastructure sector are under implementation with the aim to enhance efficiency and economic profitability. We have reorganised the railway sector to achieve a more market-oriented and effective governance structure, and established a new road development company in order to develop our big highway projects more efficiently and at a lower cost.

I believe in a free and independent business sector without special treatment or anti-competitive agreements, a free flow of goods and services and free access to markets. These are prerequisites for strong productivity growth. Therefore, we should foster competition and trade, both domestically and across borders, and remove structural barriers to entry.

The government aims at a flexible labour market where workers possess skills demanded by employers. Active labour market policies and flexible employment protection have been central to Norway’s ability to facilitate structural change in the economy and the reallocation of labour.

Closing

I have underlined the importance of open and well-functioning markets. Few other countries have made such a large bet on the capitalist system and well-functioning financial markets as Norway. Our natural resources have value only as long as we can export to the international market, and we invest the Government Pension Fund Global (GPFG) in stocks, bonds and real estate all across the world. Good, strong and stable international framework conditions are essential, to us as investors and to our financial institutions and enterprises who fund themselves abroad.

A safe and sound banking system and a strong capital market are both crucial to ensure financial stability and economic growth. The banks must ensure that their business model is robust and profitable. And the markets must remain efficient, given the role of these markets in allocating resources between issuers and investors. And I can promise that the Norwegian authorities will continue to promote predictable, robust and good regulatory standards for banks and capital markets.

Thank you.